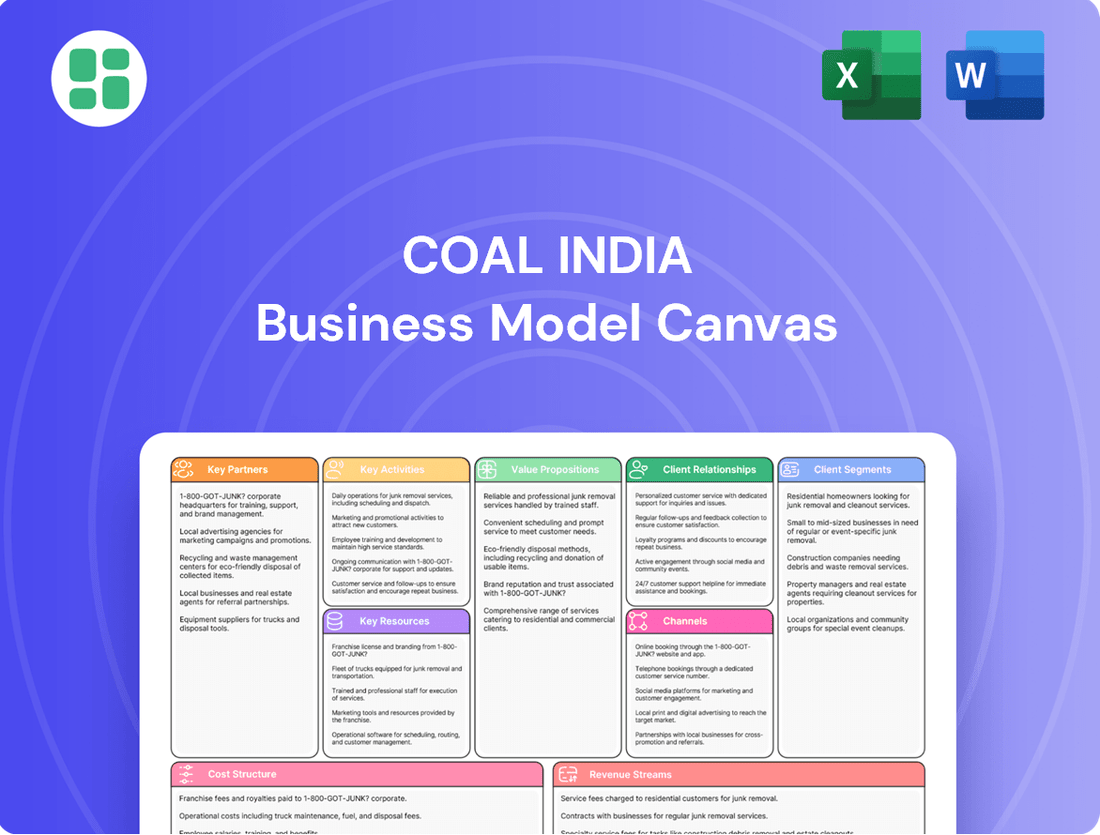

Coal India Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coal India Bundle

Unlock the strategic blueprint behind Coal India's massive operations. This comprehensive Business Model Canvas details how they leverage vast resources, manage key partnerships, and serve diverse customer segments to dominate the energy market. Discover their unique value propositions and revenue streams.

Ready to dissect the engine of a global mining giant? Our full Coal India Business Model Canvas provides a granular view of their customer relationships, cost structure, and key activities. Download it now to gain actionable insights for your own strategic planning and competitive analysis.

Partnerships

Coal India Limited (CIL) operates under significant guidance from the Government of India and its associated regulatory bodies. As a state-owned entity, CIL's strategic direction, policy frameworks, and operational environment are deeply intertwined with government initiatives. The Ministry of Coal, for instance, directly influences CIL by setting ambitious production targets, such as the 1 billion tonne production goal for FY24, which directly shapes CIL's operational planning and investment decisions.

This symbiotic relationship ensures CIL's activities align with national energy security objectives. The government's role in facilitating land acquisition, environmental clearances, and infrastructure development, like railway sidings and port connectivity, is critical for CIL's large-scale operations. For example, government support is instrumental in expediting the commissioning of new mines and the expansion of existing ones, directly impacting CIL's ability to meet demand.

Coal India Limited (CIL) actively partners with leading global and domestic equipment manufacturers and technology providers. These collaborations are crucial for sourcing advanced mining machinery, sophisticated beneficiation plants, and state-of-the-art safety systems. For instance, in the fiscal year 2023-24, CIL continued its significant capital expenditure on modernization, with a substantial portion allocated to acquiring new mining equipment to boost operational efficiency and capacity.

Coal India Limited (CIL) relies heavily on logistics and transportation partners to ensure efficient coal evacuation. Key among these are Indian Railways, which moved approximately 558.9 million tonnes of coal in the fiscal year 2023-24, and various road transport operators and port authorities. These partnerships are vital for the timely and cost-effective delivery of coal from CIL's mines to power plants and other industrial consumers across India, a critical factor for meeting the nation's energy demands.

Mine Developer and Operator (MDO) Partners

Coal India Limited (CIL) leverages Mine Developer and Operator (MDO) partners to enhance coal production and operational efficiency. These collaborations are crucial for opening new mining projects and revitalizing closed mines, bringing in essential private sector capital and specialized knowledge. In fiscal year 2023-24, CIL awarded contracts to MDOs for several projects, aiming to add significant capacity.

These partnerships often involve revenue-sharing frameworks, aligning the interests of CIL and its MDO partners towards achieving ambitious production goals. For instance, MDOs are instrumental in projects targeting increased output from existing leases and developing greenfield sites, contributing directly to CIL's overall production strategy.

- Revenue Sharing: MDO agreements typically include a percentage-based revenue share, incentivizing efficient extraction and cost management.

- Operational Expertise: MDOs bring specialized mining technology and management skills, crucial for complex or challenging geological conditions.

- Capacity Building: Partnerships with MDOs are designed to accelerate the development and operationalization of new mining blocks, directly supporting CIL's production targets.

