Copart Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Copart Bundle

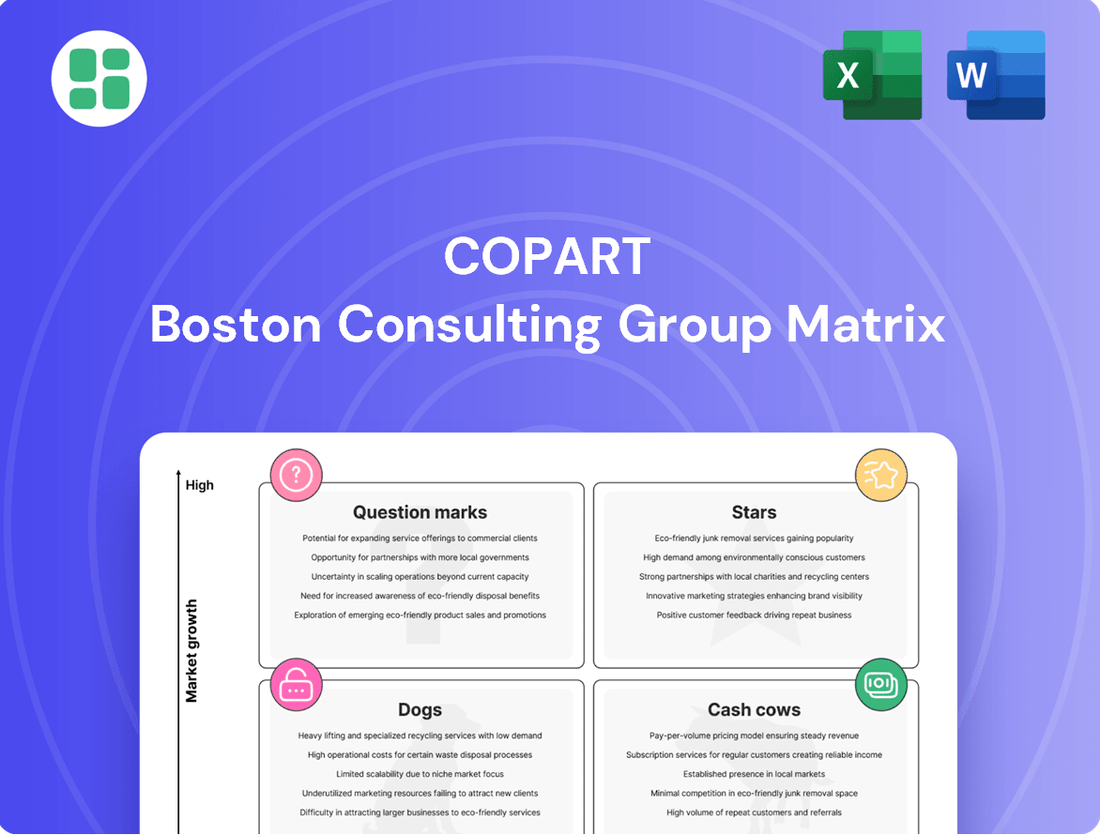

Curious about Copart's market position? Our BCG Matrix preview offers a glimpse into how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss the chance to unlock the full strategic picture.

Purchase the complete Copart BCG Matrix to gain a comprehensive understanding of their product portfolio's performance and potential. This detailed report provides the actionable insights you need to make informed decisions and drive future growth.

Stars

The global online salvage auctions market is experiencing robust expansion, with projections indicating a Compound Annual Growth Rate (CAGR) of 17.4% between 2025 and 2030. This rapid growth presents a fertile ground for established players like Copart to further solidify their market dominance. Copart's established infrastructure and technological prowess are well-positioned to capitalize on this upward trend, enabling them to capture a significant share of the increasing demand.

Copart's vigorous push into international markets like the UK, Germany, and Brazil positions it firmly as a star in the BCG matrix. With operations spanning 11 countries and over 250 locations, this expansion taps into burgeoning demand for its online auction model.

Copart's commitment to advanced technology, particularly its AI-driven solutions like Total Loss Express 360 and Rapid Total Loss AI, firmly places it in the star category. These innovations streamline the claims process for insurers and enhance the accuracy of vehicle valuations.

