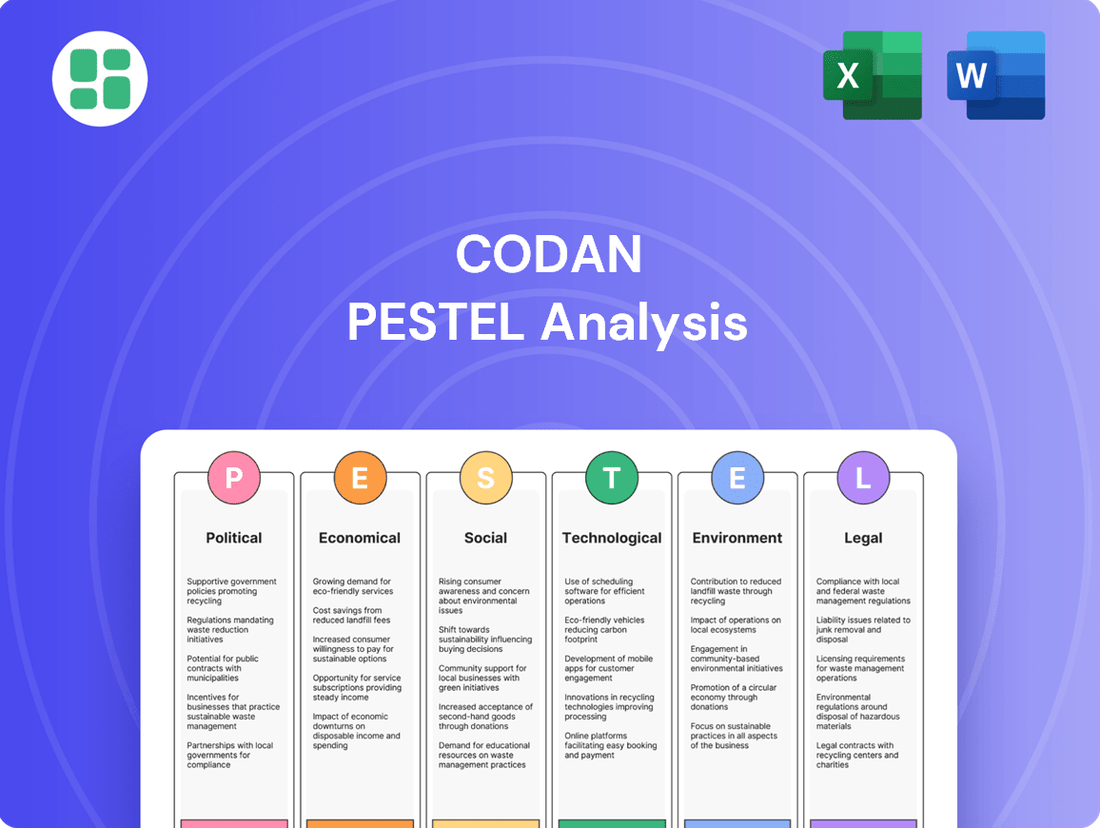

Codan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Codan Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Codan's trajectory. Our meticulously researched PESTLE analysis provides the essential context for strategic decision-making. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full version now for a comprehensive understanding.

Political factors

Government defense spending is a critical driver for Codan Limited, given its focus on radio communications and tracking for defense applications. Heightened geopolitical instability and a renewed emphasis on national security across key markets such as Australia, the USA, New Zealand, and the UK are anticipated to lead to increased military expenditure. This trend is directly beneficial to Codan's communications division.

For instance, the Australian Department of Defence's Force Structure Plan 2020-2030 outlines significant investment in modernizing its communication and electronic warfare capabilities, a sector where Codan operates. Similarly, the US Department of Defense's FY2025 budget request includes substantial allocations for command, control, communications, computers, and intelligence (C4I) systems, signaling continued demand for advanced solutions like those Codan provides.

Codan's significant reliance on exports, with over 85% of its sales generated across 150 countries, makes it highly sensitive to shifts in global trade policies. For instance, the imposition of new tariffs or changes in existing trade agreements, such as those affecting electronics or communication equipment, could directly increase Codan's cost of goods sold or limit its market access. The company's 2024 fiscal year saw continued global trade tensions, with some regions implementing protectionist measures that could impact supply chains and pricing for components used in their advanced communication and detection systems.