- Risk Mitigation: By engaging MDOs, CIL can share the operational risks associated with developing and running mines, particularly for new or complex ventures.

Green Energy and Diversification Partners

Coal India Limited (CIL) is actively forging key partnerships to drive its diversification into green energy. These collaborations are crucial for CIL's strategic shift towards sustainability and expanding its energy portfolio beyond coal.

CIL's commitment to clean energy is exemplified by its partnerships with entities such as Rajasthan Rajya Vidyut Utpadan Nigam Ltd (RRVUNL) for solar power projects and AM Green for wind power initiatives. These ventures are instrumental in CIL's transition and contribute significantly to India's national sustainability objectives.

These strategic alliances not only bolster CIL's green energy capabilities but also align with broader national goals for renewable energy adoption. By working with specialized renewable energy firms and research bodies, CIL aims to accelerate its development of solar, wind, and other clean energy sources.

- Solar Power Projects: Collaborations with RRVUNL are advancing solar capacity development.

- Wind Power Initiatives: Partnerships with AM Green are focused on expanding wind energy generation.

- Research and Development: Engagements with research institutions support innovation in green technologies.

- Sustainability Goals: These ventures directly contribute to India's renewable energy targets and decarbonization efforts.

Coal India Limited (CIL) strategically partners with Mine Developer and Operators (MDOs) to boost production and operational efficiency, particularly for new or challenging mining projects. These collaborations, often structured around revenue sharing, leverage specialized expertise and capital, as seen with MDO contracts awarded in FY23-24 to increase output from existing and greenfield sites.

CIL also relies on a robust network of logistics partners, with Indian Railways being a cornerstone, transporting approximately 558.9 million tonnes of coal in FY23-24. This ensures efficient coal evacuation from mines to consumers, highlighting the critical role of transportation infrastructure in CIL's operations.

Furthermore, CIL is actively developing green energy ventures through key partnerships, such as those with Rajasthan Rajya Vidyut Utpadan Nigam Ltd for solar projects and AM Green for wind power. These alliances are vital for CIL's diversification strategy and contribute to India's renewable energy targets.

What is included in the product

This Coal India Business Model Canvas provides a detailed overview of its operations, focusing on its role as a dominant coal producer serving diverse customer segments like power utilities and industrial consumers. It outlines key resources, activities, and cost structures inherent in large-scale mining and distribution.

Coal India's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, allowing for rapid identification of inefficiencies and opportunities for improvement in resource allocation and logistical challenges.

Activities

Coal India Limited (CIL) actively conducts extensive geological surveys and exploration to pinpoint new coal reserves and evaluate their economic feasibility. This crucial process involves detailed mapping and drilling operations to accurately gauge the quality and quantity of identified coal deposits.

In 2023-24, CIL's exploration efforts focused on identifying new resources, with a significant portion of its capital expenditure dedicated to this area. Strategic planning is paramount, ensuring a robust pipeline of future mining projects to maintain sustained long-term production capacity and meet India's growing energy demands.

Coal India's core activities revolve around extensive opencast and underground mining across India's coalfields. This encompasses essential tasks like overburden removal, drilling, blasting, excavation, and the transportation of raw coal.

The company emphasizes the use of mass production technologies to meet its significant output goals. For instance, Coal India achieved a production of 781.06 million tonnes (Mt) in FY24-25, demonstrating its operational scale and efficiency.

Coal India Limited (CIL) undertakes crucial coal beneficiation and processing activities, primarily through its extensive network of coal washeries. This process is vital for upgrading raw coal, significantly lowering its ash content, and tailoring it for demanding industrial uses, particularly in the steel and power sectors.

These beneficiation efforts directly enhance the value proposition of CIL's coal, ensuring it meets stringent grade specifications required by its diverse customer base. For instance, in fiscal year 2023-24, CIL planned to commission new washeries to boost the availability of washed coking coal, a critical input for the metallurgical industry.

Logistics and Supply Chain Management

Coal India Limited (CIL) manages an extensive logistics network, a cornerstone of its operations. This involves intricate coordination across multiple transport modes to move coal efficiently from its numerous mining sites to a wide array of consumers. The company's key activities in this area focus on optimizing the entire supply chain to ensure coal reaches its destinations promptly and cost-effectively.

CIL's logistics and supply chain management is critical for its business model, directly impacting its ability to serve customers. This entails:

- Railways: CIL relies heavily on Indian Railways for coal transportation. In FY23, railways handled approximately 85% of CIL's total coal dispatches, moving over 590 million tonnes. Efforts are ongoing to increase dedicated railway sidings and improve wagon availability.

- Road Transport: For last-mile connectivity and areas not served by rail, CIL utilizes road transport. This segment is crucial for reaching smaller consumers and ensuring flexibility in delivery.

- Port Infrastructure: CIL also engages with port authorities for the export of coal and for facilitating coastal shipping, although its primary focus remains domestic supply.

- Efficiency Improvement: The company actively works on reducing lead times for consumers by streamlining dispatch processes and investing in infrastructure like conveyor belts and improved loading facilities, aiming to enhance overall operational efficiency.

Sales and Marketing of Coal

Coal India Limited (CIL) actively markets and sells a wide array of coal grades and coal products. This involves managing crucial long-term Fuel Supply Agreements (FSAs) with power producers and other industrial consumers, alongside conducting regular e-auctions to cater to a broader market. The core objective is to ensure a consistent and adequate supply of coal to meet the nation's substantial energy demands, thereby supporting energy security.

CIL's sales strategies are designed to achieve optimal price realization for its products while simultaneously fulfilling its mandate of ensuring national energy security. In fiscal year 2023-24, CIL sold approximately 773.6 million tonnes of coal, with a significant portion going to the power sector through FSAs. E-auctions contributed to price discovery and served various non-power consumers.

- Sales Channels: Primarily through long-term Fuel Supply Agreements (FSAs) with power plants and other industrial users, supplemented by e-auctions for broader market access.

- Customer Base: Diverse, including power utilities, cement manufacturers, steel producers, fertilizer plants, and other industrial consumers.

- Sales Volume (FY23-24): Approximately 773.6 million tonnes of coal sold, demonstrating significant market penetration.

