Compal Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compal Electronics Bundle

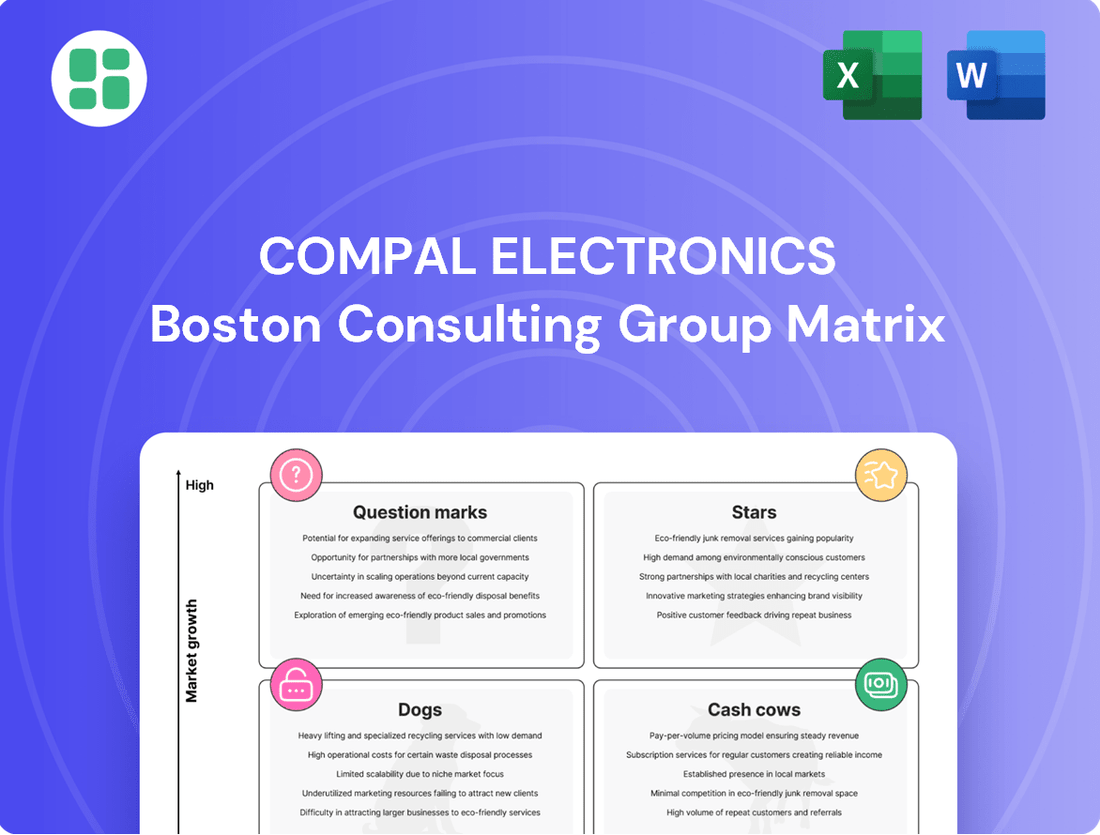

Curious about Compal Electronics' strategic product positioning? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. To truly understand where Compal's products fall as Stars, Cash Cows, Dogs, or Question Marks, and to unlock actionable insights for your own business strategy, dive into the complete report.

Get the full BCG Matrix report for Compal Electronics and uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions. This comprehensive analysis will empower you to navigate the competitive landscape with confidence.

Stars

Compal Electronics is making significant strides in the AI/HPC server market, a key growth driver for the company. They are actively developing and showcasing advanced solutions, including those leveraging NVIDIA's MGX architecture. This focus on cutting-edge technology positions Compal to capitalize on the booming demand for AI infrastructure.

The company has already commenced shipments of servers featuring the powerful NVIDIA GH200 Grace Hopper Superchip. With robust market demand anticipated, Compal expects these shipments to increase substantially. This strategic move underscores Compal's commitment to becoming a major supplier in the high-growth AI server segment.

Compal Electronics is making significant strides in next-generation 5G communication solutions, building on its robust capabilities in 5G RF, PHY layer, and Open Radio Access Network (O-RAN) technologies. This focus positions them to capitalize on the evolving wireless landscape.

