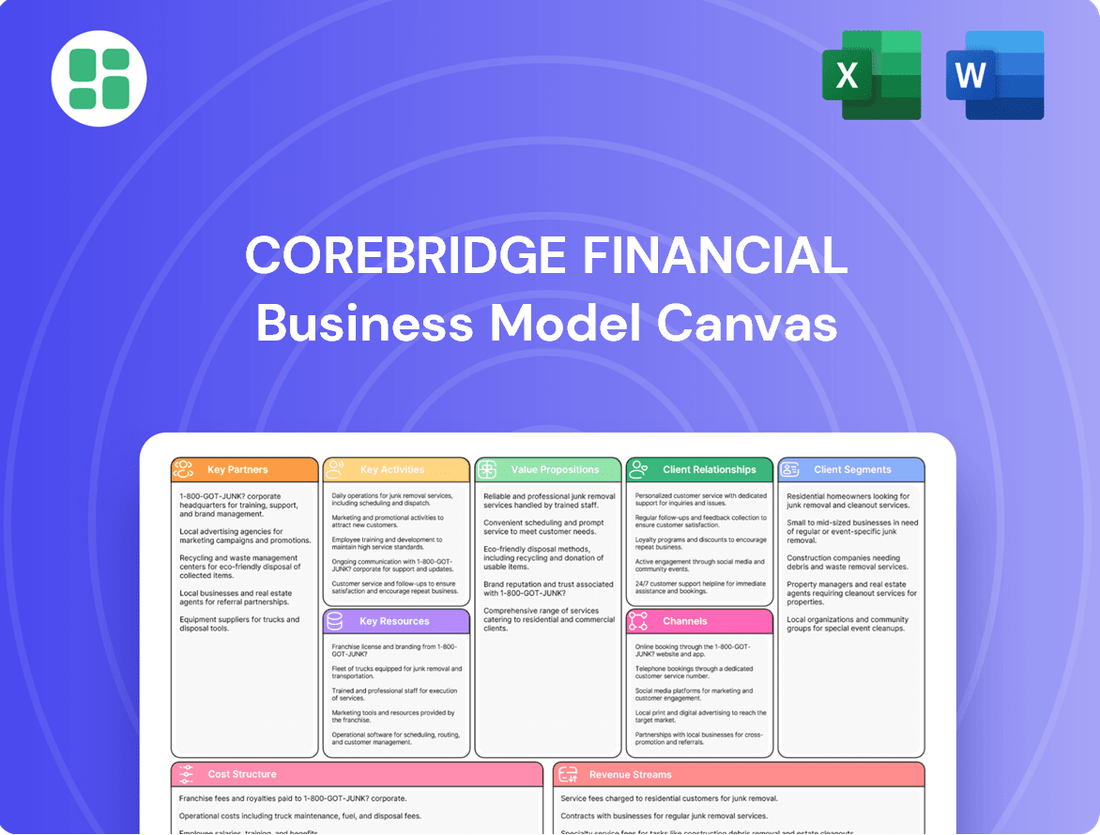

Corebridge Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corebridge Financial Bundle

Unlock the strategic blueprint behind Corebridge Financial's success with our comprehensive Business Model Canvas. Discover their key customer segments, value propositions, and revenue streams that drive their market leadership. This detailed canvas is your key to understanding their operational excellence and competitive advantage.

Partnerships

Corebridge Financial collaborates with independent financial advisors, wealth management firms, and major broker-dealers to offer its retirement and insurance solutions. These alliances are vital for accessing a wide range of clients and capitalizing on established client connections.

These partnerships serve as a trusted conduit for product sales and sustained client assistance, thereby strengthening Corebridge’s extensive distribution network. As of the first quarter of 2024, Corebridge reported total assets under management and administration of $1.4 trillion, underscoring the significant reach these channels provide.

Corebridge Financial's collaborations with Third-Party Administrators (TPAs) are crucial for its group retirement solutions. These partnerships enable Corebridge to effectively manage the intricate administrative needs of employer-sponsored retirement plans, ensuring smooth operations for institutional clients.

By leveraging TPAs' specialized expertise, Corebridge provides comprehensive services including efficient plan setup, accurate record-keeping, and diligent compliance management. This allows Corebridge to extend its operational capabilities and deepen its specialized knowledge within the group retirement market.

Corebridge Financial strategically partners with fintech and digital platform providers to bolster its technological infrastructure. These collaborations are crucial for refining client onboarding processes, enhancing customer service delivery, and advancing data analytics capabilities. For instance, by integrating with specialized platforms, Corebridge can offer more seamless digital experiences and leverage sophisticated tools for financial planning, ultimately streamlining operations.

These partnerships enable Corebridge to adopt cutting-edge digital automation, particularly in areas like underwriting and customer support. This focus on automation not only improves efficiency but also allows for quicker turnaround times and more personalized interactions with clients. The company's commitment to digital transformation, supported by these key alliances, positions it to better serve a digitally-native customer base and adapt to evolving market demands.

Reinsurers

Corebridge Financial actively partners with reinsurers to effectively manage and diversify its insurance risk. A prime example of this strategy is the significant variable annuity reinsurance transaction with Venerable, which was completed in 2023 and involved approximately $27 billion of reserves. This type of alliance is crucial for optimizing capital requirements and stabilizing earnings.

By transferring portions of its underwriting risk to reinsurers, Corebridge aims to reduce its overall risk profile and enhance the quality of its earnings. This strategic approach allows the company to maintain a more robust financial position and focus on core growth areas.

