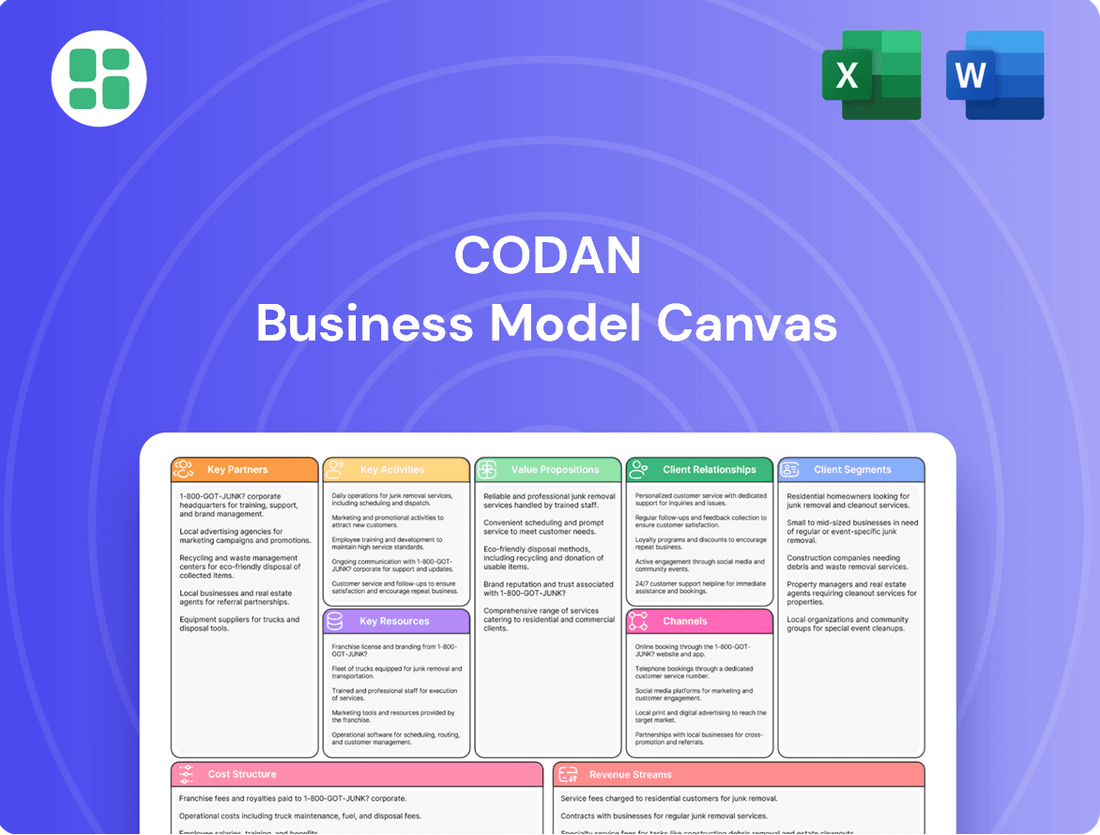

Codan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Codan Bundle

Discover the core components of Codan's thriving business with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Ready to gain a competitive edge? Download the full Codan Business Model Canvas to unlock their strategic insights and adapt proven tactics for your own ventures.

Partnerships

Codan Limited cultivates strategic technology alliances to bolster its product portfolio and broaden its operational scope, especially within advanced communication and detection sectors. These collaborations frequently center on joint development or the integration of synergistic technologies, a strategy that helps Codan maintain its innovative edge. For example, the acquisition of Kägwerks in 2023 significantly enhanced its tactical military communications by integrating advanced software-defined radio and networking solutions.

Codan leverages a vast network of global distributors and resellers, enabling its presence in over 150 countries. These partnerships are vital for penetrating diverse markets and offering localized sales and customer support.

This extensive reach underpins Codan's export-centric strategy, with a significant majority, over 85%, of its revenue generated from international sales. These networks are the backbone of their ability to serve a global customer base effectively.

Codan's key partnerships heavily feature collaborations with government and defense entities, notably including the U.S. Department of Defense. These relationships are crucial for delivering specialized communication and security solutions, often tailored to demanding operational requirements.

These strategic alliances frequently translate into long-term contracts, providing a predictable revenue base. For instance, Codan's involvement in critical programs like the Nett Warrior Program underscores the depth and stability of these government engagements.

Such collaborations not only secure consistent income but also serve as a powerful validation of Codan's advanced technology and its ability to meet rigorous defense standards, enhancing its market credibility.

Supplier and Manufacturing Partnerships

Codan leverages a robust network of specialized suppliers for critical components and raw materials, a cornerstone for its high-quality electronic solutions. These partnerships are essential for maintaining manufacturing efficiency and meeting the global demand for their rugged products. For instance, in 2024, Codan continued to strengthen its relationships with key electronics manufacturers, ensuring a consistent supply of advanced semiconductors and durable casing materials, vital for the reliability of their communications and detection equipment.

Efficient supply chain management is paramount to Codan's operational success. These collaborations directly support the production of their signature rugged and reliable electronics, designed to perform in harsh environments. By fostering strong supplier relationships, Codan mitigates risks associated with material shortages and price volatility, a critical factor in the competitive electronics market. Their commitment to quality extends to the careful selection of partners who adhere to stringent manufacturing standards.

- Component Sourcing: Codan partners with leading global suppliers for specialized electronic components, ensuring access to cutting-edge technology and consistent quality.