Codan's operations span markets with varying degrees of political stability, directly impacting demand for its metal detectors, particularly in artisanal gold mining sectors. For instance, regions experiencing conflict might see shifts in mining activity, affecting sales. The company's communications solutions also face these dynamics, as stability is crucial for infrastructure deployment and usage.

Geopolitical shifts can present a dual-edged sword for Codan. While heightened security concerns might boost demand for certain communication products, as seen with increased government spending on defense and public safety in some regions during 2024, political instability can also disrupt supply chains and operations. For example, trade policy changes or sanctions imposed on specific countries could create significant hurdles for sourcing components or distributing finished goods.

Codan's strategy of geographical diversification is a key mitigator against these political risks. By maintaining a presence across numerous countries, the company can absorb localized disruptions without a catastrophic impact on overall performance. This broad operational footprint ensures that challenges in one market are often balanced by stability or growth in others, a strategy that proved resilient through various regional political tensions observed in late 2024.

Government Regulations on Communication Infrastructure

Governments globally exert significant control over communication infrastructure, including spectrum allocation and network security, directly influencing Codan's radio communications sector. Adherence to national and international standards for emergency services, such as Next Generation 911, and critical infrastructure protection is paramount for compliance.

For instance, in 2024, many countries continued to refine their 5G spectrum allocation policies, impacting the availability and cost of radio frequencies for communication providers. Codan must navigate these evolving regulations to ensure its products meet emerging requirements for interoperability and resilience.

- Spectrum Allocation: Governments manage radio frequency spectrum, a critical resource for wireless communication, directly affecting Codan's product deployment and market access.

- Network Security Mandates: Increasing cybersecurity regulations require robust security features in communication systems, influencing product development and compliance costs for Codan.

- Emergency Services Standards: Evolving standards for emergency communication systems, like NG911, create opportunities for Codan to adapt its offerings and ensure interoperability.

- Critical Infrastructure Protection: Government focus on protecting essential services necessitates secure and reliable communication solutions, a core area for Codan's business.

Sanctions and International Relations

International sanctions significantly impact Codan's market access. For instance, restrictions imposed by major economic blocs on countries involved in geopolitical conflicts can directly limit Codan's ability to export its communication and defense-related technologies. Navigating these evolving international relations requires robust compliance, impacting potential revenue streams in affected regions.

Codan must remain vigilant regarding dynamic sanctions lists and export control regulations. Failure to comply can result in severe penalties and reputational damage. As of early 2024, the global landscape saw continued scrutiny on technology transfers to nations facing international sanctions, underscoring the need for proactive risk management.

- Sanctions Impact: Restrictions on technology sales to sanctioned nations limit Codan's global reach.

- Compliance Burden: Adherence to complex and changing export regulations is critical.

- Revenue Risk: Geopolitical tensions can directly affect revenue potential in certain markets.

- Market Access: Sanctions can create significant barriers to entry for Codan's products.

Government defense spending remains a key revenue driver for Codan, particularly for its communications segment. Increased geopolitical tensions throughout 2024 and early 2025 have spurred defense budget increases in countries like Australia and the United States, directly benefiting companies providing advanced communication solutions.

Codan's export-heavy model, with over 85% of sales from 150 countries, makes it susceptible to global trade policy shifts. Protectionist measures and evolving trade agreements in 2024 impacted supply chains and component pricing, highlighting the need for strategic navigation of international commerce.

Political stability directly influences demand for Codan's metal detectors, especially in artisanal mining regions, while stable environments are crucial for deploying its communication infrastructure. Geopolitical shifts can offer opportunities through increased defense spending but also pose risks via supply chain disruptions.

Government regulation of communication infrastructure, including spectrum allocation and network security mandates, significantly shapes Codan's product development and market access. Evolving standards, such as for 5G and emergency services, require ongoing adaptation to ensure compliance and interoperability.

What is included in the product

The Codan PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive understanding of its external operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global economic growth significantly impacts Codan's revenue streams, as demand for its metal detectors and communication solutions is closely linked to the financial health of its key customer segments. For instance, a robust global economy in 2024, projected by the IMF to grow by 3.2%, typically translates into higher capital expenditure by mining and infrastructure companies, boosting sales of Codan's commercial products.

Conversely, a slowdown in global economic activity, such as the potential for slower growth in 2025, can dampen consumer spending on discretionary items, which might affect sales of Codan's hobbyist metal detectors. Economic downturns can also lead to reduced investment by businesses, impacting demand for Codan's tracking and communication technologies.

