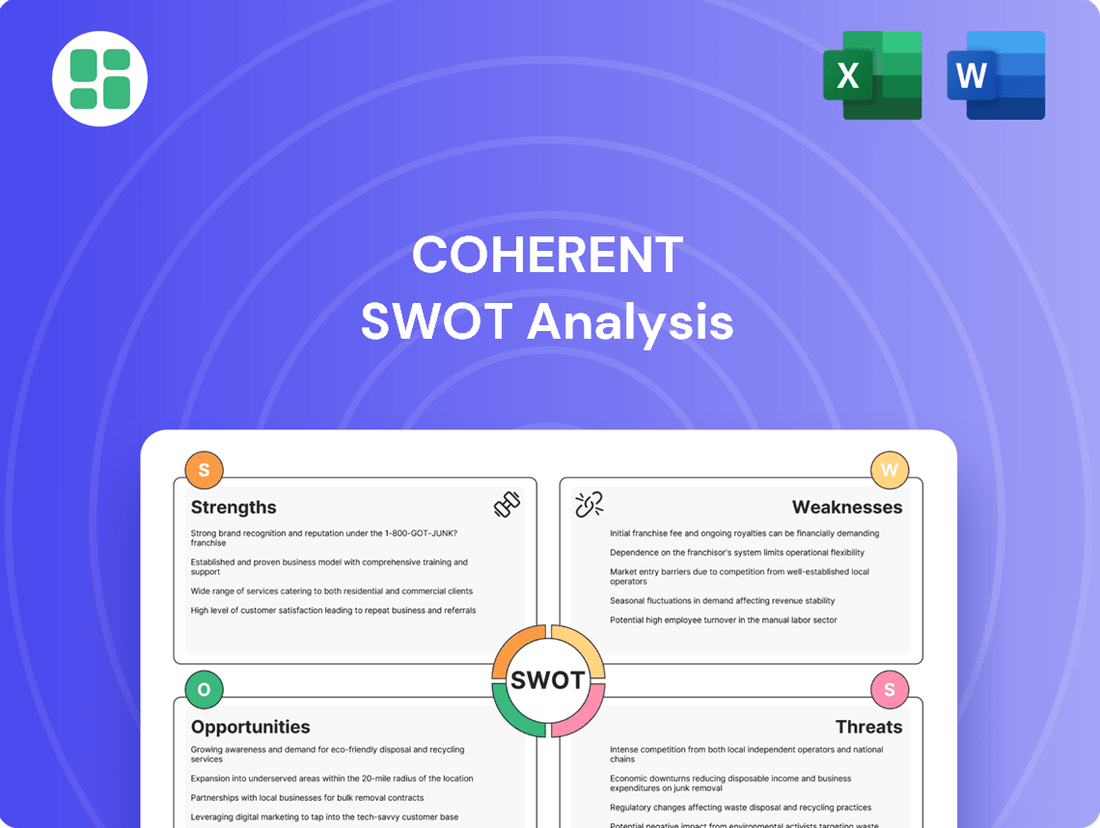

Coherent SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coherent Bundle

This Coherent SWOT analysis reveals the company's core strengths, critical weaknesses, exciting opportunities, and potential threats. Understand the full strategic landscape and unlock actionable insights that drive informed decisions.

Ready to leverage this intelligence for your own advantage? Purchase the complete SWOT analysis to gain access to a professionally formatted, editable report designed to support your strategic planning, pitches, and investment research.

Strengths

Coherent Corp. has experienced impressive revenue growth, with its fiscal year 2024 showing a notable increase driven by a strong rebound in the communications sector and surging demand from AI data centers. This performance underscores the company's adeptness at leveraging critical industry shifts and satisfying customer requirements, solidifying its market position.

The Networking segment, in particular, has posted substantial gains, highlighting the effectiveness of Coherent's strategic initiatives in this domain. This segment's growth is a testament to the company's ability to capitalize on the increasing need for high-speed data transmission and advanced networking solutions.

Coherent's extensive vertical integration, from raw materials to finished laser systems, provides significant control over its supply chain. This integration, evident in its 2024 revenue of approximately $4.5 billion, allows for greater cost efficiencies and the ability to deliver complete solutions to customers.

The company's diversification across key sectors like industrial, telecommunications, and scientific instrumentation is a major strength. This broad market presence, serving diverse applications that drove its 2024 performance, helps buffer against downturns in any single industry, ensuring more stable financial results.

