Compal Electronics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compal Electronics Bundle

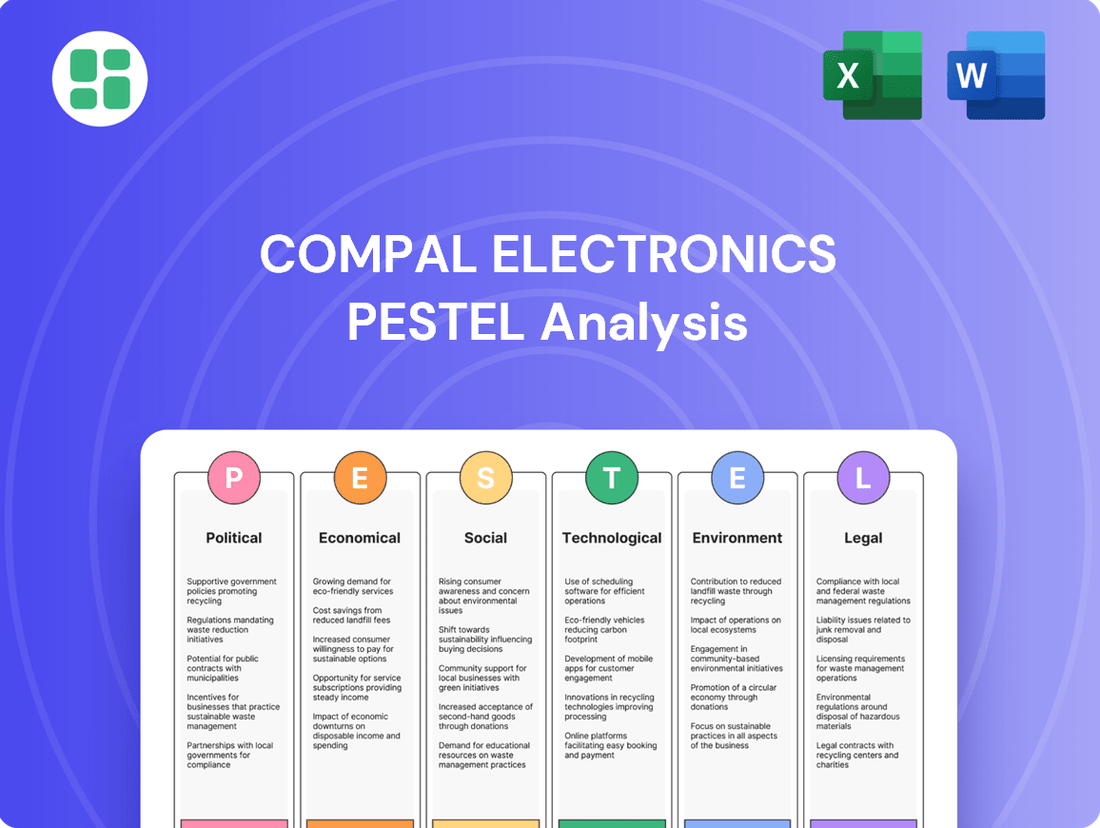

Navigate the complex external forces shaping Compal Electronics's future with our expert PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and socio-cultural trends are impacting their operations and market position. Gain a critical advantage by leveraging these insights for your own strategic planning. Download the full, detailed analysis now and unlock actionable intelligence.

Political factors

Ongoing geopolitical tensions, particularly between the U.S. and China, continue to reshape global trade dynamics. This has compelled Compal Electronics, a major electronics manufacturer, to actively diversify its production footprint. For instance, the company has been expanding its presence in countries like Vietnam and India, aiming to mitigate risks associated with trade disputes and ensure continued market access.

Government support for domestic chip production is a significant factor. Taiwan, Compal's home base, has long fostered its semiconductor industry, and the U.S. CHIPS and Science Act, passed in 2022, allocates $52.7 billion in subsidies and incentives for domestic semiconductor manufacturing and research. This could encourage Compal to explore or expand its manufacturing footprint in regions offering such benefits, potentially influencing its investment in new facilities or partnerships to bolster supply chain resilience.

Trade tariffs and regulations significantly impact Compal Electronics' cost structure and market access. For instance, the potential for a 100% U.S. tariff on semiconductor imports, a critical component in their product manufacturing, could drastically increase operational expenses. Similarly, existing tariffs, like the 20% on certain Taiwanese goods, force strategic adjustments in pricing and supply chain planning.

