Corebridge Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corebridge Financial Bundle

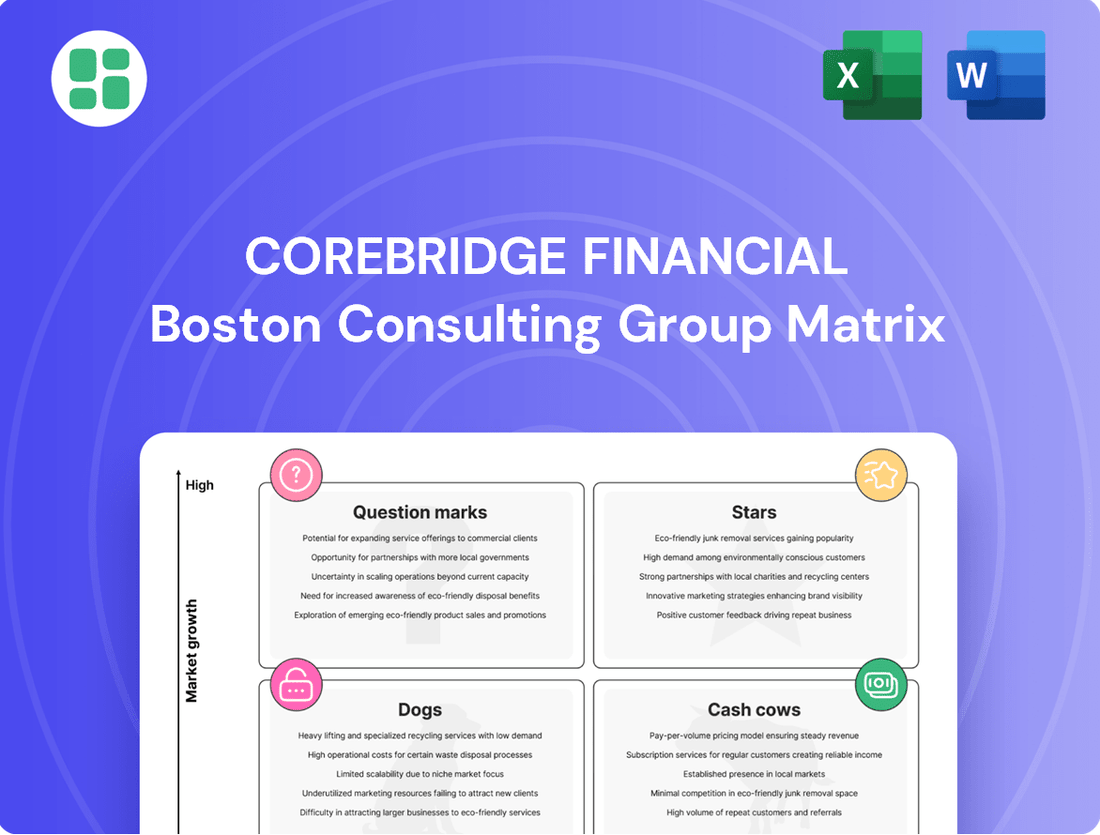

Curious about Corebridge Financial's strategic positioning? Our BCG Matrix analysis breaks down their product portfolio into Stars, Cash Cows, Dogs, and Question Marks, offering a glimpse into their market performance.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of each product's quadrant placement and receive actionable insights to guide your investment and product development strategies.

Don't miss out on the strategic clarity this report provides. Purchase the full Corebridge Financial BCG Matrix today for a data-driven roadmap to competitive advantage.

Stars

Corebridge Financial's MarketLock RILA, introduced in late 2024, is a prime candidate for the Star category within the BCG Matrix. This innovative product taps into the burgeoning registered index-linked annuity market, a segment experiencing significant expansion.

With its launch, Corebridge solidified its position as the sole top-tier annuity provider offering products across all major annuity types. This comprehensive offering, coupled with the MarketLock RILA's strong initial market reception and a rapidly growing pipeline, signals substantial future growth potential and high market adoption.

