Coherent Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coherent Bundle

This brief snapshot only scratches the surface of the intricate competitive landscape Coherent navigates. Understanding the true power of buyer bargaining, the intensity of rivalry, and the looming threat of substitutes is crucial for strategic success.

Unlock the full Porter's Five Forces Analysis to explore Coherent’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you with the knowledge to anticipate industry shifts and capitalize on opportunities.

Suppliers Bargaining Power

Coherent Corp.'s reliance on highly specialized materials like compound semiconductors and precision optics means it often depends on a small pool of niche suppliers. This dependence can give these suppliers considerable leverage, particularly when their products are essential and hard to replace. For instance, the global photonics market, a key area for Coherent, saw significant price increases in 2024 due to persistent supply chain disruptions.

For Coherent, the bargaining power of suppliers is amplified when switching costs for critical inputs are high. Imagine needing a specialized laser component; changing that supplier isn't like swapping out a standard office supply. It often means significant investment in re-qualifying the new part, potentially redesigning parts of Coherent's own sophisticated equipment, and facing the risk of production delays. For instance, in the semiconductor industry, where Coherent operates, the lead times for highly specialized materials can extend for months, and the cost of integrating a new supplier can run into hundreds of thousands, if not millions, of dollars.

When a market features a limited number of suppliers for essential components or raw materials, their collective bargaining power escalates. Coherent's reliance on specialized suppliers, particularly those possessing proprietary technology or advanced production methods, inherently restricts its options and strengthens the suppliers' negotiating position.

This situation can translate into less advantageous pricing structures and supply chain terms for Coherent. For instance, in the semiconductor industry, where advanced chip manufacturing is concentrated among a few global leaders, Coherent's access to critical processing units could be subject to supplier-driven cost increases and allocation priorities.

Potential for Forward Integration by Suppliers

Suppliers possessing highly specialized technologies might consider forward integration into Coherent's market. This is a less common threat due to the significant capital and expertise needed for system integration and market penetration. Nevertheless, the mere possibility of this happening can affect Coherent's negotiation leverage.

Coherent's strategic investments in supply chain resilience, such as its facility in Vietnam, aim to reduce this risk by bringing certain production processes in-house. This proactive approach can bolster Coherent's position when dealing with suppliers.

- Forward Integration Threat: While theoretically possible for specialized tech suppliers to integrate forward, the high capital and expertise requirements make it a less probable scenario for Coherent's markets.

- Negotiation Influence: The mere potential for supplier forward integration, however remote, can still influence Coherent's bargaining power and pricing discussions.

- Coherent's Mitigation: Coherent's investments in supply chain resilience, including facilities like the one in Vietnam, help internalize production and reduce reliance on external suppliers, thereby mitigating this risk.

Impact of Geopolitical Factors on Supply Chains

Geopolitical tensions and trade barriers significantly impact supplier bargaining power. For instance, new U.S. tariffs on photonics imports in 2024 have fragmented global supply chains, increasing operational costs for companies in this sector. This fragmentation can bolster the leverage of suppliers located in more stable regions or those with diversified production capabilities.

Coherent's strategic focus on building an "unmatched supply chain resilience" directly addresses these external pressures. This resilience is crucial for mitigating risks associated with geopolitical instability and ensuring the consistent availability of vital components, thereby managing supplier power.

- Trade Barriers: Tariffs and import restrictions can limit sourcing options, strengthening the position of domestic or politically favored suppliers.

- Geopolitical Instability: Conflicts or political unrest in key manufacturing regions can disrupt production and logistics, giving suppliers in unaffected areas greater leverage.

- Supply Chain Fragmentation: As global supply chains break apart due to geopolitical factors, companies may face fewer supplier choices, increasing the bargaining power of remaining suppliers.

- Resilience as a Mitigator: Companies investing in supply chain resilience, like Coherent, aim to reduce their dependence on single sources or vulnerable regions, thereby lessening supplier bargaining power.

The bargaining power of suppliers for Coherent Corp. is a significant factor, driven by the specialized nature of its inputs. When suppliers provide essential, hard-to-replace components, their leverage increases, especially when switching costs are high. For example, the photonics market experienced notable price hikes in 2024 due to ongoing supply chain issues, directly impacting companies like Coherent that rely on these specialized materials.

