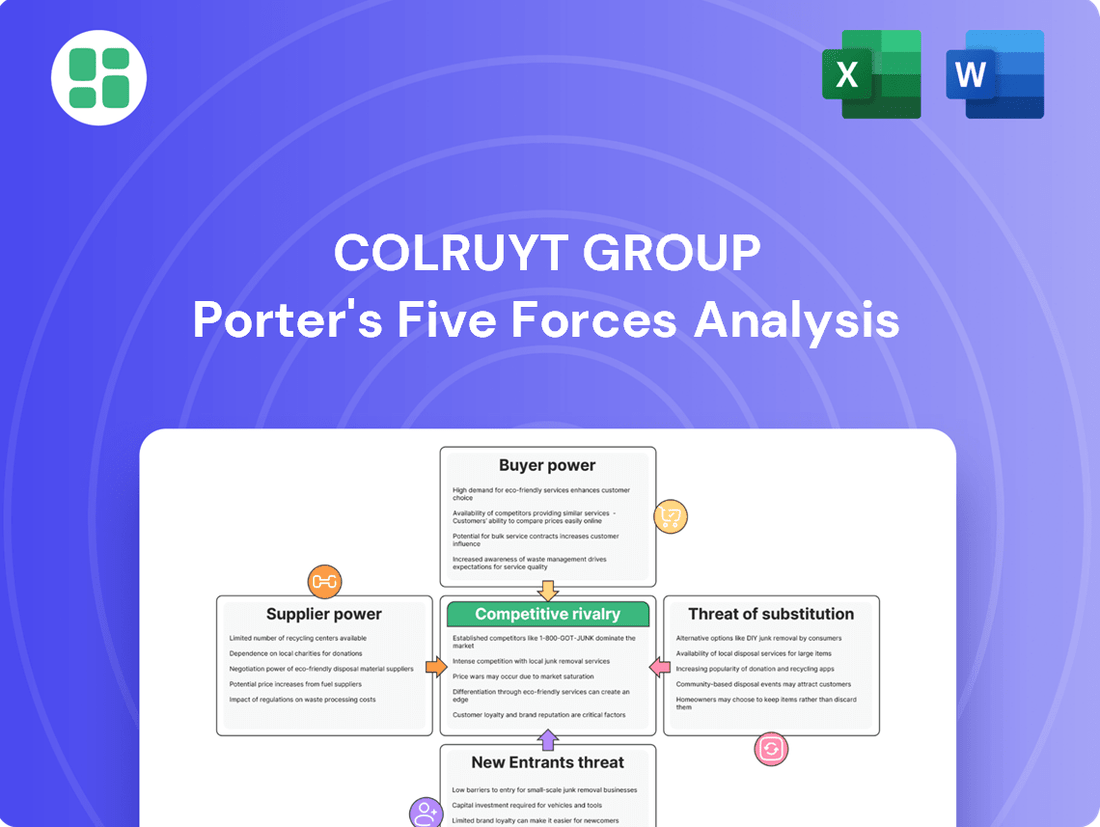

Colruyt Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

Colruyt Group operates in a highly competitive retail landscape, facing significant pressure from powerful buyers and a constant threat of new entrants. Understanding the intensity of these forces is crucial for navigating the market effectively.

The complete report reveals the real forces shaping Colruyt Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Colruyt Group's commitment to its private labels, like Boni Selection and Everyday, inherently creates a dependence on specific manufacturers. This reliance grants these suppliers a degree of bargaining power, particularly when their products are unique or difficult to source elsewhere.

The leverage these suppliers hold is directly tied to the switching costs for Colruyt and the availability of viable alternatives that can match their quality and production scale. In 2023, private labels represented a substantial portion of Colruyt's sales, underscoring the importance of these supplier relationships.

Colruyt Group actively diversifies its supplier base across fresh produce, groceries, and non-food items. This broad network limits the bargaining power of any single supplier, as Colruyt can shift purchasing volume to alternative sources. For instance, in 2024, the group sourced from thousands of suppliers, many of them smaller, local producers for its fresh categories, thereby fragmenting supply and reducing individual supplier leverage.

Colruyt Group actively manages supplier power through long-term contracts and strategic partnerships. By securing multi-year agreements with essential suppliers, Colruyt can lock in pricing, guaranteeing a stable cost base that supports its low-price strategy. For instance, in 2024, Colruyt continued to emphasize direct sourcing for key product categories, aiming to reduce reliance on intermediaries and gain better control over input costs.