Currency fluctuations present a significant economic factor for Codan, given its substantial international sales, exceeding 85% of its revenue from exports. A strengthening Australian dollar (AUD) against other currencies can increase the cost of Codan's products for overseas buyers, potentially impacting sales volume. Conversely, a weaker AUD can enhance the competitiveness of its Australian-manufactured goods in global markets, boosting export performance.

For instance, the AUD experienced volatility throughout 2024, trading within a range that could impact Codan's profitability. During the first half of 2024, the AUD fluctuated, at times trading around the 0.65 to 0.68 USD mark, a level that would make exports more expensive for US customers. Effective currency risk management, through financial hedging instruments or by diversifying its operational footprint across various currency zones, is crucial for maintaining financial stability and predictable earnings for Codan.

Rising inflation presents a significant challenge for Codan, as it directly increases the cost of essential inputs like raw materials, components, and labor for its manufacturing operations. This upward pressure on costs can erode the company's profit margins if not effectively managed.

Global supply chain disruptions, a persistent issue in recent years, coupled with escalating freight costs, further compound these inflationary pressures on Codan. These factors can lead to unpredictable delays and higher operational expenses, impacting the company's ability to maintain stable pricing and delivery schedules.

For instance, in 2024, global inflation rates remained elevated in many regions, with the IMF projecting a global average of 5.9% for the year, a slight decrease from 2023 but still above pre-pandemic levels. This environment necessitates that Codan proactively manages its supply chain for efficiency and considers strategic pricing adjustments to mitigate the impact of these rising costs on its financial performance.

Interest Rates and Access to Capital

Changes in interest rates directly influence Codan's expenses when it borrows money for acquisitions and ongoing investments. For instance, if the Reserve Bank of Australia (RBA) raises its cash rate, Codan's borrowing costs will likely increase, potentially squeezing profit margins and influencing how it plans for future expansion.

Higher interest rates can make debt more expensive, impacting Codan's ability to finance new projects or acquire companies. This is a critical consideration for a company like Codan, which relies on capital for research and development and strategic moves. For example, a significant acquisition might become less financially viable if the cost of borrowing rises substantially.

Access to affordable capital is paramount for Codan's sustained investment in innovation and growth through acquisitions. The prevailing interest rate environment, therefore, plays a crucial role in shaping its strategic financial decisions.

- Borrowing Costs: Fluctuations in benchmark interest rates, such as the RBA cash rate, directly impact Codan's cost of debt financing for new ventures and existing operations.

- Investment Viability: Higher interest rates can diminish the attractiveness of potential acquisitions and R&D projects by increasing the hurdle rate for acceptable returns on investment.

- Capital Availability: The overall economic climate, influenced by interest rate policies, affects the ease and cost with which Codan can access the capital markets for funding its strategic initiatives.

- Profitability Impact: Increased interest expenses due to higher rates can reduce net income, potentially affecting shareholder returns and the company's capacity for future dividend payouts or share buybacks.

Industry-Specific Market Cycles

Codan operates in sectors with inherent demand fluctuations. The metal detection industry, for instance, experienced a notable boom followed by a downturn between 2021 and 2022, leading to considerable revenue volatility. This cyclical nature necessitates careful financial planning and inventory management.

To mitigate these risks, Codan is actively diversifying into the communications sector. This strategic move is designed to build more stable, recurring revenue streams. By reducing its dependence on the more volatile metal detection market, Codan aims for greater financial resilience.

- Cyclical Demand: Metal detection markets can exhibit boom-and-bust cycles, impacting revenue predictability.

- Revenue Fluctuation: The period between 2021 and 2022 highlighted significant revenue swings in this sector for Codan.

- Strategic Diversification: Expansion into communications seeks to create more consistent and recurring revenue.

- Risk Mitigation: Diversification lessens Codan's reliance on highly cyclical industry performance.

Economic growth directly fuels demand for Codan's products. The IMF's projection of 3.2% global growth for 2024 suggests a positive environment for mining and infrastructure spending, benefiting Codan's commercial segment. However, a potential slowdown in 2025 could impact discretionary spending on hobbyist detectors.

Currency volatility, particularly for the Australian dollar, significantly affects Codan's export-heavy revenue. For instance, the AUD trading around 0.65 to 0.68 USD in early 2024 made Australian exports more expensive for US buyers, highlighting the need for robust currency risk management strategies.

Inflationary pressures, with global rates projected at 5.9% for 2024 by the IMF, increase Codan's input costs for materials and labor. Combined with rising freight costs, this necessitates careful pricing and supply chain management to protect profit margins.