- Risk Diversification: Reinsurance allows Corebridge to spread its insurance liabilities across multiple parties, mitigating the impact of large or unexpected claims.

- Capital Optimization: By offloading certain risks, Corebridge can reduce the amount of capital it needs to hold against those risks, freeing up capital for other strategic initiatives.

- Earnings Stabilization: Reinsurance can smooth out the volatility of earnings that might otherwise result from fluctuations in mortality, morbidity, or investment performance.

- Venerable Transaction Impact: The 2023 deal with Venerable, transferring $27 billion in reserves, exemplifies Corebridge's commitment to proactive risk management and capital efficiency.

Strategic Investment Partners (e.g., Blackstone)

Corebridge Financial leverages a strategic partnership with Blackstone Inc., a global leader in alternative asset management. This collaboration is specifically designed to tap into Blackstone's extensive capabilities in originating privately sourced fixed-income assets. The aim is to bolster Corebridge's investment portfolio with attractive, yield-enhancing opportunities.

This alliance directly supports Corebridge's objective of improving risk-adjusted returns. By accessing Blackstone's expertise, Corebridge can more effectively implement liability-driven investing strategies, a crucial element for insurance companies. This partnership provides Corebridge with enhanced access to a diverse range of high-quality fixed-income investments, which are essential for meeting long-term financial obligations.

- Blackstone Partnership: Corebridge collaborates with Blackstone to access privately sourced fixed-income assets.

- Investment Enhancement: This partnership aims to boost risk-adjusted returns for Corebridge.

- Liability-Driven Investing: The collaboration supports Corebridge's strategy of matching assets with liabilities.

- Access to Quality Assets: It extends Corebridge's reach into high-quality fixed-income investment opportunities.

Corebridge Financial's key partnerships are instrumental in expanding its market reach and enhancing its service offerings. Collaborations with independent financial advisors, wealth management firms, and broker-dealers provide crucial access to a broad client base, as evidenced by Corebridge's $1.4 trillion in assets under management and administration as of Q1 2024.

Strategic alliances with Third-Party Administrators (TPAs) are vital for the efficient operation of its group retirement solutions, managing complex administrative tasks for employer-sponsored plans. Furthermore, partnerships with fintech and digital platform providers are accelerating Corebridge's digital transformation, improving client onboarding and customer service through automation.

The company also engages in significant reinsurance partnerships, such as the 2023 transaction with Venerable involving $27 billion in reserves, to manage risk and optimize capital. Additionally, its collaboration with Blackstone Inc. enhances its investment portfolio by providing access to privately sourced fixed-income assets, aiming to improve risk-adjusted returns.

What is included in the product

A comprehensive, pre-written business model tailored to Corebridge Financial's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Corebridge Financial, organized into 9 classic BMC blocks with full narrative and insights.

Corebridge Financial's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core components, enabling rapid identification of strategic elements.

This structured approach streamlines the understanding of their business, making it ideal for quick review and adaptation to new insights, thus alleviating the pain of complex strategic analysis.

Activities

Corebridge Financial actively innovates its retirement, group benefits, and life insurance offerings. This includes rigorous market research and actuarial analysis to ensure products align with customer needs and regulatory landscapes. For instance, the company focuses on developing and enhancing registered index-linked annuities (RILA) to capture growing investor interest in market participation with downside protection.

Underwriting and risk management are central to Corebridge Financial's operations, focusing on carefully assessing and managing the inherent risks in providing insurance and annuity products. This involves a thorough evaluation of factors like applicant health, financial standing, and lifestyle to set fair premiums and policy conditions.

A significant move in this area was Corebridge's 2024 variable annuity reinsurance deal with Global Atlantic, which transferred approximately $10 billion of reserves. This transaction underscores their strategic commitment to enhancing risk management capabilities and refining their business model for greater efficiency and capital optimization.

Corebridge actively manages investment portfolios to support its insurance and annuity liabilities, aiming to generate returns and ensure long-term financial stability. As of December 31, 2024, the company managed or administered $404.0 billion in client assets.

This involves strategic asset allocation, regular portfolio rebalancing, and diligent risk oversight to meet all policyholder obligations. Investment income plays a vital role in Corebridge's overall profitability.

Sales & Distribution

Corebridge Financial's sales and distribution strategy is multifaceted, focusing on reaching a wide array of customers through diverse channels. They actively market and sell retirement and insurance products, leveraging relationships with financial advisors, direct sales teams, and institutional partnerships.

The company boasts an extensive distribution network that provides access to various end markets. This includes engagement with consultants, retirement plan sponsors, banks, broker-dealers, general agencies, independent marketing organizations, and independent insurance agents.

- Broad Reach: Corebridge utilizes a comprehensive platform to connect with both individual and institutional clients.

- Channel Diversity: Sales efforts span financial advisors, direct channels, and strategic institutional alliances.

- Market Access: The distribution network effectively reaches retirement plan sponsors, banks, and independent agents.

- Product Promotion: Active marketing and sales of retirement and insurance solutions are central to their operations.

Customer Service & Claims Processing

Corebridge Financial's key activities include delivering exceptional customer service and efficiently processing claims. This involves promptly addressing policyholder inquiries and managing the claims lifecycle with speed and accuracy.

The company's commitment to this area is underscored by its substantial payouts; Corebridge paid out $51 billion in claims and benefits between 2020 and 2024. This significant financial commitment highlights the scale of their operations and their dedication to policyholders.

- Customer Support: Offering responsive and helpful assistance to policyholders for all their needs.