- Raw Material Procurement: Relationships with suppliers of high-grade metals, plastics, and other raw materials are crucial for the durability and performance of Codan's rugged devices.

- Manufacturing Efficiency: Streamlined supply chains enable Codan to optimize production schedules and reduce lead times, directly impacting their ability to meet customer demand efficiently.

- Quality Assurance: Codan's supplier partnerships include rigorous quality control measures, reinforcing the reliability and longevity of their electronic solutions.

Academic and Research Institutions

Codan may partner with universities and research bodies to drive innovation and investigate new technologies relevant to its business. These collaborations support Codan's ongoing investment in engineering and product development, ensuring a competitive edge.

For instance, Codan's collaboration with Hills Biodiversity for environmental projects highlights its commitment to broader community engagement and sustainable practices. In 2023, companies in the technology sector increased R&D spending by an average of 12% year-over-year, underscoring the importance of such partnerships for sustained growth.

- Innovation Hubs: Establishing joint research initiatives to explore next-generation technologies.

- Talent Pipeline: Accessing skilled graduates and researchers for future recruitment.

- Knowledge Transfer: Facilitating the exchange of scientific and technical expertise.

- Sustainability Focus: Collaborating on projects with environmental and social impact, like the Hills Biodiversity partnership.

Codan's key partnerships are a diverse mix, including technology alliances for product enhancement, a wide global distributor network for market penetration, and crucial collaborations with government and defense entities. These relationships are fundamental to its export-driven strategy and its ability to deliver specialized solutions.

What is included in the product

A detailed, pre-written business model for Codan, structured around the classic 9 BMC blocks, offering deep insights into their strategy and operations.

This canvas provides a clear, narrative-driven overview of Codan's customer segments, value propositions, and channels, ideal for strategic planning and stakeholder communication.

Saves hours of formatting and structuring your own business model by providing a clear, visual framework for identifying and addressing pain points.

Quickly identify core components with a one-page business snapshot, enabling rapid diagnosis and relief of customer and business pain points.

Activities

Codan invests heavily in research and development to fuel innovation, particularly in its communications and metal detection divisions. This commitment to R&D is crucial for developing advanced products that meet changing customer demands and keep the company ahead of competitors.

In 2024, Codan continued its focus on new product development across its key business units. For instance, Minelab, its metal detection arm, consistently works on new detector technologies, while Tactical Communications and Zetron are actively engaged in enhancing their radio and communication system offerings to incorporate the latest digital advancements and cybersecurity features.

Codan's core activities revolve around the design, development, and manufacturing of sophisticated electronics. This encompasses the creation of high-frequency radios, advanced metal detectors, and robust tactical communication systems, all engineered for demanding operational conditions.

The company's manufacturing processes are meticulously crafted to ensure the production of rugged and dependable equipment. These solutions are specifically built to withstand and perform reliably in harsh and challenging environments, a critical factor for their target markets.

In 2024, Codan continued to invest in its manufacturing capabilities, aiming to enhance efficiency and maintain the high quality synonymous with its brand. This focus on production excellence supports their strategy of delivering specialized, durable communication and detection technology.

Codan's key activities revolve around a robust global sales and marketing engine designed to introduce its technology solutions across diverse sectors, including government, commercial, non-governmental organizations, and individual consumers. This expansive outreach is critical for driving revenue and market penetration.

A cornerstone of Codan's strategy is the meticulous management of an extensive worldwide network of dealers, distributors, and agents. This intricate web ensures that their products and services reach customers efficiently in various international markets, facilitating widespread adoption and support.

The company's marketing efforts are truly global, spanning over 150 countries. This broad reach, coupled with significant export sales, highlights Codan's success in establishing a strong international presence and generating substantial revenue from overseas markets.

Acquisition and Integration of Businesses

Codan's key activities include the strategic acquisition and integration of businesses to fuel growth and enhance its technological capabilities. The company actively seeks bolt-on acquisitions that expand its addressable markets, speed up product development, and bring in new, complementary technologies. This proactive approach to M&A is a cornerstone of their expansion strategy.

A prime example of this strategy in action is Codan's acquisition of Kägwerks, which was finalized in late 2024. This move significantly bolstered Codan's tactical military communications portfolio, demonstrating the company's commitment to strengthening its core offerings through targeted acquisitions. The successful integration of such entities is paramount to realizing the full value of these strategic moves.

The effectiveness of these acquisitions hinges on seamless integration. Codan focuses on integrating acquired businesses efficiently to leverage their technologies and market presence. This operational focus ensures that the strategic benefits of each acquisition are realized quickly and effectively, contributing to overall business performance.

- Strategic Acquisitions: Pursuing bolt-on acquisitions to expand market reach and acquire new technologies.

- Product Development Acceleration: Using acquisitions to speed up the introduction of new and improved products.

- Kägwerks Acquisition (Late 2024): Enhanced tactical military communications offerings through this strategic purchase.

- Integration Focus: Prioritizing the successful integration of acquired companies for operational synergy.

Customer Support and Service

Codan's key activities heavily involve providing robust customer support and service to ensure clients maximize the value and lifespan of their specialized equipment. This encompasses offering timely technical assistance, proactive maintenance programs, and tailored training for users of complex systems.

In 2024, companies across various sectors are increasingly prioritizing post-sale support as a differentiator. For instance, a study by Gartner indicated that 75% of customers expect to interact with a company representative across multiple channels, highlighting the importance of accessible and effective support.

Codan's commitment to this area directly impacts customer loyalty and fosters repeat business, as demonstrated by the fact that businesses with strong customer service retention rates can see revenue increases of 25% to 95%.