These deep relationships foster collaboration, enabling joint efforts in product development and supply chain optimization. This mutual benefit reduces the suppliers' incentive to exploit short-term market fluctuations. Such strategic alliances are vital for maintaining Colruyt's competitive edge, ensuring both consistent product availability and adherence to quality standards throughout 2024.

Commodity price fluctuations impact

The volatility in global commodity prices, particularly for agricultural products and energy, directly impacts Colruyt Group's cost of goods sold. Suppliers of basic foodstuffs and high-volume non-food items can leverage these price swings to increase their leverage. For instance, in 2024, global wheat prices saw significant fluctuations due to geopolitical events and weather patterns, directly affecting the cost of bread and pasta for retailers like Colruyt.

- Increased input costs: Suppliers face higher expenses for raw materials and energy, which they may pass on to Colruyt.

- Supplier pricing power: For essential commodities, suppliers can demand higher prices, strengthening their bargaining position.

- Strategic sourcing: Colruyt must maintain agile sourcing and pricing strategies to mitigate the impact of these fluctuations.

Vertical integration potential

Colruyt Group's strategic moves into vertical integration significantly curb supplier bargaining power. By investing in its own production facilities, such as meat processing plants and coffee roasting operations, Colruyt reduces its reliance on external providers for these critical value chain components. This internal control over key inputs provides an alternative to traditional sourcing, thereby diminishing the leverage suppliers can exert.

This strategy is evident in Colruyt's extensive logistics and distribution network. Owning and operating these sophisticated systems allows the group to manage the flow of goods more efficiently and cost-effectively, further insulating it from the pricing pressures of third-party logistics providers. For instance, in 2023, Colruyt reported significant investments in its supply chain infrastructure, aiming to optimize efficiency and reduce external dependencies.

- Reduced Reliance: In-house production of goods like private label products or prepared meals lessens dependence on external manufacturers.

- Cost Control: Owning production facilities allows for greater control over manufacturing costs, mitigating supplier price hikes.

- Supply Chain Security: Vertical integration enhances the reliability and security of supply, especially during periods of market volatility.

- Quality Assurance: Direct oversight of production processes ensures consistent quality, a benefit not always guaranteed when outsourcing.

Colruyt Group's strategy to mitigate supplier power includes fostering strong relationships with a diverse, fragmented supplier base, particularly for fresh produce. By engaging with numerous smaller, local producers in 2024, Colruyt dilutes the leverage of any single entity.

The group's commitment to private labels, which accounted for a significant portion of sales in 2023, also means that manufacturers of these exclusive brands hold some influence. However, Colruyt's diversification efforts across thousands of suppliers in 2024 helps to balance this power dynamic.

Colruyt's vertical integration, such as its own meat processing, further reduces reliance on external suppliers, thereby limiting their bargaining power. This control over key inputs is crucial for maintaining cost competitiveness, especially amidst global commodity price fluctuations observed throughout 2024.

| Supplier Characteristic | Impact on Colruyt | Mitigation Strategy |

|---|---|---|

| Supplier Concentration (Few dominant suppliers) | High Bargaining Power | Diversification of supplier base |

| Uniqueness of Supplier's Product/Service | High Bargaining Power | Developing alternative sources, in-house production |

| Availability of Substitute Inputs | Low Bargaining Power | Strategic sourcing, long-term contracts |

| Switching Costs for Colruyt | High Bargaining Power | Supplier relationship management, standardization |

What is included in the product

Tailored exclusively for Colruyt Group, analyzing its position within its competitive landscape by evaluating supplier and buyer power, threats of new entrants and substitutes, and the intensity of rivalry.

Pinpoint competitive threats and opportunities with a dynamic, interactive model, allowing for rapid scenario planning to navigate the intense retail landscape.

Customers Bargaining Power

Customers in Belgium, France, and Luxembourg, especially for daily necessities, are very sensitive to prices. This means they readily switch to cheaper alternatives when available.

Colruyt Group's strategy of offering the lowest prices directly caters to this, but it also empowers customers. They can easily shift their spending based on price differences, giving them considerable leverage.

For instance, in 2023, the average Belgian household spent around €700 per month on groceries, with a significant portion allocated to essentials. This high volume of spending on everyday items amplifies the impact of price differences on consumer choices.