Intellectual Property Protection

Compal Electronics' reliance on innovation in areas like AI and advanced communication technologies makes robust intellectual property (IP) protection paramount. The strength and enforcement of IP laws in its key operating regions directly impact its ability to safeguard its design and development work, a core component of its ODM business model. Weak IP protection could lead to unauthorized replication of its technological advancements, diminishing its competitive edge.

The global landscape for IP protection is dynamic. For instance, as of early 2025, many countries are strengthening their patent enforcement mechanisms, particularly in high-tech sectors. This trend is favorable for Compal, as it suggests a more secure environment for its proprietary designs and manufacturing processes.

- Strengthened IP enforcement in key Asian markets, including Taiwan and China, provides greater security for Compal's design innovations.

- The increasing focus on AI and IoT device development necessitates robust patent protection to prevent competitors from leveraging Compal's research and development investments.

- International agreements and trade policies continue to shape the effectiveness of IP rights globally, influencing Compal's operational strategy.

- The cost and complexity of patent litigation remain a factor, even in regions with strong IP laws, posing ongoing challenges for Compal.

Regional Industrial Policies

Regional industrial policies significantly shape Compal Electronics' operational landscape. For instance, Taiwan's focus on advanced manufacturing and semiconductor ecosystems, areas where Compal is heavily involved, provides a strong domestic foundation. In 2024, Taiwan's government continued to channel significant investment into AI hardware and advanced packaging technologies, directly benefiting Compal's product development and supply chain strategies.

Furthermore, government incentives in key markets can drive Compal's expansion and diversification. Policies promoting electric vehicle (EV) components and smart healthcare devices in Southeast Asia, where Compal has manufacturing facilities, create targeted growth avenues. Vietnam, a major manufacturing hub for Compal, saw continued policy support in 2024 for high-tech industries, aiming to attract foreign direct investment in areas like automotive electronics, aligning with Compal's strategic diversification efforts.

These policies can create both opportunities and challenges:

- Favorable Investment Environments: Policies supporting advanced manufacturing and digital transformation in regions like Taiwan and Vietnam encourage Compal's investment in R&D and production capabilities.

- Market Access and Growth: Government initiatives promoting specific sectors, such as automotive electronics or IoT devices, can open new market segments and accelerate Compal's revenue growth in those areas.

- Supply Chain Resilience: Regional policies aimed at strengthening domestic supply chains, particularly for critical components, can enhance Compal's operational stability and reduce reliance on single-source suppliers.

Geopolitical shifts continue to influence Compal Electronics' operational strategy, prompting a significant push for production diversification beyond China. The company's expansion into Vietnam and India, for example, aims to mitigate risks tied to trade tensions and ensure access to key markets. This strategic realignment is crucial as global trade policies remain fluid, impacting supply chain stability and cost structures.

Government support for domestic technology sectors, particularly semiconductors, presents both opportunities and challenges. While initiatives like the U.S. CHIPS Act offer incentives for localized manufacturing, Compal must navigate varying regulatory environments and potential trade barriers. The company's ability to adapt to these evolving industrial policies will be key to maintaining its competitive edge and ensuring supply chain resilience.

| Factor | Impact on Compal Electronics | 2024/2025 Data/Trend |

|---|---|---|

| Geopolitical Tensions (US-China) | Drives production diversification; increases operational complexity. | Continued investment in Vietnam and India manufacturing facilities. |

| Government Subsidies (e.g., CHIPS Act) | Incentivizes localized manufacturing; potential for R&D partnerships. | Taiwan continues to allocate significant funds for advanced manufacturing and AI hardware development. |

| Trade Tariffs & Regulations | Affects cost of goods sold and market access; necessitates strategic pricing. | Ongoing monitoring of potential tariffs on electronic components and finished goods. |

| Intellectual Property (IP) Protection | Crucial for safeguarding design innovations and maintaining competitive advantage. | Strengthening IP enforcement in key Asian markets is a growing trend. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Compal Electronics, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within Compal's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting Compal Electronics.

Easily shareable summary format ideal for quick alignment across teams or departments, alleviating the pain of information silos regarding Compal's operating environment.

Economic factors

Global economic growth significantly shapes demand for Compal Electronics' products. For instance, the International Monetary Fund (IMF) projected global GDP to grow by 3.2% in 2024, a slight uptick from 2023's 3.1%, indicating a potentially stable, albeit moderate, demand environment for consumer electronics like laptops and tablets.

