CNX PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNX Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CNX's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Equip yourself with actionable intelligence – download the full report now.

Political factors

Government energy policy significantly shapes CNX's operating landscape. Federal and state regulations, including those impacting natural gas production, consumption, and infrastructure, directly influence the company's strategic decisions and financial performance. For instance, the Inflation Reduction Act of 2022, with its focus on clean energy incentives, could indirectly affect the demand for natural gas as a transition fuel, while also potentially spurring investment in related infrastructure.

CNX, operating in the Appalachian Basin, faces evolving political factors, particularly concerning regulatory framework changes. Shifts in regulations for drilling permits, pipeline construction, and land use directly impact operational efficiency and costs. For instance, new environmental standards implemented in 2024, such as stricter methane emission controls, could necessitate significant capital investment for CNX to ensure compliance, potentially affecting project timelines and profitability.

Geopolitical stability is a significant driver for CNX, as global energy markets are highly sensitive to international relations. Disruptions stemming from conflicts or trade disputes can directly impact natural gas prices and demand, affecting CNX's operational environment. For instance, in early 2024, ongoing geopolitical tensions in Eastern Europe continued to influence European energy security, indirectly affecting global LNG flows and pricing, which can have ripple effects on US domestic markets where CNX operates.

Trade relations, including tariffs and international agreements, also play a crucial role. Favorable trade policies can bolster demand for US natural gas exports, benefiting companies like CNX. Conversely, trade barriers or disputes can hinder market access and depress prices. The ongoing discussions and potential shifts in trade relationships throughout 2024 and into 2025 will be closely watched for their impact on CNX's export opportunities and overall market competitiveness.

Local and state political climate

The political landscape in Pennsylvania, Ohio, and West Virginia significantly influences CNX's operations. Local and state government priorities, such as economic development initiatives or environmental regulations, directly shape the ease of permitting and community engagement. For instance, Pennsylvania's focus on energy jobs and infrastructure development in 2024-2025 could create a more favorable environment for CNX's expansion plans.

However, shifts in political sentiment can introduce uncertainty. Opposition from local communities or state-level policy changes regarding natural gas extraction could impact CNX's ability to secure necessary approvals and maintain smooth operations. CNX's 2024 capital expenditure plan of $1.3 billion, for example, is sensitive to these political variables.

- State-level incentives for natural gas production in Pennsylvania and West Virginia could bolster CNX's financial performance in 2024-2025.

- Local opposition to new pipeline projects in Ohio, driven by environmental concerns, might delay or increase the cost of CNX's infrastructure development.

- The upcoming 2024 elections in these states could lead to policy shifts affecting the regulatory environment for energy companies like CNX.

Fiscal policies and taxation

CNX's profitability and investment strategies are significantly influenced by government fiscal policies and taxation. For instance, changes in corporate tax rates directly affect the company's bottom line. In 2023, the US federal corporate tax rate remained at 21%, a key figure for CNX's financial planning.

Severance taxes on natural gas production, a core component of CNX's operations, also play a crucial role. State-specific severance tax rates can vary, impacting the cost of production and overall revenue. For example, Pennsylvania, a primary operating state for CNX, has its own impact fee structure on natural gas wells, which functions similarly to a severance tax.

Fiscal incentives or disincentives, such as tax credits for certain types of energy production or environmental regulations with associated costs, can also sway CNX's strategic decisions. The Inflation Reduction Act of 2022, for instance, offers tax credits for clean energy production, which could potentially benefit CNX's future investments if they align with its operational shifts.

- Corporate Tax Rate: The U.S. federal corporate tax rate was 21% in 2023, a stable factor for CNX's profit calculations.

- Severance Taxes: State-specific severance taxes, like Pennsylvania's impact fee, directly affect the cost of natural gas extraction for CNX.

- Fiscal Incentives: Tax credits, such as those under the Inflation Reduction Act for clean energy, can influence CNX's investment in new technologies or operational changes.

Political factors significantly influence CNX's operational environment, from federal energy policies to state-level regulations. The Inflation Reduction Act of 2022, for example, could indirectly impact natural gas demand. Evolving regulations on drilling and emissions, such as stricter methane controls expected in 2024, may require substantial capital investment for CNX.

Geopolitical stability and trade relations are also key. Global energy market volatility, influenced by conflicts in early 2024, can affect US domestic prices. Favorable trade policies could boost CNX's export opportunities, while trade barriers might limit market access.