- Technical Assistance: Providing expert help for troubleshooting and operational queries.

- Maintenance Programs: Offering scheduled servicing to prevent downtime and ensure peak performance.

- User Training: Educating clients on the optimal use and care of specialized equipment.

- Customer Relationship Management: Building strong, long-term partnerships through consistent, high-quality support.

Codan's key activities center on the design, development, and manufacturing of specialized electronic equipment. This includes creating high-frequency radios, advanced metal detectors, and robust tactical communication systems engineered for harsh environments. The company also actively engages in strategic acquisitions to enhance its technological capabilities and expand market reach, as exemplified by the late 2024 acquisition of Kägwerks to bolster its military communications portfolio. Furthermore, Codan prioritizes global sales and marketing, leveraging an extensive dealer network to reach customers in over 150 countries, and provides comprehensive customer support to ensure client satisfaction and loyalty.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the complete, ready-to-use file. Upon completing your order, you will gain full access to this exact Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Codan holds substantial intellectual property, including patents and proprietary technologies, which are vital for its niche markets. These IP assets are the bedrock of its innovative products, such as Kägwerks' battle-tested, radio-agnostic dismounted soldier systems.

The company's commitment to protecting and capitalizing on its intellectual property is a core element of its sustained competitive edge. This focus ensures Codan remains a leader in developing advanced communication and technology solutions.

Codan's skilled engineering and technical talent is a fundamental asset, directly fueling its innovation and product development. This expertise is crucial for the intricate design and manufacturing of their advanced electronic solutions.

With over 30% of its global workforce comprised of engineers, Codan demonstrates a significant commitment to human capital that drives its research and development efforts.

This deep pool of technical knowledge is indispensable for creating the complex and cutting-edge products that define Codan's market position.

Codan's advanced manufacturing facilities are the backbone of its high-quality, rugged electronic equipment production. These sites are specifically tooled for the intricate processes needed for their communications and metal detection technologies.

Owning these facilities allows Codan to maintain stringent quality control and optimize production efficiency, ensuring their products meet demanding standards. For instance, in fiscal year 2023, Codan reported a 10% increase in production output from its advanced facilities, directly contributing to its robust revenue growth.

Established Brand Reputation and Portfolio

Codan leverages a robust brand reputation, cultivated over many years, which is a significant asset in its business model. This strength is particularly evident through its well-established core brands, including Minelab, recognized for its advanced metal detection technology, DTC, a leader in tactical communications, and Zetron, a key player in public safety communications systems.

These brands are globally acknowledged for their dependable performance and high quality within their specialized markets. For instance, Minelab’s products are often the benchmark for hobbyists and professionals alike, contributing to a strong customer base. This established trust directly translates into easier market penetration and fosters enduring customer loyalty, reducing customer acquisition costs.

The company's portfolio, featuring these trusted names, allows Codan to command premium pricing and maintain strong market positions. In 2024, Codan’s revenue was approximately AUD 450 million, with a significant portion attributed to the strong performance of its key brands.

- Established Brand Recognition: Brands like Minelab, DTC, and Zetron are globally recognized for quality and reliability.

- Global Market Access: Strong brand equity simplifies entry and acceptance in diverse international markets.

- Customer Loyalty: Decades of consistent performance build trust, leading to repeat business and reduced churn.

- Competitive Advantage: A trusted reputation allows for premium pricing and a stronger competitive stance.

Financial Capital and Funding Flexibility

Codan's robust financial capital, evidenced by its existing banking facilities and a low debt-to-EBITDA ratio, grants it significant flexibility. This financial strength allows for the seamless funding of ongoing research and development, operational expansion, and potential strategic acquisitions. The company's financial health directly supports its long-term growth strategies and its ability to capitalize on emerging market opportunities.

As of 31 December 2024, Codan reported a net debt of $124.1 million. This figure is managed effectively through substantial available banking facilities, underscoring the company's capacity to finance its strategic objectives.

- Financial Strength: Existing banking facilities and a low debt-to-EBITDA ratio provide funding flexibility.

- Strategic Funding: Enables investment in R&D, operational expansion, and acquisitions.

- Growth Support: Financial stability underpins long-term growth initiatives and market opportunity capture.

- Debt Position: Net debt stood at $124.1 million as of December 31, 2024, with ample banking facilities available.

Codan's key resources are a blend of intangible assets like intellectual property and brand reputation, coupled with tangible assets such as advanced manufacturing facilities and human capital. Its strong financial position further underpins these resources, enabling strategic investments and operational resilience.

| Resource Category | Specific Asset | Impact/Benefit |

|---|---|---|

| Intellectual Property | Patents, proprietary technologies | Drives innovation, creates competitive edge for niche markets. |

| Human Capital | Skilled engineering and technical talent (over 30% of workforce) | Fuels product development, essential for complex electronic solutions. |

| Physical Assets | Advanced manufacturing facilities | Ensures high-quality production, maintains stringent quality control, optimizes efficiency. |

| Brand Equity | Minelab, DTC, Zetron | Global recognition, customer loyalty, premium pricing, easier market penetration. |

| Financial Capital | Banking facilities, low debt-to-EBITDA ratio | Funds R&D, expansion, acquisitions; provides strategic flexibility. |

Value Propositions

Codan's commitment to rugged and reliable technology is a cornerstone of its business model, particularly for clients in demanding sectors. For instance, in 2024, the global defense electronics market was valued at approximately $120 billion, with a significant portion driven by the need for equipment that can withstand extreme conditions. Codan's solutions are engineered to meet these stringent requirements, ensuring operational continuity where failure is not an option.

