Colruyt Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

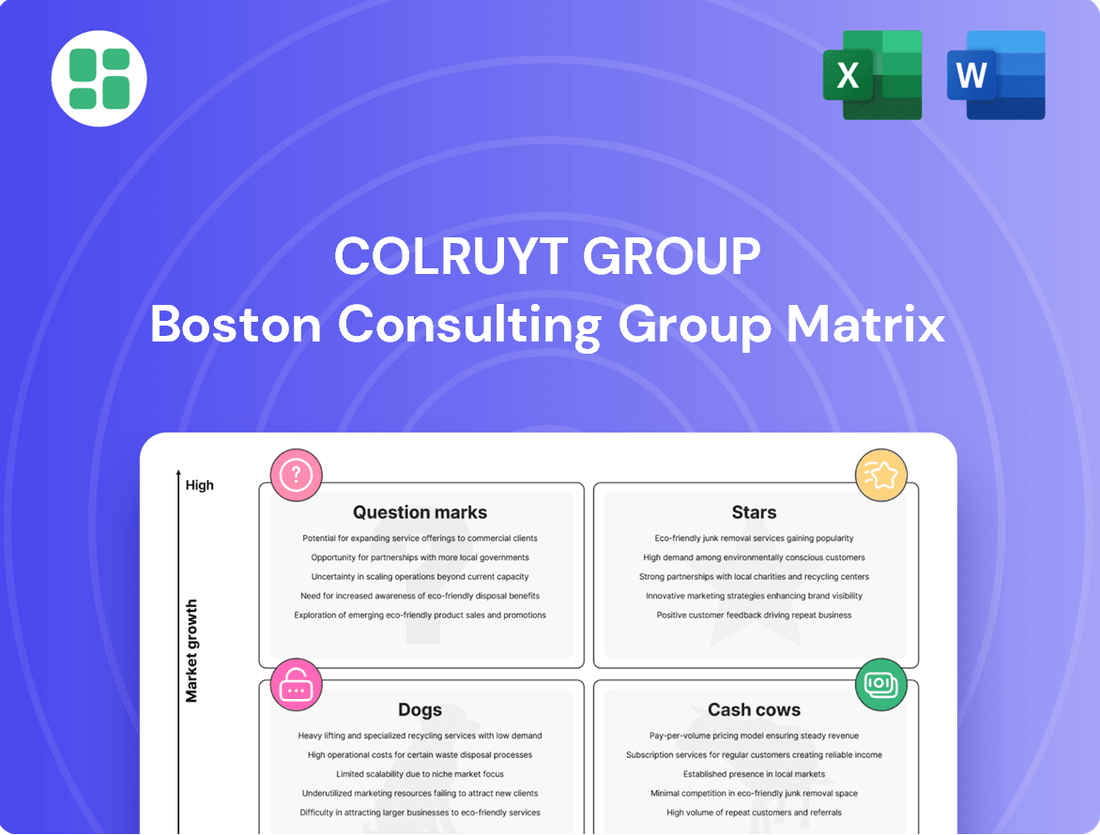

Curious about the Colruyt Group's product portfolio performance? Our BCG Matrix analysis breaks down their offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a crucial snapshot of their market standing.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Colruyt Group.

Stars

Boni Bio, Colruyt Group's private label for organic products, is a significant player in the Belgian organic market, showcasing robust growth. This brand is outperforming national organic brands, capturing a substantial portion of the market.

In 2024, Boni Bio's strong performance is evident, contributing over 40% to Colruyt Group's total organic sales. This success highlights its appeal to consumers increasingly prioritizing sustainable and healthy food options, securing a high market share within this expanding segment.

Solucious, Colruyt Group's foodservice arm, is a standout performer, demonstrating robust growth. In the first half of the 2024/25 financial year, its sales surged by an impressive 19.4%.

