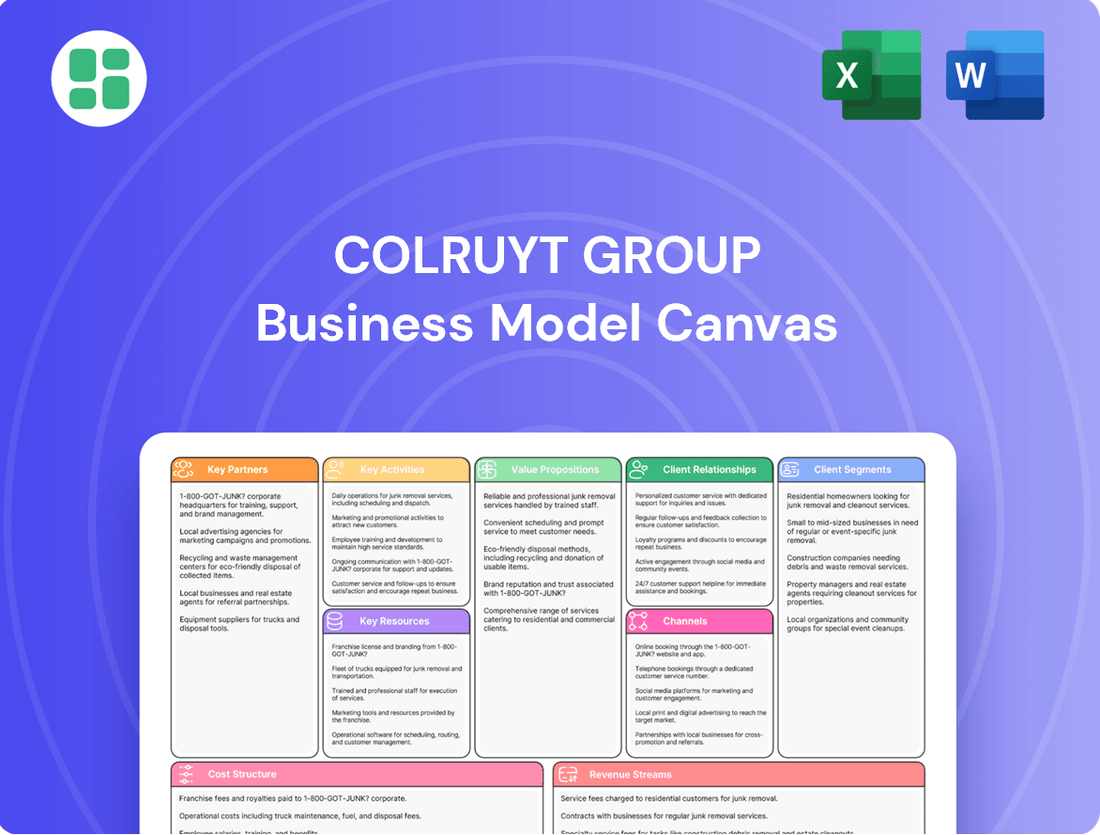

Colruyt Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

Unlock the strategic blueprint of Colruyt Group with our comprehensive Business Model Canvas. This detailed analysis reveals how they effectively serve diverse customer segments through unique value propositions and robust key partnerships. Discover their efficient cost structure and revenue streams that drive their market leadership.

Ready to dissect Colruyt Group's success? Our full Business Model Canvas provides an in-depth look at their customer relationships, channels, and key resources. Download the complete, professionally crafted document to gain actionable insights for your own business strategy.

Partnerships

Colruyt Group cultivates deep, enduring ties with its suppliers, emphasizing collaboration for increasingly sustainable operations. A prime illustration is their renewed three-year pact with Inex, specifically for Boni’s dairy range, which targets improving Belgian milk sustainability and cutting greenhouse gas emissions.

Colruyt Group actively participates in international buying alliances, like Vasco International Trading, to bolster its competitive edge in the demanding retail sector. This strategy is designed to enhance the procurement of globally recognized brands, thereby securing more favorable pricing and building a more robust supply chain.

These collaborations are instrumental in navigating the complexities of the modern retail environment and are key to sustaining Colruyt Group's market standing. For instance, in 2023, the grocery retail sector in Europe saw significant price pressures, making such alliances vital for cost management.

Colruyt Group actively partners with technology providers to enhance operational efficiency and foster innovation. A key collaboration is with GS1, utilizing their Global Data Synchronization Network (GDSN) to standardize product data exchange with suppliers, aiming for seamless data flow.

Further demonstrating their commitment to innovation, Colruyt Group has integrated Xsens technology. This high-tech solution is deployed in retail settings to develop advanced ergonomic tools, directly contributing to improved employee well-being and workplace safety.

Acquisition and Investment Partnerships

Colruyt Group actively pursues acquisition and investment partnerships to bolster its market position and diversify its retail portfolio. A significant move in 2023 was the full consolidation of Match and Smatch stores, alongside the acquisitions of Degrenne Distribution and Délidis, signaling an aggressive expansion strategy.

Further demonstrating this commitment, Colruyt Group increased its ownership in Smartmat NV to 100% and entered into an agreement to acquire Delitraiteur SA. These moves highlight a clear focus on vertical integration and consolidating its presence across various segments of the food retail landscape.

- Acquisition of Match and Smatch stores: Completed in 2023, expanding market reach.

- Increased stake in Smartmat NV: Reached 100% ownership, strengthening online grocery capabilities.

- Agreement to acquire Delitraiteur SA: Focus on vertical integration within the food sector.

Sustainability and Community Partnerships

Colruyt Group actively engages with organizations like CIFAL Flanders and The Shift to foster knowledge sharing and drive its sustainability agenda. These collaborations are crucial for staying ahead of evolving environmental and social standards.

A significant step in ensuring ethical sourcing is their pilot project with &Wider. This initiative directly surveys workers in high-risk supply chains, providing invaluable, on-the-ground data about working conditions. In 2024, such direct feedback mechanisms are becoming increasingly vital for transparency and accountability.

- CIFAL Flanders & The Shift: Facilitating knowledge exchange on sustainability best practices.

- &Wider Pilot Project: Direct worker surveys in high-risk supply chains for improved oversight.

- Local Community Support: Investments in education, health, and local sustainability projects, reflecting a commitment to societal well-being.

