Colruyt Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

Colruyt Group’s strong brand loyalty and efficient operations are significant strengths, but they also face intense competition and evolving consumer preferences. Understanding these dynamics is key to navigating the retail landscape.

Want the full story behind Colruyt Group’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Colruyt Group commands a formidable position in Belgium's retail landscape, operating a spectrum of supermarket formats like Colruyt Lowest Prices, Okay, and Spar, alongside its convenience stores. This multi-pronged strategy effectively addresses diverse consumer demands, bolstering the group's market reach and stability.

The enduring 'Lowest Prices' commitment of its flagship Colruyt brand, a strategy maintained for half a century, has cultivated deep-rooted customer loyalty. As of fiscal year 2023-2024, Colruyt Group's Belgian market share remained robust, demonstrating the continued effectiveness of its diversified format approach.

Colruyt Group's robust private label strategy is a significant strength, particularly as consumers increasingly prioritize value amidst persistent inflation. Their focus on private labels, such as the expanding Boni Selection, allows them to offer quality products at more accessible price points, directly addressing consumer needs in the 2024-2025 economic climate.

This strategic emphasis on private labels, which now number around 13,000 products, is designed to drive economies of scale and enhance their competitive edge against national brands. Colruyt's commitment to rigorous quality control for these own-brand items ensures consumer trust and brand loyalty, a crucial differentiator in a crowded retail landscape.

Colruyt Group's dedication to sustainability, particularly through its Virya Energy subsidiary, is a significant strength. The company has set an ambitious target to achieve nearly 100% green electricity usage, demonstrating a clear commitment to environmental responsibility.

Furthermore, Colruyt Group is actively pursuing a zero-emission transport goal by 2035. This involves pioneering the use of electric and hydrogen-powered vehicles, positioning them as leaders in sustainable logistics and supply chain management.

This strong focus on sustainability resonates with an increasing number of environmentally conscious consumers, while also promising long-term operational cost savings and enhancing the group's overall brand reputation.

Advanced Supply Chain and Digital Innovation

Colruyt Group is making significant strides in digital transformation and automation, aiming to boost efficiency throughout its entire operation, from the back-end supply chain to the customer experience in its stores. This focus on innovation is a key strength, positioning the company to adapt to evolving retail landscapes.

The company's investment in advanced technology is already yielding tangible results. For instance, an automated storage system implemented in stores has demonstrably saved staff time and importantly, freed up valuable selling space, a critical factor in retail profitability. This efficiency gain directly impacts the bottom line by optimizing resource allocation.

Further evidence of their digital prowess is seen in their new Supply Chain Portal, which has successfully streamlined planning processes, achieving a remarkable 25% increase in efficiency. This operational improvement is crucial for managing inventory and ensuring product availability, directly impacting customer satisfaction and reducing waste.

Colruyt Group's commitment to technological advancement is further highlighted by the deployment of smart AI cameras at checkouts. These cameras are designed to accelerate the checkout process, with an impressive 17% speed increase observed. This not only enhances customer convenience but also improves throughput during peak shopping hours.

- Digital Transformation: Active investment in automation and digital solutions across supply chain and in-store operations.

- Supply Chain Efficiency: A new Supply Chain Portal has boosted planning efficiency by 25%.

- In-Store Automation: Automated storage systems are creating more selling space and saving staff time.

- Checkout Acceleration: Smart AI cameras at checkouts are increasing processing speed by 17%.

Vertical Integration and B2B Expansion

Colruyt Group's vertical integration, particularly in expanding production capacity and logistics within Belgium, provides a significant advantage in cost and quality control. This strategic move bolsters their operational efficiency.

The group is actively pursuing B2B expansion through specialized formats like Colruyt Professionals and its foodservice division, Solucious. This diversification strategy aims to tap into new revenue streams.

- Solucious experienced strong growth in the 2023/2024 financial year, contributing positively to the group's overall performance.

- Colruyt Professionals offers tailored solutions, leveraging the group's established retail infrastructure to serve business clients effectively.

- This dual approach to B2B growth allows Colruyt to capitalize on its core competencies while broadening its market reach beyond traditional retail.

Colruyt Group's extensive network of diverse retail formats, including Colruyt Lowest Prices, Okay, and Spar, allows it to effectively cater to a broad customer base and maintain a strong market presence. This multi-format strategy, coupled with a deeply ingrained 'Lowest Prices' philosophy for its flagship brand, has fostered significant customer loyalty over decades, as evidenced by its sustained market share in Belgium.