This substantial sales increase highlights Solucious's strong position in the professional catering and institutional supply market. The segment's rapid expansion suggests favorable market conditions and Colruyt Group's successful strategy in capturing market share.

Jims, the fitness chain owned by Colruyt Group, is a significant growth driver. In the first half of fiscal year 2024/25, Jims saw its comparable revenue climb by a robust 14.9%.

Colruyt Group is strategically expanding Jims' footprint, aiming to double its presence in Belgium. This growth is fueled by acquisitions, such as the recent integration of NRG, underscoring Jims' ambition to capture a larger share of the burgeoning wellness sector.

Newpharma (Online Pharmacy)

Newpharma, an integral part of the Colruyt Group, is demonstrating impressive performance within the online pharmacy sector. Its comparable revenue saw a substantial 20% jump in the first half of fiscal year 2024/25, highlighting its strong market traction.

Operating within the dynamic digital health and e-commerce landscape, Newpharma is strategically positioned to capitalize on market expansion. It effectively utilizes Colruyt's established infrastructure to secure a considerable share of this burgeoning high-growth market.

- Newpharma's robust growth: A 20% comparable revenue increase in H1 FY 2024/25.

- Market position: Operating in the rapidly expanding digital health and e-commerce sector.

- Strategic advantage: Leverages Colruyt's infrastructure to capture market share.

Collect&Go (Online Grocery Service)

Collect&Go, Colruyt Group's online grocery service, holds a strong position in the expanding Belgian online retail market. In 2024, the service continued to be a key driver of the group's digital revenue growth.

The company is actively pursuing leadership in the online grocery sector. This strategic focus means ongoing investment in expanding its convenient pick-up and delivery options to cater to changing shopper preferences.

- Market Share: Collect&Go is a significant player in Belgium's online grocery market.

- Digital Growth: The service contributes substantially to Colruyt Group's overall digital sales.

- Strategic Ambition: Colruyt aims for market leadership in online grocery shopping.

- Investment Focus: Continued investment is directed towards enhancing and broadening the service's reach.

Stars in the Colruyt Group's BCG Matrix represent high-growth, high-market-share businesses. These are the brands and services that are leading their respective markets and are poised for continued expansion. They are the current engines of growth and require investment to maintain their momentum.

Newpharma, with its 20% comparable revenue growth in H1 FY 2024/25, exemplifies a Star due to its strong performance in the rapidly expanding online pharmacy sector. Similarly, Solucious, experiencing a 19.4% sales surge in the same period, is a Star in the foodservice segment, demonstrating significant market traction and growth potential.

Jims, the fitness chain, with its 14.9% comparable revenue growth and strategic expansion plans, also fits the Star category. Its ambition to double its presence in Belgium signals a commitment to capturing a larger share of the growing wellness market.

| Business Unit | Growth Rate (H1 FY 2024/25) | Market Position | Category |

|---|---|---|---|

| Newpharma | +20% comparable revenue | Strong traction in online pharmacy | Star |

| Solucious | +19.4% sales | Leading position in foodservice | Star |

| Jims | +14.9% comparable revenue | Significant expansion in fitness | Star |

What is included in the product

Highlights which units to invest in, hold, or divest for Colruyt Group.

A clear BCG Matrix visualizes Colruyt's portfolio, easing strategic decision-making by highlighting growth and market share.

Cash Cows

Colruyt Lowest Prices, the group's flagship, is a true cash cow, anchoring Colruyt Group's dominance in the Belgian supermarket sector. Despite a mature and competitive market, its unwavering commitment to its lowest-price strategy has solidified its market leadership for decades, ensuring consistent and substantial cash generation.

In the fiscal year 2023-2024, Colruyt Group reported a turnover of €11.1 billion, with the Belgian market accounting for the lion's share. The Colruyt Lowest Prices format, with its extensive network of stores, continues to be the primary driver of this revenue, demonstrating its resilience and ability to attract a broad customer base seeking value.

