Compal Electronics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compal Electronics Bundle

Discover the strategic engine behind Compal Electronics's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their operational brilliance.

Unlock the full strategic blueprint behind Compal Electronics's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Compal Electronics secures vital partnerships with leading technology providers like Intel, AMD, and Qualcomm. These collaborations are crucial for integrating the latest processors and advanced components into their diverse product lines, ensuring competitive performance and innovation.

For its growing AI server segment, Compal is actively exploring partnerships with companies such as Nvidia. This strategic alignment allows Compal to leverage cutting-edge GPU technology, essential for developing high-performance computing solutions demanded by the AI market.

Compal Electronics' key partnerships are anchored by its role as a major Original Design Manufacturer (ODM) for globally recognized technology brands. These collaborations are the bedrock of Compal's business, supplying the vast majority of its revenue. For instance, Compal is a critical manufacturing partner for leading companies in the notebook and tablet sectors, enabling these brands to bring innovative products to market.

These relationships are not merely transactional; they are deep-seated strategic alliances. Compal's ability to offer end-to-end solutions, from design and development to large-scale manufacturing and supply chain management, makes it an indispensable partner. In 2023, Compal reported revenues exceeding $30 billion, a significant portion of which is directly attributable to these high-profile client relationships.

Compal Electronics relies heavily on its logistics and distribution partners to ensure the efficient global delivery of its diverse electronic products. These strategic alliances are crucial for navigating the complexities of international supply chains and reaching a broad customer base across numerous geographical markets.

In 2024, Compal continued to leverage these partnerships to enhance supply chain efficiency and responsiveness. For instance, its collaborations with major shipping carriers and warehousing providers are instrumental in managing inventory levels and ensuring timely product dispatch, critical for maintaining customer satisfaction in the fast-paced electronics industry.

Strategic Alliances in Emerging Sectors

Compal Electronics is actively forging key partnerships to drive its expansion into burgeoning markets such as automotive electronics, smart healthcare, and 5G. These strategic alliances are crucial for leveraging specialized expertise and accessing new customer bases.

A prime example of this strategy is Compal's collaboration with Kalyani Powertrain Ltd. This partnership focuses on the manufacturing of X86 platform servers within India, tapping into the growing demand for localized IT infrastructure solutions. Furthermore, Compal is investing in a new manufacturing facility in Poland. This plant is specifically designed to produce automotive electronics, aiming to directly supply European original equipment manufacturers (OEMs).

- Automotive Electronics Expansion: Building a dedicated factory in Poland to serve European OEMs signifies a significant commitment to the automotive sector.

- India Market Entry: The partnership with Kalyani Powertrain Ltd. for X86 server manufacturing in India highlights a focus on regional production and market penetration.

- Diversification Strategy: These alliances underscore Compal's strategic pivot towards high-growth areas like automotive, healthcare, and 5G.

- Technological Advancement: Collaborations are essential for Compal to integrate advanced technologies required for these sophisticated new product lines.

Research and Development Collaborators

Compal actively partners with universities and research institutions to drive innovation, especially in cutting-edge fields like artificial intelligence and advanced communication technologies. These collaborations are vital for staying ahead in rapidly evolving sectors.

For instance, in 2024, Compal's commitment to R&D saw continued investment in exploring new materials and designs for high-performance computing, including advancements in liquid cooling infrastructure for data centers. This focus on next-generation cooling solutions is crucial for the efficiency and scalability of modern data processing.

- Focus on AI and Cloud Servers: Compal collaborates with academic and research bodies to develop next-generation AI capabilities and enhance cloud server technologies.

- Advanced Communication Technologies: Partnerships extend to research in areas like 5G and beyond, ensuring Compal remains competitive in communication hardware.

- Data Center Infrastructure: A key area of collaboration involves developing efficient solutions like liquid cooling for data centers, addressing the growing demand for high-density computing power.

- Continuous Innovation: These external R&D collaborations are fundamental to Compal's strategy of maintaining technological leadership and introducing innovative products to the market.

Compal’s key partnerships are the bedrock of its business, primarily driven by its role as a major Original Design Manufacturer (ODM) for global tech brands, supplying the majority of its revenue. These strategic alliances, including collaborations with Intel, AMD, and Qualcomm, are critical for integrating the latest components and ensuring competitive product performance. In 2023, Compal's revenue exceeded $30 billion, a testament to the strength of these client relationships.

Compal is actively expanding its reach through strategic alliances in emerging sectors like automotive electronics, smart healthcare, and 5G. A notable example is its partnership with Kalyani Powertrain Ltd. for X86 server manufacturing in India, and its investment in a new Polish facility to produce automotive electronics for European OEMs. These moves highlight a diversification strategy into high-growth markets.

Furthermore, Compal fosters innovation by partnering with universities and research institutions, focusing on AI, advanced communication technologies, and data center infrastructure like liquid cooling. These R&D collaborations are vital for maintaining technological leadership and developing next-generation solutions, particularly for the burgeoning AI server market where partnerships with companies like Nvidia are crucial for leveraging cutting-edge GPU technology.

| Partnership Type | Key Partners | Strategic Importance | Example 2024 Focus |

|---|---|---|---|

| Component Suppliers | Intel, AMD, Qualcomm | Access to latest processors, ensuring product competitiveness | Integration of new-generation chipsets for notebooks and servers |

| AI Technology Providers | Nvidia | Leveraging GPU technology for AI servers and high-performance computing | Developing advanced AI server solutions with next-gen GPUs |

| Major ODM Clients | Global Tech Brands (Notebooks, Tablets) | Core revenue driver, enabling large-scale manufacturing for leading brands | Continued high-volume production for flagship consumer electronics |

| Logistics & Distribution | Shipping Carriers, Warehousing Providers | Efficient global delivery and supply chain management | Optimizing inventory and ensuring timely product dispatch worldwide |

| Emerging Markets | Kalyani Powertrain Ltd. (India), European OEMs (Poland) | Market expansion into automotive, healthcare, 5G, and localized production | Manufacturing X86 servers in India; automotive electronics in Poland |

| Research & Development | Universities, Research Institutions | Driving innovation in AI, 5G, and advanced computing solutions | Exploring advanced cooling for data centers, AI material research |

What is included in the product

This Compal Electronics Business Model Canvas outlines its strategy as a leading ODM/OEM provider, focusing on efficient manufacturing, strong supplier relationships, and diverse customer segments in consumer electronics and IT. It details how Compal leverages its operational excellence and technological capabilities to deliver value to global brands.

