Copart Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Copart Bundle

Copart operates in a dynamic salvage auto auction market, facing unique competitive pressures. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for grasping their strategic landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Copart’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Copart's reliance on insurance companies for its vehicle inventory, which represented about 81% in fiscal year 2024, highlights a key aspect of supplier bargaining power. While the market includes many insurance providers, a notable concentration exists among the top players.

The fact that the top 10 insurance companies supplied roughly 60-65% of Copart's vehicle inventory in 2023 indicates that these major insurers possess a degree of leverage. This concentration means that a significant portion of Copart's business is tied to a smaller group of suppliers, potentially influencing contract terms and pricing.

Copart's online auction platform is incredibly important for insurance companies and other businesses that need to sell vehicles that are considered total losses or salvage. This platform provides a fast and efficient way for them to get rid of these vehicles. Its global reach means they can connect with buyers worldwide, and the system is designed to help them get the most money back for each vehicle.

Because Copart's platform is so effective at maximizing recovery values and offers such a broad market, suppliers have very little reason to look for other ways to dispose of their salvage vehicles. The convenience and financial benefits of using Copart make switching to alternatives unattractive. This strong reliance on Copart's services significantly reduces the suppliers' power to negotiate better terms.

In 2024 alone, Copart handled the sale of over 2 million vehicles. This massive volume underscores just how central Copart is to the remarketing process for its suppliers, further solidifying its position and limiting the bargaining power of those supplying the vehicles.

Suppliers can exert bargaining power if switching to a new buyer is costly for them. While integrating new systems or building fresh buyer relationships can be a hassle, these costs aren't always so high that suppliers have no leverage. For instance, if a supplier has to invest significantly in new technology or retraining to serve a different customer, that cost gives them some power to negotiate better terms with their current buyer.

However, Copart's robust infrastructure and integrated services like its Title Express system make it less attractive for suppliers to switch. These offerings create efficiencies and provide solutions that would be expensive and time-consuming for a supplier to replicate with a new buyer, thereby limiting the supplier's bargaining power.

Differentiation of Supplied Products

The vehicles Copart sources, predominantly salvage vehicles, are largely seen as commodities rather than unique offerings. This lack of distinctiveness among individual vehicles typically reduces the leverage of individual suppliers, as Copart can readily find comparable vehicles from a wide array of sources.

Copart's operational strength lies in its capacity to manage a broad spectrum of vehicle types, ranging from standard passenger cars to heavy machinery. This versatility further solidifies its position by ensuring a consistent supply of similar assets, thereby diminishing the bargaining power of any single supplier. For instance, in 2024, Copart's extensive inventory management systems processed millions of vehicles, showcasing the sheer volume and interchangeability of the assets it handles.

- Commoditized Inventory: Salvage vehicles generally lack unique features that would grant suppliers significant pricing power.

- Broad Sourcing Options: Copart's ability to source from numerous providers mitigates reliance on any single supplier.

- Operational Scale: Handling diverse vehicle types, from cars to heavy equipment, reinforces Copart's purchasing power.

Threat of Forward Integration by Suppliers

The threat of insurance companies, a primary supplier of vehicles to Copart, integrating forward into the auction business is generally low. This is primarily because establishing and operating a successful online auction platform requires substantial investment in specialized infrastructure, advanced technology, and a vast, established network of buyers.

While some insurers might consider direct-to-consumer sales models, replicating Copart's global reach, operational efficiency, and the deep liquidity it offers would represent a significant hurdle. For instance, Copart's robust digital marketplace facilitates millions of transactions annually, a scale that is difficult and costly for external entities to match quickly.

In 2024, Copart continued to demonstrate its dominance in the salvage vehicle auction market, processing a significant volume of vehicles and maintaining a strong buyer base. This established infrastructure and buyer loyalty act as a considerable barrier to entry for any potential forward integration attempts by suppliers, reinforcing Copart's competitive position.

- Specialized Infrastructure: Copart operates a global network of physical yards and advanced digital auction platforms.

- Technology Investment: Significant ongoing investment in bidding technology, data analytics, and customer interfaces is crucial.

