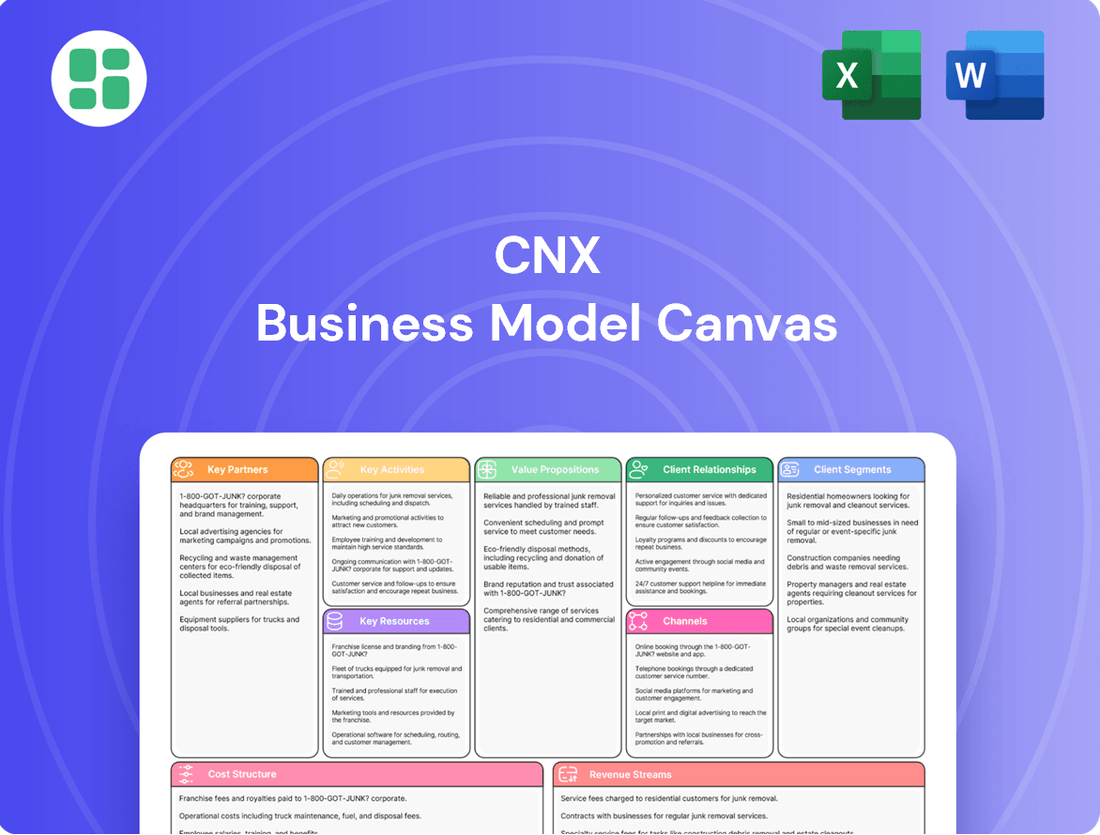

CNX Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNX Bundle

Unlock the strategic blueprint of CNX’s success with our comprehensive Business Model Canvas. This detailed breakdown reveals how CNX effectively delivers value, manages costs, and builds customer relationships. Perfect for anyone looking to understand and replicate successful business strategies.

Partnerships

CNX Resources actively cultivates strategic industry alliances, forming joint ventures and collaborations to boost operational efficiency and foster technological innovation. These partnerships are crucial for sharing specialized expertise and driving advancements across the sector.

A prime illustration of this strategy is the AutoSepSM Technologies joint venture with Deep Well Services. This collaboration specifically targets the development and implementation of automated flowback systems, a critical component of the completions process in the oil and gas industry.

Through these alliances, CNX aims to achieve significant improvements in cost reduction, enhanced safety protocols, and better environmental stewardship. For instance, in 2024, the industry saw a continued push for automation, with companies like CNX leveraging partnerships to integrate advanced technologies and streamline operations, potentially leading to substantial savings and reduced environmental impact.

CNX actively partners with state environmental regulators through programs like the 'Radical Transparency' initiative. This public-private collaboration with the Pennsylvania Governor's office enhances operational disclosures and reinforces adherence to stringent environmental standards.

These collaborations are crucial for building public trust and demonstrating a commitment to responsible resource development. In 2024, CNX reported a 15% reduction in methane emissions intensity compared to 2023, a testament to the effectiveness of these transparent, collaborative efforts.

CNX relies on a robust network of midstream and transportation partners to ensure its natural gas reaches consumers efficiently. While CNX manages its own considerable gathering infrastructure, it strategically connects with major third-party interstate transmission pipelines. These collaborations are vital for the reliable and cost-effective delivery of its product to market.

Technology and Service Providers

CNX collaborates with key technology and service providers to enhance its drilling and completion efficiency. For example, in 2025, CNX leveraged Precision Drilling Rig 575 for its well drilling operations. These partnerships provide access to advanced equipment and specialized knowledge, ultimately boosting capital efficiency and well productivity.

- Access to Advanced Technology: Partnerships ensure CNX utilizes state-of-the-art drilling and completion technologies.

- Enhanced Operational Efficiency: Collaborations with service providers like Precision Drilling lead to optimized wellsite operations.

- Improved Capital Allocation: By accessing specialized expertise and equipment, CNX aims to maximize the return on its capital investments in drilling.

