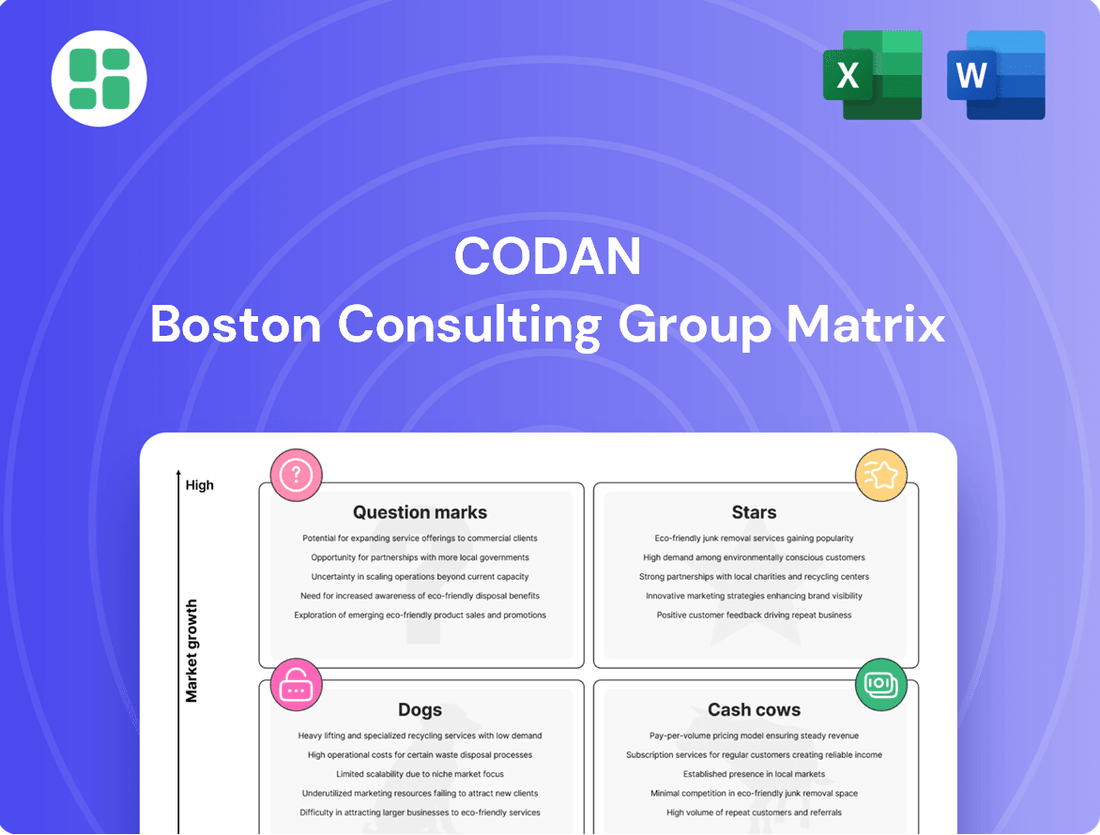

Codan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Codan Bundle

Unlock the strategic potential of Codan's product portfolio with a clear understanding of its position within the BCG Matrix. Identify your Stars, Cash Cows, Dogs, and Question Marks to make informed decisions. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to optimize your investments.

Stars

Codan's Tactical Communications division, strengthened by the December 2024 Kägwerks acquisition, operates in a high-growth sector fueled by escalating global defense expenditures and the proliferation of unmanned systems. This segment provides cutting-edge MESH radio technology, vital for enhancing battlefield intelligence and operational effectiveness in demanding conditions.

The Kägwerks acquisition is projected to significantly boost Codan's revenue and EBITDA, solidifying its dominant position in the tactical communications market. This strategic move is expected to contribute an estimated $30 million in annual revenue and a 25% EBITDA margin, underscoring its market leadership.

Zetron, a vital component of Codan's Communications division, is making significant strides in the Land Mobile Radio (LMR) systems market, particularly with its focus on Next Generation 911 (NG911) advancements. This market is experiencing robust growth, driven by the need for superior voice clarity, enhanced security, and seamless interoperability across public safety, utility, and transportation sectors.

The LMR market, a crucial area for Zetron, is projected for substantial expansion. For instance, the global LMR market was valued at approximately USD 6.8 billion in 2023 and is anticipated to reach around USD 9.5 billion by 2028, exhibiting a compound annual growth rate (CAGR) of about 7.0% during this period. Zetron's commitment to innovation within this expanding landscape, coupled with its strengthening presence in these critical industries, underscores its high growth potential and strategic significance within Codan's portfolio.