Corebridge Financial's new digital retirement planning tools, launched in February 2025, are positioned to aggressively capture market share. This initiative targets the rapidly expanding digital financial planning sector, a high-growth area driven by increasing consumer demand for accessible and intuitive financial management.

Individual Retirement Annuities (IRAs) are a cornerstone for Corebridge Financial, significantly contributing to their revenue. The company has seen robust sales growth in this area, particularly with annuity products.

Accumulation-focused IRAs are currently very popular. This is largely because individuals are actively looking for ways to grow their retirement nest egg, especially with today's interest rate environment. For instance, Corebridge reported that its annuity sales reached $12.5 billion in the first quarter of 2024, up from $10.2 billion in the same period of 2023, highlighting this trend.

ESG-focused Investment Solutions

Corebridge Financial's ESG-focused investment solutions are strategically positioned to capture significant market share. The global ESG investment market is anticipated to surpass $53 trillion by 2025, underscoring the immense growth potential. Corebridge's proactive approach, including its 2023 launch of an ESG-focused insurance product line, demonstrates a clear commitment to this expanding sector. This aligns directly with the escalating investor preference for sustainable and socially responsible financial products.

This strategic focus places Corebridge's ESG offerings in a strong position within the BCG matrix, likely categorizing them as Stars. The company's investment in sustainable financial products and the introduction of its ESG insurance line in 2023 are key indicators of this. This move addresses a clear and growing demand from investors seeking to align their portfolios with environmental, social, and governance principles.

- Market Growth: Global ESG investment market projected to exceed $53 trillion by 2025.

- Product Innovation: Launched an ESG-focused insurance product line in 2023.

- Investor Demand: Capitalizing on increasing investor preference for sustainable options.

- Strategic Positioning: Aiming for high-growth, high-potential market segment.

Innovative Index Annuities (e.g., Power Select AICO)

Corebridge Financial's Power Select AICO represents a significant innovation in the annuity market, particularly with its unique Additional Interest Credit Overlay (AICO) feature. This product is designed to capture market-linked growth while offering principal protection, a combination highly sought after by investors in the current economic climate.

The index annuity sector is experiencing robust growth, with total annuity sales reaching an estimated $318.1 billion in 2023, according to LIMRA. Within this, fixed index annuities (FIAs) have shown particular strength, accounting for a substantial portion of sales. Power Select AICO, by offering enhanced growth potential through its AICO feature, is well-positioned to capitalize on this trend.

- Market Segment Growth: The fixed index annuity market has seen consistent growth, with sales in 2023 surpassing previous records.

- Product Innovation: The AICO feature provides a novel approach to enhancing potential returns, differentiating it in a competitive landscape.

- Investor Appeal: The product's blend of principal protection and market participation aligns with investor demand for safety and growth.

- Potential Star Status: Given its innovative features and alignment with market trends, Power Select AICO is poised for strong performance, fitting the Star quadrant of the BCG Matrix.

Corebridge Financial's MarketLock RILA and its new digital retirement planning tools are positioned as Stars due to their strong market reception and aggressive market share capture strategies in high-growth sectors. The company's robust sales in accumulation-focused IRAs, evidenced by a significant year-over-year increase in annuity sales to $12.5 billion in Q1 2024, further solidify these offerings as Stars.

The company's ESG-focused investment solutions are also strong candidates for the Star category, capitalizing on the projected growth of the ESG market, which is expected to exceed $53 trillion by 2025. Corebridge's 2023 launch of an ESG-focused insurance product line directly addresses increasing investor demand for sustainable options.

Similarly, the Power Select AICO annuity is a Star. The fixed index annuity market saw robust growth in 2023, with total annuity sales reaching an estimated $318.1 billion, according to LIMRA. Power Select AICO's innovative AICO feature, offering principal protection and market-linked growth, aligns perfectly with investor demand in this expanding segment.

| Product/Initiative | BCG Category | Key Growth Drivers | Market Data/Projections |

|---|---|---|---|

| MarketLock RILA | Star | Expansion in registered index-linked annuity market; strong initial reception. | High market adoption anticipated. |

| Digital Retirement Planning Tools | Star | Targeting high-growth digital financial planning sector; consumer demand for accessible planning. | Aggressively capturing market share. |

| ESG-Focused Investment Solutions | Star | Increasing investor preference for sustainable options; 2023 ESG insurance product line launch. | Global ESG market projected to exceed $53 trillion by 2025. |

| Power Select AICO | Star | Innovative AICO feature; demand for principal protection and market participation. | Fixed index annuity market strong; total annuity sales $318.1 billion in 2023. |

What is included in the product

This BCG Matrix analysis categorizes Corebridge Financial's offerings into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

A clear BCG Matrix visualizes Corebridge's portfolio, easing the pain of strategic uncertainty.

