Compal Electronics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compal Electronics Bundle

Compal Electronics operates in a highly competitive electronics manufacturing landscape, facing significant pressure from rivals and powerful buyers. Understanding the intricate interplay of these forces is crucial for navigating this dynamic market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Compal Electronics’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Compal Electronics, a significant Original Design Manufacturer (ODM), faces increased supplier bargaining power due to its reliance on a limited number of key high-tech component providers. Suppliers of critical parts such as processors, memory modules, and display panels, often holding dominant market shares or offering highly specialized technologies, can exert considerable influence. For instance, in 2024, major chip manufacturers like Intel and AMD continued to command significant pricing power in the CPU market, directly impacting Compal's procurement costs.

Switching suppliers for Compal Electronics can be a costly endeavor, often involving substantial expenses for redesigning products, retooling manufacturing lines, and rigorous re-qualification of new components. This is particularly true for intricate, integrated parts where a supplier's expertise is deeply embedded.

The significant investment required to transition to a new supplier naturally creates a degree of dependency for Compal on its established partners, especially for critical, high-tech components. For instance, a shift from a supplier of advanced display panels might necessitate months of engineering work and extensive testing to ensure compatibility and performance standards are met.

These high switching costs directly bolster the bargaining power of Compal's suppliers. When a supplier knows that changing them would incur considerable financial outlays and potential production delays for Compal, they are in a stronger position to negotiate terms, pricing, and contract conditions, impacting Compal's overall cost structure.

Suppliers providing highly unique or proprietary components, like custom-designed chipsets or specialized intellectual property, hold considerable sway. Compal's capacity to bring innovative, leading-edge products to market hinges on securing these distinctive inputs. The greater the uniqueness of an input, the fewer practical alternatives exist, thereby bolstering the supplier's leverage.

Threat of Forward Integration by Suppliers

While it's not a frequent occurrence, there's a theoretical risk that dominant component suppliers could move into manufacturing complete electronic products themselves. This would position them as direct rivals to Original Design Manufacturers (ODMs) like Compal Electronics. For instance, a major chip manufacturer might decide to assemble and brand their own devices, bypassing ODMs entirely.

This potential for forward integration serves as a significant motivator for Compal to cultivate robust and collaborative partnerships with its critical component providers. By maintaining strong relationships, Compal can help deter suppliers from pursuing this competitive path. It also underscores the vital role of Compal's own in-house design capabilities and manufacturing prowess in retaining its market position.

- Supplier Forward Integration Risk: The possibility of component suppliers manufacturing finished electronic devices, directly competing with ODMs.

- Mitigation Strategy: Fostering strong, collaborative relationships with key suppliers to reduce this threat.

- Compal's Competitive Edge: The importance of Compal's own design and manufacturing expertise in maintaining its market standing.

Impact of Supply Chain Geopolitical Risks

Geopolitical tensions and evolving trade policies, including tariffs, directly influence global supply chains, potentially amplifying supplier bargaining power. This occurs by restricting available sourcing options or driving up costs for manufacturers like Compal. For instance, the ongoing trade friction between major economic blocs can lead to sudden cost increases on key components.

Compal Electronics has proactively addressed these risks by diversifying its production footprint. By establishing operations in multiple countries beyond its traditional base in China, the company aims to build greater supply chain resilience and flexibility. This strategy helps to cushion the impact of localized geopolitical disruptions.

- Diversification Strategy: Compal's move to establish production facilities in Vietnam and other regions aims to reduce reliance on any single country, a critical strategy given the 2024 geopolitical landscape.

- Cost Mitigation: By spreading production, Compal can potentially negotiate better terms with suppliers in different regions, mitigating the impact of tariffs or trade restrictions imposed elsewhere.

- Supply Chain Resilience: In 2024, companies with diversified supply chains demonstrated greater ability to maintain operations during periods of international instability, a key advantage for Compal.

Compal Electronics faces significant bargaining power from its suppliers, particularly those providing critical, high-tech components like advanced processors and display panels. In 2024, major chip manufacturers continued to hold substantial pricing power, directly impacting Compal's procurement costs. The high costs and complexities associated with switching suppliers, often involving extensive redesign and re-qualification, create a strong dependency for Compal, further empowering these suppliers in negotiations.