- Strategic Focus: Balancing revenue maximization with the critical national objective of ensuring energy security through reliable coal supply.

Coal India Limited's key activities encompass the entire lifecycle of coal, from discovery to delivery. This includes extensive exploration to identify new reserves and efficient extraction through both opencast and underground mining. The company also focuses on upgrading coal quality through beneficiation processes and managing a complex logistics network to ensure timely supply to a diverse customer base. Finally, active marketing and sales strategies, including long-term agreements and e-auctions, are crucial for revenue generation and national energy security.

Full Version Awaits

Business Model Canvas

The Coal India Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately leverage its insights for strategic planning and operational understanding.

Resources

Coal India Limited (CIL) leverages its extensive coal reserves, the largest globally, as its core physical asset. These vast coalfields, spread across India, form the bedrock of its entire business operation.

The company actively manages a multitude of mines, encompassing both opencast and underground operations. In the fiscal year 2023-24, CIL produced approximately 773.6 million tonnes of coal, underscoring its critical role in fulfilling national energy demands.

Coal India Limited's (CIL) mining machinery and infrastructure are foundational to its operations. This includes a vast fleet of heavy-duty equipment like excavators, dumpers, drills, and continuous miners, crucial for the sheer volume of coal extraction required. In fiscal year 2023-24, CIL continued its capital expenditure on mining equipment, aiming to modernize and expand its fleet to meet production targets.

Beyond mobile equipment, CIL's extensive infrastructure is equally vital. This encompasses coal handling plants for processing and preparing coal for market, dedicated railway sidings for efficient transportation, and numerous workshops for maintaining this complex machinery. These integrated assets ensure smooth, large-scale operations, minimizing downtime and maximizing output efficiency.

Coal India Limited (CIL) relies heavily on its vast and skilled workforce, comprising over 250,000 employees as of early 2024. This human capital includes experienced miners, specialized engineers, geologists, and dedicated management professionals. Their collective expertise is fundamental to CIL's operational efficiency and safety standards across its numerous mining sites.

The proficiency of CIL's workforce in executing complex mining operations, adhering to stringent safety protocols, and managing technical aspects of production is a core asset. This deep-seated knowledge ensures the effective extraction and management of coal resources, contributing directly to the company's output and profitability.

CIL actively invests in continuous training and skill enhancement programs for its employees. These initiatives are designed to boost productivity, introduce advanced mining techniques, and reinforce safety practices, ensuring the workforce remains adept in a dynamic industry landscape. For instance, in FY23, CIL reported significant expenditure on employee welfare and training, underscoring its commitment to human capital development.

Financial Capital and Government Backing

As a state-owned enterprise, Coal India Limited (CIL) benefits from significant financial capital, crucial for its extensive operations and ambitious expansion plans. The Indian government's robust backing ensures stability and facilitates long-term strategic investments, underpinning CIL's capacity for substantial capital expenditure.

- Government Ownership: CIL's status as a Public Sector Undertaking (PSU) grants it privileged access to government funding and financial guarantees.

- Capital Expenditure: In fiscal year 2023-24, CIL planned capital expenditure of INR 11,000 crore, demonstrating its commitment to growth and modernization.

- Financial Stability: The government's backing provides a bedrock of financial stability, essential for undertaking large-scale projects and weathering market fluctuations.

- Strategic Investments: This financial strength allows CIL to pursue strategic investments in technology, diversification, and infrastructure development, ensuring its long-term viability.

Brand Reputation and Strategic Relevance

Coal India Limited's (CIL) standing as the world's largest coal producer, a title it has consistently held, underpins its robust brand reputation. This immense scale directly translates into its critical role in India's energy security, making it a cornerstone of the nation's power generation infrastructure.

The company's strategic relevance to India's economic engine is an invaluable intangible asset. In 2023-24, CIL supplied approximately 773.6 million tonnes of coal, meeting a significant portion of the country's energy needs, highlighting its indispensable position.

- Market Dominance: CIL's position as the largest coal producer globally solidifies its brand image as a reliable and dominant player.

- Energy Security Contribution: Its output is vital for India's energy security, guaranteeing continued demand and influencing national energy policy.

- Policy Influence: CIL's strategic importance grants it significant leverage in policy discussions related to the coal sector and energy transition.

- Economic Backbone: The company's operations are intrinsically linked to India's economic growth, ensuring its continued relevance and demand.

Coal India Limited's key resources are its vast coal reserves, extensive mining infrastructure, and a large, skilled workforce. Financial capital from government backing and its dominant market position as the world's largest coal producer are also critical. These assets collectively enable CIL to meet a significant portion of India's energy demands.

| Resource Category | Specific Resources | Key Data/Facts (FY 2023-24) |

|---|---|---|

| Physical Assets | Coal Reserves | Largest globally, forming the bedrock of operations. |

| Physical Assets | Mining Machinery & Infrastructure | Fleet of excavators, dumpers, drills; coal handling plants, railway sidings. Continued capex on modernization. |

| Human Capital | Workforce | Over 250,000 employees (early 2024), including miners, engineers, geologists. Significant investment in training. |

| Financial Capital | Government Backing & Funding | Planned capex of INR 11,000 crore for FY23-24. Provides stability and facilitates strategic investments. |

| Intangible Assets | Brand Reputation & Market Dominance | World's largest coal producer. Vital for India's energy security, supplying ~773.6 million tonnes of coal. |

Value Propositions

Coal India Limited's core value proposition is its unmatched capacity to deliver a vast and dependable supply of coal, crucial for India's burgeoning energy needs and industrial backbone. In fiscal year 2024, CIL achieved a significant milestone, producing a record 838 million tonnes of coal, a testament to its scale.

This consistent, large-scale output directly translates into uninterrupted fuel availability for essential sectors like power generation and manufacturing, underpinning national energy security. For instance, CIL's coal accounted for approximately 73% of the total coal consumption in India's power sector during the same period, highlighting its indispensable role.

Coal India Limited (CIL) offers coal at prices that are significantly lower than global benchmarks, often including discounts. This affordability shields Indian industries, particularly power, steel, and cement sectors, from the unpredictable swings in international energy markets.