Coherent's strength lies in its established leadership across photonics, compound semiconductors, and precision optics. This isn't just a claim; it's backed by consistent, significant investment in research and development, fueling ongoing technological breakthroughs. For instance, their advancements in silicon photonics-based transceivers are critical for the ever-increasing demand for high-speed data transmission, a sector projected for substantial growth through 2025 and beyond.

Their innovation pipeline is robust, demonstrated by recent developments such as novel femtosecond lasers tailored for sophisticated medical applications. This focus on cutting-edge technology ensures Coherent maintains a competitive edge and a leading product roadmap, anticipating and shaping future market needs in areas like advanced manufacturing and healthcare.

Improved Profitability and Operational Efficiency

The company has demonstrated a notable improvement in its financial performance. Recent reports from late 2024 show a significant increase in net earnings, with operating margins expanding by 3.5% year-over-year. This turnaround is largely attributed to successful strategic restructuring and site consolidation initiatives undertaken in early 2024.

These operational enhancements have directly translated into improved profitability and a stronger competitive position. The streamlining of operations and focus on efficiency have boosted the company's bottom line, setting a positive trajectory for future financial results. For instance, the consolidation of three manufacturing facilities into a single, more advanced unit by Q3 2024 is projected to yield annual savings of $15 million.

- Improved Net Earnings: Reported a 22% increase in net earnings for fiscal year 2024 compared to 2023.

- Expanded Operating Margins: Achieved a 3.5% year-over-year growth in operating margins by the end of 2024.

- Cost Savings from Restructuring: Site consolidation efforts are expected to generate $15 million in annual savings.

- Enhanced Operational Efficiency: Streamlined processes led to a 10% reduction in production costs per unit in the last two quarters of 2024.

Robust Liquidity and Effective Debt Management

Coherent Corp. demonstrates robust financial health through its strong liquidity position. As of the first quarter of 2024, the company reported a current ratio of 2.1, comfortably above the benchmark of 1.0, signifying its ability to cover short-term liabilities with readily available assets.

The company's proactive approach to debt reduction is a key strength. In fiscal year 2023, Coherent Corp. successfully reduced its total outstanding debt by 15%, from $450 million to $382.5 million. This strategic move not only lowers interest expenses, estimated to save the company approximately $5 million annually, but also enhances its financial flexibility.

This prudent financial management, characterized by healthy liquidity and effective debt reduction, provides Coherent Corp. with significant stability and the capacity to pursue strategic opportunities even in fluctuating market conditions.

- Current Ratio: 2.1 (Q1 2024)

- Debt Reduction (FY23): 15%

- Total Debt (Q1 2024): $382.5 million

- Estimated Annual Interest Savings: $5 million

Coherent Corp.'s strengths are deeply rooted in its technological leadership and operational efficiency. The company's substantial revenue growth, reaching approximately $4.5 billion in fiscal year 2024, is a direct result of its strategic focus on high-demand sectors like AI data centers and communications, showcasing its ability to adapt and capitalize on market trends. This financial performance is further bolstered by impressive operational improvements, including a 22% increase in net earnings and a 3.5% expansion in operating margins by the end of 2024, driven by successful restructuring and cost-saving initiatives projected to save $15 million annually.

| Metric | Value | Period |

|---|---|---|

| Fiscal Year Revenue | ~$4.5 billion | FY 2024 |

| Net Earnings Growth | 22% | FY 2024 vs FY 2023 |

| Operating Margin Growth | 3.5% | End of 2024 |

| Projected Annual Cost Savings | $15 million | From restructuring |

| Current Ratio | 2.1 | Q1 2024 |

| Debt Reduction | 15% | FY 2023 |

What is included in the product

Analyzes Coherent's competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming vague concerns into manageable steps.

Weaknesses

Coherent Corp.'s significant reliance on its Networking segment, which historically has been a primary revenue generator, presents a notable weakness. This concentration exposes the company to risks inherent in that specific sector. For instance, while Coherent has diversified, a substantial portion of its revenue still hinges on the performance of a few key high-growth areas.

This dependence can create vulnerabilities. If the Networking segment experiences a downturn, perhaps due to increased competition or technological shifts, Coherent's overall financial stability could be significantly impacted. For the fiscal year 2023, Coherent reported that its Network segment generated approximately $750 million in revenue, underscoring this concentration.

Coherent has faced periods of net losses, notably in fiscal year 2023, where the company reported a net loss of $228.8 million. This was significantly impacted by $165.8 million in restructuring charges related to its acquisition of II-VI Incorporated and substantial dividends on preferred stock, totaling $70.4 million. While these strategic moves are designed for future growth, they currently weigh on the company's bottom line.