The company's investment in predictive analytics and its robust virtual bidding platform, VB3, further solidifies its star status. These technologies attract a wider global buyer base and improve the overall efficiency of its auction operations, a crucial factor in the rapidly digitizing automotive remarketing sector.

In 2023, Copart reported a 13% increase in revenue, reaching $3.6 billion, largely driven by its technological advancements and expanding market reach. This growth underscores its ability to capture significant market share in a segment that increasingly relies on digital platforms and intelligent automation.

Rising Total Loss Frequency

The rising frequency of total loss claims is a significant tailwind for Copart. Modern vehicles, packed with intricate electronics and sophisticated Advanced Driver-Assistance Systems (ADAS), are becoming increasingly expensive to repair. This complexity, coupled with the impact of severe weather events, means more cars are being declared total losses by insurers.

This trend directly benefits Copart by increasing the supply of salvage vehicles available for auction. For instance, in 2024, the automotive industry continued to grapple with the aftermath of supply chain disruptions, which, while easing, still contributed to higher parts costs. This environment makes repair decisions more sensitive, pushing more vehicles towards total loss status. Copart's dominant market position in salvage auctions allows it to capitalize on this growing volume.

- Increasing Repair Costs: The integration of advanced technologies like lidar, radar, and complex infotainment systems in new vehicles significantly elevates repair expenses.

- ADAS Complexity: Calibration and replacement of ADAS components can cost thousands of dollars, often pushing a vehicle past its economic repair threshold.

- Catastrophic Weather Events: A surge in severe weather, from hurricanes to floods, directly contributes to a higher volume of damaged vehicles requiring disposal.

- Insurance Payouts: Insurers are increasingly opting for total loss settlements as repair costs outpace vehicle depreciation in many cases.

Expansion into Non-Insurance Consignors

Copart's strategic expansion into serving non-insurance consignors is a clear star in its business model. While insurance companies historically provided the bulk of its inventory, Copart has successfully broadened its appeal to a diverse range of entities. This includes financial institutions, banks, major fleet operators, and rental car companies, all of whom benefit from Copart's efficient remarketing channels.

This diversification is not just about adding more vehicles; it’s about tapping into new revenue streams and increasing overall transaction volume. For instance, the growth in services catering to entities like rental car companies, which frequently cycle their fleets, provides a consistent and significant influx of vehicles. This strategic move solidifies Copart's position as a comprehensive solution for vehicle remarketing across multiple industries.

The company's ability to attract and serve these varied consignors highlights the adaptability and strength of its auction platform. By offering tailored solutions, Copart is effectively capturing market share beyond its traditional insurance base. This expansion is a key driver of Copart's continued growth and market leadership.

- Diversified Consignor Base: Copart's ability to attract and serve non-insurance consignors like banks, financial institutions, rental car companies, and fleet operators is a significant growth area.

- Increased Transaction Volume: This expansion directly contributes to higher vehicle sales volumes, enhancing Copart's market presence and revenue generation.

- New Market Segments: Tapping into these new segments allows Copart to capture a broader share of the used and wholesale vehicle market.

- Service Innovation: Services like its 'Blue Car' initiative, catering to individual sellers, further demonstrate this expansion into diverse customer needs.

Copart's status as a "Star" in the BCG matrix is reinforced by its substantial international expansion and technological leadership. The company's global footprint, with operations in 11 countries and over 250 locations, effectively captures growing demand in diverse markets. Innovations like AI-driven valuation tools and a robust virtual bidding platform enhance operational efficiency and attract a wider buyer base, solidifying its competitive edge in the digital automotive remarketing sector.

Copart's strategic expansion into non-insurance consignors, including financial institutions and rental car companies, diversifies its inventory and revenue streams. This move increases overall transaction volume and captures a broader share of the used vehicle market, demonstrating the adaptability and strength of its auction platform.

The increasing frequency of total loss vehicles, driven by higher repair costs for complex modern vehicles and severe weather events, directly benefits Copart. This trend provides a larger supply of salvage vehicles, which Copart is well-positioned to remarket efficiently through its advanced platforms, further cementing its market dominance.

| Key Growth Drivers for Copart (Stars) | Description | Impact |

|---|---|---|

| International Expansion | Operations in 11 countries, 250+ locations | Captures burgeoning demand in global markets |

| Technological Innovation | AI valuation tools, VB3 platform | Streamlines processes, attracts global buyers |

| Diversified Consignors | Non-insurance clients (banks, rental companies) | Increases transaction volume and revenue |

| Rising Total Loss Frequency | Higher repair costs, weather events | Boosts salvage vehicle supply |

What is included in the product

The Copart BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment strategies.