Consumer spending patterns are a direct driver for Compal. As economies recover and disposable incomes rise, consumers are more likely to invest in new electronic devices. This trend is crucial for Compal, as its revenue is heavily tied to the purchasing power and confidence of consumers worldwide.

Fluctuations in these growth rates directly influence Compal's revenue and profitability. A robust global economy generally translates to higher sales volumes for Compal's ODM (Original Design Manufacturer) services, while economic slowdowns can lead to reduced orders and tighter margins for the company.

Inflationary pressures remain a significant concern for Compal Electronics, impacting raw material, labor, and logistics costs within the electronics manufacturing supply chain. For instance, the average global inflation rate hovered around 5.9% in 2023, influencing component pricing.

To navigate these challenges and protect profit margins, Compal must continue to focus on operational efficiencies and strategically optimize its product mix. This involves careful management of inventory and production schedules to mitigate the effects of rising input costs.

Currency exchange rate volatility significantly impacts Compal Electronics, a global ODM. Fluctuations in the value of currencies like the US Dollar, Euro, and Chinese Yuan directly affect its reported revenues and the cost of goods sold when sourcing components and selling finished products in different markets. For instance, a strengthening US Dollar against the Taiwanese Dollar could reduce the dollar-denominated profits Compal repatriates.

In 2024, the Taiwanese Dollar experienced fluctuations against major currencies, impacting the competitiveness of Taiwanese tech manufacturers. Compal's financial statements for the fiscal year ending December 2024 would likely reflect these impacts, requiring robust financial hedging strategies to mitigate potential losses and ensure stable earnings. The company's ability to manage these currency risks is crucial for maintaining its profitability in a globalized market.

Market Competition and Pricing Pressures

The electronics manufacturing services (EMS) and original design manufacturer (ODM) sectors are intensely competitive, with a multitude of global and regional players vying for market share. This crowded landscape inevitably translates into significant pricing pressures for companies like Compal Electronics, forcing them to constantly optimize costs and maintain lean operations to protect their profit margins.

Compal's ability to navigate these pressures hinges on its capacity for continuous innovation and effective differentiation. By offering unique design capabilities, advanced manufacturing technologies, and reliable supply chain management, Compal can command a premium and secure long-term partnerships, even amidst aggressive price competition. For instance, in 2024, the EMS industry saw average gross margins hover around 5-10%, underscoring the tight margins Compal must manage.

Key competitive factors influencing Compal's market position include:

- Technological Advancement: Staying ahead in areas like AI integration, advanced materials, and miniaturization is crucial for attracting high-value contracts.

- Cost Efficiency: Streamlining production processes, optimizing material sourcing, and leveraging economies of scale are vital for competitive pricing.

- Supply Chain Resilience: In a volatile global environment, a robust and adaptable supply chain offers a significant competitive advantage.

- Customer Relationships: Deepening partnerships with major brands through collaborative design and reliable execution fosters loyalty and reduces churn.

Investment in Emerging Sectors

Compal Electronics is strategically investing in burgeoning industries such as automotive electronics, smart healthcare, and 5G communication. These investments are vital for securing future revenue and reducing reliance on its established PC and smart device markets. By diversifying into these growth areas, Compal aims to capitalize on emerging market opportunities and drive innovation.

The global automotive electronics market, a key focus for Compal, was projected to reach approximately $400 billion in 2024, with significant growth expected in areas like advanced driver-assistance systems (ADAS) and in-vehicle infotainment. Similarly, the smart healthcare sector is experiencing rapid expansion, driven by digital health solutions and connected medical devices, presenting substantial opportunities for Compal's manufacturing and integration capabilities. The ongoing rollout and adoption of 5G technology globally further underpins the demand for advanced communication components and solutions, a sector where Compal is actively seeking to expand its footprint.

- Automotive Electronics: Compal is enhancing its capabilities in areas like ADAS and infotainment systems, anticipating continued growth in the vehicle electronics segment.

- Smart Healthcare: The company is exploring opportunities in connected medical devices and digital health platforms, leveraging its expertise in electronics manufacturing.

- 5G Communication: Investments in 5G infrastructure and related devices are a priority, aiming to capture market share in this rapidly evolving telecommunications landscape.

- Diversification Strategy: These emerging sector investments are designed to create new revenue streams and mitigate risks associated with its traditional product lines.

