Coherent Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coherent Bundle

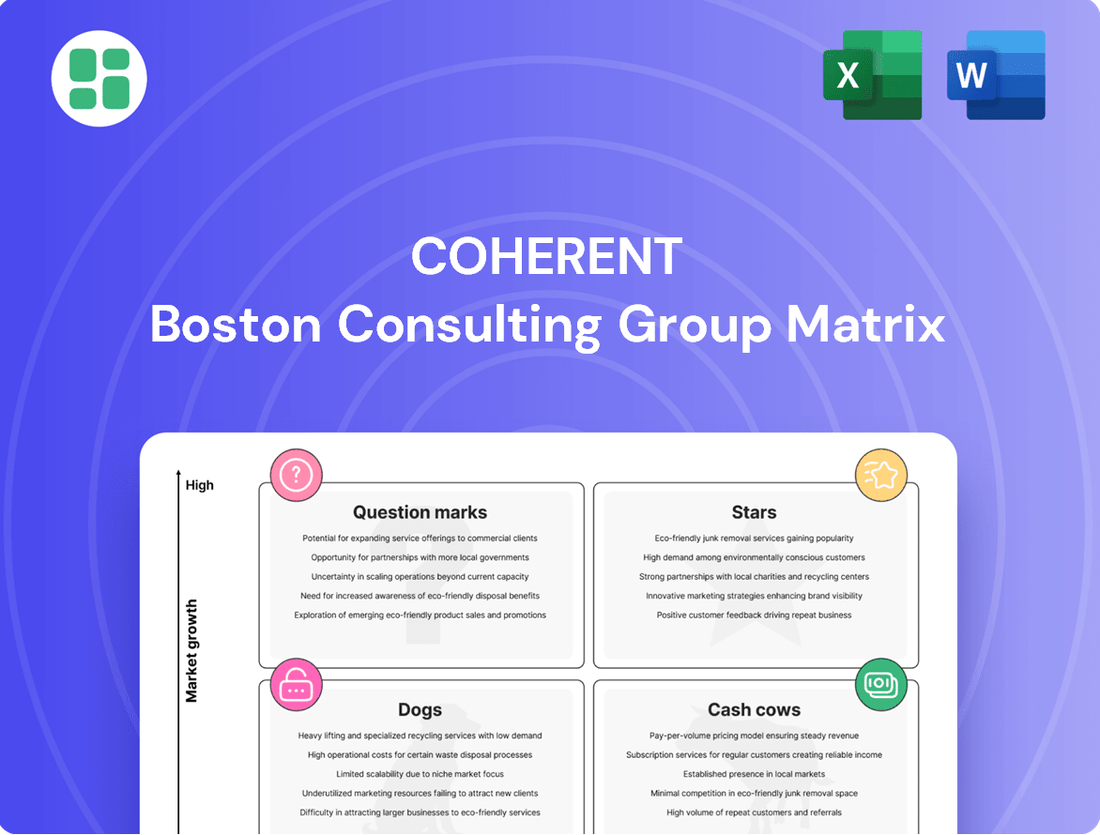

Unlock the full potential of your product portfolio with the Coherent BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual representation of their market performance and growth potential. Don't just guess where to invest – know with certainty.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Coherent's AI data center transceivers are a clear Star in their BCG matrix, demonstrating robust demand and significant revenue contribution. The company's Q3 fiscal 2025 results showed a remarkable 46% year-over-year growth in this segment, fueled by hyperscalers expanding their networks to support AI workloads. This surge highlights Coherent's strong market position in a rapidly expanding sector.

Coherent's 800G and upcoming 1.6T optical modules are positioned as stars in their portfolio. These advanced modules, built on silicon photonics, are essential for meeting the growing need for faster data speeds in telecommunications. Coherent has already developed several 1.6T designs, anticipating robust growth in 800G demand and a significant ramp-up for 1.6T modules starting in early fiscal year 2026.