Colruyt Group's key partnerships are vital for its operational success and strategic growth. These alliances span suppliers, technology providers, and other businesses, all contributing to efficiency, innovation, and market expansion.

| Partner Type | Example Partnership | Strategic Importance |

|---|---|---|

| Suppliers | Inex (dairy range) | Enhancing sustainability and reducing emissions in the supply chain. |

| Buying Alliances | Vasco International Trading | Improving procurement efficiency and securing favorable pricing. |

| Technology Providers | GS1 (GDSN) | Standardizing product data for seamless exchange with suppliers. |

| Acquisitions/Investments | Match and Smatch stores (2023 acquisition) | Expanding market reach and consolidating retail presence. |

| Sustainability Organizations | &Wider (worker surveys) | Ensuring ethical sourcing and improving working conditions in supply chains. |

What is included in the product

A comprehensive, pre-written business model tailored to Colruyt Group's strategy, detailing customer segments, channels, and value propositions with a focus on everyday low prices and operational efficiency.

Reflects the real-world operations and plans of Colruyt Group, organized into 9 classic BMC blocks with full narrative and insights on their discount retail and food service businesses.

The Colruyt Group Business Model Canvas offers a clear, one-page snapshot of their strategy, simplifying complex operations for easier understanding and adaptation.

It effectively highlights how Colruyt alleviates customer pain points by detailing their value propositions and key activities in a digestible format.

Activities

Colruyt Group's core activity revolves around managing a wide array of retail formats, from its well-known Colruyt Lowest Prices supermarkets and the more compact Okay stores to specialized outlets like Bio-Planet for organic products. Beyond groceries, the group also operates non-food retailers such as Dreamland for toys and sports equipment, Dreambaby for baby essentials, Bike Republic for cycling enthusiasts, and Zeb for fashion.

This operational scope involves overseeing an extensive network of both company-owned and independently affiliated stores. As of the fiscal year 2023-2024, Colruyt Group operated 238 Colruyt Lowest Prices stores, 153 Okay stores, and 30 Bio-Planet stores, alongside their non-food formats, demonstrating a significant physical presence across Belgium, France, and Luxembourg.

A key aspect of their strategy is the continuous investment in their store network. In the fiscal year 2023-2024, Colruyt Group undertook renovations for 22 stores and opened 11 new ones, reflecting a commitment to modernizing their retail spaces and expanding their market accessibility to better serve customer needs.

Colruyt Group's efficient distribution and logistics are central to its business. They focus on optimizing supply chains across Belgium and France, ensuring products reach stores smoothly. This efficiency is crucial for managing their vast product range and serving a large customer base.

The Group actively expands its logistics capacity, a key activity to support its growing retail footprint. This includes investments in infrastructure and technology to enhance the flow of goods. For instance, in 2023, Colruyt Group reported a significant increase in their logistics investments to bolster operational efficiency.

Implementing advanced inventory management and product flow systems is another core activity. This technology helps minimize waste and ensures product availability. Furthermore, Colruyt Group is committed to sustainability, investing in emission-free transport, such as electric cargo bikes and hydrogen vans, to reduce their environmental impact.

Colruyt Group's commitment to private label development is a cornerstone of its strategy, focusing on delivering quality and value to customers. This involves rigorous development processes to ensure products meet high standards for taste, health, and sustainability.

The Group's involvement in food production grants them significant control over the entire value chain, from sourcing ingredients to the final product. This vertical integration allows for enhanced quality assurance and cost management, directly benefiting consumers through competitive pricing.

In 2023, Colruyt Group's private labels accounted for a substantial portion of their sales, demonstrating strong customer trust and brand loyalty. For instance, their Boni brand continues to be a popular choice, reflecting the success of their private label initiatives.

Furthermore, Colruyt Group actively pursues innovation in packaging and waste reduction. In 2024, they announced targets to further decrease food loss across their operations, implementing advanced inventory management and efficient distribution systems.

Digital Transformation and Innovation

Colruyt Group actively invests in digital transformation, focusing on enhancing customer experience and operational efficiency. This includes significant upgrades to their e-commerce platform, Collect&Go, aiming to streamline online grocery shopping and delivery services. For instance, in the fiscal year 2023-2024, Colruyt Group continued to expand its digital offerings, with e-commerce sales showing consistent growth, contributing to their overall revenue streams.

Innovation is a cornerstone, with the group implementing advanced technologies in their physical stores. The deployment of smart AI cameras for an 'easy check-out' system is a prime example, designed to reduce waiting times and improve the in-store journey. This commitment to technological advancement is crucial for maintaining a competitive edge in the evolving retail landscape.

- Digital Investment: Colruyt Group allocates substantial resources to digital transformation initiatives, including e-commerce and in-store technology.

- E-commerce Enhancement: Continued development of platforms like Collect&Go to meet growing online demand.

- In-Store Innovation: Implementation of AI-powered solutions, such as smart cameras for faster checkout processes.

- Data-Driven Strategies: Leveraging programs like Customer1.0 for personalized customer engagement and operational improvements, as evidenced by their focus on data analytics for targeted marketing and loyalty programs.

Sustainable and Responsible Business Practices

Colruyt Group actively pursues sustainable entrepreneurship by embedding environmental, social, and governance (ESG) principles across its business. This commitment translates into concrete actions aimed at minimizing environmental impact and fostering social responsibility.

Key activities revolve around reducing the company's carbon footprint and championing circular economy models. For instance, Colruyt Group is investing in renewable energy sources and optimizing logistics to cut emissions. By 2024, the group aims to have 100% of its electricity consumption covered by renewable energy sources, a significant step towards its climate goals.

- Reducing Carbon Footprint: Colruyt Group is actively working to lower its greenhouse gas emissions. In 2023, they reported a 15% reduction in Scope 1 and 2 emissions compared to their 2017 baseline, with a target of 55% reduction by 2030.

- Circular Economy Initiatives: The group is expanding its efforts in waste reduction and resource efficiency. This includes initiatives like increasing the use of recycled materials in packaging and exploring food waste reduction programs across their stores.

- Responsible Sourcing: Colruyt Group ensures that its products are sourced ethically and sustainably. This involves working with suppliers to uphold fair labor practices and environmental standards, particularly for key commodities like palm oil and cocoa.

- Promoting Conscious Consumption: Through tools like the Eco-score, Colruyt Group empowers customers to make more environmentally friendly choices. The Eco-score provides a clear indication of a product's environmental impact, with over 70% of their private label products now displaying this score.