The concentration of suppliers for critical components also amplifies their negotiating strength. Coherent's dependence on suppliers with proprietary technologies or advanced manufacturing processes limits its alternatives, thereby enhancing the suppliers' position and potentially leading to less favorable pricing and terms.

| Factor | Impact on Coherent | Supporting Data/Example |

| Supplier Concentration | Increases supplier leverage | Limited number of advanced semiconductor material providers |

| Switching Costs | Elevates supplier power | High costs for re-qualifying specialized optical components, potentially millions of dollars |

| Input Essentiality | Strengthens supplier position | Reliance on proprietary laser systems for precision manufacturing |

| Market Conditions | Can shift bargaining power | Photonics market price increases of up to 15% in early 2024 due to supply chain disruptions |

What is included in the product

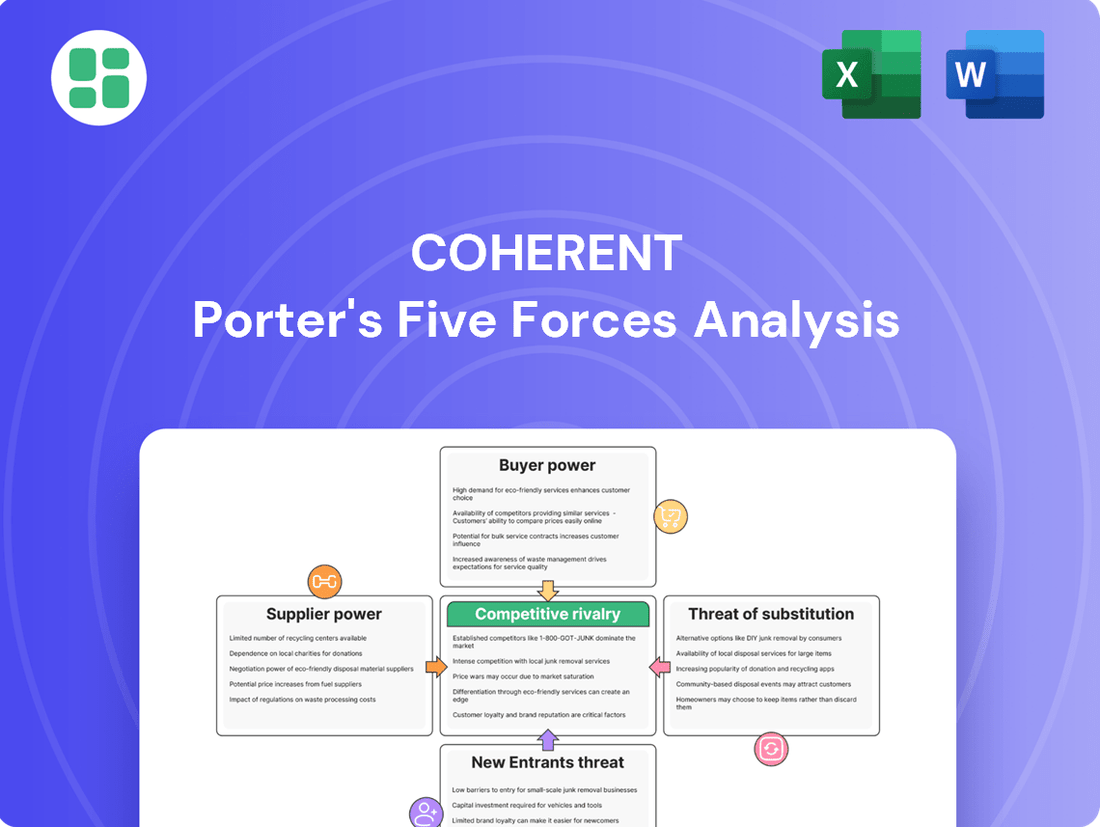

Coherent's Porter's Five Forces analysis dissects the competitive intensity within its industry, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly identify and address competitive threats with a clear, actionable framework that simplifies complex market dynamics.

