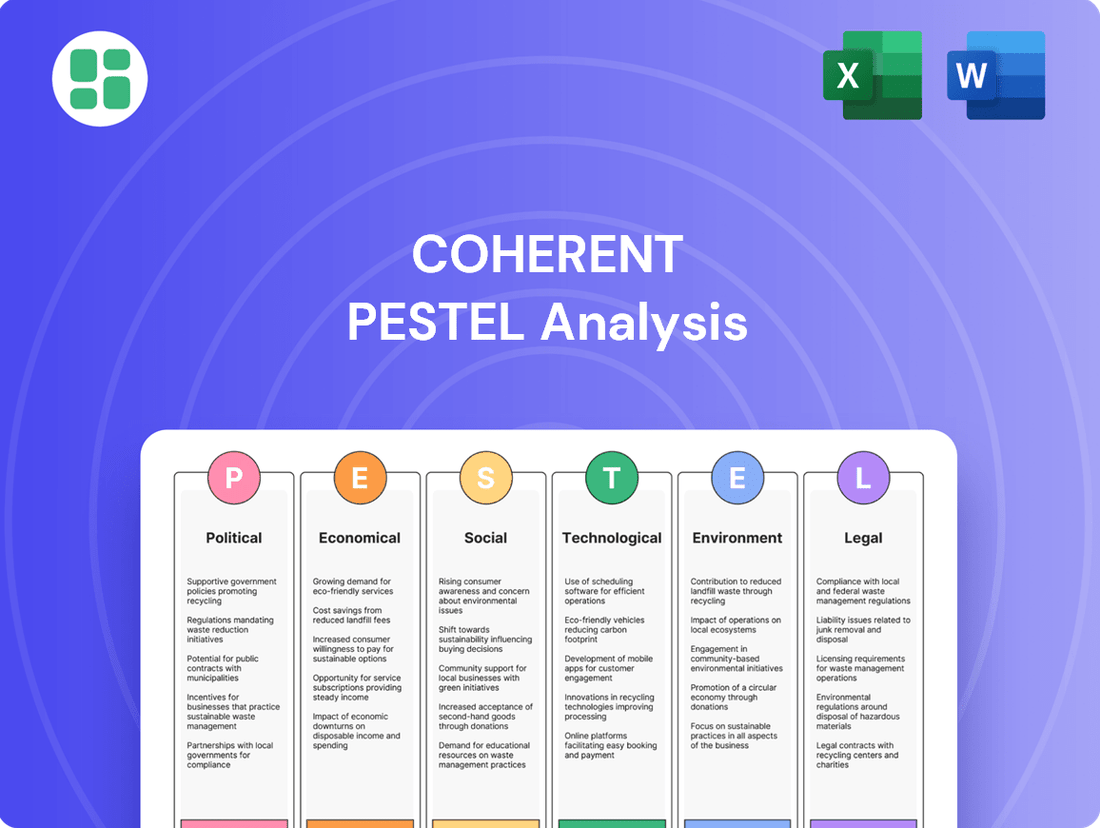

Coherent PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coherent Bundle

Uncover the critical external factors shaping Coherent's trajectory with our meticulously researched PESTLE analysis. Understand how political shifts, economic fluctuations, technological advancements, environmental concerns, and legal landscapes are influencing the company's operations and market position. Equip yourself with actionable intelligence to refine your strategies and anticipate future challenges. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

Geopolitical trade tensions, especially between the US and China, continue to shape global supply chains and market access for companies like Coherent Corp. For instance, in 2023, the US Department of Commerce's Bureau of Industry and Security (BIS) expanded export controls on certain advanced technologies, impacting the flow of critical components. This can directly affect Coherent's ability to sell its photonics and semiconductor equipment into specific markets, potentially necessitating strategic shifts in production or sales focus to mitigate revenue impacts and ensure compliance with evolving regulations.

Government investment in research and development is a significant driver for companies like Coherent Corp., particularly in cutting-edge fields. For instance, the US CHIPS and Science Act, enacted in 2022, allocated over $52 billion for semiconductor manufacturing and research, directly benefiting sectors where Coherent operates. This funding aims to bolster domestic capabilities in advanced manufacturing and critical technologies, creating a more favorable environment for innovation and supply chain resilience.

Coherent Corp. operates within a global landscape where political stability significantly shapes its investment horizons. For instance, in 2024, countries with a history of consistent regulatory frameworks, like Germany and the United States, continue to offer a more predictable environment for Coherent's advanced manufacturing and materials businesses, attracting substantial capital. Conversely, regions experiencing heightened political volatility, such as parts of Eastern Europe, present increased operational risks, potentially impacting Coherent's planned expansions or supply chain reliability.