- Buyer Network: Cultivating and maintaining a diverse, international network of licensed vehicle buyers is a core competency.

- Economies of Scale: Copart's sheer volume provides cost advantages and market liquidity that are hard to replicate.

Copart's bargaining power with its suppliers is relatively low, largely due to the commoditized nature of its inventory and the significant value proposition it offers. The company's expansive global auction platform provides a highly efficient and lucrative channel for insurance companies and others to dispose of salvage vehicles, making it difficult for suppliers to find comparable alternatives.

In fiscal year 2024, insurance companies accounted for approximately 81% of Copart's vehicle inventory. This heavy reliance on a concentrated group of suppliers, with the top 10 providing 60-65% in 2023, suggests some leverage for these major players. However, Copart's indispensability in maximizing recovery values and its established infrastructure, like the Title Express system, significantly diminish the suppliers' incentive and ability to negotiate for better terms or switch to alternative remarketing channels.

The sheer scale of Copart's operations, handling over 2 million vehicles in 2024, further solidifies its market position. This volume, combined with the lack of unique differentiation in salvage vehicles, means Copart can readily source comparable inventory, limiting individual supplier bargaining power.

| Supplier Characteristic | Impact on Copart's Bargaining Power | Supporting Data/Reasoning |

|---|---|---|

| Supplier concentration | Moderate | Top 10 insurers provided 60-65% of inventory in 2023. |

| Switching Costs for Suppliers | Low for suppliers | Copart's platform offers significant value and efficiency, making alternatives less attractive. |

| Uniqueness of Product | Low | Salvage vehicles are largely commoditized. |

| Forward Integration Threat | Low | High barriers to entry for replicating Copart's infrastructure and buyer network. |