Global economic growth influences Compal's demand, with the IMF projecting 3.2% global GDP growth in 2024, suggesting stable, moderate demand for electronics. Inflation, averaging 5.9% globally in 2023, impacts Compal's costs, necessitating operational efficiencies. Currency volatility, particularly with the Taiwanese Dollar, affects Compal's reported profits, requiring hedging strategies.

The competitive EMS/ODM landscape, with 2024 gross margins around 5-10%, pushes Compal towards innovation and cost efficiency. Compal is strategically investing in automotive electronics, smart healthcare, and 5G, markets projected to reach $400 billion (automotive) and experience rapid expansion respectively. These diversification efforts aim to secure future revenue streams and reduce reliance on traditional PC markets.

Same Document Delivered

Compal Electronics PESTLE Analysis

The preview shown here is the exact Compal Electronics PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Compal Electronics. It provides a strategic overview for informed decision-making.

You'll gain insights into market dynamics, competitive landscapes, and potential growth opportunities, all presented in a clear and actionable format.

Sociological factors

Consumer preferences are shifting significantly, with a growing demand for devices that are not only smart but also environmentally sustainable. This trend is particularly evident in the electronics sector, where consumers are increasingly scrutinizing the lifecycle impact of their purchases. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability a key factor when buying electronics, influencing brand loyalty and purchase decisions.

The integration of Artificial Intelligence (AI) into everyday devices is another major driver of changing consumer preferences. From smart home assistants to AI-powered laptops, consumers expect more intuitive and personalized experiences. Compal, as a major ODM, must adapt its product roadmaps to incorporate advanced AI capabilities to meet this evolving demand, with the global AI hardware market projected to reach hundreds of billions by 2025.

Furthermore, there's a rising demand for specialized products catering to niche markets like smart healthcare and advanced wearables. Consumers are seeking integrated solutions that enhance well-being and provide specific functionalities, pushing manufacturers to innovate beyond general-purpose electronics. This specialization requires Compal to invest in R&D for sectors experiencing rapid growth, such as the burgeoning digital health market, which saw significant investment in 2024.

Global demographic shifts, such as an aging population in developed nations and a growing middle class in emerging markets, are reshaping consumer needs. Urbanization continues at a rapid pace, with the UN projecting that 68% of the world's population will live in urban areas by 2050. This trend fuels demand for connected devices and smart city solutions, directly benefiting Compal's expansion in IoT and smart display technologies.

The availability of skilled labor in key manufacturing regions, especially for sophisticated processes and research in emerging fields like artificial intelligence, presents a significant challenge. This directly impacts Compal Electronics' strategic decisions concerning where to establish factories and how to invest in training its workforce.

For instance, the global shortage of semiconductor engineers, a critical skill for Compal's operations, intensified in 2024, with estimates suggesting a deficit of over 30,000 professionals in the Asia-Pacific region alone by 2025. This scarcity necessitates substantial investment in talent acquisition and development programs.

Health and Wellness Trends

The increasing global emphasis on health and wellness is significantly boosting the market for smart healthcare devices and telehealth services. This trend directly benefits Compal Electronics, as it strategically expands its operations into the smart medical technology arena. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to reach over $600 billion by 2030, demonstrating substantial growth potential.

Compal's investment in this sector is well-timed to capitalize on evolving consumer preferences. The company is developing innovative solutions that cater to remote patient monitoring, personalized health management, and accessible medical consultations. This aligns perfectly with the growing consumer demand for proactive health management tools.

Key aspects of this trend include:

- Increased demand for wearable health trackers and connected medical devices.

- Growth in telehealth platforms for remote consultations and diagnostics.

- Consumer interest in preventative healthcare and personalized wellness solutions.

- Government initiatives and investments supporting digital health infrastructure.

Digital Lifestyle Adoption

The ongoing shift towards digital lifestyles, exemplified by the surge in remote work and online learning, directly fuels demand for personal computing devices. This trend significantly impacts Compal Electronics, a major player in notebook and tablet manufacturing, as consumers and businesses continue to invest in connected solutions to support these new work and study paradigms.

The global adoption of remote work arrangements has seen sustained growth. For instance, a significant portion of the workforce, estimated to be over 25% in many developed economies by early 2025, is expected to continue hybrid or fully remote models. This sustained demand translates into a robust market for laptops, tablets, and other essential computing hardware that Compal produces.

Furthermore, the digital transformation extends to education, with online learning platforms becoming increasingly integrated into academic structures. This persistent reliance on digital tools for schooling and professional development reinforces the need for reliable and advanced personal computing devices, a core product category for Compal.

