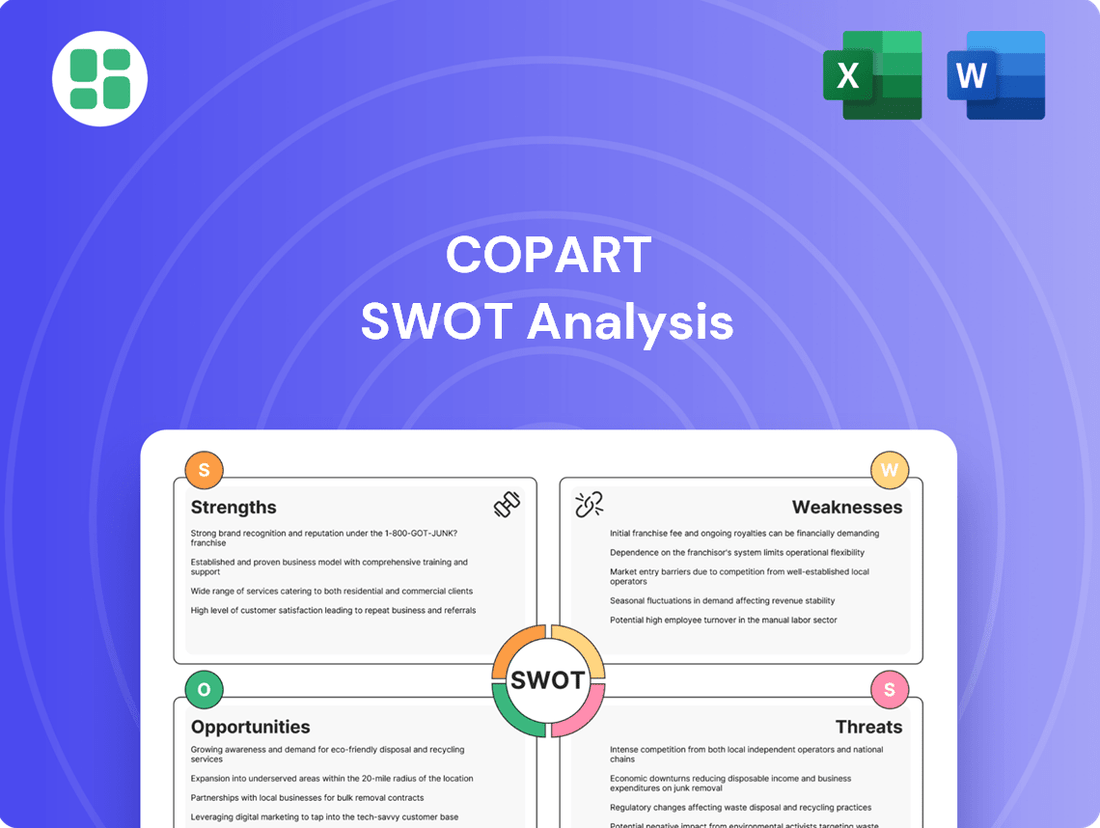

Copart SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Copart Bundle

Copart's market dominance is built on a robust online auction platform and extensive global reach, but it also faces intensifying competition and evolving regulatory landscapes. Understanding these dynamics is crucial for anyone looking to capitalize on its growth or mitigate potential risks.

Want the full story behind Copart's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Copart stands as a titan in the online vehicle auction space, often described as operating within a duopoly and holding a substantial portion of the market. This leadership is underpinned by its impressive global presence, with over 250 facilities strategically located across 11 countries. This extensive network not only grants broad access to both buyers and sellers but also enables the efficient processing of massive vehicle volumes, catering to a truly international clientele.

Copart's innovative online auction platform, particularly its VB3 virtual bidding system and mobile apps, is a significant strength. This technology, augmented by predictive analytics, creates a seamless and engaging experience for buyers worldwide. In 2023, Copart reported that approximately 90% of its sales were conducted virtually, highlighting the platform's dominance.

Copart's ownership of over 8,500 acres of physical salvage yards globally is a significant competitive advantage. This extensive land ownership provides immense storage capacity, crucial for managing a large volume of vehicles. By owning these facilities, Copart bypasses substantial rental expenses, contributing to its financial resilience and operational efficiency.

Diversified Revenue Streams and Strong Client Relationships

Copart's strength lies in its diversified client base, extending beyond insurance companies to include banks, dealerships, and rental car firms. This broad reach, exemplified by the growth in its 'Blue Car' service for financial and fleet customers, significantly mitigates risk by reducing dependence on any single market segment. For instance, in fiscal year 2023, Copart reported a substantial increase in revenue from its non-insurance channels, demonstrating the success of this diversification strategy.