Cash Cows

Traditional fixed annuities represent a significant cash cow for Corebridge Financial, with a substantial base of premiums and deposits. These products are a cornerstone of their Individual Retirement segment, consistently generating predictable income. In 2024, the demand for stable income solutions like fixed annuities remained robust, particularly as interest rate environments offered more attractive yields compared to recent years, supporting their cash flow generation.

Established Group Retirement Plans are a cornerstone of Corebridge Financial's offerings, serving non-profit organizations and employers. This segment represents a stable and mature part of their business, contributing significantly to their overall revenue.

While the shift from spread-based to fee-based revenue models is occurring, these group plans remain a substantial and dependable source of fee income for Corebridge. In 2024, Corebridge reported strong performance in its retirement solutions, with assets under management in this segment consistently growing, underscoring its 'cash cow' status.

Basic term life insurance products are a cornerstone for Corebridge Financial, holding a significant market share within the mature life insurance sector. These policies are known for their predictable premium streams and benefit from lower ongoing marketing expenses once established, contributing to their cash cow status. For instance, in 2024, Corebridge continued to see robust demand for these foundational products, reflecting their enduring appeal and stable revenue generation.

Guaranteed Investment Contracts (GICs)

Corebridge Financial's consistent issuance of Guaranteed Investment Contracts (GICs) positions them firmly within the Cash Cows quadrant of the BCG Matrix. The company has achieved over $1 billion in GIC issuance for five consecutive quarters, demonstrating a robust and sustained market presence in this segment.

These GICs are characterized as stable, low-growth products. Their appeal lies in providing predictable and consistent cash flows, a valuable attribute for investors seeking to de-risk their portfolios, particularly within institutional markets where such solutions are in high demand.

- Consistent Issuance: Corebridge has issued over $1 billion in GICs for five consecutive quarters.

- Market Position: This sustained issuance indicates a strong and stable market position in the GIC sector.

- Product Characteristics: GICs are recognized for their stability and low growth, serving as reliable cash flow generators.

- Demand Driver: The demand for de-risking solutions in institutional markets underpins the continued success of GICs.

Institutional Markets Offerings

Corebridge Financial’s institutional markets offerings are designed to bolster financial resilience for organizations. These solutions are a cornerstone of their business, consistently contributing to adjusted pre-tax operating income. In 2024, the institutional segment demonstrated this stability, reflecting the mature nature of the financial services landscape for businesses and large entities.

The company's established relationships and robust product suite within the institutional sector ensure a steady revenue stream. This segment benefits from long-term partnerships and a predictable demand for financial solutions that enhance an organization's stability and long-term planning. For instance, Corebridge's group retirement and institutional investment business saw continued engagement from clients seeking reliable financial management tools.

- Stable Revenue Contribution: Institutional markets provide a consistent and significant portion of Corebridge's adjusted pre-tax operating income, highlighting their role as a cash cow.

- Established Relationships: Deep-rooted partnerships within the institutional sector foster loyalty and predictable business flows.

- Mature Market Presence: Corebridge leverages its experience in a well-understood market to deliver reliable financial solutions to organizations.

- Financial Resilience Focus: Offerings are geared towards helping institutions build and maintain financial strength, a key driver of continued demand.

Corebridge Financial's traditional fixed annuities are a prime example of a cash cow, consistently generating predictable income from a large premium base. In 2024, the demand for these stable income solutions remained strong, supported by more favorable interest rate environments that boosted their cash flow generation.

