Coal India Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coal India Bundle

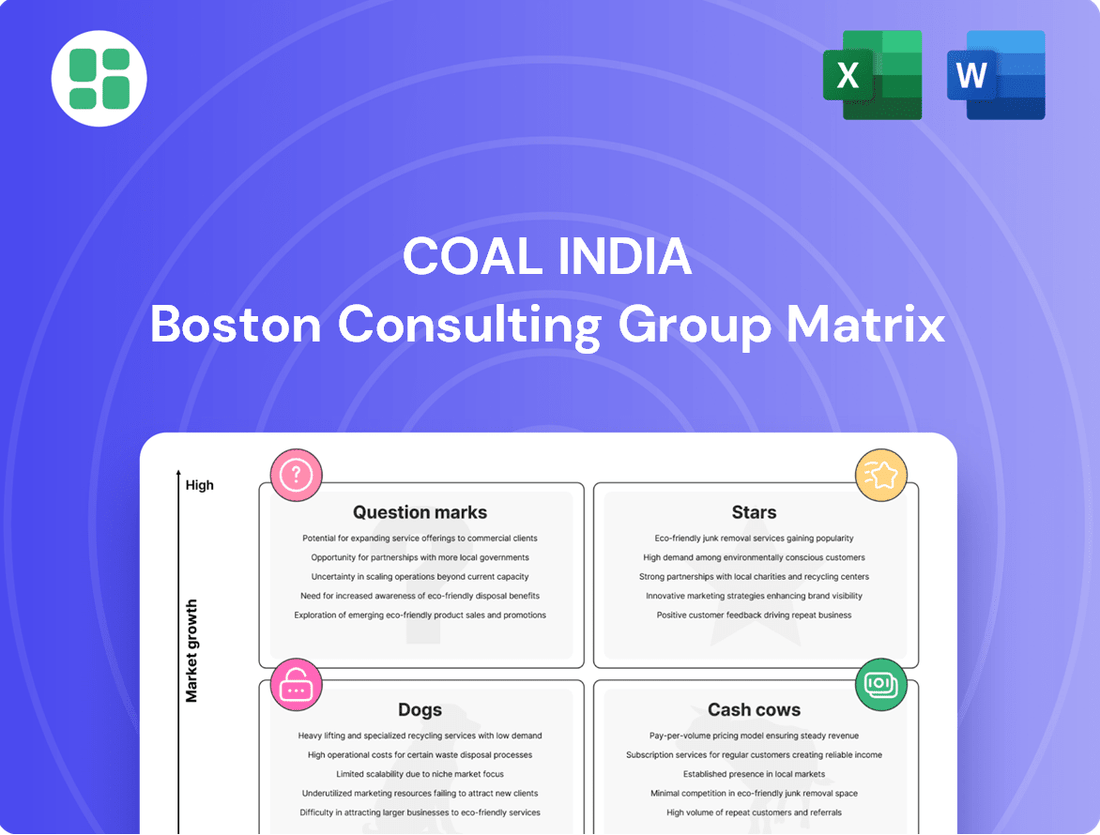

Curious about Coal India's strategic positioning? Our BCG Matrix analysis reveals which of their operations are generating substantial cash (Cash Cows) and which require careful consideration for future investment (Question Marks). Understanding these dynamics is crucial for navigating the energy sector effectively.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Coal India.

Stars

Coal India is making significant strides with new high-capacity mining projects. For instance, they are expanding production in areas like the North Karanpura Coalfield in CCL, the Korba Coalfield in SECL, and the IB & Talcher coalfields in MCL. These initiatives are fundamental to Coal India's goal of reaching a production of 1 billion tonnes by FY 2028-29.

The company's strategic investments in these large-scale, modern mines are designed to drive substantial production increases. This focus is crucial for maintaining its leading position in supplying key coal-consuming industries. For example, in FY 2023-24, Coal India's total coal production reached 773.6 million tonnes, a 10% increase year-on-year, showcasing the impact of such projects.

Coal India Limited (CIL) is making substantial investments in First Mile Connectivity (FMC) projects. These initiatives focus on automated coal evacuation through conveyor belts, moving coal from pitheads directly to loading points. This strategy is designed to boost efficiency and cut down on transportation expenses.

The implementation of FMC projects is projected to yield significant benefits, including reduced environmental impact and improved coal quality upon delivery. CIL aims to commission 19 new FMC projects by the fiscal year 2026, with a broader target of 92 projects by FY 2029, highlighting a strong commitment to modernizing its logistics and operational capabilities.

