Corebridge Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corebridge Financial Bundle

Navigate the complex external landscape impacting Corebridge Financial with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are creating both challenges and opportunities for the company. Gain a strategic advantage by downloading the full analysis today and unlocking actionable intelligence.

Political factors

Changes in financial regulations, such as those impacting insurance solvency, capital requirements, and consumer protection laws, directly affect Corebridge Financial's operations and product offerings. For instance, the NAIC's ongoing review and potential revisions to the Risk-Based Capital (RBC) framework, with anticipated further developments in 2024, could influence Corebridge's capital management strategies and the types of products they can offer efficiently.

Policy shifts concerning retirement savings incentives, like potential adjustments to contribution limits or tax deductibility of insurance premiums, can significantly sway consumer demand and, consequently, Corebridge's profitability. For example, any changes to the tax treatment of annuities or life insurance products, which are central to Corebridge's business, would necessitate strategic product adjustments and marketing efforts.

While Corebridge Financial's core operations are in the United States, global trade policies and international relations still cast a shadow. For instance, escalating trade tensions between major economies in 2024 could trigger market volatility, potentially affecting the value of Corebridge's diverse investment holdings. The company's strategic divestment of international operations in previous years underscores a concentration on the U.S. market, yet broader global economic stability remains a crucial backdrop.

The United States' political stability and the clarity of its economic policies, including fiscal and monetary measures, are paramount for Corebridge Financial. A predictable policy environment, characterized by consistent legislative and regulatory frameworks, underpins long-term financial planning and investment strategies. For instance, the Federal Reserve's monetary policy decisions, such as interest rate adjustments, directly impact the cost of capital and investment returns, influencing Corebridge's product pricing and profitability.

Government Spending on Social Security and Healthcare

Government spending on Social Security and healthcare directly impacts retirement planning and financial security. For instance, in the United States, Social Security benefits are a cornerstone of retirement income for millions. The projected solvency of Social Security is a recurring topic, with discussions around potential reforms, such as adjustments to retirement age or benefit formulas, influencing long-term financial planning.

Changes in government healthcare spending, including Medicare and Medicaid, also play a crucial role. Increased healthcare costs or shifts in coverage can lead individuals to seek more robust private retirement and insurance solutions. Corebridge Financial, as a provider of retirement solutions and life insurance, must monitor these trends. For example, the Centers for Medicare & Medicaid Services projected U.S. health spending to grow by 5.4% in 2024, reaching $5.0 trillion. This highlights the increasing financial burden individuals may face in retirement, potentially boosting demand for private financial products.

- Government spending on Social Security and healthcare influences retirement planning.

- Potential reforms to social safety nets can increase demand for private financial solutions.

- Rising healthcare costs, projected at 5.4% growth in U.S. health spending for 2024, underscore the need for private financial security.

- Corebridge Financial must adapt its strategies to evolving government policies and their impact on consumer needs.

Taxation Policies

Modifications in corporate tax rates, investment income taxation, or individual income tax policies directly influence Corebridge Financial's profitability and the attractiveness of its products. For example, the U.S. federal corporate income tax rate, which stood at 21% following the Tax Cuts and Jobs Act of 2017, remains a key consideration for Corebridge. Changes in this rate or how investment income is taxed can significantly impact the company's net earnings and the appeal of its annuity and life insurance offerings to clients.

Continuous monitoring of tax legislation is crucial. For instance, potential discussions around adjusting capital gains tax or dividend tax rates could affect investor behavior and, consequently, demand for Corebridge's investment-linked products. The company must remain agile, strategically adjusting its product design and financial forecasting to navigate these evolving tax landscapes, ensuring continued competitiveness and compliance.

- Corporate Tax Rate Impact: The 21% U.S. federal corporate income tax rate directly affects Corebridge's retained earnings.

- Investment Income Taxation: Changes in capital gains and dividend tax rates influence the attractiveness of Corebridge's investment products for consumers.

- Product Design Adaptability: Corebridge needs to adjust product features and pricing in response to shifts in individual income tax policies.

- Financial Forecasting Accuracy: Evolving tax laws necessitate ongoing refinement of financial models to accurately project profitability and tax liabilities.