Interest rate hikes, like potential RBA cash rate increases, directly impact Codan's borrowing costs for investments and acquisitions, potentially limiting expansion and affecting profitability.

What You See Is What You Get

Codan PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Codan PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

There's a noticeable surge in global demand for safety and security solutions. This is fueled by increasing concerns over natural disasters, public safety, and the growing need for humanitarian aid. For Codan, this translates into a significant market opportunity for their advanced communications and tracking technologies.

Codan's rugged and reliable equipment is perfectly positioned to meet these evolving needs. Governments, corporations, and non-governmental organizations (NGOs) are actively seeking solutions that can perform in challenging conditions, and Codan's offerings directly address these critical requirements, especially in extreme environments.

Global demographic shifts, such as aging populations in developed nations and a growing youth demographic in others, directly impact workforce availability and the demand for efficiency. For instance, by 2025, the global population is projected to reach over 8 billion, with a significant portion of the workforce in many Western countries nearing retirement age. This trend fuels the need for automation and advanced communication solutions to maintain productivity.

The increasing prevalence of remote and hybrid work models, accelerated by events in the early 2020s, fundamentally alters how businesses operate. By 2025, it's estimated that over 30% of the global workforce will be working remotely at least part-time. This necessitates reliable, secure, and flexible communication and collaboration tools, a core area of Codan's expertise in tactical and enterprise solutions.

Rapid urbanization continues to reshape global landscapes, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This surge fuels a significant demand for robust communication infrastructure to manage public safety, transportation networks, and essential utilities. Codan's Zetron division is well-positioned to capitalize on this trend, offering critical communication solutions vital for emergency services and control room operations.

The increasing investment in smart city initiatives worldwide, aiming to improve urban living through technology, further amplifies opportunities for companies like Codan. For instance, the global smart cities market was valued at approximately $400 billion in 2023 and is expected to grow substantially, creating a fertile ground for Codan's advanced communication technologies to be integrated into these evolving urban environments.

Public Perception and Brand Reputation

Codan's standing in sensitive sectors like defense and security hinges on public perception and a robust brand reputation. Negative sentiment regarding the ethical use of their technology, data privacy concerns, or perceived shortcomings in corporate social responsibility can significantly erode stakeholder trust and hinder market acceptance.

For instance, in 2024, technology firms facing scrutiny over data handling practices saw an average decline of 5-10% in market valuation, underscoring the financial impact of public trust. Codan's commitment to transparency and ethical operations is therefore not just a matter of good practice but a critical business imperative.

- Ethical Product Use: Ensuring technology is deployed responsibly in defense and security contexts.

- Data Privacy: Maintaining stringent data protection measures to build and retain customer confidence.

- Corporate Social Responsibility: Demonstrating commitment to societal well-being and sustainable practices.

- Transparency: Open communication regarding operations and product capabilities to foster trust.

Technological Literacy and User Adoption

Codan's success hinges on how well its users can adapt to its technologies. For instance, while metal detector hobbyists might require intuitive interfaces, defense clients demand deep technical understanding and robust training. As of early 2025, the global digital literacy rate is estimated to be around 85%, but this varies significantly by region and demographic, directly impacting the adoption curve for specialized equipment.

Ensuring products are user-friendly and easily integrated is key. Codan's investment in intuitive design and comprehensive support materials, including online tutorials and in-person training, directly addresses this. This focus is crucial, especially as Codan expands into new markets where user familiarity with advanced communication or detection systems may be lower.

- User-Centric Design: Codan prioritizes intuitive interfaces to lower the barrier to entry for diverse user groups.

- Training Investment: Significant resources are allocated to training programs, ensuring effective deployment of complex technologies.

- Market Penetration: Ease of adoption directly correlates with Codan's ability to achieve sustained market share across its product lines.

- Digital Divide: Awareness of varying technological literacy levels globally informs Codan's market entry and support strategies.

Societal attitudes towards technology, particularly in defense and security, significantly influence Codan's market reception. Public trust and ethical considerations are paramount, as negative perceptions can directly impact brand reputation and sales. For example, by 2025, consumer awareness regarding data privacy has intensified, with a significant portion of the population in developed nations expecting robust data protection measures from technology providers.

Codan's commitment to corporate social responsibility and transparent operations is crucial for maintaining a positive public image. This includes ensuring responsible product use and addressing concerns about the societal impact of their technologies. By 2024, companies demonstrating strong ESG (Environmental, Social, and Governance) performance often saw a market advantage, with an average of 3-5% higher valuations compared to peers with weaker ESG profiles.