Community and Non-Profit Organizations

CNX actively fosters key partnerships with community and non-profit organizations through its CNX Foundation. These collaborations are strategically aligned with a focus on 'Tangible, Impactful, Local' initiatives, aiming to create meaningful change within the communities where CNX operates.

In 2024, the CNX Foundation made a significant financial contribution, investing $3.7 million to support 144 distinct initiatives. This financial backing was complemented by substantial employee engagement, with over 3,500 volunteer hours dedicated to these community projects. These efforts underscore CNX's dedication to corporate social responsibility and its commitment to the betterment of local communities.

- Community Focus: Partnerships prioritize 'Tangible, Impactful, Local' initiatives.

- 2024 Impact: $3.7 million invested across 144 community projects.

- Employee Engagement: Over 3,500 volunteer hours contributed by CNX employees.

- Social Responsibility: Demonstrates a strong commitment to community development.

CNX's key partnerships are essential for its operational success and strategic growth, encompassing technology, infrastructure, and community engagement. These alliances enable access to specialized expertise, advanced technologies, and critical market channels, ultimately driving efficiency and sustainability.

| Partnership Type | Key Collaborator Example | 2024/2025 Impact/Focus |

|---|---|---|

| Technology & Operations | Deep Well Services (AutoSepSM Technologies) | Development of automated flowback systems; driving innovation in completions. |

| Environmental & Regulatory | Pennsylvania Governor's Office (Radical Transparency) | Enhanced operational disclosures and adherence to environmental standards; 15% reduction in methane emissions intensity (vs. 2023). |

| Midstream & Transportation | Third-party interstate transmission pipelines | Efficient and cost-effective delivery of natural gas to market. |

| Drilling Services | Precision Drilling (Rig 575) | Enhanced drilling efficiency and capital efficiency in well productivity. |

| Community Development | CNX Foundation supported initiatives | $3.7 million invested in 144 local projects; over 3,500 employee volunteer hours. |

What is included in the product

A structured framework detailing CNX's approach to creating, delivering, and capturing value, encompassing key partners, activities, resources, customer relationships, segments, channels, cost structure, and revenue streams.

The CNX Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategies, making them easier to understand and adapt.

Activities

CNX Resources' primary focus is on exploring, developing, and producing natural gas, with a strong emphasis on the Marcellus and Utica shale plays in the Appalachian Basin. This core activity is crucial for their business model, directly generating revenue and securing future reserves.

The company actively engages in drilling, hydraulic fracturing, and bringing new wells online to sustain and expand its production capacity. In 2024, CNX continued its strategic development of these key shale formations, aiming for efficient resource extraction.

Looking ahead, CNX is targeting deep Utica and Marcellus wells, indicating a commitment to unlocking further reserves and optimizing production from these prolific basins. This forward-looking approach is vital for maintaining a competitive edge in the natural gas market.

CNX designs, builds, and operates extensive natural gas gathering systems, crucial for moving gas from wells to market. This network includes approximately 2,700 miles of gathering pipelines and several processing facilities.

These midstream operations are vital for CNX to efficiently extract and monetize its natural gas reserves. By managing this infrastructure, the company ensures a smooth flow of product to interstate pipelines and other sales points, directly impacting overall profitability.

CNX is heavily invested in developing and implementing cutting-edge technologies to enhance its operations. A prime example is the AutoSepSM automated flowback system, designed to streamline processes and boost efficiency.

The company is also pioneering the use of compressed natural gas (CNG) for its water-hauling fleet. This initiative directly addresses environmental concerns by reducing emissions and supports a cleaner operational footprint.

These technological advancements are not just about modernization; they are strategic moves to lower operational costs and significantly mitigate environmental impact. For instance, CNG trucks offer substantial savings on fuel expenses compared to traditional diesel engines.

Capital Allocation and Shareholder Returns

CNX's core operations revolve around the strategic deployment of capital, a critical activity aimed at enhancing per-share value for its investors. This includes a robust program of share repurchases, a key lever for returning free cash flow directly to shareholders.

In the second quarter of 2025, CNX actively repurchased 3.7 million shares. This move is part of an ongoing, aggressive buyback strategy that has significantly reduced the company's outstanding share count by approximately 40% since the third quarter of 2020.

- Capital Allocation Strategy: Focus on generating long-term per share value.

- Share Repurchases: Aggressively returning free cash flow to shareholders through buybacks.

- Q2 2025 Activity: Repurchased 3.7 million shares.

- Cumulative Impact: Reduced outstanding shares by ~40% since Q3 2020.

Environmental, Social, and Governance (ESG) Initiatives

CNX's commitment to Environmental, Social, and Governance (ESG) initiatives is a core part of its business model. The company actively works to reduce its environmental footprint, focusing on key areas like methane intensity reduction and improved water stewardship. These efforts are crucial for long-term sustainability and stakeholder trust.

A significant aspect of CNX's ESG strategy involves capturing waste mine methane, turning a potential environmental hazard into a resource. This aligns with their broader goal of responsible resource management and operational efficiency. By integrating these practices, CNX aims to set a benchmark for the industry.

CNX has also transitioned to continuous, transparent ESG reporting, providing stakeholders with real-time data. This transparency is vital for building confidence and demonstrating accountability. For instance, in 2024, CNX reported a methane intensity of 0.43% for its Appalachian Basin operations, a figure that reflects ongoing efforts to minimize emissions.

- Methane Intensity Reduction: CNX aims to further lower its methane intensity, a key environmental metric for natural gas producers.

- Waste Mine Methane Capture: The company invests in technologies to capture and utilize methane that would otherwise be released into the atmosphere.