The uniqueness of certain components, such as custom chipsets or proprietary intellectual property, also grants suppliers considerable leverage. Compal's ability to innovate and deliver cutting-edge products hinges on securing these specialized inputs, with fewer alternatives available. This situation is exacerbated by geopolitical factors and trade policies in 2024, which can restrict sourcing options and increase component costs, thereby amplifying supplier influence.

| Supplier Type | Bargaining Power Factors | Impact on Compal | 2024 Context |

|---|---|---|---|

| Key Component Providers (e.g., Chip Manufacturers) | High market share, specialized technology, high switching costs | Increased procurement costs, potential supply disruptions | Continued dominance of major chip suppliers (Intel, AMD) |

| Providers of Unique/Proprietary Components | Lack of alternatives, critical for product innovation | Supplier dictates terms, limits Compal's flexibility | Essential for Compal's competitive product launches |

| All Suppliers | Geopolitical tensions, trade policies, tariffs | Increased costs, restricted sourcing options | Trade friction impacting global supply chains |

What is included in the product

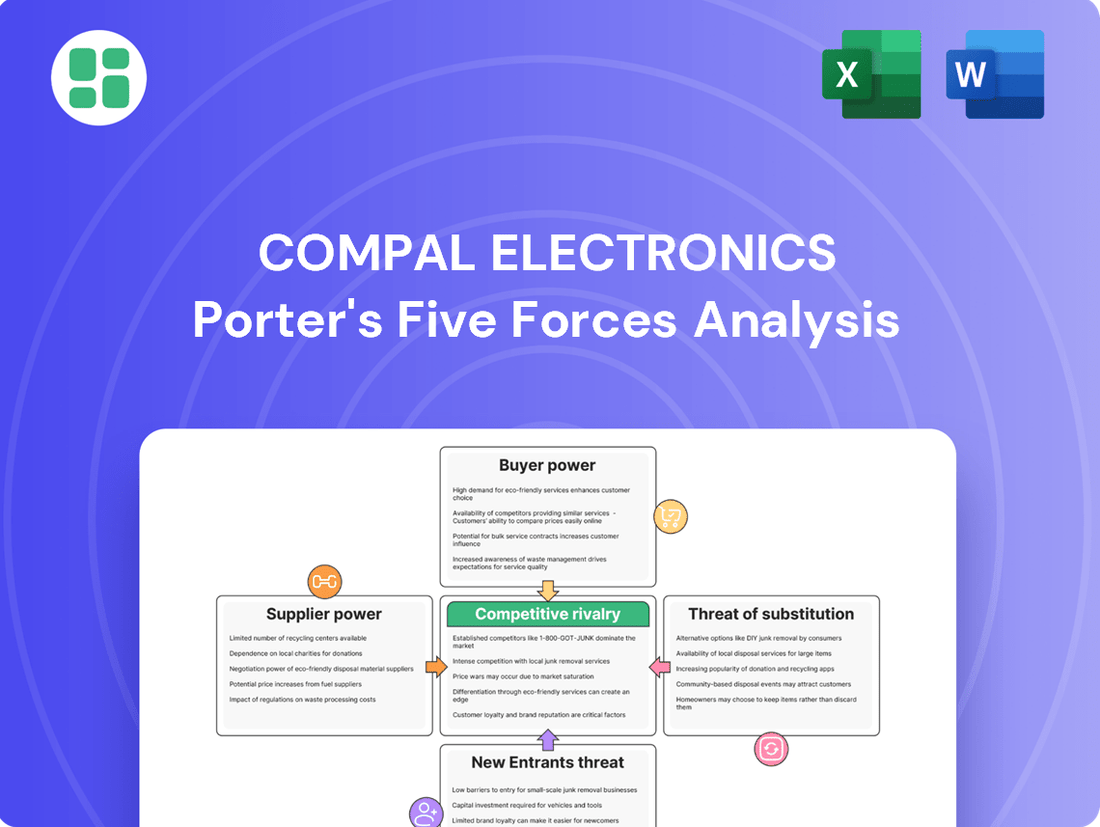

This analysis unpacks the competitive forces shaping Compal Electronics' operating environment, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize Compal's competitive landscape with a dynamic five forces chart, highlighting key pressure points for strategic action.