Colruyt Group's key activities center on managing a diverse retail portfolio, encompassing supermarkets, convenience stores, and specialized formats like organic and baby product stores, alongside non-food offerings in toys, sports, fashion, and cycling.

A significant focus is on the continuous optimization and expansion of their store network and logistics infrastructure, ensuring efficient product distribution across Belgium, France, and Luxembourg.

The group actively develops and promotes its private label brands, emphasizing quality, value, and sustainability, which have become a substantial contributor to their sales.

Colruyt Group also drives digital transformation, enhancing its e-commerce platform and implementing innovative in-store technologies like AI-powered checkout systems to improve customer experience.

Furthermore, a core activity is the commitment to sustainable entrepreneurship, actively reducing their environmental impact through renewable energy adoption and circular economy initiatives.

Delivered as Displayed

Business Model Canvas

This preview offers a genuine glimpse into the Colruyt Group Business Model Canvas. The document you see here is not a sample or a mockup, but an exact representation of the comprehensive analysis you will receive upon purchase. You'll gain full access to this same, meticulously crafted document, ready for your immediate use and strategic planning.

Resources

Colruyt Group leverages an extensive retail network comprising 782 owned stores and an additional 1,006 independent or affiliated stores and franchisees as of March 31, 2025. This substantial physical presence, coupled with its associated real estate holdings, is a cornerstone of its market penetration and customer accessibility strategy.

Colruyt Group's 33,852 employees as of March 31, 2025, represent a critical asset, bringing diverse expertise across retail operations, intricate logistics, food production, and advanced IT solutions, alongside a strong commitment to sustainability.

The group actively invests in its people, prioritizing employee well-being and professional development. Initiatives focused on enhancing craftsmanship and operational efficiency, such as ergonomic improvements in the workplace, directly translate into superior service quality for customers.

Colruyt Group's business model thrives on a robust brand portfolio, including household names like Colruyt Lowest Prices and Okay, alongside specialized offerings such as Bio-Planet. This diverse brand presence is a cornerstone of their customer relationship strategy.

Furthermore, their extensive range of private labels, exemplified by Boni Selection, plays a crucial role. These labels are not just products; they are significant intangible assets that build customer trust and loyalty through consistent quality and perceived value, often highlighting sustainable sourcing.

In 2024, private labels continued to be a major driver of sales for European retailers, with many reporting that these own-brand products accounted for over 30% of their total turnover. Colruyt Group's strategic focus on these brands and private labels directly taps into this consumer trend, reinforcing their market position.

Advanced Technology and Data Infrastructure

Colruyt Group leverages advanced technology and a robust data infrastructure to optimize its operations. This includes sophisticated IT systems and significant automation within its logistics network, contributing to efficiency and cost management. For instance, their investment in automated distribution centers, like the one in Wilsele, aims to streamline inventory and delivery processes.

The Group places a strong emphasis on data analytics, exemplified by initiatives such as Customer1.0. This program underscores the critical role of data in understanding customer preferences and enabling highly personalized marketing and communication strategies. By analyzing vast amounts of customer data, Colruyt can tailor offers and improve the shopping experience.

Colruyt Group's commitment to digital transformation is evident in its ongoing investments in cutting-edge technologies, including artificial intelligence. These investments are designed to further enhance operational efficiency, personalize customer interactions, and drive innovation across the business. For example, AI is being explored for inventory management and predictive analytics to reduce waste and improve stock availability.

- IT Systems and Automation: Colruyt Group's operational backbone relies on advanced IT systems and automation, particularly in logistics, to ensure smooth and efficient supply chain management.

- Data Infrastructure for Customer Insights: Programs like Customer1.0 highlight the strategic importance of a strong data infrastructure for analyzing customer behavior and facilitating personalized communication.

- Digital Transformation and AI Investments: The Group actively invests in digital transformation and artificial intelligence to enhance customer experience, optimize operations, and foster innovation.

Financial Capital and Investments

Colruyt Group's substantial financial capital is a cornerstone of its business model, fueling significant investments across various operational areas. This financial strength allows for the continuous expansion and modernization of its store network, enhancing production capabilities, and driving crucial digital transformation initiatives.

In the financial year 2024/25, the group demonstrated this commitment by allocating EUR 479 million to investments. This considerable sum underscores their strategic focus on long-term growth and operational excellence.

- Investment in Growth: EUR 479 million invested in FY 2024/25 for new stores, renovations, and production capacity.

- Digital Transformation: Financial capital supports the ongoing integration of digital technologies across the business.

- Strategic Acquisitions: Financial reserves enable the pursuit of strategic acquisition opportunities to expand market reach and offerings.

- Sustainability Projects: Funding is allocated to ambitious sustainability initiatives, aligning with long-term environmental and social goals.

Colruyt Group's key resources are deeply rooted in its expansive physical footprint and its dedicated workforce. The group commands a vast retail presence with 782 owned stores and an additional 1,006 affiliated or franchised locations as of March 31, 2025, supported by significant real estate assets. This extensive network is complemented by a workforce of 33,852 employees as of the same date, whose expertise spans retail, logistics, food production, and IT, all underpinned by a commitment to sustainability and continuous professional development.

The group's brand portfolio, featuring well-recognized names like Colruyt Lowest Prices and Okay, alongside specialized brands such as Bio-Planet, forms a crucial intangible asset. This is further strengthened by a robust offering of private labels, notably Boni Selection, which cultivate customer loyalty through consistent quality and perceived value, often emphasizing sustainable sourcing. In 2024, private labels represented over 30% of turnover for many European retailers, a trend Colruyt strategically capitalizes on.

Advanced technology and a strong data infrastructure are pivotal, with sophisticated IT systems and significant logistics automation enhancing efficiency and cost management. Initiatives like Customer1.0 leverage data analytics for personalized marketing, while ongoing investments in digital transformation and AI, including for inventory management, aim to boost customer experience and operational innovation. Furthermore, substantial financial capital, demonstrated by EUR 479 million in investments during FY 2024/25, fuels network expansion, production enhancements, and digital integration.

| Key Resource | Description | Data Point (as of March 31, 2025, unless otherwise stated) |

| Retail Network | Owned and affiliated/franchised stores | 782 owned stores, 1,006 affiliated/franchised stores |

| Human Capital | Employees across diverse functions | 33,852 employees |

| Brand Portfolio | Owned brands and private labels | Colruyt Lowest Prices, Okay, Bio-Planet, Boni Selection |

| Technology & Data | IT systems, automation, data analytics | Customer1.0 program, AI investments |

| Financial Capital | Investment capacity for growth | EUR 479 million invested in FY 2024/25 |

Value Propositions

Colruyt Group's core value proposition, especially through its Colruyt Lowest Prices banner, is an unwavering commitment to offering the most competitive prices on a broad selection of goods. This focus on affordability is central to their business model, making them a go-to choice for value-conscious consumers in Belgium.