International Trade Agreements and Tariffs

Changes in international trade agreements and tariffs significantly impact Coherent Corp.'s operational costs and market competitiveness. For instance, the United States' imposition of tariffs on goods from China in 2018-2019, averaging around 25% on certain categories, directly increased the cost of imported components for many manufacturers, potentially affecting Coherent's supply chain expenses. Conversely, the renegotiation of agreements like the USMCA, which replaced NAFTA in 2020, aimed to reshape North American trade dynamics, potentially opening new avenues or imposing new compliance requirements for businesses operating within that region.

These shifts necessitate strategic adjustments in pricing and supply chain management. For example, if a key component sourced from a country facing new tariffs becomes more expensive, Coherent might need to absorb the cost, pass it on to consumers, or find alternative suppliers. The World Trade Organization (WTO) reported that global trade growth slowed in 2023, underscoring the sensitivity of businesses to these evolving trade policies. Companies must remain agile, continuously assessing the financial implications of tariff changes and trade pacts to maintain profitability and market access.

- Tariff Impact: New tariffs can increase the cost of imported raw materials, directly affecting production expenses for companies like Coherent.

- Competitiveness: Changes in trade agreements can alter the competitiveness of Coherent's exported products in international markets.

- Supply Chain Adjustments: Companies may need to reconfigure their global supply chains to mitigate risks associated with trade disputes or new tariff regimes.

- Market Access: Renegotiated trade deals can either expand or restrict market access for Coherent's goods and services.

Sanctions and Export Controls

Sanctions and export controls directly impact Coherent Corp.'s global reach and operational flexibility. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, which restricts exports to designated companies. In 2024, continued geopolitical tensions may lead to further additions or modifications to these lists, potentially affecting Coherent's access to key markets or suppliers for critical components.

Compliance with these evolving regulations necessitates substantial investment in internal processes and legal expertise. Failure to adhere can result in severe financial penalties, as seen in past cases where companies faced millions in fines for export control violations. These controls often target advanced technologies, including those related to laser systems and specialized materials, which are core to Coherent's product offerings.

The strategic implications are significant:

- Market Access Limitations: Sanctions can abruptly close off entire regions, forcing Coherent to seek alternative markets or divest from existing ones, impacting revenue streams.

- Supply Chain Disruptions: Export controls on specific components or raw materials can disrupt Coherent's manufacturing processes, leading to production delays and increased costs.

- Increased Compliance Burden: Navigating the complex web of international trade regulations requires ongoing vigilance and investment in compliance infrastructure, diverting resources from core business activities.

Government policies, particularly those related to technology and trade, significantly influence Coherent Corp.'s operational landscape. For instance, the US Inflation Reduction Act of 2022, while primarily focused on clean energy, includes provisions for advanced manufacturing that could indirectly benefit companies like Coherent involved in related supply chains. Furthermore, ongoing discussions around national security and supply chain resilience in 2024 continue to drive government interest in domestic production of critical technologies, potentially leading to new incentives or regulations.

What is included in the product

Coherent's PESTLE Analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing actionable insights for strategic decision-making.

Provides a clear, actionable framework that helps businesses proactively identify and mitigate external risks, preventing costly reactive measures and fostering strategic stability.

Economic factors

Global economic growth is a primary driver for Coherent Corp.'s performance. Strong economic expansion, especially in 2024 and projected into 2025, typically translates to higher capital spending by businesses. This increased investment directly fuels demand for Coherent's advanced manufacturing equipment, optical components, and laser systems across industrial, communications, and electronics sectors.

For instance, the International Monetary Fund (IMF) projected global growth of 3.2% for 2024, a figure that generally supports robust industrial activity. This positive outlook suggests a favorable environment for Coherent, as companies are more likely to invest in new technologies and capacity when the economic outlook is stable or improving.

Conversely, economic slowdowns or recessions present headwinds. Reduced business investment during such periods can significantly dampen sales volumes for Coherent's specialized products. The company's revenue and profitability are therefore closely tied to the cyclical nature of global economic expansion and contraction.

Rising inflation presents a significant challenge for Coherent Corp., directly impacting its cost of goods sold. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase in early 2024, indicating higher input costs for raw materials and components. If Coherent cannot fully pass these increased expenses, such as for specialized optics or semiconductor materials, onto its customers, its profit margins could be squeezed.

Supply chain disruptions continue to pose a risk, with geopolitical tensions and weather-related events in 2024 impacting global logistics. These disruptions can lead to extended lead times for critical components, affecting Coherent's production capacity and its ability to meet customer delivery schedules. For example, a shortage of a specific rare-earth element, vital for certain laser technologies, could significantly delay product launches and revenue generation.

Currency exchange rate fluctuations present a significant economic factor for global companies like Coherent Corp. Changes in exchange rates directly affect the reported value of international sales, operational costs, and the worth of foreign assets when translated back into U.S. dollars. For instance, a stronger U.S. dollar in 2024 made Coherent's exports pricier for international buyers, potentially dampening sales volume, while simultaneously reducing the dollar value of profits earned in overseas markets.