Customers Bargaining Power

Compal Electronics' primary customers are major global brands like HP, Dell, and Acer. These industry giants procure electronic devices in enormous quantities, granting them significant bargaining power. This leverage is particularly evident in price negotiations and the shaping of contractual agreements.

Customers of Original Design Manufacturers (ODMs) like Compal Electronics often experience low switching costs. This means a brand can move its manufacturing business to a different ODM without incurring significant expenses or disruptions. For instance, if a brand finds a better price or service elsewhere, the ease of switching puts pressure on Compal.

The ODM sector is quite crowded, with numerous large companies capable of providing similar manufacturing services. This competitive landscape allows brands to easily compare offerings and solicit bids from multiple ODMs. In 2023, the global contract electronics manufacturing market was valued at approximately $571.6 billion, indicating a highly competitive environment where customer retention is key.

This ease of switching and the abundance of choices directly fuel price competition among ODMs. Brands can leverage this situation to negotiate more favorable terms, as ODMs vie for their business. This dynamic can impact Compal's profit margins if they are forced to lower prices to secure contracts.

While mass-produced electronics manufacturing is complex, a few large customers might consider bringing production in-house for specialized or critical components. This potential for backward integration, though often impractical for Compal's scale, serves as leverage. It pushes Compal to maintain competitive pricing and excellent service to secure and retain these valuable client relationships.

Price Sensitivity of Customers

Compal Electronics operates in a highly competitive consumer electronics landscape, meaning its customers, primarily major electronics brands, exhibit significant price sensitivity. This sensitivity directly translates into considerable pressure on Compal's profit margins, as brands relentlessly pursue the lowest possible manufacturing costs to maintain their own competitive pricing. For instance, in 2023, the global consumer electronics market experienced a slight contraction, intensifying the need for cost-efficiency among manufacturers like Compal.

This dynamic necessitates that Compal continually refines its operational efficiency and cost management strategies. The constant drive for lower unit costs means Compal must innovate in its supply chain and production processes to remain attractive to its brand partners. The thin margins prevalent in the electronics sector underscore the critical importance of Compal's ability to deliver value through cost-effective manufacturing solutions.

- Price Sensitivity: Customers in the consumer electronics sector are highly attuned to price, impacting Compal's pricing power.

- Margin Pressure: Brands seek the lowest manufacturing costs, squeezing Compal's profit margins.

- Operational Optimization: Compal must constantly enhance efficiency to meet customer cost demands.

- Competitive Landscape: The intense competition in electronics amplifies customer bargaining power.

Access to Multiple ODM Alternatives

Compal Electronics operates in a highly competitive Original Design Manufacturer (ODM) market, where customers, often large technology brands, have a significant advantage due to the availability of numerous alternatives. This means customers can easily switch suppliers if they aren't satisfied with pricing, quality, or service. For instance, in 2024, the global ODM market for consumer electronics was robust, with key players like Quanta Computer, Wistron, and Pegatron actively competing for contracts.

The sheer number of qualified ODMs available means customers can solicit bids from multiple companies, driving down prices and demanding better terms. This readily available competition directly translates to increased bargaining power for the customer. In 2023, Compal Electronics reported net sales of approximately NT$1.07 trillion (roughly $33 billion USD), highlighting the scale of operations but also the intense pressure to maintain competitiveness against rivals who can offer similar manufacturing capabilities.

- Customer Choice: Customers like Apple, Dell, and HP can choose from a wide array of ODMs, fostering a buyer's market.

- Price Sensitivity: The presence of multiple ODMs intensifies price competition, forcing manufacturers like Compal to offer competitive pricing to secure orders.

- Service Demands: Beyond price, customers leverage their options to demand higher service levels, faster turnaround times, and greater flexibility in design and production.