The company has introduced innovative AI server solutions, specifically AI RAN, which integrate seamlessly with 5G base stations. These solutions are designed to boost network intelligence and operational efficiency, a key differentiator in the competitive 5G market.

Compal's active participation in prominent industry showcases like MWC 2024 and their planned presence at COMPUTEX 2025 underscore their dedication to advancing technologies such as B5G satellite communication and smart retail solutions, demonstrating a forward-looking approach to market opportunities.

Compal Electronics is strategically positioning itself in the automotive electronics sector, evidenced by substantial investments like its new manufacturing facility in Poland. This facility is specifically designed for automotive electronic parts, signaling a serious commitment to this high-growth market. The company projects impressive high single-digit percentage growth for this segment, reflecting confidence in its expansion strategy.

Further underscoring this focus, Compal showcased its AI-integrated infrared sensing technology for driving safety at CES 2025. This initiative highlights their dedication to developing cutting-edge, innovative solutions that cater to the evolving demands of the automotive industry, particularly in areas crucial for safety and advanced driver-assistance systems.

Advanced Smart Healthcare Solutions

Compal Electronics is actively positioning its Advanced Smart Healthcare Solutions as a star in its business portfolio, demonstrating significant investment and strategic alliances with healthcare providers. This focus on AI-driven diagnostics, such as quantitative lung fibrosis imaging, and integrated pediatric X-ray systems, highlights their commitment to high-growth areas. These ventures aim to revolutionize clinical workflows and patient care, indicating a strong potential for future expansion and market leadership.

Compal's strategic investments in smart healthcare are yielding promising results. For instance, their collaborations are developing AI models that can analyze medical images with remarkable speed and accuracy, potentially reducing diagnostic times significantly. In 2023, the global AI in healthcare market was valued at approximately $15.4 billion and is projected to grow substantially, with Compal aiming to capture a meaningful share of this expanding market.

- AI-Powered Diagnostics: Focus on AI for enhanced medical imaging analysis, improving diagnostic accuracy and efficiency.

- Strategic Partnerships: Collaborations with leading medical institutions to integrate and validate advanced healthcare technologies.

- Quantum-Inspired Algorithms: Exploration of cutting-edge computational methods to accelerate complex medical data processing.

- Market Growth Potential: Targeting the rapidly expanding global AI in healthcare market, projected for significant expansion in the coming years.

High-Value ODM Services for Growing Segments

Compal's high-value ODM services are shining brightly in rapidly expanding markets. Their expertise in manufacturing premium wearables and AI-powered devices for major global brands positions these segments as Stars in their portfolio. This focus leverages Compal's strong manufacturing capabilities in areas experiencing significant demand.

The wearable electronics market, for instance, is a key growth driver. Projections indicate continued strong expansion, with the market expected to reach over $150 billion by 2027, according to some industry analyses. Compal's role in producing these devices for leading companies means they are capturing a substantial share of this burgeoning market.

- Premium Wearables: Compal manufactures advanced wearables for top global brands, tapping into a market segment with high growth potential and increasing consumer adoption.

- AI-Enabled Devices: The company's involvement in AI-powered gadgets, from smart home devices to specialized computing, caters to the growing demand for intelligent, connected products.

- Market Share in Growth Segments: By aligning its ODM services with these high-growth categories, Compal secures a strong market position, benefiting from the expanding demand for innovative electronics.

Compal Electronics' AI/HPC server business is a clear Star, driven by significant demand for AI infrastructure. The company's early shipments of NVIDIA GH200 Grace Hopper Superchip-based servers are a testament to this, with substantial growth anticipated. This segment is poised for continued expansion as AI adoption accelerates across industries.

The company's Advanced Smart Healthcare Solutions are also positioned as a Star. Compal's investment in AI-driven diagnostics, like quantitative lung fibrosis imaging, and strategic partnerships are targeting the rapidly expanding global AI in healthcare market, which was valued at approximately $15.4 billion in 2023. This focus on innovation and market growth potential solidifies its Star status.