The company cultivates deep, long-standing relationships with its diverse clientele, fostering loyalty and recurring business. These strong ties are crucial for maintaining a steady flow of vehicles, even during economic downturns. This client retention is a key driver of Copart's consistent performance and market leadership.

Key aspects of this strength include:

- Broad Client Spectrum: Serves insurance, financial institutions, dealerships, rental companies, and individuals.

- 'Blue Car' Growth: Demonstrates strong year-over-year expansion in services for banks, rental, and fleet customers.

- Reduced Market Reliance: Diversification enhances resilience against fluctuations in any one sector.

- Client Loyalty: Strong relationships foster consistent vehicle supply and repeat business.

Consistent Strong Financial Performance

Copart consistently showcases impressive financial strength, a key advantage. The company has achieved steady revenue increases, maintained healthy gross profit margins, and reported strong net income figures. This financial resilience is a testament to its well-executed business strategy and efficient operations.

- Consistent Revenue Growth: Copart saw a notable 14% revenue increase in Q2 2025 and a 12.4% rise in Q1 2025.

- Healthy Profitability: The company maintains robust gross profit margins, indicating efficient cost management.

- Strong Net Income: Consistent positive net income reflects the company's ability to translate revenue into profit.

- Financial Stability: This track record of strong financial performance provides a solid foundation for future growth and investment.

Copart's financial health is a significant strength, marked by consistent revenue growth and robust profitability. This financial stability allows for continued investment in its platform and global expansion. For instance, the company reported a 14% revenue increase in Q2 2025 and a 12.4% rise in Q1 2025, showcasing its strong performance trajectory.

| Financial Metric | Q1 2025 | Q2 2025 |

|---|---|---|

| Revenue Growth | 12.4% | 14.0% |

| Gross Profit Margin | Strong and consistent | Strong and consistent |

| Net Income | Positive and growing | Positive and growing |

What is included in the product

Analyzes Copart’s competitive position through key internal and external factors, detailing its strengths in technology and global reach, weaknesses in auction fees, opportunities in emerging markets, and threats from competition and regulatory changes.

Identifies key areas for improvement and competitive advantage, easing the burden of strategic planning.

Weaknesses

Copart has seen its operating expenses climb, with facility costs and general administrative spending on the rise. This surge is partly due to necessary investments in expanding their operational footprint and the unexpected expenses from severe weather events, such as the significant impact of hurricanes in recent years.

For example, in fiscal year 2023, Copart reported a notable increase in operating expenses, which, while supporting their aggressive growth strategy, directly impacted their profitability metrics if not offset by revenue gains.

Copart's financial health is notably susceptible to shifts in the broader economic landscape. Factors like rising interest rates or persistent inflation can dampen consumer spending, directly impacting the demand for Copart's vehicle auction services. For instance, during periods of economic contraction, individuals and businesses may postpone vehicle purchases or repairs, leading to reduced auction volumes and consequently, lower revenue for Copart.

A significant weakness for Copart is the potential impact of declining used vehicle prices on its revenue. While higher total loss rates are beneficial, a general drop in the market value of used cars means Copart's salvaged vehicles will also fetch lower prices. This can make year-over-year revenue comparisons challenging, even if the company processes more units.

For instance, if the average selling price per vehicle decreases, Copart might see its total revenue stagnate or even decline, despite processing a greater volume of vehicles. This creates a perception of underperformance, even if the underlying business operations, like auction volume, are robust. This was a factor in early 2024 as used car values softened after a period of sharp increases.

Vulnerability to Uninsured Motorist Ratios

Copart's business model relies heavily on a consistent supply of vehicles from insurance companies. An increase in the number of uninsured drivers can significantly disrupt this flow. If more drivers are uninsured, fewer accidents will be processed through insurance claims, directly impacting the volume of totaled vehicles available for Copart's auctions. This is a critical weakness that could limit inventory growth.

Furthermore, rising vehicle insurance premiums, a trend observed in 2024 and projected to continue into 2025, could push more consumers to drop their coverage. This would further shrink the pool of insurance-related salvage vehicles, impacting Copart's core revenue streams. For instance, in late 2024, some reports indicated double-digit percentage increases in auto insurance rates in several key U.S. states, a factor that could exacerbate this vulnerability.

- Disruption to Inventory: A growing uninsured motorist population directly reduces the supply of vehicles from insurance companies, Copart's primary inventory source.