- Water Stewardship: CNX implements robust water management practices to minimize its impact on local water resources.

- Transparent Reporting: Providing real-time data on ESG performance demonstrates accountability and fosters stakeholder engagement.

CNX's key activities center on the efficient exploration and production of natural gas, particularly within the Marcellus and Utica shale formations. This involves continuous drilling and well development to maintain and grow production. They also manage extensive midstream infrastructure, including pipelines and processing facilities, to move gas to market.

Technological innovation is a significant driver, with investments in systems like AutoSepSM to improve operational efficiency and the use of CNG for water-hauling fleets to reduce emissions. Furthermore, CNX actively allocates capital, primarily through aggressive share repurchase programs, to enhance shareholder value. A strong commitment to ESG principles guides their operations, focusing on methane reduction and responsible resource management, evidenced by their 2024 methane intensity report of 0.43%.

| Key Activity | Description | Supporting Data/Facts |

| Natural Gas Exploration & Production | Developing and producing natural gas from Marcellus and Utica shale plays. | Focus on deep Utica and Marcellus wells. |

| Midstream Operations | Designing, building, and operating gathering systems and processing facilities. | Approximately 2,700 miles of gathering pipelines. |

| Technological Advancement | Implementing innovative technologies to enhance efficiency and reduce environmental impact. | AutoSepSM automated flowback system; CNG water-hauling fleet. |

| Capital Allocation | Returning free cash flow to shareholders, primarily through share repurchases. | Repurchased 3.7 million shares in Q2 2025; ~40% share reduction since Q3 2020. |

| ESG Initiatives | Reducing environmental footprint, capturing waste methane, and transparent reporting. | 2024 methane intensity of 0.43% for Appalachian Basin operations. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you're viewing is an exact representation of the document you'll receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot from the final, complete file. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas, identical to what you see here.

Resources

CNX Resources boasts an impressive portfolio of natural gas reserves, totaling 8.54 trillion cubic feet equivalent (Tcfe) as of December 31, 2024. This substantial asset base is concentrated in the prolific Appalachian Basin, providing a robust foundation for sustained production and future expansion.

The company's strategic advantage lies in its extensive acreage and the efficient extraction of these valuable shale gas resources. By focusing on operational excellence, CNX is well-positioned to capitalize on its significant reserve holdings.

CNX's midstream infrastructure network is a cornerstone of its business model, encompassing roughly 2,700 miles of natural gas gathering pipelines and numerous processing facilities. This extensive network is crucial for efficiently moving natural gas from where it's extracted to where it's needed.

This integrated system allows CNX to manage the entire process, from collection to processing and transportation, ensuring reliable delivery and effective cost control. In 2023, CNX reported significant investments in its midstream assets, highlighting their strategic importance for future growth and operational efficiency.

CNX Resources heavily relies on advanced drilling and completion technologies as a cornerstone of its business model. This includes sophisticated horizontal drilling, which allows access to vast reserves within shale plays, and advanced hydraulic fracturing techniques. These innovations are critical for maximizing the recovery of natural gas from challenging formations like the Marcellus and Utica shales.

In 2024, CNX continued to refine these technologies, aiming for greater capital efficiency and improved production rates. The company's commitment to technological advancement directly impacts its ability to extract resources cost-effectively, a key driver for profitability in the competitive natural gas market. For instance, their focus on shorter, more precise lateral wells and optimized fracturing designs aims to reduce well costs while increasing output.

Financial Capital and Free Cash Flow

CNX's robust financial capital, underscored by its consistent free cash flow generation, serves as a critical resource. This financial health allows the company to pursue growth initiatives and maintain stability.

- Consistent Free Cash Flow: CNX reported $188 million in free cash flow for Q2 2025, extending its streak to 22 consecutive quarters of positive free cash flow.

- Strategic Investment Capability: This strong financial position empowers CNX to make strategic investments in its operations and future growth opportunities.

- Debt Management and Shareholder Returns: The company can effectively manage its debt obligations and provide returns to its shareholders, reinforcing investor confidence.

Skilled Workforce and Intellectual Capital

CNX leverages a management team boasting decades of experience in the natural gas sector, coupled with a workforce skilled in exploration, production, and midstream logistics. This deep bench of talent is instrumental in navigating the complexities of resource extraction and infrastructure management.

The company's intellectual capital is a core asset, particularly its expertise in geology, reservoir engineering, and efficient operational execution. This specialized knowledge allows CNX to maximize recovery rates from its Appalachian Basin assets and maintain operational excellence.

CNX’s commitment to technology development further enhances its skilled workforce and intellectual capital. For instance, in 2024, the company continued to invest in advanced drilling techniques and data analytics to improve production efficiency and reduce costs, a testament to its forward-looking approach.

- Experienced Management: CNX benefits from a leadership team with extensive industry knowledge.

- Specialized Workforce: Employees possess critical skills in natural gas operations.

- Technological Advancement: Investment in technology optimizes resource recovery and operational efficiency.

- Competitive Edge: Expertise in geology and engineering drives a sustained advantage in the market.

CNX's key resources are its vast natural gas reserves, extensive midstream infrastructure, advanced extraction technologies, strong financial capital, and a highly skilled workforce. These elements collectively form the backbone of its operational capabilities and market position.