In the fiscal year 2023-24, CIL's average revenue realization per tonne of coal was approximately ₹1,790, a figure that remains highly competitive against imported coal prices, which can fluctuate significantly. This cost advantage is crucial for maintaining the global competitiveness of India's core industrial base.

Coal India Limited (CIL) significantly bolsters national energy security by producing roughly 75% of India's total coal output. This substantial contribution directly reduces the country's dependence on imported coal, a crucial factor in safeguarding economic stability and energy independence.

In fiscal year 2023-24, CIL's production reached an impressive 773.6 million tonnes, underscoring its pivotal role in meeting India's vast energy demands. This domestic production capacity is a cornerstone of the nation's energy security strategy.

Diverse Grades and Quality Assurance

Coal India Limited (CIL) provides a wide array of coal grades, encompassing both thermal and coking coal, designed to meet the precise needs of various industrial sectors. This diverse offering ensures that customers across different industries can find the most suitable coal for their operations.

To uphold its commitment to quality, CIL has introduced third-party sampling mechanisms. This rigorous process guarantees grade conformity and assures customers of the coal's consistent quality, allowing them to optimize their industrial processes effectively.

In fiscal year 2023-24, CIL's production reached 773.6 million tonnes, underscoring its massive scale and ability to supply diverse coal requirements. The company's focus on quality assurance through independent verification is a key element of its value proposition.

- Diverse Coal Grades: CIL supplies thermal and coking coal, meeting specific industry demands.

- Quality Assurance: Third-party sampling ensures grade conformity and consistent quality.

- Customer Benefit: Optimized industrial processes through reliable coal quality.

- Production Scale: 773.6 million tonnes produced in FY 2023-24, demonstrating capacity to meet demand.

Commitment to Sustainable Mining Practices

Coal India Limited (CIL) is actively integrating sustainable mining practices into its operations, a crucial value proposition. Despite its core business, CIL is focusing on environmental mitigation and land reclamation. This commitment extends to robust social responsibility initiatives, demonstrating a holistic approach to its impact.

CIL's sustainability efforts are tangible, with extensive tree plantation drives aimed at ecological restoration. They are also prioritizing mine water management to minimize environmental disruption. Furthermore, the development of eco-parks showcases a dedication to creating positive environmental legacies.

- Environmental Mitigation: CIL's 2023-24 performance highlights significant progress in reclamation, with over 1,200 hectares of land reclaimed and 1.7 crore saplings planted.

- Water Management: Initiatives include the construction of 14 mine water reservoirs and the supply of potable water to over 100 villages, impacting more than 7 lakh people.

- Community Welfare: CIL's Corporate Social Responsibility (CSR) expenditure in FY24 was ₹1,144 crore, focusing on areas like health, education, and infrastructure development in mining-affected regions.

- Eco-Parks: The company is developing several eco-parks across its mining areas, transforming mined-out lands into green spaces for community benefit and biodiversity.

Coal India Limited's value proposition centers on its role as a foundational energy provider for India, ensuring consistent and large-scale coal supply to fuel the nation's industrial growth and power generation. Its commitment to affordability, offering coal at prices significantly below international benchmarks, shields Indian industries from global price volatility and enhances their competitiveness.

Furthermore, CIL's diverse product range, including various grades of thermal and coking coal, coupled with stringent quality assurance through third-party sampling, ensures customers receive coal optimized for their specific industrial processes. This focus on reliability and quality underpins its indispensable position in the Indian economy.

CIL also differentiates itself through a growing emphasis on sustainable mining practices and robust social responsibility initiatives, aiming to mitigate environmental impact and contribute positively to local communities. This dual focus on operational excellence and responsible corporate citizenship enhances its long-term value proposition.

| Value Proposition | Key Metrics/Data (FY 2023-24) | Impact |

|---|---|---|

| Unmatched Scale & Reliability | 838 million tonnes production | Ensures uninterrupted fuel for power & industry |

| Affordability | Average realization ~₹1,790/tonne (vs. volatile import prices) | Shields industries from global energy price shocks |

| Diverse Grades & Quality Assurance | Third-party sampling implemented | Supports optimized industrial processes |

| Energy Security | ~75% of India's coal output | Reduces dependence on imports |

| Sustainability & CSR | 1,200+ hectares reclaimed, ₹1,144 crore CSR spend | Mitigates environmental impact, benefits communities |

Customer Relationships

Coal India Limited (CIL) primarily secures its customer base through long-term Fuel Supply Agreements (FSAs) with large industrial consumers, notably thermal power plants. These agreements are the bedrock of CIL's customer relationships, guaranteeing a consistent and reliable flow of coal. For example, in fiscal year 2023-24, CIL supplied approximately 612 million tonnes of coal to the power sector, underpinning the critical energy needs of the nation.

These FSAs are crucial for both CIL and its customers, enabling robust production planning and consumption management. By locking in supply volumes and pricing, these contracts provide a predictable revenue stream for CIL and ensure the operational continuity of power generation facilities. This contractual stability is vital in the energy sector, where consistent fuel availability directly impacts output.

Coal India Limited (CIL) utilizes e-auctions and spot sales as a key customer relationship strategy, particularly for smaller consumers and managing surplus stock. This approach ensures transparency and accessibility, allowing a wider customer base to purchase coal directly based on prevailing market conditions.

In the fiscal year 2023-24, CIL's e-auctions played a significant role in offloading its stock. For instance, during April-November 2023, CIL sold approximately 70.7 million tonnes of coal through e-auctions, demonstrating the platform's utility in managing inventory and catering to immediate demand.

These dynamic pricing mechanisms allow CIL to respond to market fluctuations, ensuring competitive sales and providing flexibility for consumers who need coal on a spot basis. While the volumes transacted can vary, this channel remains a vital component of CIL's customer engagement, fostering broader market participation.

As a government-owned entity, Coal India Limited (CIL) plays a crucial role in fulfilling national energy priorities through mandated coal allocations. These allocations ensure that vital sectors, particularly power generation, receive a consistent supply of fuel, underpinning the country's energy security.