Compal's high-value ODM services for premium wearables and AI-enabled devices represent another Star. The wearable electronics market alone is projected to exceed $150 billion by 2027, and Compal's manufacturing of these advanced devices for leading brands positions it to capture significant market share in this burgeoning sector.

| Business Segment | BCG Matrix Classification | Key Growth Drivers | Market Data/Projections |

| AI/HPC Servers | Star | AI infrastructure demand, NVIDIA GH200 shipments | Continued acceleration of AI adoption |

| Advanced Smart Healthcare Solutions | Star | AI-driven diagnostics, strategic partnerships | Global AI in healthcare market ~$15.4 billion (2023), significant future growth |

| High-Value ODM (Wearables & AI Devices) | Star | Demand for premium wearables, AI-enabled gadgets | Wearable electronics market projected >$150 billion by 2027 |

What is included in the product

This BCG Matrix analysis categorizes Compal's product lines, guiding strategic decisions for growth and resource allocation.

Compal's BCG Matrix offers a clear, one-page overview to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Compal Electronics' notebook computer manufacturing stands as a strong Cash Cow. As the world's second-largest notebook Original Design Manufacturer (ODM), Compal commands a significant portion of the market, estimated at around 16% of global notebook shipments. This robust market share in a mature, yet moderately expanding industry, allows for consistent revenue generation.

The notebook market itself is showing resilience, with projections indicating moderate growth for 2024 and 2025. This growth is anticipated to be fueled by renewed business demand and ongoing refresh cycles for existing devices. Compal's established manufacturing capabilities are well-positioned to capitalize on these trends, further solidifying its Cash Cow status by generating substantial profits with relatively low investment needs.

Compal Electronics' tablets manufacturing division operates as a Cash Cow within its BCG Matrix. As a leading original design manufacturer (ODM), Compal is instrumental in producing tablets for major global brands. This segment benefits from consistent, high-volume orders, reflecting its strong position in a mature market dominated by established players like Apple and Samsung.

The stability of this business unit stems from Compal's deep-rooted ODM relationships, which ensure a steady stream of manufacturing contracts. In 2024, the global tablet market continued to show resilience, with Compal leveraging its manufacturing prowess to maintain a significant market share in production for these well-known brands. This consistent demand translates into reliable and substantial cash flow for the company.

Compal Electronics' traditional PC and peripheral manufacturing business, while not experiencing rapid expansion, remains a stable contributor to its revenue. This segment benefits from Compal's established client base and highly optimized production processes, allowing it to maintain profitability even with slower market growth.

In 2024, Compal continued to leverage its manufacturing scale in this sector, focusing on product mix adjustments to ensure consistent earnings. The company's ability to efficiently produce a wide range of components and peripherals underpins its status as a cash cow, providing a reliable financial foundation.

Established Server ODM Business (Non-AI/HPC)

Compal Electronics' established server ODM business, excluding AI and high-performance computing (HPC), represents a significant cash cow. This segment benefits from Compal's extensive experience and a substantial market share in producing standard servers for a broad range of clients.

While not experiencing the rapid expansion seen in AI-focused server markets, this core business generates consistent revenue and strong cash flow. This stability is a direct result of its high penetration in the production of conventional server hardware, a market that, while mature, remains robust.

Compal's ongoing efforts to grow this segment underscore its importance as a reliable contributor to the company's financial health. For instance, in 2023, Compal reported overall revenue of NT$973.4 billion (approximately $30.8 billion USD), with its server and storage business being a key component.

- Steady Revenue Generation: The non-AI/HPC server business provides a predictable and substantial income stream for Compal.

- High Market Share: Compal holds a strong position in the standard server manufacturing market, ensuring consistent demand.

- Cash Flow Stability: This segment acts as a reliable generator of cash, supporting other business ventures and investments.

- Continued Expansion: Compal's commitment to growing this established business highlights its ongoing strategic value.

Maturity in Wearable Device ODM Services

Compal Electronics' established ODM services for mature wearable devices like fitness trackers and smartwatches are firmly positioned as Cash Cows. This strength stems from the consistent demand within the growing wearable market, projected to reach over $100 billion globally by 2024. Compal leverages its extensive manufacturing expertise to fulfill high-volume orders for leading brands, ensuring stable revenue streams and profitability.