What is included in the product

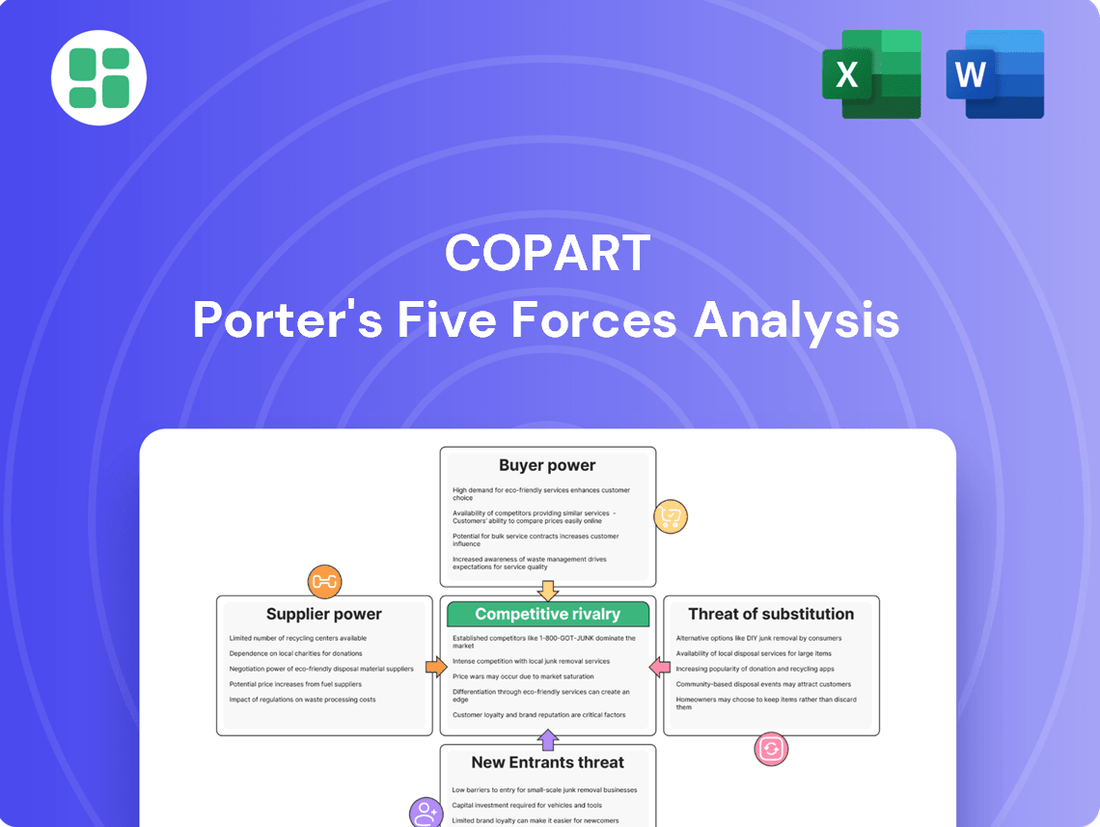

This analysis delves into the five competitive forces impacting Copart, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the prevalence of substitutes within the used vehicle auction industry.

Instantly identify and mitigate competitive threats with a clear, visual breakdown of Copart's industry landscape.

Customers Bargaining Power

Copart's customer base is incredibly diverse and spread out, covering over 185 countries. This includes everyone from professional dismantlers and rebuilders to used car dealers, exporters, and even everyday individuals. This wide reach means no single customer or small group can really call the shots on pricing or terms.

With roughly 1 million members globally, the sheer number of buyers significantly dilutes the bargaining power of any individual. This fragmentation is a key strength for Copart, as it prevents any concentrated pressure from customers seeking to drive down prices for the vehicles they purchase through Copart's auctions.

Buyers have numerous ways to obtain vehicles, from purchasing new cars to exploring traditional used car dealerships or engaging in private sales. This wide array of options generally gives buyers significant leverage.

However, for salvage vehicles and specialized vehicle types, direct substitutes for Copart's auction model are less common. While online salvage auctions have become more accessible, Copart's vast inventory and extensive global network provide a distinct advantage, particularly for buyers seeking specific or hard-to-find vehicles.

In 2023, Copart reported net sales of $3.7 billion, highlighting its substantial market presence and the demand for its unique inventory, suggesting that while substitutes exist, Copart's specific offering holds considerable appeal for a dedicated buyer base.

Copart's customers, particularly those in the salvage vehicle market, exhibit a notable price sensitivity. They are actively searching for economical solutions, whether for acquiring spare parts, undertaking vehicle repairs, or engaging in export activities. This inherent drive for cost savings means they are highly attuned to the final price of a vehicle.

The very nature of Copart's online auction platform intensifies this price sensitivity. The competitive bidding environment naturally encourages buyers to seek the lowest possible prices, creating a constant downward pressure on the selling prices of vehicles. This dynamic is a core element of the bargaining power customers wield.

While price sensitivity is a significant factor, Copart's unique value proposition can partially offset this. The company's extensive and often specialized inventory, coupled with its efficient processing and logistics, provides a level of convenience and access that can make buyers less solely focused on price. For instance, in 2023, Copart reported net sales of $3.6 billion, indicating a substantial volume of transactions where these price dynamics play out.

Information Availability to Buyers

Copart significantly enhances buyer information availability through detailed vehicle descriptions, numerous high-resolution photos, and often comprehensive condition reports. This transparency directly empowers buyers, allowing them to make more informed bidding decisions and effectively reducing information asymmetry.

The increasing sophistication of digital platforms and the integration of AI-driven predictions further bolster this transparency. For instance, Copart’s extensive online inventory, accessible globally, means buyers can thoroughly research available vehicles from anywhere, strengthening their position.

- Enhanced Transparency: Copart’s detailed listings, including multiple images and condition assessments, empower buyers.

- Reduced Information Asymmetry: Buyers can compare vehicles and prices more effectively, leading to better-informed decisions.

- Digital Tools and AI: Advanced online features and AI predictions provide deeper insights, further leveling the playing field for customers.

Switching Costs for Buyers

Switching costs for buyers in the online vehicle auction space are generally low. Many buyers actively participate on multiple platforms, easily comparing prices and inventory. This ease of movement across different auction sites inherently limits the bargaining power of any single platform, including Copart.