Established Group Retirement Plans are another significant cash cow for Corebridge, providing a stable and mature revenue stream from non-profit organizations and employers. Despite a market shift towards fee-based models, these plans continue to be a dependable source of fee income, with assets under management showing consistent growth in 2024.

Basic term life insurance products, with their predictable premium streams and lower ongoing marketing costs, are a foundational cash cow for Corebridge. The enduring appeal of these products ensured robust demand and stable revenue generation throughout 2024.

Guaranteed Investment Contracts (GICs) are a strong cash cow for Corebridge, evidenced by over $1 billion in issuance for five consecutive quarters, demonstrating a stable market position. These low-growth, stable products are highly sought after in institutional markets for their reliable cash flow generation, particularly for investors looking to de-risk.

| Product Segment | BCG Matrix Quadrant | 2024 Performance Indicator | Key Driver |

|---|---|---|---|

| Traditional Fixed Annuities | Cash Cow | Robust demand for stable income | Favorable interest rates |

| Established Group Retirement Plans | Cash Cow | Consistent AUM growth | Dependable fee income |

| Basic Term Life Insurance | Cash Cow | Stable revenue generation | Predictable premiums, low marketing costs |

| Guaranteed Investment Contracts (GICs) | Cash Cow | Over $1 billion issuance for 5 consecutive quarters | Demand for de-risking solutions |

What You See Is What You Get

Corebridge Financial BCG Matrix

The Corebridge Financial BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, offers a detailed breakdown of Corebridge Financial's business units within the BCG framework, ready for your strategic decision-making. You can confidently use this preview as an accurate representation of the final, fully formatted report that will be yours to download and integrate into your business planning.

Dogs

Outdated legacy life insurance policies, often characterized by less competitive features and higher administrative costs, are likely candidates for the Dogs quadrant in a BCG Matrix analysis. These older products, especially those lacking modern benefits or digital accessibility, face low growth potential and declining market share, yielding minimal returns for Corebridge Financial.

For instance, a traditional whole life policy issued in the 1980s might have guaranteed cash values that are significantly lower than current market offerings, making it unattractive to new buyers and potentially a drag on profitability. In 2024, the continued reliance on paper-based processes for these legacy products further exacerbates their inefficiency and limits their ability to compete in an increasingly digital insurance landscape.

Before its reinsurance deal with Venerable, Corebridge Financial's variable annuities with high guarantees were a significant drain. These products, particularly those offering generous guaranteed minimum benefits, were cash-consuming due to the inherent market risks and the substantial costs associated with hedging those risks.

The company previously held approximately $20 billion in statutory reserves for these guaranteed products, representing a substantial capital commitment. The ongoing need to manage market volatility and fulfill these long-term guarantees meant this segment required continuous investment and attention, fitting the profile of a 'Dog' in the BCG matrix.

Certain niche retirement plans, often characterized by their lack of flexibility and limited digital features, are seeing reduced employer adoption. These plans may struggle to meet modern employee expectations for portability and a wide array of investment choices, leading to a shrinking market presence. For instance, older defined benefit plans, while still valuable, are less common for new hires compared to defined contribution plans.

These specialized plans could be categorized as Dogs within the BCG matrix if the cost of maintaining them outweighs their potential for growth or profitability. Consider plans that require significant administrative overhead but have a declining participant base or limited appeal to younger workforces. Data from 2024 indicates a continued shift towards more adaptable and digitally-enabled retirement solutions, further pressuring these older, less agile offerings.

Products with Declining Base Spread Income due to Rate Changes

Corebridge Financial's products heavily reliant on base spread income, especially those sensitive to short-term interest rate fluctuations without immediate pricing adjustments, may be experiencing a decline in profitability. These offerings could be categorized as potential 'Dogs' within the BCG matrix, indicating a low-growth, low-profitability scenario until strategic adjustments are made.

For instance, certain fixed annuity products issued in prior years, when interest rates were lower, might now face a compressed spread as new money yields on their reserves rise faster than the crediting rates on existing policies. This dynamic can lead to reduced net investment income. In 2023, for example, a significant portion of the annuity market saw increased sensitivity to rate changes, impacting the profitability of older blocks of business.