What is included in the product

Delivers a strategic overview of Colruyt Group’s internal and external business factors, highlighting its strong market position and operational efficiencies alongside potential challenges in a dynamic retail landscape.

Offers a clear, actionable framework to address Colruyt Group's competitive pressures and operational inefficiencies.

Weaknesses

Colruyt Group's market share in Belgium saw a slight dip to 29.0% in the fiscal year 2024/25, down from 29.3% in 2023/24. This contraction is primarily driven by heightened competition, with rivals like Delhaize leveraging extended Sunday opening hours.

The group's traditional model, which doesn't rely heavily on franchised outlets, places it at a disadvantage against competitors offering greater shopping flexibility, particularly on Sundays.

Colruyt Group faces profitability hurdles in its highly competitive Belgian retail market. For the fiscal year 2024/25, the group's operating profit, or EBIT, dipped by 5% to €446 million. This decline stems from increased operational expenses, such as higher staff benefits, and less food inflation than expected.

The pressure on profit margins is exacerbated by the stark competition, leading to a negative gap between how much prices are rising for consumers and how much Colruyt's own purchasing costs are increasing.

Colruyt's retail presence in France has been a significant drain, with operations consistently failing to turn a profit. In 2024, these French operations reported a substantial loss of €32 million, a sharp increase from the prior year, highlighting persistent challenges in the market.

The group is actively working to exit its 101 French stores, a move underscoring its difficulty in establishing a competitive foothold and its strategic shift to concentrate on its more successful Belgian core business.

Reliance on 'Lowest Price' Strategy

Colruyt Group's unwavering commitment to offering the lowest prices, while a significant strength, also poses a notable weakness. In the face of escalating operational costs and aggressive pricing from rivals such as Aldi and Lidl, maintaining this core promise becomes increasingly challenging. This can put considerable strain on profit margins and restrict the company's ability to adapt its pricing strategies flexibly.

This reliance on a low-price strategy can limit investment in other areas, potentially impacting long-term competitiveness. For instance, during periods of high inflation, as seen in 2023 where food inflation in Belgium averaged around 10%, Colruyt's ability to absorb rising supplier costs while keeping prices low is tested. This tightrope walk can affect their capacity to invest in store upgrades, employee benefits, or innovative product development.

- Profitability Pressure: The constant need to undercut competitors can compress margins, especially when input costs rise.

- Limited Pricing Flexibility: The 'lowest price' pledge reduces room for strategic price adjustments during economic volatility.

- Competitive Vulnerability: Discounters with similar or even lower cost structures can exploit this strategy during market downturns.

- Investment Constraints: Funds that might otherwise be allocated to innovation or expansion could be diverted to maintaining price competitiveness.

Impact of External Factors on Revenue

Colruyt Group's revenue trajectory in the 2024/2025 period faced headwinds from a slowdown in food inflation and unfavorable weather patterns. This demonstrates the company's susceptibility to broader economic fluctuations and environmental challenges.

These external forces directly influence consumer purchasing power and the productivity of agricultural sectors, consequently affecting sales volumes and the reliability of the supply chain.

- Decreased Food Inflation: A notable slowdown in food price increases during 2024/25 reduced the nominal value of sales, impacting revenue growth.

- Adverse Weather Conditions: Unfavorable weather negatively affected agricultural yields, potentially leading to supply shortages and increased procurement costs.

- Macroeconomic Vulnerability: The group's performance is sensitive to macroeconomic shifts that alter consumer spending on essential goods.

- Supply Chain Disruptions: Environmental factors can create volatility within the supply chain, posing risks to product availability and operational efficiency.

Colruyt's commitment to the lowest prices, while a strength, also creates a weakness by compressing profit margins, especially when input costs rise. This strategy limits pricing flexibility, making it difficult to adjust prices during economic volatility and potentially hindering investment in other crucial areas like innovation or store upgrades.

The group's French operations continue to be a significant drain, reporting a €32 million loss in 2024, underscoring persistent market challenges and a lack of competitive foothold. This ongoing financial burden necessitates a strategic exit from these 101 stores, highlighting difficulties in diversifying beyond its core Belgian market.

A slowdown in food inflation during the 2024/25 fiscal year, coupled with adverse weather conditions, negatively impacted revenue growth and supply chain reliability. This demonstrates Colruyt's vulnerability to broader economic fluctuations and environmental challenges that affect consumer spending and agricultural productivity.