Government policies concerning Social Security and healthcare directly influence retirement planning behavior, potentially increasing demand for private financial solutions like those offered by Corebridge. For example, the Centers for Medicare & Medicaid Services projected U.S. health spending to reach $5.0 trillion in 2024, a 5.4% increase, highlighting the growing need for individuals to secure their own financial futures. Corebridge must monitor these trends and adapt its strategies to meet evolving consumer needs driven by these public policy shifts.

What is included in the product

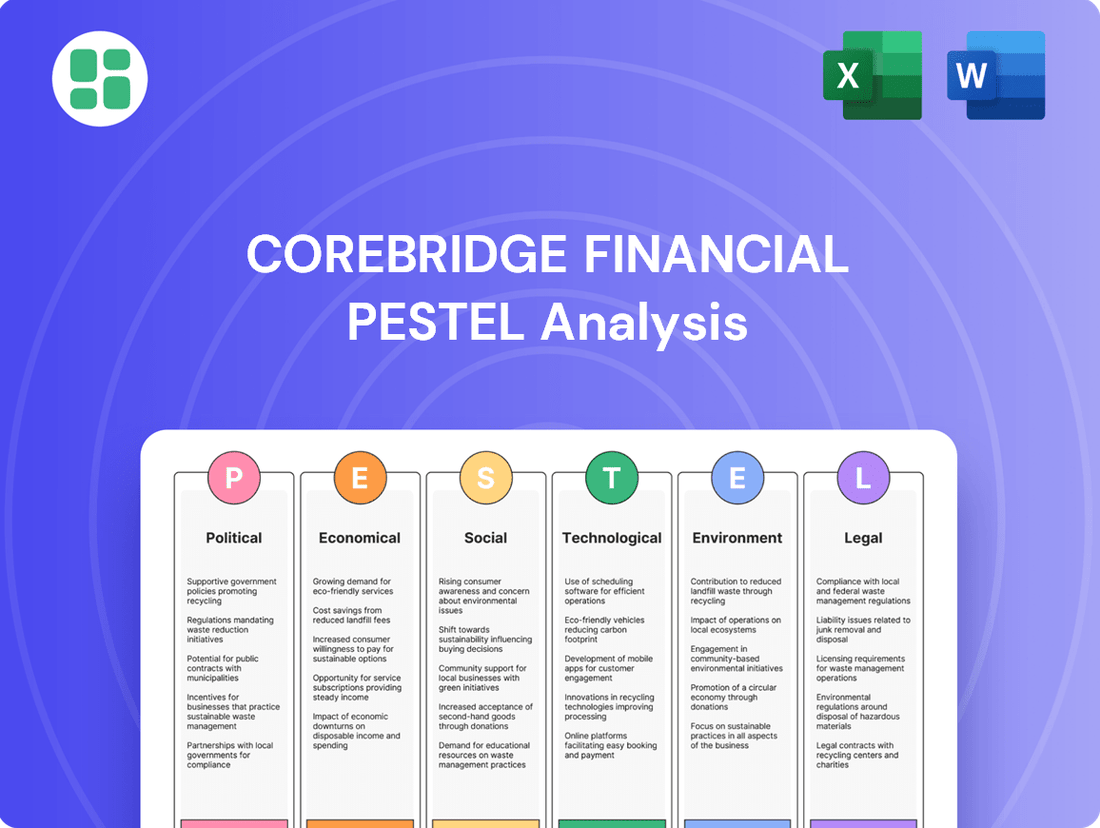

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Corebridge Financial, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the financial services sector.

A concise PESTLE analysis for Corebridge Financial provides a readily digestible overview of external factors, alleviating the pain of sifting through extensive data during critical strategy discussions.

Economic factors

Interest rate shifts directly influence Corebridge Financial's earnings from its investments and how it prices its various financial products. For instance, a rising rate environment, as potentially observed in early to mid-2025, could boost net investment income from newly acquired assets.

However, these same higher rates also increase the cost of borrowing for Corebridge and can make its fixed-income offerings less attractive compared to newly issued, higher-yielding alternatives. Conversely, a prolonged period of low interest rates, a scenario that persisted through much of the early 2020s and could continue into 2025, tends to squeeze profit margins on products that rely on interest rate spreads and makes it harder to provide competitive returns on annuities.

