Copart PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Copart Bundle

Navigate the complex external forces shaping Copart's landscape with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting its operations and future growth. This expert-crafted analysis provides the critical insights you need to make informed strategic decisions. Download the full version now and gain a competitive edge.

Political factors

Government regulations on vehicle salvage, disposal, and recycling significantly shape Copart's business model. Stricter environmental protection mandates, such as those impacting the handling of hazardous materials in vehicles, can raise operational expenses. However, these same regulations can also benefit companies like Copart that invest in compliant and efficient practices.

For instance, upcoming End-of-Life Vehicles (ELVs) directives, with some regional implementations starting in April 2025, are designed to boost the recycling and reuse of automotive parts. This focus on circular economy principles within the automotive sector presents Copart with opportunities to enhance its service offerings in component recovery and responsible disposal.

International trade policies and tariffs directly affect Copart's global operations, particularly its substantial export business. For instance, in 2024, the ongoing discussions around potential tariffs on imported vehicles and auto parts in various regions could increase the landed cost for international buyers of salvage vehicles. This could dampen demand from rebuilders and dismantlers who rely on cost-effective sourcing.

New or adjusted trade agreements, such as those impacting North American trade, can significantly influence the profitability of cross-border transactions for both Copart's buyers and sellers. For example, if tariffs are imposed on specific types of salvaged auto parts being exported from the US to Mexico or Canada, it could create headwinds for those markets, impacting the overall volume of vehicles processed and sold by Copart in those corridors.

Government mandates pushing for electric vehicle (EV) adoption, such as the 2024 targets set by many nations for EV sales, directly influence the composition of vehicles entering the salvage market. For instance, by 2030, California aims for 100% of new passenger car sales to be zero-emission vehicles, meaning a significant influx of EVs will eventually reach their end-of-life. This trend necessitates specialized handling and processing for EV batteries, a critical component with evolving recycling and disposal regulations.

The increasing number of EVs reaching their end-of-life, driven by government incentives and stricter emissions standards, presents both challenges and opportunities for companies like Copart. As of early 2024, the global EV battery recycling market is projected to grow significantly, with some estimates reaching over $20 billion by 2030. Copart's ability to adapt its infrastructure and processes to safely and efficiently manage these high-voltage systems and their components will be crucial for maintaining its market position.

Insurance Industry Regulation

Insurance industry regulations, especially concerning total loss declarations and claims processing, directly impact the flow of vehicles to Copart's auctions. Shifts in how insurers manage claims, assess damage, or declare vehicles a total loss can alter the quantity and nature of vehicles available for sale. For instance, ongoing claims inflation, which saw the average cost of auto physical damage claims rise by an estimated 7.5% in 2023 according to the Insurance Information Institute, could pressure insurers to declare more vehicles a total loss, potentially increasing inventory for Copart.

These regulatory environments also dictate how quickly insurers must process claims and dispose of salvaged vehicles. Delays or changes in these procedures can affect the predictability of Copart's supply chain. Furthermore, regulatory scrutiny over fair claims practices may lead insurers to adopt more standardized total loss valuation methods, which could indirectly influence the types of vehicles entering the salvage market.

- Regulatory Impact on Total Loss: Changes in insurance regulations can alter the criteria for declaring a vehicle a total loss, directly affecting the supply of salvage vehicles to auction platforms like Copart.

- Claims Inflation Influence: Rising claims costs, exemplified by a projected 7.5% increase in auto physical damage claims in 2023, may incentivize insurers to declare more vehicles as total losses, thereby boosting auction inventory.

- Processing Efficiency: Regulations governing claims processing timelines and salvage disposal directly influence the efficiency and volume of vehicles Copart receives.

Political Stability and International Relations

Copart's extensive global footprint, operating in 11 countries and serving buyers in over 185, exposes it to significant geopolitical risks. Political instability or conflicts in these regions can directly impact its operations and market access. For instance, ongoing geopolitical tensions in Eastern Europe or the Middle East could disrupt vehicle logistics and buyer engagement from those areas, affecting Copart's international sales volumes.

Shifts in international relations, such as trade disputes or new sanctions, can also pose challenges. These changes might affect the ease of cross-border vehicle transportation, import/export duties, or even the ability of buyers in certain nations to participate in auctions. Maintaining a keen eye on global political developments is therefore crucial for Copart's business continuity and market expansion strategies.

- Global Operations: Copart operates in 11 countries, with buyers in over 185 nations.

- Geopolitical Sensitivity: The company is directly impacted by political stability in its operating and buyer markets.

- Supply Chain Disruption: Conflicts and altered international relations can interrupt vehicle flow and buyer access.

- Market Volatility: Political shifts can influence buyer participation and cross-border transaction ease.