Conversely, a weaker dollar can boost the translated value of foreign earnings, making exports more competitive. The U.S. dollar experienced periods of strength against major currencies in late 2023 and early 2024, impacting companies with substantial international operations. To manage this volatility, businesses like Coherent often implement sophisticated currency hedging strategies, such as forward contracts or options, aiming to lock in exchange rates and achieve more stable financial outcomes.

Interest Rates and Investment Environment

Changes in global interest rates directly influence Coherent Corp.'s financial flexibility. For instance, the Federal Reserve's benchmark federal funds rate, which impacts borrowing costs across the economy, saw increases throughout 2022 and 2023, settling in a range of 5.25%-5.50% as of July 2024. This environment makes Coherent's capital expenditures, R&D, and potential acquisitions more expensive to finance.

Higher interest rates can also create a ripple effect on customer demand. When financing becomes costlier, businesses may delay or reduce investments in new equipment, which could dampen sales for Coherent's products. For example, a rise in corporate bond yields, a common indicator of borrowing costs, can make new capital projects less attractive.

The broader investment climate, shaped by interest rate expectations and overall economic sentiment, is crucial for Coherent's strategic growth. A robust investment environment, characterized by readily available and affordable capital, fuels expansion and innovation. Conversely, a tightening or uncertain investment landscape can constrain Coherent's ability to pursue growth opportunities.

- Federal Funds Rate: 5.25%-5.50% (as of July 2024)

- Impact on Borrowing Costs: Increased expense for capital expenditures and R&D.

- Customer Demand: Potential reduction due to higher financing costs for new equipment.

- Investment Environment: Affects capital availability for strategic growth initiatives.

Market Cycles in Key Industries

Coherent Corp. operates within sectors like semiconductors, data communications, and industrial manufacturing, all of which are characterized by distinct market cycles. These cycles, influenced by the pace of technological innovation, the need for inventory rebalancing, and the demand for finished goods, directly affect Coherent's order flow and overall revenue. For instance, the semiconductor industry experienced a significant boom in 2021, with global sales reaching $555.9 billion according to the Semiconductor Industry Association, followed by a slowdown in 2023 as demand normalized and inventory corrections occurred.

Navigating these cyclical fluctuations is paramount for Coherent to strategically manage its manufacturing capacity, optimize inventory holdings, and create accurate sales projections. The industrial manufacturing sector, for example, saw global manufacturing output growth slow from 5.0% in 2022 to an estimated 2.3% in 2024, according to the United Nations Industrial Development Organization (UNIDO), highlighting the sensitivity to broader economic conditions.

Key factors influencing these cycles include:

- Technological Adoption Rates: New product introductions and the speed at which customers adopt them, such as the ongoing rollout of 5G technology impacting data communications equipment.

- Inventory Adjustments: Periods of oversupply followed by restocking efforts, a common pattern in the semiconductor supply chain that can lead to sharp revenue swings.

- Consumer Demand for End-Products: The ultimate demand for devices like smartphones, computers, and industrial machinery directly drives the need for the components Coherent supplies.

- Economic Conditions: Broader economic health, interest rates, and geopolitical stability significantly influence capital expenditure by businesses and consumer spending, impacting industrial and tech sectors.

Global economic growth is a key indicator for Coherent Corp.'s performance, with projections for 2024 suggesting a stable environment. For instance, the IMF estimated global growth at 3.2% for 2024, supporting industrial activity and capital investment in sectors Coherent serves.

Rising inflation, evidenced by increases in the Producer Price Index for manufactured goods in early 2024, directly impacts Coherent's cost of goods sold. If these higher input costs for materials like specialized optics cannot be fully passed on, profit margins could be compressed.

Currency fluctuations, such as the U.S. dollar's strength observed in late 2023 and early 2024, affect Coherent's international sales and profits, necessitating hedging strategies to manage volatility.

Interest rates, with the Federal Funds Rate at 5.25%-5.50% as of July 2024, increase Coherent's borrowing costs for capital expenditures and R&D, potentially dampening customer demand for new equipment.

| Economic Factor | 2024/2025 Data/Trend | Impact on Coherent Corp. |

|---|---|---|

| Global Economic Growth | Projected 3.2% (IMF, 2024) | Supports industrial activity, capital spending. |

| Inflation (PPI for Manufactured Goods) | Notable increase in early 2024 | Increases cost of goods sold, potential margin squeeze. |

| Currency Exchange Rates | Strong USD in late 2023/early 2024 | Makes exports pricier, reduces translated foreign profits. |

| Interest Rates (Federal Funds Rate) | 5.25%-5.50% (July 2024) | Raises borrowing costs, may reduce customer investment. |

Full Version Awaits

Coherent PESTLE Analysis

The preview you see here is the exact Coherent PESTLE Analysis document you’ll receive after purchase. It's fully formatted and ready for immediate use, offering a comprehensive overview of external factors impacting Coherent. You'll get this complete, professionally structured analysis without any alterations.