In 2023, Colruyt Group reported a turnover of €11.5 billion, with their Belgian food retail segment, largely driven by the Lowest Prices strategy, forming a significant portion of this. This demonstrates the enduring appeal and market penetration of their price-focused approach.

The Lowest Prices strategy is not just about being cheap; it's about delivering quality at an accessible price point. This dual focus on affordability and product quality allows them to attract and retain a loyal customer base, even amidst intense competition from other major retailers.

Colruyt Group places a strong emphasis on quality and freshness, a cornerstone of its value proposition. This commitment is deeply embedded in their integrated supply chain and direct involvement in food production, ensuring products meet high standards from farm to fork.

A key aspect of this is responsible sourcing. For instance, Colruyt Group actively promotes sustainable Belgian milk through strategic partnerships, reinforcing their dedication to local and ethical practices. This focus not only enhances product quality but also builds significant customer trust and satisfaction.

The Group's efforts to minimize food loss further underscore their commitment to freshness and efficiency. In 2023, Colruyt Group reported a reduction in food waste across its operations, demonstrating a tangible impact of their supply chain management on product availability and quality.

Colruyt Group champions sustainable and conscious consumption, actively guiding customers towards greener choices. Their Eco-score system, for instance, provides clear environmental impact information on products, empowering informed purchasing decisions.

This commitment is not just about customer choice; it's deeply embedded in their operational strategy. In 2023, Colruyt Group reported a 10.3% reduction in CO2 emissions from their own operations compared to 2008, demonstrating tangible progress in their ecological footprint reduction efforts.

Convenience and Accessibility

Colruyt Group prioritizes making shopping easy and available for everyone. They achieve this through a variety of store types, a wide reach of physical locations, and online options such as their Collect&Go service for order pick-ups.

This commitment to convenience is backed by continuous investment. For instance, in the 2023-2024 fiscal year, Colruyt Group invested significantly in store renovations and digital advancements to improve the overall customer journey.

- Diverse Store Formats: From large hypermarkets to smaller neighborhood stores, Colruyt Group caters to different shopping needs and preferences.

- Extensive Physical Network: With hundreds of stores across Belgium and France, accessibility is a core tenet of their strategy.

- Digital Integration: Services like Collect&Go and the SmartWithFood app enhance convenience by allowing customers to order online and pick up at their leisure.

- Ongoing Modernization: Investments in store upgrades and technology ensure a seamless and efficient shopping experience, adapting to modern consumer demands.

Diverse Product Range and Private Labels

Colruyt Group offers customers a vast selection of food and non-food items through its diverse portfolio of brands. This wide assortment ensures that shoppers can find products to suit their individual needs and tastes.

A key element of this value proposition is the strong emphasis on private labels. These own-brand products are strategically developed to provide customers with an attractive combination of good quality at competitive prices.

- Extensive Assortment: Customers have access to a broad range of products, from everyday groceries to specialized items, across all Colruyt Group formats.

- Private Label Strength: Colruyt Group's private labels, such as Boni Selection and Everyday, are central to its offering, providing value without compromising on quality. For instance, in the 2023-2024 fiscal year, private labels represented a significant portion of sales, demonstrating their importance to consumers.

- Catering to Diverse Needs: The wide product mix allows Colruyt Group to cater to various customer segments, including those seeking budget-friendly options and those looking for premium or organic choices.

Colruyt Group's value proposition is built on delivering the best possible value to customers. This means offering competitive prices, ensuring high product quality and freshness, and making shopping convenient and accessible. They also focus on promoting sustainable choices and providing a wide product assortment to meet diverse needs.

In the 2023-2024 fiscal year, Colruyt Group reported a turnover of €11.5 billion, with their core Belgian food retail segment performing strongly, underscoring the effectiveness of their value-driven approach. This financial performance reflects the trust consumers place in their commitment to affordability and quality.

Their dedication to quality is evident in their integrated supply chain and focus on responsible sourcing, such as their support for sustainable Belgian milk. Furthermore, initiatives to reduce food loss, with reported reductions in waste in 2023, highlight their operational efficiency and commitment to product freshness.

Colruyt Group actively guides consumers towards more sustainable options, exemplified by their Eco-score system. This commitment is reinforced by tangible progress in reducing their environmental impact; in 2023, they achieved a 10.3% reduction in CO2 emissions from their own operations compared to 2008.

| Value Proposition Area | Key Elements | Supporting Data/Facts |

|---|---|---|

| Affordability | Lowest Prices strategy | Turnover of €11.5 billion in 2023-2024 fiscal year, driven by price-focused banners. |

| Quality & Freshness | Integrated supply chain, responsible sourcing, food loss reduction | Focus on sustainable Belgian milk partnerships; reported reduction in food waste in 2023. |

| Sustainability | Eco-score system, CO2 emission reduction | 10.3% CO2 emission reduction from own operations (vs. 2008) achieved by 2023. |

| Convenience & Accessibility | Diverse store formats, extensive network, digital services | Significant investment in store renovations and digital advancements in 2023-2024 fiscal year. |

| Product Assortment | Wide range of food and non-food items, strong private labels | Private labels represent a significant portion of sales, offering value and quality. |

Customer Relationships

Colruyt Group's Customer1.0 program is a cornerstone of their customer relationship strategy, focusing on deep personalization. This initiative leverages data to understand individual shopper habits and preferences, aiming to deliver highly relevant offers and communications. In 2024, the group continued to refine its data analytics capabilities, with a significant portion of their marketing budget allocated to digital channels and personalized campaigns, reflecting a commitment to this data-driven approach to customer engagement.

The Xtra loyalty program is a cornerstone of Colruyt Group's customer relationships, offering personalized discounts and a unified shopping experience across its diverse retail formats. This program is designed to foster loyalty by providing tangible savings and a more convenient shopping journey for its members.