Government regulations on vehicle salvage, disposal, and recycling significantly shape Copart's business model, with upcoming End-of-Life Vehicles (ELVs) directives, starting April 2025 in some regions, aiming to boost part recycling. International trade policies and tariffs, like potential 2024 tariffs on auto parts, directly affect Copart's substantial export business by altering landed costs for international buyers.

Government mandates pushing for electric vehicle (EV) adoption, with targets set in 2024 for EV sales, influence the salvage market composition, necessitating specialized handling for EV batteries and their evolving recycling regulations. The global EV battery recycling market is projected to grow significantly, potentially exceeding $20 billion by 2030, impacting Copart's need for adapted infrastructure.

Insurance industry regulations, particularly concerning total loss declarations, directly impact vehicle flow to Copart's auctions. Claims inflation, estimated at a 7.5% rise in auto physical damage claims in 2023, could lead insurers to declare more vehicles a total loss, thereby increasing Copart's inventory.

What is included in the product

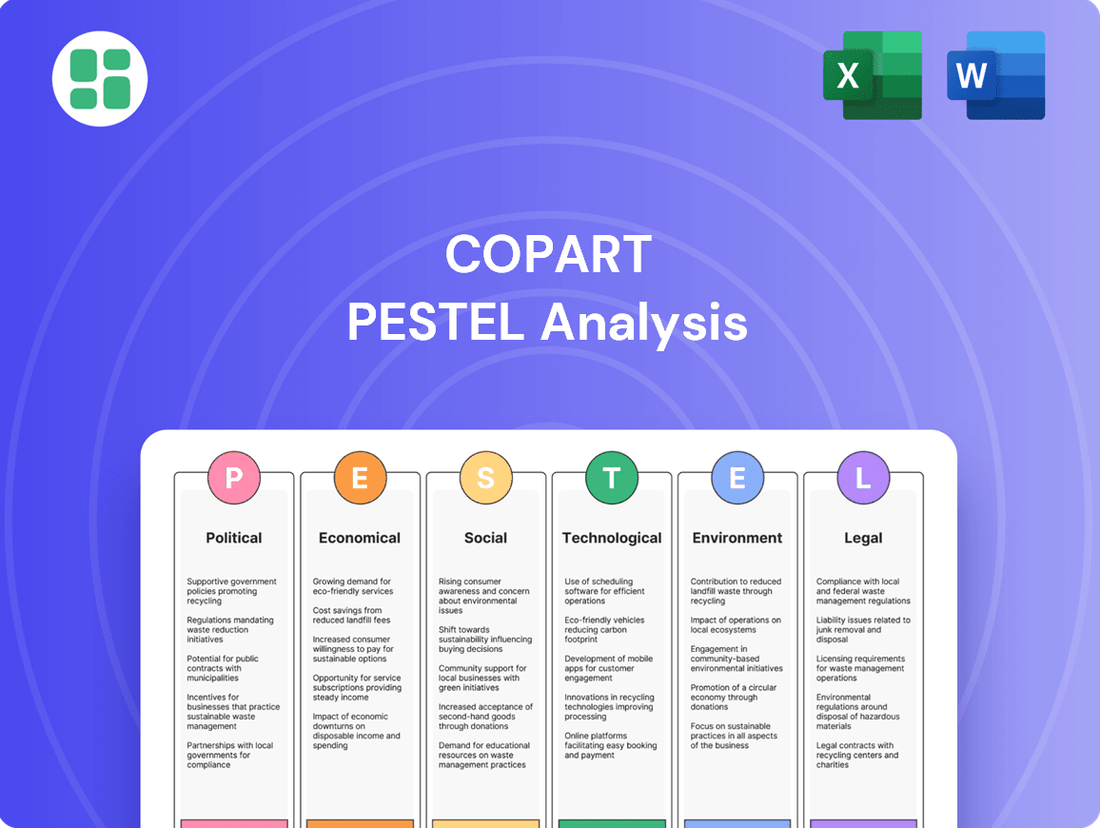

This Copart PESTLE analysis examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions influence the company's operations and strategic positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for strategic decision-making.

Economic factors

Inflation, especially in the motor insurance industry, directly influences repair expenses and the likelihood of vehicles being declared total losses. This means higher repair costs can make it more financially sensible for insurers to write off vehicles, ultimately boosting the supply of salvage vehicles for companies like Copart.

As of early 2024, inflation has remained a persistent concern globally, with many developed economies experiencing rates above central bank targets. For instance, the US Consumer Price Index (CPI) saw a notable increase throughout 2023, impacting the cost of auto parts and labor. This trend continues into 2024, with projections indicating persistent, albeit potentially moderating, inflationary pressures.

Furthermore, elevated interest rates, a common response to inflation, can dampen consumer spending on new and used cars. This affordability challenge might steer more buyers towards the used car market and, consequently, increase demand for Copart's more budget-friendly salvage or repairable vehicle options.