- Stable Revenue: High-volume production for established wearable brands generates consistent income.

- Market Maturity: The fitness tracker and smartwatch segments are mature, offering predictable demand.

- Brand Partnerships: Strong relationships with major wearable brands secure ongoing contracts.

- Manufacturing Efficiency: Compal's proven capabilities ensure cost-effective production, boosting margins.

Compal's established server ODM business, excluding AI and high-performance computing (HPC), represents a significant cash cow. This segment benefits from Compal's extensive experience and a substantial market share in producing standard servers for a broad range of clients.

While not experiencing the rapid expansion seen in AI-focused server markets, this core business generates consistent revenue and strong cash flow. This stability is a direct result of its high penetration in the production of conventional server hardware, a market that, while mature, remains robust.

Compal's ongoing efforts to grow this segment underscore its importance as a reliable contributor to the company's financial health. For instance, in 2023, Compal reported overall revenue of NT$973.4 billion (approximately $30.8 billion USD), with its server and storage business being a key component.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) |

| Notebook Manufacturing | Cash Cow | 2nd largest global ODM, ~16% market share, mature but growing market | Significant portion of NT$973.4 billion total revenue |

| Tablet Manufacturing | Cash Cow | Leading ODM for major brands, high-volume production, mature market | Consistent revenue from established brand partnerships |

| Traditional PC & Peripherals | Cash Cow | Established client base, optimized production, stable earnings | Reliable financial foundation, focus on product mix |

| Standard Server ODM (Non-AI/HPC) | Cash Cow | High penetration in conventional server hardware, consistent revenue | Key component of server and storage business revenue |

Preview = Final Product

Compal Electronics BCG Matrix

The Compal Electronics BCG Matrix you see here is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the fully formatted and analysis-ready report, providing you with the precise strategic insights you need without any hidden surprises or demo content.

Dogs

Compal Electronics is strategically shifting away from its legacy low-margin electronics manufacturing. This indicates a focus on shedding product lines or contracts that yield minimal profit and exhibit sluggish growth. These less profitable ventures likely tie up capital and resources without generating substantial returns, positioning them for potential divestment or scaled-back operations.

Undifferentiated Consumer Electronics Components would likely be categorized as Dogs in Compal Electronics' BCG Matrix. These are segments where products are highly commoditized, meaning there's little to distinguish them from competitors' offerings, leading to intense price wars. Compal's involvement in these areas, if not strategically managed, can result in low market share and minimal profitability.

In 2024, the global consumer electronics market saw continued pressure on component pricing, particularly for more standardized parts. For instance, basic display panels and memory chips, often produced by multiple vendors with minimal proprietary technology, exemplify this. Companies like Compal, operating in these segments, face a challenging environment where differentiation is scarce, and margins are often thin due to the sheer number of suppliers and the maturity of the technology.

Compal's involvement with older generation smartphone ODM services, especially for brands with diminishing market share, likely places this segment in the Dogs category of the BCG Matrix. The intense competition and swift technological advancements in the smartphone industry mean that contracts for less innovative or low-margin models offer minimal profitability. For instance, in 2023, the global smartphone market saw a 3.2% decline in shipments, with older, less differentiated models bearing the brunt of this slowdown.

Underperforming Niche Display Products

Certain niche display products, perhaps older monitor technologies, could be classified as Dogs for Compal Electronics. These items likely experience declining demand as newer, more advanced display solutions gain traction. In 2024, the global monitor market saw continued shifts, with OLED and Mini-LED technologies capturing increasing attention, potentially leaving legacy products with a shrinking user base.

Products in this category would typically hold a low market share within a stagnant or contracting market segment. For instance, if Compal still produces some specialized industrial displays or older LCD panel types that are being phased out, these would fit the Dog profile. The overall growth rate for these specific niche segments might be negative, indicating a lack of future potential.

- Declining Demand: Older monitor technologies face reduced consumer and business interest.

- Low Market Share: Compal's position in these niche segments is likely minimal.

- Stagnant/Shrinking Market: The overall market for these specific products is not growing.

- Limited Future Prospects: Investment in these areas offers little return potential.