Compal Electronics' Business Model Canvas serves as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying the understanding of their value proposition and key partnerships.

It acts as a pain point reliever by providing a structured framework that streamlines the identification of core components, facilitating efficient strategy development and adaptation for Compal.

Activities

Compal's product design and engineering activities are central to its role as an original design manufacturer (ODM). This involves the complete lifecycle of creating electronic devices, from initial concept to final engineering. For instance, in 2024, Compal continued to heavily invest in R&D, focusing on innovation for the next generation of laptops and expanding into high-growth areas such as AI PCs and automotive electronics.

Leveraging deep market insights is crucial for Compal's design process. They actively identify trends and consumer needs to ensure their engineered products are competitive and desirable. This proactive approach allows them to anticipate market shifts and develop solutions that meet future demands, a strategy evident in their push into specialized sectors.

Compal's advanced manufacturing operations are the backbone of its business, encompassing mass production, meticulous assembly, and rigorous quality assurance for a wide array of electronic devices. These state-of-the-art facilities are strategically positioned to meet global demand efficiently.

To bolster supply chain resilience and navigate geopolitical complexities, Compal is actively expanding its manufacturing footprint. Significant investments are being made in Vietnam, India, Mexico, and Poland, with ongoing considerations for establishing a presence in the United States. This diversification strategy is crucial for maintaining operational continuity and adapting to evolving global trade dynamics.

Compal's core activities revolve around expertly managing its intricate global supply chain. This involves everything from procuring raw materials and essential components to orchestrating sophisticated logistics for timely product delivery worldwide.

Recognizing the vulnerabilities exposed by recent global events, Compal is proactively reshaping its supply chain. A significant focus is placed on diversifying sourcing locations and manufacturing partners to lessen reliance on any single region, thereby bolstering resilience against unforeseen disruptions.

Research and Development for Diversification

Compal Electronics heavily invests in Research and Development to fuel its diversification strategy, focusing on high-growth emerging sectors. Significant R&D efforts are directed towards expanding into areas like AI applications, cloud servers, automotive electronics, advanced communications (5G), and medical technology. This commitment is evident in their work on developing AI PCs, liquid cooling solutions for data centers, and advanced driver-assistance systems (ADAS) sensors for the automotive industry.

In 2024, Compal's R&D spending reflects a strategic pivot towards these future-oriented markets. For instance, their advancements in AI PCs aim to capture a growing segment of the personal computing market, while innovations in automotive electronics, such as ADAS sensors, position them to benefit from the increasing sophistication of vehicles.

- AI and Cloud Computing: Development of AI-powered devices and infrastructure solutions for data centers.

- Automotive Electronics: Focus on advanced driver-assistance systems (ADAS) and other in-car technologies.

- 5G and Communications: Innovation in networking solutions to support the next generation of wireless technology.

- Medical Technology: Exploration of opportunities in the healthcare technology sector.

Quality Assurance and Testing

Compal Electronics places a critical emphasis on quality assurance and testing to guarantee the dependability, performance, and safety of its diverse electronic product portfolio. This commitment is underscored by their adherence to stringent international quality management systems.

The company’s manufacturing facilities are largely certified under ISO-9001, a globally recognized standard for quality management. This certification reflects Compal's dedication to consistent product quality and customer satisfaction across its operations.

Furthermore, Compal is actively investing in specialized certifications for new ventures. For instance, its recently established automotive plant in Poland is being developed to meet the rigorous requirements of IATF 16949, the international standard for automotive quality management systems, highlighting their strategic expansion into demanding sectors.

These robust quality protocols are essential for Compal, particularly as it expands its manufacturing capabilities in areas like automotive electronics, where product failure can have severe consequences. By maintaining high quality standards, Compal aims to build trust and secure long-term partnerships with its clients.

Compal's key activities center on its prowess as an Original Design Manufacturer (ODM), encompassing product design, engineering, and advanced manufacturing. They excel in managing complex global supply chains, ensuring efficient procurement and logistics. A significant focus is placed on rigorous quality assurance and testing across their diverse product lines.

In 2024, Compal continued to prioritize R&D for future growth sectors like AI PCs and automotive electronics. Their manufacturing diversification strategy, with investments in Vietnam, India, Mexico, and Poland, aims to enhance supply chain resilience. Quality certifications, such as ISO-9001 and the developing IATF 16949 for automotive, underscore their commitment to high standards.

| Key Activity | Description | 2024 Focus/Data |

| Product Design & Engineering (ODM) | Concept to final engineering of electronic devices. | Heavy R&D investment in AI PCs, automotive electronics. |

| Manufacturing Operations | Mass production, assembly, and quality assurance. | Expanding footprint in Vietnam, India, Mexico, Poland. |

| Supply Chain Management | Procurement, logistics, and diversification. | Reducing reliance on single regions; exploring US presence. |

| Quality Assurance & Testing | Ensuring product dependability, performance, and safety. | ISO-9001 certified facilities; pursuing IATF 16949 for automotive. |