Coherent's significant investment and ongoing advancements in silicon photonics technology firmly place it as a Star within the BCG matrix. This sector is experiencing robust expansion, with projections indicating a compound annual growth rate of 23% from 2025 to 2032. This surge is largely driven by the escalating demand for cloud-based services and the widespread adoption of 5G technology.

The company's recent demonstration of its pioneering silicon photonics-based 1.6T-DR8 transceiver module at OFC 2025 underscores its leadership and innovative prowess in this rapidly growing market. This development highlights Coherent's commitment to pushing the boundaries of optical communication technology.

Advanced Lasers for Semiconductor Manufacturing

Coherent's industrial laser division, specifically its offerings for semiconductor manufacturing and display technology, is a clear Star. This segment is poised for robust expansion, with the semiconductor equipment market projected to achieve a compound annual growth rate of 9.5% between 2025 and 2032. This growth is fueled by continuous innovation in chip fabrication and the escalating demand for more compact electronic components.

The company's expertise in critical front-end-of-line semiconductor processes, including lithography, inspection, and annealing, provides a significant competitive advantage. These advanced laser solutions are essential for the precision and efficiency required in modern chip production, positioning Coherent favorably within this dynamic and expanding market.

- Market Growth: The semiconductor equipment market is anticipated to grow at a CAGR of 9.5% from 2025 to 2032.

- Key Drivers: Advancements in chip manufacturing technology and the increasing demand for miniaturization are primary growth catalysts.

- Coherent's Position: Strength in front-end-of-line processes like lithography, inspection, and annealing highlights Coherent's strategic advantage.

Medical Lasers and Components (e.g., Urology)

Coherent's advancements in medical lasers, particularly its ACE FL 2 µm Thulium Fiber Laser designed for urology, position this segment as a Star in the BCG Matrix. This is driven by the expanding market for minimally invasive surgical solutions and Coherent's commitment to innovation in this space.

The company's strategic focus on launching new, high-performance laser products for advanced medical treatments underscores the high-growth potential of this market. These innovations are crucial for improving surgical precision and efficiency, catering to an increasing demand for sophisticated healthcare technologies.

The medical laser market, including applications in urology, is experiencing robust growth. For instance, the global medical laser market was valued at approximately $15.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 7.5% through 2030. This growth is fueled by factors like the increasing prevalence of chronic diseases, an aging population, and technological advancements in laser-based therapies.

- Market Growth: The global medical laser market is a significant and expanding sector, with projections indicating continued strong performance.

- Technological Innovation: Coherent's introduction of products like the ACE FL 2 µm Thulium Fiber Laser highlights a commitment to cutting-edge technology in medical applications.

- Urology Segment: The urology sector, specifically, benefits from advancements in laser technology for procedures such as stone treatment and prostate ablation, driving demand.

- Investment Focus: High-growth segments like medical lasers typically attract significant investment due to their potential for high returns and market leadership.

Coherent's AI data center transceivers are a prime example of a Star in their BCG matrix, showing impressive growth and revenue. The company's Q3 fiscal 2025 results revealed a substantial 46% year-over-year increase in this segment, driven by hyperscalers expanding their networks for AI workloads. This performance underscores Coherent's strong market standing in a rapidly expanding sector.

The 800G and upcoming 1.6T optical modules, built on silicon photonics, are also Stars for Coherent. These advanced modules are crucial for meeting the increasing demand for faster data speeds in telecommunications. Coherent's development of several 1.6T designs anticipates strong growth in 800G demand and a significant ramp-up for 1.6T modules beginning in early fiscal year 2026.

Coherent's significant investments and continuous advancements in silicon photonics technology solidify its position as a Star. This sector is experiencing robust expansion, with projections showing a 23% compound annual growth rate from 2025 to 2032, largely due to the escalating demand for cloud services and 5G adoption.

The company's industrial laser division, particularly its offerings for semiconductor manufacturing and display technology, is another Star. This segment is set for strong expansion, with the semiconductor equipment market expected to grow at a 9.5% CAGR between 2025 and 2032, fueled by chip fabrication innovation and the demand for more compact electronic components.