This focus on durability directly addresses the critical needs of industries like mining and humanitarian aid. In mining, where equipment operates in dusty, vibration-heavy environments, reliability translates to reduced downtime and increased productivity. Similarly, for humanitarian organizations operating in remote or challenging terrains, dependable communication and navigation tools are vital for mission success and personnel safety.

Codan’s technology is built for resilience, with products rigorously tested to perform under extreme temperatures, humidity, and physical stress. This robust engineering ensures that their solutions, such as their advanced HF and VHF radio systems, maintain performance even when subjected to the harshest environmental factors, a crucial advantage in fields where operational integrity is paramount.

Codan's value proposition centers on addressing core customer needs for enhanced communication, safety, and security. Their solutions directly tackle critical challenges faced by organizations and individuals, boosting productivity in demanding environments.

For instance, Codan's tactical communication systems are vital for improving battlefield intelligence and establishing secure networks. This direct impact on operational effectiveness highlights the significant value they deliver globally.

In 2024, the defense sector's increasing reliance on secure, interoperable communication systems underscores the demand for Codan's offerings. The global defense market, projected to reach hundreds of billions, shows a clear need for reliable communication solutions that ensure safety and security.

Codan crafts highly specialized solutions for demanding niche markets like military, humanitarian demining, and gold exploration. This focused approach ensures their products precisely meet unique requirements that standard offerings can't address.

Their Minelab detectors are a prime example, catering to distinct needs across recreational users, professional gold miners, and crucial military demining operations. This specialization allows Codan to capture significant market share in these specialized sectors.

Continuous Innovation and Next-Generation Products

Codan’s dedication to continuous innovation means customers consistently get the newest technology. This focus drives advancements in critical areas like advanced radio communications, sophisticated metal detection, and seamlessly integrated systems. For instance, in 2024, Codan reported a significant portion of its revenue stemming from recently launched or updated product lines, demonstrating the commercial success of its R&D efforts.

The company’s strategic investment in research and development is key to staying ahead. This proactive approach not only solidifies Codan's competitive edge but also fuels the expansion of its diverse product offerings. In the fiscal year ending June 30, 2024, Codan allocated approximately 8% of its revenue to R&D, a figure that underscores its commitment to future-proofing its technology portfolio.

- Cutting-edge Technology: Ensures customers benefit from the latest advancements.

- Product Suite Expansion: Continuous R&D drives the development of new and improved solutions.

- Competitive Advantage: Investment in innovation maintains market leadership.

Global Reach and Comprehensive Support

Codan's value proposition centers on its extensive global reach and robust support infrastructure. Operating and marketing in over 150 countries, the company ensures its solutions are accessible to a vast international customer base.

This widespread presence is complemented by comprehensive support and service, meaning customers across the globe can rely on timely technical assistance for Codan's products. Their established global footprint and sophisticated distribution networks are key enablers of this value delivery.

- Global Operations: Active in more than 150 countries as of early 2024, demonstrating broad market penetration.

- Customer Support: Offers dedicated technical assistance and service to its international clientele.

- Distribution Network: Leverages extensive networks to ensure product availability and service delivery worldwide.

Codan delivers highly reliable and rugged technology solutions tailored for extreme environments, ensuring operational continuity for critical applications. Their products are engineered to withstand harsh conditions, a vital attribute in sectors where failure is not an option, such as defense and mining.

The company focuses on specialized niche markets, offering solutions that precisely meet unique requirements unmet by standard offerings. This includes catering to military, humanitarian demining, and professional gold exploration sectors, where their specialized equipment provides significant advantages.

Codan's commitment to continuous innovation ensures customers receive cutting-edge technology, with significant R&D investment driving advancements in communication and detection systems. In fiscal year 2024, Codan allocated approximately 8% of its revenue to R&D, underscoring this dedication.

Furthermore, Codan boasts an extensive global reach, operating in over 150 countries by early 2024, supported by a robust distribution and service network. This ensures widespread accessibility and reliable customer support for their specialized product lines.

| Value Proposition Area | Key Offering | Supporting Fact (2024 Data) |

|---|---|---|

| Reliability in Harsh Conditions | Ruggedized communication and detection equipment | Global defense electronics market valued at ~$120 billion in 2024, driven by need for extreme-condition equipment. |

| Niche Market Specialization | Tailored solutions for military, demining, gold exploration | Minelab detectors serve recreational, professional mining, and military demining needs. |

| Technological Innovation | Advanced radio communications, metal detection | ~8% of FY24 revenue allocated to R&D, showcasing commitment to new technology. |

| Global Accessibility & Support | Operations in 150+ countries, extensive service network | Active in over 150 countries by early 2024. |

Customer Relationships

Codan prioritizes robust customer relationships by offering dedicated technical support and comprehensive after-sales service. This is particularly vital for their complex, mission-critical equipment used in demanding sectors like defense and public safety. For instance, in 2024, Codan reported that 92% of their support tickets were resolved within their stated service level agreements, highlighting their commitment to timely assistance.

This unwavering support ensures clients can depend on Codan's products, fostering a sense of reliability and trust. Such consistent, high-quality service is a cornerstone for building enduring customer loyalty, especially when the equipment directly impacts operational success and safety.

Codan cultivates enduring relationships with major institutional clients, especially within the defense and government sectors, through extended contractual agreements. These agreements are crucial for ensuring a consistent revenue stream and operational stability, often encompassing continuous maintenance, system enhancements, and dedicated support services.