State-specific politics in Pennsylvania, Ohio, and West Virginia are crucial. Local government priorities and potential policy shifts following the 2024 elections could impact CNX's permitting and expansion plans. For instance, Pennsylvania's focus on energy jobs in 2024-2025 may create a more favorable operating climate.

| Factor | Impact on CNX | 2024/2025 Relevance |

|---|---|---|

| Government Energy Policy | Shapes production, consumption, and infrastructure regulations. | Inflation Reduction Act incentives, potential methane emission controls. |

| Regulatory Framework | Affects drilling permits, pipeline construction, land use. | New environmental standards may increase capital expenditure. |

| Geopolitical Stability | Influences global energy prices and demand. | Ongoing geopolitical tensions affecting European energy security. |

| Trade Relations | Impacts demand for US natural gas exports. | Potential shifts in trade relationships affecting market access. |

| State-Level Politics | Determines local permitting and community engagement ease. | Potential policy shifts from 2024 elections in key operating states. |

What is included in the product

This CNX PESTLE analysis dissects the influence of external macro-environmental factors on the company, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and potential threats within the current market landscape.

Provides a concise, actionable summary of the CNX PESTLE analysis, enabling rapid decision-making and de-risking strategic initiatives.

Economic factors

Natural gas commodity prices are a critical economic factor for CNX, directly influencing its revenue and profitability. For instance, average spot prices for Henry Hub natural gas hovered around $2.60 per million British thermal units (MMBtu) in early 2024, a figure that can significantly impact CNX's earnings depending on its production costs and hedging strategies.

These price fluctuations are driven by a complex interplay of supply and demand. Factors like colder-than-average winters boosting heating demand, or increased industrial activity, can push prices higher, while mild weather or oversupply can lead to price drops. Storage levels also play a crucial role; as of April 2024, U.S. natural gas storage inventories were reported to be above the five-year average, suggesting potential downward pressure on prices if demand doesn't keep pace.

Global energy market shifts, including the pace of renewable energy adoption and geopolitical events affecting international supply chains, further contribute to natural gas price volatility. For CNX, understanding these trends is essential for strategic planning, particularly in managing production volumes and securing favorable long-term contracts to mitigate the impact of sharp price swings.

Global and regional economic growth significantly influences the demand for natural gas, impacting CNX's sales volumes and pricing. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, suggesting a stable demand environment. However, regional variations are crucial; a slowdown in key industrial regions could dampen industrial and residential gas consumption.

Economic downturns, characterized by reduced industrial output and lower consumer spending, directly translate to decreased energy consumption. This can lead to lower sales volumes for CNX and exert downward pressure on natural gas prices, affecting the company's revenue and profitability. For example, if a major manufacturing hub experiences a recession, its demand for industrial natural gas will likely fall sharply.

Conversely, periods of robust economic expansion, particularly in developing economies, can drive increased demand for natural gas as industries grow and living standards rise, leading to greater residential use. The U.S. Energy Information Administration (EIA) noted that U.S. dry natural gas production was expected to average 103.1 billion cubic feet per day (Bcf/d) in 2024, reflecting strong supply to meet demand, which is influenced by overall economic activity.

Rising inflation in 2024 and 2025 presents a significant challenge for CNX, directly impacting its operational costs. We're seeing increased expenses for essential inputs like labor, equipment, and raw materials, driven by broader economic trends.

These higher input costs can squeeze CNX's profit margins. For instance, if the cost of natural gas, a key input for CNX's operations, rises significantly without a corresponding increase in the price of the commodities it produces, profitability will be directly affected.

CNX must strategically manage these cost pressures. This could involve securing long-term supply contracts for raw materials, investing in energy efficiency technologies to reduce utility expenses, or implementing productivity improvements to offset higher labor costs.

Interest rates and capital availability

Interest rates significantly impact CNX's cost of capital. As of early 2024, the US Federal Reserve maintained a hawkish stance, with benchmark interest rates hovering around 5.25%-5.50%. This elevated rate environment makes borrowing for capital expenditures and expansion projects more expensive for companies like CNX.

Higher borrowing costs can directly affect CNX's investment decisions. If interest rates remain high throughout 2024 and into 2025, it could potentially limit CNX's capacity to fund new production facilities or crucial infrastructure upgrades, impacting its long-term growth trajectory.