Preview Before You Purchase

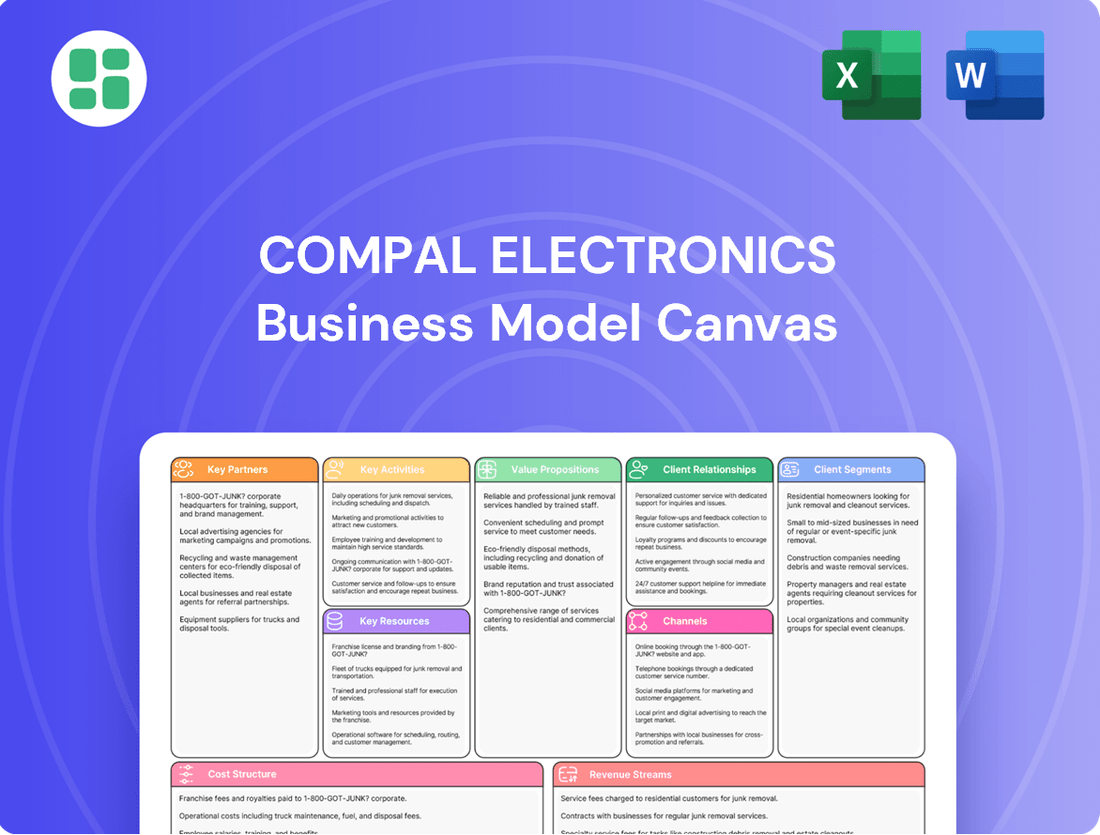

Business Model Canvas

The Compal Electronics Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You're getting a direct snapshot of the complete, ready-to-use business model analysis for Compal Electronics.

Resources

Compal Electronics leverages substantial intellectual property, including a robust portfolio of design patents, which is fundamental to its Original Design Manufacturer (ODM) operations. This deep well of design expertise enables Compal to consistently deliver award-winning aesthetics and innovative concept development for its global clientele.

In 2023, Compal's commitment to design innovation was evident in its numerous accolades, underscoring the commercial value of its accumulated design know-how. This intellectual capital directly translates into a competitive advantage, allowing Compal to offer differentiated and high-value product design services, a key component of its business model.

Compal Electronics' global manufacturing facilities, including major sites in China, Vietnam, India, Mexico, and Poland, represent a cornerstone of its operational strength. These strategically located plants offer significant, scalable production capacity essential for fulfilling worldwide demand for diverse electronic devices.

As of early 2024, Compal's extensive network allows it to efficiently produce millions of units annually, supporting its role as a leading contract manufacturer for major global brands. The company's ability to leverage these diverse locations mitigates supply chain risks and optimizes production costs.

Compal Electronics heavily relies on its skilled R&D and engineering talent as a core resource. This human capital is crucial for their innovation in areas like system integration and AI computing. In 2024, Compal continued to invest in its workforce, recognizing that the expertise of its engineers in thermal management and diverse product categories is what allows them to tackle complex design challenges and drive product development.

Robust Supply Chain Network

Compal's robust supply chain network is a cornerstone of its operations, covering everything from sourcing raw materials to delivering finished products globally. This intricate web of suppliers and logistics partners is essential for maintaining efficient manufacturing processes across its numerous facilities.

This established global network is critical for Compal's ability to procure a vast array of electronic components and materials reliably. It ensures that production lines have the necessary inputs to meet fluctuating market demands, a key factor in their competitive edge.

The efficiency of this network directly impacts Compal's ability to manage costs and delivery times. For instance, in 2024, Compal continued to leverage its extensive supplier relationships to mitigate potential disruptions and optimize inventory levels, a strategy that has historically contributed to their financial stability.

- Global Reach: Compal operates a supply chain that spans continents, enabling sourcing from diverse regions and serving a worldwide customer base.

- Supplier Relationships: Long-standing partnerships with key component manufacturers ensure consistent quality and availability, even during periods of high demand.

- Logistics Optimization: Advanced logistics management systems are employed to streamline transportation and warehousing, reducing lead times and operational costs.

- Risk Mitigation: The network is designed with redundancy and flexibility to navigate geopolitical shifts and unforeseen events, safeguarding production continuity.

Financial Capital for Investment and Expansion

Compal Electronics relies on substantial financial capital as a cornerstone of its business model. This access allows for crucial investments in research and development, ensuring the company remains competitive in rapidly evolving technology markets. Furthermore, it fuels the expansion of its global manufacturing footprint, a necessity for meeting worldwide demand.

The company is strategically allocating significant resources for future growth. For 2025, Compal has increased its capital expenditure plans, with a pronounced focus on expanding server production capabilities and establishing new overseas manufacturing facilities. This proactive financial strategy underscores their commitment to capturing opportunities in high-growth sectors.

- Access to significant financial capital: Enables R&D investment and global facility expansion.