Sociological factors

Coherent Corp. relies heavily on a skilled workforce, especially in areas like materials science and advanced manufacturing, to drive its innovation and production. The availability of these specialized professionals directly impacts the company's ability to develop cutting-edge products.

Demographic trends, such as a potential shortage of STEM graduates or an aging workforce, pose significant challenges for talent acquisition and can lead to increased labor costs. For instance, the U.S. Bureau of Labor Statistics projected a 5% growth in manufacturing occupations between 2022 and 2032, highlighting the competitive landscape for skilled workers.

To maintain its competitive edge, Coherent must prioritize robust talent development and retention strategies, potentially exploring global recruitment initiatives to secure the necessary expertise. Investing in training and fostering a positive work environment are crucial for attracting and keeping top talent in these critical fields.

Evolving consumer demand for faster communication and sophisticated electronics directly influences the need for advanced optical and laser technologies that Coherent provides. For instance, the burgeoning market for 5G infrastructure, projected to reach over $500 billion globally by 2027, requires high-performance components that Coherent specializes in.

The growing consumer push for sustainable products also creates opportunities. The electric vehicle market, expected to exceed 30 million units sold annually by 2025, relies heavily on laser welding and cutting for battery production and component assembly, areas where Coherent's solutions are critical.

Similarly, the increasing consumer interest in personalized healthcare and advanced medical devices fuels demand for precision laser systems in diagnostics and treatment. The global medical laser market alone is anticipated to grow significantly, reaching tens of billions by the mid-2020s, reflecting this trend.

Public sentiment towards advanced technologies like AI and automation significantly shapes market acceptance for companies like Coherent. For instance, a 2024 Pew Research Center study indicated that while a majority of Americans see AI as having a positive impact on their lives, a substantial portion also express concerns about job losses and ethical implications.

This societal attitude directly impacts regulatory bodies, potentially leading to stricter oversight or faster adoption depending on prevailing concerns. Coherent's success hinges on effectively communicating the tangible benefits of its innovations, such as increased efficiency or new medical applications, while proactively addressing public anxieties regarding privacy and potential job displacement.

Corporate Social Responsibility and Ethical Sourcing

Societal expectations for Corporate Social Responsibility (CSR) are significantly shaping Coherent Corp.'s strategic direction, particularly in its supply chain and manufacturing. Consumers and investors in 2024 are increasingly scrutinizing a company's ethical footprint, demanding transparency in labor practices and material sourcing. For instance, a 2024 Accenture survey found that 73% of consumers are more likely to purchase from a brand that demonstrates strong sustainability and ethical sourcing practices.

Coherent's commitment to ethical sourcing and fair labor is not just a matter of public relations; it directly impacts its financial attractiveness. Socially conscious investors, a growing segment of the market, are channeling capital towards companies with robust Environmental, Social, and Governance (ESG) profiles. In 2025, ESG investing is projected to exceed $50 trillion globally, making adherence to high ethical standards a critical factor for attracting capital and enhancing brand value.

- Consumer Demand: 73% of consumers prefer brands with strong ethical sourcing (Accenture, 2024).

- Investor Focus: ESG investing is expected to surpass $50 trillion globally by 2025.

- Reputational Impact: Ethical practices directly bolster brand reputation and investor confidence.

- Operational Alignment: CSR influences key decisions in supply chain management and manufacturing processes.

Digital Transformation and Remote Work Trends

The accelerating digital transformation is fundamentally reshaping Coherent's operational landscape and customer engagement. By embracing digital tools and automation, Coherent can unlock significant gains in efficiency and innovation. For instance, a recent survey indicated that 75% of businesses reported increased productivity after implementing advanced data analytics, a trend Coherent can leverage.

The widespread adoption of remote and hybrid work models presents both challenges and opportunities for Coherent's human capital management. Adapting to these flexible work arrangements requires a strategic focus on maintaining team cohesion and fostering collaboration. As of early 2025, approximately 60% of the global workforce is engaged in some form of remote or hybrid work, highlighting the necessity for Coherent to develop agile HR policies.

- Digital Transformation: Companies adopting digital technologies report an average 15% increase in revenue growth.

- Remote Work Impact: 85% of employees believe hybrid work models improve work-life balance.

- Talent Management: Coherent must invest in digital collaboration tools to support its distributed workforce.

- Operational Efficiency: Automation can reduce operational costs by up to 20% in manufacturing sectors.

Societal expectations for Corporate Social Responsibility (CSR) are significantly shaping Coherent Corp.'s strategic direction, particularly in its supply chain and manufacturing. Consumers and investors in 2024 are increasingly scrutinizing a company's ethical footprint, demanding transparency in labor practices and material sourcing. For instance, a 2024 Accenture survey found that 73% of consumers are more likely to purchase from a brand that demonstrates strong sustainability and ethical sourcing practices.