Compal Electronics' customers, primarily large global brands, possess substantial bargaining power due to the highly competitive nature of the Original Design Manufacturer (ODM) market. These brands can readily switch suppliers, which intensifies price competition and puts pressure on Compal's profit margins. The availability of numerous capable ODMs means customers can negotiate favorable terms, demanding lower prices and higher service levels.

| Factor | Impact on Compal | Customer Leverage |

|---|---|---|

| Low Switching Costs | Increased pressure to retain clients | Ability to move business easily |

| Numerous Alternatives | Intensified price competition | Soliciting multiple bids |

| Price Sensitivity | Margin erosion | Seeking lowest manufacturing costs |

Full Version Awaits

Compal Electronics Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Compal Electronics, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering actionable insights into Compal's competitive landscape and strategic positioning.

Rivalry Among Competitors

The Original Design Manufacturer (ODM) sector is a crowded space, with a handful of major players, including Compal, Quanta, Pegatron, Wistron, Inventec, and Foxconn (Hon Hai), dominating the landscape. This intense competition means companies are constantly vying for contracts and market share, driving down margins.

These leading ten ODMs collectively hold about 60% of the worldwide market. This concentration signifies that while there are many smaller players, the real power and competition lie with these giants, making it a challenging environment for any single company to gain a significant advantage without aggressive strategies.

The Original Design Manufacturer (ODM) sector, where Compal operates, is characterized by fierce price competition, especially for high-volume consumer electronics such as laptops and tablets. This intense rivalry directly impacts profit margins, forcing companies like Compal to meticulously manage costs and streamline operations to remain competitive.

In 2023, the global notebook PC market shipments were approximately 197 million units, a slight decrease from the previous year. This volume indicates a highly competitive landscape where price is a significant differentiator for securing large orders, putting substantial pressure on Compal's profitability.

While Original Design Manufacturers (ODMs) like Compal traditionally focus on production, intense rivalry also stems from differentiating through advanced design, robust engineering, and pioneering technological innovation. This means staying ahead isn't just about building efficiently, but about creating smarter, more advanced products that clients want to put their brand on.

Compal is actively investing in research and development to carve out a competitive advantage in emerging sectors. For instance, their push into AI servers and automotive electronics signifies a strategic move to diversify and capture higher-margin opportunities, aiming to lessen their dependence on the increasingly commoditized PC market.

In 2024, Compal Electronics reported a significant portion of its revenue coming from non-PC segments, reflecting its successful diversification efforts. Their R&D spending, which reached approximately $500 million in 2023, is a testament to their commitment to innovation in areas like smart healthcare solutions and advanced display technologies, aiming to secure future growth.

Global Reach and Supply Chain Management

Competitors in the electronics manufacturing sector, including Compal, intensely battle over their capacity to orchestrate intricate global supply chains. This rivalry centers on offering a diverse array of production locations and guaranteeing punctual delivery of goods. Companies that can effectively navigate these complexities gain a significant edge.

Compal's strategic move to broaden its manufacturing base into countries such as Vietnam and Poland exemplifies a proactive approach to mitigating geopolitical risks. This diversification is not merely a strategic option but a fundamental requirement for remaining competitive in a rapidly evolving global market.

- Global Supply Chain Complexity: Companies compete on their ability to manage extensive and often volatile global supply networks, ensuring component sourcing and product distribution efficiency.

- Production Diversification: A key competitive factor is the establishment of manufacturing facilities across multiple geographical regions to reduce reliance on single locations and buffer against disruptions.

- Timely Delivery Assurance: Meeting customer demand with consistent and on-time deliveries is paramount, impacting customer satisfaction and market share.

- Geopolitical Risk Mitigation: Diversifying production locations, as Compal is doing in Vietnam and Poland, is a direct response to global political and economic uncertainties, aiming to maintain operational continuity.

Diversification into Emerging Sectors

Compal Electronics faces intensifying competition not just in traditional areas but also in rapidly expanding sectors. This includes fierce rivalry in the development and manufacturing of AI applications, cloud server infrastructure, automotive electronics, advanced communication technologies, and emerging medical devices.