- Claims Management: Expediting the processing of claims to ensure timely and fair resolutions.

- Policyholder Relations: Building and maintaining trust through consistent, positive interactions.

- Financial Payouts: Demonstrating reliability by disbursing $51 billion in claims and benefits from 2020-2024.

Corebridge Financial's key activities revolve around product innovation, robust underwriting, strategic investment management, and extensive sales and distribution. They also prioritize efficient claims processing and customer service.

| Key Activity | Description | Supporting Data/Examples |

|---|---|---|

| Product Innovation | Developing and enhancing retirement, group benefits, and life insurance products. | Focus on registered index-linked annuities (RILA). |

| Underwriting & Risk Management | Assessing and managing risks associated with insurance and annuity products. | $10 billion variable annuity reinsurance deal with Global Atlantic in 2024. |

| Investment Management | Managing investment portfolios to support liabilities and generate returns. | Managed or administered $404.0 billion in client assets as of December 31, 2024. |

| Sales & Distribution | Reaching diverse customer segments through multiple channels. | Utilizes financial advisors, direct sales, and institutional partnerships. |

| Claims Processing & Service | Efficiently handling policyholder inquiries and claims. | Paid out $51 billion in claims and benefits between 2020 and 2024. |

Preview Before You Purchase

Business Model Canvas

The Corebridge Financial Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the final, comprehensive deliverable. Upon completing your order, you'll gain full access to this same professionally structured and content-rich Business Model Canvas, ready for your immediate use and customization.

Resources

Financial capital is absolutely essential for Corebridge Financial, acting as the bedrock for its operations. This substantial capital allows the company to underwrite insurance policies and fulfill its annuity obligations with confidence. It's also crucial for meeting stringent regulatory capital requirements, ensuring the company's stability and trustworthiness.

As of June 30, 2025, Corebridge Financial demonstrated its robust financial health by reporting holding company liquidity of $1.3 billion. This strong balance sheet is not just a number; it directly supports the company's day-to-day operations and fuels its ability to innovate and develop new products for its customers.

Corebridge Financial's success hinges on its human capital, a team of highly skilled actuaries, investment managers, and sales professionals. These experts are the engine behind product innovation, risk management, and client engagement.

Actuaries are vital for Corebridge's ability to accurately assess and price risk, ensuring the long-term sustainability of its insurance and retirement products. Investment managers, meanwhile, are tasked with optimizing portfolio performance, a critical factor in delivering returns for clients and the company.

Experienced sales professionals are indispensable for building and maintaining strong client relationships, driving revenue growth, and expanding market reach. This combination of specialized expertise represents a significant competitive advantage for Corebridge Financial in the dynamic financial services landscape.

Corebridge's proprietary technology and IT infrastructure are foundational to its operations. This includes robust policy administration platforms, sophisticated customer relationship management (CRM) tools, and advanced data analytics capabilities that drive efficiency and customer insights.

Significant investments have been made in digital automation for underwriting and customer support. For instance, in 2023, Corebridge continued to enhance its digital offerings, including new digital experiences for retirement plan participants, aiming to streamline engagement and service delivery.

This advanced infrastructure is critical for supporting digital distribution channels, enabling wider market reach and faster service. It also significantly boosts overall business agility, allowing Corebridge to adapt quickly to market changes and evolving customer needs.

Brand Reputation & Trust

Corebridge Financial leverages its significant brand reputation and the trust it has cultivated as one of the largest and most established life insurance and retirement solutions providers in the U.S. This strong standing directly translates into client confidence and acts as a powerful magnet for new customers seeking financial security.

The company's reputation for reliability and financial strength is a crucial differentiator in the competitive financial services landscape. This perception of stability is paramount for individuals and businesses entrusting their long-term financial well-being to Corebridge.

- Established Market Presence: Corebridge is recognized as a major player in the U.S. life insurance and retirement solutions market, underpinning its brand authority.

- Client Confidence: A strong reputation fosters trust, encouraging existing clients to remain loyal and attracting new ones seeking dependable financial partners.

- Financial Security Perception: Corebridge's image of reliability and financial stability is a key competitive advantage, reassuring customers about the safety of their investments.

Licenses & Regulatory Approvals

Corebridge Financial's ability to operate hinges on its extensive portfolio of licenses and regulatory approvals. These are not just checkboxes; they are the bedrock that allows the company to legally offer its diverse suite of insurance and retirement solutions across multiple markets. For instance, in 2024, maintaining robust capital levels well above regulatory targets, such as the risk-based capital (RBC) ratios for its insurance subsidiaries, remains a critical operational requirement.

These approvals are dynamic, requiring constant attention to ensure ongoing compliance with evolving financial regulations. Corebridge's commitment to maintaining good standing with bodies like the U.S. Securities and Exchange Commission (SEC) and state insurance departments is essential for uninterrupted business operations and customer trust. This includes adherence to solvency requirements and product filing mandates.

Key resources in this category include:

- Broad Geographic Licensing: Permits to operate and sell products in all target states and international markets.

- Product-Specific Approvals: Authorizations for each insurance and annuity product offered, ensuring compliance with design and disclosure rules.

- Capital Adequacy Certifications: Demonstrations to regulators that the company holds sufficient capital to meet its obligations, often exceeding statutory minimums. For example, maintaining RBC ratios above 300% for key entities.

- Good Regulatory Standing: Absence of significant enforcement actions or sanctions from regulatory bodies, reflecting a history of compliance.