- Impact on Borrowing Costs: Higher interest rates increase the expense of debt financing for CNX's capital projects.

- Investment Constraints: Elevated rates may lead CNX to scale back or delay expansion plans due to increased financing expenses.

- Capital Availability: A tighter monetary policy, often associated with higher rates, can reduce the overall availability of capital for businesses.

Energy market supply and demand dynamics

The energy market, particularly for natural gas, is a critical factor for CNX. The balance between how much natural gas is available from producers and how much is needed by consumers like power plants, industries, and homes directly influences prices. For instance, a mild winter in 2023-2024, which saw lower residential demand, contributed to price moderation.

CNX's performance is intrinsically linked to these dynamics. When supply outstrips demand, prices tend to fall, impacting CNX's revenue and profitability. Conversely, strong demand, perhaps driven by increased electricity generation needs due to heatwaves or industrial expansion, can boost prices and CNX's market position.

- Supply Factors: Production levels from shale plays, pipeline capacity, and geopolitical events affecting global energy flows.

- Demand Drivers: Weather patterns (heating/cooling), industrial activity, and the transition to cleaner energy sources influencing natural gas consumption.

- Price Volatility: Fluctuations in the spot and futures markets for natural gas, with prices in early 2024 averaging around $2.50 per MMBtu, down from previous years.

- CNX's Position: CNX's focus on efficient, low-cost production in the Marcellus and Utica Basins positions it to capitalize on favorable supply/demand balances.

Inflationary pressures continue to impact CNX's operational costs, with the Consumer Price Index (CPI) showing a 3.4% annual increase as of April 2024. This rise in general prices directly translates to higher expenses for labor, materials, and services essential for natural gas extraction and transportation. CNX must navigate these rising costs to maintain its profit margins, potentially through operational efficiencies or strategic pricing adjustments.

Interest rates remain a key economic consideration for CNX, with the Federal Reserve holding its target range between 5.25% and 5.50% as of mid-2024. This environment increases the cost of capital for any new projects or expansions, potentially influencing CNX's investment decisions and overall financial strategy. Higher borrowing costs can also affect the company's ability to refinance existing debt favorably.

Global economic growth projections for 2024, estimated at 3.2% by the IMF, suggest a generally supportive demand environment for natural gas. However, regional economic performance is critical, as localized slowdowns in industrial or residential sectors can dampen natural gas consumption, directly impacting CNX's sales volumes and revenue streams.

| Economic Factor | 2024 Data/Projection | Impact on CNX |

|---|---|---|

| Inflation (CPI Annual) | 3.4% (April 2024) | Increases operational costs (labor, materials). |

| Federal Funds Rate | 5.25%-5.50% (Mid-2024) | Raises cost of capital for investments and debt. |

| Global GDP Growth | 3.2% (IMF Projection 2024) | Suggests stable to growing demand for natural gas. |

| Natural Gas Spot Price (Henry Hub) | ~$2.60/MMBtu (Early 2024) | Influences revenue and profitability based on production costs. |