Same Document Delivered

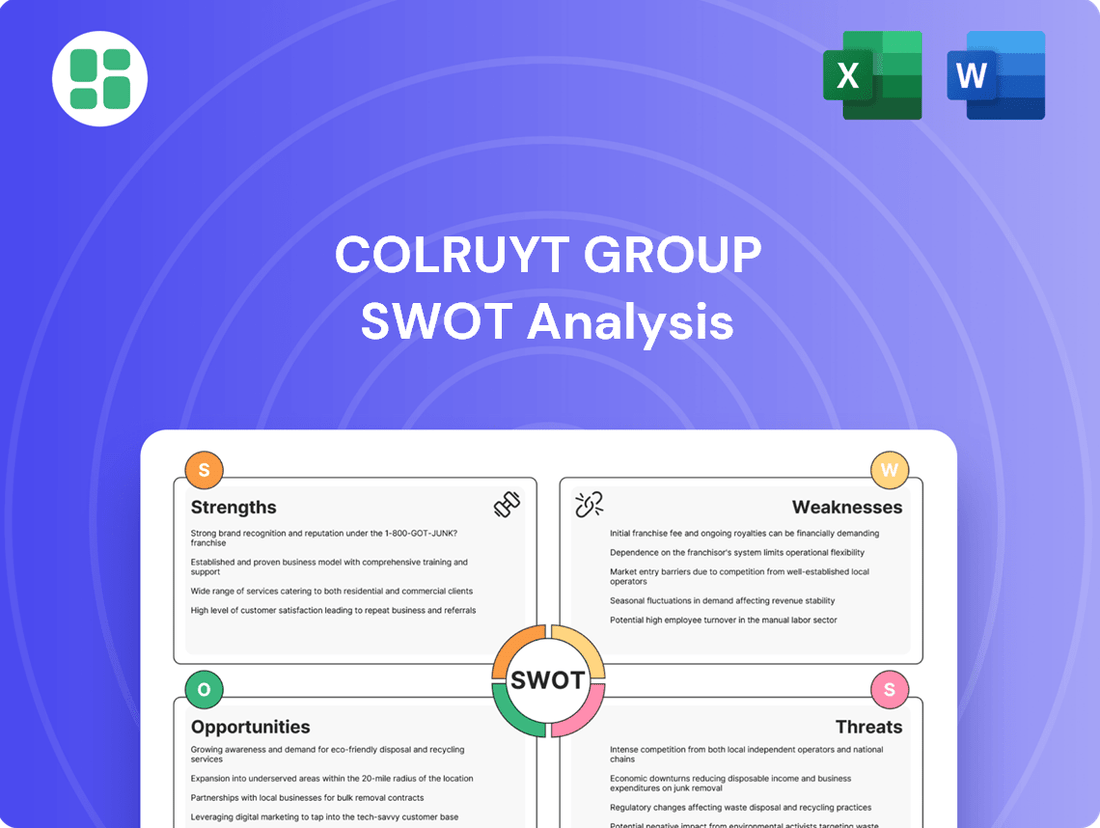

Colruyt Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing the Colruyt Group's Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete document, showcasing the professional quality and structure of the Colruyt Group's SWOT analysis. Once purchased, you’ll receive the full, editable version for your strategic planning needs.

Opportunities

Colruyt Group can seize the opportunity to further digitize its operations, building on its 2023 fiscal year investments. For example, their continued focus on automated warehouses for Collect&Go, which saw increased capacity in 2023, offers a path to greater logistical efficiency and faster order fulfillment.

Expanding smart AI checkout solutions across its physical stores presents another avenue for improvement. This initiative, already in pilot phases, can significantly reduce wait times for customers and lower labor costs, thereby enhancing the overall in-store experience and operational margins.

Colruyt Group sees significant opportunity in expanding its B2B operations, targeting independent supermarkets and the hospitality sector. This strategic move aims to tap into new revenue streams beyond its traditional retail focus.

The growth of Solucious, the foodservice division, is a key driver here. In fiscal year 2023-2024, Solucious reported a notable increase in sales, demonstrating strong demand in the professional catering market. This expansion into foodservice diversifies Colruyt's business model.

Furthermore, the development of B2B2E offerings, providing services to employers and their employees, presents another avenue for growth. By leveraging the established Colruyt Professionals chain, the group can offer tailored solutions, further solidifying its presence in the business-to-business arena.

Colruyt Group's deep-rooted commitment to sustainability, exemplified by its significant investments in renewable energy and its ambitious goal of zero-emission transport by 2030, presents a prime opportunity for market differentiation. This strong environmental stance can attract the growing segment of eco-conscious consumers, enhancing brand loyalty and potentially opening up new revenue avenues through green product lines and services.