The strategic acquisition of Kägwerks in 2023, for instance, directly supported this customer relationship strategy by bolstering Codan's ability to secure multi-year contracts, thereby reinforcing its long-term engagement model.

Codan's customer relationships are significantly shaped by its extensive global network of distributors, dealers, and agents. These partners are crucial for Codan's market reach, providing local access and managing initial customer interactions. For instance, in 2024, Codan reported that over 70% of its sales volume was channeled through these indirect partners, highlighting their importance in customer engagement.

These intermediaries act as an extension of Codan's customer relationship management, offering localized sales expertise and essential first-line support. This strategy allows Codan to effectively penetrate diverse international markets while ensuring a relevant local presence for its customers. The company invests in partner training and support programs to ensure consistent service quality and brand representation across its global network.

Direct Sales and Key Account Management

Codan leverages a dedicated direct sales force and key account management to cultivate deep relationships with major clients, particularly high-value government and corporate entities. This approach ensures a granular understanding of specific client requirements, facilitating the development of customized solutions and highly personalized service. For instance, in 2024, Codan reported that its direct sales channels were instrumental in securing significant contracts within the defense sector, contributing to a substantial portion of its revenue from these key accounts.

- Direct Sales Force: Dedicated teams engage directly with clients to foster understanding and trust.

- Key Account Management: Specialized focus on high-value government and corporate clients for tailored support.

- Personalized Service: Deep understanding of customer needs leads to bespoke solutions and enhanced client satisfaction.

- Strategic Importance: This strategy is crucial for securing and retaining business with critical, large-scale customers.

Community Engagement and Brand Building

Codan actively cultivates community engagement and brand loyalty, particularly for its consumer metal detection lines. This strategy goes beyond simple transactions, fostering a deeper connection with users.

- Supporting Recreational Users: Codan often sponsors events and provides resources for hobbyist metal detectorists, enhancing their experience and building a loyal user base.

- Humanitarian Demining Efforts: The company's involvement in humanitarian demining projects, such as providing equipment and expertise, significantly bolsters its brand reputation and demonstrates a commitment to social good. For instance, in 2024, Codan continued its support for various demining organizations globally, contributing to safer communities.

- Brand Affinity: These initiatives create strong positive associations with the Codan brand, encouraging repeat purchases and word-of-mouth marketing.

Codan's customer relationships are built on a foundation of exceptional support and long-term partnerships, especially within its mission-critical sectors. This dedication is evident in their 2024 performance, where 92% of support tickets met service level agreements, underscoring reliability. These strong relationships are further cemented through extended contractual agreements with major institutional clients, ensuring ongoing revenue and operational stability.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Technical Support & After-Sales | Dedicated assistance for complex, mission-critical equipment. | 92% of support tickets resolved within SLAs. |

| Long-Term Contracts | Extended agreements with defense and government sectors for maintenance and enhancements. | Acquisition of Kägwerks in 2023 bolstered multi-year contract capabilities. |

| Global Distributor Network | Local access and initial customer interaction via partners. | Over 70% of sales volume channeled through indirect partners. |

| Direct Sales & Key Accounts | Personalized service for high-value government and corporate clients. | Direct sales instrumental in securing significant defense sector contracts. |

| Community Engagement | Fostering brand loyalty for consumer products and social good initiatives. | Continued support for global demining organizations in 2024. |

Channels

Codan's global reach is powered by a vast network of authorized distributors and dealers, enabling sales and support in over 150 countries. This extensive network is crucial for delivering their metal detection and commercial communication products to a worldwide customer base.

These local partners are instrumental in providing essential sales, service, and ongoing support, ensuring Codan's products are accessible and well-maintained across diverse international markets.

Codan's direct sales force and key account teams are vital for engaging high-value clients in sectors like government and defense. This direct approach facilitates tailored solutions and the negotiation of substantial contracts, essential for securing major defense programs.

In 2024, Codan's focus on these key accounts is evident in their strategy to deliver customized communication and technology solutions. This direct channel allows for a deep understanding of client needs, leading to more effective long-term partnerships and significant revenue streams from these specialized markets.

Codan leverages its corporate website and robust digital marketing to disseminate product details, investor relations updates, and company news. This online hub serves as a crucial touchpoint for global brand awareness and customer engagement, even if not a direct sales channel for all offerings.

In 2024, Codan's investor centre continued to be a vital resource, offering easy access to annual reports, financial statements, and investor presentations. This commitment to transparency is key for building trust with stakeholders.

The company's digital strategy actively supports lead generation and addresses customer inquiries worldwide. For instance, their focus on search engine optimization and targeted online advertising in 2024 likely contributed to increased website traffic and engagement with potential clients.

Government Tender and Procurement Processes

Government tender and procurement processes represent a crucial channel for Codan to deliver its advanced demining and communications equipment. This pathway is essential for engaging with defense ministries and global humanitarian organizations worldwide.

The strategic acquisition of Kägwerks in 2023, for instance, directly integrated Codan into the US Army's Nett Warrior Program of Record, a significant step in accessing a major government procurement stream. This integration is expected to bolster Codan's presence in the U.S. defense market, a sector characterized by substantial and consistent demand for specialized technology.

- Key Government Procurement Channels: Defense departments and international aid organizations are primary customers.

- Strategic Acquisition Impact: Kägwerks acquisition provides direct access to the US Army Nett Warrior Program of Record.

- Market Significance: This channel is vital for securing large-scale contracts and expanding global reach in critical sectors.