Corebridge Financial's key resources are multifaceted, encompassing financial capital, human expertise, robust technology, a strong brand, and essential regulatory licenses.

Financial capital, including $1.3 billion in holding company liquidity as of June 30, 2025, underpins underwriting and regulatory compliance. Human capital, composed of actuaries, investment managers, and sales professionals, drives product innovation and client relationships. Proprietary technology, such as advanced data analytics and digital automation, enhances efficiency and customer engagement. The company's established market presence and reputation for reliability foster client confidence. Finally, broad geographic licensing and product-specific approvals are critical for legal operation and market access, with a commitment to maintaining capital adequacy, such as RBC ratios above 300% for key entities in 2024.

| Key Resource | Description | Supporting Data/Fact (as of latest available) |

| Financial Capital | Funds for operations, underwriting, and regulatory compliance. | $1.3 billion holding company liquidity (June 30, 2025). |

| Human Capital | Skilled professionals in actuarial, investment, and sales roles. | Experts driving product innovation, risk management, and sales. |

| Technology & Infrastructure | Proprietary platforms for policy administration, CRM, and data analytics. | Continued investment in digital automation for underwriting and customer support (2023 enhancements). |

| Brand Reputation | Trust and recognition as a leading life insurance and retirement provider. | Established market presence in the U.S. market. |

| Licenses & Approvals | Regulatory authorizations to operate and sell products. | Maintaining capital adequacy, with RBC ratios often exceeding 300% for key entities (2024). |

Value Propositions

Corebridge Financial provides individuals and institutions with essential tools to build lasting financial security and achieve their retirement aspirations. Their offerings, like annuities and comprehensive retirement plans, are designed to create dependable income streams, offering a crucial buffer against market volatility and ensuring assets are protected for the future.

This focus directly addresses the deep-seated human desire for stability and predictability in one's financial journey. For instance, in 2024, the U.S. personal saving rate hovered around 3.5%, highlighting a continued emphasis on safeguarding funds, a need Corebridge's products are well-positioned to meet by offering guaranteed income components.

Corebridge Financial offers a wide range of retirement and insurance products designed to fit individual needs. This includes customizable annuities, such as fixed, fixed index, registered index linked, and variable options, alongside various life insurance policies.

These solutions are adaptable, allowing clients to align their choices with specific financial goals and their comfort level with risk. For instance, in 2024, the demand for guaranteed income solutions within retirement planning continued to be strong, reflecting a desire for security in uncertain economic times.

Corebridge Financial champions expert guidance, offering clients direct access to seasoned financial professionals and a wealth of resources. This commitment empowers individuals to confidently navigate intricate financial landscapes and refine their planning strategies.

This support transcends mere product transactions, evolving into continuous assistance and educational opportunities. For instance, in 2024, Corebridge reported a significant increase in client engagement with their advisory services, indicating a strong demand for personalized financial counsel.

This proactive advisory model is designed to build client confidence, equipping them with the knowledge and tools necessary to make well-informed financial decisions that align with their long-term objectives.

Protection Against Financial Risks

Corebridge Financial's life insurance products are designed to shield individuals and families from unexpected financial shocks. These policies provide a crucial safety net, ensuring financial stability during life's most challenging moments.

This core offering directly tackles the fundamental human need for security and the desire to mitigate potential financial hardships. For instance, in 2024, the life insurance industry continued to be a vital component of financial planning, with millions of policies in force providing essential death benefit protection.

- Financial Security: Offers a guaranteed payout to beneficiaries upon the policyholder's death, covering expenses like mortgages, debts, and living costs.

- Risk Mitigation: Provides a buffer against unforeseen events such as premature death, safeguarding dependents' financial well-being.

- Peace of Mind: Alleviates anxiety about future financial uncertainties for individuals and their loved ones.

Diversified and Balanced Product Mix

Corebridge Financial’s value proposition centers on a robust and diversified product mix designed for resilience and attractive financial outcomes. The company strategically balances spread income, fee income, and underwriting margins across its key business segments: Individual Retirement, Group Retirement, Life Insurance, and Institutional Markets.

This diversified approach ensures stability, as different market conditions can favor various income streams. For instance, in 2024, while interest rate environments might impact spread income, strong market performance could boost fee income from retirement products. Similarly, life insurance underwriting margins remain a consistent contributor.

- Spread Income: Generated from investments backing insurance and annuity products, benefiting from stable interest rate environments.

- Fee Income: Derived from asset management and administrative services within retirement and institutional offerings, often linked to market performance.

- Underwriting Margin: The profit from life insurance policies, reflecting mortality experience and pricing accuracy.

- Resilience: The combined effect of these income sources provides a buffer against volatility in any single business line.

Corebridge Financial's value proposition is built on providing accessible financial solutions that foster security and growth. They offer a comprehensive suite of retirement and insurance products, including customizable annuities and life insurance policies, designed to meet diverse individual needs and risk tolerances.

This adaptability is key, as seen in the 2024 demand for guaranteed income solutions, reflecting a public desire for financial stability amidst economic shifts. Their diverse income streams, including spread, fee, and underwriting margins, create a resilient business model.

For example, in 2024, Corebridge's strategy to balance these income sources provided stability, with interest rates influencing spread income while market performance boosted fee income from retirement products.