Coal India is prioritizing coking coal production to lessen India's reliance on imports, a critical move for the steel industry. The government's 'Mission Coking Coal' aims for 140 million tonnes (MT) of domestic raw coking coal by FY 2029-30, with Coal India's subsidiaries playing a crucial role in achieving this goal.

This strategic push into the high-demand coking coal market, despite the inherent difficulties in rapidly scaling output, positions it as a significant growth area for Coal India. In FY 2023-24, Coal India's production of coking coal reached approximately 60 MT, indicating a substantial increase needed to meet the mission's targets.

Coal Beneficiation Capacity Augmentation

Coal India is actively expanding its coal beneficiation capacity, with a strategic focus on coking coal. This initiative is driven by the crucial role coking coal plays in the steel industry and the growing demand for higher quality raw materials.

The company is not only operating existing coal washeries but also planning new ones to enhance coal quality. This augmentation directly addresses the need for better coking coal to support the expanding steel sector.

- Augmenting Beneficiation Capacity: Coal India is increasing its ability to process coal, especially coking coal.

- Focus on Coking Coal: The expansion prioritizes coking coal, vital for steel manufacturing.

- New Washery Plans: New washing facilities are being planned to boost capacity and quality.

- FY25 Growth: Washed coal production from existing coking coal washeries grew by 7.07% in FY 2024-25, indicating strong demand and growth in this segment.

Strategic Mine Developer cum Operator (MDO) Mode Projects

Coal India Limited (CIL) is strategically partnering with Mine Developer cum Operators (MDOs) to accelerate domestic coal production and lessen reliance on imports. This approach is crucial for meeting India's growing energy demands. By the end of the fiscal year 2023-24, CIL had awarded 15 Phase-I projects to MDOs, with six of these already operational, injecting substantial private sector capital into these ventures.

The MDO model enables CIL to harness specialized expertise and financial resources from the private sector. This collaboration is designed to expedite project timelines and boost coal output efficiently. For instance, the operational MDO projects are contributing to CIL’s overall production targets, demonstrating the effectiveness of this strategic growth avenue.

- Ramp-up Production: CIL's engagement with MDOs aims to significantly increase domestic coal output, supporting national energy security.

- Private Sector Investment: The MDO model attracts significant private capital, with 15 Phase-I projects awarded and six already operational as of FY24.

- Expertise and Efficiency: Leveraging external expertise and capital allows for faster project execution and enhanced operational efficiency.

- Reduced Import Dependency: By boosting domestic production, these projects directly contribute to reducing India's coal import bill.

Coal India's focus on expanding production in key mining areas like North Karanpura and Korba, alongside investments in First Mile Connectivity, positions its large-scale, modern mines as Stars in the BCG matrix. These ventures are crucial for achieving the 1 billion tonne production target by FY 2028-29, with FY 2023-24 production already showing a 10% year-on-year increase to 773.6 million tonnes.

The strategic emphasis on coking coal, driven by government initiatives like Mission Coking Coal, further solidifies these operations as Stars. By augmenting beneficiation capacity and planning new washeries, Coal India is enhancing coal quality to meet steel industry demands, with washed coal production from existing coking coal washeries already growing by 7.07% in FY 2024-25.

Furthermore, the successful engagement with Mine Developer cum Operators (MDOs), where 15 Phase-I projects were awarded and six were operational by FY24, represents another significant Star. This model accelerates production, leverages private sector capital and expertise, and directly contributes to reducing import dependency, aligning with national energy security goals.

What is included in the product

The Coal India BCG Matrix analyzes its diverse mining operations, identifying which segments are Stars, Cash Cows, Question Marks, or Dogs to guide investment and divestment strategies.

The Coal India BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

This optimized layout provides a clean, export-ready design, allowing for quick drag-and-drop into presentations.

Cash Cows

Coal India's primary business, supplying thermal coal to India's power sector, is its undisputed cash cow. This segment benefits from consistent, high demand as coal-fired power generation remains a cornerstone of India's energy mix, representing a substantial portion of installed capacity and electricity generation.

In 2023-24, Coal India reported a production of 773.7 million tonnes, a testament to its scale. The company's dominant market share, hovering around 75% of India's total coal output, in this mature yet essential sector, ensures a predictable and steady stream of revenue and cash flow, even as the broader coal market experiences limited growth.

Coal India's established opencast mines are the company's cash cows, consistently generating substantial revenue. These operations, characterized by their scale and efficiency, benefit from existing infrastructure, minimizing the need for significant new capital outlays. Their contribution is vital, underpinning Coal India's impressive production figures, which reached 781.06 million tonnes in FY2024-25.