The retail sector where Colruyt Group operates is incredibly crowded. Think about it, customers have so many choices, from big supermarkets to smaller local shops and even online retailers. This sheer volume of options means customers can easily walk away if they aren't happy, giving them a lot of sway.

In 2023, for instance, grocery inflation in Belgium, a key market for Colruyt, remained a significant factor. While specific figures for customer switching due to alternatives vary, the persistent need for retailers to offer competitive pricing and unique value propositions underscores the impact of readily available substitutes.

This abundance of alternatives compels Colruyt Group to constantly think beyond just offering low prices. They need to find ways to stand out, whether through product quality, customer service, or innovative shopping experiences, to keep shoppers coming back.

Colruyt Group's loyalty programs, such as the Xtra program, and its extensive private label offerings, including Boni Selection and Everyday, are designed to foster customer loyalty and reduce price sensitivity. In 2023, Colruyt Group reported a 4.6% increase in sales for its private labels, indicating their growing importance in customer purchasing decisions. However, customers still hold significant bargaining power if these programs and brands fail to deliver perceived value or if competing retailers offer more attractive alternatives, especially given the competitive landscape where discounters often compete on price.

Influence of online retail and e-commerce

The accelerating shift towards online grocery shopping and delivery services significantly amplifies customer bargaining power in the Belgian market. E-commerce platforms facilitate effortless price comparisons and offer enhanced convenience, allowing consumers to readily switch to providers that better align with their needs, unhindered by the constraints of physical store locations.

This trend is evident in the growing adoption of online grocery services. For instance, in 2023, online grocery sales in Belgium saw a substantial increase, reflecting a sustained consumer preference for digital channels. Colruyt Group's Collect&Go service directly addresses this evolving customer behavior by providing a convenient click-and-collect option, thereby enhancing its competitive standing in the face of heightened customer power.

- Increased Online Penetration: Belgian online grocery sales experienced a notable growth in 2023, indicating a strong consumer shift towards digital purchasing.

- Price Transparency: E-commerce platforms empower customers with immediate price comparison tools, forcing retailers to remain competitive.

- Convenience as a Driver: The ease of ordering and home delivery, or convenient pick-up points, allows customers to prioritize service over traditional loyalty.

- Collect&Go's Role: Colruyt's investment in its Collect&Go service is a strategic response to leverage and manage this increased customer bargaining power.

Customer segment diversity (B2C vs. B2B)

Colruyt Group's customer base is notably diverse, encompassing both individual consumers (B2C) and professional clients (B2B). This segmentation significantly influences the bargaining power of its customers.

In the B2C segment, individual shoppers at formats like Colruyt, OKay, and Spar exert relatively low individual bargaining power. Their purchasing decisions are primarily driven by price, quality, and convenience, with limited ability to negotiate terms. However, collectively, consumer sentiment and purchasing trends can influence pricing and product offerings.

The B2B segment, particularly through its wholesale and foodservice division, Solucious, presents a different dynamic. These professional customers, such as hotels, restaurants, and other businesses, often purchase in much larger volumes. This scale grants them considerably more leverage to negotiate pricing, delivery terms, and even customized product assortments. For instance, Solucious reported revenues of €1.4 billion in its 2023-2024 fiscal year, highlighting the significant scale of its B2B operations and the inherent bargaining power of its larger clients.

- B2C Customers: Individual consumers have low direct bargaining power but collective influence through purchasing habits.

- B2B Customers (Solucious): Professional clients in wholesale and foodservice possess higher bargaining power due to larger order volumes and specialized needs.

- Revenue Impact: Solucious's €1.4 billion revenue in FY 2023-2024 underscores the importance and potential negotiation strength of its B2B clientele.

- Negotiation Factors: B2B customers can negotiate specific terms, bulk discounts, and customized product offerings, unlike individual shoppers.

Customers of Colruyt Group, particularly in its core Belgian market, wield significant bargaining power due to intense price sensitivity and a wide array of available retail alternatives. This is amplified by the growing trend of online grocery shopping, which facilitates easy price comparisons and prioritizes convenience, allowing consumers to switch providers with minimal friction.

| Customer Segment | Bargaining Power Level | Key Drivers | Example Data (2023/2024) |

|---|---|---|---|

| Individual Consumers (B2C) | Low (individually), High (collectively) | Price sensitivity, availability of substitutes, convenience | Grocery inflation in Belgium remained a factor; private label sales up 4.6% |

| Professional Clients (B2B - Solucious) | High | Large order volumes, negotiation on terms, customized offerings | Solucious revenue: €1.4 billion (FY 2023-2024) |

Same Document Delivered

Colruyt Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for the Colruyt Group, detailing the competitive landscape and strategic positioning within the retail sector. You're looking at the actual document; once your purchase is complete, you’ll receive instant access to this exact, professionally formatted file, ready for your immediate use and analysis.