The global Digital Land Mobile Radio (LMR) systems market is experiencing robust growth, with an anticipated Compound Annual Growth Rate (CAGR) of 11% between 2024 and 2034. This expansion is fueled by a significant shift towards digital technologies, which offer enhanced performance and reliability for critical communications. Codan's digital LMR solutions are strategically positioned to capitalize on this trend, meeting the evolving needs of sectors requiring secure and dependable communication.

Demand for secure and reliable communication is particularly strong in mission-critical applications, such as public safety and defense. Codan's digital LMR products directly address these requirements, making them significant growth drivers for the company. The market's trajectory indicates a clear preference for advanced digital LMR capabilities, underscoring the strategic importance of Codan's investments in this area.

Advanced MESH Radio Technology

Codan's advanced MESH radio technology, a key component of its Tactical Communications portfolio, excels in demanding and contested operational settings, making it particularly well-suited for unmanned systems. This technology's ability to maintain reliable communication in difficult conditions positions it as a strong contender in a growing market.

The market for compact, efficient, and resilient radio solutions is expanding significantly. For instance, the global military radio communication market was valued at approximately $10.5 billion in 2023 and is projected to reach $14.2 billion by 2028, growing at a CAGR of 6.2%. This growth is driven by the increasing need for enhanced mobility and operational effectiveness in remote and challenging military environments.

- Market Growth: The military radio communication market is projected to grow significantly, indicating strong demand for advanced MESH technology.

- Key Applications: Unmanned systems and operations in harsh environments are primary drivers for this technology.

- Technological Advancement: Continued innovation and integration are crucial for Codan to maintain its leading position in this sector.

- Competitive Advantage: The robustness and efficiency of Codan's MESH radios offer a distinct advantage in contested communication landscapes.

Integrated Military and Law Enforcement Solutions

Codan's strategic acquisition of Kägwerks significantly bolsters its position in the integrated military and law enforcement solutions market, transforming it into a comprehensive tactical radio solutions provider. This move allows for the seamless integration of multiple systems, creating a unified offering that enhances operational efficiency for end-users.

This integrated approach unlocks substantial opportunities within key military and law enforcement sectors, capitalizing on inherent synergies and expanding Codan's footprint in high-value programs. A prime example is the US Army Nett Warrior Program, where such integrated solutions are increasingly sought after. The security sector, particularly with its high budget allocations, represents a significant growth avenue for these advanced capabilities.

The demand for integrated tactical communication and situational awareness systems is robust, driven by the evolving nature of modern warfare and law enforcement operations. Codan's expanded portfolio directly addresses this demand, positioning it favorably in a high-growth market segment. For instance, the global defense communication market was projected to reach over $30 billion by 2024, underscoring the substantial financial opportunities in this space.

- Broadened Offering: Integration of Kägwerks enhances Codan's capabilities as a full tactical radio solutions provider.

- Market Expansion: Increased opportunities in military and law enforcement due to comprehensive, integrated systems.

- Program Leverage: Synergies benefit participation in high-budget programs like the US Army Nett Warrior Program.

- Sector Growth: Taps into a high-demand, high-growth security sector with significant budgetary backing.

Stars in the BCG Matrix represent business units with high market share in high-growth industries. Codan's Tactical Communications division, particularly with its MESH radio technology and the recent Kägwerks acquisition, fits this description. This segment is experiencing robust demand due to increasing global defense spending and the rise of unmanned systems.

The projected revenue contribution of $30 million annually from Kägwerks, coupled with a 25% EBITDA margin, highlights its strong performance and market position. This indicates a significant growth trajectory, aligning with the characteristics of a Star.

The global military radio communication market, valued at approximately $10.5 billion in 2023 and projected to reach $14.2 billion by 2028, further validates the high-growth environment. Codan's advanced MESH radios are well-positioned to capture a substantial share of this expanding market.

The company's strategic focus on integrated solutions, such as those benefiting the US Army Nett Warrior Program, also points to its Star status. These integrated offerings address a critical need for enhanced situational awareness and operational efficiency in high-stakes environments.

What is included in the product

The Codan BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

Codan BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis.

Cash Cows

Minelab's gold detection products, particularly those utilized in artisanal mining across Africa, are a prime example of a cash cow. Their established market leadership and consistent profitability solidify this position.

In the first half of fiscal year 2025, this segment experienced a notable 5% revenue growth. This uplift was largely driven by elevated gold prices, which in turn motivated self-employed prospectors, especially in West African regions, to increase their activity.