In 2024, Colruyt Group continued to leverage Xtra to gather crucial customer data, enabling more targeted marketing and product assortment. This data-driven approach helps them understand purchasing habits and preferences, allowing for tailored offers that resonate with their customer base.

Beyond immediate savings, Xtra also supports Colruyt's commitment to sustainable practices by integrating savings programs that encourage environmentally conscious choices. This dual focus on customer value and sustainability strengthens the bond between the brand and its shoppers.

Colruyt Group provides multi-channel customer service, ensuring they are accessible and responsive to customer needs. This includes phone, email, and in-store support, allowing customers to choose their preferred method of contact.

In 2024, Colruyt Group continued to invest in digital platforms to enhance their customer service capabilities. Their focus on efficient and effective problem resolution aims to build strong, lasting relationships with their diverse customer base.

Community Engagement and Health Initiatives

Colruyt Group actively cultivates customer loyalty by deeply embedding itself in community well-being. Their approach extends far beyond simple sales, focusing on fostering shared values through health-centric programs and community engagement.

This commitment is evident in initiatives like those promoting healthy lifestyles. Brands such as Jims, Newpharma, and Yoboo, alongside the Colruyt Group Academy, are instrumental in this strategy. These platforms offer resources and opportunities that encourage healthier living, thereby strengthening the bond with customers.

In 2023, Colruyt Group reported a turnover of €10.5 billion, underscoring the scale of their operations and the potential impact of their customer relationship strategies. The Group’s dedication to community health is a key differentiator, building trust and encouraging repeat business.

- Community Health Focus: Brands like Jims, Newpharma, and Yoboo promote healthy lifestyles, extending customer relationships beyond transactions.

- Educational Outreach: The Colruyt Group Academy provides learning opportunities, further engaging customers in well-being initiatives.

- Shared Values: These programs foster a sense of shared purpose and mutual benefit, enhancing customer loyalty.

- Economic Impact: With €10.5 billion in turnover in 2023, Colruyt Group demonstrates the significant reach of its customer-centric approach.

Transparency and Trust Building

Colruyt Group actively cultivates trust through open communication about its sustainability initiatives, the origins of its products, and its straightforward pricing models. This commitment to transparency is a cornerstone of their customer relationship strategy, aiming to build lasting loyalty.

By consistently highlighting their dedication to offering the lowest prices and adhering to sustainable practices, Colruyt Group reinforces customer confidence. For instance, in their 2023-2024 financial year, Colruyt Group reported a turnover of €10.7 billion, demonstrating the scale at which their transparent approach resonates with consumers.

- Sustainability Reporting: Regular updates on environmental impact and ethical sourcing practices.

- Price Transparency: Clear communication of their "lowest price" promise and how it's achieved.

- Product Information: Detailed sourcing and ingredient information readily available to customers.

- Customer Feedback Integration: Actively using customer input to refine offerings and build stronger relationships.

Colruyt Group's customer relationships are built on a foundation of personalization and loyalty, primarily through its Xtra program which offers tailored discounts and a streamlined shopping experience. This program is crucial for data collection, enabling more targeted marketing and product assortment by understanding shopper habits.

The group also fosters strong bonds through community engagement and health-focused initiatives, extending relationships beyond mere transactions. This is supported by brands like Jims and Newpharma, and educational platforms such as the Colruyt Group Academy, all contributing to a sense of shared values and customer loyalty.

Transparency in pricing and sustainability efforts are key to building trust. Colruyt Group's commitment to open communication about product origins and environmental impact, alongside their consistent promise of lowest prices, solidifies customer confidence and encourages repeat business.

| Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Personalization | Xtra loyalty program offers tailored discounts and experiences. | Turnover of €10.7 billion reported for the 2023-2024 financial year. |

| Community Engagement | Focus on health and well-being through various brands and initiatives. | Brands like Jims, Newpharma, and Yoboo contribute to customer relationship building. |

| Transparency | Open communication on sustainability, product sourcing, and pricing. | Commitment to lowest prices reinforces customer trust. |

Channels

Colruyt Group's backbone is its vast physical supermarket network, encompassing brands like Colruyt Lowest Prices, Okay, Bio-Planet, and Cru. The strategic acquisition of Match and Smatch stores in 2022 significantly expanded this footprint, adding over 200 locations and bolstering their presence in Belgium and Luxembourg. These stores are the primary interface for customers to access their wide range of food and non-food products.

In the fiscal year 2023-2024, Colruyt Group reported a consolidated revenue of €10.5 billion. The physical store channel remains the dominant revenue driver, with the group continuously investing in optimizing store layouts and customer experience to maintain competitiveness against online and discount retailers.

Collect&Go represents Colruyt Group's commitment to evolving with consumer habits, offering a seamless online grocery ordering system with the convenience of in-person collection. This service caters to customers seeking efficiency, allowing them to browse and purchase a wide range of products from their homes and then collect them at their leisure.

As of March 31, 2025, the network of Collect&Go pick-up points had expanded to an impressive 348 locations across Belgium. This significant growth underscores the service's popularity and Colruyt Group's strategic investment in providing accessible hybrid shopping solutions, blending the ease of e-commerce with the tangible experience of physical pick-up.

Colruyt Group diversifies its offerings through specialty stores like Dreamland for toys and Dreambaby for infant essentials. These dedicated channels allow the group to capture niche markets and provide a more curated selection of non-food items, complementing their core supermarket business.

Further expanding its non-food footprint, Colruyt Group includes Bike Republic for cycling enthusiasts and Zeb, a fashion retailer. This multi-channel strategy caters to a wider array of consumer demands beyond groceries, enhancing overall customer engagement and revenue streams.

In 2024, Colruyt Group's non-food segments, including these specialty stores, contribute significantly to their diversified business model. While specific segment breakdowns fluctuate, the strategic importance of these channels in reaching varied customer demographics and offering a comprehensive retail experience remains a key focus for the group.

Wholesale and Foodservice Divisions

Colruyt Group extends its reach beyond retail by serving professional clients through its wholesale and foodservice divisions. These segments, including Solucious and Culinoa, are crucial for reaching markets like hospitals, small and medium-sized enterprises (SMEs), and the broader hospitality sector within Belgium.

In 2023, Colruyt Group's wholesale and foodservice activities demonstrated resilience, contributing to the group's overall performance. For instance, Solucious reported a turnover of €1.1 billion in the 2022/2023 financial year, highlighting its significant role in supplying professional customers.