Customers Bargaining Power

Coherent's diverse customer base spans industrial, communications, electronics, and instrumentation sectors. This broad reach mitigates risk, but also includes exceptionally large and influential clients.

Major customers like Apple, for example, wield considerable bargaining power. A multiyear strategic supply agreement for VCSELs highlights this, as such significant buyers can negotiate highly favorable terms, impacting Coherent's pricing and margins.

Coherent's products, like optical transceivers vital for AI datacenters and laser systems for sophisticated manufacturing, frequently serve as mission-critical components for their clients' operations. This indispensability makes customers less inclined to switch providers, as any disruption could significantly harm their own business performance.

For example, in the rapidly expanding AI datacenter market, the reliability and speed of optical transceivers are paramount for maintaining network integrity and processing power. A failure in these components can lead to costly downtime and lost revenue for the datacenter operator.

Similarly, in advanced manufacturing sectors such as semiconductor fabrication or medical device production, Coherent's laser systems are often integral to the precision and quality of the final product. The high stakes involved in these applications create a strong dependency, giving Coherent considerable bargaining power.

While large customers can indeed exert price pressure, Coherent's specialized and integrated materials, components, and systems often create substantial switching costs. These costs can stem from the need for new qualification processes, potential performance degradation, or the integration challenges associated with adopting a competitor's product. For instance, in the high-speed optical transceiver market, where Coherent is a key player, the complexity of interoperability and system compatibility means that switching vendors isn't a simple plug-and-play exercise.

Coherent's commitment to continuous innovation, particularly in areas like pluggable and Co-Packaged Optics (CPO) transceivers, further solidifies its market position and raises the bar for competitors. This forward-looking product roadmap means customers are less likely to find direct, cost-effective, or performance-equivalent alternatives. In 2024, the demand for higher bandwidth and lower latency in data centers continues to drive the need for advanced optical solutions, a segment where Coherent's differentiated technology provides a significant advantage.

Price Sensitivity in Commoditized Segments

In segments where Coherent's offerings are more commoditized, customers may exhibit higher price sensitivity, thereby increasing their bargaining power. This is particularly true for buyers operating on thinner profit margins who are more inclined to seek the lowest possible price for components. For instance, in the broader optical components market, where differentiation can be less pronounced, customers might leverage competitive quotes to drive down prices.

While Coherent's strategic emphasis is on high-value, differentiated solutions, especially in areas like AI datacenters and advanced photonics, some of its more standard product lines could still encounter price-conscious buyers. This dynamic can lead to increased negotiation pressure on pricing for these specific offerings.

Coherent's strategy to counter this involves a deliberate focus on high-growth, technologically advanced markets where value and performance are prioritized over pure cost. For example, the company's significant investments in laser technologies for semiconductor manufacturing and advanced displays aim to position its products as indispensable solutions, thereby reducing the leverage of price-sensitive customers. In 2023, Coherent reported that over 80% of its revenue was derived from markets characterized by high growth and technological innovation, a figure expected to increase as its strategic initiatives mature.

- Price Sensitivity: Higher in commoditized segments, potentially impacting bargaining power.

- Coherent's Mitigation: Focus on high-growth, differentiated markets like AI datacenters.

- Strategic Advantage: Emphasizing value and performance over cost in key segments.

- 2023 Revenue Insight: Over 80% from high-growth, innovative markets, reducing price sensitivity impact.

Customer's Ability for Backward Integration

The bargaining power of customers is influenced by their ability to backward integrate, meaning they could produce the products or services themselves. For Coherent, a leader in photonics and lasers, this is a complex consideration.

While large customers in sectors like electronics or telecommunications might possess the scale to consider producing certain components internally, the reality is far more challenging. The compound semiconductor, photonics, and precision optics industries demand immense capital investment, cutting-edge research and development, and highly specialized technical knowledge. These barriers make successful backward integration by most customers a formidable undertaking.

- High Capital Intensity: Manufacturing advanced photonics components often requires billions in upfront investment for specialized fabrication facilities.

- R&D Demands: Continuous innovation in materials science and optical engineering necessitates substantial and ongoing R&D expenditures, which most customers cannot sustain for these niche areas.

- Technical Expertise: The deep, specialized knowledge required to design, manufacture, and test these high-performance components is a significant hurdle for companies not focused on this core competency.