Coal India's supply to non-regulated sectors, including cement and aluminum, acts as a significant cash cow. These industries rely on coal as a crucial fuel and raw material, ensuring a steady demand. In fiscal year 2023-24, Coal India supplied approximately 70 million tonnes of coal to the cement sector, a consistent off-take that underscores its role as a reliable supplier.

Existing Logistics and Evacuation Infrastructure

Coal India's existing logistics and evacuation infrastructure are the backbone of its operations, acting as a classic Cash Cow. This extensive network, featuring dedicated railway sidings and advanced mechanized loading systems, is crucial for the efficient dispatch of its vast coal output.

This robust infrastructure directly contributes to Coal India's ability to meet customer demand reliably, which is essential for maintaining its market dominance and generating consistent revenue. The company actively invests in upgrading this vital asset, ensuring it can handle the immense volume of coal movement required to sustain its core business.

- Extensive Network: Coal India operates a vast network of railway sidings and mechanized loading facilities, enabling efficient coal dispatch.

- Cost Optimization: The established logistics system minimizes bottlenecks and optimizes operational costs, directly impacting profitability.

- Revenue Generation: This infrastructure facilitates the high-volume coal movement that forms the company's primary revenue stream.

- Reliable Delivery: The infrastructure ensures consistent and timely delivery of coal to a wide customer base.

Coal Production for Domestic Consumption

Coal India's domestic coal production for consumption is a quintessential cash cow. This segment consistently meets the vast majority of India's energy needs, significantly reducing the country's dependence on imported coal. This stable demand is further bolstered by government initiatives prioritizing energy security.

The company's unwavering commitment to indigenous production ensures a captive market and predictable revenue streams. In the fiscal year 2023-24, Coal India reported a record production of 773.6 million tonnes, a testament to its robust operational capacity and its critical role in the nation's energy landscape.

- Consistent Demand: Captive market driven by national energy security policies.

- Reduced Import Reliance: CIL's production directly mitigates the need for foreign coal.

- Record Production: Achieved 773.6 million tonnes in FY 2023-24.

- Stable Revenue: Underpins financial stability through reliable supply to diverse sectors.

Coal India's thermal coal supply to the power sector is its primary cash cow, fueled by India's ongoing reliance on coal for energy generation. This segment benefits from consistent, high demand, as coal remains a cornerstone of the nation's energy mix.

The company's extensive opencast mines, characterized by their scale and efficiency, are also significant cash cows. These operations require minimal new capital, ensuring consistent revenue generation and contributing to Coal India's impressive production volumes.

Coal India's supply to non-regulated sectors, like cement and aluminum, provides another stable revenue stream, acting as a crucial cash cow. These industries depend on coal as both fuel and raw material, guaranteeing a steady demand.

The company's domestic coal production for consumption is a quintessential cash cow, bolstering India's energy security and reducing import reliance. This segment consistently meets the vast majority of the country's energy needs, ensuring predictable revenue.

| Segment | Role in BCG Matrix | Key Characteristics | FY23-24 Data |

| Thermal Coal Supply (Power Sector) | Cash Cow | High, consistent demand; mature market; significant market share | 773.7 million tonnes production |

| Opencast Mines | Cash Cow | Scale, efficiency, low capital expenditure | 781.06 million tonnes production (FY24-25 estimate) |

| Supply to Non-Regulated Sectors | Cash Cow | Essential fuel/raw material; steady demand | ~70 million tonnes to cement sector |

| Domestic Coal Production | Cash Cow | National energy security focus; reduced import reliance | 773.6 million tonnes production (record) |

Preview = Final Product

Coal India BCG Matrix

The Coal India BCG Matrix preview you're examining is the precise, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, offering you ready-to-use insights into Coal India's business units. You can confidently expect the exact same professionally crafted report, enabling immediate application in your business planning and competitive analysis.

Dogs

Some of Coal India's older underground mines, particularly those with difficult geological conditions or dwindling coal reserves, are likely experiencing higher operating costs and reduced efficiency. These operations might demand substantial capital for only minor gains, positioning them for potential rationalization or closure.

While Coal India Limited (CIL) has a strategic goal to boost its overall underground coal output, specific underperforming units could become financial drains, barely breaking even or even incurring losses. For instance, in fiscal year 2023-24, CIL's overall production saw an increase, but the cost of production for underground mines can vary significantly, with older mines often being less cost-effective.

Mines with significant environmental liabilities, often legacy sites, act as a considerable drag on Coal India's profitability. These operations can incur substantial costs for unreclaimed land and untreated mine water discharge, diverting resources from revenue-generating activities. For instance, Coal India's total environmental expenditure for FY2023 was approximately ₹2,500 crore, a portion of which is allocated to managing these historical issues.