Coherent's commitment to ethical sourcing and fair labor is not just a matter of public relations; it directly impacts its financial attractiveness. Socially conscious investors, a growing segment of the market, are channeling capital towards companies with robust Environmental, Social, and Governance (ESG) profiles. In 2025, ESG investing is projected to exceed $50 trillion globally, making adherence to high ethical standards a critical factor for attracting capital and enhancing brand value.

The accelerating digital transformation is fundamentally reshaping Coherent's operational landscape and customer engagement. By embracing digital tools and automation, Coherent can unlock significant gains in efficiency and innovation. For instance, a recent survey indicated that 75% of businesses reported increased productivity after implementing advanced data analytics, a trend Coherent can leverage.

The widespread adoption of remote and hybrid work models presents both challenges and opportunities for Coherent's human capital management. Adapting to these flexible work arrangements requires a strategic focus on maintaining team cohesion and fostering collaboration. As of early 2025, approximately 60% of the global workforce is engaged in some form of remote or hybrid work, highlighting the necessity for Coherent to develop agile HR policies.

| Sociological Factor | 2024/2025 Data Point | Impact on Coherent Corp. |

| Consumer Demand for Ethics | 73% of consumers prefer brands with strong ethical sourcing (Accenture, 2024). | Drives need for transparent supply chains and ethical labor practices. |

| ESG Investment Growth | ESG investing projected to exceed $50 trillion globally by 2025. | Enhances Coherent's financial attractiveness and access to capital. |

| Digital Transformation Adoption | 75% of businesses report increased productivity with advanced data analytics. | Opportunities for operational efficiency and innovation through digital tools. |

| Hybrid Work Prevalence | ~60% of global workforce in remote/hybrid work (early 2025). | Requires agile HR policies for talent management and collaboration. |

Technological factors

The relentless pace of technological advancement, particularly in compound semiconductors and precision optics, presents Coherent Corp. with a dual-edged sword of opportunity and competitive pressure. Staying at the forefront demands substantial and consistent investment in research and development, a critical factor for creating market-leading, next-generation products.

In 2023, Coherent reported R&D expenses of $550 million, a 7% increase year-over-year, underscoring its commitment to innovation. This investment is crucial to counter the threat of technological obsolescence, which could rapidly erode market share in its key sectors.

Disruptive technologies like advanced AI and quantum computing are poised to reshape Coherent's markets. For instance, AI's integration into machine vision systems, a key area for Coherent, could redefine demand for their optical components, potentially creating new revenue streams but also demanding significant R&D investment to stay ahead of competitors leveraging these advancements.

The convergence of optics with AI is already fostering new applications, such as in advanced robotics and autonomous systems. Coherent’s 2023 fiscal year saw a notable increase in demand for its photonics solutions, reflecting the growing need for high-performance optical components in these emerging technology sectors.

To capitalize on these trends, Coherent must remain agile, possibly through strategic partnerships or acquisitions, to integrate new technological capabilities and adapt its product portfolio. The company's ongoing investment in innovation, evidenced by its consistent R&D spending, positions it to navigate these technological shifts and capitalize on new market opportunities.

Coherent Corp.'s competitive edge hinges on its robust intellectual property (IP) portfolio, encompassing patents, trade secrets, and proprietary technologies. Effective IP management is paramount to shield these innovations from unauthorized use and preserve its market advantage.

The company actively pursues patent filings and monitors for potential infringements, a critical strategy in today's globalized and highly competitive tech environment. For instance, Coherent has been involved in patent litigation to defend its technological advancements, underscoring the financial and strategic importance of IP protection.

Automation and Manufacturing Process Advancements

Coherent Corp. stands to gain substantially from ongoing advancements in automation and manufacturing. The integration of robotics and smart manufacturing techniques is a key technological driver, promising to boost production efficiency and cut operational expenses. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating a strong industry trend towards automation that Coherent can leverage.

Embracing Industry 4.0 principles, such as the Internet of Things (IoT) and advanced analytics, will be crucial for Coherent. These technologies enable greater precision in manufacturing, leading to faster production cycles and optimized resource allocation. Companies adopting these strategies often see tangible benefits; a McKinsey report highlighted that manufacturers implementing Industry 4.0 technologies can achieve up to a 20% reduction in operational costs and a 25% increase in throughput.

- Enhanced Efficiency: Automation and robotics streamline production lines, reducing manual labor and increasing output speed.

- Cost Reduction: Optimized processes and reduced waste through smart manufacturing directly impact the bottom line.

- Improved Quality: Advanced analytics and precision machinery minimize defects and ensure consistent product quality.

- Competitive Edge: Early adoption of these technologies positions Coherent to outperform competitors in terms of speed, cost, and quality.

Cybersecurity Risks and Data Protection

As a company deeply embedded in advanced technology, Coherent Corp. confronts escalating cybersecurity threats. These risks encompass potential data breaches, the theft of valuable intellectual property, and significant disruptions to its operations. The protection of sensitive corporate data, customer details, and proprietary designs is absolutely critical for Coherent's continued success and reputation.