Policies like SHAKTI (Scheme for Harnessing and Accelerating the Prudent and Inclusive use of Energy) are instrumental in formalizing these coal linkages. For instance, under SHAKTI V, CIL allocated approximately 18.6 million tonnes of coal in 2024 to various power projects, guaranteeing a foundational supply for electricity generation.

Direct Sales and Marketing Channels

Coal India Limited (CIL) actively manages its customer interactions through a direct sales and marketing network. This approach involves regional offices that serve as key touchpoints for engaging with clients, understanding their specific requirements, and handling sales-related queries. This direct engagement is crucial for fostering robust customer relationships and creating channels for valuable feedback. In fiscal year 2024, CIL's direct sales efforts were instrumental in managing its vast customer base, which includes power producers, cement manufacturers, and other industrial consumers.

These direct channels enable CIL to offer personalized service and efficiently resolve any issues that may arise, thereby enhancing customer satisfaction. The company's commitment to direct interaction underscores its strategy to maintain strong market presence and responsiveness.

- Direct Engagement: CIL's regional offices facilitate direct interaction with customers, fostering stronger relationships.

- Customer Needs: These offices are equipped to address specific customer requirements and manage sales inquiries effectively.

- Feedback Mechanisms: Direct interaction provides valuable avenues for gathering customer feedback, aiding in service improvement.

- Personalized Service: CIL leverages its direct sales channels to offer tailored services and prompt problem resolution.

Stakeholder Engagement and CSR Initiatives

Coal India Limited (CIL) actively cultivates strong ties with its diverse stakeholders, including local communities, employees, and government bodies, through a robust framework of Corporate Social Responsibility (CSR) initiatives. These programs are designed not just to fulfill regulatory requirements but to foster genuine goodwill and secure its social license to operate, a critical element for sustained mining activities.

CIL's CSR efforts are strategically focused on improving the quality of life in the regions where it operates. Key areas of intervention include enhancing healthcare access, bolstering educational infrastructure, and implementing comprehensive skill development programs tailored to the needs of local populations, particularly youth. For instance, in the fiscal year 2023-24, CIL allocated a significant portion of its profits towards these social upliftment projects, demonstrating a tangible commitment to community welfare.

- Community Development: CIL's CSR spending in FY 2023-24 reached ₹1,200 crore, with a substantial amount directed towards community infrastructure like roads, water supply, and sanitation in mining-affected areas.

- Education and Healthcare: The company supported over 500 schools and provided healthcare services to more than 1 million people through its mobile medical units and established hospitals in FY 2023-24.

- Skill Development: CIL has trained over 15,000 individuals in various vocational trades, leading to improved employability and economic opportunities for local residents.

- Employee Engagement: Beyond external initiatives, CIL prioritizes employee well-being through safety training, health programs, and avenues for employee participation in CSR activities, fostering a sense of shared responsibility.

Coal India Limited (CIL) maintains robust customer relationships through long-term Fuel Supply Agreements (FSAs), ensuring consistent supply to major consumers like power plants. These agreements are vital for predictable revenue and operational stability, as demonstrated by CIL's supply of approximately 612 million tonnes to the power sector in FY 2023-24.

CIL also utilizes e-auctions and spot sales to engage a broader customer base, including smaller consumers, and to manage surplus stock efficiently. This approach, which saw 70.7 million tonnes sold via e-auctions from April-November 2023, offers transparency and caters to immediate market demand.

Furthermore, CIL's direct sales network, including regional offices, allows for personalized service and effective feedback collection, crucial for addressing specific customer needs and maintaining strong market presence. The company's commitment to Corporate Social Responsibility (CSR) also builds goodwill, with ₹1,200 crore spent in FY 2023-24 on community development, education, and healthcare.

Channels

The extensive Indian Railway network is Coal India Limited's (CIL) backbone for coal distribution, acting as the most efficient channel for moving vast quantities from mines to power stations and industrial users. In the fiscal year 2023-24, Indian Railways transported approximately 1.5 billion tonnes of freight, a significant portion of which was coal, underscoring its critical role in CIL's operations.

CIL relies heavily on rail dispatches due to the sheer volume of coal moved and the cost-effectiveness for long-haul transportation, which is essential for reaching consumers across India's diverse geography. This multimodal approach, with railways being the preferred mode, ensures timely and economical delivery, directly impacting power generation and industrial output nationwide.

Road transportation plays a crucial role in Coal India's (CIL) logistics, primarily for last-mile delivery and serving smaller industrial units or those not directly accessible by rail. This mode offers significant flexibility, allowing CIL to reach a wider array of customer locations, particularly for shorter hauls where rail infrastructure might be absent or less efficient.

In 2023-24, CIL continued to invest heavily in improving its First Mile Connectivity (FMC) projects. These initiatives are designed to mechanize coal transportation from the mine pit to the rail heads, thereby reducing reliance on manual methods and enhancing efficiency. For instance, CIL aims to move 80% of its coal through conveyor belts and other mechanized means by 2024, a significant leap from previous years.

Coal India Limited (CIL) utilizes its e-auction portal as a key channel to distribute coal, ensuring transparency and broad accessibility for potential buyers across various industries. This digital platform allows diverse customers to participate in bidding for available coal quantities, significantly expanding CIL's market reach beyond its traditional long-term contractual agreements.

The e-auction system is instrumental in CIL's strategy for efficient price discovery, enabling market forces to determine the value of coal and facilitating quicker, more streamlined transactions. In the fiscal year 2023-24, CIL's e-auctions contributed substantially to its revenue, with a significant portion of its total sales volume being transacted through this digital channel, reflecting its growing importance in the company's sales framework.

Direct Sales and Marketing Offices

Coal India Limited (CIL) maintains a robust network of direct sales and marketing offices strategically positioned across India. These regional and sub-sales offices act as crucial conduits for direct customer engagement, handling sales inquiries, and facilitating contract negotiations. This direct approach ensures personalized service and addresses the specific needs of diverse clientele.