Inflation directly impacts Corebridge Financial by eroding the purchasing power of its annuity and life insurance payouts, potentially decreasing customer demand for products without inflation protection. For instance, the US CPI rose 3.3% year-over-year in May 2024, highlighting the persistent need for strategies that shield policyholders from this erosion.

Conversely, deflationary environments, though less frequent, can reduce asset values and increase the real burden of Corebridge's fixed liabilities, creating a different set of financial challenges. Managing the investment portfolio and designing products that account for both inflationary and deflationary risks is crucial for Corebridge's long-term stability and customer satisfaction.

Robust economic growth and elevated consumer spending directly fuel Corebridge Financial's performance by increasing disposable income, which in turn encourages greater investment in retirement and insurance solutions. For instance, the projected US GDP growth of around 2.3% for 2024 and a similar outlook for 2025 suggests a favorable environment for increased savings and protection product uptake.

Conversely, economic contractions or periods of high inflation can significantly dampen consumer confidence and spending power. This directly impacts Corebridge by potentially reducing new premium collections and deposit inflows as individuals may defer long-term financial planning to address immediate economic pressures, a trend observed in past downturns impacting the financial services sector.

Corebridge's financial reports for 2024 and early 2025 will likely demonstrate this sensitivity, with premium and deposit figures showing a correlation to prevailing macroeconomic trends, highlighting the importance of sustained economic expansion for the company's growth trajectory.

Unemployment Rates

Unemployment rates significantly impact Corebridge Financial. High unemployment, for instance, can shrink the pool of individuals covered by employer-sponsored retirement plans, directly affecting Corebridge's reach in that market. Furthermore, job losses can impair policyholders' ability to maintain their premium payments, potentially leading to policy lapses and slower new business acquisition.

Conversely, a robust employment landscape is a key driver for Corebridge's stability and growth. A healthy job market ensures consistent premium collections across its product lines and facilitates the expansion of its customer base as more people have disposable income and employer benefits.

- US Unemployment Rate (May 2024): The U.S. unemployment rate stood at 4.0% in May 2024, marking a slight increase from 3.9% in April 2024. This indicates a tightening labor market that could influence premium collection consistency.

- Impact on Retirement Plans: A 1% increase in the unemployment rate has been historically linked to a decrease in participation in employer-sponsored retirement plans, a core area for Corebridge.

- Policyholder Stability: For Corebridge, a stable employment environment supports the consistent payment of premiums for life insurance and annuity products, crucial for maintaining policyholder retention and financial health.

Capital Market Performance and Volatility

The performance of equity and bond markets significantly influences Corebridge Financial's investment portfolio and the valuation of its market risk benefits. For instance, the S&P 500 saw a substantial rise in 2024, gaining over 15% by mid-year, which positively impacts the asset values backing Corebridge's products. Conversely, increased market volatility, as experienced with interest rate fluctuations in late 2024, can reduce investment income and strain the company's financial stability.

Corebridge employs strategic hedging programs to counter these market risks. These programs are crucial for protecting the guaranteed benefit features embedded within their annuity and life insurance products. For example, in response to the heightened volatility in bond markets during 2024, where yields on the 10-year Treasury note swung by over 50 basis points in a single quarter, Corebridge would have actively adjusted its hedging strategies to maintain the integrity of these guarantees.

- Equity Market Impact: A robust equity market performance, such as the projected 10-12% growth for the S&P 500 in 2025, generally boosts Corebridge's investment returns and the value of its assets under management.

- Bond Market Volatility: Fluctuations in interest rates, a key driver of bond market performance, directly affect the valuation of Corebridge's liabilities, particularly those with guaranteed minimum withdrawal benefits or death benefits.

- Hedging Strategies: The company utilizes derivative instruments and dynamic asset allocation to manage the sensitivity of its portfolio to market movements, aiming to preserve capital and meet guaranteed obligations.

- Financial Health: Sustained market downturns or periods of high volatility can lead to unrealized losses, impacting regulatory capital ratios and overall profitability, necessitating proactive risk management.