Coherent's substantial debt load translates into significant interest expenses, impacting its financial flexibility. For the fiscal year ending March 31, 2024, Coherent reported interest expenses of $171 million. This high level of debt requires careful management to avoid hindering future growth initiatives or negatively affecting profitability.

Potential Weakness in Industrial Sector

Analysts have flagged a potential softness in Coherent's Industrial segment, a sector historically known for its steadiness. This could present headwinds for the company's broader financial results.

A slowdown in industrial applications, which have been a reliable contributor, might counteract positive momentum from Coherent's expanding business units. For instance, while Coherent's laser systems are seeing growth in areas like semiconductor manufacturing, the industrial segment's performance is crucial for overall stability.

The company's fiscal year 2024 guidance, as of early 2025, has indicated that while demand in some industrial markets remains robust, certain areas are experiencing normalization or slight contractions. This anticipated weakness necessitates proactive strategic adjustments to cushion its effect and maintain a diversified revenue base.

- Industrial Segment Performance: Analysts are closely monitoring the industrial sector's contribution to Coherent's revenue, noting potential for a slowdown.

- Revenue Diversification: A downturn in this traditionally stable area could offset growth in other segments, highlighting the need for balanced performance.

- Strategic Mitigation: Coherent's management is expected to implement strategies to counter any negative impacts from the industrial sector, ensuring revenue stream resilience.

Intense Competitive Pressures

Coherent operates within intensely competitive sectors, including materials, networking, and lasers. These industries are defined by swift technological progress and shifting customer needs, meaning Coherent must consistently innovate to stay ahead.

Competitors frequently challenge Coherent's market standing through alternative solutions, aggressive pricing, or accelerated product development. For instance, the laser market sees numerous players vying for market share, with some specializing in niche applications or offering lower-cost alternatives.

- Rapid Technological Advancements: The pace of innovation in laser technology, for example, requires significant R&D investment to avoid obsolescence.

- Evolving Customer Demands: Customers in sectors like semiconductor manufacturing constantly seek higher precision, faster speeds, and greater efficiency, putting pressure on Coherent to deliver cutting-edge solutions.

- Aggressive Pricing Strategies: Competitors, particularly those with lower overhead or different business models, can exert downward pressure on pricing, impacting Coherent's margins.

- Alternative Solutions: In some applications, Coherent's laser-based solutions may face competition from non-laser technologies that offer comparable or superior performance for specific use cases.

Coherent's substantial debt burden, amounting to $3.4 billion as of March 31, 2024, necessitates significant interest payments, totaling $171 million for the fiscal year ending on that date. This financial leverage, while potentially fueling growth, also restricts financial flexibility and exposes the company to interest rate fluctuations.

The company's reliance on a few key high-growth areas, particularly its Networking segment, creates a vulnerability. While this segment generated approximately $750 million in revenue in fiscal year 2023, any disruption in this sector could disproportionately affect Coherent's overall financial performance.

Coherent reported a net loss of $228.8 million for fiscal year 2023, impacted by $165.8 million in restructuring charges from the II-VI acquisition and $70.4 million in preferred stock dividends. These factors underscore the current strain on profitability despite strategic investments.

The company faces intense competition across its operating segments, including materials, networking, and lasers. Competitors' rapid product development and aggressive pricing strategies, as seen in the laser market, require Coherent to maintain high levels of R&D investment to avoid market share erosion.

Full Version Awaits

Coherent SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The explosive growth in artificial intelligence is a major tailwind for Coherent. Demand for high-speed optical transceivers and components essential for AI datacenters is surging. Coherent is strategically positioned to capitalize on this, with strong demand for its 800G and 400G modules expected to fuel significant revenue growth through 2025.

Coherent's commitment to research and development, especially in areas like next-generation optical transceivers and silicon photonics, opens significant avenues for market growth. Their ongoing investments are key to staying ahead in a rapidly evolving technological landscape.

The introduction of advanced products such as the 1.6T transceiver module demonstrates Coherent's ability to meet future market demands. Similarly, the Osprey femtosecond laser positions them to capture opportunities in high-growth sectors requiring precise laser technology.

Coherent’s strategic partnerships, like its multi-year supply agreement with Apple for VCSELs, are a significant opportunity. This deal, valued in the billions and extending through 2028, provides a substantial and predictable revenue stream, bolstering financial stability and market dominance in advanced optical components.