- Strategic diversification: Funding for entry into new, high-growth sectors.

- Increased 2025 CAPEX: Primarily directed towards server manufacturing and overseas factory development.

Compal's key resources include its intellectual property, manufacturing capabilities, skilled workforce, robust supply chain, and financial capital. These elements collectively enable the company to function as a leading ODM and contract manufacturer, delivering innovative products and meeting global demand efficiently.

The company's intellectual property, particularly its design patents, is a critical asset for its ODM services. This expertise allows Compal to offer differentiated product designs, a key value proposition for its clients. In 2023, Compal received numerous design awards, highlighting the commercial success of its accumulated design know-how.

Compal's extensive global manufacturing footprint, with facilities in China, Vietnam, India, Mexico, and Poland, provides significant production capacity. By early 2024, these strategically located plants allowed Compal to produce millions of units annually, ensuring efficient fulfillment of worldwide orders and mitigating supply chain risks.

| Key Resource | Description | 2023/2024 Relevance |

| Intellectual Property | Design patents and innovation expertise. | Drives ODM competitiveness; numerous accolades received in 2023. |

| Manufacturing Facilities | Global network of production sites. | Scalable capacity to produce millions of units annually by early 2024; risk mitigation. |

| Skilled Workforce | R&D and engineering talent. | Crucial for system integration, AI computing, and complex design challenges; ongoing investment in 2024. |

| Supply Chain Network | Global sourcing and logistics. | Ensures component availability and cost/delivery time optimization; leveraged supplier relationships in 2024 to manage disruptions. |

| Financial Capital | Funding for operations and growth. | Enables R&D, facility expansion, and strategic investments, with increased CAPEX planned for 2025 in servers and new facilities. |

Value Propositions

Compal provides a complete suite of original design manufacturing (ODM) services. This covers everything from initial design and development to full-scale manufacturing and intricate supply chain management for various electronic products.

By offering these integrated ODM solutions, Compal empowers brand-name companies. They can efficiently launch new products without the need for substantial in-house manufacturing infrastructure, streamlining their go-to-market strategy.

For instance, in 2024, Compal continued its strong performance in notebook ODM, a sector where it holds a significant market share. The company's ability to manage complex product lifecycles and diverse client needs underpins its value proposition.

Compal Electronics leverages significant economies of scale, enabling cost-effective manufacturing for its global clientele. In 2024, the company's robust supply chain and optimized production lines allowed it to maintain competitive pricing, a key factor in securing large-volume contracts.

The company's manufacturing infrastructure is highly scalable, designed to adapt to fluctuating client demands. This flexibility is crucial in the fast-paced electronics market, allowing Compal to efficiently ramp up or down production volumes to meet specific order requirements, thereby maximizing resource utilization.

Compal's deep expertise in system integration is a significant driver of its rapid time-to-market value proposition. This capability allows them to efficiently combine various components and technologies, drastically shortening development cycles for their clients.

For brand-name companies in the electronics sector, where staying ahead of the curve is paramount, this accelerated product launch is a critical competitive edge. It means clients can get their innovative products into consumers' hands faster, capturing market share before competitors.

In 2024, Compal's agility in navigating complex supply chains and manufacturing processes enabled key partners to introduce next-generation devices months ahead of initial projections. This speed directly translates into increased revenue opportunities and stronger brand positioning for their customers in rapidly evolving markets.

Design and Engineering Innovation

Compal Electronics leverages its significant investment in research and development to deliver cutting-edge design and engineering innovation. This commitment is evidenced by their numerous design awards and a particular focus on emerging technologies like AI PCs, smart devices, and automotive electronics.

Their expertise allows clients to create products that stand out in the market, offering advanced functionalities and superior user experiences. For instance, Compal's work in the burgeoning AI PC sector in 2024 has seen them collaborate on devices integrating advanced AI processing capabilities, aiming to redefine personal computing efficiency and intelligence.

- AI PC Development: Compal is actively involved in the design and manufacturing of next-generation AI PCs, integrating specialized processors for enhanced on-device AI tasks.

- Smart Device Integration: They offer comprehensive design services for a range of smart devices, ensuring seamless connectivity and intuitive user interfaces.

- Automotive Electronics Solutions: Compal provides innovative engineering for automotive components, focusing on areas like advanced driver-assistance systems (ADAS) and in-car infotainment.

- R&D Investment: The company consistently allocates a substantial portion of its revenue to R&D, fostering a culture of continuous innovation and technological advancement. In 2023, Compal reported R&D expenditure of approximately NT$15.5 billion (roughly $480 million USD), underscoring their dedication to design and engineering excellence.

Geographically Diversified Production and Risk Mitigation

Compal Electronics' strategic move to diversify its production locations beyond China, including significant investments and expansions in Vietnam and India, directly addresses client needs for a more robust and secure supply chain. This global manufacturing footprint, also encompassing facilities in Mexico and Poland, significantly mitigates the impact of geopolitical tensions and trade disruptions that have become increasingly prevalent. For instance, by 2024, Compal's Vietnam operations are expected to handle a substantial portion of its notebook production, offering a vital alternative to its China-based facilities.

This geographical diversification is not merely about spreading risk; it's about building resilience. Clients benefit from reduced lead times and greater flexibility in sourcing, especially in light of ongoing global supply chain challenges. Compal’s commitment to establishing new sites, such as its planned facility in India, underscores its dedication to providing clients with manufacturing options that offer greater stability and predictability. This approach is crucial in an environment where supply chain disruptions can have significant financial consequences.

- Enhanced Supply Chain Resilience: By distributing production across multiple countries, Compal minimizes reliance on any single region, offering clients greater assurance against disruptions.

- Reduced Geopolitical Risk: Diversification away from a single dominant manufacturing hub helps clients navigate international trade uncertainties and political instability.

- Increased Manufacturing Flexibility: A broader production network allows Compal to adapt more readily to shifts in demand and optimize production based on regional advantages and client needs.