Optimization of Private Label Portfolio

Colruyt Group's strategic consolidation of its private label portfolio, particularly by elevating Boni Selection as its flagship brand, presents a significant opportunity. This streamlining allows for enhanced economies of scale in sourcing and production, ultimately driving down costs and improving margins. By focusing resources on a core private label, Colruyt can build stronger brand equity and customer loyalty, enabling it to compete more effectively against both established national brands and aggressive discounters.

This optimization directly translates to more efficient product line management. For instance, by reducing the number of distinct private label SKUs, Colruyt can simplify inventory, improve shelf space utilization, and streamline marketing efforts. In 2023, private labels accounted for a substantial portion of sales for many European retailers, with some reporting over 30% of their turnover coming from own brands, highlighting the potential for increased profitability through a well-managed private label strategy.

The benefits of this approach include:

- Increased Brand Recognition: A unified private label like Boni Selection can achieve greater visibility and consumer trust.

- Cost Efficiencies: Larger production runs and consolidated sourcing lead to lower per-unit costs.

- Improved Competitive Stance: A strong private label offering strengthens Colruyt's value proposition against national brands and low-price competitors.

Strategic Acquisitions and Partnerships

Colruyt Group has a history of expanding through strategic moves, like fully integrating Comarkt/Comarché and acquiring Delitraiteur. This shows a clear strategy for growth. Looking ahead, further targeted acquisitions or collaborations, particularly in areas that complement their existing business or in new territories, offer significant potential for increasing market share and diversifying their operations.

These strategic ventures are crucial for navigating the evolving retail landscape. For instance, in fiscal year 2023-2024, Colruyt Group reported a revenue of €10.5 billion, highlighting their scale and the impact of past strategic decisions. Future acquisitions could unlock new customer segments or strengthen their position in high-growth markets.

- Acquisition of Delitraiteur: Strengthened Colruyt's presence in the premium convenience food sector.

- Integration of Comarkt/Comarché: Expanded their footprint and customer base in specific Belgian regions.

- Focus on complementary businesses: Opportunities exist in areas like e-commerce logistics or specialized food production.

- Geographic expansion: Exploring partnerships in neighboring European countries could be a key growth driver.

Colruyt Group can leverage its established expertise in digital transformation to enhance operational efficiency. The group's investment in automated warehouses for its Collect&Go service, which saw increased capacity in 2023, points to a strategic focus on improving logistics and speeding up order fulfillment.

Expanding AI-powered checkout solutions across its physical stores offers another significant opportunity. These systems, already undergoing pilot testing, have the potential to reduce customer wait times and lower labor expenses, ultimately boosting in-store experience and profit margins.

The company is well-positioned to grow its B2B operations, targeting independent grocers and the hospitality industry. This strategic expansion aims to diversify revenue streams beyond its core retail business, with Solucious, the foodservice division, showing strong sales growth in fiscal year 2023-2024, indicating robust demand in the professional catering market.

Colruyt Group's commitment to sustainability, including substantial investments in renewable energy and a 2030 zero-emission transport goal, provides a distinct market advantage. This environmental focus can attract eco-conscious consumers, strengthening brand loyalty and potentially opening new revenue streams through green product offerings.

Consolidating its private label portfolio, particularly by elevating Boni Selection as its flagship brand, offers opportunities for increased economies of scale in sourcing and production, leading to cost reductions and improved margins. In 2023, private labels represented over 30% of sales for many European retailers, underscoring the profitability potential of a well-managed private label strategy.

Furthermore, Colruyt Group's history of strategic acquisitions, such as Delitraiteur and Comarkt/Comarché, demonstrates a clear growth strategy. Future targeted acquisitions or collaborations, especially in complementary sectors or new geographic markets, could significantly increase market share and diversify operations, building on their fiscal year 2023-2024 revenue of €10.5 billion.

Threats

The Belgian retail landscape is intensely competitive, with established giants like Delhaize and aggressive discounters such as Aldi and Lidl consistently challenging Colruyt Group's market position. This intense rivalry forces constant strategic adjustments to maintain its core 'lowest price' promise.

Competitors, especially franchised outlets, are increasingly embracing Sunday openings, a move that directly impacts Colruyt's traditional operating model and market share. This shift necessitates a critical evaluation of how to counter the convenience factor offered by competitors, even as Colruyt aims to uphold its price leadership.

Colruyt Group faces a significant threat from rising operational costs, especially concerning staff benefits and general inflation. These increasing expenses put pressure on the company's ability to maintain its core 'lowest price' promise.

For instance, in the fiscal year ending March 2024, Colruyt Group reported an increase in its cost of sales, reflecting these inflationary pressures. The challenge lies in absorbing these higher costs without compromising its competitive pricing strategy, which could lead to compressed profit margins and impact overall financial performance.