Economic stability and growth are paramount for Corebridge Financial, directly influencing consumer confidence and spending power. For instance, the U.S. economy is projected to grow by approximately 2.3% in 2024 and a similar rate in 2025, suggesting a supportive environment for increased savings and protection product uptake.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Corebridge Financial |

|---|---|---|---|

| GDP Growth (US) | ~2.3% | ~2.3% | Favorable for increased savings and protection product uptake. |

| Inflation (US CPI) | 3.3% (May 2024) | Projected to moderate | Erodes purchasing power of payouts; necessitates inflation-protected products. |

| Unemployment Rate (US) | 4.0% (May 2024) | Projected to remain stable | Impacts employer-sponsored plans and policyholder premium payment ability. |

Preview Before You Purchase

Corebridge Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Corebridge Financial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

What you’re previewing here is the actual file—fully formatted and professionally structured. It offers a detailed examination of how external forces shape Corebridge Financial's operations and future growth opportunities.

Sociological factors

The aging population, with an increasing number of individuals reaching retirement age, presents a substantial market for Corebridge Financial's retirement solutions. This trend, often referred to as 'Peak 65,' signifies a growing demand for products like annuities and guaranteed income streams. For instance, in 2024, the U.S. Census Bureau projected that the 65 and older population would reach approximately 73 million by 2030, a significant increase from recent years.

This demographic evolution directly fuels the need for long-term care planning and comprehensive retirement strategies. Corebridge Financial is well-positioned to capitalize on this by offering products designed to provide financial security and income stability for retirees. The company's focus on annuities and life insurance with cash value components directly addresses the financial needs of this expanding demographic segment.

Modern lifestyles are dramatically reshaping financial planning. Many individuals are delaying retirement, with a significant portion of Baby Boomers still working past 65, and the rise of the gig economy means more people are managing variable incomes. These shifts necessitate flexible financial products that cater to diverse saving patterns and risk tolerances, as seen in the growing demand for adaptable retirement solutions.

Corebridge must recognize that evolving family structures, such as single-parent households or multi-generational living, also impact financial priorities. This means offering solutions that address a wider range of needs, from childcare expenses to elder care support. The increasing reliance on digital platforms for managing finances underscores the need for user-friendly online tools and personalized financial wellness resources to engage these varied customer segments effectively.

A growing understanding of financial planning's importance is crucial for Corebridge Financial. In 2024, surveys indicated that while many Americans recognize the need for retirement savings, a significant portion still feel unprepared, highlighting a clear opportunity for enhanced education. For instance, a recent study found that over 50% of individuals aged 45-60 are concerned about outliving their retirement savings, underscoring the demand for accessible financial guidance.

Corebridge Financial can capitalize on this by simplifying complex financial topics and emphasizing the long-term benefits of insurance and retirement products. As of early 2025, the demand for personalized financial advice continues to rise, with digital tools and educational content playing a key role in reaching a wider audience. Initiatives that demystify concepts like annuities and life insurance can drive greater market penetration for Corebridge.

Cultural Attitudes Towards Risk and Saving

Societal views on saving, investing, and risk significantly shape how people approach insurance and retirement planning. In 2024, a notable trend in many developed economies, including the US, is a growing emphasis on financial security, potentially boosting demand for products like those offered by Corebridge. For instance, a recent survey indicated that over 60% of Americans are more focused on long-term financial planning than they were a year ago.

Cultural norms that prioritize financial prudence and long-term security often translate into higher adoption rates for insurance and retirement solutions. Corebridge Financial can leverage this by aligning its marketing with these cultural values. For example, in cultures where intergenerational wealth transfer is important, highlighting the legacy-building aspects of retirement savings could resonate strongly.

Understanding these variations is key to effective strategy. For instance, while some demographics might be highly receptive to aggressive investment strategies, others may prefer more conservative approaches. Corebridge's success in different markets will depend on its ability to tailor its product messaging and sales approaches to these nuanced cultural attitudes.

Key considerations include:

- Cultural Emphasis on Prudence: Societies that value thrift and long-term planning tend to have higher rates of insurance and retirement product uptake.

- Risk Tolerance Variations: Attitudes towards investment risk differ significantly across cultures and age groups, impacting product preferences.

- Demographic Shifts: Aging populations in many countries are increasing the focus on retirement security, creating opportunities for financial service providers.