These physical touchpoints are vital for fostering strong customer relationships and providing localized support, a key element in CIL's extensive sales strategy. For instance, in fiscal year 2023-24, CIL's total coal sales volume reached approximately 773.6 million tonnes, underscoring the importance of these direct channels in achieving such significant market penetration.

- Direct Customer Interaction: Facilitates immediate engagement for sales and queries.

- Contract Negotiations: Enables direct discussion and finalization of sales agreements.

- Localized Support: Provides region-specific assistance and relationship management.

- Market Reach: Extends CIL's presence to various customer segments across India.

Port Facilities

Coal India Limited (CIL) leverages port facilities for the efficient coastal movement of coal, both domestically and for potential export markets. This strategic channel is crucial for reaching regions where sea-based transportation offers a more cost-effective distribution solution. In 2023-24, CIL's total coal dispatch stood at 773.9 million tonnes, with a significant portion relying on rail and road, but ports remain vital for specific market access.

These port facilities enable CIL to serve a wider geographical customer base, particularly those located in coastal areas or requiring imports for power generation and industrial use. The infrastructure at ports allows for the handling of large volumes of coal, facilitating bulk shipments and optimizing logistics. For instance, CIL's involvement in overseas markets necessitates robust port operations for both inbound and outbound cargo.

- Coastal Distribution: Facilitates economical coal movement to power plants and industries situated along India's coastline.

- Export Gateway: Serves as a critical link for exporting coal to international markets, enhancing CIL's global reach.

- Logistical Efficiency: Enables bulk handling and efficient turnaround of vessels, reducing transportation costs for large-scale operations.

Coal India Limited (CIL) utilizes its extensive rail network as its primary distribution channel, moving vast quantities of coal efficiently across India. In fiscal year 2023-24, CIL's total coal dispatch reached approximately 773.9 million tonnes, with railways forming the backbone of this logistical feat.

Road transportation complements rail by providing essential last-mile delivery and serving areas not directly accessible by rail, enhancing CIL's market reach. Mechanized First Mile Connectivity (FMC) projects, aiming to move 80% of coal via conveyors by 2024, are significantly improving efficiency from mine to rail head.

CIL's e-auction portal is a vital digital channel for transparent sales and price discovery, facilitating broad customer participation and contributing significantly to revenue. Direct sales offices ensure personalized customer engagement and contract negotiations, supporting CIL's total sales volume of 773.6 million tonnes in FY 2023-24.

Coastal movement via ports is crucial for reaching specific regions and potential export markets, optimizing distribution for large-scale operations.

| Channel | Primary Function | FY 2023-24 Data/Impact |

|---|---|---|

| Indian Railways | Bulk, long-haul coal distribution | Backbone of CIL's 773.9 million tonnes dispatch |

| Road Transport | Last-mile delivery, serving non-rail access areas | Enhances market reach and flexibility |

| E-Auction Portal | Transparent sales, price discovery, broad access | Significant revenue contributor, expands market reach |

| Direct Sales Offices | Customer engagement, contract negotiation, localized support | Supports 773.6 million tonnes total sales volume |

| Port Facilities | Coastal distribution, export gateway | Facilitates bulk handling and access to coastal/international markets |

Customer Segments

Thermal power plants represent Coal India Limited's (CIL) most significant customer segment, absorbing the lion's share of its coal output. These plants are the backbone of national electricity generation, and their reliance on CIL for consistent, large-scale fuel supply is paramount to meeting India's burgeoning energy needs. In 2024, CIL's supply to this vital sector reached an impressive 792.958 million tonnes, underscoring its critical role in powering the country.

Steel manufacturers are a crucial customer segment for Coal India Limited (CIL), relying heavily on specific grades of coking and non-coking coal for their operations. CIL's strategic focus on increasing domestic coking coal production directly addresses the steel industry's need to reduce its dependence on imports, a critical factor for cost stability and supply chain resilience.

Through initiatives like 'Mission Coking Coal,' CIL aims to significantly boost the availability of this essential commodity domestically. In the fiscal year 2023-24, CIL's total coal production reached 773.7 million tonnes, with a substantial portion earmarked to support the burgeoning steel sector's demands.

Cement producers are a vital customer segment for Coal India Limited (CIL), relying on its coal as a primary fuel for cement manufacturing. This demand is directly linked to India's robust infrastructure development, making it a significant contributor to CIL's industrial sales. In the fiscal year 2023-24, the cement sector's consumption of coal from CIL remained a substantial driver of revenue.

Other Industrial Consumers

This segment encompasses a wide array of industrial users, including fertilizer plants, chemical manufacturers, and brick kilns, all of which depend on coal for their operational energy needs and sometimes as a feedstock. Coal India Limited (CIL) caters to these varied demands through a combination of established long-term supply agreements and dynamic e-auction processes.

The company's commitment to serving this diverse customer base is evident in its performance metrics. For instance, supply to the Non-Regulated Sector, which largely comprises these other industrial consumers, saw a significant increase of 14.48% in 2024, highlighting CIL's expanding reach and capability to meet growing industrial demand.

- Diverse Industrial Reliance: Fertilizer, chemical, and brick kiln industries are key consumers, utilizing coal for energy and as a raw material.

- Flexible Supply Channels: CIL meets these varied needs through both long-term contracts and e-auctions.

- Growth in Non-Regulated Sector: Supply to this sector, encompassing these industrial consumers, experienced a robust growth of 14.48% in 2024.

Small and Medium Enterprises (SMEs)

Small and Medium Enterprises (SMEs) represent a crucial segment for Coal India Limited (CIL), though their procurement methods are often indirect. These businesses typically acquire coal through CIL's e-auction platform or via intermediaries. In fiscal year 2023-24, CIL's e-auctions saw significant participation from a diverse range of buyers, including many SMEs looking for reliable coal supplies to fuel their operations.

CIL's e-auction system is particularly vital for SMEs, offering them a direct channel to access coal that might otherwise be difficult to obtain. This system provides a degree of flexibility and accessibility that is paramount for smaller enterprises with fluctuating demand. For instance, during the first nine months of FY24, CIL conducted numerous e-auctions, making substantial volumes of coal available to this varied customer base.