- Coherent's Scale and IP: Coherent's extensive intellectual property portfolio, global manufacturing footprint, and established technological leadership create a substantial deterrent against customer attempts at backward integration.

Customers' bargaining power is amplified when they can easily switch to competitors or find readily available substitutes for Coherent's products. However, Coherent's specialized nature and the high costs associated with switching often limit this power. For instance, the intricate design and performance requirements of Coherent's laser systems for medical applications mean that finding a comparable alternative is difficult and costly for healthcare providers.

In 2024, the demand for advanced semiconductor manufacturing equipment, a key market for Coherent, continues to outstrip supply, giving Coherent more leverage. The company's photonics solutions are critical for next-generation chip production, making customers hesitant to disrupt their operations by switching to less proven suppliers. This situation is exacerbated by the fact that developing and qualifying new suppliers for such specialized components can take years and significant investment.

The bargaining power of customers is also shaped by the importance of the supplier's product to the customer's overall business. When Coherent's components are mission-critical, as they are in many high-tech manufacturing processes, customers are less likely to exert significant price pressure. For example, in the production of advanced displays, the precision of Coherent's laser processing systems directly impacts yield and quality, making reliability and performance paramount over minor cost savings.

Coherent's strategic focus on innovation and its strong intellectual property position in areas like high-power fiber lasers and photonic integrated circuits serve to further reduce customer bargaining power. By offering unique, high-performance solutions, Coherent creates a competitive moat that makes it difficult for customers to find comparable alternatives, thereby strengthening Coherent's negotiating stance.

What You See Is What You Get

Coherent Porter's Five Forces Analysis

This preview showcases the complete Coherent Porter's Five Forces Analysis, offering a thorough examination of competitive forces within your industry. The document you see here is the exact, professionally formatted file you will receive immediately upon purchase, ensuring no discrepancies or missing information. You can confidently proceed, knowing that the insights and strategic framework presented are precisely what you'll gain access to for your business planning.

Rivalry Among Competitors

Coherent operates within a dynamic and crowded marketplace, facing off against both broad-spectrum technology giants and highly specialized firms. This means the competitive pressure isn't uniform, but rather tailored to Coherent's specific product offerings and the markets they serve.

Major players like Broadcom, Cognex, Lumentum Holdings Inc., MKS Inc., and IPG Photonics Corp. are significant rivals, each bringing their own strengths and market share to the table. For instance, Broadcom is a diversified semiconductor and infrastructure software giant, while Cognex focuses on machine vision. Lumentum is a leader in optical and photonics components, MKS Instruments provides instruments, systems, and process control solutions, and IPG Photonics is a prominent laser manufacturer.

This rich competitive tapestry means Coherent must constantly innovate and differentiate itself across its diverse product portfolio, from lasers and photonics to materials processing solutions. For example, in the laser market, IPG Photonics is known for its high-power fiber lasers, directly challenging Coherent's offerings in industrial applications.

The photonics and laser sectors are defined by a relentless pace of technological progress and ongoing innovation, directly translating into fierce competition. Companies such as Coherent are compelled to perpetually invest in research and development, ensuring the consistent introduction of novel and enhanced products to preserve their market standing. This imperative for innovation often results in substantial R&D outlays and accelerated product obsolescence.

The laser industry is booming, with projections showing the global market reaching $30.4 billion by 2029, growing at a 7.7% annual rate. This significant expansion, fueled by demand from sectors like AI datacenters, signals a highly attractive market. Such growth often intensifies competition as existing players vie for market share and new entrants are drawn to the opportunity.

Product Differentiation and Specialization

Coherent's competitive rivalry is influenced by its product differentiation. In specialized areas like advanced optical transceivers, where Coherent holds a leading position, differentiation can reduce direct price competition. For instance, their high-speed coherent transceivers are critical for next-generation telecommunications networks, a niche where performance and reliability command a premium, thus mitigating intense rivalry.

However, in more standardized product categories, the competitive landscape shifts. When products are similar and features are largely comparable, rivalry intensifies, often leading to price-based competition. This is particularly true in certain laser components or general optical materials where numerous suppliers exist, making it harder for any single player to command significant pricing power.