- Generational Attitudes: Younger generations may have different saving and investing habits compared to older ones, requiring tailored engagement strategies.

Workforce Dynamics and Employee Benefits Trends

Societal shifts in workforce dynamics, particularly the move from traditional pension plans to defined contribution models like 401(k)s, directly influence Corebridge Financial's group retirement offerings. This transition necessitates a strong emphasis on employee financial wellness, making Corebridge's ability to provide comprehensive retirement solutions and educational tools a critical differentiator in the market.

Companies are increasingly prioritizing holistic employee benefits, recognizing that financial well-being is as important as health coverage. This trend plays to Corebridge's strengths, as robust group retirement plans coupled with accessible financial wellness programs can attract and retain talent, directly impacting the demand for Corebridge's services. For instance, a 2024 survey indicated that 75% of employees consider financial wellness benefits a key factor when choosing an employer.

- Shift to Defined Contribution: The ongoing migration from defined benefit to defined contribution retirement plans is a fundamental change in how employees save for the future, increasing the reliance on employer-sponsored plans.

- Financial Wellness Focus: Employers are investing more in financial wellness programs, recognizing their impact on employee productivity and retention, creating opportunities for integrated solutions.

- Competitive Advantage: Corebridge's capacity to deliver sophisticated group retirement plans alongside valuable financial wellness resources positions it favorably against competitors.

- Employee Demand: Data from early 2025 suggests that over 60% of employees actively seek financial guidance from their employers, underscoring the market need for these services.

Societal attitudes toward financial prudence and long-term security are increasingly favoring products like those Corebridge Financial offers. In 2024, a significant portion of the population, over 60% according to recent surveys, expressed a heightened focus on long-term financial planning compared to previous years. This cultural shift towards valuing thrift and security directly correlates with a greater demand for insurance and retirement solutions.

Corebridge can effectively leverage these evolving societal values by ensuring its marketing efforts resonate with these priorities, potentially highlighting legacy-building aspects for cultures that value intergenerational wealth transfer. Understanding that risk tolerance varies greatly across different demographics is crucial, as some groups may prefer conservative approaches while others are open to more aggressive investment strategies, necessitating tailored product messaging.

| Societal Factor | Impact on Corebridge | Supporting Data (2024-2025) |

| Increased Focus on Financial Security | Boosts demand for retirement and insurance products. | Over 60% of Americans more focused on long-term planning (2024). |

| Cultural Emphasis on Prudence | Higher uptake of insurance and retirement products. | Societies valuing thrift show greater product adoption. |

| Risk Tolerance Variations | Requires tailored product messaging and sales approaches. | Attitudes towards risk differ significantly across demographics. |

Technological factors

Digital transformation is paramount for Corebridge Financial to boost operational efficiency and elevate customer interactions. Automation in key areas like underwriting and claims processing is a significant driver for cost reduction and faster service delivery. Corebridge's focus on productivity improvements directly reflects this technological imperative.

The company is actively developing advanced digital tools to refine investment management strategies and deepen client engagement. This commitment to technological advancement is crucial for staying competitive in the evolving financial services landscape.

Corebridge Financial is increasingly leveraging data analytics and artificial intelligence to gain a competitive edge. By analyzing vast datasets, the company can understand customer preferences more deeply, leading to more personalized product offerings and targeted marketing campaigns. This data-driven approach is crucial for refining risk assessment and pricing models, ensuring competitive and accurate product development.

The integration of AI extends to operational efficiencies and risk mitigation. For instance, AI-powered tools can significantly enhance fraud detection capabilities, protecting both the company and its policyholders. Furthermore, AI is being employed to optimize investment strategies, seeking to maximize returns while managing risk effectively in dynamic market conditions. This technological adoption is a key component of Corebridge's strategy to navigate the evolving financial landscape.

As a financial services provider, Corebridge Financial's reliance on technology means robust cybersecurity and data privacy are critical. Handling sensitive customer information, the company faces significant risks from data breaches, which can result in substantial financial penalties and reputational damage. For instance, the global average cost of a data breach reached $4.45 million in 2024, a figure that underscores the financial imperative for strong security.