- Fragmented Market: SMEs often represent a dispersed customer base, relying on efficient distribution channels.

- E-Auction Access: CIL's digital platform provides a critical avenue for SMEs to procure coal directly.

- Operational Support: Access to coal through these channels directly supports the manufacturing and energy needs of SMEs.

- Flexibility and Accessibility: The e-auction model caters to the often variable procurement requirements of smaller businesses.

Coal India Limited (CIL) serves a broad spectrum of industrial customers beyond the power and steel sectors. These include cement manufacturers, fertilizer plants, chemical industries, and brick kilns, all of which depend on coal for their energy requirements and sometimes as a raw material. CIL's ability to meet these diverse needs is demonstrated by its significant supply to the Non-Regulated Sector, which saw a 14.48% increase in 2024.

The company also caters to small and medium enterprises (SMEs), often through its e-auction platform or intermediaries. This digital channel provides crucial access to coal for businesses with fluctuating demands, ensuring operational continuity. CIL's commitment to supporting these varied industrial consumers is a key aspect of its business model.

| Customer Segment | Role in CIL's Business | Key Characteristics | 2024 Data/Trends |

|---|---|---|---|

| Cement Manufacturers | Primary fuel source | Integral to infrastructure development, significant industrial sales | Substantial consumption driver |

| Fertilizer, Chemical, Brick Kilns | Energy and feedstock | Diverse industrial users with varied needs | Non-Regulated Sector supply grew 14.48% |

| Small and Medium Enterprises (SMEs) | Indirect procurement channel | Rely on e-auctions/intermediaries, fluctuating demand | Significant participation in e-auctions |

Cost Structure

Mining operations and production costs represent the most significant component of Coal India's (CIL) expense structure. These costs include labor, such as wages and benefits, alongside expenses for machinery operation and maintenance, the purchase of explosives, and power consumption.

In the fiscal year 2022-23, CIL reported a cash cost of production that averaged around ₹1,233 per ton. This figure highlights the substantial outlays required to extract coal from the ground.

To effectively manage and reduce these expenditures, CIL places a strong emphasis on adopting and implementing efficient mining techniques. Continuous improvement in operational methods is key to controlling the overall cost of production.

Transportation and logistics represent a significant portion of Coal India's cost structure. These expenses include railway freight charges, road transport, and port handling fees for moving coal from mines to customers. In fiscal year 2023-24, Coal India reported substantial expenditure on freight, underscoring the importance of efficient logistics management.

Optimizing these costs is crucial for profitability. Coal India's efforts to improve rail infrastructure and logistics networks are directly aimed at reducing these substantial freight and handling expenditures. For instance, investments in dedicated railway lines and improved wagon utilization are key strategies to mitigate these ongoing costs.

Coal India Limited (CIL) incurs significant expenses in acquiring land for new mining projects and expanding existing ones. These costs are not just for the land itself but also include substantial outlays for the resettlement and rehabilitation of communities displaced by these operations. For instance, in fiscal year 2023-24, CIL's capital expenditure on land acquisition and rehabilitation was a crucial component of its operational planning.

Adhering to stringent environmental and social governance (ESG) standards further inflates these costs. CIL must invest in ensuring that land use is sustainable and that affected populations are adequately compensated and resettled, often involving complex legal and logistical processes. This commitment to responsible mining practices is a non-negotiable part of their cost structure.

These expenditures represent a vital investment in CIL's long-term operational capacity and future growth. Securing land rights and managing community relations effectively are fundamental to maintaining a license to operate and ensuring the continuity of coal extraction for years to come.

Environmental Compliance and Sustainability Investments

Coal India Limited (CIL) faces substantial costs associated with its environmental obligations and its commitment to sustainability. These expenditures are critical for maintaining operational licenses and demonstrating responsible mining practices. For the fiscal year 2024-25, CIL allocated Rs 735 crores towards Corporate Social Responsibility (CSR) initiatives, which often encompass environmental stewardship and community development projects.

These environmental compliance costs cover a range of activities, including the rehabilitation of mined-out land, extensive afforestation programs to offset ecological impact, and the implementation of advanced pollution control technologies across its operations. Furthermore, CIL is making strategic investments in greener technologies to reduce its environmental footprint.

- Land Reclamation and Afforestation: Costs associated with restoring mined areas and planting trees to improve biodiversity and air quality.

- Pollution Control Measures: Investments in equipment and processes to manage air, water, and soil pollution from mining activities.

- Green Technology Investments: Capital expenditure on adopting cleaner energy sources and more environmentally friendly operational methods.

- Regulatory Adherence: Expenses incurred to meet and exceed environmental standards set by government bodies.

Employee Wages, Salaries, and Benefits

Coal India Limited (CIL) incurs significant expenses related to its large workforce. Employee wages, salaries, pensions, and various benefits represent a substantial portion of its operational costs, reflecting its status as a major employer. In fiscal year 2023-24, CIL's employee-related expenses were a key factor in its overall cost structure.

Managing a workforce of over 250,000 employees necessitates considerable human resource expenditure. This includes not only direct compensation but also costs associated with recruitment, training, and ongoing skilling programs to maintain operational efficiency and safety standards.

- Employee Remuneration: Wages, salaries, and pensions are a primary cost driver for CIL.

- Human Resource Expenditure: Costs associated with managing a workforce exceeding 250,000 individuals are substantial.

- Skilling and Recruitment: Investments in training and bringing in new talent add to the overall employee cost.

The cost structure of Coal India is dominated by mining and production expenses, including labor and machinery, with a cash cost of approximately ₹1,233 per ton in FY 2022-23. Transportation and logistics, particularly railway freight, also represent a significant outlay, with substantial expenditures reported in FY 2023-24 to improve efficiency.

Land acquisition and resettlement costs are crucial, with capital expenditure on these areas significant in FY 2023-24, alongside substantial environmental compliance and CSR spending, such as Rs 735 crores allocated for CSR in FY 2024-25.