Boni Selection, Colruyt Group's main private label, is a cornerstone of their strategy, boasting significant market penetration and strong consumer trust. Its presence in a mature retail landscape, where value-seeking is paramount, allows Boni Selection to deliver robust profit margins and stable sales.

This brand acts as a consistent cash generator for Colruyt Group, demanding minimal promotional expenditure. For instance, in the fiscal year 2023-2024, private labels like Boni Selection contributed significantly to Colruyt's overall sales performance, reflecting their importance in driving profitability and customer loyalty within the group's diverse brand portfolio.

Colruyt Group's wholesale activities, encompassing Retail Partners Colruyt Group in Belgium and Codifrance in France, are a cornerstone of its business. These operations contributed a substantial 12.8% to the group's consolidated revenue in the fiscal year 2023/24, highlighting their importance.

Serving a well-established business-to-business market, these wholesale ventures generate a reliable and consistent stream of cash flow for Colruyt Group. This stability is further bolstered by the efficient distribution infrastructure that the group has developed over the years.

Okay (Traditional Supermarket Format)

The Okay supermarket format functions as a Cash Cow for the Colruyt Group. Its established presence in the Belgian convenience retail sector ensures a consistent revenue stream. This maturity means it doesn't demand significant capital for expansion, instead contributing reliably to the group's financial health.

These local supermarkets benefit from a stable customer base, capitalizing on their convenience-oriented offerings. In 2024, Colruyt Group reported that its smaller store formats, which include Okay, continued to demonstrate resilience, contributing to overall sales figures. This steady performance solidifies Okay's position as a dependable profit generator within the group's diverse portfolio.

- Established market share in Belgium's convenience segment.

- Generates steady revenue with limited need for high growth investments.

- Contributes consistently to Colruyt Group's overall profitability.

DATS 24 (Conventional Fuels)

DATS 24, the energy and mobility arm of Colruyt Group, functions as a significant cash cow within the conglomerate's BCG matrix. Its vast network of filling stations across Belgium and France is a testament to its established presence and operational efficiency.

The conventional fuels segment, while mature, boasts a substantial market share, consistently delivering robust cash flows. For instance, in the fiscal year 2023-2024, Colruyt Group reported that its fuel sales, primarily through DATS 24, contributed significantly to the group's overall revenue, although specific figures for conventional fuels are often aggregated. This steady income stream is crucial for funding the group's investments in newer, potentially higher-growth areas.

- Extensive Network: DATS 24 operates a widespread network of filling stations, solidifying its market presence.

- Mature Segment: Conventional fuel sales represent a stable, mature business with a high market share.

- Cash Generation: This segment consistently generates substantial cash flow, vital for group investments.

- Strategic Support: The cash generated fuels growth initiatives in other business units within Colruyt Group.

Colruyt Lowest Prices, the group's flagship, is a true cash cow, anchoring Colruyt Group's dominance in the Belgian supermarket sector. Despite a mature and competitive market, its unwavering commitment to its lowest-price strategy has solidified its market leadership for decades, ensuring consistent and substantial cash generation. In the fiscal year 2023-2024, Colruyt Group reported a turnover of €11.1 billion, with the Belgian market accounting for the lion's share. The Colruyt Lowest Prices format, with its extensive network of stores, continues to be the primary driver of this revenue, demonstrating its resilience and ability to attract a broad customer base seeking value.

Boni Selection, Colruyt Group's main private label, is a cornerstone of their strategy, boasting significant market penetration and strong consumer trust. Its presence in a mature retail landscape, where value-seeking is paramount, allows Boni Selection to deliver robust profit margins and stable sales. This brand acts as a consistent cash generator for Colruyt Group, demanding minimal promotional expenditure. For instance, in the fiscal year 2023-2024, private labels like Boni Selection contributed significantly to Colruyt's overall sales performance, reflecting their importance in driving profitability and customer loyalty within the group's diverse brand portfolio.