- Specialized Segments: Coherent leverages its market leadership in areas like high-power fiber lasers and advanced photonics, where unique technological capabilities create barriers to entry and reduce direct competitive pressure.

- Commoditized Segments: In broader markets for optical components or standard laser systems, Coherent faces more intense rivalry from competitors offering similar products, often leading to price sensitivity.

- Innovation as a Differentiator: The company's ongoing investment in R&D, aiming for next-generation technologies, is a key strategy to maintain differentiation and command premium pricing in evolving markets.

Strategic Portfolio Management

Coherent's proactive approach to its strategic portfolio, categorizing offerings into growth, profit, long-term, and non-strategic segments, directly addresses competitive rivalry. This internal assessment is crucial for understanding where its resources are best deployed to counter competitors. For instance, if Coherent identifies a product line as a ‘Non-Strategic’ asset, its potential divestiture can free up capital and management focus for more competitive arenas.

By shedding underperforming or non-core assets, Coherent aims to sharpen its competitive edge. This strategic pruning allows for a more concentrated effort on business units that demonstrate strong market positions or significant growth potential. For example, in 2024, many technology firms have divested non-core software divisions to reinvest in AI or cloud computing, areas with higher competitive barriers and growth prospects.

- Focus on Growth Engines: Reallocating resources to high-potential product lines enhances Coherent's ability to compete aggressively in expanding markets.

- Optimize Profit Engines: Strengthening existing profitable segments allows Coherent to generate cash flow to fund competitive initiatives and R&D.

- Strategic Divestitures: Selling off non-strategic assets can improve overall financial health and allow for a more targeted competitive strategy.

- Long-Term Bets: Investing in nascent but promising technologies positions Coherent to disrupt competitors in the future.

Competitive rivalry within Coherent's markets is intense, driven by a mix of large, diversified players and specialized innovators. The global laser market alone is projected to reach $30.4 billion by 2029, growing at a 7.7% annual rate, indicating significant opportunity but also attracting robust competition. Companies like Broadcom, Cognex, Lumentum, MKS Instruments, and IPG Photonics are key rivals, each with distinct strengths that challenge Coherent across its product lines.

Coherent navigates this landscape by differentiating itself through technological advancements, particularly in specialized areas like high-speed coherent transceivers crucial for next-generation telecommunications. However, in more commoditized segments, price-based competition intensifies due to the presence of numerous suppliers offering similar products.

The company's strategy involves focusing on growth engines, optimizing profit centers, and making strategic divestitures to sharpen its competitive edge. This portfolio management approach allows Coherent to allocate resources effectively, prioritizing areas with strong market positions or high growth potential to counter competitive pressures and maintain market leadership.

SSubstitutes Threaten

The threat of substitutes for Coherent's optical components, particularly in data transmission and sensing, is significant. Alternative technologies that perform similar functions, such as advanced wireless communication systems, can reduce the demand for fiber optic couplers. For instance, the increasing capabilities of 5G and future 6G networks offer higher bandwidth and lower latency, potentially displacing some fiber optic applications in areas where extreme speed is not paramount.

The increasing sophistication of integrated photonic circuits (PICs) presents a significant threat of substitution for Coherent's discrete optical components. These PICs, which consolidate multiple optical functions onto a single chip, are gaining traction due to their potential for reduced energy consumption and enhanced bandwidth, making them particularly attractive for burgeoning AI applications.

This technological shift could directly impact Coherent's sales of individual components, as customers increasingly opt for these more consolidated and efficient solutions. For instance, by 2024, the global market for silicon photonics, a key enabler of PICs, was projected to reach approximately $1.7 billion, indicating a substantial and growing alternative.

The threat of substitutes for laser technologies is growing, particularly in specialized industrial and defense sectors. For example, in certain defense applications, high-powered microwaves (HPMs) are being developed as alternatives to lasers for tasks like drone defense. This shift reflects a broader trend where diverse technological solutions are emerging to fulfill similar functions.

The development of non-laser alternatives poses a significant challenge, as these substitutes can offer comparable or even superior performance in specific niches. For instance, advancements in directed energy weapons that utilize HPMs are gaining traction for their potential to disrupt or disable electronic systems, offering a different approach to target engagement compared to traditional lasers.