Compal offers comprehensive ODM services, enabling brand-name companies to efficiently launch products by handling everything from design to manufacturing and supply chain management.

Their deep expertise in system integration accelerates product development, giving clients a crucial time-to-market advantage in the competitive electronics landscape.

Compal's significant R&D investment, including a focus on AI PCs and automotive electronics, allows clients to offer innovative, high-performance products.

The company's strategic diversification of manufacturing locations, such as expanded operations in Vietnam by 2024, builds supply chain resilience and mitigates geopolitical risks for its clients.

| Value Proposition | Description | 2024 Relevance/Data |

| Integrated ODM Services | End-to-end product development and manufacturing solutions. | Continued strong performance in notebook ODM market share. |

| Accelerated Time-to-Market | Expertise in system integration speeds up product launches. | Key partners introduced next-gen devices months ahead of projections in 2024. |

| Design & Engineering Innovation | Focus on cutting-edge technologies like AI PCs and automotive electronics. | Collaborations on AI PCs with advanced processing capabilities in 2024. |

| Supply Chain Resilience | Diversified manufacturing footprint (e.g., Vietnam, India) reduces risk. | Vietnam operations expected to handle substantial notebook production by 2024. |

Customer Relationships

Compal Electronics prioritizes cultivating enduring relationships with its prominent global clientele by assigning dedicated account managers. This strategic focus ensures a profound comprehension of each client's unique requirements and overarching business objectives, thereby solidifying sustained collaborations.

Compal Electronics fosters customer relationships through deep collaboration in product development. They work directly with clients, often engaging in co-creation to design and refine products. This hands-on approach ensures that the final offerings precisely meet specific brand needs and anticipated market trends.

This collaborative model was evident in Compal's continued partnerships throughout 2024. For instance, their work with major tech brands on next-generation devices highlights this strategy. By integrating client feedback early and continuously, Compal minimizes development risks and accelerates time-to-market for innovative products, a key driver of their sustained revenue growth.

Compal Electronics offers robust technical support and after-sales services, ensuring clients navigate product deployment seamlessly and address any post-production concerns. This dedication to ongoing assistance is a cornerstone of their customer relationship strategy.

In 2024, Compal's commitment to customer satisfaction was reflected in their operational efficiency, with a focus on minimizing downtime and maximizing product lifespan for their partners.

Confidentiality and Intellectual Property Protection

Compal Electronics operates as an Original Design Manufacturer (ODM), making the safeguarding of client intellectual property paramount. This commitment to strict confidentiality forms the bedrock of its customer relationships, fostering deep trust.

By ensuring robust protection for sensitive product designs and proprietary information, Compal encourages leading brand-name companies to confidently outsource their manufacturing needs. This trust is crucial for securing long-term partnerships and repeat business in a competitive market.

- Confidentiality Agreements: Compal likely utilizes comprehensive Non-Disclosure Agreements (NDAs) and specific IP protection clauses within its contracts.

- Secure Manufacturing Processes: Implementing stringent physical and digital security measures throughout its production facilities is essential.

- Employee Training: Regular training for all personnel on data security and IP handling best practices reinforces a culture of protection.

Strategic Engagement for New Market Penetration

Compal Electronics cultivates strategic customer relationships to drive penetration into burgeoning markets such as automotive and AI servers. This involves forging deep partnerships with key players like European automotive original equipment manufacturers (OEMs) and leading AI server integrators.

These collaborations are often structured as joint ventures or intricate partnerships, enabling the co-creation of tailored solutions designed for specific market needs. For instance, Compal’s involvement in the automotive sector saw significant growth, with revenues from automotive electronics projected to reach approximately $1.5 billion in 2024, reflecting the success of these strategic engagements.

- Deep Collaboration: Joint ventures and co-development projects with automotive OEMs and AI server integrators.

- Market-Specific Solutions: Tailoring products and services to meet the unique demands of emerging sectors.

- Strategic Alliances: Building long-term partnerships to ensure mutual growth and innovation.

- Client Acquisition: Successfully onboarding major European automotive manufacturers and prominent AI server providers in 2024.

Compal Electronics' customer relationships are built on a foundation of dedicated account management, deep product development collaboration, and robust after-sales support. Their strategy emphasizes long-term partnerships and co-creation, ensuring client needs are met precisely.

The company's commitment to intellectual property protection is crucial, fostering trust with clients who outsource sensitive manufacturing. This, combined with strategic market penetration efforts, solidifies Compal's position as a valued partner.

In 2024, Compal's automotive electronics segment saw significant growth, with revenues projected to reach around $1.5 billion, underscoring the success of their deep collaboration strategy with key players in emerging markets.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Assigning specific managers to understand unique client needs and objectives. | Ensures sustained collaborations and deep comprehension of client goals. |

| Product Development Collaboration | Co-creation and direct client involvement in product design and refinement. | Accelerates time-to-market for innovative products, minimizing development risks. |

| Technical Support & After-Sales | Providing seamless deployment assistance and post-production support. | Enhances customer satisfaction and product operational efficiency. |

| Intellectual Property Protection | Strict confidentiality and robust safeguarding of client IP. | Fosters deep trust, encouraging outsourcing and securing long-term partnerships. |

| Strategic Market Penetration | Building partnerships in burgeoning sectors like automotive and AI servers. | Automotive electronics revenue projected at ~$1.5 billion in 2024, reflecting successful engagements. |

Channels

Compal Electronics heavily relies on direct sales channels and robust B2B engagement to serve its global clientele of brand-name electronics manufacturers. This approach involves direct negotiation of contracts and the deployment of specialized sales teams to cultivate and manage these crucial relationships.

In 2024, Compal's strategy of direct B2B engagement proved effective, contributing significantly to its revenue streams. For instance, the company secured major ODM (Original Design Manufacturer) contracts with leading global brands, underscoring the importance of these direct relationships in its business model.