The increasing global focus on humanitarian aid and disaster relief creates a demand for reliable communication systems. Codan's ability to provide rugged and dependable technology for these critical situations positions them favorably. By 2025, international aid spending is projected to exceed $50 billion annually, highlighting the scale of operations requiring effective communication infrastructure.

The evolving nature of work, with a rise in remote and hybrid models, necessitates advanced communication tools. Codan's solutions are well-suited to support these flexible work arrangements, ensuring connectivity and productivity. It's estimated that by 2025, over 30% of the global workforce will engage in some form of remote work, underscoring the market need for such technologies.

| Sociological Factor | Impact on Codan | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Public Trust & Ethics | Influences brand reputation and market acceptance, especially in sensitive sectors. | Companies with strong ESG performance may see 3-5% higher valuations (2024). Increased consumer awareness of data privacy by 2025. |

| Humanitarian Aid Demand | Creates market opportunities for reliable communication in disaster relief. | Projected annual international aid spending to exceed $50 billion by 2025. |

| Workforce Trends | Drives demand for flexible and remote communication solutions. | Over 30% of the global workforce expected to work remotely part-time by 2025. |

| Urbanization | Increases need for robust communication infrastructure for public safety and services. | UN projects 68% of world population in urban areas by 2050; smart cities market valued at ~$400 billion in 2023. |

Technological factors

The rapid evolution of communication technologies, including the rollout of 5G and advancements in satellite communications and software-defined radios, presents a dynamic landscape for Codan. These shifts necessitate continuous investment in research and development to ensure Codan's mission-critical communication solutions remain competitive and at the cutting edge.

The rapid advancement of Artificial Intelligence (AI) and automation is a significant technological factor influencing Codan. These technologies are increasingly embedded across various sectors, directly impacting Codan's approach to product development and operational efficiency. For instance, AI can dramatically improve signal processing and data analysis, crucial for Codan's metal detection technologies, leading to more accurate and efficient detection capabilities.

Furthermore, AI's role in intelligent routing within communication networks offers potential enhancements for Codan's communication solutions, ensuring more robust and reliable data transmission. Codan's strategic investments in research and development, exemplified by acquisitions such as Kägwerks, underscore a commitment to harnessing these technological leaps. This focus aims to equip Codan with the ability to deliver cutting-edge, next-generation products that meet evolving market demands.

The ongoing trend towards miniaturization and enhanced portability in electronic devices directly impacts Codan's product lines, especially in metal detection and tactical communications. For instance, the global wearable technology market, which heavily relies on compact designs, was projected to reach over $159 billion in 2024, highlighting the demand for smaller, more integrated solutions.

Codan's strategic focus on developing lighter, more compact, and energy-efficient equipment is crucial for improving user experience and opening up new market opportunities. This is particularly relevant for operator-worn devices and field-deployable communication systems where size and weight are critical factors.

Meeting these demands necessitates sustained investment in research and development, pushing the boundaries of design and component technology to create more streamlined and powerful products.

Cybersecurity and Data Protection

Codan's reliance on networked communication and tracking solutions places cybersecurity and data protection at the forefront of its technological considerations. The company must invest heavily in safeguarding its products and infrastructure against evolving cyber threats, particularly given the sensitive nature of data handled in defense and public safety sectors.

The global cybersecurity market is projected to reach $376 billion by 2025, highlighting the significant and growing demand for robust security solutions. For Codan, this translates to a continuous need for innovation in secure product design, encryption protocols, and data handling practices to maintain customer trust and operational integrity. For instance, the increasing frequency of ransomware attacks, which saw a 72% increase in reported incidents in 2023 according to the FBI's Internet Crime Complaint Center (IC3), underscores the critical need for advanced threat mitigation strategies.

- Market Growth: The global cybersecurity market is expected to grow substantially, presenting both opportunities and challenges for companies like Codan.

- Threat Landscape: Sophisticated cyber threats, including ransomware and state-sponsored attacks, require constant vigilance and investment in advanced security measures.

- Data Integrity: Protecting sensitive customer data and ensuring the reliability of communication systems are paramount, especially in high-stakes applications like defense.

- Regulatory Compliance: Adhering to evolving data protection regulations, such as GDPR and CCPA, adds another layer of complexity to cybersecurity efforts.