The company’s 8.54 Tcfe of natural gas reserves as of December 31, 2024, primarily located in the Appalachian Basin, represent a significant tangible asset. Complementing this is its approximately 2,700 miles of gathering pipelines, crucial for efficient resource transport.

| Resource Category | Key Assets/Attributes | Recent Data/Developments |

|---|---|---|

| Natural Gas Reserves | 8.54 Tcfe (as of Dec 31, 2024) | Concentrated in Appalachian Basin |

| Midstream Infrastructure | ~2,700 miles of gathering pipelines | Investments made in 2023 for efficiency |

| Technology & Expertise | Horizontal drilling, hydraulic fracturing, reservoir engineering | Continued refinement in 2024 for capital efficiency |

| Financial Capital | Consistent Free Cash Flow | $188 million in Q2 2025 (22nd consecutive quarter) |

| Human Capital | Experienced management, skilled workforce | Expertise in geology and operational execution |

Value Propositions

CNX Resources guarantees a steady and cost-effective supply of natural gas, mainly sourced from the rich Appalachian Basin. This ensures customers have the energy they need, when they need it.

The company's dedication to operational efficiency, demonstrated by strong capital returns and excellent well productivity, underpins this dependable product flow. For instance, CNX reported a capital efficiency of approximately 1.4x in 2024, meaning for every dollar invested, they generated $1.40 in returns.

This reliability is crucial for CNX's wide range of customers, from industrial users to power generators, who depend on a consistent energy source to maintain their operations and meet their own demands.

CNX is leading the charge in providing ultra-low carbon intensity natural gas, including Remediated Mine Gas (RMG). This strategic move caters to the increasing demand for cleaner energy sources, directly supporting environmental objectives and offering a unique product for rapidly expanding industries like AI data centers that prioritize sustainable power.

The company's commitment to reducing emissions is evident in its achievement of capturing approximately 9.1 million metric tons of waste methane, expressed as CO2 equivalent. This substantial reduction highlights CNX's proactive approach to environmental stewardship and its ability to deliver energy solutions that align with global sustainability targets.

CNX is dedicated to building substantial long-term value for its shareholders on a per-share basis. This commitment is driven by a focused approach to capital allocation, prioritizing consistent free cash flow generation, robust share repurchase initiatives, and the maintenance of a solid financial foundation.

The company's operational discipline is evident in its impressive track record, having achieved 22 consecutive quarters of positive free cash flow. This consistent cash generation allows CNX to actively return capital to shareholders through buybacks, thereby increasing the value of each outstanding share.

Technological Leadership and Operational Excellence

CNX's commitment to technological leadership is evident in its adoption of advanced drilling and completion techniques, alongside proprietary innovations like AutoSepSM. This focus drives superior operational performance, allowing them to extract more resources efficiently.

This pursuit of operational excellence directly impacts their bottom line. By consistently reducing fully burdened cash costs, CNX enhances its competitiveness and builds a more resilient business model capable of navigating market fluctuations.

- Advanced Drilling & Completion: CNX employs cutting-edge technologies to optimize resource extraction.

- Proprietary Solutions: Innovations like AutoSepSM improve efficiency and reduce waste.

- Cost Reduction Focus: The company actively works to lower fully burdened cash costs, enhancing profitability. For instance, CNX reported a significant reduction in its cash costs per barrel of oil equivalent in recent periods, demonstrating tangible progress in operational efficiency.

Commitment to Radical Transparency and Community Benefit

CNX's commitment to radical transparency is a cornerstone of its business model, offering stakeholders unprecedented access to environmental and operational data. This open approach fosters trust and accountability. For instance, in 2023, CNX reported on key environmental metrics, including a 15% reduction in methane emissions intensity compared to 2019 levels, demonstrating tangible progress.

Beyond transparency, CNX actively invests in community benefit initiatives. In 2024, the company allocated over $25 million towards local economic development, education, and environmental stewardship programs across its operating regions. This focus on positive impact is designed to create shared value.

CNX prioritizes local job creation, with over 80% of its workforce residing in the communities where it operates. This strategy not only supports local economies but also cultivates a deeper connection to the company's mission and values.

- Radical Transparency Program: Provides stakeholders with detailed environmental and operational data, enhancing accountability.

- Community Investments: Over $25 million invested in 2024 for local economic development, education, and environmental programs.

- Local Job Creation: More than 80% of CNX employees are from the communities where the company operates.

- Responsible Corporate Citizenship: Demonstrates dedication to positive societal and environmental impact.

CNX provides reliable, cost-effective natural gas, emphasizing operational efficiency and strong capital returns, exemplified by a 2024 capital efficiency of approximately 1.4x. They are a leader in ultra-low carbon intensity natural gas, including Remediated Mine Gas, catering to the growing demand for cleaner energy and supporting industries like AI data centers. This commitment is underscored by capturing roughly 9.1 million metric tons of waste methane (CO2 equivalent) and a dedication to building long-term, per-share shareholder value through consistent free cash flow and share repurchases, maintaining 22 consecutive quarters of positive free cash flow.

| Value Proposition | Key Feature | Supporting Data/Fact |

|---|---|---|

| Reliable & Cost-Effective Energy Supply | Steady natural gas flow from Appalachian Basin | Capital efficiency of ~1.4x in 2024 |

| Ultra-Low Carbon Intensity Natural Gas | Includes Remediated Mine Gas (RMG) | Captured ~9.1 million metric tons of waste methane (CO2 equivalent) |

| Long-Term Shareholder Value | Focus on free cash flow and share repurchases | 22 consecutive quarters of positive free cash flow |

Customer Relationships

CNX prioritizes direct sales and contractual engagements, fostering long-term relationships with natural gas wholesalers and major commercial and industrial clients. This direct approach allows for the creation of bespoke energy solutions, precisely meeting the unique requirements of each customer.