Compal leverages a vast global logistics and distribution network to ensure its manufactured electronic devices reach clients worldwide efficiently. This intricate system manages the physical flow of goods from its manufacturing centers to diverse customer locations, guaranteeing timely delivery.

In 2023, Compal's supply chain operations handled millions of units, with a significant portion of its revenue, approximately 70%, generated from its ODM (Original Design Manufacturer) services, which heavily rely on these robust distribution channels. The company's commitment to optimizing these networks is crucial for maintaining its competitive edge in the fast-paced electronics market.

Compal likely leverages secure online collaboration portals to facilitate seamless interaction with its clients. These platforms are crucial for managing design specifications, tracking order progress, and overseeing project milestones throughout the product lifecycle.

These digital channels are designed to enhance efficiency and transparency, streamlining communication between Compal and its partners. For instance, in 2024, Compal reported a significant increase in digital service adoption among its key clients, indicating a growing reliance on these online tools for day-to-day operations.

Industry Trade Shows and Conferences

Compal Electronics actively participates in major industry trade shows and technology conferences. These events are crucial for acquiring new clients and fostering relationships within the tech ecosystem. For instance, presence at events like COMPUTEX provides a platform to showcase their latest innovations.

These conferences are vital for networking and demonstrating Compal's capabilities in emerging areas. By exhibiting at events such as MWC, they can directly engage with potential and existing clients, highlighting advancements in AI infrastructure and 5G solutions. This direct interaction is key to understanding market needs and positioning their offerings.

- Client Acquisition: Trade shows are a primary channel for identifying and securing new business opportunities.

- Networking: Conferences facilitate crucial connections with industry partners, suppliers, and potential collaborators.

- Technology Showcase: Compal leverages these events to demonstrate its expertise in cutting-edge technologies.

- Market Intelligence: Participation offers insights into competitor activities and evolving market trends.

Regional Sales and Service Offices

Compal Electronics strategically establishes regional sales and service offices to foster closer client relationships and enhance market responsiveness. For instance, their presence in Poland serves the European automotive sector, offering localized support and strengthening partnerships.

This direct regional engagement is crucial for understanding diverse market needs and providing tailored solutions. By having boots on the ground, Compal can react swiftly to customer inquiries and service requirements, improving overall client satisfaction.

- Localized Support: Regional offices in key markets like Poland for the European automotive sector enable Compal to offer tailored assistance and build stronger client connections.

- Enhanced Responsiveness: This distributed network allows for quicker turnaround times on service requests and sales inquiries, improving operational efficiency.

- Market Penetration: A localized presence facilitates deeper understanding of regional demands, aiding in more effective market penetration and competitive positioning.

Compal's channels are primarily direct, focusing on B2B relationships with major electronics brands. They also utilize a global logistics network for efficient product delivery and engage in industry trade shows for client acquisition and networking. Regional sales offices provide localized support and market responsiveness.

| Channel Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Direct B2B Sales | Contract negotiation, relationship management | Secured major ODM contracts; significant revenue contribution |

| Global Logistics & Distribution | Physical flow of goods, timely delivery | Managed millions of units in 2023; crucial for 70% ODM revenue |

| Industry Trade Shows & Conferences | Client acquisition, networking, technology showcase | Platform for showcasing innovations (e.g., COMPUTEX), market intelligence |

| Regional Sales & Service Offices | Localized support, market responsiveness | Example: Poland office serves European automotive sector; enhances client satisfaction |

Customer Segments

Global brand-name PC and tablet companies form Compal's bedrock, relying on its expertise for manufacturing their devices. This segment is crucial, with demand expected to surge due to ongoing corporate PC refresh cycles and the anticipated wave of AI PC adoption throughout 2024 and beyond.

Compal Electronics is a significant player in the burgeoning wearable device market, offering comprehensive design and manufacturing services to leading global brands. They cater to the production of smartwatches, fitness trackers, and a variety of other smart electronic wearables, a critical component of their broader smart device offerings.

In 2024, the global wearable technology market was projected to reach over $150 billion, highlighting the substantial demand Compal addresses. Brands rely on Compal's expertise to bring their innovative wearable concepts from design to mass production efficiently.

Compal Electronics is increasingly focusing on the automotive sector, specifically targeting car manufacturers and Tier-one suppliers, with a notable emphasis on the European market. This segment represents a significant growth opportunity for the company as the automotive industry continues its rapid electrification and digitalization.

The company is already producing electronic control units (ECUs), which are fundamental components in modern vehicles. Compal’s strategic expansion plans include venturing into advanced driver-assistance systems (ADAS) and sensors for autonomous driving. This move aligns with the global trend towards smarter, more connected, and self-driving vehicles.

The automotive electronics market is experiencing robust growth. For instance, the global automotive electronics market was valued at approximately $230 billion in 2023 and is projected to reach over $350 billion by 2028, with a compound annual growth rate (CAGR) of around 8.5%. This expansion is driven by increasing demand for in-car infotainment, safety features, and electric vehicle components.

Smart Healthcare Solution Providers

Compal Electronics is actively engaging smart healthcare solution providers, focusing on businesses that create advanced medical and healthcare electronic devices. This strategic pivot aims to leverage Compal's manufacturing expertise in a rapidly growing sector.

The company's target market includes developers of sophisticated systems such as smart medical imaging equipment and artificial intelligence (AI) platforms for healthcare applications. These solutions are crucial for improving diagnostic accuracy and patient care.

- Targeting innovative medical device manufacturers: Compal seeks partnerships with companies at the forefront of medical technology development.

- Focus on high-growth segments: Key areas of interest include smart imaging and AI-driven medical systems, which are experiencing significant market expansion.

- Leveraging manufacturing capabilities: Compal offers its robust ODM (Original Design Manufacturer) and OEM (Original Equipment Manufacturer) services to bring these advanced healthcare solutions to market efficiently.

- Addressing evolving healthcare needs: By supporting these providers, Compal contributes to the digital transformation of healthcare, aiming to enhance efficiency and patient outcomes.