Some of Coal India's older or less efficient coal washeries might be considered 'dogs' in its BCG matrix. These facilities often struggle with underutilization and produce lower-quality washed coal, driving up operational costs per tonne. For instance, while Coal India aims to increase beneficiation capacity, older plants may not meet current quality benchmarks or incur significant maintenance expenses, reducing their competitive edge.

Road-Based Coal Transportation

Road-based coal transportation, particularly in areas lacking mechanized First Mile Connectivity, remains a less efficient and more expensive logistical method. This approach contributes to increased dust and noise pollution, alongside higher operational costs due to increased vehicular traffic and potential environmental penalties. For instance, in fiscal year 2023-24, Coal India reported that road logistics accounted for a significant portion of its transportation costs, especially for smaller, more remote mines.

This segment is characterized by declining profitability and is actively being phased out in favor of more sustainable and cost-effective alternatives. By the end of 2024, Coal India aimed to reduce its reliance on road transport by an additional 10% through the expansion of rail and conveyor belt networks.

- Inefficiency: Higher costs per ton-mile compared to rail or conveyor systems.

- Environmental Impact: Increased dust emissions and noise pollution.

- Operational Challenges: Congestion, road wear, and higher fuel consumption.

- Declining Segment: Represents a legacy method being replaced by modern logistics.

Non-core or Divested Assets

Coal India has been actively divesting non-core and discontinued assets, a strategic move aligned with shedding 'dogs' from its portfolio. This includes the monetization of previously abandoned mines, aiming to streamline operations and unlock capital.

These divested assets likely represented ventures with low market share and growth potential, consuming resources without significant returns. For instance, Coal India's first-ever coal washery monetization exemplifies this strategy, signaling a departure from unprofitable operations.

- Divestment of Non-Core Assets: Coal India is shedding underperforming or discontinued mines.

- Strategic Monetization: The company is actively generating capital by selling off these assets.

- Focus on Profitability: This move targets the elimination of ventures with low market share and growth potential.

- Example: The first-ever coal washery monetization highlights this strategic shift.

Certain older, less efficient underground mines within Coal India's operations can be categorized as 'dogs'. These mines often face challenging geological conditions or depleted reserves, leading to higher operating costs and reduced output efficiency. For example, while overall production increased in FY2023-24, the cost per tonne can be significantly higher in these legacy mines.

These 'dog' assets, including some older coal washeries struggling with underutilization and lower quality output, represent a drag on overall profitability. They require substantial capital investment for minimal returns, making them candidates for rationalization. Coal India's strategic divestment of non-core and discontinued assets, such as its first coal washery monetization, exemplifies the shedding of these low-growth, low-market-share ventures.

| Asset Type | Characteristics | Financial Impact | Strategic Action |

|---|---|---|---|

| Older Underground Mines | Difficult geology, dwindling reserves, high operating costs | Low profitability, potential losses | Rationalization, potential closure |

| Less Efficient Coal Washeries | Underutilization, lower quality output, high maintenance | Increased cost per tonne, reduced competitiveness | Divestment, modernization |

| Road-Based Logistics (remote areas) | High cost per ton-mile, environmental impact (dust, noise) | Increased transportation expenses | Phasing out, replacing with rail/conveyor |

| Discontinued/Non-Core Mines | Low market share, low growth potential | Resource drain, low returns | Monetization, divestment |

Question Marks

Coal India is actively pursuing coal gasification projects, forming joint ventures with companies such as BHEL, GAIL, and BPCL. These ventures are focused on transforming coal into syngas, which can then be used to create higher-value products like methanol and ammonium nitrate. This strategic move aligns with India's broader goals for energy diversification and reducing reliance on imported fuels.

These gasification initiatives represent potential high-growth areas for Coal India, bolstered by substantial government backing and financial incentives. However, due to their early stage of development, these projects currently hold a low market share. Their ultimate success hinges on the effective scaling of the underlying technology and widespread market acceptance in the coming years.

Coal India Limited (CIL) is actively exploring overseas ventures for critical minerals essential for clean energy, including lithium, nickel, cobalt, and graphite. This strategic move, driven by government mandates to bolster mineral security, positions these new initiatives as potential high-growth, high-reward 'question marks' within CIL's portfolio.

These overseas exploration and acquisition efforts are still in their nascent stages, characterized by ongoing discussions for asset purchases and the signing of Memoranda of Understanding (MOUs) for exploration in countries such as Australia and Chile. While the global market for these critical minerals is experiencing significant expansion, CIL's current footprint remains relatively small, underscoring the inherent risks and potential rewards associated with these ventures.