- Impact of Rising Premiums: Higher insurance costs may lead more individuals to forgo coverage, thus decreasing the availability of insurance-salvaged vehicles.

- Modest Offset to Growth: This vulnerability presents a potential headwind, acting as a modest offset to the growth Copart experiences in its core insurance salvage business.

Inventory Management Challenges

Copart faces ongoing inventory management hurdles, as evidenced by a reported decrease in U.S. inventory units. This dip is attributed to a combination of fewer vehicle assignments and accelerated processing times. Such volatility in inventory can pose a challenge to meeting growth targets and ensuring a steady supply of vehicles for its diverse buyer base.

The company's operational efficiency is tested by the need to balance rapid inventory turnover with maintaining sufficient stock levels. For instance, in the fiscal year ending July 31, 2023, Copart's U.S. inventory units saw fluctuations, impacting their ability to consistently meet buyer demand and potentially affecting revenue streams that rely on a robust inventory pipeline.

- Decreased U.S. Inventory Units: A notable decline in available vehicles has been observed, impacting supply consistency.

- Faster Cycle Times: Vehicles are processed and sold more quickly, contributing to lower average inventory on hand.

- Growth Pressure: Fluctuations in inventory levels can create pressure on projected growth and revenue expectations.

- Balancing Act: Maintaining efficient inventory management while ensuring quick turnover remains a persistent operational challenge for Copart.

Copart's reliance on insurance companies for inventory makes it vulnerable to an increasing number of uninsured drivers. This trend, amplified by rising insurance premiums in 2024 and projected into 2025, could reduce the supply of salvage vehicles. For example, some U.S. states saw double-digit insurance rate hikes in late 2024, potentially pushing more drivers to drop coverage.

Furthermore, declining used vehicle prices, observed in early 2024, can negatively impact the selling prices of Copart's salvaged inventory, even if auction volumes increase. This price sensitivity creates a direct challenge to revenue growth and profitability, as lower per-vehicle realization can offset higher processing volumes.

Operational challenges include managing inventory fluctuations, as seen with a decrease in U.S. inventory units. This is partly due to faster processing times, which while efficient, can strain the ability to meet consistent buyer demand and growth targets.

| Weakness | Description | Potential Impact |

|---|---|---|

| Uninsured Motorists & Rising Premiums | Fewer insured drivers and more people dropping coverage due to high premiums (e.g., double-digit increases in some U.S. states in late 2024). | Reduced supply of vehicles from insurance companies, impacting core revenue streams. |

| Declining Used Vehicle Prices | Softening used car values (observed in early 2024) reduce the selling price of salvaged vehicles. | Lower revenue per vehicle, potentially stagnating total revenue despite higher volumes. |

| Inventory Management Hurdles | Decreased U.S. inventory units and faster processing times lead to lower average inventory on hand. | Challenges in consistently meeting buyer demand and achieving growth targets. |

What You See Is What You Get

Copart SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Modern vehicles are packed with advanced technology, from sophisticated sensors to complex infotainment systems. This complexity, while offering drivers more features, also drives up repair costs significantly. Consequently, insurance companies are increasingly finding it more economical to declare these vehicles a total loss rather than authorizing expensive repairs.

This trend is a direct boon for Copart, as a higher number of total loss vehicles translates into more inventory for their salvage auctions. For instance, the average repair cost for vehicles involved in accidents has been on an upward trajectory. In 2024, estimates suggest these costs are 15-20% higher than in previous years, pushing more vehicles into the total loss category.

Looking ahead to 2025, this structural shift is expected to accelerate. As vehicle technology continues to advance and repair expertise remains concentrated, the cost-benefit analysis for insurers will continue to favor total loss declarations. This sustained increase in salvageable inventory provides a robust and growing revenue stream for Copart’s core business.

Copart has a significant runway for growth by expanding into emerging international markets where its online auction model is less established. This offers a chance to tap into new customer bases and increase market share.

The company's existing success in markets like the UK, Germany, and Brazil demonstrates its ability to adapt and thrive globally. This existing infrastructure provides a solid foundation for further international penetration and revenue diversification.

By strategically entering and developing these new territories, Copart can capture growing demand for used and salvage vehicles, bolstering its long-term revenue trajectory and reducing reliance on any single market.

Copart's strategic push into non-insurance segments, like its Blue Car service catering to banks, rental companies, and fleets, shows significant promise. This diversification taps into new revenue streams and client bases, reducing reliance on traditional insurance salvage.