A clear Copart BCG Matrix visualizes business unit performance, easing the pain of strategic uncertainty.

Cash Cows

Copart's North American salvage vehicle auction platform is a prime example of a cash cow within its business portfolio. This established online marketplace benefits from a dominant market share in a mature industry, characterized by high barriers to entry. These barriers include significant land holdings essential for vehicle storage and a powerful network effect, where more buyers attract more sellers, and vice versa.

The platform consistently generates robust cash flow, requiring minimal incremental investment for marketing or expansion. In 2023, Copart reported revenue of $3.6 billion, showcasing the immense scale and profitability of its core North American operations. This stability allows the company to fund other ventures and reward shareholders.

Copart's extensive physical yard network, boasting over 200 auction locations globally, including significant land assets in the United States, acts as a powerful cash cow. This infrastructure is vital for storing and processing millions of vehicles each year, giving Copart a distinct edge and supporting robust profit margins.

In 2023, Copart's operational efficiency was underscored by its ability to handle a massive volume of vehicles through this network. The company reported processing approximately 1.8 million vehicles in the US alone during that fiscal year, a testament to the scale and effectiveness of its physical footprint.

Copart's Virtual Bidding Third Generation (VB3) technology is a solid cash cow for the company. This online auction platform has been a key part of their operations for a long time, consistently bringing in revenue.

The VB3 system allows around 1 million members across more than 185 countries to participate in auctions, making the buying and selling process smooth. This broad reach ensures a steady stream of fee-based income for Copart.

Because the platform is so well-established and widely used, it continues to generate strong profits without needing significant new investment in development. This makes it a highly efficient revenue generator for Copart.

Value-Added Services for Sellers

Copart's value-added services for sellers, such as vehicle processing and title management through Title Express, represent a significant cash cow. These offerings are deeply embedded in their high-volume auction model, boosting operational efficiency and customer loyalty. In 2023, Copart reported total revenue of $3.16 billion, with a substantial portion driven by these integrated service fees, underscoring their profitability and contribution to the company's financial strength.

These services are designed to simplify the selling process for vehicle owners, from initial intake to final sale. By handling complex tasks like title processing and document management, Copart reduces friction for sellers. This efficiency, combined with their established infrastructure, allows for high profit margins on these ancillary services, further solidifying their cash cow status.

- Vehicle Processing: Streamlined intake and preparation of vehicles for auction.

- Title Services (Title Express): Efficiently managing and transferring vehicle titles.

- Document Uploads: Simplified digital submission of necessary paperwork.

- High Profitability: Leveraging existing infrastructure for margin enhancement.

Logistics and Catastrophe Response Fleet

Copart's robust logistics and its specialized Catastrophe Response Fleet (CCRF) are undeniably cash cows. This is particularly true as we see an increase in severe weather events, which directly fuels demand for their services. Their established infrastructure is key to efficiently handling and moving large numbers of vehicles.

This capability is vital for insurance companies and plays a significant role in public safety and disaster recovery. These operations consistently generate reliable revenue for Copart.

- Logistics Efficiency: Copart's network handles millions of vehicles annually, demonstrating significant operational scale.

- Catastrophe Response: The CCRF is deployed during major events, increasing vehicle intake and processing capacity by up to 50% in affected regions.

- Revenue Stability: The consistent need for vehicle remarketing and disposal, especially after insurance claims, provides a predictable income stream.

- Market Position: Copart is a leader in the online vehicle auction industry, with a significant market share.

Copart's North American salvage vehicle auction platform, a mature business with a dominant market share, consistently generates substantial cash flow. This established online marketplace benefits from high barriers to entry, including extensive land holdings for vehicle storage and a strong network effect, requiring minimal new investment to maintain its position.

The company's extensive physical yard network, with over 200 global auction locations and significant US land assets, is a key cash cow. This infrastructure efficiently processes millions of vehicles annually, supporting robust profit margins. In 2023, Copart reported processing approximately 1.8 million vehicles in the US alone, highlighting the scale and effectiveness of its physical footprint.