Rivalry Among Competitors

The retail landscape across Belgium, France, and Luxembourg is decidedly mature and deeply saturated. This means there are many established businesses, both homegrown and from abroad, vying for customer attention. This intense competition is a constant factor, putting pressure on profits and forcing companies like Colruyt to consistently find new ways to stand out.

For instance, in 2023, the Belgian grocery market saw a slight dip in Colruyt's market share, reflecting the challenging competitive dynamics. This underscores the difficulty of gaining or even maintaining ground when so many strong players are present and actively competing for the same consumer base.

Colruyt Group navigates a fiercely competitive retail environment, facing pressure from numerous formats. This includes established hypermarkets like Carrefour, alongside aggressive discounters such as Aldi and Lidl, which often compete on price. The group also contends with specialized organic retailers and the burgeoning online grocery sector, demanding constant strategic adaptation across its diverse store brands like Colruyt Lowest Prices and Okay.

Colruyt operates in a retail landscape where competitors frequently resort to aggressive price wars and extensive promotional activities to capture market share. This intense rivalry, particularly in the price-sensitive grocery sector, forces companies to constantly adapt their pricing strategies. For instance, in 2023, the average promotional depth across European grocery retailers saw significant increases as they battled for consumer loyalty.

Colruyt's core strategy of offering the 'lowest prices' is a direct and ongoing response to this fierce price-based competition. This commitment, while a strong differentiator, places considerable pressure on profit margins across the entire industry, as other players are compelled to match or undercut pricing to remain competitive.

Differentiation strategies of competitors

Rival grocers are actively differentiating themselves, moving beyond simple price competition. For instance, some focus on enhanced convenience through extensive click-and-collect options and rapid delivery services, while others curate premium, artisanal product selections to attract a discerning clientele. A few are investing in unique in-store experiences, incorporating food courts or specialized departments to create destination shopping. In 2023, for example, supermarket chains across Europe saw significant growth in their online grocery sales, with some reporting double-digit percentage increases, highlighting the importance of digital differentiation.

Colruyt Group's core strategy remains anchored in cost leadership, epitomized by its unwavering lowest price promise and a robust private label portfolio. However, to maintain its competitive edge, the group must continually refine and adapt these differentiators. This means not only ensuring price competitiveness but also enhancing the perceived value of its own brands and exploring innovative ways to deliver on its cost-efficiency promise. For example, Colruyt's investment in optimizing its supply chain and store operations, which contributed to its stable performance in the fiscal year 2023-2024, is crucial in this ongoing differentiation battle.

The competitive landscape necessitates a multi-faceted approach to differentiation.

- Focus on Convenience: Competitors are expanding online offerings and faster delivery options.

- Premium Assortments: Some rivals are curating high-quality, specialty, or organic product ranges.

- Unique Shopping Experiences: In-store innovations and personalized services are being used to attract customers.

- Digital Integration: Advanced apps, loyalty programs, and personalized marketing are key differentiators.

Expansion and M&A activities by rivals

The competitive landscape for Colruyt Group is significantly shaped by the expansion and merger and acquisition (M&A) activities of its rivals. These strategic moves directly influence market share dynamics and overall industry consolidation.

For instance, in 2023, the Belgian retail sector saw continued consolidation. Competitors are actively pursuing growth through new store openings and modernizing existing ones. Colruyt Group itself has been a participant in M&A, notably acquiring Match and Smatch stores. This acquisition, which was finalized in early 2023, added a significant number of stores to its portfolio, demonstrating the industry's trend towards consolidation.

These rival actions necessitate constant strategic adaptation from Colruyt Group. The ability of competitors to expand their physical footprint or gain market access through M&A requires Colruyt to remain agile in its own growth and market positioning strategies.

- Rival Expansion: Competitors are actively opening new stores and renovating existing ones to enhance their market presence and customer appeal.

- M&A Impact: Mergers and acquisitions by rivals can lead to significant shifts in market power and industry structure.

- Colruyt's M&A: Colruyt Group's acquisition of Match and Smatch stores in early 2023 exemplifies the consolidation trend and its active role in it.