Colruyt Group's wholesale activities, encompassing Retail Partners Colruyt Group in Belgium and Codifrance in France, are a cornerstone of its business. These operations contributed a substantial 12.8% to the group's consolidated revenue in the fiscal year 2023/24, highlighting their importance. Serving a well-established business-to-business market, these wholesale ventures generate a reliable and consistent stream of cash flow for Colruyt Group. This stability is further bolstered by the efficient distribution infrastructure that the group has developed over the years.

The Okay supermarket format functions as a Cash Cow for the Colruyt Group. Its established presence in the Belgian convenience retail sector ensures a consistent revenue stream. This maturity means it doesn't demand significant capital for expansion, instead contributing reliably to the group's financial health. These local supermarkets benefit from a stable customer base, capitalizing on their convenience-oriented offerings. In 2024, Colruyt Group reported that its smaller store formats, which include Okay, continued to demonstrate resilience, contributing to overall sales figures. This steady performance solidifies Okay's position as a dependable profit generator within the group's diverse portfolio.

DATS 24, the energy and mobility arm of Colruyt Group, functions as a significant cash cow within the conglomerate's BCG matrix. Its vast network of filling stations across Belgium and France is a testament to its established presence and operational efficiency. The conventional fuels segment, while mature, boasts a substantial market share, consistently delivering robust cash flows. For instance, in the fiscal year 2023-2024, Colruyt Group reported that its fuel sales, primarily through DATS 24, contributed significantly to the group's overall revenue, although specific figures for conventional fuels are often aggregated. This steady income stream is crucial for funding the group's investments in newer, potentially higher-growth areas.

| Business Unit | BCG Category | Key Characteristics | Fiscal Year 2023-2024 Contribution |

| Colruyt Lowest Prices | Cash Cow | Market leader, lowest-price strategy, broad customer appeal | Primary driver of €11.1 billion group turnover |

| Boni Selection (Private Label) | Cash Cow | High market penetration, strong consumer trust, robust profit margins | Significant contributor to overall sales and profitability |

| Wholesale (Retail Partners, Codifrance) | Cash Cow | Established B2B market, reliable cash flow, efficient distribution | 12.8% of consolidated revenue |

| Okay Supermarkets | Cash Cow | Convenience retail, stable customer base, consistent revenue | Demonstrated resilience, contributing to overall sales |

| DATS 24 (Conventional Fuels) | Cash Cow | Vast network, substantial market share in mature segment | Significant contributor to group revenue, steady income |

Preview = Final Product

Colruyt Group BCG Matrix

The Colruyt Group BCG Matrix preview you are viewing is the precise, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered directly to you, ready for immediate application in your business planning or presentations. You can be confident that the full report contains the same in-depth market positioning and strategic recommendations as this preview, ensuring no surprises and immediate value for your decision-making processes.

Dogs

Colruyt Group's decision to sell Dreambaby, described as a tough choice, signals the baby specialist chain was likely a Dogs category asset. This divestiture suggests Dreambaby faced challenges with low market share and growth prospects within its competitive niche, making it a strategic candidate for portfolio pruning.

Bike Republic, a non-food segment of Colruyt Group, faced a challenging period. In the first half of fiscal year 2024/25, its sales saw a decline of 8.9%. This downturn occurred within a bicycle market that is currently under significant pressure, indicating a difficult operating environment for the retailer.

This sales performance positions Bike Republic as a potential 'dog' within the Colruyt Group's BCG Matrix. The substantial drop in sales, coupled with a generally pressured market, suggests that Bike Republic likely holds a low market share and is experiencing declining growth. Such a combination typically leads to low profitability and limited potential for future returns.

Colruyt Group's 'Everyday' private label is being phased out in favor of 'Boni Selection'. This strategic move suggests 'Everyday' is considered a 'Dog' in the BCG Matrix, indicating low market share and low growth potential. Colruyt's focus is shifting towards brands that better support its future growth and profitability objectives.