5G Communication Technology Companies and AI Server Clients

Compal Electronics targets a crucial segment within the technology landscape: companies at the forefront of 5G communication and artificial intelligence. This includes manufacturers of 5G user equipment and small cell infrastructure, as well as businesses demanding robust AI server and data center solutions. The demand for these advanced technologies is soaring, with the global AI server market projected to reach approximately $100 billion by 2028, showcasing the immense opportunity for Compal.

Compal is strategically positioning itself to serve these high-growth sectors by fostering key alliances. A prime example of this is their active pursuit of partnerships with AI leaders like Nvidia. This collaboration is vital, as Nvidia's GPUs are foundational to the computational power required for AI training and inference, directly benefiting Compal's clients in this domain.

- 5G Infrastructure Providers: Companies developing and deploying 5G networks, including manufacturers of base stations, small cells, and related user equipment.

- AI & Machine Learning Companies: Businesses requiring high-performance computing for AI model training, inference, and data analytics, necessitating advanced server solutions.

- Data Center Operators: Entities managing large-scale data processing and storage facilities that increasingly rely on specialized hardware for AI workloads.

- Semiconductor and Component Suppliers: Key partners like Nvidia, whose advanced processors are integral to the AI server solutions Compal offers.

Compal Electronics serves a diverse clientele, ranging from established global PC and tablet manufacturers to emerging players in the wearable technology market. They also cater to the automotive industry, specifically car manufacturers and Tier-one suppliers, and are actively pursuing partnerships with smart healthcare solution providers. Furthermore, Compal targets companies involved in 5G communication infrastructure and artificial intelligence, including those requiring advanced server solutions.

Cost Structure

Compal Electronics' primary expense stems from acquiring raw materials and electronic components. This includes essential parts like processors, memory chips, and display panels, which form the backbone of their diverse product lines.

In 2024, the global semiconductor shortage continued to impact component pricing, with some key chips seeing price increases of over 20% compared to 2023, directly affecting Compal's procurement costs. Effective global sourcing strategies and robust supply chain management are therefore paramount for Compal to mitigate these significant expenses and maintain competitive pricing.

Manufacturing labor and overhead are a substantial expense for Compal Electronics. These costs encompass wages for assembly line workers, quality control technicians, and factory supervisors, alongside essential factory expenses like electricity, water, and ongoing machinery upkeep. In 2023, Compal reported significant operating expenses related to its manufacturing operations, reflecting the scale of its global production.

Compal's extensive manufacturing facilities, spread across various countries, directly impact these cost structures. The company's commitment to efficient production processes and the depreciation of its substantial investment in manufacturing equipment also contribute to overhead. For instance, in the fiscal year ending December 31, 2023, Compal's cost of goods sold, which largely includes these manufacturing expenses, represented a significant portion of its revenue.

Compal Electronics dedicates significant resources to Research and Development, a crucial cost driver as the company expands into cutting-edge sectors. These investments are essential for fostering innovation in areas such as artificial intelligence, 5G technology, automotive solutions, and smart healthcare.

These R&D expenditures encompass the acquisition of specialized talent, the procurement of advanced equipment, and the ongoing development of intellectual property. For instance, in 2023, Compal’s R&D spending represented a notable portion of its operational costs, reflecting its commitment to staying ahead in these competitive high-tech fields.

Logistics, Shipping, and Supply Chain Management Costs

Logistics, shipping, and supply chain management represent a significant portion of Compal Electronics' operational expenses. These costs encompass the global movement of components and finished goods, warehousing, and navigating international customs regulations. In 2024, as Compal continued its strategy of diversifying manufacturing locations beyond China, for instance, establishing new facilities in Vietnam and Taiwan, the logistical complexities and associated costs were a key consideration in optimizing its overall cost structure.

Compal's proactive approach to managing these expenditures includes strategic investments in technology to enhance supply chain visibility and efficiency. The company's global footprint, while necessary for market access and risk mitigation, inherently drives up these costs. For example, the ongoing geopolitical shifts and trade dynamics in 2024 underscored the importance of flexible and cost-effective transportation solutions.

- Global Transportation: Costs for air, sea, and land freight for millions of components and finished products.

- Warehousing and Inventory: Expenses related to storing raw materials, work-in-progress, and finished goods across multiple international locations.

- Customs and Duties: Tariffs, taxes, and fees incurred when importing components and exporting finished electronics globally.

- Supply Chain Technology: Investments in software and systems for tracking, planning, and optimizing the flow of goods.

Capital Expenditures (Capex) for Facilities and Equipment

Compal Electronics' capital expenditures are a major component of its cost structure, particularly for facilities and equipment. This involves substantial investment in building new manufacturing sites and enhancing current ones. The company also dedicates significant funds to acquiring cutting-edge production machinery to maintain its competitive edge in the fast-paced electronics manufacturing industry.

In 2025, Compal Electronics has projected a capital expenditure of NT$10 billion. This increased investment is strategically allocated towards expanding its server manufacturing capabilities and supporting the growth of its overseas factory operations. These investments are crucial for scaling production and meeting growing global demand.

- Investment in New Facilities: Building new plants to increase production capacity.

- Upgrades to Existing Plants: Modernizing current facilities for improved efficiency and advanced manufacturing processes.

- Acquisition of Advanced Equipment: Purchasing state-of-the-art machinery for higher quality and faster production.

- 2025 Capex Allocation: NT$10 billion primarily directed towards server production and overseas factory expansion.