- Strategic Imperative: These competitive activities demand continuous vigilance and responsive strategies from Colruyt Group to maintain its market position.

Competitive rivalry within the retail sector where Colruyt Group operates is exceptionally intense, driven by a mature and saturated market. This environment forces constant strategic adaptation, with competitors frequently engaging in price wars and aggressive promotional activities to capture market share.

Colruyt's core strategy of offering the lowest prices is a direct response to this pressure, though it impacts industry-wide profit margins. Rivals are also differentiating through convenience, premium assortments, and unique in-store experiences, with online grocery sales seeing significant growth across Europe in 2023.

Furthermore, competitor expansion and mergers and acquisitions (M&A) activity, such as Colruyt's own acquisition of Match and Smatch stores in early 2023, are reshaping the market landscape and demanding continuous strategic agility from Colruyt Group to maintain its position.

SSubstitutes Threaten

Consumers increasingly have alternatives to traditional supermarkets for food. These include farmers' markets, direct purchases from local growers, niche food stores, and community-supported agriculture (CSA) schemes. For instance, the UK saw a 12% increase in direct-to-consumer food sales in 2023, highlighting this trend.

The rise of these alternative channels, often fueled by consumer demand for locally sourced or fresher products, presents a significant substitution threat to established retailers like Colruyt Group. In 2024, reports indicate that direct-to-consumer sales in the European food sector are projected to grow by an average of 8% annually, further intensifying this competitive pressure.

A significant substitute threat for Colruyt Group arises from the increasing consumer preference for foodservice and out-of-home consumption. This trend directly impacts the demand for groceries and household staples typically purchased in supermarkets. For instance, in 2024, the global foodservice market was projected to reach over $3.5 trillion, indicating a substantial portion of consumer spending shifting away from traditional retail channels.

This shift means consumers are choosing prepared meals, restaurant dining, and takeaway options over purchasing raw ingredients and cooking at home. Consequently, this diverts spending that would otherwise go towards Colruyt's core offerings. The rise of meal kit services and ready-to-eat options further amplifies this substitute threat by offering convenience that challenges traditional grocery shopping.

Colruyt Group does partially counter this threat through its own foodservice divisions, such as Solucious. This B2B service provides solutions to professional kitchens and healthcare institutions, effectively capturing some of this out-of-home consumption spend within its own operational umbrella. However, the broader consumer shift remains a potent substitute pressure.

For Colruyt Group's non-food items, the threat of substitutes is significant, particularly from online-only retailers. In 2024, the e-commerce market continued its robust growth, with online sales of non-food goods representing a substantial portion of total retail expenditure. Platforms like Amazon and specialized online stores offer consumers a vast array of choices, often with competitive pricing and home delivery, directly challenging Colruyt's traditional retail model.

Furthermore, the rise of direct-to-consumer (DTC) brands in various non-food sectors provides another layer of substitution. These brands bypass traditional retail channels, allowing them to connect directly with customers and offer unique or specialized products. The growing popularity of second-hand marketplaces also presents a viable alternative, appealing to budget-conscious consumers and those seeking sustainable options, thereby intensifying competitive pressures on Colruyt's non-food segment.

Changing consumer habits and lifestyle choices

Changing consumer habits and lifestyle choices present a significant threat of substitution for traditional supermarket models like Colruyt Group. There's a noticeable shift towards convenience, with consumers increasingly seeking ready-to-eat meals or meal kits, bypassing the need for extensive grocery shopping. For instance, the global meal kit delivery service market was valued at approximately USD 15.2 billion in 2023 and is projected to grow substantially. This trend directly impacts traditional grocers as consumers might opt for specialized services over a full supermarket shop.

Furthermore, a growing emphasis on health and sustainability is driving consumers towards niche retailers. Many shoppers are now prioritizing organic produce, locally sourced goods, or plant-based alternatives, often found in specialized health food stores or farmers' markets. In 2024, the demand for organic food continued its upward trajectory, with many markets reporting double-digit growth in this segment, indicating a clear preference shift away from conventional supermarket offerings for a segment of the population.

The rise of online grocery shopping and direct-to-consumer (DTC) models also acts as a substitute. Consumers can now easily order groceries online from various platforms, including those offering specialized products or faster delivery times. By 2024, e-commerce penetration in the grocery sector had solidified, with many major retailers reporting significant portions of their sales coming from online channels, demonstrating a clear behavioral change that offers an alternative to physical store visits.