These enduring partnerships are cemented through multi-year supply contracts, which are crucial for securing predictable demand for CNX's natural gas output. For instance, in 2024, CNX continued to emphasize these contractual agreements, aiming to solidify its market position and revenue streams through stable, long-term customer commitments.

CNX cultivates strong investor relations through consistent engagement, including quarterly earnings calls and investor presentations. For instance, in the first quarter of 2024, CNX reported adjusted EBITDA of $415 million, demonstrating operational strength and providing a key metric for shareholder evaluation.

The company prioritizes transparency by offering detailed financial reports and updates on its investor relations website. This commitment ensures shareholders have access to critical information regarding CNX's strategic direction and capital deployment, fostering trust and supporting informed investment decisions.

CNX actively cultivates deep connections with its operating communities through substantial local investments and dedicated engagement programs. This commitment is exemplified by the CNX Foundation's strategic focus on Tangible, Impactful, Local initiatives, further amplified by widespread employee volunteerism, underscoring their role as a responsible corporate citizen.

In 2024, CNX's community investments reached significant milestones, with over $15 million allocated to local projects and economic development, fostering social license to operate and enduring goodwill.

Radical Transparency and Open Dialogue

CNX's commitment to radical transparency is a cornerstone of its customer relationships, especially with the public and regulatory bodies. This program involves making real-time environmental monitoring data and operational metrics readily available. For instance, in 2024, CNX continued to publish detailed reports on methane emissions, with a stated goal of reducing fugitive emissions by 50% compared to 2019 levels.

This open disclosure strategy is designed to foster trust by providing verifiable information about their environmental stewardship. By proactively addressing potential concerns with factual data, CNX aims to build stronger relationships based on accountability.

- Real-time Environmental Monitoring: CNX provides live data feeds on air and water quality near its operations.

- Open Disclosure of Operational Data: Key performance indicators, including emissions data, are publicly accessible.

- Building Trust: This approach aims to preemptively address public and regulatory concerns through verifiable information.

- 2024 Focus: Continued emphasis on methane emission reduction targets, with specific data shared quarterly.

Strategic Partnerships for Value Chain Optimization

CNX actively cultivates strategic partnerships with technology providers and other industry leaders to optimize its entire value chain. These collaborations are crucial for enhancing operational efficiency and promoting environmentally sound practices in natural gas production and delivery.

For instance, in 2024, CNX continued its focus on digital transformation initiatives, partnering with firms specializing in advanced analytics and automation. These partnerships directly translate to more streamlined processes, reducing waste and improving resource utilization, which ultimately benefits end customers through a more reliable and cost-effective supply.

- Value Chain Enhancement: Partnerships with technology firms in 2024 focused on implementing AI-driven predictive maintenance for equipment, aiming to reduce downtime by an estimated 15%.

- Environmental Responsibility: Collaborations with environmental solutions providers are driving the adoption of methane detection and reduction technologies, contributing to CNX's sustainability goals.

- Customer Benefit: These strategic alliances ensure a consistent supply of high-quality natural gas, directly improving the customer experience through reliability and adherence to stringent environmental standards.

CNX builds strong, long-term relationships through direct sales, multi-year contracts with wholesale and industrial clients, and transparent investor relations. The company also invests heavily in its operating communities and maintains open communication with the public and regulators.

CNX's commitment to transparency is evident in its provision of real-time environmental data and operational metrics. This approach fosters trust and accountability, particularly with public and regulatory bodies. In 2024, CNX continued its focus on methane emission reduction, aiming for a 50% decrease from 2019 levels.

Strategic partnerships with technology and industry leaders are key to optimizing CNX's value chain and promoting environmental responsibility. These collaborations, including AI-driven predictive maintenance initiatives in 2024, enhance operational efficiency and ensure a reliable, cost-effective, and environmentally sound natural gas supply for customers.

| Relationship Type | Key Engagement Strategy | 2024 Data/Focus |

| Wholesale & Industrial Clients | Direct Sales, Multi-year Contracts | Securing predictable demand, bespoke energy solutions |

| Investors | Quarterly Earnings Calls, Financial Reports | Reported $415 million adjusted EBITDA in Q1 2024, emphasis on transparency |

| Operating Communities | Local Investments, Engagement Programs (CNX Foundation) | Over $15 million allocated to local projects |

| Public & Regulators | Radical Transparency, Real-time Environmental Data | Detailed methane emission reports, 50% reduction goal from 2019 |

| Technology/Industry Partners | Collaborations for Value Chain Optimization | AI-driven predictive maintenance, methane detection technologies |

Channels

CNX leverages its dedicated internal sales and marketing teams to directly connect with key customers like natural gas wholesalers, industrial users, and commercial businesses. This direct approach is crucial for building strong relationships and understanding specific client needs.

Through these direct interactions, CNX can offer highly customized contract terms and supply solutions, ensuring they meet the unique demands of each customer. This personalized service is a significant advantage in securing and maintaining long-term sales agreements.

In 2024, CNX reported that its direct sales efforts were instrumental in securing a substantial portion of its revenue from long-term contracts, demonstrating the effectiveness of this business model component in providing stable income streams and predictable growth.

CNX's extensive midstream infrastructure network, comprising owned and operated gathering pipelines and processing facilities, is a critical channel for moving its natural gas from wells to major interstate transmission lines. This robust network ensures efficient market access for CNX's production.

In 2024, CNX continued to leverage its midstream assets to optimize its operations. The company's strategic investment in these assets allows for reliable and cost-effective transportation of its natural gas, directly contributing to its competitive advantage in the market.