Maintaining the confidentiality and availability of technology systems presents an ongoing challenge, especially with evolving cyber threats. Corebridge must continually invest in advanced security protocols and compliance with regulations like GDPR and CCPA to protect customer data and ensure operational continuity.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) present a significant technological frontier for the insurance and retirement sectors. While still in developmental stages, these innovations hold the promise of fundamentally altering how Corebridge Financial manages data and contracts. Think enhanced security for policyholder information and more transparent, efficient processing of claims and transactions. The potential for DLT to streamline back-office operations and reduce fraud is substantial, impacting everything from underwriting to claims settlement.

Corebridge Financial must actively monitor the evolving landscape of blockchain and DLT. Staying ahead means understanding how these technologies can be integrated to create new efficiencies and competitive advantages. This could involve exploring pilot programs or partnerships to test DLT applications in areas like digital identity verification or smart contracts for annuities. The global investment in blockchain technology reached an estimated $5.1 billion in 2023, indicating a strong trend towards its adoption across various industries, including financial services.

The implications for Corebridge Financial are far-reaching:

- Enhanced Security and Transparency: DLT can provide an immutable and auditable record of transactions and policy data, reducing the risk of errors and fraud.

- Operational Efficiency: Automating processes through smart contracts could significantly cut down on administrative costs and processing times for insurance products and retirement plans.

- New Product Development: Blockchain could enable innovative insurance products, such as parametric insurance triggered automatically by verifiable data feeds.

Mobile and Online Platform Development

The financial industry's ongoing shift towards digital channels means companies like Corebridge must constantly enhance their mobile and online offerings. This ensures customers can easily manage their finances and access information conveniently. A significant development is Corebridge's planned launch of an updated digital experience for retirement plan participants in 2025, aiming to boost accessibility and offer tailored financial advice.

This digital push is critical as consumer behavior increasingly favors online interactions. For instance, a 2024 survey indicated that over 70% of individuals prefer managing their investments through digital platforms. Corebridge's investment in this area demonstrates a forward-looking strategy to meet these evolving customer expectations.

- Digital Engagement Growth: Expect continued growth in user adoption of digital financial tools, driven by convenience and personalization.

- Platform Security Investments: Corebridge will likely prioritize robust security measures for its online and mobile platforms to protect sensitive customer data.

- Personalized Financial Guidance: The development of digital tools will increasingly focus on providing customized financial insights and recommendations.

Corebridge Financial's technological strategy heavily emphasizes digital transformation, aiming for enhanced operational efficiency and improved customer interactions. Automation in underwriting and claims processing, for instance, is a key focus for cost reduction and faster service. The company's commitment to digital tools for investment management and client engagement is vital for maintaining competitiveness.

Leveraging data analytics and AI is central to Corebridge's competitive edge, enabling deeper customer understanding for personalized offerings and more accurate risk assessment. AI integration also bolsters operational efficiencies and risk mitigation, notably in fraud detection and investment strategy optimization. This proactive technological adoption is fundamental to navigating the evolving financial services sector.

Cybersecurity and data privacy are paramount given Corebridge's handling of sensitive customer information, with the global average cost of a data breach reaching $4.45 million in 2024. The company must continuously invest in advanced security protocols and regulatory compliance to safeguard data and ensure operational continuity against evolving cyber threats.

Blockchain and DLT offer significant potential for Corebridge, promising enhanced security, transparency, and operational efficiency through immutable records and smart contracts. The global investment in blockchain technology reached an estimated $5.1 billion in 2023, highlighting its growing importance. Corebridge's exploration of these technologies could lead to innovative product development and streamlined back-office operations.

Legal factors

Corebridge Financial navigates a landscape shaped by stringent insurance and securities regulations. Compliance with rules from bodies like the NAIC and SEC is paramount, affecting everything from product development to sales. These regulations, which are constantly evolving, directly influence operational expenses and the company's ability to adapt its strategies. For instance, the SEC's oversight of securities offerings and the NAIC's solvency requirements for insurers necessitate robust compliance frameworks and significant investment in legal and operational infrastructure.

Consumer protection laws, encompassing fair advertising, clear disclosure requirements, and robust complaint handling, directly shape Corebridge Financial's marketing and sales strategies. For instance, regulations like the Consumer Financial Protection Bureau's (CFPB) oversight in the U.S. mandate transparency in financial products, impacting how Corebridge presents its annuity and life insurance offerings.