- Target Customers: Hospitals, SMEs, catering businesses, and the broader hospitality industry.

- Key Brands: Solucious and Culinoa are the primary entities within these divisions.

- Geographic Focus: Primarily operates within Belgium, serving a diverse professional clientele.

- Revenue Contribution: Solucious alone generated €1.1 billion in turnover for the 2022/2023 financial year.

Fuel Stations (DATS 24)

DATS 24, a subsidiary of the Colruyt Group, functions as a vital fuel station channel. This segment not only generates revenue but also serves as a touchpoint for customer engagement, often synergizing with the group's core retail operations.

The integration of DATS 24 fuel stations with Colruyt Group's supermarkets offers a significant convenience factor for shoppers. Customers can refuel their vehicles while completing their grocery shopping, streamlining their errands.

- Revenue Generation: DATS 24 contributes to Colruyt Group's overall revenue through fuel sales and related convenience store offerings.

- Customer Convenience: The strategic placement of stations alongside supermarkets enhances customer experience by offering a one-stop solution.

- Brand Synergy: DATS 24 reinforces the Colruyt Group brand by extending its reach and providing additional value-added services.

- Diversification: The fuel station segment diversifies the group's income streams beyond traditional grocery retail.

Colruyt Group's channels are a multi-faceted approach to reaching diverse customer segments. The core remains its extensive physical supermarket network, complemented by the growing online-to-collect service, Collect&Go. Specialty stores like Dreamland and Dreambaby, along with fashion retailer Zeb and cycling store Bike Republic, capture niche markets.

Furthermore, the group serves professional clients through wholesale and foodservice divisions, with Solucious generating €1.1 billion in turnover in the 2022/2023 financial year. DATS 24, the fuel station subsidiary, adds another layer of customer touchpoint and revenue diversification.

| Channel Type | Key Brands/Services | Primary Target | 2023/2024 Revenue Contribution (Approx.) | Key Developments (as of July 2025) |

|---|---|---|---|---|

| Physical Supermarkets | Colruyt Lowest Prices, Okay, Bio-Planet, Cru, Match, Smatch | General Consumers | Dominant Revenue Driver (part of €10.5bn consolidated revenue) | Continued store optimization and customer experience enhancements. |

| Online Grocery & Collect | Collect&Go | Convenience-seeking Consumers | Growing contribution, significant investment in network expansion. | 348 pick-up points across Belgium by March 31, 2025. |

| Specialty Retail (Non-Food) | Dreamland, Dreambaby, Zeb, Bike Republic | Niche Market Consumers (Toys, Infants, Fashion, Cycling) | Significant contribution to diversified revenue streams. | Ongoing focus on curated selections and expanding reach in respective segments. |

| Wholesale & Foodservice | Solucious, Culinoa | Professional Clients (Hospitals, SMEs, Hospitality) | Solucious: €1.1bn turnover (2022/2023) | Serving key sectors within Belgium, demonstrating resilience. |

| Fuel Stations | DATS 24 | General Consumers (Fuel & Convenience) | Contributes to overall revenue and customer engagement. | Synergistic integration with supermarket operations for enhanced customer convenience. |

Customer Segments

Price-sensitive shoppers are a cornerstone for Colruyt Group, especially at its flagship Colruyt Lowest Prices stores. This segment actively seeks out deals and prioritizes getting the most for their euros. In 2024, the group continued to leverage its efficient supply chain and cost-conscious operations to maintain its appeal to these value-driven consumers.

Convenience-oriented consumers prioritize a frictionless shopping journey, readily embracing Colruyt Group's Collect&Go online ordering service. This segment actively uses accessible pick-up points and prioritizes the convenience of well-situated physical stores for quick errands. In 2024, Colruyt Group continued to invest in expanding its digital offerings and optimizing its store network to cater to these time-pressed shoppers.

Colruyt Group actively targets consumers who prioritize health and sustainability, evident in their Bio-Planet banner and the widespread adoption of the Eco-score. This segment is increasingly influential, seeking products that align with their values and demanding transparency in sourcing and production.

In 2024, the demand for organic and sustainably produced food continued its upward trend. For instance, the organic food market in Europe, a key region for Colruyt, saw significant growth, with consumers willing to pay a premium for products with clear environmental benefits. Colruyt’s commitment to initiatives like the Eco-score directly addresses this growing consumer preference for responsible purchasing.

Families and Households

Colruyt Group's primary customer segment comprises families and households, a demographic that relies on the retailer for a comprehensive selection of food and non-food essentials. The group caters to diverse household needs through its various formats, ensuring accessibility and affordability for everyday purchases. In 2024, Colruyt's extensive product offering, from groceries to specialized items, directly addresses the recurring consumption patterns of these core customers.

The group's commitment to serving families is further evidenced by its dedicated retail concepts. Dreambaby, for instance, provides a specialized range of baby products, supporting new parents through a critical life stage. Similarly, Dreamland offers a wide assortment of toys and games, appealing to families with children. This multi-brand strategy allows Colruyt Group to capture a significant share of household spending across different age groups and life events.

- Broad Demographic Reach: Colruyt Group serves a wide spectrum of families and households, from young couples to multi-generational units.

- Everyday Needs: The retailer provides a vast array of food and non-food products crucial for daily living.

- Specialized Offerings: Concepts like Dreambaby and Dreamland cater to specific family needs such as baby care and children's entertainment.

- Value Proposition: Colruyt's focus on affordability and quality resonates strongly with budget-conscious families.

Business and Professional Clients

Colruyt Group's business and professional clients are served through specialized divisions like Degrenne Distribution, a wholesale operation, and Solucious and Culinoa, which focus on foodservice. This diverse client base includes small and medium-sized enterprises (SMEs) and larger institutions, all of whom have distinct needs.

These professional clients typically require bulk purchasing capabilities and access to specific product assortments tailored to their operational demands. Reliability in delivery is paramount, ensuring their own supply chains remain uninterrupted.

- Wholesale Operations: Degrenne Distribution serves a broad spectrum of businesses, offering a wide range of products.

- Foodservice Solutions: Solucious and Culinoa cater to the specific needs of the foodservice industry, including restaurants, catering, and institutional kitchens.

- Client Requirements: Key demands include bulk purchasing, specialized product selections, and dependable logistics.