Beyond serving its own production needs, CNX's midstream capabilities present opportunities to offer services to third-party producers. This dual functionality enhances revenue streams and solidifies CNX's position as a key player in the Appalachian Basin's natural gas infrastructure landscape.

CNX leverages its dedicated Investor Relations website as a core digital channel for disseminating crucial financial information. This platform serves as a central hub, offering shareholders, analysts, and potential investors timely access to financial reports, earnings call transcripts, investor presentations, and SEC filings, fostering transparency.

In 2024, companies are increasingly prioritizing digital IR platforms to enhance communication efficiency. For instance, a significant portion of S&P 500 companies reported a substantial increase in website traffic following their quarterly earnings releases, indicating the platform's role in direct investor engagement and information accessibility.

Public Relations and Media Outlets

CNX strategically utilizes public relations and media outlets to broadcast key information, including financial performance and strategic shifts, to a broad audience. This proactive approach is crucial for managing brand reputation and fostering investor confidence.

Engaging with financial news services like PR Newswire ensures that official company statements reach a wide array of stakeholders efficiently. For instance, in Q1 2024, CNX issued multiple press releases detailing operational updates and market outlooks, which were picked up by major financial news platforms.

- Media Engagement: CNX actively participates in interviews and provides commentary to financial media, enhancing market understanding of its business.

- Press Release Distribution: The company relies on platforms like PR Newswire for timely dissemination of material information to investors and analysts.

- Perception Management: Consistent and transparent communication through media channels helps shape a positive public image and attract potential investors.

- Market Information: These channels serve as vital conduits for communicating CNX's financial results, strategic partnerships, and operational achievements to the market.

Industry Conferences and Summits

CNX leverages industry conferences and summits, like the Pennsylvania AI and Energy Innovation Summit, as a crucial channel to demonstrate its expertise and innovations. These gatherings are vital for staying ahead of market trends and fostering direct connections with potential clients and strategic partners within the energy landscape.

Participation in these events allows CNX to position itself as a thought leader, engaging directly with key stakeholders and influencers. For instance, in 2024, CNX representatives actively contributed to discussions on the future of energy technology and sustainable practices, highlighting their commitment to innovation and industry advancement.

- Showcasing Capabilities: Demonstrating advanced technologies and operational successes to a targeted audience.

- Market Trend Analysis: Gaining insights and sharing perspectives on evolving energy sector dynamics.

- Networking and Partnerships: Building relationships with potential customers, suppliers, and collaborators.

- Thought Leadership: Presenting research and strategies to establish industry influence.

CNX utilizes its direct sales teams to build strong relationships with key customers, offering tailored solutions and securing long-term contracts. This direct engagement is a cornerstone of their revenue generation strategy.

The company's extensive midstream infrastructure serves as a critical channel for efficient natural gas transportation, providing a competitive advantage and opportunities for third-party services. This network is vital for market access and operational optimization.

CNX also leverages digital channels like its Investor Relations website for transparent financial communication and engages with media outlets and industry conferences to manage its brand, disseminate information, and foster strategic partnerships.

| Channel | Description | 2024 Focus/Data |

|---|---|---|

| Direct Sales | Internal teams engaging with wholesalers, industrial, and commercial users. | Secured substantial revenue from long-term contracts. |

| Midstream Infrastructure | Owned pipelines and processing facilities for efficient transport. | Optimized operations and provided cost-effective transportation. |

| Investor Relations Website | Digital hub for financial reports, filings, and presentations. | Enhanced investor engagement and information accessibility. |

| Media Outlets & PR | Press releases and media commentary for broad information dissemination. | Issued multiple press releases detailing operational updates and market outlooks. |

| Industry Conferences | Participation in events to showcase expertise and foster partnerships. | Contributed to discussions on energy technology and sustainable practices. |

Customer Segments

Natural gas wholesalers and utilities are a cornerstone customer segment for CNX. These entities, like large distribution companies, purchase natural gas in bulk directly from CNX to then supply it to a wide range of end-users, including homes, businesses, and factories. They are the primary conduits through which CNX's production reaches the broader market, ensuring a steady flow of energy. In 2024, utilities continued to be significant buyers, with natural gas remaining a critical fuel source for power generation, accounting for approximately 40% of U.S. electricity generation, highlighting the ongoing demand from this segment.

Industrial and commercial consumers represent a core customer base for CNX, encompassing manufacturers, power generators, and large businesses reliant on substantial natural gas volumes. These clients seek dependable and cost-efficient energy sources to fuel their operations, often requiring tailored supply agreements and long-term price stability.

CNX is actively pursuing the burgeoning AI data center market, recognizing the critical need for dependable and low-carbon energy solutions. The company's strategy centers on offering its Remediated Mine Gas (RMG) combined with low-carbon shale gas as an immediate, net-zero power option for these energy-intensive facilities.

This strategic focus aligns with the growing demand from environmentally conscious consumers and businesses. In 2024, the demand for AI-specific data center capacity saw a significant surge, with projections indicating continued exponential growth. CNX's offering of a "ready-now" solution positions them to capture a substantial share of this high-growth sector.

Other Energy Producers and Midstream Operators

CNX also caters to other energy producers within the Appalachian Basin, offering crucial midstream services. This includes transporting natural gas and other hydrocarbons, facilitating efficient movement of resources for its peers.

Furthermore, CNX's water recycling and reuse programs present a significant service to other energy companies. By processing and reusing produced water from neighboring operations, CNX not only reduces its own freshwater intake but also provides a valuable environmental service to the industry.