The valuation and demand in the used vehicle market are critical for Copart, directly affecting auction prices. While used car prices have remained elevated, showing a 13.7% year-over-year increase in April 2024 according to Manheim Used Vehicle Value Index, a projected softening in used vehicle retention could influence total loss valuations and salvage recovery amounts.

Copart's model can also benefit from economic downturns affecting new car production. For instance, if new vehicle sales slow, as indicated by a potential dip in 2024 sales compared to 2023, demand for used vehicles often rises, potentially increasing the volume and value of vehicles available for auction.

Consumer disposable income and spending habits are key drivers for Copart. When people have more money left after essential expenses, they're more likely to bid on used or repairable vehicles, whether for personal use or business. For instance, in the US, the personal saving rate, a proxy for disposable income available for spending, saw fluctuations throughout 2024, impacting discretionary purchases.

Economic downturns directly affect Copart's auction activity. A dip in consumer confidence, as measured by various economic indices, often translates to less aggressive bidding and potentially lower average selling prices for vehicles. This was observed in certain sectors during periods of economic uncertainty in late 2023 and early 2024.

Conversely, rising real wages and a general increase in consumer confidence tend to fuel demand for vehicles on Copart's platform. As more individuals and small businesses feel financially secure, their capacity and willingness to participate in auctions increase, leading to more competitive bidding and potentially higher sales figures.

Global Economic Growth and Trade

Copart, as a global online vehicle auction platform, sees its financial performance closely tied to the health of the worldwide economy and the flow of international trade. When economies are robust across many regions, demand for salvage vehicles, often destined for export and repair, tends to rise, broadening Copart's customer reach.

A global economic downturn or a slump in trade can negatively impact Copart by decreasing the number of international buyers and subsequently lowering overall unit sales. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight increase from 2023, but still facing headwinds from geopolitical tensions and inflation.

- Global Economic Outlook: The IMF's forecast for global growth in 2024 suggests a moderate but potentially uneven recovery, impacting consumer spending and vehicle replacement cycles.

- Trade Volume Impact: Fluctuations in global trade, influenced by factors like tariffs and supply chain disruptions, directly affect the cost and ease of exporting vehicles, a key revenue driver for Copart.

- Regional Economic Strength: The economic performance of key markets, such as the United States and Europe, significantly influences the availability of salvage vehicles and the purchasing power of international buyers.

Insurance Claims Frequency and Severity

The frequency and severity of vehicle accidents and natural disasters are key drivers for Copart's business, directly impacting the volume of salvage vehicles available. For instance, in 2023, the U.S. experienced a significant number of severe weather events, contributing to an increase in total loss claims for insurers.

The rising complexity of vehicle repairs, particularly with the growing prevalence of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is leading to higher total loss frequencies. This trend means more vehicles are deemed uneconomical to repair, thereby expanding Copart's inventory. For example, the average repair cost for EVs can be substantially higher than for traditional internal combustion engine vehicles, pushing more of them into the salvage market.

Copart strategically invests in its operational capacity to effectively manage these surges in inventory. This proactive approach ensures they can process and auction a greater number of vehicles efficiently, translating into increased revenue. The company's infrastructure is designed to scale with the demand generated by these economic factors.

- Increased Total Loss Frequency: Factors like complex EV repairs and severe weather events in 2023 boosted the number of vehicles declared total losses.

- Inventory Expansion: Higher total loss rates directly translate to a larger supply of salvage vehicles for Copart.

- Revenue Growth: A greater volume of salvage vehicles processed and auctioned fuels Copart's revenue streams.

- Capacity Investment: Copart's ongoing investments in infrastructure and technology support its ability to handle increased claim volumes.

Global economic conditions significantly influence Copart's operations, with forecasts for 2024 indicating moderate growth, around 3.2% according to the IMF, though tempered by inflation and geopolitical factors. Changes in trade volumes and regional economic health, particularly in major markets like the US and Europe, directly impact the supply of salvage vehicles and the demand from international buyers.

The cost of vehicle repairs, heavily influenced by inflation and interest rates, directly affects the likelihood of vehicles being declared total losses. For instance, the US CPI saw increases throughout 2023 and into 2024, raising auto part and labor costs. Higher repair expenses can make it more financially viable for insurers to write off vehicles, thereby increasing the inventory available for Copart.