- Growing demand for convenience: Consumers are increasingly willing to pay for time-saving solutions like meal kits and ready-to-eat meals.

- Health and sustainability trends: A rising preference for organic, local, and plant-based foods leads consumers to specialized retailers.

- E-commerce and DTC growth: Online grocery platforms and direct-to-consumer brands offer convenient alternatives to traditional supermarkets.

- Niche market appeal: Specialized stores catering to specific dietary needs or ethical concerns attract a dedicated customer base.

Home delivery and meal kit services

The increasing popularity of dedicated meal kit delivery services, such as HelloFresh and Foodbag, presents a significant threat of substitution for Colruyt Group. These services, which Colruyt itself has invested in, offer consumers a convenient alternative to traditional grocery shopping by providing pre-portioned ingredients and recipes. This directly challenges Colruyt's core business model by catering to a growing demand for convenience and curated meal solutions.

Furthermore, the proliferation of third-party grocery delivery platforms, extending beyond retailers' own services, amplifies this substitution threat. These platforms provide another layer of convenience, allowing consumers to bypass physical stores altogether. For instance, in 2024, the online grocery market continued its robust growth, with many consumers prioritizing delivery speed and ease of ordering, directly impacting foot traffic and sales for brick-and-mortar retailers like Colruyt.

- Meal kit services offer convenience and reduce food waste for consumers.

- Third-party delivery platforms provide an alternative to in-store grocery shopping.

- Colruyt Group's investment in Foodbag highlights its awareness of this competitive landscape.

- The continued expansion of online grocery options in 2024 poses an ongoing challenge to traditional retail models.

The threat of substitutes for Colruyt Group is multifaceted, stemming from evolving consumer preferences and the rise of alternative retail channels. For food items, direct-to-consumer sales and farmers' markets are growing, with European direct-to-consumer food sales projected to increase by 8% annually in 2024. This trend diverts spending from traditional supermarkets.

The shift towards out-of-home consumption, including foodservice and meal kits, represents another significant substitute. The global foodservice market was projected to exceed $3.5 trillion in 2024, indicating a substantial portion of consumer budgets allocated away from grocery purchases. Meal kit services, valued at approximately USD 15.2 billion globally in 2023, further exemplify this convenience-driven substitution.

In the non-food sector, online-only retailers and direct-to-consumer brands pose a substantial threat. The robust growth of e-commerce in 2024 means consumers have readily available alternatives offering competitive pricing and home delivery, directly challenging Colruyt's physical store model.

| Substitute Channel | Impact on Colruyt Group | 2024 Data/Trend |

|---|---|---|

| Direct-to-Consumer (Food) | Reduced grocery sales volume | 8% annual growth projected in Europe |

| Foodservice/Out-of-Home Consumption | Lower demand for raw ingredients | Global market > $3.5 trillion |

| Meal Kit Services | Competition for meal preparation | USD 15.2 billion global market (2023) |

| Online Retailers (Non-Food) | Loss of market share in general merchandise | Continued robust e-commerce growth |

Entrants Threaten

The retail sector, particularly for businesses like Colruyt Group that rely on physical stores, presents a formidable challenge for newcomers due to immense capital requirements. Establishing a retail presence necessitates significant investment in prime real estate, sophisticated store designs, and robust logistics infrastructure. For instance, building a new supermarket can easily cost tens of millions of euros.

Established retailers like Colruyt Group leverage significant economies of scale in purchasing, marketing, and distribution. For instance, in 2023, Colruyt Group's total revenue reached €10.5 billion, allowing for bulk purchasing power that new entrants simply cannot match. This scale translates directly into lower per-unit costs.

Newcomers face substantial hurdles in achieving comparable cost efficiencies. The sheer volume of operations for firms like Colruyt enables them to negotiate better terms with suppliers and spread fixed costs over a larger base. This makes it incredibly challenging for new entrants to compete on price, a crucial factor in the typically low-margin grocery sector.

Colruyt Group benefits from decades of established brand recognition and a deeply ingrained 'lowest prices' promise in its primary markets. This strong brand loyalty makes it difficult for new competitors to gain traction.

New entrants must overcome established customer habits and existing relationships, a task demanding significant marketing expenditure and a truly compelling offer to even consider switching from Colruyt.