Non-Strategic, Low-Volume IT Peripherals

Non-strategic, low-volume IT peripherals represent a segment within Compal Electronics' business that may require careful management. These are often legacy contracts or product lines that don't fit with the company's strategic push towards higher-value offerings. While they might still utilize existing production capacity, their contribution to overall revenue and market leadership is typically minimal.

For instance, if Compal has contracts for manufacturing older generations of mice or keyboards, these would likely fall into this category. Such operations require ongoing investment in maintaining production lines and quality control, but the return on investment is often low. In 2023, the global market for PC peripherals, excluding monitors, was valued at approximately $25 billion, but the growth rate for many traditional peripheral segments has been modest, indicating a mature market.

- Low Revenue Contribution: These products generate a small fraction of Compal's total revenue, potentially less than 5% in recent reporting periods.

- Limited Strategic Alignment: Manufacturing these items does not align with Compal's focus on areas like advanced notebook design or smart manufacturing solutions.

- Maintenance Costs: Continued operation of production lines for these peripherals incurs costs without significant strategic benefits or market growth potential.

- Potential for Divestment or Phasing Out: Companies often consider divesting or gradually phasing out such non-core, low-volume product lines to reallocate resources to more promising ventures.

Compal Electronics' "Dogs" represent product lines with low market share in slow-growing or declining industries. These segments often involve commoditized products with intense price competition, yielding minimal profitability and limited future prospects for Compal. The company's strategy likely involves minimizing investment and potentially divesting these units to reallocate resources to more promising areas.

Undifferentiated consumer electronics components and older generation smartphone ODM services exemplify Compal's Dog category. These areas are characterized by intense competition and rapid technological obsolescence, making sustained profitability a challenge. For instance, the global smartphone market experienced a decline in shipments in 2023, impacting older, less innovative models disproportionately.

Niche display products, such as legacy monitor technologies, and non-strategic, low-volume IT peripherals also fall into the Dog quadrant. These segments face declining demand as newer technologies emerge, leading to stagnant or shrinking market shares for Compal. The company's focus is shifting away from these areas, as evidenced by the modest growth in traditional peripheral markets reported in 2023.

| BCG Category | Compal Electronics Example Segments | Market Characteristics | Financial Implications |

|---|---|---|---|

| Dogs | Undifferentiated Consumer Electronics Components | Low market share, slow/negative growth, high competition, commoditized products | Low profitability, minimal ROI, capital intensive without commensurate returns |

| Dogs | Older Generation Smartphone ODM Services | Low market share, declining demand, rapid technological obsolescence | Thin margins, risk of stranded assets, limited future growth potential |

| Dogs | Niche Display Products (e.g., Legacy Monitor Tech) | Low market share, shrinking market, declining consumer interest | Reduced revenue contribution, potential for write-downs, limited strategic value |

| Dogs | Low-Volume IT Peripherals | Low market share, mature/stagnant market, low strategic alignment | Minimal revenue growth, ongoing maintenance costs, potential for divestment |

Question Marks

Emerging automotive electronics segments, such as advanced driver-assistance systems (ADAS) and in-cabin AI solutions, represent Compal Electronics' Stars in the BCG matrix. These are areas where the company is making substantial investments, recognizing their high-growth potential within the automotive sector.

While Compal is actively developing its presence, these specific sub-segments are characterized by rapid technological evolution and intense competition. For instance, the global ADAS market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2030, according to various market research reports. This signifies a significant opportunity, but also highlights the need for Compal to aggressively build market share and establish a strong competitive footing through continuous research and development and strategic market penetration efforts.

Compal Electronics is actively developing proprietary 5G small cell technology tailored for private networks. This positions them to tap into the nascent, high-growth market of enterprise 5G deployments, which is projected to see significant expansion in the coming years. The company is also innovating in satellite IoT solutions, another emerging area with substantial future potential.

While these ventures represent exciting opportunities, Compal's involvement in new 5G private network solutions and satellite IoT places them squarely in the question mark category of the BCG matrix. They are in the early stages of market penetration, requiring considerable investment to scale and achieve widespread adoption and profitability. For instance, the global private 5G market was valued at approximately USD 2.5 billion in 2023 and is expected to grow at a CAGR of over 20% through 2030, indicating a strong growth trajectory but also the need for substantial upfront capital.