Consumer spending power, linked to disposable income and confidence, plays a crucial role in auction demand. While used car prices showed a year-over-year increase of 13.7% in April 2024, a potential softening in used vehicle retention could impact valuations. Economic downturns can dampen consumer confidence, leading to less aggressive bidding and potentially lower selling prices.

| Economic Factor | Impact on Copart | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Global Economic Growth | Influences overall demand and export activity. | IMF projects 3.2% global growth in 2024, showing moderate but uneven recovery. |

| Inflation & Interest Rates | Affects repair costs, total loss frequency, and consumer spending. | Elevated US CPI in 2023-2024; higher interest rates can reduce demand for new/used cars. |

| Used Vehicle Market | Drives auction prices and salvage vehicle valuations. | Manheim Used Vehicle Value Index up 13.7% YoY in April 2024; projected softening could impact valuations. |

| Consumer Confidence | Impacts bidding activity and average selling prices. | Downturns can lead to less aggressive bidding; rising confidence fuels demand. |

Preview Before You Purchase

Copart PESTLE Analysis

The preview you see here is the exact Copart PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers all the key political, economic, social, technological, legal, and environmental factors impacting Copart. You can trust that the detailed insights and professional structure displayed are precisely what you'll be working with.

Sociological factors

Societal shifts increasingly favor online transactions, a trend that directly bolsters Copart's digital auction model. As more consumers and businesses embrace online platforms for substantial purchases, including vehicles, Copart's accessible market broadens significantly, lessening reliance on physical interactions. This growing comfort with digital commerce is a key driver for Copart's global reach, connecting millions of members worldwide through its online infrastructure.

Increasing consumer and business awareness regarding the environmental impact of vehicles is a significant sociological trend. This heightened consciousness is fueling a desire to prolong vehicle usage and enhance recycling efforts. For instance, a 2024 survey indicated that over 70% of consumers are more likely to consider a used vehicle if its maintenance history suggests a longer potential lifespan.

Copart's operational model directly addresses this societal shift. By enabling the resale of used and salvage vehicles, as well as the dismantling and sale of their parts, Copart champions a circular economy approach. This aligns perfectly with the growing global commitment to sustainability, as evidenced by the increasing adoption of Extended Producer Responsibility schemes across various industries.

Demographic shifts are reshaping how people interact with vehicles. For instance, the U.S. Census Bureau reported that in 2023, the urban population continued to grow, potentially increasing demand for ride-sharing services and public transportation in densely populated areas. This could lead to fewer individual vehicle purchases in these locales, impacting the overall volume of vehicles that eventually enter the salvage market.

Conversely, the average age of vehicles on U.S. roads reached a new high of 12.5 years in 2023, according to the U.S. Department of Transportation. This trend suggests a sustained supply of older, higher-mileage vehicles, which are more likely to be retired and enter the salvage auction pool, offering a consistent source of inventory for companies like Copart.

Perception of Salvage and Used Vehicles

Societal attitudes toward salvage and used vehicles significantly influence demand for Copart's inventory. As economic pressures mount, consumers are increasingly open to purchasing used or even salvage vehicles for repair, expanding the potential buyer base. For instance, data from the U.S. Bureau of Labor Statistics in 2024 indicated a continued rise in used car prices, making more affordable options attractive.

A growing emphasis on sustainability also bolsters the perception of used vehicles as an environmentally conscious choice. This trend is supported by reports showing a decrease in landfill waste from automotive parts when vehicles are properly salvaged and recycled. Copart's business model aligns with this circular economy principle, which resonates with a segment of environmentally aware consumers.

Improving the perception of salvage vehicles hinges on education and transparency regarding their condition and repair potential. By providing detailed vehicle histories and condition reports, Copart can build trust and attract a wider range of buyers, including those looking for project cars or parts. This transparency is crucial for overcoming lingering negative stereotypes associated with damaged vehicles.

- Increased Demand: Economic factors in 2024, like persistent inflation, pushed more consumers towards the used vehicle market, including salvage options.

- Sustainability Trend: A growing consumer preference for eco-friendly choices supports the market for refurbished and salvaged vehicles.

- Transparency is Key: Copart's commitment to detailed vehicle information can shift negative perceptions and broaden its customer appeal.

Impact of Social Inflation on Insurance Claims

Social inflation, a trend of rising claim costs fueled by increased litigation and larger jury awards, significantly impacts the insurance industry. This phenomenon, particularly evident in personal injury and commercial auto claims, has seen jury verdicts in the US for non-economic damages in tort cases rise by an average of 9% annually between 2019 and 2023, according to a report by Verisk Analytics. This escalation in claim payouts directly affects insurers' bottom lines.

In response to escalating claim costs and the potential for higher payouts, insurers may become more inclined to classify vehicles as total losses, even for less severe damage. This strategic decision, driven by the economics of repair versus replacement in a social inflation environment, can lead to a greater volume of vehicles entering the salvage market. For companies like Copart, which specializes in the auction of salvage vehicles, this trend presents a direct opportunity to increase inventory and sales volume.

- Social inflation is characterized by increased litigation and larger jury awards, driving up insurance claim costs.

- Verisk Analytics reported a 9% average annual increase in non-economic damage jury verdicts in US tort cases from 2019 to 2023.

- Insurers may declare vehicles total losses more readily due to rising claim costs.

- This trend can increase the supply of salvage vehicles available at auction for companies like Copart.