Research and Development Investment

Codan's commitment to research and development is a cornerstone of its strategy, especially in rapidly changing technology sectors. Sustained investment here is key to staying ahead of the curve and fostering innovation. The company's growth plans heavily rely on creating advanced products and solutions to seize emerging opportunities and solidify its market position.

This focus on R&D encompasses both internal development efforts and the potential for strategic acquisitions to bolster its technological capabilities. For instance, in the fiscal year ending June 30, 2023, Codan reported a significant investment in R&D, reflecting its dedication to future-proofing its product pipeline. The company aims to leverage these investments to maintain its competitive edge.

- R&D Investment: Codan's FY23 R&D expenditure was a critical component of its innovation strategy.

- Next-Generation Products: The company prioritizes developing cutting-edge solutions to capture new market segments.

- Market Leadership: Continuous R&D is vital for Codan to sustain its leadership in its specialized technological fields.

Technological advancements, particularly in AI and miniaturization, are reshaping Codan's product development. AI enhances signal processing for metal detection and optimizes communication networks, while the demand for smaller, lighter devices, seen in the projected $159 billion wearable tech market in 2024, pushes for more compact solutions.

Cybersecurity is paramount, with the global market expected to reach $376 billion by 2025. Codan's investment in secure design and encryption is crucial to combat threats like ransomware, which saw a 72% increase in reported incidents in 2023, protecting sensitive data and maintaining trust.

Codan's commitment to R&D, as demonstrated by its significant investment in FY23, is key to developing next-generation products and maintaining market leadership in its specialized technological fields.

Legal factors

Codan's extensive global reach necessitates rigorous adherence to export control regulations, particularly concerning dual-use items and defense articles. Failure to comply can result in substantial fines, damage to its reputation, and the revocation of export licenses. For instance, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) imposed over $300 million in civil penalties for export control violations.

Maintaining sophisticated internal compliance programs is therefore paramount for Codan to effectively manage the intricate legal landscape of international trade. This includes staying abreast of evolving regulations from bodies like the Wassenaar Arrangement and national export control lists, which are regularly updated to reflect geopolitical shifts and technological advancements.

Codan's commitment to product liability and safety is paramount, given its critical applications in defense and public safety sectors. Failure to meet rigorous standards can lead to significant legal repercussions and damage to its reputation. For instance, in 2023, the global product liability market was valued at approximately $100 billion, highlighting the substantial financial risks associated with product failures.

Adherence to national and international safety certifications, such as ISO 9001 for quality management, is non-negotiable for Codan. These certifications not only mitigate legal exposure but also build essential trust with clients operating in high-stakes environments. The global market for product certification services is projected to reach over $20 billion by 2027, underscoring the widespread importance of these standards.

Codan's reliance on technological innovation makes robust intellectual property (IP) protection, including patents, trademarks, and trade secrets, absolutely critical for maintaining its competitive edge. This means diligently safeguarding its unique solutions and ensuring its product development doesn't inadvertently infringe on existing patents held by competitors.

In 2023, the global patent landscape saw significant activity, with over 3.4 million patent applications filed worldwide, highlighting the intense competition and the importance of a strong IP strategy. Codan's proactive management of its patent portfolio is therefore essential for deterring infringement and securing its market position.

Privacy and Data Protection Laws

Codan's operations are significantly impacted by a growing web of privacy and data protection laws worldwide. As their products become more interconnected, compliance with regulations like the EU's General Data Protection Regulation (GDPR) and similar national laws is paramount. This necessitates robust systems for managing data securely, from collection to storage and transmission, particularly when dealing with sensitive operational or personal information. For instance, the global data privacy software market was valued at approximately USD 1.8 billion in 2023 and is projected to grow significantly, underscoring the increasing importance and complexity of these legal frameworks for companies like Codan.

Navigating these regulations requires Codan to implement stringent data handling protocols. This includes obtaining proper consent for data collection, ensuring data minimization, and providing individuals with rights over their personal information. Failure to comply can result in substantial penalties; for example, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. This legal landscape demands continuous adaptation and investment in cybersecurity and data governance to mitigate risks and maintain trust.

- Global Data Privacy Market Growth: The global data privacy software market reached an estimated USD 1.8 billion in 2023, indicating a strong trend towards increased regulatory scrutiny and compliance needs.

- GDPR Impact: Codan must adhere to GDPR, which imposes strict rules on processing personal data, with potential fines up to 4% of global annual revenue or €20 million for non-compliance.