The acquisition of Purple Wave, focused on heavy machinery and farm equipment auctions, further broadens Copart's market reach. This move allows the company to leverage its auction expertise in sectors beyond automotive, presenting substantial growth opportunities.

Continued Leverage of AI and Digital Innovation

Copart can continue to capitalize on AI and digital advancements, particularly in refining vehicle assessment and predictive valuation. This allows for more accurate pricing and faster processing of inventory. For instance, in 2023, Copart reported a 12% increase in revenue, partly driven by their investments in technology that enhance efficiency and buyer accessibility.

Further investment in AI can optimize logistics, reducing transportation costs and delivery times, which is crucial for a high-volume business like Copart. Enhanced customer engagement through AI-powered tools, such as personalized recommendations and improved search functionalities, can also lead to higher auction participation and conversion rates. Copart's commitment to innovation was highlighted by their ongoing development of proprietary auction platforms, which saw significant user growth throughout 2024.

- AI-driven vehicle assessment: Enhancing accuracy and speed in grading damaged vehicles.

- Predictive valuation models: Leveraging data for more precise pricing strategies.

- Logistics optimization: Streamlining the transportation and storage of vehicles.

- Enhanced customer engagement: Improving user experience through personalized digital tools.

Strategic Acquisitions and Partnerships

Copart can significantly boost its market presence and service capabilities through well-chosen acquisitions and strategic alliances. For instance, its acquisition of Purple Wave in 2019 has already proven instrumental in growing its specialty equipment sales segment, demonstrating the tangible benefits of integrating complementary businesses.

These strategic moves allow Copart to not only broaden its existing service portfolio but also to venture into new, related markets. By doing so, the company can enhance its competitive edge and solidify its standing within the expansive automotive industry landscape.

- Acquisition of Purple Wave: Expanded Copart's reach into the heavy equipment and specialty vehicle auction market, contributing to a 15% increase in its specialty equipment revenue in the fiscal year ending July 2023.

- Partnership Potential: Exploring collaborations with electric vehicle charging infrastructure providers could open new avenues for remarketing and servicing damaged EVs.

- Market Expansion: Entry into new geographic regions via acquisition or partnership can tap into underserved customer bases, potentially adding millions in annual revenue.

Copart's global expansion presents a significant growth avenue, particularly in markets where its online auction model is still developing. The company's proven success in established international markets like the UK and Germany provides a strong blueprint for entering new territories. By replicating its efficient auction processes and leveraging its digital platform, Copart can capture new customer bases and increase its overall market share.

Diversifying beyond traditional insurance salvage into non-automotive sectors, such as heavy equipment and farm machinery through acquisitions like Purple Wave, opens up substantial new revenue streams. This strategic move allows Copart to leverage its auction expertise across a broader range of assets. Furthermore, continued investment in AI and digital technologies is enhancing operational efficiency, from vehicle assessment to logistics, and improving customer engagement, which drove a notable revenue increase in recent fiscal periods.

Copart's ability to adapt to the increasing complexity of modern vehicles, leading to higher total loss rates for insurers, directly benefits its inventory acquisition. As repair costs continue to rise, more vehicles are likely to be declared total losses, providing a steady and growing supply of salvageable vehicles for Copart's auctions. This trend is expected to persist through 2025, solidifying Copart's core business model.

| Opportunity Area | Key Actions | Potential Impact |

|---|---|---|

| International Expansion | Enter new geographic markets with established auction models. | Increased market share, diversified revenue streams. |

| Diversification | Expand into non-automotive salvage (e.g., heavy equipment). | New revenue sources, broader customer base. |

| Technology Advancement | Invest in AI for vehicle assessment, valuation, and logistics. | Enhanced efficiency, improved pricing accuracy, better customer experience. |

| Total Loss Trend | Capitalize on rising vehicle repair costs leading to more total losses. | Increased inventory for auctions, sustained core business growth. |

Threats

The continuous evolution of vehicle safety features, like advanced driver-assistance systems (ADAS), while improving road safety, directly impacts the volume of vehicles requiring salvage. For instance, by 2023, ADAS features were becoming standard on many new vehicle models, a trend projected to accelerate through 2025.

This reduction in accident frequency and severity, a positive for society, translates into a shrinking pool of damaged vehicles available for auction. This presents a structural challenge to Copart's business, which relies on a steady supply of salvageable vehicles.

Copart faces significant rivalry, primarily from Insurance Auto Auctions (IAA), creating a de facto duopoly in the salvage vehicle auction market. This intense competition could force Copart to lower its auction fees or spend more on digital platforms and customer acquisition to defend its market share. For instance, IAA's continued investment in its online auction capabilities presents a direct challenge to Copart's established dominance.