Societal comfort with online transactions continues to grow, directly benefiting Copart's digital auction model. This trend broadens Copart's accessible market and lessens reliance on physical interactions, supporting its global reach.

The average age of vehicles on U.S. roads reached a record 12.5 years in 2023, according to the U.S. Department of Transportation. This aging fleet suggests a sustained supply of older vehicles entering the salvage market, providing consistent inventory for Copart.

Economic pressures in 2024, such as inflation, are driving more consumers toward used and salvage vehicles, expanding Copart's potential buyer base. This is further supported by a continued rise in used car prices reported by the U.S. Bureau of Labor Statistics in 2024.

Social inflation, characterized by rising claim costs due to increased litigation and larger jury awards, can lead insurers to declare more vehicles total losses. Verisk Analytics reported a 9% average annual increase in non-economic damage jury verdicts in US tort cases from 2019 to 2023, potentially increasing salvage vehicle supply for Copart.

Technological factors

Copart's foundation is its VB3 online auction platform, a critical driver of its business. Continuous technological upgrades in areas like online bidding, user interface design, mobile app functionality, and real-time data handling are essential for Copart to stay ahead of competitors and draw in a global audience of buyers and sellers.

The company actively invests in improving its digital capabilities, incorporating features such as predictive analytics to forecast demand and processing enhancements to speed up transactions. For instance, in Q1 2024, Copart reported a 13.5% increase in revenue, partly fueled by the efficiency and reach of its advanced digital auction environment.

Artificial intelligence (AI) and data analytics are revolutionizing how Copart values vehicles and assesses damage. These technologies offer more precise, VIN-specific valuations that are also sensitive to micro-market conditions. For instance, AI-powered systems can analyze vast datasets to predict demand and optimal pricing for specific vehicle models in different geographic areas, a crucial advantage in the dynamic remarketing landscape. By automating condition assessments using imaging technology, Copart can significantly improve efficiency and reduce the potential for human error, fostering greater buyer trust.

The increasing integration of autonomous vehicle (AV) technology presents a dual impact on accident rates and the salvage market. While widespread AV adoption is projected to lower overall accident frequency, potentially reducing the volume of traditional salvage vehicles, the unique nature of AV damage could reshape the industry.

AVs, with their sophisticated sensors and complex systems, often incur higher repair costs even for minor collisions. This increased repair expense could lead to a higher frequency of total losses for damaged AVs. For instance, a study by the Rand Corporation in 2023 suggested that advanced driver-assistance systems (ADAS) alone can add thousands of dollars to repair bills, a figure that will likely grow with full autonomy.

This trend creates a specialized niche for salvage yards and parts suppliers capable of handling the intricate components of AVs. Companies like Copart will need to adapt by developing expertise in dismantling, assessing, and remarketing AV parts, potentially finding new revenue streams in this evolving technological landscape.

Electric Vehicle (EV) Technology and Battery Management

The accelerating adoption of electric vehicles (EVs) is a significant technological factor impacting Copart's operations. While EVs increase the overall volume of vehicles needing disposal, their advanced battery systems necessitate specialized knowledge and infrastructure. For instance, by the end of 2024, it's projected that over 30 million EVs will be on the road globally, a number expected to climb significantly by 2025, creating a growing need for companies like Copart to adapt.

Managing EV batteries presents unique challenges. These high-voltage components require specific safety protocols for handling, storage, and transportation to prevent thermal runaway or other hazards. Copart's investment in specialized training for its staff and the development of appropriate facilities will be crucial for compliance and operational efficiency. Furthermore, the recycling and disposal of these batteries are becoming increasingly important environmental considerations, with evolving regulations worldwide.

The remarketing of used EVs also hinges on battery health. Unlike traditional internal combustion engine vehicles where engine condition is paramount, a used EV's value is heavily influenced by its battery's remaining capacity and lifespan. Copart's ability to provide accurate battery health reports will be a critical differentiator in the used EV market, influencing pricing and buyer confidence.

- EV Market Growth: Global EV sales are projected to reach over 15 million units in 2024, with continued strong growth expected through 2025.

- Battery Handling Expertise: Specialized training programs for handling high-voltage EV batteries are becoming a necessity for salvage yards.

- Battery Health Reporting: The demand for reliable battery health diagnostics for used EVs is increasing, impacting resale values.

- Recycling Infrastructure: Significant investment is required in infrastructure for the safe and environmentally sound recycling of EV batteries.

Logistics and Supply Chain Optimization Technologies

Copart heavily relies on technology to streamline its vast logistics and supply chain operations, from vehicle transport to storage. Advanced telematics and route optimization software are key to boosting efficiency and cutting costs. These systems are particularly crucial for rapid deployment during widespread disaster events.