Compal Electronics' cost structure is heavily influenced by the procurement of raw materials and electronic components, with global supply chain disruptions in 2024, such as semiconductor shortages, leading to price increases of over 20% for certain key chips. Manufacturing labor and overhead, including wages, utilities, and machinery upkeep, represent another substantial expense, as evidenced by significant operating expenses reported in 2023. Significant investments in Research and Development are crucial for innovation in areas like AI and 5G, with R&D spending forming a notable portion of operational costs in 2023.

| Cost Category | Key Components | 2023/2024 Impact/Notes |

| Raw Materials & Components | Processors, memory chips, display panels | 2024: Over 20% price increase for some chips due to shortages. |

| Manufacturing Labor & Overhead | Wages, factory utilities, machinery maintenance | Significant operating expenses reported in 2023; reflects global production scale. |

| Research & Development | Talent acquisition, advanced equipment, IP development | Notable portion of costs in 2023; essential for AI, 5G, automotive tech. |

| Logistics & Supply Chain | Global freight, warehousing, customs, tech investments | Increased complexity and costs with manufacturing diversification (e.g., Vietnam, Taiwan) in 2024. |

| Capital Expenditures (Capex) | New facilities, plant upgrades, advanced machinery | Projected NT$10 billion for 2025, focusing on server production and overseas expansion. |

Revenue Streams

Compal Electronics' primary revenue source stems from charging major global brands for the manufacturing and assembly of their diverse electronic devices. This includes popular items like laptops, tablets, and wearable technology, with revenue directly correlating to the volume of units produced.

In 2023, Compal reported total revenues of approximately NT$1.03 trillion (roughly $32 billion USD), underscoring the significant scale of its manufacturing and assembly operations. This volume-driven model is the backbone of their financial performance.

Compal Electronics generates revenue through its design and engineering services, a core component of its Original Design Manufacturer (ODM) business. These services encompass the entire product development lifecycle, from initial concept and industrial design to detailed hardware and software engineering and the creation of prototypes for its clients.

This revenue stream is crucial for Compal, as it allows them to offer end-to-end solutions to brands looking to bring new products to market without extensive in-house R&D. For instance, in 2024, Compal continued to leverage its engineering expertise to secure design contracts for a range of consumer electronics and IT products, contributing significantly to its overall financial performance.

Compal Electronics is actively expanding its revenue base beyond traditional consumer electronics. New growth is coming from areas like automotive electronics, where the company is investing in solutions for connected vehicles. The development of AI servers is another key area, catering to the increasing demand for high-performance computing. Furthermore, Compal is exploring opportunities in smart healthcare, indicating a strategic pivot towards higher-growth, more specialized markets.

The company's diversification efforts are showing tangible progress, with emerging business units contributing to a broader revenue portfolio. For instance, Compal's new automotive plant, slated to commence operations in Poland in 2026, is projected to become a significant sales generator in the coming years. This investment underscores their commitment to capturing market share in the rapidly evolving automotive sector.

Licensing of Intellectual Property (if applicable)

While Compal Electronics primarily focuses on contract manufacturing, its significant investment in research and development suggests a robust portfolio of intellectual property. This IP, encompassing design patents and technological innovations, presents a potential, albeit secondary, revenue stream through licensing agreements with other firms in the electronics sector. For instance, in 2023, Compal reported approximately $1.1 billion in R&D expenses, indicating a continuous development of new technologies that could be licensed.

The licensing of intellectual property, if pursued more aggressively, could diversify Compal's income sources beyond its core manufacturing services. This strategy is common among technology-centric companies that possess unique designs or patented processes. While specific figures for IP licensing revenue are not prominently disclosed, the sheer volume of patents held by a company of Compal's scale could translate into meaningful financial contributions.

- Potential for IP Licensing: Compal's extensive R&D investments and patent portfolio offer opportunities for revenue generation through licensing agreements.

- Secondary Revenue Stream: IP licensing is considered a supplementary income source, complementing the primary revenue from manufacturing services.

- R&D Investment Context: Compal's significant R&D spending, reaching around $1.1 billion in 2023, underscores the potential depth of its intellectual property assets.

- Industry Trend Alignment: Licensing IP aligns with common practices in the technology industry for monetizing innovation.

After-Sales Support and Maintenance Services

Compal Electronics generates recurring revenue through its after-sales support and maintenance services. This is particularly relevant for the sophisticated products they manufacture, such as servers and specialized industrial equipment, which often require ongoing upkeep.

These services ensure customer satisfaction and product longevity, creating a stable income stream beyond the initial product sale. For instance, Compal's commitment to support can translate into long-term service contracts, a key element of their business model.

- Recurring Revenue: Ongoing technical support, maintenance, and repair services for manufactured products.

- Targeted Products: Especially beneficial for complex systems like servers and specialized industrial devices.

- Customer Value: Enhances product lifespan and customer satisfaction, fostering loyalty.

- Financial Impact: Contributes to a predictable and stable revenue stream for the company.

Compal Electronics' revenue streams are diverse, primarily driven by its core contract manufacturing business for major global brands. Beyond this, the company leverages its design and engineering capabilities, expanding into new growth sectors like automotive electronics and AI servers. Additionally, recurring revenue from after-sales support and the potential for intellectual property licensing contribute to its financial model.

| Revenue Stream | Description | Key Drivers/Examples | 2023 Data/Context |

|---|---|---|---|

| Contract Manufacturing | Assembly and production of electronic devices for clients. | Volume of laptops, tablets, wearables produced. | NT$1.03 trillion total revenue. |

| Design & Engineering (ODM) | End-to-end product development services. | Securing design contracts for new consumer electronics and IT products. | Crucial for offering full solutions to brands. |

| New Growth Areas | Expansion into emerging markets. | Automotive electronics, AI servers, smart healthcare. | Poland automotive plant to commence operations in 2026. |

| After-Sales Support | Recurring revenue from maintenance and repair. | Service contracts for servers and industrial equipment. | Ensures customer satisfaction and product longevity. |

| IP Licensing (Potential) | Monetizing intellectual property through agreements. | Licensing design patents and technological innovations. | Approx. $1.1 billion R&D expenses in 2023. |

Business Model Canvas Data Sources

The Compal Electronics Business Model Canvas is informed by a blend of internal financial reports, extensive market research on the electronics industry, and analysis of competitor strategies. These data sources ensure a comprehensive and grounded understanding of Compal's operational landscape and strategic positioning.