Despite low switching costs, Copart has cultivated significant buyer loyalty. Its strong brand recognition, user-friendly bidding interface, and an extensive selection of specialized vehicles, particularly salvage and used cars, encourage repeat business. For instance, Copart reported a substantial increase in its vehicle sales volume in its fiscal year 2024, indicating a robust customer base that finds value in its offerings, making a complete switch less attractive for many.

- Low Switching Costs: Buyers can easily move between online auction platforms, limiting individual seller power.

- Copart's Competitive Advantages: Reputation, user experience, and specialized inventory foster buyer preference.

- Buyer Loyalty: A significant portion of Copart's customer base remains loyal due to these advantages.

- Market Dynamics: While low switching costs exist, Copart's unique value proposition mitigates some of this buyer power.

Copart's customers, while numerous and globally dispersed, have a relatively moderate bargaining power. This is primarily due to the company's vast inventory and the specialized nature of salvage vehicles, which limits readily available substitutes for many buyers.

However, buyers' price sensitivity is high, as they often seek cost-effective solutions for parts or repairs. The transparency of Copart's online platform, with detailed listings and competitive bidding, further empowers customers to seek the best prices.

Despite low switching costs between auction platforms, Copart fosters loyalty through its brand, user experience, and unique inventory, which somewhat counterbalances individual buyer leverage.

| Factor | Copart's Position | Impact on Bargaining Power |

|---|---|---|

| Customer Concentration | Highly fragmented, over 1 million global members | Lowers individual buyer power |

| Price Sensitivity | High, due to salvage/parts focus | Increases buyer power |

| Information Availability | High, detailed listings and photos | Increases buyer power |

| Switching Costs | Low | Increases buyer power |

| Substitutes | Limited for specialized salvage | Lowers buyer power |

Preview Before You Purchase

Copart Porter's Five Forces Analysis

This preview showcases the complete Copart Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the automotive remarketing industry. The document you are viewing is the exact, professionally formatted report you will receive immediately upon purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The online vehicle auction market is highly concentrated, with Copart and IAA Holdings LLC (now integrated with Ritchie Bros.) effectively forming a duopoly. This duopoly controls a substantial portion of the market share, indicating a significant level of industry concentration.

Copart itself holds a dominant position in the auto salvage auction sector. As of 2023, the company commanded an impressive market share of approximately 64.7%. This substantial share underscores the fierce competition among players vying for volume and overall market leadership.

The online salvage auctions industry is booming, with the global market valued at USD 10.63 billion in 2024. This rapid expansion, projected to hit USD 54.6 billion by 2034 with a CAGR of 17.4% from 2025, naturally intensifies rivalry. As the pie gets bigger, more companies are entering and existing players are aggressively seeking to capture greater market share.

The salvage vehicle auction industry, exemplified by companies like Copart, is characterized by substantial fixed costs. These include maintaining vast physical auction yards, investing in advanced digital bidding platforms, and managing complex logistics for vehicle transportation. For instance, Copart's extensive global footprint with numerous yards requires significant ongoing investment in property, plant, and equipment.

These high initial and ongoing capital expenditures create formidable exit barriers. Companies are compelled to remain active and competitive to spread these fixed costs over a larger volume of sales. This pressure often leads to intense rivalry among established players, as ceasing operations would mean failing to recoup these substantial investments.

Product and Service Differentiation

Copart stands out through its vast global footprint, boasting over 250 physical locations. This extensive network is complemented by its proprietary VB3 online auction platform and advanced AI-driven tools, offering a seamless experience for both sellers and buyers.

The company further differentiates itself by providing a full spectrum of services. These include efficient vehicle processing, reliable transportation logistics, and streamlined titling services, all designed to attract and retain a diverse customer base.

- Global Infrastructure: Over 250 locations worldwide.

- Proprietary Technology: VB3 auction platform, AI tools.

- Comprehensive Services: Vehicle processing, transportation, titling.

Competitive Strategies

Copart's competitive rivalry is intense, primarily driven by its strategic investments in land and advanced technology. This allows them to optimize operations and offer enhanced services, such as Title Express, to key partners like insurance companies.

A significant rival is IAA, now part of Openlane and Ritchie Bros. However, Copart's ownership of its land and its expansive global network offer distinct, long-term advantages that help it stand out in the market.