Original Equipment Manufacturers (OEMs) and other Original Design Manufacturers (ODMs) are aggressively vying for market share in these lucrative, high-growth segments. This push requires significant investment in specialized research and development, advanced manufacturing processes, and skilled talent to secure new partnerships and contracts.

- Rivalry in AI Applications: ODMs are competing to supply components and assemble systems for AI-driven devices and data centers.

- Cloud Server Competition: The demand for cloud infrastructure fuels intense competition among ODMs to provide server hardware solutions.

- Automotive Electronics Growth: The automotive sector, with its increasing reliance on sophisticated electronics, presents a key battleground for ODMs.

- Advanced Communications: ODMs are positioning themselves to capitalize on the rollout of 5G and future communication technologies.

- Medical Technology Expansion: The medical technology market, driven by innovation, is another area where ODMs are seeking to establish a presence.

The competitive rivalry within the Original Design Manufacturer (ODM) sector is exceptionally high, driven by a concentrated group of major players like Compal, Quanta, and Foxconn, who collectively dominate the global market. This intense competition forces companies to constantly fight for contracts, often leading to squeezed profit margins, particularly in high-volume consumer electronics like laptops.

Compal's strategic diversification into areas such as AI servers and automotive electronics reflects the need to escape the commoditized PC market and capture higher-margin opportunities. The company's 2023 R&D investment of around $500 million underscores the commitment to innovation required to stay ahead in these rapidly evolving, competitive sectors.

The battle for market share extends to the ability to manage complex global supply chains and ensure timely delivery, with companies like Compal expanding manufacturing bases to Vietnam and Poland to mitigate geopolitical risks and maintain operational resilience.

Compal faces escalating rivalry not only in traditional electronics but also in high-growth areas like AI applications, cloud servers, and automotive electronics, demanding significant investment in specialized R&D and advanced manufacturing.

| Competitor | 2023 Revenue (USD Billions) | Key Markets | Focus Areas |

|---|---|---|---|

| Compal Electronics | ~19.6 | Notebooks, Servers, Automotive | AI Servers, Automotive Electronics, Smart Healthcare |

| Quanta Computer | ~17.4 | Notebooks, Servers, Cloud | Cloud Infrastructure, AI Servers, Wearables |

| Foxconn (Hon Hai) | ~182.0 | Smartphones, Servers, Consumer Electronics | Electric Vehicles, AI, 5G Infrastructure |

| Pegatron | ~11.7 | Smartphones, Laptops, Gaming Consoles | 5G Devices, IoT, Smart Home |

SSubstitutes Threaten

The electronics market is a dynamic landscape where consumer device preferences are constantly in flux. For Compal, a major notebook and tablet manufacturer, this presents a significant threat from substitutes. For example, the increasing ubiquity and capability of smartphones, coupled with the growing adoption of cloud-based services, can directly substitute for some functions previously requiring dedicated notebooks or tablets. This shift could erode demand for Compal's traditional product lines.

While outsourcing to Original Design Manufacturers (ODMs) like Compal is common, some brand companies may opt for in-house manufacturing for specific, high-value, or strategically sensitive products. This is not typically for mass production but rather for specialized runs where control over design, intellectual property, and quality is paramount. For instance, a premium electronics brand might develop its own proprietary manufacturing process for a cutting-edge device, bypassing ODM services entirely for that particular product line.

The increasing adoption of Software-as-a-Service (SaaS) and cloud computing presents a significant threat to traditional hardware manufacturers like Compal Electronics. As more applications and data reside in the cloud, the demand for powerful, high-end personal computing devices that require substantial local processing power diminishes. This shift means that users may opt for less powerful, more affordable devices as long as they offer reliable internet connectivity and access to cloud-based services.

For instance, by the end of 2024, it's estimated that over 90% of enterprises will be utilizing cloud-based services, a trend that directly impacts the market for PCs and laptops. This growing reliance on cloud infrastructure means that the competitive landscape for Compal is evolving, with a greater emphasis placed on factors like device integration with cloud platforms and the overall user experience within a connected ecosystem rather than just raw hardware specifications.