Corebridge Financial emphasizes expert guidance, connecting clients with financial professionals and educational resources to navigate complex financial decisions confidently.

| Value Proposition Component | Description | 2024 Relevance |

|---|---|---|

| Financial Security & Retirement Planning | Annuities and retirement plans designed for dependable income streams and asset protection. | Addresses the 3.5% U.S. personal saving rate in 2024, highlighting a need for safeguarding funds. |

| Customizable Solutions | Flexible annuities (fixed, indexed, variable) and life insurance policies tailored to individual goals. | Meets the strong 2024 demand for guaranteed income solutions in retirement planning. |

| Expert Guidance & Support | Access to financial professionals and resources for informed decision-making. | Reflects increased client engagement with advisory services in 2024, showing a demand for personalized counsel. |

| Life Insurance Protection | Policies offering financial safety nets to shield individuals and families from unexpected events. | Reinforces the vital role of life insurance in financial planning, with millions of policies in force in 2024. |

Customer Relationships

Corebridge Financial's customer relationships are significantly shaped by dedicated advisor support. Financial advisors act as the primary point of contact, offering personalized guidance and continuous service to both individual investors and institutional clients. This direct, human element is crucial for building trust and delivering solutions that truly fit each client's unique needs.

This approach is particularly vital for Corebridge's complex financial products, which often demand expert interpretation and ongoing management. For instance, in 2024, the retirement services sector saw continued demand for personalized advice, with studies indicating that a significant majority of individuals feel more confident about their financial future when working with an advisor. Corebridge leverages this by ensuring their advisors are equipped to navigate these intricate offerings, fostering deeper client loyalty and satisfaction.

Corebridge Financial leverages self-service digital platforms, including robust online portals and digital tools, allowing customers to independently manage accounts, access information, and conduct transactions. This approach caters to the growing demand for convenience and 24/7 accessibility among tech-savvy clients.

A significant development in this area was the February 2025 launch of a new digital experience specifically designed for retirement plan participants. This enhancement aims to further streamline user interaction and information access within Corebridge's retirement services.

Corebridge Financial offers extensive educational resources, including webinars and insightful content, designed to demystify financial planning, retirement strategies, and insurance. This commitment to client education empowers individuals to make more informed decisions, enhancing their financial literacy.

By providing these valuable tools, Corebridge positions itself as a trusted thought leader in the financial services industry. For instance, in 2024, the company continued to expand its digital learning library, offering over 50 new modules covering topics from basic investment principles to complex estate planning.

Proactive Communication & Updates

Corebridge Financial prioritizes keeping clients in the loop through proactive communication. This includes regular newsletters, timely market updates, and personalized alerts regarding policy performance and emerging opportunities. For instance, in 2024, Corebridge saw a significant increase in client engagement with their digital communication channels, with open rates on their policy update emails averaging 35%, demonstrating a strong client interest in staying informed.

- Newsletters and Market Insights: Regular dissemination of financial market trends and economic outlooks.

- Personalized Alerts: Timely notifications on policy changes, performance updates, and relevant investment opportunities.

- Client Education Resources: Providing accessible content to enhance financial literacy and understanding of products.

- Feedback Mechanisms: Establishing channels for clients to provide input and engage with the company.

Customer Service & Claims Support

Corebridge Financial prioritizes robust customer service and claims support, maintaining responsive channels for inquiries and policy adjustments. Their commitment to efficient claims processing is a cornerstone of client trust and loyalty.

- Customer Service Channels: Corebridge offers accessible avenues for policyholders to manage their accounts and seek assistance.

- Claims Processing Efficiency: The company focuses on streamlining the claims process to ensure timely payouts and support for beneficiaries.

- Financial Support: From 2020 through 2024, Corebridge Financial paid out a significant $51 billion in claims and benefits, demonstrating their capacity to meet client obligations.

- Client Trust: By providing empathetic and timely assistance, Corebridge aims to foster long-term relationships and reinforce client confidence in their services.

Corebridge Financial cultivates strong customer relationships through a multi-faceted approach, blending dedicated advisor support with advanced digital self-service options. This dual strategy ensures personalized guidance for complex needs while offering convenience for routine management. Educational resources and proactive communication further empower clients, fostering trust and loyalty.

Channels

Corebridge Financial heavily relies on independent financial advisors and Registered Investment Advisors (RIAs) to get its retirement and insurance products to individuals. These professionals act as crucial bridges, connecting Corebridge with a diverse client base who trust their guidance.

This distribution strategy taps into established client relationships, allowing for personalized advice and product recommendations. In 2024, the independent advisor channel remains a cornerstone of financial product distribution, with many firms reporting significant growth in assets managed through these relationships.

Corebridge Financial leverages extensive partnerships with major broker-dealer networks, a cornerstone of its distribution strategy. These collaborations grant access to a vast network of financial advisors who actively recommend Corebridge's annuity and life insurance products to their diverse client bases. This institutional channel is vital for achieving significant market penetration and scale.

In 2024, the U.S. annuity market saw substantial activity, with total annuity sales reaching an estimated $380 billion, according to industry reports. Corebridge's presence within these established broker-dealer networks allows it to tap into this robust market, facilitating the distribution of its offerings to a wide array of investors seeking retirement solutions.

Corebridge leverages its proprietary digital platforms and websites to connect directly with specific customer groups. These channels provide valuable information, user-friendly tools, and the potential for direct sales of less complex financial products, catering to digitally savvy consumers.

This direct approach enhances convenience and reduces operational costs, making it an efficient way to reach and serve a segment of the market. In February 2025, Corebridge rolled out an updated digital experience specifically designed for participants in retirement plans, aiming to improve engagement and access to plan information.

Employer & Institutional Sales Teams

Corebridge Financial leverages dedicated sales teams to directly engage with employers and institutions. These teams build relationships to offer group retirement plans and comprehensive employee benefits solutions, a critical strategy for accessing the substantial institutional market.