Okay Compact (Original Format)

The original Okay Compact store format, a part of the Colruyt Group, is being completely rebranded to Okay City. This strategic shift affects all 20 existing Okay Compact locations.

This rebranding indicates that the Compact format, in its prior iteration, likely faced challenges in capturing substantial market share or achieving consistent growth within urban settings. The move to Okay City signifies a necessary strategic adjustment to better compete in these environments.

The decision to transition all 20 Okay Compact stores to the Okay City format underscores a commitment to revitalizing the group's urban presence. This initiative aims to address previous performance limitations and capitalize on new opportunities within city centers.

- Rebranding Initiative: All 20 Okay Compact stores are transitioning to the new Okay City format.

- Strategic Rationale: The change suggests the original Compact format underperformed in urban markets.

- Market Adaptation: The pivot to Okay City is designed to improve market share and growth in city environments.

The Fashion Society (Zeb, PointCarré, The Fashion Store)

The Fashion Society, encompassing brands like Zeb and PointCarré, likely falls into the Dogs category of the BCG Matrix. While reporting stable to slightly rising comparable revenue in H1 2024/25, the broader fashion retail sector is characterized by intense competition and often thin profit margins.

Without evidence of substantial market share expansion or rapid growth, this segment represents a low-growth, low-market-share position.

- Low Market Share: Fashion retail is fragmented, and The Fashion Society, despite its brands, may not hold a dominant position in key markets.

- Low Growth Potential: The fashion industry, particularly for established brands, often experiences moderate growth, making significant expansion challenging.

- Competitive Pressures: High competition from fast fashion, online retailers, and private labels can suppress profitability and market growth.

- Resource Allocation: As a Dog, The Fashion Society might require significant investment to maintain its current position rather than drive substantial future growth.

The divestiture of Dreambaby, a strategic decision for Colruyt Group, points to its classification as a 'Dog' due to low market share and growth prospects. Similarly, the phasing out of the 'Everyday' private label in favor of 'Boni Selection' indicates 'Everyday' was also a 'Dog', lacking the desired market traction. The rebranding of 20 Okay Compact stores to Okay City suggests the former format struggled to gain significant urban market share, a characteristic of 'Dogs'. The Fashion Society, despite stable revenue, likely remains a 'Dog' due to intense competition and limited growth potential in the fashion sector.

| Business Unit | BCG Category | Rationale | Key Data Point (H1 FY24/25 unless noted) |

|---|---|---|---|

| Dreambaby | Dog | Divested due to low market share and growth prospects. | Divestiture completed. |

| Bike Republic | Dog | Sales declined 8.9% in H1 FY24/25 in a pressured market. | -8.9% sales decline. |

| 'Everyday' Private Label | Dog | Phased out in favor of 'Boni Selection' due to low market share/growth. | Discontinuation in progress. |

| Okay Compact | Dog | Rebranding to Okay City for 20 stores indicates underperformance in urban markets. | 20 stores rebranded. |

| The Fashion Society (Zeb, PointCarré) | Dog | Faces intense competition and limited growth potential despite stable revenue. | Stable to slightly rising comparable revenue. |

Question Marks

Okay City is Colruyt Group's strategic move into the burgeoning urban convenience sector, aiming for 100 stores by 2032. This ambitious project seeks to significantly boost the group's urban market share from its current 20% to a target of 30%.

Positioned as a potential star in the BCG matrix, Okay City operates within a high-growth urban convenience market. However, its current contribution to Colruyt Group's overall market share is relatively small, necessitating considerable investment to unlock its full potential and drive future growth.

Colruyt Group's acquisition of 54 Match and Smatch stores, with many rebranded as Comarkt/Comarché, represents a significant strategic move. These additions bolster Colruyt's presence, particularly in Belgium's intensely competitive grocery sector. However, the full impact on market share and profitability is still unfolding, placing these rebranded stores in a position of uncertainty within the BCG matrix.