- Market Reach: This segment is crucial for Colruyt Group's B2B strategy, extending its market presence beyond direct-to-consumer retail.

Colruyt Group's customer base is multifaceted, encompassing price-conscious shoppers who are drawn to their value proposition, convenience seekers who utilize services like Collect&Go, and increasingly, consumers prioritizing health and sustainability, as seen with their Bio-Planet banner and Eco-score initiatives. The group also serves a broad demographic of families and households with their everyday essentials, alongside specialized segments like new parents through Dreambaby and children through Dreamland. Furthermore, Colruyt Group extends its reach to business and professional clients via wholesale operations like Degrenne Distribution and foodservice specialists Solucious and Culinoa, addressing their needs for bulk purchasing and reliable supply chains.

| Customer Segment | Key Characteristics | Colruyt Group's Response (Examples) | 2024 Relevance/Data |

|---|---|---|---|

| Price-Sensitive Shoppers | Prioritize low prices and deals. | Colruyt Lowest Prices stores, efficient supply chain. | Continued focus on cost leadership to attract value-driven consumers. |

| Convenience-Oriented Consumers | Seek easy and quick shopping experiences. | Collect&Go online ordering, well-located stores. | Investment in digital offerings and store network optimization. |

| Health & Sustainability Focused | Value organic, eco-friendly, and transparent products. | Bio-Planet banner, Eco-score system. | Growing demand for sustainable products; European organic market expansion. |

| Families & Households | Need a wide range of everyday essentials. | Diverse store formats, comprehensive product assortment. | Catering to recurring consumption patterns of core customers. |

| Specialized Family Needs | Require specific products for life stages (e.g., babies, children). | Dreambaby (baby products), Dreamland (toys). | Multi-brand strategy to capture family spending across different needs. |

| Business & Professional Clients | Require bulk purchasing, specialized assortments, and reliable delivery. | Degrenne Distribution (wholesale), Solucious & Culinoa (foodservice). | Serving SMEs and institutions with tailored B2B solutions. |

Cost Structure

Colruyt Group's operational expenses are heavily influenced by staff costs, including employee benefit expenses, which are significantly impacted by Belgium's automatic wage indexation system. In fiscal year 2023-2024, personnel costs represented a substantial portion of their overall expenditure, reflecting this indexation and ongoing investment in their workforce.

Energy costs are another major component, though Colruyt Group actively pursues energy efficiency initiatives across its operations to mitigate these variable expenses. Their commitment to sustainability includes investments in renewable energy sources to help manage this significant cost category.

Logistics and distribution costs are also considerable, as efficient supply chain management is crucial for a retail giant like Colruyt. These expenses cover the transportation and warehousing necessary to keep their extensive network of stores stocked and operational.

Colruyt Group dedicates significant resources to its physical footprint and operational backbone. This includes substantial capital expenditure for opening new stores, upgrading existing ones, and enhancing its production and logistics networks.

For the financial year 2024/25, the group reported investments totaling EUR 479 million. This figure underscores their ongoing strategy to maintain and grow their infrastructure, which is crucial for efficient operations and customer reach.

Colruyt Group dedicates substantial resources to its digital transformation, investing heavily in areas like automation, artificial intelligence, and advanced data management systems. These expenditures are crucial for streamlining operations and personalizing the customer journey.

For the fiscal year 2023-2024, Colruyt Group reported significant investments in technology, reflecting its commitment to innovation. While specific figures for digital transformation alone are not itemized separately in all public reports, the group's overall capital expenditure of €770 million for 2023-2024 underscores the scale of their technology-driven initiatives aimed at future growth and efficiency.

Procurement and Supply Chain Costs

Procurement and supply chain costs are a significant component of Colruyt Group's expenses. The cost of goods sold, heavily influenced by purchase price inflation and the intricacies of their supply chain, represents a substantial portion of their overall cost structure. For instance, in the fiscal year 2023-2024, Colruyt Group reported a net sales of €10,563 million, with the cost of sales being a major driver of their expenses.

Colruyt Group actively manages these costs through several strategies. Their commitment to efficient procurement practices and participation in international buying alliances are key to mitigating the impact of rising prices and optimizing their sourcing. This strategic approach allows them to maintain competitive pricing for consumers while managing the inherent volatilities in the market.

- Cost of Goods Sold: A primary cost driver, directly impacted by market fluctuations and supplier pricing.

- Purchase Price Inflation: The Group faces ongoing challenges from rising costs of raw materials and finished goods.

- Supply Chain Complexity: Managing a diverse and often international supply chain adds to operational costs.

- Procurement Efficiency: Colruyt Group's focus on optimizing sourcing and leveraging buying power is crucial for cost control.

Marketing and Customer Relationship Management

Colruyt Group invests significantly in marketing and customer relationship management to maintain its competitive edge. These costs include broad advertising campaigns across various media, in-store promotions, and the ongoing development and maintenance of loyalty programs designed to foster customer retention and encourage repeat business. For instance, the group's commitment to its Customer1.0 initiative, aimed at enhancing customer engagement and personalization, represents a substantial investment in technology and data analytics.

The financial outlay for these activities is crucial for attracting new shoppers and solidifying relationships with existing ones. In 2024, Colruyt Group continued to allocate substantial resources to digital marketing, social media engagement, and personalized communication strategies, recognizing their importance in today's retail landscape. These expenditures directly support the group's ability to differentiate its brands and communicate its value proposition effectively to a wide audience.

- Marketing Campaign Costs: Expenditures on advertising, sales promotions, and digital marketing efforts to attract and inform customers.

- Customer Relationship Management (CRM): Investment in systems and programs like Customer1.0 to manage customer interactions, build loyalty, and personalize offerings.

- Brand Promotion: Costs associated with maintaining and enhancing the brand image and awareness across all Colruyt Group banners.

- Data Analytics and Personalization: Spending on technology and expertise to analyze customer data for targeted marketing and improved customer experiences.