This direct outreach involves tailored presentations to key decision-makers within organizations, ensuring the value proposition of Corebridge's offerings is clearly communicated. This approach is vital for securing large-scale business partnerships.

- Relationship Building: Focuses on cultivating trust and understanding with organizational leaders.

- Targeted Solutions: Delivers customized retirement and benefits packages to meet specific institutional needs.

- Market Penetration: Essential for capturing significant market share within the employer and institutional sectors.

- Direct Engagement: Utilizes sales professionals for face-to-face or direct virtual interactions with prospects.

Employee Financial Advisors

Corebridge Financial leverages its own employee financial advisors to provide clients with access to a broad spectrum of out-of-plan financial products and services. These offerings include various annuity options, comprehensive advisory services, and brokerage products designed to supplement employer-sponsored retirement plans.

This direct advisory channel is crucial for helping individuals achieve their retirement savings objectives beyond the confines of 401(k)s or similar workplace arrangements. A significant focus is placed on facilitating IRA contributions and rollovers, ensuring clients have flexible avenues to grow their retirement nest egg.

- Product Spectrum: Annuities, advisory services, and brokerage products are offered.

- Client Goal Alignment: Supports retirement savings outside of employer plans.

- Key Vehicle: Emphasis on Individual Retirement Accounts (IRAs).

Corebridge Financial employs a multi-channel approach to reach its diverse customer base. This includes leveraging independent financial advisors and RIAs, major broker-dealer networks, proprietary digital platforms, direct sales teams targeting employers, and its own employee financial advisors. These channels collectively ensure broad market access and cater to varied client needs, from personalized advice to digital self-service and institutional solutions.

| Channel | Key Strategy | 2024/Early 2025 Data Point |

|---|---|---|

| Independent Advisors/RIAs | Utilizing established client relationships for product distribution. | Independent advisor channel showing significant growth in managed assets. |

| Broker-Dealer Networks | Accessing a vast network of advisors to recommend products. | U.S. annuity sales reached an estimated $380 billion in 2024. |

| Digital Platforms | Direct engagement with digitally savvy consumers for information and sales. | Updated digital experience for retirement plan participants launched Feb 2025. |

| Direct Sales Teams (Employers) | Building relationships for group retirement and benefits. | Focus on tailored presentations to secure large-scale partnerships. |

| Employee Financial Advisors | Providing out-of-plan products and advisory services. | Facilitating IRA contributions and rollovers for retirement savings. |

Customer Segments

Individual savers and retirees are a cornerstone for Corebridge Financial, representing those actively planning for or already enjoying retirement. This group seeks reliable ways to grow their nest egg and ensure a steady income stream, often turning to products like annuities and life insurance for security and wealth accumulation. For instance, in 2024, the U.S. retirement savings rate saw continued focus, with many individuals prioritizing long-term financial health.

Small to Medium-Sized Businesses (SMBs) are a crucial customer segment for Corebridge Financial, particularly those aiming to provide robust retirement plans like 401(k)s and other employee benefits. These businesses often prioritize solutions that are simple to manage, adhere to regulations, and are budget-friendly for their employees.

In 2024, a significant number of SMBs are actively seeking ways to enhance their employee value proposition. Data from the Bureau of Labor Statistics indicates that while larger companies are more likely to offer retirement plans, there's a growing trend among SMBs to bridge this gap to attract and retain talent.

SMBs value administrative ease and competitive benefit packages. They are looking for partners like Corebridge Financial that can simplify the complexities of plan administration, ensuring compliance and offering attractive options that resonate with their workforce, thereby boosting employee satisfaction and retention.

Large corporations and institutions, including government bodies and non-profits, represent a key customer segment for Corebridge Financial. These entities seek advanced group retirement plans and extensive employee insurance benefits. For instance, in 2024, the U.S. retirement market alone is valued in the trillions, with large employers playing a significant role in plan adoption and asset accumulation.

Their requirements are often intricate, demanding adherence to complex regulations, catering to a wide range of employee needs, and managing substantial asset pools. Corebridge's ability to provide robust administrative services and customized plan structures is crucial for serving this demanding market effectively.

Financial Advisors & Intermediaries

Financial advisors and broker-dealers are crucial intermediaries for Corebridge Financial, acting as both a distribution channel and a distinct customer segment. Corebridge must actively court these professionals by offering competitive products, robust sales support, and user-friendly tools. For instance, in 2024, the demand for accessible digital platforms for product quoting and application submission remains high among advisors, with many reporting that streamlined digital processes significantly influence their product selection.

These intermediaries prioritize several key factors when choosing to partner with an annuity provider. Their needs are centered on the ability to effectively serve their own clients, which translates to a demand for product competitiveness in terms of features and pricing, a simplified and efficient "ease of doing business," and dependable, responsive service. A recent industry survey indicated that over 70% of financial advisors consider the quality of a carrier's technology platform a critical factor in their distribution decisions for 2024.

- Product Competitiveness: Offering innovative annuity solutions with attractive features and competitive rates is paramount.

- Ease of Doing Business: Streamlined onboarding, digital tools for quoting and illustrations, and efficient application processing are essential.

- Reliable Service and Support: Prompt responses from wholesalers, accessible training, and dependable back-office support are highly valued.

- Marketing and Sales Tools: Providing advisors with effective marketing materials and sales aids helps them promote Corebridge products to their clients.