- Strategic Land Ownership: Copart's substantial investment in owning its physical locations provides a stable operational base and reduces reliance on third-party leases, a key differentiator.

- Technological Integration: Continuous investment in technology, including its online auction platform, enhances efficiency and customer experience, setting a high bar for competitors.

- Insurance Partnerships: Deepening relationships with insurance companies through value-added services like Title Express creates sticky customer relationships and a competitive moat.

- Global Reach: Copart's established global network allows for efficient processing and remarketing of vehicles worldwide, offering scale that is difficult for smaller competitors to match.

The competitive rivalry within the salvage vehicle auction industry is fierce, primarily due to the market duopoly formed by Copart and IAA (now part of Openlane and Ritchie Bros.). Copart's substantial market share, around 64.7% in 2023, highlights its dominant position and the intense competition it faces. The industry's rapid growth, with the global market valued at USD 10.63 billion in 2024 and projected to reach USD 54.6 billion by 2034, further fuels this rivalry as players vie for increased market penetration.

| Company | Market Share (approx. 2023) | Key Differentiators |

|---|---|---|

| Copart | 64.7% | Global infrastructure (250+ locations), proprietary VB3 platform, AI tools, comprehensive services (processing, transport, titling), strategic land ownership. |

| IAA (now part of Openlane and Ritchie Bros.) | Significant, but less than Copart | Integration with Openlane and Ritchie Bros. offers expanded services and reach. |

SSubstitutes Threaten

Sellers, predominantly insurance companies, find few direct substitutes for the specialized, large-scale remarketing services Copart provides for salvage vehicles. While internal processing or direct sales to dismantlers are theoretical alternatives, they lack Copart's efficiency and broad buyer reach.

Copart's established digital auction platform and vast global buyer base significantly enhance recovery values for sellers compared to less sophisticated methods. In 2023, Copart facilitated the sale of over 1.1 million vehicles, underscoring the difficulty for sellers to replicate such scale and market access independently.

Buyers looking for vehicles, whether for repair, parts, or export, have options beyond salvage auctions. They can turn to new car dealerships or purchase used vehicles from traditional dealerships or private sellers. These channels offer a different kind of value, though often at a higher price point.

However, when it comes to sourcing specific types of damaged or salvage vehicles, the direct substitutes that can match the pricing and sheer variety found in online salvage auctions are quite scarce. This makes Copart's core offering particularly strong in its niche.

The increasing popularity of new and used electric vehicles (EVs) could also indirectly affect the demand for older, internal combustion engine (ICE) salvage vehicles. As the automotive market shifts, so too might the types of vehicles available and sought after in the salvage sector.

Technological advancements like electric vehicles (EVs) and autonomous driving systems could eventually alter the composition of salvage vehicles, potentially impacting the demand for traditional salvage parts. However, the core threat from substitutes is mitigated as online auction platforms themselves are heavily investing in technology.

For instance, Copart's 2024 performance highlights the increasing reliance on digital platforms, with online auctions driving a significant portion of their revenue. AI-powered bidding tools and enhanced virtual inspection capabilities are making these platforms more efficient and accessible, thereby strengthening the existing online auction model against potential disruptive substitutes.

Cost-Benefit of Substitutes

The cost-benefit analysis strongly favors online salvage auctions for specific needs, such as sourcing parts or rebuilding vehicles. These vehicles are often purchased at a significantly lower price compared to vehicles intended for immediate road use or new models. For instance, in 2023, the average selling price for a salvage title vehicle at auction was considerably less than its retail market value, making it an attractive option for cost-conscious buyers.

While the overall cost of ownership can fluctuate based on repair needs and market conditions, direct substitutes often fail to match the unique value proposition offered by salvage vehicles for certain buyer segments. This is particularly true for those with the expertise and resources to repair or repurpose the vehicles, effectively creating a distinct market niche where substitutes are less competitive.

- Lower Acquisition Costs: Salvage vehicles are typically acquired at a fraction of the cost of comparable vehicles with clean titles.