New Computing Paradigms and Form Factors

The rise of new computing paradigms, like immersive AR/VR experiences that bypass traditional PCs, presents a significant substitute threat to Compal Electronics. If these technologies mature and gain widespread consumer adoption, they could siphon demand away from the laptops and desktops Compal manufactures.

For instance, the global AR/VR market was valued at approximately $20.3 billion in 2023 and is projected to reach $221.7 billion by 2030, indicating substantial growth potential for these alternative computing platforms. This shift could impact Compal's market share if their product development doesn't align with these emerging trends.

- Emerging Computing Paradigms: The growth of augmented reality (AR) and virtual reality (VR) devices offers alternative ways to compute, potentially reducing reliance on traditional PCs.

- Form Factor Innovation: Novel computing form factors that integrate functionality currently served by PCs could emerge as direct substitutes.

- Market Demand Shift: Widespread adoption of AR/VR for tasks like productivity or entertainment, without needing a traditional PC, would represent a significant threat.

- Market Growth Data: The AR/VR market's projected growth from $20.3 billion in 2023 to $221.7 billion by 2030 highlights the potential scale of this substitution threat.

Longevity and Upgrade Cycles of Devices

Improvements in device durability and performance can significantly extend product lifecycles, directly impacting upgrade cycles for both consumers and businesses. This trend acts as a powerful substitute for frequent hardware purchases, as existing devices remain functional and capable for longer periods. For instance, the average lifespan of a smartphone has been observed to increase, with many users now holding onto their devices for 2.5 to 3 years, up from around 2 years previously, a trend likely to continue as technology matures.

This extended longevity directly reduces the overall volume of new device manufacturing and sales. When consumers and enterprises delay upgrades, the demand for new products diminishes, effectively substituting for the need to purchase the latest models. This phenomenon impacts companies like Compal Electronics, which rely on consistent demand for new device production. The market for refurbished and second-hand electronics also grows, further acting as a substitute for new purchases.

- Extended Product Lifecycles: Devices are built to last longer, reducing the perceived need for frequent replacements.

- Reduced Upgrade Frequency: Consumers and businesses are delaying upgrades, opting to use existing technology for extended periods.

- Growth of Refurbished Market: The secondary market for used electronics offers a cost-effective alternative to new devices.

- Impact on Manufacturing Volume: Slower upgrade cycles translate to lower demand for new device production.

The threat of substitutes for Compal Electronics is multifaceted, encompassing shifts in computing paradigms and evolving consumer behavior. The increasing capability of smartphones and the rise of cloud services can replace some functions of traditional notebooks and tablets. Furthermore, emerging technologies like AR/VR offer entirely new ways to interact with digital content, potentially bypassing the need for Compal's core products.

The growing adoption of cloud computing means users may opt for less powerful, more affordable devices as long as they have reliable internet access. By the end of 2024, over 90% of enterprises are expected to use cloud-based services, a trend that directly impacts the demand for high-end personal computing hardware. This necessitates Compal's focus on device integration with cloud platforms.

The global AR/VR market, valued at approximately $20.3 billion in 2023 and projected to reach $221.7 billion by 2030, highlights the significant growth potential for these alternative computing platforms. Additionally, extended product lifecycles and the growing refurbished market act as substitutes for new purchases, as devices remain functional for longer periods, with smartphone lifespans now averaging 2.5 to 3 years.

Entrants Threaten

Entering the Original Design Manufacturer (ODM) industry, particularly in a competitive landscape like that occupied by Compal Electronics, demands immense capital. Newcomers must invest heavily in advanced manufacturing plants, cutting-edge machinery, and the latest technological infrastructure to even stand a chance.

The significant financial outlay needed to establish operations at a scale comparable to incumbents like Compal presents a formidable hurdle. For instance, building a modern electronics manufacturing facility can easily run into hundreds of millions of dollars, a sum that deters many potential entrants.

The threat of new entrants for Compal Electronics is significantly mitigated by the substantial R&D and engineering expertise required in the electronics manufacturing sector. Developing or acquiring the deep research and development capabilities and engineering talent necessary to compete in offering advanced design and manufacturing solutions presents a formidable barrier.