Adherence to these legal frameworks is paramount for fostering customer trust and mitigating the risk of costly legal battles and penalties. Non-compliance can lead to substantial fines; for example, the CFPB has levied billions in penalties against financial institutions for various consumer protection violations in recent years, underscoring the financial and reputational stakes for companies like Corebridge.

Corebridge Financial must navigate a complex web of data privacy and security laws like GDPR and CCPA. These regulations mandate strict protocols for collecting, storing, and utilizing customer data, directly impacting how Corebridge handles sensitive financial information. Failure to comply can lead to significant fines; for instance, GDPR violations can incur penalties up to 4% of global annual revenue or €20 million, whichever is higher.

Anti-Money Laundering (AML) and Sanctions Laws

Corebridge Financial operates under stringent Anti-Money Laundering (AML) and sanctions laws, a critical legal factor impacting its operations. These regulations are designed to thwart financial crimes, requiring robust customer identification and verification processes, ongoing transaction monitoring, and the reporting of any suspicious activities to relevant authorities. For instance, the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) reported over $3.5 trillion in suspicious activity reports (SARs) filed in 2023 alone, highlighting the scale of financial crime detection efforts.

Failure to adhere to these legal mandates can result in significant financial penalties and reputational damage. In 2024, several financial institutions faced substantial fines for AML deficiencies, with some penalties reaching hundreds of millions of dollars. Corebridge Financial’s commitment to compliance ensures its integrity and maintains trust within the global financial ecosystem.

- Customer Due Diligence (CDD): Implementing thorough Know Your Customer (KYC) procedures is paramount.

- Transaction Monitoring: Utilizing advanced systems to detect and flag unusual or potentially illicit transactions.

- Suspicious Activity Reporting (SAR): Timely and accurate reporting of suspicious activities to regulatory bodies.

- Sanctions Compliance: Ensuring all business dealings adhere to international and domestic sanctions lists.

Labor and Employment Laws

As a major employer, Corebridge Financial navigates a complex landscape of labor and employment laws. These regulations cover critical areas such as minimum wage requirements, workplace safety standards, anti-discrimination statutes, and the provision of employee benefits. Adhering to these laws is paramount for ensuring equitable treatment of employees and minimizing the risk of costly labor disputes or legal actions.

Corebridge Financial's commitment to competitive compensation and comprehensive benefits packages is a strategic imperative for attracting and retaining a skilled workforce. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that the average annual wage for financial managers, a key talent pool for Corebridge, was approximately $144,800. Offering attractive benefits, including health insurance and retirement plans, further enhances its employer brand.

- Compliance with federal and state wage and hour laws, such as the Fair Labor Standards Act (FLSA), is essential.

- Adherence to anti-discrimination laws, including Title VII of the Civil Rights Act, prevents legal challenges and fosters an inclusive workplace.

- Providing robust employee benefits, such as health, dental, and retirement plans, is crucial for talent acquisition and retention in the competitive financial services sector.

- Staying abreast of evolving labor regulations, including potential changes to overtime rules or paid leave mandates, is critical for ongoing compliance.

Corebridge Financial operates within a heavily regulated sector, necessitating strict adherence to insurance and securities laws. For example, compliance with the NAIC's solvency requirements and the SEC's disclosure rules directly impacts product design and market entry strategies. These evolving legal frameworks demand significant investment in compliance infrastructure and personnel to mitigate risks and ensure operational continuity.

Environmental factors

Climate change is increasingly driving more frequent and severe extreme weather events. For Corebridge Financial, this translates to potential impacts on their insurance liabilities, especially within their life insurance segment, as these events can affect public health and economic stability indirectly.

While Corebridge's direct property exposure might be limited, the broader economic fallout from climate-related disasters, such as supply chain disruptions or increased healthcare costs, can still influence their financial performance and the overall market environment in which they operate.

Corebridge Financial itself recognizes the significant risks posed by climate change and its associated catastrophes. In their 2023 annual report, they explicitly listed climate-related events as a key risk factor, highlighting their awareness and the need for ongoing risk management strategies to address these evolving environmental challenges.