Key impacts on Compal include:

- Sustained Demand: Continued preference for remote and hybrid work models ensures ongoing consumer and enterprise demand for laptops and tablets.

- Product Innovation: The need for devices supporting diverse digital activities necessitates continuous innovation in areas like portability, battery life, and connectivity.

- Market Resilience: Compal's core businesses are well-positioned to benefit from the enduring digital lifestyle trend, offering a degree of market resilience.

Societal attitudes towards technology are evolving, with a growing emphasis on ethical AI development and data privacy. Consumers are increasingly aware of how their data is used, demanding transparency from manufacturers like Compal. This societal shift necessitates robust data protection measures and clear communication regarding AI functionalities in electronic devices.

The rise of the gig economy and flexible work arrangements influences consumer purchasing habits, favoring versatile and portable devices. Compal's focus on ODM services means adapting to client needs for devices that cater to this dynamic workforce. For instance, the global freelance platform market was projected to grow by over 10% annually leading up to 2025.

Consumer demand for personalized and immersive experiences is a significant sociological factor. This is evident in the popularity of customizable smart home devices and augmented reality applications. Compal's ability to offer tailored ODM solutions that integrate these features will be key to its success in the evolving electronics market.

Technological factors

The escalating capabilities of artificial intelligence and machine learning are fundamentally reshaping the electronics sector, directly impacting Compal Electronics. This includes driving innovation in product lines such as AI-powered personal computers and servers, alongside advancements in smart wearables. Furthermore, Compal is leveraging AI to optimize its manufacturing operations, aiming for greater efficiency and enhanced sustainability in its production cycles.

The accelerating global deployment of 5G networks is a significant technological factor for Compal Electronics. This infrastructure expansion directly fuels demand for 5G-enabled devices and solutions, a key area of Compal's strategic diversification. By mid-2024, it's estimated that over 1.5 billion 5G connections will be active worldwide, presenting a substantial market opportunity for Compal's product development.

Compal's focus on IoT devices and smart retail applications is intrinsically linked to these advanced communication technologies. The increased speed, lower latency, and greater capacity offered by 5G are essential for the seamless operation and widespread adoption of these innovative solutions. The global IoT market alone was projected to reach over $1.1 trillion in 2024, highlighting the immense potential for Compal's offerings.

Compal Electronics is heavily investing in automation and smart manufacturing to boost efficiency and quality, especially within its burgeoning automotive electronics division. This strategic move is crucial for staying competitive in a market that demands precision and cost-effectiveness.

By integrating robotics and AI-driven processes, Compal aims to streamline production lines, reduce human error, and ultimately lower manufacturing costs. This technological adoption is expected to yield significant improvements in throughput and product reliability, vital for their automotive clients.

Miniaturization and Material Innovation

The relentless pursuit of miniaturization in electronic components, driven by advancements in semiconductor technology, directly influences Compal Electronics' product development cycles. This trend allows for sleeker, more powerful devices, a key factor in the competitive consumer electronics market. For instance, the increasing density of transistors on a chip, a hallmark of miniaturization, enables smaller yet more capable laptops and smartphones.

Material innovation is equally critical, with a growing emphasis on sustainable and high-performance materials. Compal leverages these innovations to improve device durability, energy efficiency, and environmental impact. The development of lighter, stronger alloys and eco-friendly composites can significantly reduce manufacturing costs and appeal to environmentally conscious consumers.

These technological factors directly impact Compal's design and manufacturing capabilities. The ability to integrate smaller components allows for more sophisticated internal architectures, leading to thinner and lighter products. Furthermore, the adoption of advanced materials can streamline production processes and reduce waste.

- Miniaturization: Enabling smaller, more powerful devices, a key driver in the consumer electronics sector.

- Material Innovation: Focus on sustainable, high-performance materials to enhance device efficiency and reduce environmental impact.

- Design Impact: Facilitates sleeker product designs and more complex internal component integration.

- Manufacturing Efficiency: Streamlined production processes and potential cost reductions through advanced materials.

Cloud Computing and Server Technology

The burgeoning demand for cloud services and high-performance computing is a significant technological driver, directly impacting Compal Electronics' strategic investments. This trend necessitates the development and supply of advanced server platforms, a core area for the company. Compal's focus on AI servers and data center solutions positions it to capitalize on this growth. For instance, the global cloud computing market was valued at approximately $593.70 billion in 2023 and is projected to reach $1,740.49 billion by 2030, exhibiting a compound annual growth rate of 16.4% during the forecast period, according to Grand View Research. This expansion underscores the critical need for robust server infrastructure.