Compal Electronics is making a significant move into AI applications, particularly AI PCs and AI servers tailored for businesses and cloud providers. This strategic focus places them squarely in the Question Mark quadrant of the BCG matrix, reflecting the high-growth potential of these emerging markets.

The company's aggressive investment in research and development, coupled with strategic partnerships, aims to quickly establish a strong market presence. For instance, Compal announced in early 2024 its commitment to developing AI PCs, anticipating a substantial market shift. The success of these initiatives will determine if they can transition these ventures into Stars, generating significant future revenue.

Smart Healthcare and MedTech Ventures

Compal Electronics' smart healthcare and MedTech ventures, encompassing areas like long-term care facilities, telehealth, electronic medical records, and precision medicine, are positioned in a market experiencing robust growth. The global digital health market was valued at approximately $200 billion in 2023 and is projected to reach over $600 billion by 2030, demonstrating significant expansion potential.

These initiatives represent new frontiers for Compal, where the company is actively establishing its market footprint and developing its service offerings. While the market is expanding, these ventures are still in their nascent stages, requiring substantial investment and resource allocation. Consequently, Compal is currently building its market share in these segments, with the high-growth potential yet to be fully realized.

The company's strategic investment in these areas aligns with the broader trend of increasing demand for integrated healthcare solutions and personalized medical approaches. For instance, the telehealth market alone saw a surge, with a significant increase in adoption rates observed globally following recent health events, indicating a strong underlying demand that Compal aims to capitalize on.

- Market Growth: The digital health sector is expanding rapidly, with projections indicating substantial future value.

- Resource Intensive: These new ventures require significant investment and resource commitment from Compal.

- Market Penetration: Compal is actively building its presence and market share in these emerging healthcare segments.

- Future Potential: The long-term outlook for smart healthcare and MedTech is strong, offering significant growth opportunities.

Smart Home and IoT Solutions

Compal Electronics is actively pursuing a strategy to become a comprehensive solutions provider by embedding its products into the burgeoning Internet of Things (IoT) landscape, specifically targeting smart home and smart car applications. This move positions Compal to capitalize on the significant growth potential within these interconnected technology sectors.

While the overall IoT market is experiencing rapid expansion, Compal's current market share within the highly competitive smart home solutions segment is likely still in its nascent stages. This necessitates substantial investment in marketing efforts and the cultivation of a robust ecosystem to effectively compete and gain market traction.

- Market Growth: The global smart home market was valued at approximately $84.5 billion in 2023 and is projected to reach $240.8 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 16.1%.

- Compal's Position: As a relatively new entrant to offering complete smart home solutions, Compal's market share is anticipated to be below 5% as of 2024, requiring significant R&D and partnership development.

- Investment Needs: To establish a strong foothold, Compal must allocate considerable resources towards brand building, channel development, and fostering interoperability with other smart devices and platforms.

Compal Electronics' ventures into private 5G network solutions and satellite IoT are currently classified as Question Marks. These represent high-growth potential markets where Compal is investing heavily to establish a foothold, but profitability and significant market share are yet to be secured.

The company is actively developing proprietary technologies and seeking market penetration, acknowledging the substantial upfront capital and ongoing resource commitment required. Success in these areas hinges on Compal's ability to scale operations and gain widespread adoption in the coming years.

For instance, the global private 5G market was valued at approximately USD 2.5 billion in 2023 and is expected to grow at a CAGR of over 20% through 2030, highlighting the significant growth trajectory but also the need for substantial upfront capital and strategic execution.

| Area | Current Status | Investment Focus | Market Potential | Compal's Position |

| 5G Private Networks | Nascent, High-Growth | Proprietary Technology Development | Strong projected CAGR (>20%) | Early Stage Market Penetration |

| Satellite IoT | Emerging, High-Potential | Solution Development | Significant Future Growth | Building Market Share |

BCG Matrix Data Sources

Our Compal Electronics BCG Matrix is built on comprehensive market data, incorporating financial reports, industry growth rates, and competitive analysis to provide strategic insights.