The acquisition of Delitraiteur by Colruyt Group is a strategic play to bolster its presence in the burgeoning convenience food market, particularly in urban areas. This acquisition targets the high-growth segment of ready-to-eat and ready-to-heat meals, a sector experiencing sustained consumer demand.

While Delitraiteur operates within a promising niche, its market share under Colruyt's umbrella is still developing. Significant investment and strategic execution will be crucial for Delitraiteur to capture a more substantial portion of this specialized convenience market.

DATS 24 (EV Charging & Hydrogen Infrastructure)

DATS 24, a subsidiary of Colruyt Group, is strategically pivoting towards electric vehicle (EV) charging and hydrogen infrastructure, recognizing these as burgeoning, high-growth sectors. This diversification marks a significant departure from its traditional fuel retail operations.

While these green energy infrastructure segments offer substantial future potential, Colruyt Group's current market share is still in its nascent stages. The expansion into these areas requires considerable capital investment for development and establishing a strong future market position.

- Investment Focus: DATS 24 is channeling significant resources into expanding its network of EV charging points and developing hydrogen refueling stations.

- Market Position: As of the latest available data, Colruyt Group's presence in the EV charging and hydrogen infrastructure markets is still developing, indicating a relatively low market share but high growth potential.

- Capital Expenditure: The group's financial reports highlight substantial capital expenditures allocated to building out this green energy infrastructure, reflecting a long-term strategic commitment.

- Future Outlook: These investments position DATS 24 to capitalize on the anticipated surge in demand for sustainable transportation solutions in the coming years.

Virya Energy (Remaining Stake in Renewable Energy)

Virya Energy, with Colruyt Group holding a 30% stake, is positioned as a Star or Question Mark depending on future growth and market share within the rapidly expanding renewable energy sector. Despite divesting a majority stake, Colruyt Group's continued involvement signifies a strategic bet on the sector's potential. Virya Energy aims to significantly increase its renewable energy production capacity, a move that aligns with high-growth industry trends.

While the sector offers substantial growth prospects, Colruyt's minority stake means its direct influence and immediate contribution to the group's core business performance are less defined. This makes Virya Energy a venture with high potential reward but also considerable inherent risk, characteristic of a Question Mark that requires careful monitoring and potential future investment to solidify its position.

- Virya Energy's 30% stake represents a strategic investment for Colruyt Group in a high-growth sector.

- The company's ambitious plans for renewable energy capacity development align with market trends.

- Colruyt's reduced control introduces uncertainty regarding direct contribution to group performance, classifying it as a potential Question Mark.

- The venture carries high potential rewards alongside inherent risks due to market dynamics and minority ownership.

Okay City, Colruyt's urban convenience venture, is a prime example of a Question Mark. It operates in a high-growth market, but its current market share is still minimal, requiring substantial investment to become a Star.

The rebranded Match and Smatch stores also fit the Question Mark profile. While integrated into Colruyt's network, their future market impact and profitability are yet to be fully determined, necessitating ongoing strategic evaluation and investment.

Delitraiteur, acquired to tap into the convenience food market, is another Question Mark. Its niche focus offers growth potential, but significant investment is needed for it to capture a more dominant market share.

DATS 24's expansion into EV charging and hydrogen infrastructure places it firmly in the Question Mark category. These are high-growth sectors, but Colruyt's current market share is nascent, demanding considerable capital to establish a strong future presence.

Virya Energy, with Colruyt's 30% stake, is a Question Mark due to the sector's high growth potential contrasted with Colruyt's minority ownership and thus less defined immediate impact on group performance.

BCG Matrix Data Sources

Our Colruyt Group BCG Matrix is built on a foundation of robust data, incorporating internal financial statements, market share analysis, and industry growth rates to provide a clear strategic overview.