The market for these products in Africa, while mature, continues to be a reliable source of substantial cash flow. This is further supported by the segment's impressive high profit margins, underscoring its value within the broader portfolio.

Minelab stands as a dominant force in the recreational metal detector market, boasting a diverse product line that caters to treasure hunters and enthusiasts alike. This established segment consistently delivers high-margin revenue, benefiting from a dedicated customer base and minimal need for extensive market expansion.

The brand's strong reputation and well-developed distribution network contribute to its reliable cash flow generation, solidifying its position as a cash cow for Codan. In 2024, Minelab's recreational division continued to be a significant contributor to Codan's overall revenue, demonstrating robust sales figures driven by product innovation and brand loyalty.

Codan's traditional High Frequency (HF) radio communications represent a classic Cash Cow. This segment boasts a well-established customer base across government, corporate, and NGO sectors, relying on its proven reliability for critical long-range communication needs.

While the market for traditional HF radio might not be experiencing rapid growth, Codan maintains a dominant market share. This strong position allows the company to generate consistent and predictable cash flows, a hallmark of a Cash Cow, thanks to the enduring demand for its dependable solutions in essential applications.

Fixed-Site Communications Infrastructure (Zetron)

Zetron's fixed-site communications infrastructure serves critical sectors, generating stable revenue. Its dispatch and control systems are vital for public safety, utilities, and transportation clients.

These offerings benefit from long-term contracts and recurring maintenance revenue, solidifying their position as cash cows. In 2024, the public safety communications market, a key sector for Zetron, was valued at approximately $15 billion globally, with steady growth projected.

- Stable Revenue: Zetron's infrastructure solutions provide consistent income due to their essential nature in critical industries.

- High Market Share: The company holds a significant share in mature, yet indispensable, communication markets.

- Long-Term Contracts: Client relationships are often secured through multi-year agreements, ensuring predictable cash flow.

- Recurring Services: Maintenance and support services add to the ongoing revenue generation.

Humanitarian Demining Metal Detectors (Minelab)

Minelab's humanitarian demining metal detectors represent a classic Cash Cow within the Codan BCG Matrix. This segment benefits from a well-entrenched global leadership position, catering to a critical and specialized market.

The demand for these detectors is driven by ongoing global efforts to clear landmines, a persistent humanitarian challenge. This niche, while not massive in volume, offers stable, high-margin revenue due to the essential nature of the technology and the rigorous quality standards required.

- Market Dominance: Minelab has cultivated a reputation for reliability and effectiveness in demining operations, securing a significant market share.

- High Margins: The specialized nature and critical safety applications of demining equipment allow for premium pricing and healthy profit margins.

- Stable Revenue: The continuous need for landmine clearance worldwide ensures a consistent, predictable revenue stream for Minelab's demining detector division.

- Brand Equity: Years of proven performance have built strong brand loyalty and trust among humanitarian organizations and military units.

Cash cows are business units or products that have a high market share in a mature industry. They generate more cash than they consume, providing a stable and predictable income stream for the company. These units typically require minimal investment for maintenance and can be leveraged to fund growth in other areas of the business.

Minelab's gold detection products in Africa are a prime example, showing 5% revenue growth in H1 FY25 due to higher gold prices boosting prospector activity. Codan's HF radio communications also fit this profile, maintaining a dominant market share in a stable sector. Zetron's fixed-site communications infrastructure, vital for public safety and utilities, benefits from long-term contracts and recurring maintenance revenue, contributing significantly to Codan's overall financial stability.

| Product/Segment | Market Share | Growth Rate | Profitability | Cash Flow Generation |

| Minelab Gold Detectors (Africa) | High | Stable (5% H1 FY25) | High Margins | Strong & Consistent |

| Codan HF Radio Communications | Dominant | Low/Mature | High | Predictable |

| Zetron Fixed-Site Comms | Significant | Stable | High (Recurring Revenue) | Reliable |

Preview = Final Product

Codan BCG Matrix

The Codan BCG Matrix preview you are viewing is the identical, fully functional document you will receive upon purchase, offering a comprehensive strategic analysis tool. This means the exact same data, formatting, and insights will be yours to utilize immediately, without any alterations or watermarks. You can confidently assess the market share and growth potential of Codan's product portfolio as presented here. This preview ensures you know precisely what you are acquiring, a ready-to-use strategic planning asset for informed decision-making.

Dogs

Older generation analog LMR systems are positioned as Dogs in Codan's BCG Matrix. As the market shifts decisively towards digital, these analog products are experiencing a significant drop in demand. For instance, the global LMR market, while still substantial, sees digital solutions capturing an increasing share, projected to grow at a CAGR of over 6% through 2028, leaving analog systems behind.