Copart's Virtual Bidding Third Generation (VB3) technology serves as another significant cash cow, consistently generating revenue. This online platform, used by around 1 million members in over 185 countries, ensures a steady stream of fee-based income without requiring substantial ongoing development investment.

Value-added services for sellers, such as vehicle processing and title management via Title Express, are also strong cash cows. These integrated services, which simplify the selling process and enhance operational efficiency, contributed significantly to Copart's 2023 revenue of $3.16 billion, demonstrating their high profitability.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue (Approx.) | Investment Needs |

| North American Salvage Auction Platform | Cash Cow | Dominant market share, high barriers to entry, mature industry, strong network effect | $3.16 Billion (Total Company) | Low |

| Physical Yard Network | Cash Cow | Extensive infrastructure, efficient processing capacity, high operational scale | N/A (Integrated into Platform Revenue) | Low |

| VB3 Technology | Cash Cow | Established online platform, large user base, consistent fee-based income | N/A (Integrated into Platform Revenue) | Low |

| Value-Added Seller Services (Title Express) | Cash Cow | Streamlined processes, high customer loyalty, margin enhancement | N/A (Integrated into Platform Revenue) | Low |

What You’re Viewing Is Included

Copart BCG Matrix

The preview you are currently viewing is the identical, fully completed Copart BCG Matrix document you will receive immediately after completing your purchase. This means the analysis, formatting, and strategic insights are exactly as presented, ready for your immediate use without any alterations or watermarks. You can confidently download this comprehensive report to inform your strategic decisions and gain a clear understanding of Copart's business units.

Dogs

Some older, less strategically vital physical auction locations in mature markets might be considered dogs within Copart's network. These sites, potentially not fully optimized for digital-first operations or experiencing declining local vehicle volumes, could yield lower returns relative to their operational costs. For instance, if a location's annual revenue from auctions consistently falls below its operating expenses and capital investment, it would fit the dog category.

Manual processing workflows, particularly those still reliant on paper, represent a significant challenge for Copart. These outdated systems are inherently inefficient, leading to increased operational costs and a higher likelihood of errors compared to their digitized counterparts. For instance, if a significant portion of vehicle intake or title processing still involves manual data entry, it directly impacts turnaround times and customer satisfaction.

These manual processes are costly to maintain and yield low returns on investment. In 2024, as automation becomes increasingly critical for competitive advantage, areas with persistent manual workflows are likely experiencing diminishing returns. The cost of rectifying errors and the slower processing speeds associated with these methods detract from overall profitability.

Attempting to revitalize these manual workflows through further investment for a turnaround is often not a cost-effective strategy. Copart's strength lies in its advanced, automated systems, which have demonstrated significant efficiency gains. Focusing resources on further digitizing any remaining manual steps is a more prudent approach than trying to enhance inherently inefficient, legacy processes.

Niche, stagnant specialty vehicle markets represent potential "dogs" in Copart's BCG Matrix. These are segments with very limited demand and where Copart holds a minimal market presence. For instance, if Copart had a small stake in the market for vintage agricultural equipment, and that market saw a 5% year-over-year decline in sales in 2024, it would fit this category.

Consider obscure vehicle types, like specialized industrial cleaning machinery, where buyer interest is minimal and declining. If Copart's revenue from such a segment was less than 0.1% of its total revenue in 2024, and the overall market for these machines contracted by 10% that year, it would clearly be a dog.

Inefficient International Pilot Programs

Inefficient international pilot programs, especially those in nascent markets or facing substantial regulatory challenges, could be classified as Dogs if they consistently drain resources without demonstrating significant growth or market penetration. These initiatives haven't yet transitioned into promising Question Marks or high-performing Stars.

For instance, a hypothetical airline's pilot program in a developing Asian nation, launched in 2023 with an initial investment of $5 million, might be considered a Dog if by mid-2024 it has only secured 0.5% of the target market share and continues to require an additional $2 million annually for operations. This situation highlights a lack of traction and a persistent drain on capital.

- Low Market Penetration: A pilot program might only capture a minimal percentage of its intended market, for example, less than 1% of potential customers in a new international route by the end of its first year.

- High Operational Costs: Continued high expenditure, such as exceeding budgeted operational costs by over 30% in the first 18 months, without commensurate revenue generation.