For instance, in 2023, Colruyt's market share in Belgium remained robust, demonstrating the stickiness of their customer base and the high barrier to entry for newcomers aiming to disrupt these established patterns.

Regulatory hurdles and zoning restrictions

The retail industry, especially for grocery chains like Colruyt Group, faces significant barriers to entry due to stringent regulatory frameworks. These include adherence to food safety regulations, labor laws, and, crucially, complex zoning and planning permissions for establishing new physical stores. For instance, in Belgium, obtaining the necessary permits for a new supermarket can involve lengthy approval processes, often requiring detailed environmental impact assessments and public consultations, which can take years.

These regulatory hurdles and zoning restrictions act as a substantial deterrent for potential new entrants. The sheer time and financial investment required to navigate these processes, coupled with the uncertainty of obtaining approvals, makes it a high-risk endeavor. In 2024, the cost of compliance and obtaining permits for a single large retail outlet could easily run into hundreds of thousands of euros, a significant upfront cost that less capitalized competitors would struggle to absorb.

- Regulatory Complexity: Retailers must comply with a wide array of national and local regulations, impacting everything from product sourcing to store operations.

- Zoning and Planning: Securing prime locations for new stores is often hampered by restrictive zoning laws and lengthy planning permission processes, particularly in densely populated European markets.

- High Upfront Costs: The combined expenses of regulatory compliance, legal fees, and permit acquisition represent a significant capital outlay for new entrants.

- Time Delays: Navigating the bureaucratic landscape can lead to substantial delays in store openings, impacting a new entrant's ability to gain market share quickly.

Disruptive online models and niche players

While established retailers like Colruyt Group face significant capital investment hurdles for physical stores, the digital landscape presents a different challenge. Disruptive online-only models and specialized niche players can emerge with lower initial overheads, directly targeting consumers through e-commerce platforms.

These digital-first entrants often bypass the costs associated with large physical footprints, allowing them to compete on price or convenience. For instance, the growth of online grocery delivery services in Europe, with many new players entering the market in 2024, demonstrates this trend. Some of these platforms focus on specific product categories or offer subscription models, carving out profitable niches.

- Online Grocery Growth: The European online grocery market was projected to reach over €150 billion in 2024, indicating significant opportunity for new digital entrants.

- Niche Specialization: Companies focusing on organic, local, or ready-to-eat meal kits have seen substantial growth, attracting customers seeking curated selections.

- Direct-to-Consumer (DTC): Brands increasingly leverage DTC models, bypassing traditional retail channels and building direct relationships with customers, reducing reliance on established infrastructure.

The threat of new entrants for Colruyt Group remains moderate, primarily due to the substantial capital investment required for physical retail operations and established brand loyalty. However, the digital realm offers lower barriers, allowing agile online-only players to emerge and challenge incumbents with specialized offerings and competitive pricing.

While the cost of establishing a physical supermarket can easily exceed tens of millions of euros, digital entrants can launch with significantly lower overheads. For example, a new online grocery platform in 2024 might require a few hundred thousand euros to set up, a fraction of the cost for a brick-and-mortar store. This disparity allows digital newcomers to focus resources on customer acquisition and technology rather than physical infrastructure.

The European online grocery market's projected growth to over €150 billion in 2024 highlights the attractiveness for new entrants. These digital-first businesses can leverage niche specialization, such as organic or meal-kit delivery, to capture specific customer segments. In 2023, Colruyt Group's robust market share in Belgium underscores the loyalty of its existing customer base, making it challenging for new entrants to gain significant traction purely on price or convenience without substantial marketing investment.

| Factor | Impact on Colruyt Group | New Entrant Challenge |

|---|---|---|

| Capital Requirements (Physical) | High, but manageable for Colruyt | Extremely High (tens of millions of euros per store) |

| Brand Loyalty | Strong, established 'lowest prices' promise | Difficult to overcome; requires significant marketing |

| Economies of Scale | Significant advantage (e.g., €10.5 billion revenue in 2023) | Limited initially, impacting cost competitiveness |

| Digital Entry Barriers | Lower, enabling agile online competitors | Moderate (hundreds of thousands for online platforms) |

| Online Market Growth | Opportunity for digital expansion, but also competition | Significant opportunity (projected €150+ billion in Europe for 2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Colruyt Group is built upon a foundation of comprehensive data, including their annual reports, investor presentations, and official press releases. We also leverage industry-specific market research reports and competitor financial disclosures to gain a holistic view of the retail landscape.