Price-Performance Trade-offs of Substitutes

The threat of substitutes for Coherent's products hinges significantly on the price-performance trade-offs available in the market. If alternative solutions can match or exceed Coherent's performance metrics at a lower price point, customers may be compelled to switch.

For instance, in the semiconductor industry, advancements in alternative materials or manufacturing processes could lead to cost reductions for competitors, directly impacting Coherent's market position. In 2024, the average selling price for certain advanced semiconductor components saw a slight decrease year-over-year, highlighting the constant pressure on pricing due to potential substitutes.

- Price Sensitivity: Customers will evaluate whether the performance gains offered by Coherent justify any price premium over substitute products.

- Technological Parity: If substitutes achieve technological parity, the cost advantage becomes the primary decision driver.

- Innovation Imperative: Coherent's ongoing investment in research and development, which reached $1.2 billion in 2024, is crucial to maintain a performance edge and mitigate the threat of substitutes.

High Switching Costs and Performance Gaps

For many of Coherent's advanced and precision-critical applications, such as those in semiconductor manufacturing and medical fields, the performance and reliability of their laser and optical systems are often superior to potential substitutes. This technological edge makes it difficult for competitors to offer comparable solutions.

The threat of substitutes is further diminished by high switching costs. For instance, in the semiconductor industry, retooling an entire fabrication line to accommodate a different laser system can cost tens of millions of dollars, making the transition economically prohibitive for many companies. Coherent's established integration and support infrastructure also contribute to these high switching costs.

- Unmatched Performance: Coherent's systems often provide precision and reliability that substitutes cannot replicate, particularly in demanding sectors.

- High Switching Costs: Significant financial and operational investments are required to switch from Coherent's solutions, deterring many potential replacements.

- Performance Gaps: Alternatives frequently exhibit performance degradation or lack critical features, creating a tangible gap that favors Coherent.

The threat of substitutes for Coherent's offerings is a dynamic factor, influenced by evolving technologies and price-performance considerations. While Coherent often maintains a performance edge, particularly in high-precision applications, the emergence of integrated solutions and alternative technologies like high-powered microwaves presents a growing challenge. For instance, the silicon photonics market, a key area for integrated optical circuits, was projected to reach approximately $1.7 billion by 2024, highlighting the significant growth of a potential substitute area.

| Technology Area | Potential Substitute | Impact on Coherent | 2024 Market Data/Projection |

|---|---|---|---|

| Optical Components (Data Transmission) | Advanced Wireless (5G/6G) | Reduced demand for fiber optic couplers in certain applications | 5G rollout continues, increasing wireless capabilities |

| Optical Components (General) | Integrated Photonic Circuits (PICs) | Displacement of discrete components by consolidated chip solutions | Silicon Photonics Market: ~$1.7 billion projected for 2024 |

| Laser Technologies (Defense) | High-Powered Microwaves (HPMs) | Alternative for drone defense and electronic disruption | Ongoing development in directed energy weapons |

| Laser Technologies (Industrial) | Alternative Materials/Processes | Pressure on pricing due to cost reductions by competitors | Average selling price for some advanced semiconductor components saw slight decrease YoY in 2024 |

Entrants Threaten

The photonics, laser systems, and compound semiconductor sectors demand substantial capital for cutting-edge manufacturing, specialized equipment, and ongoing research and development. For instance, establishing a state-of-the-art semiconductor fabrication plant can easily cost billions of dollars, a figure that presents a formidable hurdle for most aspiring companies.

This immense financial requirement acts as a significant deterrent, effectively blocking many potential new entrants from challenging established giants like Coherent. Coherent's established global infrastructure and deep technological expertise further solidify this barrier to entry, making it incredibly difficult for newcomers to gain a foothold.

Entering Coherent's competitive landscape requires significant investment in specialized scientific and engineering talent, particularly in precision optics, laser design, and advanced materials. This steep learning curve and the necessity for deep technical knowledge act as a substantial deterrent to potential new players.