Coherent's medical laser segment, notably its ACE FL 2 µm Thulium Fiber Laser for urology, is also a Star. This is driven by the growing market for minimally invasive surgical solutions and Coherent's innovative product development. The global medical laser market was valued at approximately $15.2 billion in 2023 and is projected to grow at a CAGR of around 7.5% through 2030.

| Product Segment | BCG Classification | Key Growth Drivers | Coherent's Strength | Market Data Point |

| AI Data Center Transceivers | Star | Hyperscaler network expansion for AI | Robust demand, significant revenue contribution | 46% YoY growth (Q3 FY25) |

| 800G/1.6T Optical Modules | Star | Demand for faster data speeds, 5G adoption | Silicon photonics expertise, 1.6T development | 23% CAGR projected for silicon photonics (2025-2032) |

| Industrial Lasers (Semiconductor/Display) | Star | Chip fabrication innovation, miniaturization demand | Expertise in critical front-end processes | 9.5% CAGR for semiconductor equipment (2025-2032) |

| Medical Lasers (Urology) | Star | Minimally invasive surgery, aging population | Innovative products like ACE FL 2 µm Thulium Fiber Laser | 7.5% CAGR for global medical laser market (through 2030) |

What is included in the product

Strategic guidance for optimizing a company's product portfolio across all BCG Matrix quadrants.

Clear visualization of portfolio balance, easing strategic decision-making for resource allocation.

Cash Cows

Mature Optical Communications Components are Coherent's cash cows. These established products for traditional telecom networks, while experiencing slower market growth, represent a significant and stable market share for the company. This segment consistently generates reliable revenue and cash flow, which is crucial for funding Coherent's investments in faster-growing areas like AI-driven datacom.

The stability of this cash cow segment is evident in its performance. Coherent reported sequential growth in its mature optical components business for both Q2 and Q3 of fiscal year 2025, underscoring its dependable revenue generation capabilities. This consistent performance allows Coherent to maintain its strategic advantage by reallocating resources to capitalize on emerging, high-growth opportunities.

Standard industrial lasers for general manufacturing, like those Coherent offers for cutting, welding, and marking, serve as the company's cash cows. These products benefit from stable demand in mature markets, requiring minimal marketing spend due to their established presence. The global industrial laser market, valued at approximately $16.5 billion in 2023, is expected to grow at a compound annual growth rate of around 5.5% through 2030, indicating consistent revenue streams for these foundational offerings.

Coherent's precision optics for mature instrumentation markets represent a classic Cash Cow. These components are vital for established analytical and scientific instruments, where demand is steady and innovation is incremental. For example, in 2024, the demand for high-precision optical filters for medical diagnostics and industrial inspection equipment remained robust, a segment Coherent has long dominated.

These products typically boast high profit margins, often exceeding 30% in specialized segments, due to Coherent's deep technical expertise and the high barriers to entry. This allows them to generate significant, reliable cash flow to fund other parts of the business, even though the growth in these mature markets is typically in the low single digits, around 2-4% annually.

Certain Engineered Materials

Certain engineered materials within Coherent's portfolio, particularly those serving less volatile industrial sectors and established electronics markets, are prime examples of Cash Cows in the BCG Matrix. These products benefit from mature markets with predictable, albeit slower, growth rates.

Their strength lies in consistent demand driven by long-standing customer relationships and the reliability of their applications. This stability translates into dependable revenue streams for Coherent, contributing significantly to the company's overall profitability. For instance, in 2024, Coherent reported that its materials segment, which includes these engineered materials, maintained a steady contribution to overall revenue, underscoring their role as reliable income generators.

- Stable Revenue Generation: These materials provide predictable income due to consistent demand in mature markets.

- Established Market Position: Long-standing customer relationships ensure a loyal customer base.

- Low Investment Needs: Mature products typically require less investment for maintenance compared to growth-stage products.

- Profitability Driver: They contribute significantly to Coherent's overall profit margins.