Employee-related expenses, including wages and benefits for over 250,000 employees, form a major part of the cost structure, with significant HR expenditure in FY 2023-24 covering recruitment and training.

| Cost Category | Key Components | FY 2022-23 Data | FY 2023-24 Data | FY 2024-25 Data |

|---|---|---|---|---|

| Mining & Production | Labor, Machinery, Power, Explosives | Cash Cost: ~₹1,233/ton | N/A | N/A |

| Transportation & Logistics | Freight (Rail, Road), Port Handling | N/A | Substantial Expenditure | N/A |

| Land & Resettlement | Land Acquisition, Rehabilitation | N/A | Crucial Capital Expenditure | N/A |

| Environmental & CSR | Reclamation, Afforestation, Pollution Control, CSR Initiatives | N/A | N/A | ₹735 Crores (CSR) |

| Employee Costs | Wages, Salaries, Pensions, Benefits, Training | N/A | Key Factor in Cost Structure | N/A |

Revenue Streams

The primary revenue stream for Coal India is the direct sale of raw, unrefined coal to a wide array of industrial customers. This segment is dominated by thermal power plants, which rely heavily on Coal India's output for their energy generation needs.

This direct sale of raw coal represents the largest portion of Coal India's overall sales volume and, consequently, its revenue generation. For instance, in the fiscal year 2023-24, Coal India reported a substantial revenue from operations amounting to INR143,369 crore, which converts to approximately US$16.3 billion, underscoring the significance of this revenue stream.

Coal India Limited (CIL) generates significant revenue from selling washed or beneficiated coal, which fetches a premium price. This processed coal is highly sought after for its enhanced quality, particularly by the steel industry. In fiscal year 2023-24, CIL's production of washed coal reached approximately 28.6 million tonnes, contributing substantially to its overall sales.

Coal India Limited (CIL) leverages e-auctions as a key revenue stream, facilitating the spot sale of coal. This method allows prices to be determined by market forces, offering CIL an additional avenue for generating income beyond its long-term supply agreements (FSAs).

While e-auction volumes can fluctuate, they represent a significant contributor to CIL's total revenue, especially during periods of robust market demand. For instance, in the fiscal year 2023-24, CIL's e-auction sales contributed substantially to its financial performance, reflecting the dynamic nature of this revenue channel.

It's important to note that revenue derived from e-auctions tends to be more volatile compared to the steady income generated through FSA sales. This variability is a direct consequence of its market-driven pricing mechanism, making it sensitive to supply and demand shifts.

Long-Term Fuel Supply Agreements (FSAs)

Long-Term Fuel Supply Agreements (FSAs) are a cornerstone of Coal India Limited's (CIL) revenue generation. These agreements with power producers and other industrial consumers offer a predictable income stream, crucial for financial stability and long-term strategic planning.

While the per-tonne price from FSAs may be less than what CIL can achieve through e-auctions, the sheer volume stability these contracts provide is invaluable. This ensures consistent off-take, mitigating the risks associated with market price volatility.

For the fiscal year 2023-24, CIL's total revenue stood at approximately ₹1,32,339 crore. A significant portion of this is directly attributable to the volume commitments secured through these FSAs, underscoring their importance to CIL's business model.

- Revenue Stability: FSAs provide a bedrock of consistent revenue, insulating CIL from short-term market fluctuations.

- Volume Assurance: These agreements guarantee a substantial and predictable offtake of coal, ensuring operational continuity.

- Financial Planning: The predictable nature of FSA revenue allows for more accurate budgeting and investment decisions.

- Market Share: Long-term contracts help CIL maintain its dominant position in the domestic coal supply market.

Ancillary Services and Other Income

Coal India Limited (CIL) diversifies its revenue through ancillary services and other income streams, complementing its core coal mining operations. These secondary sources, while smaller in scale, contribute to the company's overall financial health.

- Ancillary Services: CIL may offer specialized services such as coal testing and analysis, providing valuable data to clients. Additionally, consultancy services related to mining and resource management can be a source of revenue. The sale of by-products generated during coal processing also adds to this category.

- Other Income: Significant contributions to other income often come from interest earned on the company's substantial investments and cash reserves. This non-operational revenue stream helps bolster profitability.

- Financial Year 2023-24 Data: For the fiscal year ending March 31, 2024, CIL reported other income, including interest and investment gains, amounting to approximately ₹2,048 crore. This highlights the importance of these supplementary revenue sources.

- Strategic Contribution: While CIL's primary focus remains on coal production and supply, these ancillary services and other income streams demonstrate a strategy to maximize asset utilization and financial returns, enhancing its robust business model.

Coal India Limited's revenue streams are primarily driven by the sale of coal, both raw and processed, to various industrial consumers, with thermal power plants being the largest segment. The company also generates income through e-auctions, which allow for market-driven pricing, and long-term Fuel Supply Agreements (FSAs) that ensure volume stability and predictable revenue. Additionally, ancillary services and interest income from investments contribute to its overall financial performance.

| Revenue Stream | Description | FY 2023-24 Data/Significance |

|---|---|---|

| Direct Sale of Raw Coal | Sale of unrefined coal to industrial users, predominantly thermal power plants. | Largest revenue contributor by volume; FY 2023-24 revenue from operations: INR 143,369 crore (approx. US$16.3 billion). |

| Washed/Beneficiated Coal Sales | Sale of processed coal with enhanced quality, sought after by industries like steel. | Fetches a premium price; FY 2023-24 washed coal production: approx. 28.6 million tonnes. |

| E-Auctions | Spot sale of coal through an online platform, with prices determined by market forces. | Provides an additional revenue avenue beyond FSAs; significant contributor, though prices are volatile. |

| Fuel Supply Agreements (FSAs) | Long-term contracts with power producers and industrial consumers for consistent coal supply. | Cornerstone of revenue, ensuring predictable income and offtake; FY 2023-24 total revenue: approx. ₹1,32,339 crore. |

| Ancillary Services & Other Income | Revenue from services like coal testing, consultancy, sale of by-products, and interest on investments. | Complements core operations; FY 2023-24 other income: approx. ₹2,048 crore, including interest and investment gains. |

Business Model Canvas Data Sources

The Coal India Business Model Canvas is built using a blend of financial disclosures, operational reports, and market intelligence. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.