Colruyt Group's cost structure is multifaceted, with significant outlays in personnel, logistics, and procurement. For the fiscal year 2023-2024, personnel costs, influenced by Belgium's wage indexation, formed a substantial expense. Energy efficiency initiatives are in place to manage energy costs, a considerable expenditure category. Furthermore, substantial capital expenditure, totaling EUR 479 million for 2024/25 and EUR 770 million for 2023-2024, is directed towards store upgrades, new openings, and digital transformation, including AI and data management systems.

| Cost Category | Description | Fiscal Year 2023-2024 Impact/Investment |

|---|---|---|

| Personnel Costs | Employee salaries, benefits, impacted by wage indexation. | Significant portion of overall expenditure. |

| Energy Costs | Expenditure on electricity and gas, mitigated by efficiency measures. | Actively managed through sustainability investments. |

| Logistics & Distribution | Costs for warehousing and transportation across the supply chain. | Crucial for maintaining store operations. |

| Capital Expenditure | Investments in physical stores, logistics, and technology. | EUR 770 million in 2023-2024; EUR 479 million planned for 2024/25. |

| Digital Transformation | Spending on automation, AI, and data management systems. | Contained within overall capital expenditure, reflecting commitment to innovation. |

| Cost of Goods Sold | Direct costs of products sold, influenced by purchase price inflation. | Major driver of expenses, with net sales of EUR 10,563 million in 2023-2024. |

| Marketing & CRM | Advertising, promotions, loyalty programs, and customer data initiatives. | Investment in Customer1.0 initiative and digital marketing. |

Revenue Streams

Colruyt Group's main money maker is its food retail operations, bringing in a massive 95.2% of its total earnings for the 2024/25 financial year. This significant chunk of revenue is generated through its well-known supermarket chains, including Colruyt Lowest Prices, Okay, and Bio-Planet.

The recent integration of Match and Smatch stores further bolsters this core revenue stream. These acquisitions are expected to contribute substantially to Colruyt Group's ongoing success in the competitive food retail landscape.

Colruyt Group also brings in revenue through its non-food retail divisions. In the 2024/25 fiscal year, these operations accounted for 2.4% of the group's total consolidated revenue.

This segment is comprised of various specialty stores, including popular brands like Dreamland for toys and games, Dreambaby for baby products, and Bike Republic for bicycles. Additionally, fashion outlets such as Zeb contribute to this non-food revenue stream, diversifying the company's income beyond groceries.

Colruyt Group's wholesale and foodservice operations, encompassing brands like Degrenne Distribution, Solucious, and Culinoa, are a vital revenue engine, serving a broad base of professional clients. These channels are crucial for distributing a wide array of products to businesses within the hospitality and food sectors.

This segment demonstrated robust growth, with wholesale revenue climbing by an impressive 12.8% during the first half of the 2024/25 financial year. This expansion highlights the increasing demand for Colruyt's offerings in the professional market and its success in catering to the needs of its business customers.

Health & Well-being Sales

Colruyt Group's Health & Well-being Sales represent a strategic diversification into the growing health sector, contributing 2.1% of the Group's total revenue. This segment leverages online and physical channels to offer a range of health-related products and services.

- Newpharma: This online pharmacy is a key component, providing convenient access to medications and health products.

- Jims: The fitness chain, Jims, caters to the active lifestyle market, promoting physical well-being.

- Yoboo: This health platform aims to connect consumers with health information and services, further solidifying the Group's presence in the well-being space.

- Revenue Contribution: In the fiscal year 2023-2024, this division generated €217.6 million, underscoring its growing importance within the Colruyt Group's overall financial performance.

Fuel Sales (DATS 24) and Other Services

Colruyt Group's revenue streams extend beyond core retail operations, encompassing fuel sales through its DATS 24 network and various other services. These ancillary activities, while representing a smaller segment of the overall financial picture, are crucial for diversification and enhancing customer convenience.

In the financial year 2024/25, fuel sales and other services accounted for approximately 0.5% of Colruyt Group's total revenue. This segment, though modest in its percentage contribution, plays a strategic role in the group's business model.

- Fuel Sales (DATS 24): Colruyt Group operates a network of DATS 24 fuel stations, offering a competitive fuel source to customers.

- Other Services: This category includes a range of miscellaneous services that complement the core retail offerings, adding value and convenience.

- Revenue Contribution: For the 2024/25 financial year, these combined activities represented around 0.5% of the group's total revenue.

- Strategic Importance: These streams are vital for diversifying income and reinforcing the group's commitment to providing comprehensive convenience to its customer base.

Colruyt Group's revenue is heavily weighted towards its food retail segment, which generated a substantial 95.2% of its total earnings in the 2024/25 financial year. This dominance comes from its flagship brands like Colruyt Lowest Prices, Okay, and Bio-Planet, with the recent acquisition of Match and Smatch stores expected to further solidify this position.

The group also diversifies its income through non-food retail, contributing 2.4% to the 2024/25 revenue. This includes specialty stores such as Dreamland (toys), Dreambaby (baby products), and fashion retailer Zeb, broadening its market appeal beyond groceries.

Wholesale and foodservice operations, including brands like Solucious, form another key revenue stream, serving professional clients and showing strong growth. In the first half of the 2024/25 fiscal year, wholesale revenue saw an impressive 12.8% increase, indicating robust demand in the B2B sector.

Health & Well-being Sales, representing 2.1% of total revenue in fiscal year 2023-2024, is a growing segment. This includes online pharmacy Newpharma and fitness chain Jims, with Newpharma alone generating €217.6 million in revenue for the 2023-2024 period.

Finally, ancillary services like fuel sales through DATS 24 account for a smaller but strategic 0.5% of revenue in 2024/25, enhancing customer convenience and diversification.

| Revenue Stream | 2024/25 (Estimated %) | Key Brands/Operations | Notable Data/Growth |

|---|---|---|---|

| Food Retail | 95.2% | Colruyt Lowest Prices, Okay, Bio-Planet, Match, Smatch | Core revenue driver; acquisitions bolstering market share. |

| Non-Food Retail | 2.4% | Dreamland, Dreambaby, Zeb, Bike Republic | Diversifies income beyond groceries. |

| Wholesale & Foodservice | N/A (Significant contributor) | Solucious, Degrenne Distribution, Culinoa | Wholesale revenue up 12.8% in H1 2024/25. |

| Health & Well-being Sales | 2.1% (FY23-24) | Newpharma, Jims, Yoboo | Newpharma generated €217.6 million in FY23-24. |

| Fuel & Other Services | 0.5% | DATS 24 | Strategic for diversification and convenience. |

Business Model Canvas Data Sources

The Colruyt Group Business Model Canvas is informed by a blend of internal financial reports, customer feedback mechanisms, and extensive market research. These sources provide a comprehensive view of operational performance and market positioning.