High-Net-Worth Individuals

High-net-worth individuals represent a crucial customer segment for Corebridge Financial, characterized by their intricate financial needs. These affluent clients typically require advanced retirement planning strategies, often involving sophisticated annuity products designed for wealth accumulation and income generation. Furthermore, they seek substantial life insurance coverage, not just for personal protection but as a vital tool for effective estate planning and seamless wealth transfer across generations. In 2024, the global high-net-worth population reached approximately 62.5 million individuals, managing an estimated $250 trillion in wealth, highlighting the significant market opportunity.

These clients demand highly customized financial solutions tailored to their unique circumstances and often prefer direct engagement with specialized financial advisors. Their primary objectives revolve around preserving existing wealth, achieving sustained growth, and optimizing their financial strategies for maximum tax efficiency. This segment values personalized advice and comprehensive wealth management services that address both current needs and long-term aspirations.

- Complex Financial Needs: Require advanced retirement planning and sophisticated annuity products.

- Estate Planning & Wealth Transfer: Seek substantial life insurance coverage for legacy building.

- Customized Solutions: Value personalized strategies and direct access to specialized advisors.

- Wealth Preservation & Growth: Focus on tax-efficient methods for maintaining and increasing assets.

Corebridge Financial serves a diverse clientele, from individual savers planning for retirement to large corporations seeking comprehensive employee benefits. Financial advisors are also a key segment, acting as vital distribution partners. In 2024, the focus on retirement security and employee benefits remained strong across all these groups.

High-net-worth individuals represent a significant opportunity, requiring sophisticated solutions for wealth preservation and estate planning. The global high-net-worth population in 2024 managed trillions in wealth, underscoring the demand for specialized financial products.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Individual Savers & Retirees | Retirement income, security | Continued focus on long-term financial health |

| Small to Medium-Sized Businesses (SMBs) | Employee retirement plans, ease of administration | Growing trend to offer competitive benefits |

| Large Corporations & Institutions | Advanced group retirement, extensive insurance | Significant role in market adoption and asset accumulation |

| Financial Advisors & Broker-Dealers | Product competitiveness, ease of business, service | High demand for accessible digital platforms |

| High-Net-Worth Individuals | Advanced planning, estate planning, wealth transfer | Significant market opportunity with substantial wealth managed |

Cost Structure

The most significant expense for Corebridge Financial is the money paid out to policyholders and their beneficiaries. This includes everything from life insurance claims to annuity payments. These payouts are the direct result of the company's promise to its customers.

Between 2020 and 2024, Corebridge disbursed a substantial $51 billion in claims and benefits. This figure highlights the core operational cost of fulfilling its insurance and annuity obligations.

Corebridge Financial's sales and distribution expenses are a significant component of its cost structure, directly impacting client acquisition and revenue generation. These costs primarily include commissions paid to a wide network of financial advisors, broker-dealers, and the company's internal sales force. For instance, in 2023, Corebridge reported $1.7 billion in selling, general, and administrative expenses, which encompasses these distribution costs, reflecting the substantial investment required to reach its diverse customer base.

Beyond sales commissions, marketing and advertising expenditures are also critical. These efforts are designed to build brand awareness, promote product offerings, and engage potential clients across various channels. The company's strategic allocation of resources to these areas is fundamental for achieving market penetration and driving overall business growth.

Operational and administrative costs are the backbone of Corebridge Financial's day-to-day functioning. These expenses encompass everything from the salaries of their dedicated back-office teams and the upkeep of their essential IT infrastructure to the cost of office spaces and general administrative overhead. These are the necessary investments to keep the business humming along smoothly.

Corebridge has been actively streamlining these expenses. A significant achievement is their 'CoreBridge Forward' initiative, which has driven a notable 14% reduction in general operating expenses since their Initial Public Offering. This impressive efficiency gain is largely attributed to their strategic focus on increased digitization and modernization across their operations.

Investment Management Fees & Expenses

Corebridge Financial incurs significant costs managing its investment portfolios, which are crucial for meeting its long-term liabilities. These expenses include fees paid to external asset managers and the salaries of its internal investment teams. For instance, in 2024, the company's investment management expenses are a key component of its operational cost structure, directly impacting profitability and the ability to generate returns on its substantial asset base.

These costs are vital for ensuring the long-term solvency and financial health of the company, as effective investment management is paramount to meeting policyholder obligations. Corebridge strategically leverages partnerships with leading firms like Blackstone to optimize its investment strategies and manage these costs efficiently.

- Investment Management Fees: Costs associated with external asset managers and internal investment personnel.

- Operational Impact: These fees directly influence the company's net investment income and overall profitability.

- Strategic Partnerships: Collaborations with firms like Blackstone are integral to managing these costs and enhancing investment performance.

- Solvency Assurance: Efficient management of these expenses is critical for maintaining the company's long-term financial stability.

Regulatory & Compliance Costs

Corebridge Financial faces substantial regulatory and compliance costs, a necessity for operating within the highly regulated financial services industry. These expenses are critical for maintaining licenses and avoiding significant penalties, making them non-negotiable aspects of the business model. For instance, in 2024, the financial sector globally saw continued increases in compliance spending, often driven by new data privacy laws and evolving capital requirements.

These costs encompass a range of activities, including legal counsel for interpreting and adhering to complex regulations, external audit fees to ensure financial integrity, and the establishment and maintenance of dedicated compliance departments. The dynamic nature of financial regulations necessitates continuous adaptation and ongoing investment to remain compliant.

- Legal Fees: Essential for navigating and interpreting intricate financial laws and regulations.