This segment highlights opportunities for enhanced collaboration and operational synergies across the Appalachian Basin. For instance, in 2023, CNX processed approximately 1.2 billion gallons of produced water, a substantial portion of which could have originated from or been shared with other operators.

- Midstream Services: Transportation and processing of natural gas and NGLs for third-party producers.

- Water Management: Recycling and reuse of produced water, reducing freshwater dependency for CNX and peers.

- Synergistic Opportunities: Collaboration with other operators to improve efficiency and environmental performance in the basin.

- 2023 Water Processed: Approximately 1.2 billion gallons, demonstrating significant capacity for peer service.

Shareholders and the Investment Community

Shareholders and the investment community are a vital customer segment for CNX, even though they do not directly consume natural gas. CNX focuses on generating long-term value for these stakeholders through strong financial performance and strategic capital allocation. For instance, in 2024, CNX continued its commitment to returning capital to shareholders, demonstrating its dedication to their financial interests.

The company’s approach involves transparent reporting and consistent financial results to foster confidence within the investment community. This confidence is essential for securing future funding and maintaining a healthy market valuation. CNX’s strategic capital deployment, including potential share repurchases, directly impacts shareholder returns and the overall financial health of the company.

- Value Creation: CNX prioritizes delivering long-term value through operational efficiency and strategic growth initiatives.

- Capital Returns: The company actively engages in capital return programs, such as share repurchases, to directly benefit shareholders.

- Transparency: CNX maintains open communication and transparent reporting practices to build trust with investors.

- Financial Health: Investor confidence is critical for CNX's financial stability and its ability to fund future growth opportunities.

CNX serves a diverse customer base, primarily focusing on natural gas wholesalers and utilities who are crucial for distributing energy to end-users. The company also targets industrial and commercial clients seeking reliable, cost-effective energy solutions. A key growth area is the AI data center market, where CNX offers low-carbon energy solutions.

Beyond direct energy sales, CNX provides essential midstream services, including transportation and processing for other producers in the Appalachian Basin. Furthermore, its water recycling initiatives offer a valuable service to industry peers, promoting efficiency and environmental responsibility. In 2023, CNX processed approximately 1.2 billion gallons of produced water, underscoring its capacity to support other operators.

| Customer Segment | Description | Key Needs | 2024 Relevance |

|---|---|---|---|

| Wholesalers & Utilities | Bulk purchasers for distribution | Reliable supply, stable pricing | Continued demand as primary fuel for power generation (approx. 40% of U.S. electricity in 2024) |

| Industrial & Commercial | Manufacturers, power generators, large businesses | Dependable, cost-efficient energy | Essential for operations requiring significant gas volumes |

| AI Data Centers | Emerging high-demand sector | Low-carbon, reliable power | Significant surge in demand, offering net-zero solutions |

| Other Energy Producers | Peers in the Appalachian Basin | Midstream services (transport, processing) | Facilitating resource movement and water management |

Cost Structure

Capital expenditures for drilling and completions represent a substantial cost for CNX, directly fueling its growth and production capacity. These investments are essential for accessing and developing new natural gas reserves.

For 2025, CNX has projected its capital expenditures in this area to range between $450 million and $500 million. This significant outlay underscores the company's commitment to expanding its operational footprint and securing future production volumes.

Lease Operating Expenses (LOE) represent the ongoing costs of keeping wells and associated equipment running on producing leases. These are the day-to-day expenses that ensure operations continue smoothly. For CNX, this includes crucial elements like water disposal, which is a significant component in natural gas extraction, along with routine repairs and maintenance to prevent downtime.

Furthermore, LOE encompasses costs for equipment rental, ensuring access to necessary machinery, and the purchase of operating supplies that are consumed during regular activities. In 2024, for instance, effective management of these variable costs is paramount for CNX to maintain robust operating margins. This focus on efficiency directly impacts the company's profitability and its ability to generate free cash flow.

Transportation, gathering, and compression costs are a major component of CNX's expenses, covering the journey of natural gas from the wellhead to its final sale. This includes essential processing steps like dehydrating and fractionating to prepare the gas for market.

CNX's substantial investment in midstream infrastructure, while designed to optimize these operations, still results in significant outlays. For instance, in 2023, CNX reported gathering and compression expenses of approximately $380 million, highlighting the ongoing capital commitment required for these services.

These costs are fundamental to delivering natural gas that meets market specifications, and they represent an unavoidable element of the business model for any natural gas producer.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the corporate overhead necessary to run the business, encompassing salaries for executive and administrative teams, office rent, utilities, and legal or accounting services. These costs are crucial for maintaining the operational infrastructure that supports all business activities, even those not directly tied to production or service delivery.

Efficient management of G&A is a key focus for CNX, directly impacting overall profitability. For instance, in 2024, CNX reported G&A expenses of $245 million, which was a slight increase from $238 million in 2023, reflecting investments in enhanced corporate systems and talent. This demonstrates the company's commitment to optimizing these essential supporting functions.

- Corporate Overhead: Covers essential non-production costs like executive salaries and office space.

- Operational Support: Includes expenses for administrative staff, legal, and accounting functions.

- Profitability Impact: Efficient G&A management is vital for maintaining healthy profit margins.

- 2024 Data: CNX's G&A expenses were $245 million in 2024, up from $238 million in 2023.

Interest Expense and Debt Servicing

CNX's capital-intensive operations necessitate substantial borrowing, leading to significant interest expenses. As of June 30, 2025, the company's total debt stood at $2.6 billion, directly influencing its financial leverage and the cost of servicing this debt.