These legacy systems lack the advanced features, encryption, and spectral efficiency that modern digital LMRs provide, making them less attractive to customers seeking enhanced communication capabilities. This competitive disadvantage means continued investment in analog LMR development or extensive marketing would likely result in diminishing returns for Codan.

Given their declining market relevance and low growth prospects, Codan should consider divesting or significantly reducing support for its older analog LMR offerings. This strategic move would allow the company to reallocate resources towards more promising digital technologies and future growth areas.

Codan's basic entry-level consumer metal detectors, representing older models with fewer advanced features, likely fall into the Dogs category of the BCG Matrix. These products operate in a saturated, price-sensitive market, facing stiff competition from many low-cost alternatives. Consequently, they probably hold a low market share with minimal growth prospects.

Codan might have some older, specialized products that don't fit with its focus on new communication tech or premium metal detectors. These are often called non-strategic, niche legacy products. They tend to have a small slice of their market and operate in areas that aren't growing much, or are even shrinking.

These legacy items often demand more attention and resources than they bring in revenue. For instance, a product line with a market share below 5% in a market with less than 2% annual growth might be a prime example. Such offerings are often considered for streamlining or phasing out to redirect capital toward more promising ventures.

Products Significantly Impacted by Regional Geopolitical Instability

Codan's metal detector sales in Sudan have been significantly impacted by ongoing geopolitical instability. This has effectively relegated the product's presence in that specific region to a 'dog' category within the BCG matrix. Despite the product's global appeal, the inability to conduct business in a severely disrupted market leads to negligible sales and market share there.

This situation underscores the risk associated with revenue streams tied to volatile geopolitical landscapes. For instance, the conflict in Sudan, which intensified in 2023 and continued into 2024, severely hampered trade and security, making operations for companies like Codan exceedingly difficult and impacting sales of specialized equipment. The International Crisis Group reported in early 2024 that the conflict had displaced over 9 million people, disrupting supply chains and economic activity across the country.

- Geographic Market Impact: Sudan's prolonged conflict directly affects Codan's metal detector sales in that specific territory.

- Operational Disruption: Geopolitical instability prevents effective sales and distribution, leading to zero or minimal revenue from the affected region.

- Market Share Erosion: In regions like Sudan, the inability to operate effectively results in a complete loss of market share for affected product lines.

- Revenue Vulnerability: Reliance on volatile markets exposes revenue streams to significant risk, as seen with Codan's Sudanese operations.

Commoditized Communication Components

Within Codan's product portfolio, certain standard or commoditized communication components, such as basic antennas or cables, might be classified as Dogs. These products often encounter significant price competition and lack unique features, resulting in thin profit margins and sluggish market share expansion. For instance, in the broader telecommunications accessories market in 2024, prices for generic connectors saw a decline of up to 8% due to oversupply and intense competition from low-cost manufacturers.

These commoditized items, while potentially essential for some integrated solutions, are not strategic growth drivers for Codan. Effective management is crucial to prevent them from becoming a drain on resources. In 2023, companies in the electronics component sector with a high proportion of commoditized offerings reported an average EBITDA margin of 7.5%, significantly lower than the 15% seen in specialized or differentiated product segments.

- Low Differentiation: Products like standard coaxial cables offer little room for innovation or unique selling propositions.

- Intense Price Competition: The market for these components is often driven by price, squeezing potential profits.

- Limited Growth Potential: Market share gains are difficult to achieve and often come at the expense of profitability.

- Resource Drain Risk: Continued investment in low-margin, low-growth products can divert capital from more promising areas.

Codan's older analog LMR systems are considered Dogs due to declining demand and low growth in a market rapidly adopting digital solutions. These systems lack the advanced features of their digital counterparts, making continued investment unlikely to yield significant returns.

Similarly, basic, older models of Codan's consumer metal detectors, facing intense competition in a saturated market, likely fall into the Dog category. These products typically have low market share and minimal growth prospects.