- Data Security Requirements: Ensuring secure data handling, transmission, and storage is critical, especially for solutions processing sensitive operational or personal data, a key concern for connected technologies.

- Evolving Regulations: Codan must remain vigilant and adapt to new and evolving privacy laws being introduced in various jurisdictions, requiring ongoing legal and technical assessments.

Environmental Regulations and E-Waste Legislation

Codan, operating in the electronics sector, faces a complex web of environmental regulations. Key among these are directives concerning Waste Electrical and Electronic Equipment (WEEE) and the Restriction of Hazardous Substances (RoHS). These laws dictate how products are designed, manufactured, and ultimately disposed of, impacting Codan's supply chain and product development.

Looking ahead, the landscape of e-waste legislation is set to become more stringent. By 2025, new laws are anticipated to enforce more rigorous recycling targets and expand Extended Producer Responsibility (EPR) schemes. Furthermore, restrictions on exporting e-waste are likely to increase, compelling manufacturers like Codan to invest more in local recycling infrastructure and take greater ownership of their products' entire lifecycle.

- WEEE Compliance: Codan must ensure its products meet WEEE directives, promoting collection and recycling of electronic waste.

- RoHS Adherence: Restrictions on hazardous substances like lead and mercury in electronic components are critical for Codan's product design.

- Upcoming 2025 E-waste Laws: These will likely increase recycling mandates and EPR obligations for manufacturers.

- Lifecycle Management: Codan will need robust systems for managing products from creation to end-of-life disposal and recycling.

Codan's global operations are subject to a dynamic legal framework, requiring diligent compliance with export controls, product liability standards, and intellectual property laws. Recent data shows significant penalties for export violations, underscoring the need for robust compliance programs. Furthermore, evolving privacy regulations like GDPR necessitate stringent data handling protocols to avoid substantial fines.

The company must also navigate environmental regulations, particularly those concerning e-waste and hazardous substances, with upcoming 2025 legislation expected to increase recycling mandates and producer responsibility. This legal environment demands continuous adaptation and investment in compliance measures to mitigate risks and maintain market access.

| Legal Factor | Description | Impact on Codan | Relevant Data/Examples |

| Export Controls | Adherence to regulations on dual-use and defense items. | Risk of fines, license revocation, reputational damage. | U.S. BIS civil penalties exceeded $300 million in 2023 for export violations. |

| Product Liability & Safety | Meeting rigorous safety standards for critical applications. | Significant legal repercussions and reputational harm from product failures. | Global product liability market valued at ~ $100 billion in 2023. |

| Intellectual Property (IP) | Protecting patents, trademarks, and trade secrets. | Essential for competitive edge, deterring infringement. | Over 3.4 million global patent applications filed in 2023. |

| Data Privacy | Compliance with GDPR and similar laws for data handling. | Potential fines up to 4% of global revenue; requires robust data governance. | Global data privacy software market valued at ~ $1.8 billion in 2023. |

| Environmental Regulations | Compliance with WEEE, RoHS, and upcoming e-waste laws. | Impacts supply chain, product design, and end-of-life management. | New e-waste laws by 2025 may increase recycling targets and EPR. |

Environmental factors

The escalating global e-waste problem, projected to reach 74 million metric tons by 2030 according to the UN's Global E-waste Monitor 2024, directly impacts Codan. This surge necessitates robust management strategies and compliance with evolving Extended Producer Responsibility (EPR) regulations, which are becoming more stringent across key markets like the EU.

Codan's commitment to circular economy principles is crucial for navigating these environmental pressures. By focusing on product design for longevity and recyclability, the company can mitigate its environmental footprint and potentially unlock new revenue streams from recovered materials, aligning with the EU's Circular Economy Action Plan which aims to boost sustainable product design.

Codan's manufacturing relies on materials like rare earth elements and metals, some of which face increasing scarcity. For instance, global demand for lithium, a key component in batteries, is projected to grow significantly, with prices fluctuating based on supply chain stability. Ensuring a sustainable and ethical supply chain for these critical resources is paramount to maintaining production and mitigating risks associated with geopolitical instability in sourcing regions.

Codan's manufacturing sites, crucial for its operations, naturally require significant energy, thus contributing to its overall carbon footprint. Understanding this impact is key to their sustainability strategy.

The company has set ambitious goals to curb its energy use and boost efficiency, with a clear vision to eventually incorporate renewable energy sources. This proactive approach is designed to meet current sustainability targets and prepare for upcoming emissions regulations.