Investor and public focus on Environmental, Social, and Governance (ESG) factors is increasingly shaping Corebridge Financial's approach to investments and its overall reputation. This growing emphasis means companies like Corebridge must consider sustainability in their operations and product development to appeal to a wider investor base.

By embedding ESG criteria into their investment processes, Corebridge can attract capital from socially conscious investors. Demonstrating a commitment to sustainability, perhaps through initiatives like aiming for carbon neutrality or introducing ESG-focused financial products, can significantly boost brand value and market appeal. For instance, in 2024, the global sustainable investment market saw continued growth, with assets under management in ESG funds reaching new highs, indicating a strong demand for such strategies.

Global resource scarcity and disruptions in supply chains, while not directly touching Corebridge Financial's core business of insurance and retirement services, can still cast a shadow. For instance, the ongoing impacts of geopolitical events and climate change on raw material availability and transportation routes can slow down economic growth. This broader economic slowdown can indirectly affect the performance of Corebridge's investment portfolios, as companies they invest in might face higher operating costs or reduced demand.

Consider the impact on sectors where Corebridge holds significant investments. For example, disruptions in semiconductor supply chains, which persisted well into 2024, affected technology companies, impacting their earnings and, consequently, the value of Corebridge's holdings in those firms. Similarly, volatility in energy prices due to geopolitical tensions in 2024 and early 2025 can ripple through various industries, influencing corporate profitability and investor confidence.

Pollution and Environmental Regulations

Stricter environmental regulations, especially concerning pollution and carbon emissions, significantly influence the sectors Corebridge Financial invests in. Companies burdened with higher compliance expenses or environmental responsibilities may experience diminished financial performance, directly affecting Corebridge's investment returns.

For instance, the increasing focus on climate-related financial disclosures, with many jurisdictions mandating reporting by 2024 and 2025, means companies must account for their environmental impact. This can lead to increased operational costs for polluters and opportunities for green technology firms.

- Increased Compliance Costs: Industries like manufacturing and energy face substantial investments in pollution control technologies and cleaner operational processes.

- Carbon Pricing Mechanisms: The expansion of carbon taxes and emissions trading schemes globally adds a direct financial cost to greenhouse gas emissions.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are increasingly driving investment decisions, with a growing preference for companies demonstrating strong environmental stewardship.

- Litigation Risks: Companies failing to meet environmental standards face potential legal challenges and fines, impacting their balance sheets.

Natural Disaster Preparedness and Resilience

Corebridge Financial must maintain robust business continuity plans to ensure operational resilience against natural disasters. For instance, the increasing frequency and severity of climate-related events, such as the record-breaking hurricane season in 2024, pose significant risks to infrastructure and data centers.

The company's ability to continue providing services and protecting client data during these disruptive events is paramount for maintaining customer trust and ensuring business continuity. Financial institutions globally are investing heavily in disaster recovery and resilience measures; for example, a 2024 industry survey indicated that 78% of financial services firms had updated their business continuity plans in response to evolving climate risks.

- Operational Resilience: Corebridge Financial's ability to maintain critical operations during and after natural disasters is key to its service delivery.

- Data Protection: Safeguarding sensitive customer data from loss or corruption due to environmental events is a top priority.

- Customer Trust: Demonstrating preparedness and effective response to disasters reinforces customer confidence and loyalty.

- Industry Trends: The financial sector is increasingly prioritizing climate risk assessment and resilience planning, with significant investments being made in technology and infrastructure upgrades.

Climate change presents a growing challenge, with more frequent extreme weather events impacting public health and economic stability, which indirectly affects Corebridge's insurance liabilities. The company acknowledges these risks, listing climate-related events as a key risk factor in its 2023 annual report, underscoring the need for robust risk management. Investor and public focus on ESG factors is also increasing, pushing companies like Corebridge to embed sustainability into their operations and product development to attract capital and enhance brand value, a trend supported by the continued growth in the global sustainable investment market in 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Corebridge Financial is built upon a robust foundation of data from reputable financial institutions, government economic reports, and leading industry publications. We meticulously gather insights on political stability, economic trends, technological advancements, and regulatory changes impacting the financial services sector.