Strategic Acquisitions for Channel Expansion

Codan leverages strategic acquisitions as a key component of its channel expansion strategy, aiming to broaden market reach and tap into new customer segments. These bolt-on acquisitions are designed to accelerate market entry and diversify distribution networks, enhancing the company's overall competitive positioning.

For example, the acquisitions of Zetron UK and Wave Central significantly strengthened Codan's communications profile. Zetron's expertise in mission-critical communications, particularly for public safety and defense sectors, opened up established channels within these vital industries. Wave Central's capabilities in advanced communication solutions further diversified Codan's product portfolio and customer base.

- Acquisition Rationale: Expansion of market reach and access to new customer channels.

- Key Acquisitions: Zetron UK and Wave Central bolstered communications capabilities.

- Strategic Benefit: Accelerated market entry and diversification of distribution channels.

- Impact on Business Model: Strengthened value proposition and increased revenue streams through expanded offerings and customer access.

Codan's channels are a multi-faceted approach, combining a vast global distributor network with direct engagement for high-value clients. This hybrid model ensures broad market penetration while also allowing for specialized attention to key sectors like government and defense. Strategic acquisitions are also a critical channel strategy, integrating new capabilities and customer access.

In 2024, Codan's distributor network remained central, facilitating sales in over 150 countries. Their direct sales force focused on significant government and defense contracts, a strategy bolstered by the 2023 Kägwerks acquisition, which provided direct access to the US Army's Nett Warrior Program. The company also actively utilized its website and digital marketing for brand awareness and lead generation.

| Channel Type | Description | 2024 Focus/Impact | Key Examples |

|---|---|---|---|

| Global Distributors & Dealers | Authorized partners for sales and support | Extensive reach in over 150 countries | Local sales, service, and maintenance providers |

| Direct Sales & Key Accounts | Engaging high-value clients | Tailored solutions for government and defense | Major defense programs, large contracts |

| Corporate Website & Digital Marketing | Brand awareness, product info, investor relations | Lead generation, customer engagement, transparency | Investor centre, SEO, online advertising |

| Government Procurement | Tender and procurement processes | Access to defense ministries and humanitarian organizations | US Army Nett Warrior Program (via Kägwerks) |

| Strategic Acquisitions | Broadening market reach and customer segments | Accelerated market entry and network diversification | Zetron UK, Wave Central |

Customer Segments

Defense and military organizations, including national forces and special operations units, represent a crucial customer segment for Codan. These entities demand highly reliable, rugged, and secure communication and detection equipment capable of performing in extreme conditions. Codan's tactical communications and countermine solutions are engineered precisely for these challenging operational environments, ensuring mission success.

The strategic acquisition of Kägwerks in 2023, for instance, was a direct move to bolster Codan's offerings and market penetration within the defense sector. This acquisition is expected to enhance Codan's ability to serve these specialized customers with advanced technology, reinforcing its position in a market that prioritizes resilience and performance under pressure.

Codan’s commercial and corporate segment is a cornerstone of their business, providing essential communication and metal detection solutions to a wide array of industries. Think of mining operations, where robust communication is paramount for safety and efficiency, or emergency services that rely on dependable links in critical situations. These entities, from infrastructure developers to remote resource extraction companies, depend on Codan’s technology to keep their operations running smoothly and securely.

In 2024, Codan reported that its communications division, which heavily serves this segment, saw continued demand for its resilient and secure radio systems. This is particularly true for sectors like public safety and critical infrastructure, where uninterrupted communication is non-negotiable. Their metal detection products also find a strong market here, utilized in security screening and industrial applications, further diversifying their revenue streams from commercial clients.

Humanitarian and Non-Governmental Organizations (NGOs) represent a critical customer segment for Codan, relying on its robust communication and safety solutions for essential operations. These organizations, focused on disaster relief, peacekeeping missions, and demining efforts, require reliable technology to function effectively in challenging and often dangerous environments.

Codan's equipment is instrumental in enabling vital communication links for these groups, particularly in remote or conflict-affected regions where infrastructure may be compromised. This segment's reliance on Codan underscores the company's commitment to supporting humanitarian causes through its technological offerings.

Individual Consumers and Hobbyists

The Minelab brand deeply connects with individual consumers and hobbyists who are passionate about recreational metal detecting. This segment actively seeks out gold, coins, jewelry, and hidden treasures, making it a vital part of the metal detection market.

This high-volume customer group is a significant revenue driver for the metal detection business. In 2024, the global metal detector market was valued at approximately USD 300 million, with consumer and hobbyist applications forming the largest share.

- Target Audience: Recreational metal detector users, treasure hunters, and collectors.

- Key Motivations: Discovery of gold, coins, jewelry, historical artifacts, and the enjoyment of outdoor exploration.

- Market Significance: This segment represents a substantial portion of the overall metal detection industry's revenue.

- Growth Drivers: Increasing interest in outdoor hobbies and the accessibility of advanced detection technology.

Public Safety and Law Enforcement Agencies

Codan, primarily through its Zetron division, is a key provider of advanced communication solutions to public safety and law enforcement agencies. These organizations depend on robust and seamlessly integrated systems for critical functions, from day-to-day operations to life-saving emergency responses.

The demand for sophisticated communication infrastructure is growing, with agencies increasingly adopting Next Generation 911 (NG911) capabilities. This transition is driven by the need for enhanced data sharing, location accuracy, and multimedia support during emergencies. For instance, the U.S. Department of Justice reported that in 2023, approximately 80% of 911 calls involved wireless devices, highlighting the evolving nature of emergency communications and the necessity for NG911 readiness.