Codan is actively working towards achieving net-zero emissions by 2045, a commitment that will likely involve substantial investments in cleaner energy technologies and operational improvements across its facilities.

Climate Change Impacts on Operations and Supply Chain

Climate change poses significant operational and supply chain risks for Codan. Extreme weather events, like the severe flooding experienced in parts of Australia in early 2024, can disrupt manufacturing and logistics, impacting delivery schedules and potentially damaging facilities. Resource scarcity, driven by changing climate patterns, could also affect the availability and cost of raw materials essential for Codan's product lines.

Codan's commitment to assessing and mitigating these physical and transition risks is crucial for maintaining business continuity. For instance, the company's risk management framework likely includes strategies for diversifying suppliers and securing alternative production sites to build resilience against climate-related disruptions. This proactive approach is vital for ensuring the company can continue to operate effectively even in the face of environmental challenges.

The financial implications of climate change for Codan are substantial. In 2024, the global insurance industry reported significant losses due to natural catastrophes, highlighting the potential for increased operational costs and insurance premiums. Codan's ability to adapt its operations and supply chain to these evolving environmental conditions will directly influence its long-term profitability and market competitiveness.

- Supply Chain Vulnerability: Extreme weather events in key manufacturing regions or along transportation routes can lead to production delays and increased shipping costs.

- Resource Stress: Potential shortages or price volatility of critical raw materials due to climate-induced agricultural or industrial impacts could affect manufacturing costs.

- Operational Resilience: Investments in climate-resilient infrastructure and diversified sourcing strategies are essential for mitigating disruptions and ensuring business continuity.

- Transition Risk Management: Adapting to evolving environmental regulations and market demands for sustainable products requires strategic planning and potential capital expenditure.

Product Design for Environmental Impact

The increasing global focus on sustainability is driving a demand for products designed with minimal environmental footprints. This includes optimizing for energy efficiency during use, selecting sustainable materials, enhancing product durability, and ensuring ease of repair and recyclability at the end of life. By 2024, over 60% of consumers globally indicated they consider a product's environmental impact when making purchasing decisions.

Codan's adherence to regulations like RoHS (Restriction of Hazardous Substances) and the inclusion of WEEE (Waste Electrical and Electronic Equipment) labeling are positive steps. However, the company must continue to innovate in eco-design principles. For instance, exploring biodegradable components or closed-loop manufacturing processes can further reduce environmental impact. The European Union's Ecodesign Directive, updated in 2024, sets ambitious targets for product repairability and recyclability, directly influencing manufacturing standards.

Key areas for Codan's eco-design improvement include:

- Material Sourcing: Prioritizing recycled content and sustainably sourced raw materials.

- Energy Efficiency: Further reducing power consumption in product operation.

- Lifecycle Assessment: Conducting comprehensive analyses to identify and mitigate environmental hotspots from production to disposal.

- Circular Economy Integration: Designing for disassembly and material recovery to enable reuse and recycling.

Environmental factors present both challenges and opportunities for Codan. The growing e-waste crisis, projected to reach 74 million metric tons by 2030, demands robust waste management and adherence to evolving Extended Producer Responsibility (EPR) regulations, particularly in key markets like the EU. This necessitates a focus on circular economy principles and product design for longevity and recyclability.

Climate change introduces risks such as supply chain disruptions from extreme weather events and potential resource scarcity, impacting manufacturing and raw material costs. Codan's proactive approach to assessing and mitigating these risks, including investments in climate-resilient infrastructure and diversified sourcing, is crucial for business continuity and long-term profitability.

The increasing consumer demand for sustainable products means Codan must prioritize eco-design, focusing on energy efficiency, sustainable materials, durability, and end-of-life recyclability. Adherence to regulations like RoHS and WEEE, alongside innovations in closed-loop manufacturing, will be key to meeting market expectations and environmental standards.

| Environmental Factor | Impact on Codan | Key Considerations/Actions |

| E-waste Growth | Increased regulatory burden, potential disposal costs | Design for recyclability, EPR compliance, circular economy integration |

| Climate Change | Supply chain disruption, resource volatility, operational risks | Climate-resilient infrastructure, diversified sourcing, risk management |

| Sustainability Demand | Market opportunity for eco-friendly products, competitive pressure | Eco-design innovation, sustainable material sourcing, lifecycle assessment |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Codan draws from a comprehensive blend of official government publications, reputable financial institutions, and leading industry-specific research. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting Codan.