- Products with declining base spread income: Fixed annuities with long-duration liabilities and fixed crediting rates.

- Impact of rate changes: Rising short-term rates can increase the cost of reserves without a corresponding increase in revenue from older policies.

- 2024 outlook: Continued rate volatility poses a risk to spread income for products lacking rate-reset features.

- Strategic consideration: Re-pricing or hedging strategies may be necessary to mitigate the negative impact on profitability.

Certain Less Competitive Fixed Annuity Offerings

Within Corebridge Financial's fixed annuity offerings, certain products that lack competitive guaranteed rates or innovative features compared to newer market alternatives might be categorized as Dogs. These less appealing annuities could see a slowdown in new deposits and a shrinking market share.

For instance, if a particular fixed annuity product from 2023 was offering a guaranteed rate of 3.5% while competitors were actively marketing 4.25% or higher, it would likely struggle to attract new business. This disparity in returns directly impacts its competitive standing and revenue generation potential.

- Declining Deposits: Products with uncompetitive rates often experience a significant drop in new premium inflows.

- Reduced Market Share: As consumers opt for more attractive offerings, these annuities lose their slice of the market.

- Lower Profitability: With fewer new assets, the overall profitability of these specific annuity products diminishes.

- Potential for Divestment: In some cases, companies might consider discontinuing or selling off such underperforming products.

Products classified as Dogs within Corebridge Financial's portfolio are those with low market share and low growth potential, often representing legacy offerings that are no longer competitive. These may include older life insurance policies with less attractive features or certain niche retirement plans that have seen declining employer adoption. The continued reliance on these products can strain resources without generating significant returns.

For instance, a traditional whole life policy issued in the 1980s, with its lower guaranteed cash values and paper-based administration, exemplifies a Dog. Similarly, variable annuities with high, costly guarantees, like those Corebridge previously managed, required substantial capital for hedging and risk management, fitting the Dog profile due to their cash-consuming nature and limited growth prospects.

In 2024, Corebridge Financial's focus on optimizing its product portfolio means identifying and managing these Dog products. This might involve strategies to phase them out, reinsure them, or minimize the costs associated with their continued administration, thereby freeing up capital for more promising ventures.

Corebridge Financial's fixed annuity products that offer uncompetitive guaranteed rates or lack innovative features are also likely candidates for the Dogs quadrant. These products, struggling to attract new deposits due to lower yields compared to market alternatives, face shrinking market share and reduced profitability, potentially necessitating strategic decisions regarding their future.

Question Marks

Corebridge Financial's investment in new digital client engagement platforms for retirement plan participants is currently positioned as a Question Mark within the BCG Matrix. The company is channeling significant resources into creating enhanced digital experiences, aiming to draw in more users and boost their interaction with retirement planning tools. This strategic push reflects a recognition of the evolving digital landscape and the need to stay competitive.

Despite the substantial investment, the ultimate success of these platforms in capturing significant market share and achieving sustained profitability remains uncertain. The digital space for financial services is highly competitive, with many established players and innovative newcomers vying for attention. Corebridge's commitment to this area underscores its ambition to lead in participant engagement, but the return on this investment is still in the early stages of development and requires further validation.

The financial advisory landscape is rapidly evolving with the integration of Artificial Intelligence (AI). These AI-driven tools are designed to offer personalized financial planning and investment advice, catering to a growing demand for sophisticated yet accessible financial solutions. The market for these technologies is experiencing significant growth, with projections indicating a substantial expansion in the coming years.

Corebridge Financial is likely evaluating or actively developing its own AI-driven advisory and planning capabilities. Entering this high-growth market presents a strategic opportunity for Corebridge to innovate and enhance its client services. However, given the nascent stage of many such initiatives within established firms, Corebridge's current market share and profitability in this specific segment are probably minimal, placing these ventures in the question mark category of the BCG matrix.

Corebridge Financial is likely exploring expansion into emerging niche insurance markets such as cyber insurance for individuals and specialized coverage for the gig economy. These represent new ventures with significant growth potential, though Corebridge's current market share in these segments is expected to be minimal. For instance, the global cyber insurance market was valued at an estimated $10.5 billion in 2023 and is projected to grow substantially, reaching potentially $30 billion by 2028, indicating a fertile ground for new entrants.