- Parts Harvesting Value: For mechanics and DIY enthusiasts, salvage vehicles offer a cost-effective source of specific, often expensive, replacement parts.

- Rebuilding Potential: Buyers with repair capabilities can acquire vehicles at a low entry price, with the potential to restore them to operational status at a lower total cost than purchasing a similar used or new vehicle.

- Niche Market Appeal: The value proposition of salvage vehicles is most pronounced for buyers who can leverage their skills or specific needs to extract greater utility from these assets.

Regulatory and Environmental Factors

The increasing global emphasis on vehicle recycling and circular economy principles, often spurred by stringent government regulations, significantly bolsters the salvage industry and platforms like Copart. This regulatory push makes it considerably harder for potential substitutes that don't align with these environmental mandates to gain substantial market share, thereby solidifying the importance of salvage auctions.

For instance, in 2024, many regions continued to strengthen their Extended Producer Responsibility (EPR) schemes for end-of-life vehicles (ELVs), encouraging higher recycling rates and the reuse of parts. This regulatory environment directly benefits companies like Copart, which facilitate the efficient processing and resale of used vehicle components.

- Regulatory Support for Recycling: Government mandates promoting vehicle recycling and circular economy goals enhance the value proposition of salvage operations.

- Environmental Alignment: Substitutes lacking alignment with environmental objectives face significant hurdles in adoption due to regulatory favor towards sustainable practices.

- Market Reinforcement: The regulatory landscape reinforces the critical role of salvage auction platforms in the automotive lifecycle.

The threat of substitutes for Copart's core business is relatively low, particularly for its primary sellers, insurance companies, who find few alternatives offering the same scale and efficiency in remarketing salvage vehicles. While buyers have substitutes like new or used car dealerships, these typically come at a higher cost and don't cater to the specific needs of those seeking damaged vehicles for parts or rebuilding.

The specialized nature of salvage vehicle remarketing and the established global buyer network of platforms like Copart make it difficult for substitutes to replicate the value proposition. For example, in 2023, Copart's extensive buyer base facilitated the sale of over 1.1 million vehicles, a scale that is challenging for any direct substitute to match.

The increasing adoption of electric vehicles (EVs) might indirectly influence the types of salvage vehicles available and in demand, but it does not directly substitute the online auction model itself. In fact, Copart's continued investment in technology, such as AI-powered bidding tools, as seen in its 2024 performance, strengthens its position against potential disruptive substitutes by enhancing the efficiency and accessibility of its platform.

The cost-effectiveness of acquiring salvage vehicles for parts or rebuilding remains a significant draw, with average selling prices in 2023 being substantially lower than retail market values. This inherent cost advantage for specific buyer segments, coupled with regulatory support for vehicle recycling and circular economy principles, further solidifies the limited threat from substitutes.

| Substitute Type | Description | Copart's Advantage | 2023/2024 Data Point |

|---|---|---|---|

| New/Used Car Dealerships | Standard retail channels for vehicles. | Significantly lower acquisition costs for salvage vehicles. | Average salvage title vehicle selling price considerably less than retail market value. |

| Direct Sales to Dismantlers | Sellers bypassing remarketing platforms. | Broader global buyer reach and higher recovery values for sellers. | Copart facilitated over 1.1 million vehicle sales in 2023. |

| Internal Processing | Insurance companies handling salvage internally. | Economies of scale and specialized digital auction infrastructure. | Copart's 2024 performance highlights increasing reliance on digital platforms for revenue. |

Entrants Threaten

The threat of new entrants in the online vehicle auction space, particularly for a company operating at Copart's global scale, is significantly mitigated by the immense capital investment required. Establishing the necessary infrastructure, including extensive land for vehicle storage, advanced logistics networks, and robust technological platforms, demands hundreds of millions of dollars. For instance, Copart's vast operational footprint, encompassing over 250 locations across 11 countries and processing millions of vehicles annually, highlights the sheer scale that new players must overcome.

Copart benefits from deeply entrenched relationships with major insurance companies and financial institutions, built over years of reliable service. These long-standing partnerships make it difficult for new entrants to secure a comparable volume of vehicle inventory.