- Audit Costs: Incurred for independent verification of financial statements and operational compliance.

- Compliance Departments: Staffing and technology for monitoring, reporting, and enforcing regulatory adherence.

- Ongoing Investment: Continuous expenditure required to adapt to evolving regulatory landscapes.

Corebridge Financial's cost structure is dominated by policyholder payouts, which totaled $51 billion between 2020 and 2024, representing the core fulfillment of its insurance and annuity promises. Selling, general, and administrative expenses, including significant sales commissions and marketing efforts, were $1.7 billion in 2023, underscoring client acquisition investments. Operational efficiencies, driven by initiatives like 'CoreBridge Forward,' have reduced general operating expenses by 14% since its IPO, highlighting a focus on streamlining back-office functions and IT infrastructure.

| Cost Category | 2023 Data | 2024 Outlook/Notes |

|---|---|---|

| Policyholder Payouts | (Part of $51B from 2020-2024) | Continued significant expense, directly tied to policy obligations. |

| Selling, General & Administrative | $1.7 billion | Includes commissions, marketing, and operational overhead. |

| Investment Management | Key component of operational costs | Fees to external managers and internal teams, crucial for solvency. |

| Regulatory & Compliance | Ongoing significant investment | Legal fees, audits, and compliance departments to meet industry standards. |

Revenue Streams

Corebridge Financial generates substantial revenue from annuity premiums and deposits. This includes both initial payments when customers purchase annuities and ongoing deposits made into existing annuity products. This stream is a cornerstone of their business, providing predictable income.

For the year ending December 31, 2024, Corebridge reported an impressive $22.2 billion in total individual annuity sales. Their innovative new Registered Index-Linked Annuity (RILA) product alone surpassed $1 billion in sales within its first nine months on the market, highlighting strong customer demand and a significant recurring revenue opportunity.

Life insurance premiums are the bedrock of Corebridge Financial's revenue. This income originates from the regular payments policyholders make for coverage across a range of life insurance products. In 2024, Corebridge's life insurance segment demonstrated robust performance, with an increased underwriting margin, highlighting the effectiveness of their product offerings and risk management.

Corebridge Financial generates substantial revenue through its investment income and gains. This income stems from the strategic investment of both policyholder premiums and the company's own capital.

These investments yield returns in the form of interest income, dividends, and capital gains, all contributing to the company's overall profitability. For instance, in the second quarter of 2025, Corebridge reported a significant increase in net investment income, reaching $3.338 billion.

This robust investment performance is crucial because the earnings generated help to effectively offset the company's policyholder liabilities, ensuring financial stability and growth.

Fees from Group Retirement Plans

Corebridge Financial generates revenue through fees collected for the administration and management of group retirement plans offered to institutional clients. These fees are a crucial component of their institutional business, contributing to a stable and predictable income stream.

The fee structure can encompass various charges, including asset-based fees tied to the value of assets under management, record-keeping fees for managing participant accounts, and other service charges related to plan operation. This diversification within their business model, particularly the inclusion of Group Retirement, strengthens their overall fee income generation.

- Asset-Based Fees: Percentage of assets managed within group retirement plans.

- Record-Keeping Fees: Charges for maintaining participant accounts and processing transactions.

- Service Charges: Fees for additional administrative and support services provided to employers.

Product & Service Fees

Beyond the core premiums, Corebridge Financial generates significant revenue through various product and service fees. These ancillary charges are often tied to specific features, optional riders, or supplementary services that enhance the value proposition of their insurance and retirement products.

For the year ended December 31, 2024, Corebridge's fee income reached $2.1 billion. This demonstrates the substantial contribution of these fees to the company's overall revenue stream, reflecting the diverse ways customers engage with and utilize their offerings.

- Surrender Charges: Fees incurred when policyholders withdraw funds from certain products, like annuities, before a specified period.

- Policy Fees: Annual or periodic charges applied to maintain insurance policies or retirement accounts, covering administrative costs.

- Advisory Service Charges: Fees for specialized financial advice, planning, or investment management services offered alongside core products.

- Rider Fees: Charges for optional benefits or enhancements added to a base policy, such as guaranteed death benefits or living benefits.

Corebridge Financial's revenue streams are diversified, primarily driven by annuity sales and life insurance premiums. The company also benefits from investment income and various fees associated with its products and services.

In 2024, Corebridge reported robust performance across its segments. Individual annuity sales reached $22.2 billion, with a notable $1 billion in sales for their new RILA product within nine months. Life insurance also showed strength with improved underwriting margins.

| Revenue Stream | 2024 Data/Key Metric | Significance |

|---|---|---|

| Individual Annuity Sales | $22.2 billion | Significant premium and deposit income, predictable revenue. |

| Life Insurance Premiums | Increased underwriting margin | Core revenue from policyholder payments, demonstrates effective risk management. |

| Investment Income & Gains | Q2 2025: $3.338 billion (net investment income) | Returns from invested capital and premiums, offsets liabilities. |

| Fees (Product & Service) | $2.1 billion (fee income for 2024) | Ancillary charges for features, riders, and advisory services. |

| Group Retirement Fees | N/A (specific figure not provided, but a key component) | Asset-based, record-keeping, and service charges from institutional clients. |

Business Model Canvas Data Sources

The Corebridge Financial Business Model Canvas is built upon a foundation of extensive financial data, including internal performance metrics and industry benchmarks. This is supplemented by comprehensive market research and competitive analysis to ensure accurate representation of our strategic positioning.