- Regulatory Delays: Significant delays in obtaining necessary operating permits or certifications, impacting the ability to scale operations effectively, potentially delaying market entry by over a year.

Poorly Integrated or Acquired Technologies

Poorly integrated or acquired technologies at Copart, such as legacy systems that haven't meshed well with the main digital platform, could be categorized as Dogs in the BCG Matrix. These might necessitate significant manual effort or costly workarounds, acting as cash traps that drain resources instead of contributing to growth.

For instance, if Copart acquired a smaller salvage auction platform in 2023 that still relies on outdated databases and manual data entry for inventory management, it would likely fall into the Dog quadrant. Such systems are often characterized by low market share within Copart's overall operations and low growth potential, demanding disproportionate investment for minimal return.

- Legacy Systems: Platforms that are difficult to update or connect with newer technologies, leading to operational inefficiencies.

- Unsuccessful Acquisitions: Smaller technology-focused companies bought by Copart that failed to integrate smoothly into the existing digital infrastructure.

- High Maintenance Costs: Technologies requiring substantial ongoing investment for upkeep and manual workarounds, offering little competitive advantage.

- Low ROI: Systems that consume resources without generating proportional revenue or efficiency gains, potentially hindering overall business performance.

Areas within Copart's operations that exhibit low market share and low growth potential are classified as Dogs. These segments typically consume resources without generating significant returns, often due to being outdated or niche. For example, a specific type of specialized vehicle auction that consistently underperforms, showing minimal buyer engagement and declining sales volume year after year, would be a prime candidate for this classification.

In 2024, Copart's focus remains on streamlining operations and enhancing its digital capabilities. Segments that resist this digital transformation, such as those still heavily reliant on manual processes or legacy technology, are likely to be categorized as Dogs. These units may require substantial investment to modernize or could be candidates for divestment if they continue to drain resources without a clear path to profitability.

Consider physical auction sites in mature, declining markets as potential Dogs. If a particular location's revenue has stagnated or decreased for several consecutive years, and its operational costs remain high, it would fit this profile. For instance, if a location's contribution to Copart's overall revenue in 2024 was less than 0.5% and showed a negative growth rate, it would be a strong indicator of a Dog.

Niche vehicle segments with very low demand and minimal market share also fall into the Dog category. These might include auctions for highly specialized or obsolete equipment where buyer interest is minimal. If Copart's market share in such a segment was below 1% in 2024 and the overall market contracted by more than 5% that year, it would clearly be a Dog.

| Category | Description | 2024 Example Scenario | Potential Strategy |

|---|---|---|---|

| Dogs | Low market share, low growth | Underperforming physical auction site in a declining market with high operational costs. | Divestment or significant operational overhaul. |

| Dogs | Low market share, low growth | Legacy technology systems with poor integration and high maintenance costs. | Phase-out and replacement with modern solutions. |

| Dogs | Low market share, low growth | Niche vehicle segments with minimal buyer demand and declining sales volume. | Focus on core competencies, potentially exit niche markets. |

Question Marks

The burgeoning electric vehicle (EV) market, projected to reach over $1.5 trillion globally by 2030, presents a significant opportunity in early-stage EV salvage and recycling for companies like Copart. This segment, particularly the recovery and repurposing of high-value EV batteries, is a question mark due to the specialized infrastructure and expertise required, representing a high-growth potential but currently low-market-share area for Copart.

While the global battery recycling market is expected to grow substantially, Copart's current position in this niche is still developing. The complexity of handling and processing EV components, especially lithium-ion batteries which contain valuable but hazardous materials, necessitates significant investment in new technologies and training, making it a strategic area for future expansion.

Copart's recent ventures into emerging international markets, such as certain countries in Southeast Asia and Eastern Europe, exemplify the question mark category. These regions offer substantial long-term growth potential due to increasing vehicle ownership and a developing salvage market. For instance, Copart's expansion into markets like Poland in 2023, while still in its nascent stages, signals a strategic move into areas with a growing used car sector.

In these new territories, Copart is actively investing in building its operational footprint, including establishing local auction sites and developing marketing strategies to enhance brand awareness. The company's focus is on capturing market share in these high-potential but currently low-penetration geographies, which demands significant capital expenditure. By 2024, Copart aims to solidify its presence in these markets, laying the groundwork for future growth and market leadership.