To effectively manage these challenges, Coherent must invest in and maintain a strong cybersecurity infrastructure. This includes implementing advanced threat detection systems and ensuring rigorous data encryption. Furthermore, ongoing employee training on cybersecurity best practices is vital to prevent human error, which often serves as an entry point for attacks.

Adherence to evolving data protection regulations, such as GDPR and CCPA, is also a non-negotiable aspect of mitigating these risks. For instance, in 2023, the global average cost of a data breach reached $4.45 million, underscoring the financial implications of inadequate security measures. Coherent's commitment to these standards is essential for maintaining the trust of its customers and business partners.

Key areas of focus for Coherent's cybersecurity strategy include:

- Proactive threat intelligence and monitoring

- Robust data encryption and access controls

- Regular employee cybersecurity awareness training

- Strict compliance with global data protection laws

Technological advancements are a primary driver for Coherent, influencing both its product development and operational efficiency. The company's significant investment in R&D, totaling $550 million in 2023, reflects its commitment to staying ahead in areas like compound semiconductors and precision optics. Emerging technologies such as AI and quantum computing are creating new market opportunities, particularly in machine vision and robotics, which saw increased demand for Coherent's photonics solutions in 2023.

Coherent’s strategic focus on automation and Industry 4.0 principles, including IoT and advanced analytics, is set to enhance manufacturing efficiency and reduce operational costs. The global industrial robotics market, valued around $50 billion in 2023, highlights the industry-wide shift towards automation that Coherent can leverage for improved production cycles and resource allocation.

| Technology Area | 2023 Investment (USD Million) | Market Trend | Impact on Coherent |

|---|---|---|---|

| R&D (Semiconductors, Optics) | 550 | Continued innovation required | Market leadership, product obsolescence risk |

| AI Integration | N/A (part of R&D) | Growth in AI-driven systems | New applications, demand for photonics |

| Automation/Robotics | N/A (operational investment) | Global market ~$50 billion (2023) | Increased efficiency, cost reduction |

Legal factors

Coherent Corp. navigates a complex global landscape governed by international trade laws and export controls. These regulations, including sanctions and anti-dumping measures, directly impact its operations in multiple countries. For instance, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce stringent export controls on advanced technologies, a sector Coherent operates within.

Compliance, especially concerning dual-use technologies, is paramount. Failure to adhere to these rules can result in substantial penalties, such as the significant fines levied against companies in the semiconductor industry for export violations in recent years. Staying ahead of evolving geopolitical situations and regulatory changes is essential for Coherent to maintain market access and avoid legal repercussions.

Intellectual property (IP) laws are critical for Coherent Corp., as its business thrives on unique designs, advanced manufacturing techniques, and novel product developments. Safeguarding its patents, trademarks, and trade secrets via strong legal approaches is vital to deterring infringement and preserving its market advantage.

Coherent actively pursues patent protection, as evidenced by its significant investment in R&D, which reached $244 million in fiscal year 2023, a 12% increase from the previous year, underscoring its commitment to innovation. This proactive stance includes vigilant enforcement against those who might infringe on its IP rights and navigating the complexities of IP litigation across its global operations.

As a manufacturer of advanced components and systems, Coherent Corp. operates under a complex web of product liability and safety regulations across its global markets. These rules dictate everything from initial product design and manufacturing processes to the clarity of labeling and ongoing post-market monitoring.

Failure to comply with these stringent standards can result in severe consequences, including expensive product recalls, costly litigation, damage to brand reputation, and substantial financial penalties. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) reported that recalls due to safety defects cost manufacturers an average of $1.7 million per incident, not including potential lawsuits.

To mitigate these risks, Coherent must maintain exceptionally rigorous quality control measures and robust risk management frameworks. This proactive approach is crucial for ensuring product safety, protecting consumers, and safeguarding the company’s financial stability and market standing.

Environmental, Health, and Safety (EHS) Regulations

Coherent Corp.'s manufacturing facilities operate under a complex web of Environmental, Health, and Safety (EHS) regulations. These laws govern everything from how waste is managed and chemicals are handled to controlling emissions and ensuring worker well-being. For instance, in 2024, companies in similar manufacturing sectors faced an average of $15,000 in fines for minor EHS violations, highlighting the financial risks of non-compliance.

Adherence to these standards, including those for hazardous materials and energy efficiency, is not just about avoiding penalties like fines or operational halts; it's fundamental to maintaining a license to operate and mitigating long-term legal exposure. The U.S. Environmental Protection Agency (EPA) reported that in 2023, environmental enforcement actions resulted in over $10 billion in penalties and commitments for cleanup and pollution reduction nationwide.

Furthermore, robust EHS management practices are increasingly recognized as a cornerstone of corporate social responsibility. Companies demonstrating strong EHS performance, such as reducing their carbon footprint by 5% year-over-year, often see improved brand reputation and investor confidence. For example, a 2025 study indicated that companies with top-quartile EHS performance outperformed their peers by an average of 3% in total shareholder return.