Colruyt faces a significant threat from evolving consumer preferences, particularly the rapid shift towards online grocery shopping. This trend, amplified by the demand for convenience and the rise of hyperlocal retail models, necessitates constant adaptation. For instance, the e-commerce grocery market in Belgium saw substantial growth, with online sales accounting for a notable percentage of total grocery expenditure by late 2024, a figure expected to climb further in 2025.

While Colruyt is actively investing in digital capabilities and its own e-commerce platforms like Collect & Go, the accelerating pace of digital disruption poses an ongoing challenge. Maintaining a competitive edge against agile, digital-native brands and platforms requires sustained and substantial investment in seamless omnichannel experiences. This includes not only robust online ordering but also efficient click-and-collect and delivery services, ensuring a consistent customer journey across all touchpoints.

Supply Chain Disruptions and Price Volatility

Global supply chain disruptions and fluctuating raw material prices pose a significant threat to Colruyt Group. These issues can directly impact the cost of goods sold and make it challenging to maintain consistent pricing for consumers. For instance, the ongoing geopolitical tensions and weather-related events have continued to affect the availability and cost of key agricultural products throughout 2024 and into early 2025.

The gap between sales price inflation and purchase price inflation is critical for Colruyt's profitability. If purchase prices rise faster than selling prices, the gross profit margin will shrink, negatively affecting the company's overall financial performance. In 2024, many retailers, including those in the grocery sector, experienced this squeeze, with some reporting gross margins narrowing by up to 50 basis points due to these inflationary pressures.

- Impact on Margins: Volatile food inflation, where purchase prices outpace sales prices, directly erodes Colruyt's gross profit margin.

- Supply Chain Vulnerability: Reliance on global suppliers makes Colruyt susceptible to disruptions, impacting product availability and cost.

- Pricing Challenges: Maintaining stable pricing for customers becomes difficult when input costs are unpredictable, potentially affecting consumer loyalty.

Regulatory and Economic Factors

Changes in regulatory frameworks, such as those impacting labor laws, sustainability mandates, or tax policies, present a significant threat by potentially increasing compliance costs for Colruyt Group. For instance, evolving environmental regulations could necessitate investments in greener supply chains and operations.

Broader economic instability, including the prospect of recessions or significant shifts in consumer purchasing power, poses a risk to Colruyt Group's revenue and profitability. A downturn in consumer spending directly affects the volume of retail sales, a core component of the group's business.

- Increased Compliance Costs: New regulations on topics like plastic packaging or employee benefits could add to operational expenses.

- Reduced Consumer Spending: Economic slowdowns, potentially impacting disposable income, could lead to lower sales volumes for Colruyt.

- Tax Policy Changes: Alterations in corporate tax rates or specific retail taxes could directly affect net profits.

- Supply Chain Disruptions: Geopolitical events or new trade tariffs could increase the cost of sourcing goods.

Intense competition from established retailers and discounters, coupled with evolving consumer habits like increased online shopping, presents a significant challenge to Colruyt's market share and pricing strategy.

Rising operational costs, including staff benefits and general inflation, are squeezing profit margins, making it difficult to sustain the 'lowest price' promise. For example, in fiscal year 2023-2024, Colruyt experienced increased cost of sales due to these pressures.

Global supply chain volatility and fluctuating raw material prices directly impact the cost of goods, creating pricing instability and potentially affecting consumer loyalty. Geopolitical events in 2024 continued to disrupt the availability and cost of key agricultural products.

Changes in regulatory frameworks and broader economic instability, such as potential recessions, add further threats by increasing compliance costs and reducing consumer spending power, directly impacting sales volumes.

| Threat Category | Specific Example/Impact | Relevant Period Data |

|---|---|---|

| Intense Competition | Pressure on 'lowest price' promise from Delhaize, Aldi, Lidl | Ongoing |

| Evolving Consumer Habits | Shift to online grocery shopping, demand for convenience | Belgian online grocery market share grew significantly by late 2024 |

| Rising Operational Costs | Inflation impacting staff benefits and general expenses | Increased cost of sales reported in FY 2023-2024 |

| Supply Chain Disruptions | Volatility in raw material prices, geopolitical impacts | Key agricultural product costs affected by events in 2024 |

| Regulatory & Economic Factors | Increased compliance costs, reduced consumer spending | Potential for margin squeeze if purchase prices outpace sales prices |

SWOT Analysis Data Sources

This Colruyt Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary to provide a robust and actionable strategic overview.