Coal India Limited (CIL) is actively venturing into renewable energy, aiming for 5 GW of green energy capacity by 2028, encompassing solar, wind, and pumped storage projects, often through partnerships. This strategic move positions CIL to capitalize on the burgeoning global and Indian renewable energy market, a sector experiencing robust growth.

While renewables represent a high-growth area, CIL's current renewable energy footprint remains modest when contrasted with its substantial coal mining operations. The company has already commissioned 2 GW of solar capacity and is progressing with other projects, demonstrating tangible steps towards diversification.

These renewable ventures necessitate significant upfront capital investment. The ultimate profitability of these projects hinges on CIL's ability to effectively integrate them into its existing infrastructure and achieve successful scaling in the competitive energy landscape.

Digital Transformation and Advanced Technologies

Coal India Limited (CIL) is making significant investments in digital transformation and advanced mining technologies. These efforts are geared towards boosting efficiency and productivity across its vast operations. For instance, CIL has been integrating technologies like satellite surveillance for better monitoring and exploring the use of e-vehicles to reduce operational costs and environmental impact. The company also focuses on improving grade conformity, a crucial aspect for customer satisfaction and market competitiveness.

While these technological advancements hold substantial promise for future growth, their immediate impact on CIL's market share and overall profitability is still developing. The adoption of automation and advanced mining techniques, such as remote-controlled equipment and data analytics for mine planning, is essential for maintaining a competitive edge in the evolving energy landscape. These initiatives are critical for long-term sustainability, even if their direct contribution to market share is currently modest but on an upward trajectory.

- Investment Focus: CIL is channeling resources into digital transformation and advanced mining technologies to enhance operational efficiency.

- Key Technologies Adopted: Initiatives include satellite surveillance, the introduction of e-vehicles, and efforts to improve grade conformity in coal production.

- Impact on Market Share: While these technologies are vital for future competitiveness, their direct, immediate impact on market share and profitability is still unfolding.

- Future Competitiveness: The integration of automation and data-driven insights is crucial for CIL to maintain its position in the market.

Carbon Capture, Utilization, and Storage (CCUS) Research

Coal India's exploration into Carbon Capture, Utilization, and Storage (CCUS) positions it as a "question mark" within the BCG matrix. While currently representing a minimal direct revenue stream, this investment aligns with its net-zero emission targets and the growing global demand for decarbonization solutions.

The CCUS sector is characterized by high growth potential, but its commercial viability for a coal company like Coal India remains uncertain. Significant capital investment and technological advancements are still required for widespread adoption and profitability.

- Strategic Importance: CCUS is crucial for Coal India's long-term sustainability and its transition towards cleaner energy, despite current low revenue contribution.

- Emerging Technology: It's a high-growth area with significant future potential, but commercialization is still in its early stages for the coal sector.

- Investment Focus: Coal India's involvement signifies a strategic bet on future decarbonization technologies, acknowledging the evolving energy landscape.

- Uncertainty: The exact market share and revenue generation from CCUS for Coal India are negligible at present, reflecting its "question mark" status.

Coal India's ventures into critical minerals, renewable energy, coal gasification, and CCUS all fit the "question mark" profile in the BCG matrix. These are areas with high growth potential but currently low market share for Coal India, requiring significant investment and facing market uncertainties.

The company's strategic diversification into these sectors reflects a forward-looking approach to energy transition and resource security. For instance, by 2028, Coal India aims for 5 GW of green energy capacity, demonstrating a commitment to high-growth areas, though its current renewable energy footprint is small compared to its core coal business.

Similarly, overseas exploration for lithium and nickel, and investments in coal gasification and CCUS, are bets on future revenue streams. These initiatives are in early stages, with ongoing discussions and pilot projects, making their future market impact and profitability yet to be determined.

The financial commitment to these "question marks" is substantial, with ongoing capital expenditure for technology adoption and project development. The success of these ventures will depend on technological scalability, market acceptance, and favorable regulatory environments.

| Initiative | Growth Potential | Current Market Share (CIL) | Investment Focus | Key Challenges |

|---|---|---|---|---|

| Critical Minerals Exploration | High | Negligible | Overseas acquisitions, MOUs | Geopolitical risks, exploration success |

| Renewable Energy | High | Low (relative to coal) | Solar, Wind, Pumped Storage | Capital intensity, integration |

| Coal Gasification | High | Low | Joint ventures (BHEL, GAIL) | Technology scaling, market acceptance |

| CCUS | High | Negligible | R&D, pilot projects | Commercial viability, technological maturity |

BCG Matrix Data Sources

Our Coal India BCG Matrix is built on comprehensive data, integrating financial reports, operational statistics, market demand forecasts, and government policy analyses.