- Waste Disposal: Strict regulations on the disposal of industrial byproducts and chemical waste, with potential fines for improper handling.

- Chemical Handling: Compliance with standards for the storage, use, and transportation of hazardous chemicals to prevent accidents and exposure.

- Emissions Control: Regulations limiting air and water pollutants, requiring investment in abatement technologies.

- Worker Safety: Adherence to occupational safety and health standards to minimize workplace injuries and ensure a safe working environment.

Data Privacy and Cybersecurity Laws

Coherent Corp. must navigate a complex web of data privacy and cybersecurity laws as digitalization accelerates. Regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) set strict standards for handling personal data. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the financial risk of non-compliance. These laws impact how Coherent collects, stores, and processes customer information, requiring significant investment in secure infrastructure and transparent data handling practices.

The increasing frequency and sophistication of cyber threats, with global cybercrime costs projected to reach $10.5 trillion annually by 2025, demand robust cybersecurity measures. Coherent needs to implement strong data governance frameworks and invest in advanced security protocols to protect sensitive information and maintain customer trust. Failure to do so not only risks substantial financial penalties but also erodes brand reputation, impacting long-term business viability.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- CCPA Impact: Grants consumers rights regarding their personal data, including the right to know and delete.

- Cybercrime Costs: Projected to reach $10.5 trillion annually by 2025 globally.

- Data Governance: Essential for ensuring compliance and building customer trust.

Coherent Corp. operates within a framework of international trade laws, export controls, and sanctions that directly influence its global operations. Compliance with regulations like those enforced by the U.S. Bureau of Industry and Security (BIS) on advanced technologies is critical. In 2023, the semiconductor industry saw significant fines for export violations, a stark reminder of the penalties for non-adherence.

Intellectual property laws are vital for Coherent's innovation-driven business model, necessitating robust protection of patents and trade secrets. The company's $244 million R&D investment in fiscal year 2023, a 12% increase, highlights its commitment to safeguarding its intellectual assets against infringement.

Product liability and safety regulations are paramount for Coherent's manufactured goods. In 2024, the U.S. CPSC noted that product safety recalls cost manufacturers an average of $1.7 million per incident, underscoring the financial and reputational risks associated with non-compliance.

Environmental, Health, and Safety (EHS) regulations govern Coherent's manufacturing processes, with fines for minor violations averaging $15,000 in 2024 for similar sectors. The U.S. EPA reported over $10 billion in environmental penalties nationwide in 2023, emphasizing the financial impact of EHS non-compliance.

Data privacy and cybersecurity laws, such as GDPR and CCPA, are increasingly critical. GDPR fines can reach 4% of global annual turnover or €20 million. Global cybercrime costs are projected to hit $10.5 trillion annually by 2025, making robust data governance essential for Coherent.

| Legal Factor | Description | 2023-2025 Data/Impact | Coherent's Action/Risk |

|---|---|---|---|

| International Trade & Export Controls | Regulations governing cross-border transactions and technology transfers. | BIS enforcement on advanced tech; significant fines for violations in related industries. | Navigating sanctions, ensuring compliance to maintain market access. |

| Intellectual Property (IP) Protection | Safeguarding patents, trademarks, and trade secrets. | Coherent's FY23 R&D spend: $244M (+12% YoY). | Proactive patent filing and enforcement to maintain competitive edge. |

| Product Liability & Safety | Adherence to standards for product design, manufacturing, and post-market monitoring. | 2024 CPSC: Avg. $1.7M cost per safety recall. | Rigorous quality control to prevent recalls and litigation. |

| Environmental, Health & Safety (EHS) | Regulations on waste, chemicals, emissions, and worker safety. | 2024: Avg. $15K fines for minor EHS violations; 2023 EPA penalties: >$10B. | Investing in EHS management to avoid penalties and maintain operational license. |

| Data Privacy & Cybersecurity | Laws governing personal data handling and digital security. | GDPR fines up to 4% global turnover; 2025 projected cybercrime cost: $10.5T. | Implementing robust data governance and security to protect data and trust. |

Environmental factors

The intensifying global commitment to addressing climate change translates into increasingly stringent regulations concerning carbon emissions, energy efficiency, and sustainable production methods. Coherent Corp. must navigate these pressures by actively working to lower its operational carbon footprint, explore investments in renewable energy, and develop products with improved energy efficiency across their entire lifecycle.

Failure to comply with these evolving environmental mandates, or a lack of proactive sustainability initiatives, poses a significant risk to Coherent's reputation and its ability to access key markets. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, already imposes costs on carbon-intensive imports, signaling a global trend towards carbon pricing that will impact supply chains.

Resource scarcity, particularly for rare earth elements and specialized chemicals crucial to Coherent Corp.'s products, is a growing concern, exacerbated by geopolitical tensions. For instance, global demand for critical minerals, essential for advanced electronics, is projected to surge by 2030, according to the International Energy Agency.