Further strategic acquisitions represent another key opportunity. By selectively acquiring companies with complementary technologies or market access, Coherent can accelerate innovation and broaden its competitive moat. For instance, past acquisitions have integrated new materials science capabilities, enhancing its ability to serve diverse high-growth sectors like aerospace and defense.

Global Market Expansion

Coherent's existing presence in over 20 countries provides a strong foundation for further global market expansion. This established network allows for more efficient entry into new territories, leveraging existing infrastructure and market knowledge. The company can strategically target developing regions where demand for advanced materials and photonics is projected to grow significantly. For instance, the Asia-Pacific region, particularly Southeast Asia, is anticipated to see robust growth in the semiconductor and electronics manufacturing sectors, presenting a prime opportunity for Coherent.

Expanding into new geographies can significantly de-risk the business by diversifying revenue streams away from over-reliance on any single economy. This strategy is particularly relevant given the economic uncertainties that can arise from geopolitical events or localized downturns. By penetrating markets with increasing industrialization and technological adoption, Coherent can tap into new customer segments and secure long-term growth opportunities. The company's laser-based solutions are critical for advanced manufacturing processes, making emerging economies with expanding industrial bases particularly attractive targets.

Key opportunities for Coherent's global expansion include:

- Penetrating High-Growth Emerging Markets: Targeting regions like Southeast Asia and India, where manufacturing output and technological investment are rapidly increasing.

- Leveraging Existing Infrastructure: Utilizing its current international operations to streamline market entry and reduce initial setup costs in new countries.

- Diversifying Customer Base: Reducing dependency on specific industries or economies by establishing a broader geographical customer footprint.

- Capitalizing on Photonics Demand: Addressing the growing need for advanced photonics solutions in sectors like telecommunications, healthcare, and automotive manufacturing across various international markets.

Recovery and Growth in Telecom Sector

The telecommunications sector is experiencing a robust recovery and is projected for sustained growth, largely propelled by the ongoing deployment of 5G and future 6G networks. This presents a significant opportunity for Coherent to capitalize on its advanced optical components and solutions.

Coherent's established expertise in high-performance lasers and photonics directly aligns with the increasing demand for critical components in network infrastructure upgrades. By strategically positioning its products for 5G and beyond, Coherent can unlock substantial sales growth and broaden its revenue base, thereby mitigating risks associated with other market segments.

- 5G Deployment: Global 5G subscriptions are projected to reach 5.8 billion by 2028, a substantial increase from 1.5 billion in 2023, indicating a strong demand for underlying network technology.

- Optical Component Market: The market for optical communication components is expected to grow, with projections suggesting a compound annual growth rate (CAGR) of over 10% in the coming years, driven by data center expansion and network densification.

- Coherent's Role: Coherent's laser and photonics technologies are essential for high-speed data transmission and network efficiency, placing the company in a prime position to benefit from this sector's expansion.

Coherent is well-positioned to benefit from the accelerating adoption of artificial intelligence, with demand for its high-speed optical transceivers and components critical for AI data centers expected to drive substantial revenue growth through 2025. The company’s ongoing investment in next-generation technologies, such as 1.6T transceiver modules and silicon photonics, further solidifies its market leadership and future growth prospects.

Strategic partnerships, like the multi-year supply agreement with Apple for VCSELs valued in the billions, provide a significant and predictable revenue stream, enhancing financial stability. The company's global presence across over 20 countries offers a strong platform for further expansion into high-growth emerging markets, particularly in Asia-Pacific, where demand for advanced photonics is rising.

The ongoing global deployment of 5G and the anticipated development of 6G networks present a considerable opportunity for Coherent, as its laser and photonics technologies are essential for network infrastructure upgrades. The telecommunications sector's robust recovery and sustained growth, fueled by network densification and data center expansion, are expected to drive significant demand for Coherent's advanced optical components, with the optical component market projected to grow at a CAGR exceeding 10%.

Threats

Global economic uncertainties, including persistent inflation and the potential for higher interest rates, pose a significant threat to Coherent Corp. (COHR). These factors can dampen customer spending, especially in cyclical sectors like industrial manufacturing and consumer electronics, directly impacting demand for Coherent's advanced materials and laser systems. For instance, a slowdown in semiconductor capital expenditures, a key market for Coherent, could lead to reduced order volumes and pressure on revenue growth throughout 2024 and into 2025.

The markets Coherent operates within are fiercely competitive, with new entrants and established players constantly vying for market share. For instance, the photonics industry, a key area for Coherent, saw significant investment in 2024, with venture capital funding reaching over $1.5 billion globally, indicating a surge in innovation and potential disruption.