The company has invested in its own fleet and integrated these sophisticated technological solutions. For instance, in 2023, Copart reported a significant increase in its transportation assets, enabling greater control over delivery timelines and cost management within its global network. This strategic technological adoption directly supports their ability to handle a high volume of vehicles efficiently.

Key technological factors impacting Copart's logistics include:

- Real-time Fleet Tracking: Utilizing GPS and telematics to monitor vehicle locations, driver behavior, and delivery progress, ensuring accountability and dynamic rerouting.

- Advanced Route Optimization: Employing algorithms to determine the most efficient routes for vehicle pickup and delivery, minimizing fuel consumption and transit times.

- Inventory Management Software: Digital platforms that track vehicle status, location within yards, and condition, facilitating smoother processing and sale.

- Data Analytics for Predictive Maintenance: Using data from vehicle telematics to anticipate maintenance needs for their owned fleet, reducing downtime and operational disruptions.

Copart's technological edge is evident in its VB3 auction platform, which continuously evolves with upgrades to online bidding, user interface, and mobile app functionality. The company's Q1 2024 revenue growth of 13.5% was partly driven by this advanced digital environment, showcasing the direct financial impact of technological investment.

AI and data analytics are transforming vehicle valuation and damage assessment, offering more precise, VIN-specific valuations sensitive to micro-market conditions. This allows for optimized pricing and improved efficiency through automated condition assessments, fostering buyer trust.

The rise of autonomous vehicles (AVs) and electric vehicles (EVs) presents both challenges and opportunities. AVs, despite potentially lowering accident rates, may incur higher repair costs due to complex systems, creating a niche for specialized salvage expertise. EVs, with over 30 million projected on global roads by the end of 2024, require specialized handling of high-voltage batteries, with battery health becoming a key factor in resale value.

Copart's logistics are heavily reliant on technology, including real-time fleet tracking and advanced route optimization to enhance efficiency and reduce costs. Investments in their own fleet and integrated technological solutions, as seen in their increased transportation assets in 2023, underscore their commitment to operational excellence.

| Technology Area | Impact on Copart | 2024/2025 Data/Projection |

|---|---|---|

| Online Auction Platform (VB3) | Core business driver, enhances global reach and buyer/seller engagement. | Continued investment in UI/UX and mobile functionality. |

| AI & Data Analytics | Improves vehicle valuation, damage assessment, and demand forecasting. | Enables more precise, VIN-specific valuations and automated condition reports. |

| Autonomous Vehicles (AVs) | Creates demand for specialized handling and remarketing of AV parts due to higher repair costs. | ADAS systems can add thousands to repair bills, increasing total loss frequency. |

| Electric Vehicles (EVs) | Requires specialized battery handling and impacts resale value based on battery health. | Over 30 million EVs projected globally by end of 2024; battery health reporting is crucial for used EV market. |

| Logistics & Supply Chain Technology | Boosts efficiency and reduces costs through telematics and route optimization. | Increased investment in fleet assets for better control over delivery timelines and cost management. |

Legal factors

Copart operates within a framework of stringent vehicle salvage and dismantling regulations. These rules dictate how salvageable vehicles are handled, processed, and ultimately disposed of, emphasizing depollution and material segregation for environmentally sound dismantling. For instance, the European Union's End-of-Life Vehicles (ELVs) Directive, which was updated in 2020 and continues to influence national regulations, sets targets for recovery and recycling rates, impacting operations across member states.

Compliance with these evolving legal requirements, such as the forthcoming ELVs Rules in various jurisdictions, is non-negotiable for Copart's licensed facilities. Adherence ensures responsible recycling practices and effective waste management, mitigating environmental impact and maintaining operational legitimacy. Failure to comply can result in significant penalties and operational disruptions.

Environmental protection laws significantly influence Copart's operations, particularly concerning hazardous waste, emissions, and pollution control at its vehicle processing yards. Proper management of fluids like oil, gasoline, and battery acid from salvaged vehicles is essential. For instance, in 2023, the EPA continued to enforce strict regulations on hazardous waste disposal, with penalties for non-compliance potentially reaching tens of thousands of dollars per violation, directly impacting Copart's operational costs and permit validity.

Copart's commitment to environmental stewardship involves adhering to these regulations, which includes the safe handling and disposal of materials from end-of-life vehicles. The company's focus on mitigating its environmental footprint is crucial for maintaining its operating licenses and public image. Failure to comply could lead to significant fines and operational disruptions, underscoring the importance of robust environmental management systems.

Copart's reliance on its online platform and extensive customer data makes data privacy regulations like GDPR and CCPA critically important. Safeguarding buyer and seller information and ensuring secure transactions are essential for maintaining trust and operating legally.

Compliance with evolving cybersecurity laws is paramount. The remarketing industry is seeing increased scrutiny on data protection, making adherence to these regulations a key operational factor for Copart.