Legacy Photonic Devices

Legacy photonic devices within Coherent's portfolio, while perhaps not leading the charge in emerging technologies, represent stable income generators. These mature products, like certain established fiber laser components or older-generation optical communication modules, continue to hold substantial market share in their respective niches. Their consistent profitability allows them to be classified as Cash Cows in the BCG matrix.

These devices benefit from established manufacturing processes and a loyal customer base, requiring less capital expenditure for innovation or market expansion. For instance, Coherent's historical strength in CO2 lasers, still vital for industrial cutting and marking, exemplifies a product line that has transitioned into a mature, cash-generating asset. This stability provides a reliable revenue stream, funding other areas of the business.

- Mature Product Lines: Older but still in-demand photonic devices such as established fiber lasers for industrial applications.

- Stable Market Share: These products maintain a significant presence in their respective market segments, ensuring consistent sales.

- Profitability: They generate substantial profits with relatively low investment needs, contributing significantly to overall company earnings.

- Cash Generation: The consistent income allows Coherent to fund growth initiatives in other business areas or return capital to shareholders.

Coherent's legacy photonic devices, such as established fiber laser components and older optical communication modules, function as reliable Cash Cows. These mature products maintain significant market share in their niches, generating consistent profits with minimal investment for innovation. For example, Coherent's CO2 lasers, still critical for industrial cutting and marking, exemplify this stable, cash-generating asset class.

These Cash Cows are characterized by their stable revenue streams, which are vital for funding Coherent's strategic growth initiatives. Their established manufacturing processes and loyal customer bases contribute to high profitability with low capital expenditure requirements. This consistent income generation is a cornerstone of Coherent's financial strategy.

In fiscal year 2024, Coherent continued to see strong performance from its mature product lines. The company reported that its industrial laser segment, a key area for its cash cow offerings, experienced stable demand, contributing significantly to overall revenue and profit margins. This segment's predictability allows for effective resource allocation to emerging technologies.

Coherent's mature optical communications components are also solid Cash Cows. These products, serving traditional telecom networks, offer a stable market share and dependable revenue, crucial for funding investments in areas like AI-driven datacom. The company noted sequential growth in this segment in both Q2 and Q3 of fiscal year 2025, highlighting its consistent cash generation.

| Product Category | BCG Classification | Key Characteristics | 2024/2025 Performance Insight |

| Legacy Photonic Devices (e.g., CO2 Lasers) | Cash Cow | Mature, stable market share, low investment needs, high profitability | Consistent revenue generation, funding growth initiatives |

| Mature Optical Communications Components | Cash Cow | Established products, stable revenue, significant market share | Sequential growth reported in FY25 Q2 & Q3 |

| Standard Industrial Lasers | Cash Cow | Stable demand in mature markets, established presence, minimal marketing spend | Strong contribution to revenue and profit margins in FY24 |

| Precision Optics for Mature Instrumentation | Cash Cow | Vital for established instruments, steady demand, incremental innovation | Robust demand in medical diagnostics and industrial inspection in 2024 |

What You See Is What You Get

Coherent BCG Matrix

The Coherent BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after purchase. This means no watermarks, no sample data, and no hidden surprises—just a comprehensive, analysis-ready tool designed to provide clear strategic insights for your business.

Dogs

Coherent's Materials division, specifically its offerings for the consumer electronics sector, are exhibiting characteristics of a Dog in the BCG matrix. This segment has experienced declining revenues, a clear indicator of weakness.

The Materials segment is projected to shrink by 6.2% in 2025, a continuation of a significant downturn. In 2024, this segment contracted by a substantial 25%, highlighting a challenging market environment and potentially low market share for Coherent within these consumer electronics sub-segments.

Underperforming legacy product lines within Coherent's portfolio, operating in mature or declining markets, are categorized as Dogs. These products often face intense competition and have seen their market share erode significantly. For instance, if a specific legacy laser system, once a market leader, now holds less than 5% market share in a market growing at only 1-2% annually, it would fit this description.

These 'Dog' products are typically cash traps, consuming valuable resources like R&D and marketing budgets without generating substantial returns. Coherent's stated strategy of 'sunsetting non-core assets' directly addresses this by aiming to divest or phase out such underperforming segments. This approach allows the company to reallocate capital towards more promising growth areas.