- Mission-Critical Reliability: Public safety agencies require communication systems that are unfailingly dependable, even in the most challenging environments.

- Integrated Command and Control: Solutions that unify voice, data, and video across different units and agencies are essential for coordinated responses.

- NG911 Compliance: Meeting the stringent requirements of NG911, including advanced location services and multimedia capabilities, is a primary focus.

- Scalability and Future-Proofing: The ability to adapt and expand communication infrastructure to meet future demands and technological advancements is crucial.

Codan serves a diverse array of customer segments, each with distinct needs for its communication and detection technologies. These segments range from critical government and defense entities to everyday consumers, underscoring the breadth of Codan's market reach and the essential nature of its products.

The company's offerings are tailored to meet the rigorous demands of defense and military organizations, ensuring reliable performance in extreme conditions, as evidenced by strategic acquisitions like Kägwerks in 2023 to enhance these capabilities. Concurrently, commercial and corporate clients in sectors like mining and emergency services depend on Codan for secure and efficient operations, with continued demand for resilient radio systems noted in 2024.

Humanitarian organizations and NGOs rely on Codan for vital communication in challenging environments, supporting missions from disaster relief to demining. On the consumer front, the Minelab brand caters to recreational metal detectorists, a significant market segment driven by the pursuit of discovery and outdoor exploration, with the global market valued around USD 300 million in 2024.

Furthermore, public safety and law enforcement agencies are key customers, utilizing Codan's Zetron division for advanced, integrated communication systems crucial for emergency response and the evolving landscape of Next Generation 911 (NG911) capabilities, with wireless 911 calls making up about 80% in 2023.

| Customer Segment | Key Needs | Codan Solutions | 2024 Data/Notes |

| Defense & Military | Reliability, security, ruggedness | Tactical communications, countermine | Kägwerks acquisition (2023) to bolster offerings |

| Commercial & Corporate | Robust communication, safety | Resilient radio systems, metal detection | Continued demand in public safety, critical infrastructure |

| Humanitarian & NGOs | Dependable communication in remote/conflict areas | Robust communication solutions | Enabling vital links for disaster relief, demining |

| Consumers & Hobbyists (Minelab) | Discovery of treasures, outdoor exploration | Recreational metal detectors | Global market ~USD 300 million in 2024, consumer share largest |

| Public Safety & Law Enforcement (Zetron) | Mission-critical reliability, NG911 compliance | Advanced communication systems | Growing adoption of NG911; ~80% of 911 calls wireless (2023) |

Cost Structure

Research and Development (R&D) represents a substantial component of Codan's cost structure, fueling the creation of new products and advanced technologies. This commitment to innovation is vital for Codan to stay ahead in its markets and enhance its product offerings.

In the fiscal year 2024, Codan allocated $40.0 million specifically towards product development, underscoring the strategic importance of R&D in its business model.

Manufacturing and production expenses are a significant component of Codan's cost structure. These include the procurement of raw materials and electronic components, direct labor involved in assembly, and factory overheads such as utilities and equipment maintenance. For instance, the global semiconductor shortage in 2021-2022 significantly impacted component costs for electronics manufacturers, with lead times for some parts extending to over a year, forcing companies to absorb higher prices or face production delays.

Optimizing these production costs is critical for Codan's profitability, especially given the competitive landscape of electronic equipment manufacturing. This involves strategic sourcing of materials, efficient assembly line management, and leveraging economies of scale across its worldwide production facilities. In 2023, many electronics manufacturers reported increased costs due to persistent inflation in energy and logistics, making cost control a top priority.

Codan's commitment to a global presence necessitates significant investment in sales, marketing, and distribution. These expenses are crucial for reaching diverse international markets and ensuring efficient product delivery worldwide.

Personnel costs for their dedicated sales force and marketing teams represent a major component. Furthermore, the logistics involved in maintaining an extensive distribution network, from warehousing to transportation, contribute substantially to these operational outlays.

For instance, in fiscal year 2023, Codan reported selling, general, and administrative expenses of AUD 214.8 million, a significant portion of which is attributable to these critical functions supporting their broad market reach.

Acquisition and Integration Expenses

Codan faces significant costs when acquiring new companies and integrating them. These expenses encompass thorough due diligence, legal consultations, and the often-complex process of aligning different IT systems and operational procedures. In the first half of fiscal year 2025, Codan reported $2 million in group integration and acquisition expenses.

These acquisition and integration expenses are a crucial part of Codan's cost structure, directly impacting profitability. Managing these costs effectively is vital for realizing the full value of strategic acquisitions.

- Due Diligence: Costs associated with investigating potential acquisition targets.

- Legal Fees: Expenses related to contracts, negotiations, and regulatory compliance.

- Integration Costs: Expenditures for harmonizing IT systems, operational processes, and organizational structures.

- H1 FY25 Expenses: Group integration and acquisition costs amounted to $2 million.

General, Administrative, and Corporate Overheads

General, Administrative, and Corporate Overheads are the essential costs of running Codan as a global technology entity. These include expenses for its headquarters and numerous international offices, covering vital functions like legal, finance, and administrative personnel.

Efficiently managing these overheads directly impacts Codan's overall profitability. For instance, in fiscal year 2024, companies in the technology sector often saw administrative expenses ranging from 5% to 15% of revenue, depending on their scale and operational complexity.

- Legal and Compliance: Ensuring adherence to global regulations.

- Finance and Accounting: Managing financial reporting and operations.

- Human Resources: Supporting a global workforce.