Consumer Protection and Auction Laws

Consumer protection laws are paramount for Copart, dictating everything from transparent vehicle descriptions to fair bidding processes. In 2024, regulatory bodies globally continue to scrutinize online marketplaces, emphasizing clear disclosures about vehicle condition and any prior damage. Adherence to these regulations, such as those enforced by the Federal Trade Commission (FTC) in the US or similar agencies in Europe, is vital for maintaining buyer trust and avoiding costly penalties.

Specific auction laws govern how Copart conducts its sales, including rules around bidding increments, reserve prices, and dispute resolution. For instance, many jurisdictions require clear communication of auction terms and conditions before bidding commences. Copart's commitment to these legal frameworks, which can vary significantly by region, directly impacts its operational integrity and its ability to attract a broad base of buyers. In 2025, we anticipate continued focus on digital marketplace fairness.

- Consumer Protection: Laws ensuring fair practices and preventing deceptive advertising are critical for Copart's online auctions.

- Auction Regulations: Specific rules on bidding, disclosures, and buyer rights are enforced across different operating regions.

- Transparency: Clear communication regarding vehicle history and auction terms builds buyer confidence and reduces legal exposure.

- Global Compliance: Copart must navigate and comply with diverse legal landscapes in every country it serves.

International Trade and Export Regulations

Copart's extensive international operations necessitate strict adherence to a myriad of global trade agreements and export/import laws. For instance, the company must comply with varying vehicle import restrictions and tariffs imposed by countries like Germany or the United Arab Emirates, which can influence the cost and feasibility of cross-border sales. Changes in these regulations, such as new emissions standards or safety requirements for imported vehicles, directly affect Copart's ability to move inventory efficiently and serve its diverse international clientele.

Navigating these legal landscapes is crucial for maintaining Copart's competitive edge. As of early 2024, the global automotive trade is subject to ongoing adjustments in trade policies, including potential tariffs on used vehicles. Copart's proactive management of compliance with these evolving international trade frameworks is essential for its continued success in facilitating over 100,000 vehicles sold weekly across its global platforms.

- Compliance with Export Controls: Copart must ensure all vehicles exported comply with national and international export control regulations, preventing the sale of vehicles to sanctioned entities or embargoed regions.

- Customs Duties and Tariffs: The company faces varying customs duties and tariffs in different markets, impacting the final price for international buyers and influencing demand. For example, import duties in countries like Australia can significantly affect the landed cost of vehicles.

- Vehicle Import Regulations: Each country has specific regulations regarding the import of used vehicles, including age limits, emissions standards, and safety inspections, which Copart must facilitate for its buyers.

- Trade Agreement Impact: Copart benefits from or is impacted by international trade agreements that can reduce or increase tariffs and streamline customs procedures for vehicle trade between member nations.

Copart operates under a complex web of consumer protection laws, ensuring fair practices and transparent dealings in its online auctions. For instance, in 2024, regulatory bodies like the FTC continued to emphasize clear disclosures about vehicle condition and history, directly impacting how Copart presents its inventory. Adherence to these regulations is vital for maintaining buyer trust and avoiding penalties.

Auction-specific regulations govern Copart's sales processes, detailing rules for bidding, reserves, and dispute resolution across various jurisdictions. These laws, which can differ significantly by region, ensure operational integrity and attract a broad buyer base. As of early 2025, there's an ongoing focus on the fairness of digital marketplaces, meaning Copart must remain vigilant in its compliance efforts.

Global trade laws and agreements significantly influence Copart's international operations, affecting vehicle import restrictions and tariffs. For example, varying duties in markets like Australia impact vehicle landed costs. Navigating these evolving international trade frameworks, which saw ongoing adjustments in global automotive trade policies through 2024, is essential for Copart's efficiency in facilitating over 100,000 vehicle sales weekly.

Environmental factors

Copart's operational model is a cornerstone of the circular economy, extending the lifespan of vehicles and their components through its extensive resale and recycling network. This directly addresses the growing global demand for resource efficiency and waste reduction.

By facilitating the reuse of existing automotive parts and materials, Copart significantly contributes to avoiding the carbon emissions associated with manufacturing new vehicles and components. In 2023 alone, the company's activities helped prevent the emission of an estimated 10 million metric tons of CO2e, underscoring its environmental impact.

Climate change is a significant environmental factor for Copart. The increasing frequency and intensity of extreme weather events, such as hurricanes and floods, directly affect the availability of total loss vehicles. For instance, the 2023 Atlantic hurricane season saw 20 named storms, with several making landfall and causing widespread damage, potentially increasing the supply of vehicles to Copart.

These events, while boosting inventory, also demand substantial investments in disaster response and infrastructure to handle sudden surges in vehicle volume. Copart's commitment to supporting affected communities involves maintaining the capacity to manage these influxes efficiently.