Preview Before You Purchase

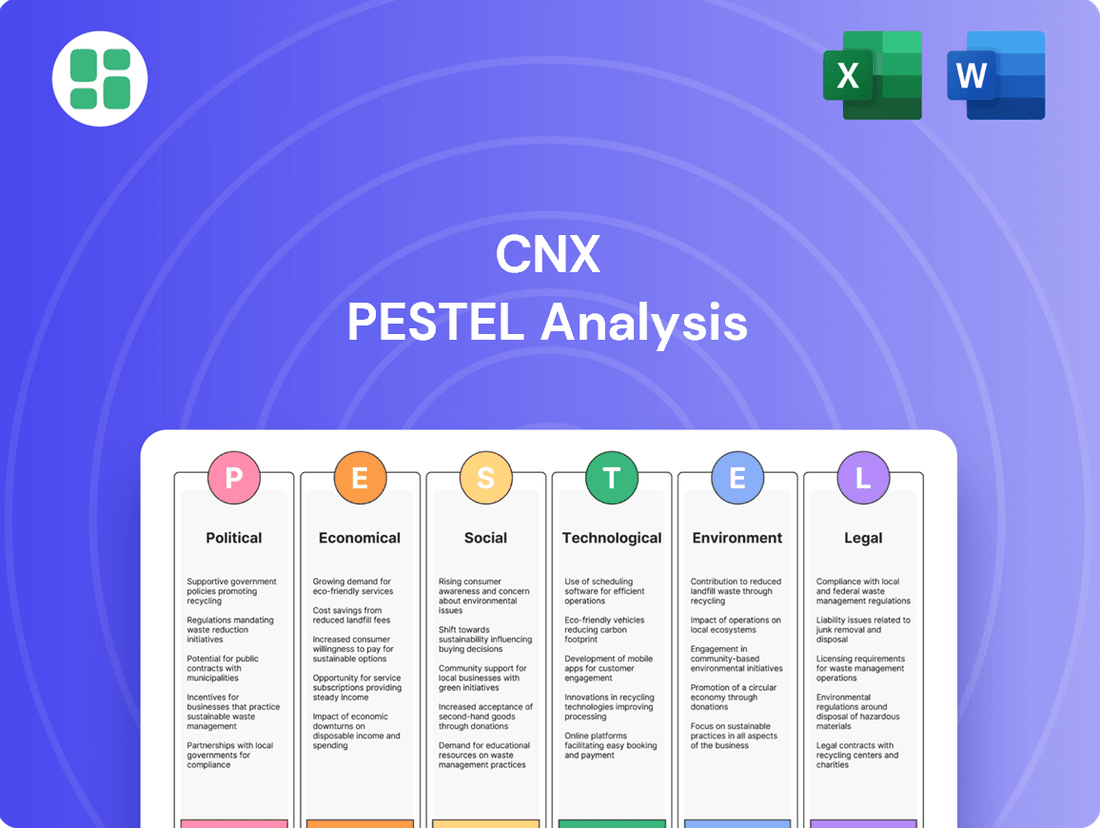

CNX PESTLE Analysis

The preview shown here is the exact CNX PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. Our CNX PESTLE Analysis is comprehensive and ready for your strategic planning.

The content and structure shown in the preview is the same CNX PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

Public perception of natural gas is increasingly shaped by concerns over climate change. Surveys in 2024 and early 2025 indicate a growing segment of the population views natural gas as a bridge fuel, while others see it as a fossil fuel that hinders the transition to renewables. This duality creates a complex landscape for companies like CNX.

Negative public sentiment can translate directly into regulatory pressure. For instance, in 2024, several municipalities enacted stricter regulations on natural gas infrastructure due to environmental advocacy. This heightened scrutiny can impact project timelines and increase operational costs for CNX.

Conversely, a portion of the public still recognizes natural gas as a more environmentally friendly alternative to coal. This perception is often driven by data showing reduced emissions when natural gas replaces coal for power generation. CNX can leverage this segment of public opinion in its communication strategies.

The Appalachian Basin's workforce demographics present a key consideration for CNX. Availability of skilled labor for exploration, drilling, and production is crucial, and an aging workforce in traditional energy sectors could pose a challenge. For instance, in 2023, the U.S. Bureau of Labor Statistics indicated a median age for oil and gas extraction workers that was higher than many other industries, suggesting a potential need for proactive recruitment and training initiatives.

Shifts in educational priorities away from traditional engineering and trades towards other fields might also impact CNX's ability to recruit and retain talent. This trend, observed in recent years, necessitates a strategic approach to workforce development to ensure a pipeline of qualified professionals for the energy sector.

CNX must actively cultivate strong community relations to secure its social license to operate. Concerns about noise pollution from operations, increased traffic congestion, land use conflicts, and potential environmental impacts are critical. For instance, in 2024, community feedback in Greene County, Pennsylvania, highlighted increased truck traffic as a significant concern, leading CNX to implement revised hauling routes to mitigate disruptions.

Health and safety concerns

Public and workforce concerns about the health and safety of natural gas operations are significant drivers in the current landscape. Incidents, such as pipeline leaks or emissions, can rapidly erode public trust and invite stricter regulatory scrutiny. For instance, in 2024, several communities experienced increased air quality monitoring following localized natural gas infrastructure issues, leading to temporary operational adjustments.

These concerns directly impact operational costs. Companies are investing more in advanced safety protocols, leak detection technologies, and community outreach programs. The U.S. Environmental Protection Agency (EPA) continues to refine methane emission standards, pushing for greater transparency and accountability in 2025. This heightened focus means that perceived risks can translate into substantial compliance expenditures and potential delays in project approvals.