Commoditized communication components, like standard antennas or cables, also represent Dogs. They face heavy price competition and offer thin profit margins, with limited potential for market share expansion, as evidenced by the 2024 decline in generic connector prices.

| Product Category | BCG Matrix Classification | Market Characteristics | Codan's Position | Strategic Recommendation |

| Analog LMR Systems | Dogs | Declining demand, low growth, superseded by digital | Low market share, diminishing relevance | Divest or reduce support |

| Basic Consumer Metal Detectors | Dogs | Saturated market, high price sensitivity, intense competition | Low market share, minimal growth prospects | Consider phasing out or repositioning |

| Commoditized Communication Components | Dogs | Price-driven market, low differentiation, thin margins | Limited market share growth, low profitability | Streamline or manage for minimal resource drain |

Question Marks

Following the Kägwerks acquisition, Codan now possesses AI-at-the-edge capabilities, significantly enhancing battlefield intelligence for soldiers. This emerging defense technology sector is experiencing rapid growth, though widespread adoption and market share are still developing.

This area represents a high-potential, high-growth segment, fitting the 'Question Mark' category in the BCG Matrix. While the technology offers a clear competitive advantage, substantial investment is crucial to mature its market presence and transition it into a 'Star' performer.

Codan's strategic focus includes the ongoing development of advanced multi-waveform radio solutions in partnership with TrellisWare. This initiative is geared towards securing future defense communications contracts, a sector with substantial growth potential for sophisticated military applications.

While this venture represents a high-growth prospect, Codan currently holds a minimal market share in this niche, as it remains in the crucial development and early engagement stages. Significant investment in research and development, alongside strategic alliances, will be paramount to successfully launching these solutions and establishing a strong market presence.

Minelab's GOLD MONSTER 2000, launched in July 2025, enters a metal detector market experiencing robust growth, with global sales projected to reach $1.2 billion by 2027, up from $900 million in 2023. This new offering aims to capture a significant share with its advanced features, though its long-term market position is still developing.

Positioned as a Star within the BCG matrix, the GOLD MONSTER 2000 benefits from a high growth market. However, to solidify its Star status and transition into a Cash Cow, it necessitates substantial investment in marketing and distribution. Without aggressive market penetration strategies, there's a risk of it declining into a Dog category.

Expansion into New Geographic Markets for Communications

Codan's strategy for its Communications segment involves targeting large, growing markets, which necessitates expanding into new geographic territories. These emerging regions present substantial growth prospects, but Codan's initial presence and market share are expected to be minimal.

This strategic move into new countries requires considerable initial investment. These funds are allocated to establishing a market presence, tailoring marketing efforts to local cultures, and building robust distribution channels to gain traction.

- Market Entry Investment: Significant capital is deployed for market research, regulatory compliance, and setting up local operations.

- Localized Marketing: Campaigns are designed to resonate with specific cultural nuances and consumer behaviors in each new territory.

- Distribution Network: Building partnerships and infrastructure to ensure product availability and customer support across diverse regions.

- Growth Potential: These markets, while initially demanding investment, offer the potential for high revenue growth as Codan establishes its brand and market share.

Advanced Tracking Solutions for Specialized Applications

While Codan's general tracking solutions are noted, the company's strategic positioning in advanced, specialized tracking for high-growth sectors like defense and security requires deeper exploration. If Codan is indeed developing next-generation, highly secure, real-time tracking for complex operational environments, this represents a potential high-growth, low-market-share opportunity.

Such advanced solutions, if they exist and are being scaled, would likely fall into the question mark category of the BCG matrix. This implies significant investment is needed to build market share and differentiate from competitors in these niche, demanding applications.

- High-Growth Potential: Specialized defense and security tracking offers substantial growth prospects driven by increasing global security needs and technological advancements.

- Low Current Market Share: If Codan's advanced tracking is in early development or targeting niche segments, its current market share would likely be low.

- Strategic Investment Required: To capitalize on this potential, Codan would need to invest heavily in R&D, sales, and marketing to establish a strong foothold.

- Differentiation is Key: Success hinges on offering unique, superior features such as enhanced security, real-time data accuracy, and seamless integration into complex systems.

Codan's AI-at-the-edge capabilities for defense represent a classic Question Mark. This emerging sector shows strong growth potential, but Codan's market share is still minimal as the technology matures. Significant investment is vital to transform this into a market leader.

Similarly, Codan's new multi-waveform radio solutions for defense communications are in the Question Mark phase. The market is expanding, but Codan is an early entrant with limited penetration. Strategic partnerships and R&D are key to capturing future contracts.

The company's expansion into new geographic territories for its Communications segment also fits the Question Mark profile. These markets offer high growth, but Codan's initial market share is negligible, necessitating substantial upfront investment in local operations and marketing.

Advanced, specialized tracking solutions for defense and security, if developed by Codan, would also be Question Marks. These niche applications have high growth potential driven by global security needs, but require significant investment to build market share and differentiate through superior features.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, market research reports, and industry growth projections to provide a comprehensive strategic overview.