The company's extensive network of roughly 1 million registered buyers creates powerful network effects. As more buyers participate, the platform's value increases for everyone, making it a significant hurdle for newcomers to attract a critical mass of demand.

Copart's proprietary VB3 online auction platform, a cornerstone of its operations, presents a formidable technological barrier for potential new entrants. This sophisticated system, continuously enhanced with AI-powered tools and advanced digital features, demands significant expertise and substantial ongoing investment to develop and maintain. For instance, Copart reported a substantial increase in technology spending in its fiscal year 2023, reflecting its commitment to staying ahead in digital innovation, a cost that new competitors would need to match to compete effectively.

Regulatory and Licensing Hurdles

The vehicle remarketing and salvage industry presents significant barriers to entry due to stringent regulatory and licensing requirements. Newcomers must meticulously navigate a patchwork of state and international laws governing vehicle sales, environmental compliance, and title transfer processes. This complexity can significantly delay market entry and inflate initial operating costs.

For instance, in the United States, each state has its own unique set of regulations for salvage vehicle dealers, auction operators, and dismantlers. Copart, as a major player, must adhere to these diverse legal frameworks, which include specific requirements for lot operations, environmental protection, and secure handling of vehicle titles. Failure to comply can result in hefty fines or the inability to operate.

Key hurdles include:

- Obtaining state-specific dealer or auction licenses, which often require background checks, surety bonds, and proof of business establishment.

- Complying with environmental regulations related to fluid disposal, battery removal, and hazardous material management.

- Navigating complex title branding and processing laws to ensure legal ownership transfer for resold vehicles.

Brand Reputation and Trust

Copart's formidable brand reputation acts as a significant barrier to new entrants. Decades of operation have cultivated a strong image of reliability and efficiency, fostering deep trust with both vehicle sellers and buyers. This established credibility is not easily replicated, making it challenging for newcomers to gain traction in a market where confidence is crucial for substantial transactions.

Consider the impact of this trust on market entry. New companies would face considerable hurdles in building a comparable level of brand equity and customer loyalty. For instance, in 2024, the automotive remarketing industry continues to value established players with proven track records, further solidifying Copart's position.

- Brand Reputation: Copart's long-standing commitment to reliability and efficiency has built significant customer trust.

- Global Reach: The company's extensive international presence reinforces its brand strength.

- Credibility Hurdle: New entrants must overcome the challenge of establishing similar trust for high-value vehicle transactions.

- Market Inertia: Established trust often leads to customer retention, making it difficult for new competitors to dislodge incumbents.

The threat of new entrants for Copart is generally low due to several substantial barriers. The significant capital investment required for infrastructure, coupled with established relationships with major sellers like insurance companies, creates a high barrier. Furthermore, Copart's extensive buyer network and proprietary technology, like its VB3 auction platform, are difficult for newcomers to replicate. In 2024, the automotive remarketing industry continues to favor established players with proven operational capabilities and trust, making market entry particularly challenging for nascent companies.

| Barrier Category | Specific Barrier | Impact on New Entrants | Copart's Advantage |

|---|---|---|---|

| Capital Investment | Infrastructure (land, logistics, technology) | Requires hundreds of millions of dollars | Vast global footprint (250+ locations) |

| Supplier Relationships | Access to vehicle inventory | Difficult to secure comparable volume | Long-standing partnerships with insurance and financial institutions |

| Customer Network | Buyer base and network effects | Challenging to attract critical mass of demand | ~1 million registered buyers globally |

| Technology | Proprietary auction platform (VB3) | Requires significant expertise and investment | Advanced digital features and AI tools; increased tech spending in FY2023 |

| Regulatory & Licensing | Navigating diverse legal frameworks | Delays market entry and inflates costs | Established compliance processes across multiple jurisdictions |

| Brand Reputation | Customer trust and credibility | Difficult to replicate established equity | Decades of operation fostering reliability and efficiency |

Porter's Five Forces Analysis Data Sources

Our Copart Porter's Five Forces analysis is built upon a foundation of comprehensive industry data, including Copart's own financial reports and investor presentations, alongside market research from leading automotive and auction industry analysts.