- Increased regulatory scrutiny: Stricter emissions standards and safety regulations are anticipated to continue in 2025, impacting operational flexibility.

- Public perception and trust: Negative incidents can lead to significant reputational damage and community opposition, affecting project timelines.

- Investment in safety technology: Companies are allocating more capital to advanced leak detection and prevention systems, adding to operational overhead.

- Workforce safety standards: Maintaining high safety standards for employees involved in natural gas extraction and transportation remains a critical and costly aspect of operations.

Corporate social responsibility expectations

Societal expectations for corporate social responsibility (CSR) are increasingly tied to a company's environmental, social, and governance (ESG) performance. CNX's demonstrated commitment to ESG principles is becoming a critical factor for investors, influencing capital allocation and potentially lowering the cost of capital. For instance, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, highlighting the significant financial implications of strong ESG credentials.

CNX's approach to CSR directly impacts its ability to attract and retain top talent, as employees, particularly younger generations, prioritize working for organizations with a clear social purpose. Furthermore, a robust CSR strategy enhances brand reputation, fostering customer loyalty and differentiating CNX in a competitive marketplace. Companies with strong ESG scores often see improved operational efficiency and reduced regulatory risks, contributing to long-term value creation.

- Growing Investor Demand: Sustainable investments are projected to account for over 50% of all managed assets globally by 2025.

- Talent Attraction: A 2024 survey indicated that 70% of millennials consider a company's social and environmental impact when choosing an employer.

- Brand Reputation: Companies with high ESG ratings reported an average of 13% higher customer satisfaction compared to their peers in 2023.

- Risk Mitigation: Strong ESG practices can lead to a 20% reduction in litigation and regulatory fines, according to industry analyses from 2024.

Public sentiment on natural gas is divided, with some viewing it as a necessary bridge fuel and others as an impediment to renewable energy. This perception directly influences regulatory actions and corporate strategy, as seen in 2024 municipal regulations impacting natural gas infrastructure.

Workforce demographics and educational trends pose challenges for CNX, highlighting the need for proactive recruitment and training to address an aging workforce and shifts in academic focus. This was underscored by 2023 labor statistics indicating a higher median age for extraction workers.

Community relations are paramount for CNX's social license to operate, with concerns like noise, traffic, and land use requiring active management. For instance, Greene County community feedback in 2024 led to revised hauling routes to address traffic congestion.

Societal expectations for corporate social responsibility (CSR) are increasingly tied to ESG performance, influencing investor decisions and talent attraction. By 2025, sustainable investments are projected to exceed 50% of global managed assets, emphasizing the financial importance of strong ESG credentials.

Technological factors

CNX continues to benefit from advancements in horizontal drilling and hydraulic fracturing, which are key to unlocking shale gas reserves. These techniques allow for more efficient extraction, leading to lower production costs and higher recovery rates.

Innovations in well design further optimize production. For instance, longer laterals and improved completion stages mean wells can access more of the reservoir, boosting initial production volumes and overall well economics.

In 2024, the industry saw continued refinement in these technologies. Companies like CNX are focusing on maximizing resource utilization, ensuring that each well drilled yields the greatest possible return on investment.

Technological advancements in methane emissions detection and mitigation are crucial for the natural gas industry's environmental performance and regulatory adherence. These technologies, ranging from advanced sensor networks to drone-based monitoring, are becoming increasingly sophisticated in pinpointing leaks across the entire value chain.

The adoption of these tools is driven by a growing emphasis on reducing greenhouse gas emissions, with methane being a primary target. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to refine regulations under the Clean Air Act targeting methane emissions from the oil and natural gas sector, necessitating robust detection capabilities.

Companies are investing in solutions like optical gas imaging (OGI) cameras and continuous monitoring systems, which offer real-time data on emission sources. This allows for quicker repairs and a more accurate assessment of a company's carbon footprint, directly impacting operational efficiency and environmental stewardship.

CNX is increasingly leveraging digitalization and automation to streamline its operations. This includes the adoption of data analytics and artificial intelligence to optimize field activities, leading to better decision-making and improved safety protocols. For instance, in 2024, the energy sector saw a significant push towards AI-driven predictive maintenance, which can reduce downtime and operational costs by an estimated 10-15%.