Copart faces threats from evolving regulations in the automotive, environmental, and auction sectors. For instance, potential state-level actions to curb rising vehicle insurance premiums could indirectly reduce the supply of vehicles available for auction, impacting Copart's inventory.

Compliance with new or updated rules, such as those concerning vehicle recycling standards or enhanced data privacy measures, presents a significant risk. These changes may necessitate costly operational adjustments or lead to increased compliance expenses, potentially affecting profitability.

Impact of Catastrophic Weather Events

Catastrophic weather events, such as hurricanes and floods, present a dual-edged sword for Copart. While they can boost the supply of damaged vehicles, increasing inventory, these events also create substantial operational hurdles and financial risks. For instance, the aftermath of Hurricane Ian in Florida in late 2022, a significant market for Copart, likely led to increased vehicle intake but also strained facility capacity and increased logistical costs.

These events can significantly inflate operational expenses. Copart may face higher costs for temporary storage solutions, increased security measures to protect vehicles from further damage, and the potential for damage to its own facilities and equipment. Ensuring adequate and secure storage for a surge of vehicles, particularly in the face of widespread infrastructure damage, is a critical challenge that can impact profitability.

Furthermore, the sheer volume of vehicles processed after a major disaster can strain Copart's processing capabilities. This includes the need for more personnel, enhanced towing services, and efficient auction management to handle the influx. The ability to scale operations rapidly and effectively during these periods is paramount to capitalizing on the increased supply while mitigating the associated risks.

- Increased Operational Costs: Facility damage, temporary storage needs, and enhanced security measures can drive up expenses following major weather events.

- Storage and Processing Strain: A surge in damaged vehicles can overwhelm existing infrastructure, requiring rapid scaling of towing, storage, and auction services.

- Inventory Risk: Vehicles in inventory are also vulnerable to further damage from ongoing weather conditions or secondary events.

- Geographic Concentration Risk: Copart's significant presence in weather-prone regions like the Gulf Coast and Florida means a single major event can have a widespread impact on operations.

Cybersecurity and Data Security Risks

Copart’s reliance on its online platform makes it a prime target for cyber threats. A significant data breach could expose sensitive customer and financial information, leading to substantial financial penalties and a loss of trust from its global user base. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a figure Copart must actively work to avoid.

Disruptions caused by cyberattacks, such as ransomware or denial-of-service attacks, could halt Copart's auction operations, impacting sales volumes and revenue. The company’s extensive data handling, including vehicle details, ownership records, and payment information, necessitates continuous investment in advanced cybersecurity protocols. A successful cyberattack could lead to system downtime, directly affecting Copart's ability to conduct business.

- Data Breach Impact: In 2023, the average cost of a data breach globally was $4.45 million, highlighting the financial risk Copart faces.

- Operational Disruption: Cyberattacks can halt auction processes, directly impacting Copart's revenue streams and market presence.

- Reputational Damage: Compromised customer data can severely erode trust, a critical asset for any online platform.

- Regulatory Fines: Non-compliance with data protection regulations following a breach can result in significant financial penalties.

The increasing prevalence of advanced driver-assistance systems (ADAS) in new vehicles, with features becoming standard by 2023 and projected to grow, reduces the frequency and severity of accidents. This trend directly shrinks the pool of damaged vehicles available for salvage, posing a structural challenge to Copart's core business model of supplying auction inventory.

Intense competition, particularly from Insurance Auto Auctions (IAA), creates pressure on Copart's pricing and necessitates ongoing investment in digital platforms and customer acquisition to maintain market share. Evolving regulations in automotive, environmental, and auction sectors also present threats, potentially increasing compliance costs or indirectly reducing vehicle supply through measures aimed at controlling insurance premiums.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point |

| Technological Advancement | Increased ADAS adoption | Reduced salvage vehicle volume | ADAS standard on many new models by 2023, accelerating through 2025 |

| Competition | Rivalry from IAA | Pressure on fees, increased marketing spend | IAA's continued investment in online auction capabilities |

| Regulatory Changes | New environmental or data privacy rules | Increased compliance costs, operational adjustments | Potential state actions to curb insurance premiums |

| Cybersecurity | Data breaches and operational disruptions | Financial penalties, loss of trust, revenue impact | Global average data breach cost was $4.45 million in 2023 |

SWOT Analysis Data Sources

This Copart SWOT analysis is built upon a robust foundation of data, drawing from their official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.