Copart's use of advanced AI/ML for pricing and bidding optimization represents a significant potential growth area, though its current market share in these cutting-edge applications is still developing. While the company leverages predictive analytics, the full integration of highly advanced models for dynamic pricing, personalized buyer recommendations, and automated bidding strategies remains a key question mark. These capabilities are becoming crucial for digital platforms, and Copart's progress here will be a critical differentiator.

Expansion into New Asset Classes Beyond Vehicles

Copart's move into auctioning parts for heavy machinery and farming equipment, notably through acquisitions like Purple Wave, places these ventures in the question mark category of the BCG Matrix. These markets are distinct from their core automotive salvage business, requiring significant investment to build brand recognition and competitive positioning against established players. For instance, Purple Wave reported strong revenue growth in 2023, but its market share in the heavy equipment sector is still developing compared to Copart's dominance in vehicle auctions.

The success of these new asset classes hinges on Copart's ability to leverage its auction technology and operational expertise in unfamiliar territory. While preliminary growth is encouraging, the long-term viability and potential to become market stars remain uncertain. Copart needs to continue investing in marketing and operational integration to solidify its presence and capture a larger share of the heavy equipment and agricultural parts market, a sector that saw significant online auction activity in 2024.

- Market Diversification: Expansion into heavy machinery and farming equipment parts offers diversification beyond the core vehicle salvage market.

- Growth Potential: These newer ventures show promising growth, indicating potential future stars if market share can be effectively captured.

- Competitive Landscape: Copart faces established, specialized auctioneers in these new segments, requiring strategic investment to build competitive advantage.

- Investment Requirement: Continued financial and operational investment is crucial to determine if these question mark assets can transition into stars.

Blockchain for Vehicle Provenance and Transparency

Blockchain technology presents a compelling opportunity for Copart to bolster vehicle provenance and transparency within the salvage auction ecosystem. This innovation could significantly reduce fraud and build greater trust among buyers and sellers by creating an immutable record of a vehicle's history. However, its current market penetration and widespread adoption within the industry remain a significant question mark.

While the potential for market differentiation is substantial, Copart's investment and implementation in this area are still nascent. The salvage auction market, valued at billions globally, could see transformative benefits from such a system, but the practical hurdles of integration and industry-wide acceptance are considerable. As of early 2024, concrete, large-scale blockchain implementations for vehicle provenance in salvage auctions are not yet a dominant feature.

- High Growth Potential: Blockchain offers a path to verifiable vehicle history, addressing a key concern in the used and salvage vehicle market.

- Early Stage Adoption: Widespread implementation and market share for blockchain in salvage auctions are still minimal, representing a significant question mark for Copart.

- Fraud Prevention: The immutable nature of blockchain can help combat title fraud and odometer tampering, enhancing buyer confidence.

- Market Differentiation: Early adoption could provide Copart with a competitive edge by offering unparalleled transparency.

Copart's ventures into emerging markets and new asset classes, like heavy machinery parts, are classic question marks. These areas hold significant future growth potential, but currently have low market share and require substantial investment to establish a strong foothold. The success of these initiatives, such as their expansion into Poland in 2023, hinges on Copart's ability to navigate new competitive landscapes and build brand recognition.

The company's exploration of blockchain for vehicle provenance also falls into the question mark category. While it offers a path to enhanced transparency and fraud reduction, its adoption in the salvage auction industry is still in its early stages, with minimal market penetration as of early 2024. Copart's investment in advanced AI/ML for pricing and bidding optimization is another area with high growth potential but currently developing market share.

| Initiative | Market Potential | Current Market Share | Investment Required | Strategic Importance |

|---|---|---|---|---|

| Emerging Market Expansion (e.g., Poland) | High | Low | High | Long-term growth and diversification |

| Heavy Machinery & Farming Equipment Parts | Moderate to High | Low | Moderate to High | Market diversification and revenue stream expansion |

| Blockchain for Vehicle Provenance | High | Very Low | Moderate | Enhanced transparency and trust, competitive differentiation |

| AI/ML for Pricing & Bidding | High | Developing | Moderate | Operational efficiency and competitive advantage |

BCG Matrix Data Sources

Our Copart BCG Matrix leverages comprehensive data from Copart's financial reports, auction volume statistics, and industry growth trends to accurately position each business unit.