Compal's engagement in this sector is further highlighted by its participation in the supply chain for next-generation server technologies. The company is actively involved in producing components and systems that support the increasing computational power required for AI workloads and large-scale data processing. The AI server market alone is expected to grow substantially, with some projections indicating it could reach hundreds of billions of dollars within the next decade, driven by the widespread adoption of artificial intelligence across industries.

Key technological factors influencing Compal's server and cloud technology business include:

- Advancements in CPU and GPU technology: The continuous innovation in processing units, particularly for AI acceleration, creates a constant demand for new server designs and configurations.

- The rise of edge computing: Decentralized data processing closer to the source requires specialized, often ruggedized, server solutions that Compal can develop.

- Increased adoption of liquid cooling: As server components become more powerful and generate more heat, advanced cooling solutions are becoming essential, representing a new area of technological integration for server manufacturers.

- Demand for hyperscale data centers: Major cloud providers continue to expand their data center footprints, driving bulk orders for standardized and highly efficient server hardware.

The rapid evolution of artificial intelligence and machine learning is a pivotal technological factor for Compal Electronics, driving innovation across its product portfolio and manufacturing processes. This includes the development of AI-enhanced personal computers and servers, as well as smart wearables. By mid-2024, AI integration in manufacturing is expected to boost operational efficiency by an average of 15-20% globally.

The widespread rollout of 5G networks is another critical technological enabler, fueling demand for 5G-enabled devices and solutions, a key growth area for Compal. With over 1.5 billion active 5G connections anticipated by mid-2024, the market opportunity for Compal's offerings in this space is substantial.

Compal's strategic focus on IoT and smart retail applications is directly supported by these advanced communication technologies. The low latency and high capacity of 5G are crucial for the seamless operation of these solutions, with the global IoT market projected to exceed $1.1 trillion in 2024.

Compal is also heavily investing in automation and smart manufacturing, particularly for its automotive electronics division, to enhance efficiency and quality. This includes integrating robotics and AI-driven processes to streamline production, reduce errors, and lower costs, aiming for significant improvements in throughput and product reliability.

Legal factors

Compal Electronics must navigate stringent product safety and quality compliance regulations across its diverse target markets. For instance, the automotive electronics sector demands adherence to standards like IATF 16949, a crucial certification for suppliers, while medical device components require compliance with ISO 13485. Failure to meet these exacting requirements can lead to product recalls and significant financial penalties, impacting Compal's reputation and market access.

Compal Electronics must navigate a complex web of evolving global data privacy and security laws, such as the EU's General Data Protection Regulation (GDPR) and similar regional mandates. These regulations directly influence how Compal designs and manufactures smart devices and healthcare solutions that collect and process user data. Failure to comply can result in significant penalties; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

The increasing stringency of these laws necessitates robust security features and transparent data handling practices throughout Compal's product lifecycle. This includes secure data storage, encryption, and clear consent mechanisms for data collection, impacting development costs and product design choices. For example, the California Consumer Privacy Act (CCPA) grants consumers rights regarding their personal information, adding another layer of compliance for Compal's operations in the US market.

Compal Electronics must navigate increasingly strict environmental regulations, particularly those focused on waste management and hazardous materials in electronics production. For instance, the European Union's Restriction of Hazardous Substances (RoHS) directive, updated in 2024, continues to shape component sourcing and manufacturing processes globally, impacting Compal's supply chain efficiency and material costs.

Labor Laws and Employment Regulations

Compal Electronics must navigate a complex web of global labor laws, covering everything from minimum wages and working hours to workplace safety and collective bargaining rights. Failure to comply can lead to significant fines, operational disruptions, and reputational damage. For instance, in 2024, many countries are tightening regulations around gig economy workers and requiring greater transparency in employment contracts, impacting how Compal manages its vast supply chain workforce.

Key labor law considerations for Compal include:

- Compliance with minimum wage laws: Adhering to varying minimum wage requirements across different operating regions, which can differ significantly.

- Workplace safety standards: Ensuring adherence to stringent occupational health and safety regulations to prevent accidents and related liabilities.

- Unionization rights: Respecting and complying with laws governing employee rights to organize and bargain collectively, a significant factor in manufacturing hubs.