Compal's decades of experience and ongoing investment in innovation, particularly in emerging areas like artificial intelligence and 5G technologies, create a high bar for any potential newcomers. For instance, in 2023, Compal reported significant investments in R&D, focusing on smart manufacturing and advanced product development, which are difficult and time-consuming for new players to match.

Compal Electronics' established, long-term relationships with major global brands are a significant barrier to new entrants. These partnerships are built on trust and a proven track record, making it difficult for newcomers to secure the large manufacturing contracts that fuel Compal's business. For instance, Compal's role as a key ODM for brands like Apple and Dell, which often involve multi-year agreements and substantial production volumes, highlights the difficulty new entrants face in replicating this level of client commitment and reliability.

Economies of Scale and Cost Advantages

Existing Original Design Manufacturers (ODMs) like Compal Electronics leverage substantial economies of scale, particularly in component sourcing, manufacturing processes, and logistics. This allows them to secure lower per-unit costs, a significant barrier for newcomers. For instance, in 2023, Compal reported net sales of approximately NT$1.09 trillion (US$35.4 billion), demonstrating the vast operational volume that underpins its cost advantages.

New entrants face immense difficulty in replicating these cost efficiencies without achieving comparable production volumes. The capital investment required to build out manufacturing capacity and establish robust supply chain relationships is substantial. Without the established scale, new players would likely operate at a higher cost base, making it challenging to compete on price with established giants like Compal.

- Economies of Scale: Compal’s 2023 net sales of NT$1.09 trillion (US$35.4 billion) highlight its massive operational scale.

- Cost Advantages: Large volumes enable Compal to negotiate better prices for raw materials and components.

- Barriers to Entry: New ODMs would struggle to match Compal’s cost efficiencies due to lower initial production volumes.

- Competitive Pricing: Compal's scale allows for competitive pricing, pressuring potential new entrants.

Complex Global Supply Chain Management

The complexity of managing a global supply chain presents a significant hurdle for new entrants. Compal Electronics, for instance, navigates a vast network of suppliers and intricate logistics, a capability honed over years of operation. In 2024, the electronics manufacturing sector continued to grapple with supply chain disruptions, highlighting the critical importance of established relationships and robust risk mitigation strategies.

New players entering the contract manufacturing space would find it incredibly challenging to replicate Compal's established global supply chain infrastructure. This includes securing reliable component sourcing, negotiating favorable terms with a multitude of suppliers, and efficiently managing international shipping and customs. The sheer scale and established nature of Compal's supply chain operations act as a powerful deterrent.

- Established Supplier Relationships: Compal benefits from long-standing partnerships with key component manufacturers, ensuring consistent supply and potentially better pricing.

- Logistical Expertise: Decades of experience in global logistics allow Compal to optimize shipping routes, manage inventory effectively, and minimize transit times.

- Risk Management: Compal has developed sophisticated strategies to mitigate risks associated with geopolitical instability, natural disasters, and economic fluctuations impacting its supply chain.

The threat of new entrants for Compal Electronics is considerably low due to the immense capital investment required to establish a competitive Original Design Manufacturer (ODM) operation. Newcomers need to fund advanced manufacturing facilities, sophisticated machinery, and cutting-edge technology, making entry prohibitively expensive for many. Furthermore, Compal's established R&D capabilities and extensive experience in areas like AI and 5G create a high barrier to entry, as replicating this expertise is time-consuming and resource-intensive.

| Factor | Impact on New Entrants | Compal's Position |

| Capital Requirements | Extremely High (e.g., hundreds of millions for a modern plant) | Established infrastructure and financial capacity |

| R&D and Engineering Expertise | Demands significant investment and talent acquisition | Decades of experience and ongoing innovation focus |

| Economies of Scale | Challenging to achieve initial cost efficiencies | NT$1.09 trillion (US$35.4 billion) in 2023 net sales |

| Supplier Relationships & Logistics | Difficult to replicate established global networks | Robust, long-standing partnerships and logistical mastery |

Porter's Five Forces Analysis Data Sources

Our Compal Electronics Porter's Five Forces analysis is built upon a foundation of verified data, including Compal's annual reports, industry-specific market research from firms like IDC and Gartner, and competitor financial filings.