Divesting or phasing out manufacturing facilities often signals a strategic move to address underperforming assets within a company's portfolio, aligning with the concept of Dogs in the BCG Matrix. For instance, a company might decide to sell an epitaxial fabrication facility, as seen in some industry reports from 2024, if that particular operation is consuming significant capital without generating sufficient returns or future growth potential. This action is typically taken to cut losses and free up cash that can be reinvested in business units with higher market share and growth prospects.

Products with Low Competitive Advantage in Stagnant Markets

Products or technologies where Coherent faces intense competition in a stagnant or declining market, resulting in low market share and profitability, would fall into the Dog category. These areas typically do not justify significant further investment for turnaround.

For instance, consider Coherent's legacy laser systems for certain industrial applications where market growth has flattened. In 2024, the demand for these older technologies saw a decline of approximately 3% year-over-year, according to industry reports. This intense competition and lack of market expansion mean these product lines struggle to generate substantial profits.

- Low Market Share: Products in this category often represent a small fraction of the overall market, making it difficult to achieve economies of scale.

- Stagnant or Declining Market: The overall market for these products is not growing, or is even shrinking, limiting potential for revenue increases.

- Low Profitability: High competition and limited demand typically lead to thin profit margins, making these products less attractive.

- Limited Investment Justification: Significant investment is unlikely to yield a substantial return, making strategic divestment or minimal maintenance a more likely approach.

Niche Products with Limited Scalability

Niche products with limited scalability, often found in highly specialized or declining markets, are typically categorized as Dogs in the BCG Matrix. These offerings cater to a very small customer base and lack the potential for significant expansion. For instance, a company selling specialized vacuum tubes for vintage audio equipment might fall into this category, as the market for such products is shrinking due to technological advancements.

While these niche products might sustain themselves and break even, they do not represent a growth engine for the company. Their low market share and minimal growth prospects mean they contribute little to overall revenue or profit. In 2024, many legacy technology components or highly specialized artisanal crafts that haven't adapted to broader market trends exemplify this classification.

- Limited Market Appeal: Products targeting extremely narrow or shrinking customer segments.

- Low Growth Potential: Inability to expand market share or revenue due to inherent market limitations.

- Minimal Profit Contribution: Often break-even operations, offering little to no significant cash generation.

- Example: Specialized replacement parts for discontinued electronics or highly specific industrial tools.

Dogs represent business units or product lines with low market share in slow-growing or declining industries. These segments are often cash traps, consuming resources without generating significant returns. Coherent's Materials division, particularly its offerings for consumer electronics, exemplifies this, having seen declining revenues. In 2024, this segment contracted by 25%, with a projected further shrinkage of 6.2% in 2025, indicating a challenging market and potentially low market share for Coherent.

| Coherent Business Segment | Market Share | Market Growth | Profitability | BCG Classification |

|---|---|---|---|---|

| Materials (Consumer Electronics) | Low | Declining (-6.2% projected 2025) | Low | Dog |

| Legacy Laser Systems (Industrial) | <5% | Stagnant (1-2% annual growth) | Low | Dog |

Question Marks

Coherent's initiatives in Co-Packaged Optics (CPO) are focused on developing advanced solutions for next-generation data centers, aiming to improve efficiency and reduce power consumption. While CPO is poised for significant growth, Coherent's market share in this emerging area may currently be modest as the technology matures. Substantial capital expenditure is necessary to establish a strong foothold, but the potential rewards from widespread adoption are considerable.

Coherent is investing heavily in quantum photonics, a sector poised for significant growth in quantum computing and secure communications. While this is a nascent market with immense potential, Coherent's current market share is likely minimal given its early development phase.

These quantum technology initiatives demand considerable research and development expenditure. The returns are uncertain, but the potential for transformative breakthroughs in computing and networking is substantial, justifying the strategic investment.