These technological advancements translate directly into enhanced operational efficiencies and substantial cost reductions for CNX. By automating routine tasks and using data to inform strategic choices, the company can achieve a more agile and cost-effective operational model. The global market for industrial automation is projected to reach over $300 billion by 2025, highlighting the widespread industry trend toward these efficiencies.

Pipeline and infrastructure innovation

Innovations in pipeline materials and construction are significantly enhancing the safety and efficiency of natural gas transportation. For instance, the development of advanced composite materials offers greater corrosion resistance and durability compared to traditional steel, potentially reducing maintenance costs and the risk of leaks. These advancements are crucial for ensuring the reliable delivery of natural gas to meet growing energy demands.

Monitoring systems are also becoming more sophisticated, employing technologies like drone surveillance and real-time sensor networks to detect potential issues proactively. This allows for quicker response times to any anomalies, thereby improving overall environmental performance and operational integrity. In 2024, investments in pipeline integrity management systems are expected to rise as companies prioritize safety and regulatory compliance.

- Advanced Materials: Use of composite materials for enhanced durability and corrosion resistance.

- Smart Monitoring: Integration of drone technology and real-time sensors for proactive issue detection.

- Efficiency Gains: Improved construction methods and material science leading to faster, safer installations.

- Environmental Performance: Reduced leak potential and better leak detection contribute to lower environmental impact.

Carbon capture, utilization, and storage (CCUS)

Carbon capture, utilization, and storage (CCUS) technologies are becoming increasingly relevant for the natural gas industry, including companies like CNX. These advancements focus on capturing CO2 emissions from sources like natural gas processing plants and power generation facilities.

While CCUS isn't directly involved in the extraction of natural gas, its increasing viability and adoption rates are poised to significantly impact the long-term demand for natural gas and shape its environmental perception. For instance, the U.S. Department of Energy's Carbon Capture Shot aims to reduce the cost of carbon capture to $120 per metric ton of CO2 by 2035, a target that could make CCUS more economically feasible for gas producers.

- Growing Investment: Global investment in CCUS projects is on the rise, with projections indicating substantial growth in the coming decade, potentially reaching hundreds of billions of dollars.

- Policy Support: Government incentives, such as tax credits for carbon capture, are crucial drivers for CCUS deployment, making it a more attractive option for emissions reduction.

- Technological Advancements: Ongoing research and development are improving the efficiency and reducing the cost of various capture technologies, from post-combustion to direct air capture.

- Market Demand: The increasing focus on decarbonization and net-zero targets by corporations and governments creates a growing market for captured CO2, particularly for utilization in products like building materials and chemicals.

CNX's technological edge is amplified by advancements in horizontal drilling and hydraulic fracturing, boosting shale gas extraction efficiency and lowering production costs. Innovations in well design, such as longer laterals, further optimize reservoir access and well economics, with companies like CNX focusing on maximizing resource yield in 2024.

The company is also prioritizing methane emission detection and mitigation technologies, driven by stricter regulations like those from the EPA under the Clean Air Act. Investments in optical gas imaging and continuous monitoring systems enhance environmental performance and operational efficiency. In 2024, the energy sector saw a significant push towards AI-driven predictive maintenance, potentially reducing downtime by 10-15%.

Digitalization and automation streamline CNX's operations, with data analytics and AI optimizing field activities and safety protocols. The global industrial automation market is projected to exceed $300 billion by 2025, underscoring this trend. Furthermore, innovations in pipeline materials and smart monitoring systems, including drone surveillance, are enhancing safety, efficiency, and environmental integrity in natural gas transportation.

Legal factors

CNX navigates a complex web of environmental regulations, including federal laws like the Clean Air Act and Clean Water Act, alongside state-specific mandates concerning emissions, water discharge, and waste management. Failure to comply can lead to substantial fines and legal challenges, impacting operational continuity and financial performance.

In 2023, the US Environmental Protection Agency (EPA) continued to enforce stringent air quality standards, with significant focus on methane emissions from the natural gas industry, a key area for CNX. The company's commitment to compliance is essential to mitigate risks and maintain its operating licenses.

Land use and permitting laws represent a critical legal hurdle for energy companies like CNX. These regulations dictate everything from where drilling can occur to the environmental standards for infrastructure, directly impacting project timelines and costs. Efficiently navigating this complex web of federal, state, and local rules is paramount for successful and timely project execution.