Managing this debt and its associated interest payments is a critical aspect of CNX's overall financial strategy and impacts its profitability.

- Interest Expense: A direct consequence of significant debt financing.

- Total Debt: Reached $2.6 billion as of June 30, 2025.

- Financial Leverage: Increased due to the debt load.

- Debt Servicing: A key operational and financial consideration.

CNX's cost structure is heavily influenced by its capital expenditures, which are crucial for expanding its natural gas production. For 2025, these expenditures are projected to be between $450 million and $500 million. Lease Operating Expenses (LOE) are the ongoing costs to keep wells operational, including water disposal and maintenance, with efficient management vital for profit margins.

Transportation, gathering, and compression costs are significant, covering the journey of natural gas from production to market, with $380 million spent on these in 2023. General and Administrative (G&A) expenses, totaling $245 million in 2024, cover corporate overhead essential for business operations.

Interest expenses are a direct result of CNX's substantial debt, which stood at $2.6 billion as of June 30, 2025, impacting financial leverage and profitability.

| Cost Category | 2023 Actual (Approx.) | 2024 Actual | 2025 Projection |

|---|---|---|---|

| Capital Expenditures | $450M - $500M | ||

| Lease Operating Expenses (LOE) | Variable, focus on efficiency | ||

| Transportation, Gathering & Compression | $380M | ||

| General & Administrative (G&A) | $238M | $245M | |

| Total Debt (as of June 30) | $2.6B (as of June 30, 2025) |

Revenue Streams

CNX Resources' main income comes from selling natural gas. In 2024, the company continued to benefit from its significant operations in the Appalachian Basin, a region known for its rich natural gas reserves. These substantial volumes are then sold to various buyers, including wholesale energy traders and directly to large industrial and commercial users, making this the cornerstone of their financial performance.

CNX generates significant revenue not just from dry natural gas but also from the sale of Natural Gas Liquids (NGLs). These valuable byproducts, including ethane, propane, and butane, are extracted during the natural gas processing phase. For instance, in the first quarter of 2024, CNX reported NGL sales volumes of approximately 30,000 barrels per day, contributing meaningfully to their overall financial performance.

While CNX is primarily known for natural gas, they also generate revenue from selling oil and condensate. These liquids are often found alongside natural gas in specific wells, contributing to a broader mix of commodity sales.

In the first quarter of 2024, CNX reported that natural gas represented approximately 95% of their total production volumes. However, the sale of oil and condensate, though a smaller segment, still provided a valuable diversification of their revenue streams, contributing to overall financial stability.

Environmental Attribute Sales

CNX generates revenue by selling environmental attributes. These include carbon credits, renewable energy credits, and methane capture credits, primarily stemming from their Remediated Mine Gas (RMG) operations.

The introduction of the 45Z tax credit, effective from 2025, is projected to significantly boost this revenue stream. This new credit is anticipated to contribute an annual run rate impact of up to $30 million.

- Environmental Attribute Sales: CNX monetizes carbon credits, renewable energy credits, and methane capture credits.

- Primary Source: Revenue is largely derived from Remediated Mine Gas (RMG) operations.

- Future Impact: The 45Z tax credit, starting in 2025, is expected to add up to $30 million annually.

Midstream Gathering and Compression Fees

CNX leverages its owned midstream infrastructure to generate revenue through gathering and compression services offered to third parties. These volumetric-based fees are crucial for diversifying the company's income, effectively utilizing its existing assets beyond its own production activities. This segment represents a key component of CNX's strategy to maximize returns from its infrastructure investments.

In 2024, CNX's midstream segment plays a vital role in its overall financial performance. The company's commitment to expanding its midstream capabilities allows it to capture additional value by providing essential services to other producers operating in its core basins.

- Midstream Gathering and Compression Fees: CNX's midstream assets, including pipelines and compression facilities, are utilized to gather and process natural gas for third-party customers.

- Volumetric-Based Revenue: Fees are typically charged per unit of natural gas processed or transported, creating a direct correlation between activity levels and revenue generation.

- Diversified Income Source: This revenue stream provides a stable and predictable income, reducing reliance solely on CNX's own production volumes and market price fluctuations.

- Asset Optimization: By offering these services to others, CNX maximizes the utilization and profitability of its substantial midstream infrastructure investments.

CNX’s revenue streams are primarily anchored in the sale of natural gas, which constituted approximately 95% of their production volumes in Q1 2024. They also generate income from Natural Gas Liquids (NGLs), with sales volumes around 30,000 barrels per day in Q1 2024, and from oil and condensate sales, which offer revenue diversification.

| Revenue Stream | Primary Source | 2024 Data/Projections |

|---|---|---|

| Natural Gas Sales | Appalachian Basin Operations | Core revenue driver, significant production volumes |

| Natural Gas Liquids (NGLs) Sales | Byproduct of gas processing | Approx. 30,000 bbl/day in Q1 2024 |

| Oil and Condensate Sales | Associated liquids in wells | Diversifies commodity sales mix |

| Environmental Attribute Sales | Remediated Mine Gas (RMG) operations | Projected $30 million annual impact from 45Z credit (starting 2025) |

| Midstream Services | Gathering and compression for third parties | Volumetric-based fees, asset utilization |

Business Model Canvas Data Sources

The CNX Business Model Canvas is built using a blend of internal financial data, comprehensive market research reports, and expert strategic insights. These foundational elements ensure each component of the canvas is grounded in factual information and actionable strategy.