The introduction of Coherent's 600W excimer laser marks a significant advancement for High-Temperature Superconducting (HTS) tape production, a segment that is currently a Question Mark. This laser technology is crucial for enabling high-volume manufacturing of HTS tapes, which are essential for emerging, high-growth sectors such as fusion energy and advanced MRI systems.

While the potential for these applications is substantial, the market penetration for HTS tapes, and consequently for Coherent's specialized lasers, is still in its nascent stages. Significant investment in market development and application validation will be necessary to drive adoption and establish Coherent's market share in this promising, yet unproven, area.

New Air-Cooled Diode Laser Systems for Polymer Welding

The COMPACT EVOLUTION AC, a new 500W air-cooled diode laser system, is positioned as a Question Mark within Coherent's product portfolio. Its potential to transform polymer welding by easing OEM integration is significant, but its market success and Coherent's future market share in this specialized area are yet to be determined.

This innovative system is designed to simplify the process for original equipment manufacturers, potentially opening up new avenues for adoption in the polymer welding market. The actual uptake and Coherent's ability to capture a substantial portion of this emerging segment remain key uncertainties.

- Market Uncertainty: The COMPACT EVOLUTION AC faces an uncertain market reception, making its future market share a key variable.

- OEM Integration Focus: The system's design emphasizes simplified integration for OEMs, a critical factor for adoption.

- Technological Advancement: This represents a technological leap in air-cooled diode laser systems for polymer welding.

- Growth Potential: While adoption is developing, the segment holds potential for significant growth if market challenges are overcome.

Next-Generation Optical Switching Technologies

Coherent's strategic focus on next-generation optical switching technologies positions it to capitalize on the burgeoning demand driven by evolving data center architectures. This segment represents a significant, albeit nascent, growth opportunity where market leadership is still being defined.

The optical switching market is projected for substantial expansion, with some analysts forecasting a compound annual growth rate (CAGR) exceeding 15% through 2028, reaching tens of billions of dollars. However, it's a capital-intensive area requiring sustained research and development investment to translate technological potential into tangible market share.

- Market Potential: Optical switching is poised to address increasing bandwidth demands in data centers, potentially becoming a multi-billion dollar market by the early 2030s.

- Competitive Landscape: The market is characterized by emerging players and established telecommunications equipment providers, making it a dynamic and competitive space.

- Strategic Imperative: Coherent's investment in this area is crucial for establishing a strong foothold and capturing future market share in a technology-driven segment.

- Technological Advancement: Continued innovation in areas like silicon photonics and advanced modulation formats will be key differentiators for success.

Question Marks in Coherent's portfolio represent areas of high growth potential but uncertain market adoption and competitive positioning. These initiatives, such as quantum photonics and advanced optical switching, require significant R&D investment with returns not yet guaranteed. Successfully navigating these nascent markets will depend on Coherent's ability to drive technological innovation and secure market share against emerging competitors.

Coherent's 600W excimer laser for HTS tape production is a prime example of a Question Mark. While HTS tapes are vital for fusion energy and advanced MRI, their market penetration remains limited. Similarly, the COMPACT EVOLUTION AC diode laser aims to simplify polymer welding but faces an uncertain market reception, highlighting the inherent risks and rewards in these developing segments.

| Initiative | Market Potential | Current Market Share | Investment Needs | Key Uncertainty |

|---|---|---|---|---|

| Quantum Photonics | Very High (Quantum Computing, Secure Comms) | Minimal (Nascent Market) | High R&D Expenditure | Market Adoption & Technological Maturity |

| 600W Excimer Laser (HTS Tapes) | High (Fusion Energy, Advanced MRI) | Low (Emerging Segment) | Significant Market Development | Volume Production & Application Validation |

| COMPACT EVOLUTION AC (Polymer Welding) | Moderate to High (OEM Integration) | Undetermined | Market Penetration Efforts | Market Reception & OEM Uptake |

| Next-Gen Optical Switching | Very High (Data Centers, >15% CAGR) | Emerging/Developing | Sustained R&D & Capital Investment | Competitive Landscape & Market Leadership |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial filings, industry growth forecasts, and market share analysis to provide a clear strategic roadmap.