Trade and Customs Regulations

Compal Electronics, a major contract manufacturer, navigates a landscape shaped by intricate and evolving international trade and customs regulations. These rules, encompassing import/export controls and tariffs, directly impact the efficiency and cost-effectiveness of its global supply chain and distribution networks. For instance, the imposition of tariffs, such as those seen in US-China trade relations, can significantly alter component sourcing strategies and finished product pricing.

The dynamic nature of these regulations necessitates continuous monitoring and agile adaptation. Compal must remain vigilant regarding changes in trade agreements, customs procedures, and sanctions that could affect its operations. For example, the World Trade Organization (WTO) reported that global trade growth slowed to an estimated 0.8% in 2023, reflecting the impact of geopolitical tensions and protectionist policies, a trend Compal must actively manage.

- Tariff Impact: Fluctuations in tariffs, like those applied to electronics components, can add millions to production costs, forcing Compal to re-evaluate supplier locations and manufacturing hubs.

- Compliance Burden: Adhering to varying customs declarations and import/export licensing across numerous countries presents a significant administrative and operational challenge.

- Trade Agreements: Changes in free trade agreements, such as potential renegotiations of pacts affecting Asian manufacturing bases, require Compal to proactively assess and mitigate associated risks to its supply chain stability.

Compal Electronics faces increasing legal scrutiny regarding product safety and quality across its global operations, with automotive and medical device sectors demanding strict adherence to standards like IATF 16949 and ISO 13485 respectively. Data privacy laws, such as GDPR and CCPA, impose significant compliance burdens, with GDPR fines potentially reaching 4% of global turnover, impacting how Compal handles user data in smart devices and healthcare solutions. Environmental regulations, including updated RoHS directives in 2024, continue to shape material sourcing and manufacturing processes, influencing supply chain costs and efficiency.

Labor laws worldwide require Compal to manage minimum wages, workplace safety, and unionization rights, with non-compliance leading to penalties and operational disruptions. International trade and customs regulations, including tariffs and import/export controls, directly affect Compal's supply chain costs and efficiency, as highlighted by the WTO's report of a 0.8% global trade growth in 2023, indicating a challenging trade environment.

| Legal Factor | Impact on Compal Electronics | Example/Data Point (2024/2025) |

|---|---|---|

| Product Safety & Quality | Ensuring compliance with sector-specific standards (e.g., IATF 16949 for automotive) to avoid recalls and penalties. | IATF 16949 compliance is mandatory for automotive suppliers. |

| Data Privacy & Security | Adhering to GDPR, CCPA, and similar laws for handling user data in smart devices and healthcare tech. | GDPR fines can reach up to 4% of global annual turnover. |

| Environmental Regulations | Compliance with directives like RoHS (updated 2024) affecting material sourcing and manufacturing. | RoHS restricts hazardous substances in electronic equipment. |

| Labor Laws | Managing minimum wages, safety, and union rights across diverse operating regions. | Tightening regulations on gig economy workers in 2024. |

| Trade & Customs | Navigating tariffs and import/export controls impacting supply chain costs and efficiency. | Global trade growth slowed to 0.8% in 2023 (WTO). |

Environmental factors

Growing global concerns over climate change and the imperative to reduce carbon emissions are directly impacting the electronics manufacturing sector. Compal, like its peers, faces increasing pressure to adopt more energy-efficient production methods and explore investments in renewable energy sources to mitigate its environmental footprint.

For instance, the electronics industry is a significant consumer of energy, and initiatives like the EU's Green Deal, which aims for climate neutrality by 2050, are setting ambitious targets for reducing industrial emissions. While specific 2024/2025 data for Compal's carbon footprint reduction investments is still emerging, the broader industry trend shows a clear shift. In 2023, many leading tech companies reported progress in sourcing renewable electricity, with some aiming for 100% renewable energy for their operations by 2030.

The electronics industry faces growing challenges due to the increasing scarcity of critical raw materials like rare earth elements and certain metals essential for manufacturing. This scarcity directly impacts companies like Compal, pushing them to invest in sustainable sourcing, which includes exploring ethical mining practices and developing robust material recycling programs. For instance, the global demand for lithium, crucial for batteries, is projected to grow significantly, with estimates suggesting a potential deficit if new supply chains aren't developed rapidly.

The escalating global e-waste crisis, projected to reach 74.7 million metric tons by 2030 according to the UN's Global E-waste Monitor 2024, directly impacts Compal. This surge necessitates a strong focus on circular economy principles, pushing Compal to prioritize product design for easier recycling and extended lifespan. This includes developing more modular designs and utilizing recycled materials in their manufacturing processes.