In 2024, the energy sector continued to grapple with evolving land use policies. For instance, in Pennsylvania, where CNX operates extensively, debates around Marcellus Shale development often center on local zoning ordinances and environmental impact assessments, which can add months or even years to permitting processes. Failure to secure necessary permits can halt operations entirely, as seen in various projects across the US that faced legal challenges and delays due to land use disputes.

Worker health and safety legislation, enforced by bodies like the Occupational Safety and Health Administration (OSHA), is critical for the natural gas industry. These regulations, such as those concerning fall protection and confined space entry, directly impact operational procedures and costs for companies like CNX. In 2023, OSHA reported over 5,000 worker fatalities nationwide, with a significant portion in industries with inherent physical risks.

Compliance with these mandates is not just about worker well-being; it's a legal and financial imperative. CNX must invest in safety training, equipment, and protocols to prevent accidents and avoid substantial fines, which can reach tens of thousands of dollars per violation. For instance, a serious violation in 2024 could incur a penalty of up to $15,625, while willful or repeated violations can cost up to $156,259.

Contractual and property rights law

Contractual and property rights law are critical for CNX, particularly concerning mineral leases and joint ventures. The company's ability to secure and enforce these agreements directly impacts its operational capacity and revenue streams. For instance, the clarity and enforceability of natural gas sales contracts are paramount for financial stability, ensuring predictable income from its production assets.

CNX's operations are deeply intertwined with the legal framework governing its property rights and contractual obligations. The company relies on robust legal protections for its mineral leases, which grant it the right to extract resources. Furthermore, joint venture agreements, often complex legal documents, dictate the terms of collaboration with other energy companies, influencing project development and cost-sharing. The enforcement of these contracts is essential for maintaining operational continuity and financial predictability.

- Mineral Lease Agreements: CNX's ability to acquire and maintain mineral leases is governed by specific property rights laws, ensuring its legal standing to extract natural gas.

- Joint Venture Contracts: The company enters into various joint venture agreements, which are legally binding contracts that define partnership terms, operational responsibilities, and profit/loss sharing.

- Natural Gas Sales Contracts: These agreements are crucial for CNX's revenue generation, outlining the terms, pricing, and delivery of natural gas to purchasers, with enforceability being key to financial health.

- Regulatory Compliance: Adherence to all relevant contractual and property rights legislation is fundamental to avoiding legal disputes and ensuring smooth business operations.

Litigation risks and legal precedents

CNX Resources faces litigation risks stemming from its extensive coal mining operations. Potential lawsuits could arise from environmental impacts, such as water contamination or land subsidence, and operational incidents. For instance, in 2023, the company was involved in ongoing litigation concerning alleged violations of environmental regulations, with settlements or judgments potentially impacting its financial standing and operational practices.

Legal precedents established in similar cases can significantly shape the regulatory landscape for the coal industry. A notable precedent could involve increased reclamation bond requirements or stricter emission standards, directly influencing CNX's cost of doing business and future investment decisions. The company's ability to navigate these legal challenges is crucial for maintaining its operational license and financial stability.

- Environmental Lawsuits: CNX has faced legal challenges related to its environmental footprint, including allegations of water pollution.

- Operational Incidents: The risk of lawsuits arising from accidents or safety breaches at its facilities remains a constant concern.

- Precedent Setting: Past litigation outcomes can establish new legal standards that affect the entire industry, potentially increasing compliance costs for CNX.

- Regulatory Impact: Adverse legal rulings could lead to more stringent environmental regulations, impacting operational flexibility and profitability.

Legal factors significantly shape CNX's operational landscape, encompassing environmental compliance, land use, worker safety, and contractual agreements. The company must adhere to a myriad of federal, state, and local regulations, with non-compliance leading to substantial financial penalties and operational disruptions.

In 2024, the energy sector continued to see evolving land use policies, particularly in Pennsylvania, where CNX operates. Local zoning and environmental impact assessments can extend permitting timelines, potentially delaying projects by months or years due to legal challenges.

Worker safety regulations, enforced by OSHA, are paramount. In 2023, OSHA penalties for serious violations could reach $15,625, with willful or repeated violations escalating to $156,259, underscoring the financial imperative of strict safety protocols for CNX.

Contractual and property rights law, particularly concerning mineral leases and joint ventures, are vital for CNX's revenue and operational continuity. The enforceability of these agreements directly impacts financial stability and predictable income streams.