The accelerating adoption of electric vehicles (EVs) presents a significant environmental hurdle for companies like Copart, primarily concerning battery recycling and disposal. As more EVs enter the market, the volume of spent batteries requiring management will surge. For instance, by the end of 2023, the global EV market surpassed 40 million vehicles, with projections indicating continued robust growth through 2025.

Copart needs to proactively adapt its handling, storage, and recycling facilitation processes to safely manage these complex battery systems. Adherence to increasingly stringent environmental regulations, which are expected to mandate greater transparency in recycled material content by 2025, will be crucial. The goal is to maximize the recovery of valuable critical minerals such as lithium, cobalt, and nickel, which are essential for new battery production and represent a significant economic opportunity.

Emissions and Pollution Control

Copart's extensive physical operations, from vehicle storage yards to transportation networks, face growing scrutiny regarding emissions and pollution control. Regulations aimed at curbing greenhouse gases and other pollutants directly impact how Copart manages its fleet and facilities. For instance, in 2023, the transportation sector accounted for approximately 29% of total U.S. greenhouse gas emissions, a figure that underscores the environmental context Copart operates within.

To address these environmental factors, Copart is increasingly focused on reducing its carbon footprint. This includes strategic initiatives like optimizing logistics routes to minimize mileage and fuel consumption, investing in more fuel-efficient vehicles for its transportation fleet, and exploring the integration of green energy solutions. For example, the company has been installing solar panels at some of its larger facilities, aiming to offset energy consumption and demonstrate a commitment to sustainability, which is crucial for long-term compliance and corporate responsibility.

- Emissions Regulations: Copart's logistics and storage activities are governed by evolving environmental laws concerning air and water pollution.

- Fleet Efficiency: Investments in fuel-efficient vehicles and route optimization are key strategies to lower emissions from transportation operations.

- Renewable Energy: The adoption of solar power at facilities represents a move towards cleaner energy sources and reduced reliance on fossil fuels.

Material Recovery and Waste Management

Copart operates within an environmental landscape increasingly focused on maximizing material recovery from end-of-life vehicles (ELVs) and minimizing waste sent to landfills. This trend is directly influencing their operational strategies, pushing for more efficient dismantling and segregation processes to ensure recyclables are sent to authorized facilities.

Regulatory pressures are intensifying, mandating higher recycling rates for a variety of vehicle components, including metals, plastics, and fluids. For instance, the European Union's End-of-Life Vehicles Directive sets ambitious targets, with member states required to achieve at least 95% reuse and recovery and 85% recycling by weight of ELVs by 2015, with ongoing efforts to increase these figures. While specific figures for Copart's operations are proprietary, the global push towards circular economy principles means companies like Copart are incentivized to optimize their processes to meet and exceed these environmental benchmarks.

- Increased Regulatory Scrutiny: Governments worldwide are implementing stricter regulations on vehicle disposal and recycling, aiming to reduce environmental impact.

- Focus on Circular Economy: The industry is shifting towards a circular economy model, emphasizing the reuse and recycling of vehicle components.

- Material Segregation and Recovery: Copart's operations involve the careful dismantling and segregation of materials like steel, aluminum, copper, and various plastics for recycling.

- Fluid Management: Proper handling and disposal or recycling of automotive fluids, such as engine oil, coolant, and brake fluid, are critical environmental considerations.

Copart's environmental strategy is increasingly shaped by the need to manage the growing influx of electric vehicles (EVs) and their complex battery systems, a trend projected to continue through 2025 with millions of new EVs entering the market annually.

The company is also actively addressing its carbon footprint by optimizing logistics and investing in renewable energy sources like solar power for its facilities, aligning with global efforts to curb greenhouse gas emissions, which accounted for about 29% of total U.S. emissions in 2023.

Furthermore, Copart operates within a framework of intensifying environmental regulations that promote a circular economy, pushing for higher rates of material recovery and reuse from end-of-life vehicles, mirroring directives like the EU's End-of-Life Vehicles Directive.

| Environmental Factor | Impact on Copart | Key Data/Trends (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Influences vehicle supply (total loss vehicles) and requires disaster response capacity. | 20 named storms in the 2023 Atlantic hurricane season. |

| Electric Vehicle (EV) Adoption | Requires adaptation for battery handling, recycling, and disposal. | Global EV market surpassed 40 million vehicles by end of 2023; continued robust growth projected. |

| Emissions and Pollution Control | Impacts logistics, fleet operations, and facility management. | Transportation sector accounted for ~29% of total U.S. greenhouse gas emissions in 2023. |

| Circular Economy & Waste Reduction | Drives focus on material recovery, reuse, and recycling of vehicle components. | Global push for higher recycling rates for metals, plastics, and fluids from ELVs. |

PESTLE Analysis Data Sources

Our Copart PESTLE analysis is built on a robust foundation of data, drawing from official government publications, reputable automotive industry reports, and leading economic and technological forecasting agencies. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors influencing the vehicle remarketing sector.