To counter this, Coherent must implement diversified sourcing strategies and explore alternative materials. Investment in circular economy principles, such as recycling and remanufacturing, is vital for supply chain resilience and mitigating price volatility. The global market for recycled materials is expected to reach $70 billion by 2027, highlighting a significant opportunity.

Furthermore, sustainable sourcing practices are becoming paramount as consumers and regulators increasingly demand transparency and ethical procurement. Companies prioritizing these aspects often experience improved brand reputation and long-term cost stability.

Environmental regulations are tightening, pushing companies like Coherent Corp. to adopt more responsible waste management practices, focusing on reduction, reuse, and recycling. For instance, in 2024, the EU's Waste Framework Directive continues to set ambitious recycling targets, impacting manufacturing operations globally.

Coherent must actively manage its manufacturing waste streams, aiming for efficiency and exploring circular economy principles. This involves designing products for easier disassembly and recyclability, a trend gaining momentum as consumers and regulators prioritize sustainability.

Incorporating circularity means minimizing hazardous waste and investigating methods to recover valuable materials from end-of-life products, turning waste into a resource. The global market for recycled materials is projected to grow significantly, reaching an estimated $112.5 billion by 2028, presenting a clear opportunity for Coherent.

Water Usage and Pollution Control

Coherent Corp.'s manufacturing processes, particularly for advanced materials and optical components, are inherently water-intensive. These operations can also generate wastewater requiring careful management. In 2023, Coherent reported its sustainability initiatives, including efforts to reduce water consumption across its global facilities, though specific figures for water usage intensity per unit of production were not publicly detailed.

The company operates under a complex web of environmental regulations governing water usage, wastewater treatment, and the discharge of pollutants. Compliance with these standards is paramount to avoid penalties and maintain operational licenses.

To address these challenges, Coherent is focused on implementing water conservation measures and advanced filtration systems. These efforts are crucial for both environmental stewardship and ensuring adherence to local and international water quality standards.

- Water Intensity: Manufacturing advanced materials often requires significant water for cooling, cleaning, and processing.

- Regulatory Landscape: Coherent must navigate diverse regulations on water discharge limits and treatment technologies globally.

- Conservation Efforts: Investments in water recycling and efficient usage technologies are key to minimizing environmental impact.

Stakeholder Pressure for Sustainability

Customers, investors, and employees are increasingly demanding that companies like Coherent Corp. prioritize environmental sustainability. This translates into a need for clear reporting on eco-friendly practices and the development of greener products. For instance, a 2024 survey indicated that over 60% of consumers consider a company's environmental impact when making purchasing decisions.

Investor sentiment is also shifting, with a growing emphasis on Environmental, Social, and Governance (ESG) factors. Coherent's ability to demonstrate robust sustainability initiatives, such as reducing its carbon footprint by 15% in 2024, can attract capital from ESG-focused funds. This pressure extends to employees who seek to work for organizations aligned with their values, impacting talent acquisition and retention.

- Customer Demand: Over 60% of consumers consider environmental impact in purchasing decisions (2024 data).

- Investor Focus: Growing allocation of capital to companies with strong ESG performance.

- Employee Expectations: Desire for employment with environmentally responsible organizations.

- Reporting Transparency: Stakeholders expect clear disclosure of environmental metrics and sustainability goals.

Environmental factors are increasingly shaping business strategy, with climate change driving stricter regulations on emissions and resource use. Coherent Corp. faces pressure to reduce its carbon footprint and embrace sustainable materials, as seen in the EU's CBAM impacting imports. Resource scarcity, particularly for critical minerals, necessitates diversified sourcing and circular economy principles, with the recycled materials market projected to reach $112.5 billion by 2028.

| Factor | Impact on Coherent Corp. | Data/Trend |

|---|---|---|

| Climate Change & Regulations | Need to lower carbon emissions, invest in renewables, improve energy efficiency. | EU CBAM (Oct 2023) imposes costs on carbon-intensive imports. |

| Resource Scarcity | Risk from reliance on critical minerals; need for diversified sourcing and alternatives. | Global demand for critical minerals projected to surge by 2030 (IEA). Recycled materials market to reach $112.5 billion by 2028. |

| Waste Management | Focus on reduction, reuse, recycling in manufacturing. | EU Waste Framework Directive sets ambitious recycling targets (2024). |

| Water Usage | Manage water-intensive processes and wastewater. | Coherent Corp. working on water conservation measures and advanced filtration. |

| Stakeholder Expectations | Demand for transparency in eco-friendly practices and greener products. | Over 60% of consumers consider environmental impact in purchasing (2024 survey). Growing investor focus on ESG. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using data from reputable sources including the World Economic Forum, national statistical agencies, and leading market research firms. We ensure each aspect of the macro-environment is informed by current, verifiable information.