- Corporate Headquarters: Maintaining the central operational hub.

Codan's cost structure is multifaceted, driven by innovation, manufacturing, global operations, strategic growth, and essential corporate functions. These elements collectively shape the company's financial outlay and impact its profitability.

| Cost Category | Description | FY2024/H1 FY2025 Data | Impact |

|---|---|---|---|

| Research & Development | New product and technology creation. | $40.0 million allocated in FY2024. | Drives innovation and market competitiveness. |

| Manufacturing & Production | Raw materials, labor, factory overheads. | Affected by global inflation and supply chain issues (e.g., semiconductor shortages). | Crucial for profitability; requires efficient sourcing and management. |

| Sales, Marketing & Distribution | Reaching international markets, logistics. | Selling, general, and administrative expenses were AUD 214.8 million in FY2023. | Supports global reach and product delivery. |

| Acquisitions & Integration | Due diligence, legal, system harmonization. | $2 million in group integration and acquisition expenses in H1 FY2025. | Impacts profitability; essential for strategic growth. |

| General & Administrative | Headquarters, international offices, support functions. | Technology sector administrative expenses typically 5-15% of revenue (FY2024 benchmark). | Manages global operations and impacts overall profitability. |

Revenue Streams

Codan generates significant revenue through the direct sale of its advanced communication equipment. This includes a range of products like high-frequency radios, sophisticated tactical communication systems, and vital public safety communication solutions.

The communications segment has demonstrably been a cornerstone of Codan's financial performance, acting as a primary engine for its revenue expansion. For the fiscal year 2024, this segment alone reported a substantial revenue of $326.9 million, underscoring its importance to the company's overall business model.

Codan's revenue from product sales, particularly through its prominent Minelab brand, is a core component of its business. This segment focuses on providing metal detection equipment to diverse markets, including recreational users, gold prospectors, and crucial demining operations.

The financial performance in fiscal year 2024 underscores the significance of this revenue stream, with metal detection equipment sales reaching $219.9 million. This substantial figure highlights Minelab's strong market presence and its ability to generate considerable income from its specialized product offerings.

Government and defense contracts form a cornerstone of Codan's revenue, providing a predictable income through long-term agreements and direct sales to national security entities. These contracts typically involve substantial projects and continuous support for vital military and defense operations, ensuring a steady financial base.

The strategic acquisition of Kägwerks is projected to contribute between $49 million and $57 million in revenue within its initial twelve-month period, underscoring the company's focus on expanding its government and defense sector presence.

Service and Support Contracts

Codan generates revenue from service and support contracts, which cover maintenance and ongoing assistance for their communication and detection systems. This recurring income stream is crucial for the company's financial stability and predictability.

These contracts foster strong, long-term relationships with customers, ensuring continued engagement and loyalty beyond the initial equipment purchase. For instance, in the fiscal year ending June 30, 2023, Codan reported that its recurring revenue, largely driven by these service agreements, represented a significant portion of its total income, contributing to a robust earnings profile.

- Recurring Revenue: Service and support contracts provide a consistent and predictable revenue base.

- Customer Retention: These agreements are key to maintaining long-term customer relationships and loyalty.

- Financial Stability: Recurring income enhances the quality and stability of Codan's overall earnings.

- Service Offerings: Contracts typically include maintenance, software updates, and technical support for deployed equipment.

Software Licenses and Royalty Payments

Codan's revenue is bolstered by the sale of software licenses for its proprietary solutions, notably the Kägwerks DOCK™ hardware and software. This stream diversifies income beyond just hardware. For instance, in fiscal year 2023, Codan reported total revenue of $333.6 million, with a significant portion attributable to its technology and software offerings.

Furthermore, certain strategic acquisitions may incorporate provisions for future royalty payments tied to the sales performance of the acquired entities. This creates an additional, performance-dependent revenue stream, enhancing the overall financial resilience of the company. These royalty agreements are structured to align with the success of the integrated technologies.

- Software License Sales: Revenue generated from the sale of licenses for proprietary software, including Kägwerks DOCK™.

- Royalty Payments: Future income derived from acquisition agreements, contingent on the sales performance of acquired businesses.

- Revenue Diversification: These streams reduce reliance on hardware sales, creating a more balanced revenue mix.

- Fiscal Year 2023 Performance: Codan's total revenue reached $333.6 million, underscoring the importance of these diverse income sources.

Codan's revenue streams are diverse, encompassing direct product sales, service and support contracts, and software licensing. The company's communications segment and metal detection equipment, particularly under the Minelab brand, are significant revenue drivers. Government and defense contracts, bolstered by strategic acquisitions like Kägwerks, provide a predictable income base.

| Revenue Stream | Fiscal Year 2024 Revenue | Notes |

| Communications Equipment Sales | $326.9 million | Includes high-frequency radios and tactical systems. |

| Metal Detection Equipment Sales (Minelab) | $219.9 million | Serves recreational, gold prospecting, and demining markets. |

| Government & Defense Contracts | Projected $49-$57 million (Kägwerks) | Long-term agreements with national security entities. |

| Service & Support Contracts | Significant portion of total income (FY23) | Recurring revenue from maintenance and ongoing assistance. |

| Software Licenses (e.g., Kägwerks DOCK™) | Contributes to total revenue ($333.6 million FY23) | Diversifies income beyond hardware. |

Business Model Canvas Data Sources

The Codan Business Model Canvas is informed by a blend of internal financial data, market research reports, and operational performance metrics. These sources provide a comprehensive view of our business, ensuring each component is grounded in quantifiable evidence.