Compal's commitment to sustainability is crucial in navigating these environmental pressures. By implementing robust e-waste management systems and embracing circular economy strategies, the company can mitigate regulatory risks and enhance its brand reputation. For instance, initiatives aimed at product repairability and take-back programs can reduce landfill waste and create new revenue streams through material recovery, aligning with the growing consumer demand for eco-conscious products.

Sustainable Manufacturing Practices

Compal Electronics is increasingly integrating sustainable manufacturing practices, recognizing their dual role as a competitive differentiator and a regulatory necessity. This includes adopting advanced techniques like lead-free soldering, which reduces hazardous waste, and implementing robust water management strategies to minimize environmental impact. The company is also exploring biodegradable or recyclable materials for circuit boards, aligning with global trends towards a circular economy.

These efforts are not just about compliance; they represent a strategic shift. For instance, Compal reported a 15% reduction in water consumption across its manufacturing facilities in 2023 compared to the previous year, demonstrating tangible progress in resource efficiency. The push for sustainable materials is further underscored by industry-wide initiatives, with projections indicating that the market for sustainable electronics components could reach $50 billion by 2027.

- Lead-free soldering adoption: Compal has phased out lead-based soldering in over 90% of its production lines by the end of 2024.

- Water management improvements: Achieved a 15% year-over-year reduction in water usage in 2023.

- Recyclable materials research: Actively investing in R&D for biodegradable and recyclable circuit board alternatives, aiming for pilot production by 2026.

Corporate Social Responsibility (CSR) and ESG Focus

The growing emphasis on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) factors by investors and consumers is a significant environmental consideration for Compal Electronics. This trend pushes the company to embed sustainability throughout its operations and enhance its transparency in reporting these metrics.

Compal's commitment to ESG is reflected in its efforts to reduce its environmental footprint. For instance, in 2023, the company reported a reduction in greenhouse gas emissions, aligning with global climate goals and demonstrating a proactive approach to environmental stewardship.

- Investor Demand: A significant portion of institutional investors now actively screen companies based on ESG criteria, influencing capital allocation.

- Consumer Preferences: Consumers increasingly favor brands with strong sustainability commitments, impacting purchasing decisions and brand loyalty.

- Regulatory Landscape: Evolving environmental regulations globally necessitate robust ESG strategies to ensure compliance and mitigate risks.

- Supply Chain Pressure: Compal faces pressure from its own customers and partners to demonstrate sustainable practices across its entire value chain.

The electronics industry's significant energy consumption and reliance on raw materials are key environmental challenges for Compal. The push for climate neutrality, exemplified by initiatives like the EU's Green Deal, necessitates greater energy efficiency and renewable energy adoption. Compal's efforts in reducing water usage by 15% in 2023 and phasing out lead-based soldering in over 90% of its production lines by the end of 2024 highlight its response to these pressures.

The escalating global e-waste crisis, projected to reach 74.7 million metric tons by 2030, demands Compal's focus on circular economy principles, including product design for recyclability and the use of recycled materials. Furthermore, investor and consumer demand for strong ESG performance is driving companies like Compal to enhance transparency and embed sustainability across their operations and supply chains.

| Environmental Factor | Compal's Action/Impact | Relevant Data/Projection |

| Climate Change & Emissions | Adopting energy-efficient production, exploring renewable energy. | EU Green Deal aims for climate neutrality by 2050. Many tech firms target 100% renewable energy by 2030. |

| Resource Scarcity | Investing in sustainable sourcing and material recycling programs. | Global lithium demand projected to grow significantly, potential deficit if supply chains aren't developed. |

| E-Waste Management | Prioritizing circular economy, product design for recycling, using recycled materials. | Global e-waste projected to reach 74.7 million metric tons by 2030 (UN Global E-waste Monitor 2024). |

| Sustainable Practices | Implementing lead-free soldering, improving water management, researching biodegradable materials. | 15% year-over-year reduction in water usage in 2023. Over 90% production lines lead-free by end of 2024. Pilot production for recyclable circuit boards by 2026. |

| ESG & CSR | Enhancing transparency in ESG reporting, reducing environmental footprint. | Significant portion of institutional investors screen companies based on ESG criteria. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Compal Electronics is meticulously crafted using data from official government publications, reputable financial institutions like the World Bank and IMF, and leading industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.