Coherent's robust intellectual property portfolio, built through decades of innovation and secured through patents, presents a formidable barrier. For instance, their extensive patent filings in laser technology and optical systems create a protected technological moat, making it difficult for newcomers to replicate their offerings or compete on innovation.

Coherent, as an established player, leverages significant economies of scale in its operations. This means they can produce goods at a lower cost per unit compared to any newcomer who lacks the same production volume. For instance, their substantial investment in advanced manufacturing facilities allows for greater efficiency and reduced overheads.

The experience curve further solidifies Coherent's competitive position. Years of refining production processes and optimizing supply chains have resulted in accumulated knowledge and operational expertise. This learning-by-doing effect leads to continuous cost reductions and quality improvements that are challenging for new entrants to match in a short timeframe.

For example, in the laser systems market, where Coherent operates, the initial setup costs for specialized equipment and R&D are substantial. New entrants would face a steep learning curve and higher initial per-unit costs, making it difficult to compete on price with Coherent's established, scaled-up operations. By 2024, the capital expenditure required to build a comparable manufacturing capability would likely be in the hundreds of millions of dollars.

Access to Distribution Channels and Customer Relationships

New companies face a tough time getting their products to market because established players, like Coherent, have already secured crucial distribution channels and built solid relationships with key customers. This is particularly true in industries like industrial, communications, and electronics where trust and reliable supply chains are paramount.

Coherent's extensive global network and deep-seated customer partnerships present a formidable barrier. For instance, their multi-year agreements with major technology firms, such as Apple, solidify their market position and make it exceedingly difficult for newcomers to secure comparable access or leverage.

- Established Distribution Networks: Coherent's existing infrastructure for delivering its products globally is a significant advantage.

- Strong Customer Loyalty: Long-term relationships with major clients create a sticky customer base.

- Customer Switching Costs: The effort and expense involved for customers to switch from Coherent to a new supplier are often high.

- Market Penetration Challenges: New entrants struggle to gain visibility and market share against incumbents with entrenched customer ties.

Regulatory Hurdles and Certification Processes

In markets like instrumentation and medical applications where Coherent operates, new entrants face significant regulatory hurdles. Obtaining approvals and certifications, such as FDA clearance for medical devices or CE marking for European markets, can take years and cost millions. For instance, the average time for FDA approval of a new medical device can range from several months to over three years, depending on the device's complexity and risk classification. This extensive process acts as a formidable barrier, deterring many potential competitors from entering these lucrative but highly regulated sectors.

These stringent requirements are not just about product safety; they also demand substantial investment in quality management systems and documentation. Companies must demonstrate compliance with standards like ISO 13485 for medical devices, which involves meticulous record-keeping and process validation. The financial and operational commitment necessary to navigate these certifications means only well-funded and prepared companies can realistically challenge established players like Coherent.

- Regulatory Approvals: Time-consuming and expensive processes like FDA clearance or CE marking are critical.

- Certification Costs: Meeting standards such as ISO 13485 requires significant financial investment.

- Time to Market: Extended approval timelines delay product launches, increasing initial capital outlay.

- Expertise Required: Navigating regulations necessitates specialized legal and technical expertise, a cost for new entrants.

The threat of new entrants for Coherent is considerably low due to several substantial barriers. High capital requirements for advanced manufacturing and R&D, estimated in the hundreds of millions of dollars for semiconductor fabrication by 2024, deter most newcomers. Furthermore, Coherent's established intellectual property, robust distribution networks, and strong customer loyalty, evidenced by multi-year agreements with major tech firms, create significant market entrenchment.

| Barrier Type | Description | Impact on New Entrants | Coherent's Advantage |

|---|---|---|---|

| Capital Requirements | High costs for advanced manufacturing and R&D. | Deters market entry. | Established infrastructure and scale. |

| Intellectual Property | Extensive patent portfolio in laser technology. | Limits replication and innovation. | Technological moat. |

| Distribution & Customer Relationships | Secured channels and long-term client agreements. | Challenges market access and penetration. | Entrenched market position. |

| Regulatory Hurdles | Time-consuming and costly approvals (e.g., FDA). | Increases time-to-market and initial outlay. | Expertise in navigating compliance. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and expert interviews with sector professionals.