Environmental factors

CNX faces increasing pressure from climate change policies and emissions targets, particularly concerning methane reduction. Governments worldwide are implementing stricter regulations. For instance, the U.S. Environmental Protection Agency's proposed methane rule for the oil and gas sector, expected to be finalized in 2024, could significantly impact CNX's operational costs through enhanced monitoring and control requirements.

CNX's operations, particularly in hydraulic fracturing, face significant environmental scrutiny regarding water management and disposal. The industry's substantial water intake and the subsequent handling of produced water, which can contain naturally occurring radioactive materials and other contaminants, are under intense regulatory focus. For instance, in 2023, the U.S. Environmental Protection Agency continued to refine regulations concerning wastewater discharge, impacting companies like CNX.

Effective and sustainable water management is not just about compliance; it's a critical component for maintaining public trust and operational viability. CNX's commitment to recycling and reusing produced water, aiming to minimize freshwater withdrawal, directly addresses these environmental concerns. This approach is increasingly important as water scarcity becomes a more pressing issue in many operational regions.

CNX's operations inherently involve land disturbance for drilling sites, well pads, and extensive pipeline networks, directly impacting local ecosystems and biodiversity. The company's environmental footprint is a significant consideration, particularly regarding the fragmentation of habitats and potential effects on wildlife.

Minimizing this land disturbance is crucial for both regulatory compliance and maintaining positive community relations. For instance, in 2024, CNX reported investing in reclamation and restoration projects aimed at mitigating the impact of its infrastructure, though specific acreage figures for ongoing disturbance versus restoration are part of their detailed environmental reporting.

Methane leakage and fugitive emissions

Methane leakage, often termed fugitive emissions, from natural gas operations presents a significant environmental challenge due to methane's potent greenhouse gas properties. Reducing these leaks is paramount for the industry's sustainability and meeting evolving environmental regulations.

The U.S. Environmental Protection Agency (EPA) has been actively working on regulations to curb methane emissions. For instance, proposed rules in 2024 aim to strengthen requirements for detecting and repairing methane leaks across the oil and gas sector, building on existing frameworks like the Greenhouse Gas Reporting Program.

- Methane's Potency: Methane is over 80 times more potent than carbon dioxide in warming the planet over a 20-year period.

- Industry Focus: Companies like CNX are investing in advanced technologies, such as aerial surveillance and sensor networks, to identify and mitigate methane leaks from their infrastructure.

- Regulatory Pressure: The Biden-Harris administration has set ambitious goals for reducing methane emissions, with significant implications for natural gas producers.

- Economic Impact: Minimizing methane loss not only improves environmental performance but also conserves a valuable commodity, enhancing operational efficiency and profitability.

Waste management and remediation

CNX's operations in natural gas exploration and production inherently generate waste, necessitating robust management and remediation strategies. This includes the careful handling, storage, and disposal of materials like drilling fluids, produced water, and solid waste to prevent environmental contamination. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize stringent regulations on wastewater management from unconventional oil and gas operations, impacting companies like CNX.

Effective waste management is not just about compliance; it’s crucial for maintaining operational integrity and public trust. CNX invests in technologies and processes to minimize waste generation and ensure responsible disposal, often exceeding minimum regulatory standards. The remediation of sites disturbed by drilling and infrastructure development is also a significant undertaking, involving reclamation and restoration to their pre-operational state or a functional equivalent. This commitment is reflected in ongoing site assessments and restoration projects across their Appalachian Basin footprint.

Key aspects of CNX's waste management and remediation efforts include:

- Minimizing waste generation through efficient operational practices and material reuse.

- Ensuring compliant disposal of all waste streams, adhering to federal, state, and local regulations.

- Implementing site remediation plans to restore land impacted by exploration and production activities.

- Investing in advanced technologies for water treatment and waste processing to reduce environmental footprint.

CNX is navigating an increasingly stringent environmental regulatory landscape, particularly concerning methane emissions and water management. The U.S. EPA's proposed methane rule, anticipated for finalization in 2024, will likely increase operational costs for CNX through enhanced monitoring and control mandates. Furthermore, ongoing regulatory refinement of wastewater discharge in 2023 highlights the critical need for robust water management strategies, including recycling produced water, to mitigate environmental impact and maintain public trust.

PESTLE Analysis Data Sources

Our CNX PESTLE Analysis is meticulously constructed using data from reputable sources such as government statistical agencies, international financial institutions, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the business landscape.