Personalized Wealth Management Solutions for Younger Demographics

Corebridge Financial's focus on younger demographics like Millennials and Gen X for retirement planning represents a strategic move into a high-growth market. These generations, increasingly prioritizing long-term financial security, are ripe for tailored wealth management solutions. Corebridge's investment in attracting these segments is crucial for building future market share.

Attracting these emerging client segments requires significant investment in digital platforms and personalized advice. For instance, by Q1 2024, over 60% of Millennials expressed a desire for digital-first financial planning tools. Corebridge's tailored offerings, such as accessible investment products and financial education resources, are designed to meet this demand.

- Targeting Millennials and Gen X: These demographics are increasingly focused on long-term financial security, making them a prime target for retirement planning and wealth management.

- Investment in Tailored Solutions: Corebridge is investing in developing digital platforms and personalized advice to attract these younger client segments.

- Market Share Growth: Success in attracting these demographics is essential for Corebridge to build significant market share in the coming years.

- Digital Engagement: Over 60% of Millennials in early 2024 indicated a preference for digital-first financial planning tools, highlighting the importance of technology in this strategy.

Strategic Partnerships for New Distribution Channels

Corebridge Financial's collaboration with Market Synergy Group for its Power Select AICO index annuity highlights a strategic move to tap into novel distribution avenues. This partnership, announced in early 2024, aims to broaden the reach of this specific product, potentially increasing its market penetration.

While the full extent of market share and revenue generation from such targeted alliances is still unfolding, these ventures are characteristic of a company seeking to diversify its sales channels and product adoption. The success of such partnerships will be a key indicator of Corebridge's ability to execute on its growth strategies for specialized offerings.

- Market Expansion: Partnerships like the one with Market Synergy Group are designed to open up new customer segments and geographic regions for Corebridge's annuity products.

- Product-Specific Focus: The collaboration is centered on the Power Select AICO index annuity, suggesting a strategy to tailor distribution efforts to specific financial instruments with growth potential.

- Developing Impact: The long-term success and market share gains from these new distribution channels are still in the early stages of measurement, making them a developing factor in Corebridge's overall market position.

Corebridge Financial's ventures into new digital client engagement platforms and AI-driven advisory tools are currently classified as Question Marks. These initiatives represent significant investments in high-growth areas with uncertain market capture and profitability. The company is actively pursuing these opportunities to enhance client experience and innovate service offerings, reflecting a strategic pivot towards digital transformation and personalized financial solutions.

The company's investment in new digital client engagement platforms for retirement plan participants is a prime example of a Question Mark. While Corebridge is dedicating substantial resources to these platforms, their ability to gain significant market share and achieve profitability is not yet established. The competitive digital financial services landscape means these investments carry inherent risk, but also the potential for substantial future rewards.

Similarly, Corebridge's exploration of AI-driven advisory services places it in the Question Mark category. The market for AI in financial advice is rapidly expanding, with projections showing significant growth. Corebridge's entry into this segment, while promising for innovation and client service enhancement, likely represents a minimal current market share, making its future success a key area to watch.

Emerging niche insurance markets, such as cyber insurance and coverage for the gig economy, also fall under the Question Mark designation for Corebridge. The global cyber insurance market, valued at $10.5 billion in 2023, is expected to grow substantially. Corebridge's minimal current market share in these areas signifies a strategic bet on future growth potential rather than established dominance.

| Initiative | Market Attractiveness | Current Market Share | Strategic Implication |

|---|---|---|---|

| Digital Client Engagement Platforms | High (Evolving digital landscape) | Low (Uncertain capture) | Investment for future growth, competitive necessity |

| AI-Driven Advisory Services | Very High (Rapidly expanding market) | Minimal (Nascent stage) | Innovation opportunity, potential disruption |

| Niche Insurance Markets (e.g., Cyber) | High (Significant growth projections) | Minimal (New entrant) | Diversification, tapping into underserved needs |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.