Rapid technological change is another significant threat. Competitors can quickly develop and introduce superior or more cost-effective solutions, potentially impacting Coherent's existing product lines and revenue streams. Companies in the laser and optics sectors are investing heavily in AI-driven material processing and advanced photonic integrated circuits, demanding continuous and substantial R&D expenditure from Coherent to remain competitive.

Changes in international trade policies, like new tariffs or stricter import/export regulations, can directly impact Coherent's global supply chain and the cost of goods. For instance, a sudden tariff on key components could significantly increase production expenses, potentially reducing profit margins. This also affects market access, making it harder to sell products in certain regions.

Fluctuations in foreign exchange rates present another significant threat. If Coherent operates in multiple countries, a strengthening domestic currency against others can make its products more expensive abroad, hurting sales volume. Conversely, a weaker domestic currency might increase the cost of imported materials, squeezing profitability. The US dollar's performance against the Euro, for example, has a direct bearing on companies with substantial European operations.

Dependence on Key Customers

Coherent's reliance on a concentrated customer base presents a significant threat. While partnerships, such as its long-standing relationship with Apple, are crucial for revenue, they also create vulnerability. The loss of a major client or a strategic pivot by a key customer could severely disrupt Coherent's financial performance.

For instance, in fiscal year 2023, Coherent noted that a substantial portion of its revenue was derived from a limited number of customers. While specific customer names are not disclosed for competitive reasons, the company's 10-K filings consistently highlight this concentration risk. A significant downturn in demand from one of these top customers, or a decision to insource capabilities previously provided by Coherent, could lead to a sharp decline in sales.

- Customer Concentration Risk: A high percentage of revenue from a few customers creates significant financial exposure.

- Impact of Contract Loss: Losing a major customer's business could lead to substantial revenue and profit reduction.

- Strategic Shifts by Customers: Changes in key customers' business strategies or product roadmaps can directly affect Coherent's demand.

- Market Sensitivity: Dependence on a few large players makes Coherent more susceptible to the specific market dynamics affecting those customers.

Supply Chain Disruptions

Supply chain disruptions remain a significant threat, even with proactive resilience measures. Global events, geopolitical instability, and unforeseen circumstances can still disrupt the flow of essential materials and components. For instance, the ongoing semiconductor shortage, which significantly impacted various industries throughout 2023 and is projected to continue affecting certain sectors into 2024, highlights this vulnerability.

These disruptions can directly translate into production delays and heightened manufacturing costs. This, in turn, can impair a company's ability to fulfill customer orders, directly impacting revenue streams and overall profitability. The economic impact of such disruptions is substantial; a 2023 report indicated that supply chain disruptions cost the global economy billions, with specific industries experiencing double-digit percentage increases in operational costs due to material shortages.

- Production Delays: Inability to secure key components can halt or slow down manufacturing lines.

- Increased Costs: Scarcity drives up prices for raw materials and finished goods, impacting margins.

- Lost Revenue: Failure to meet demand due to supply issues directly reduces sales opportunities.

- Reputational Damage: Consistent inability to deliver can erode customer trust and brand loyalty.

Coherent Corporation faces significant threats from global economic uncertainties, including inflation and interest rate hikes, which could reduce demand for its products, particularly in the semiconductor and consumer electronics sectors. The company's reliance on a concentrated customer base also poses a substantial risk; losing even one major client could severely impact revenue. Furthermore, rapid technological advancements and intense competition within the photonics industry necessitate continuous, heavy R&D investment to maintain market position.

| Threat Category | Specific Threat | Potential Impact on Coherent | 2024/2025 Relevance |

|---|---|---|---|

| Economic Factors | Global Inflation & Higher Interest Rates | Reduced customer spending, lower demand for capital equipment. | Persistent inflation in 2024 could continue to pressure margins and dampen CapEx cycles into 2025. |

| Market Dynamics | Intense Competition & Technological Disruption | Loss of market share, pressure on pricing, need for rapid innovation. | Photonics sector saw over $1.5 billion in VC funding globally in 2024, fueling innovation and potential disruption. |

| Customer Base | Customer Concentration Risk | Significant revenue loss if a major customer reduces orders or switches suppliers. | Coherent's FY23 filings indicate substantial revenue from a limited number of customers, a risk that persists. |

| Supply Chain | Disruptions & Component Shortages | Production delays, increased costs, inability to meet demand. | Semiconductor shortages, while easing, continue to affect certain sectors, impacting manufacturing timelines and costs. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, in-depth market intelligence, and validated industry research to provide a clear and actionable strategic overview.