CNX Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNX Bundle

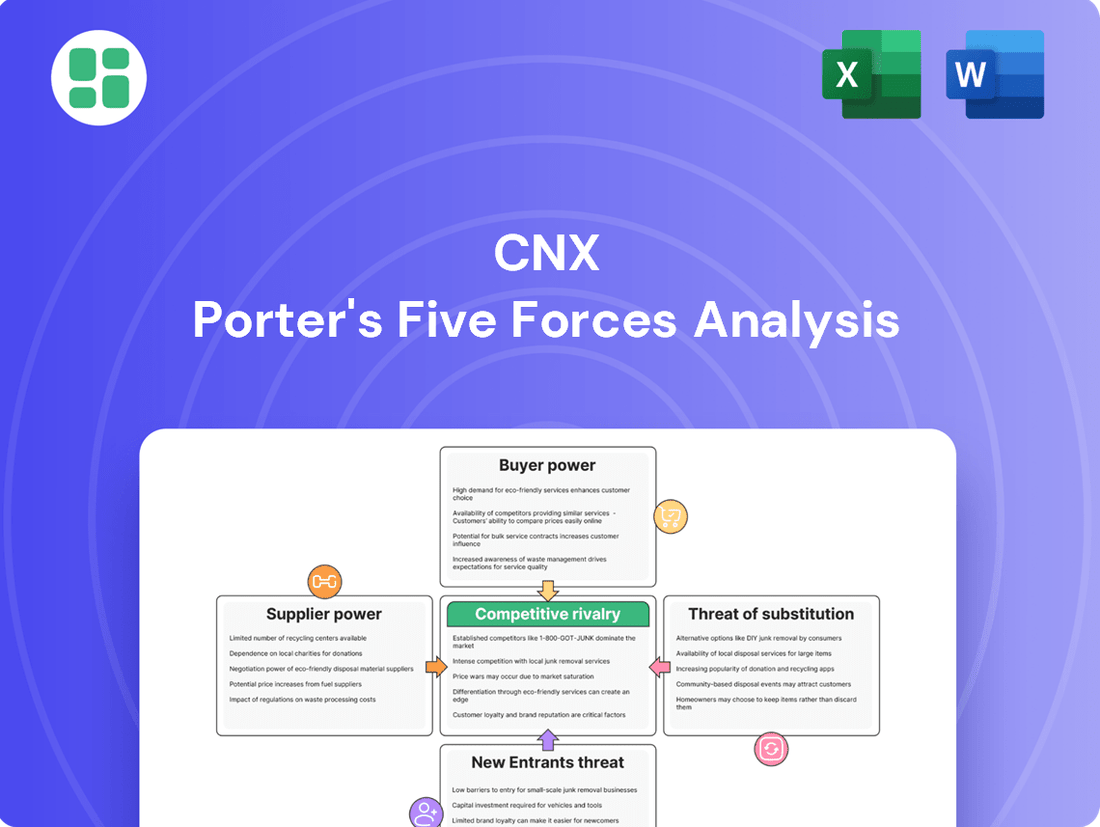

CNX navigates a complex energy landscape, where understanding the intensity of buyer power and the threat of new entrants is crucial for strategic advantage. This brief overview highlights the key pressures impacting CNX's operations.

The complete report reveals the real forces shaping CNX’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CNX Resources' reliance on a limited number of specialized drilling equipment manufacturers and fracking service providers grants these suppliers considerable leverage. For instance, in 2024, the market for advanced horizontal drilling rigs and associated services remained relatively concentrated, with a few key players dominating the supply chain. This scarcity of alternative providers for critical, high-demand services allows these suppliers to dictate terms and potentially increase prices, directly impacting CNX's operational costs.

CNX's bargaining power of suppliers is influenced by switching costs. Significant expenses for re-tooling, retraining staff, or renegotiating contracts can empower suppliers if CNX finds it difficult to change providers for essential inputs like pipeline access or specialized drilling equipment.

CNX's suppliers of unique inputs, like specialized drilling equipment or proprietary software essential for shale gas extraction, hold significant bargaining power. The less interchangeable these inputs are, the more leverage suppliers have in setting prices and terms. For instance, if a particular seismic imaging technology significantly improves well productivity, CNX's dependence on that specific provider would be high.

Threat of Forward Integration

The threat of forward integration by suppliers significantly bolsters their bargaining power. If suppliers, such as mineral rights holders or landowners, possess the capability and willingness to directly engage in natural gas production, they can exert considerable influence over companies like CNX. This potential shift means suppliers could bypass intermediaries and capture more of the value chain themselves.

While equipment suppliers are less likely to integrate forward, the prospect is more tangible for those controlling the raw resource. For instance, if landowners decide to develop their own reserves rather than leasing them, it directly curtails CNX's access to new, undeveloped natural gas fields. This strategic option for resource owners enhances their leverage in negotiations.

- Landowners' Integration Potential: Landowners controlling mineral rights could choose to develop their own wells, reducing CNX's reliance on leased reserves.

- Resource Control: The ability to directly extract and sell natural gas grants landowners substantial bargaining power.

- Market Dynamics: In a strong natural gas market, the incentive for landowners to integrate forward increases, potentially impacting CNX's reserve acquisition costs.

Supplier Importance to CNX's Cost Structure

The bargaining power of suppliers for CNX is significantly influenced by how crucial their inputs are to CNX's overall cost structure. If essential raw materials, specialized equipment, or critical services from a limited number of suppliers make up a substantial portion of CNX's operating expenses, these suppliers gain considerable leverage.

For CNX, a major player in the natural gas industry, the cost of natural gas reserves, extraction equipment, and transportation services are key components of its cost structure. For instance, in 2024, the price volatility of natural gas directly impacts CNX's profitability, highlighting the supplier's influence. A significant portion of CNX's capital expenditures in 2023, totaling approximately $980 million, was directed towards drilling and infrastructure, underscoring reliance on equipment and service providers.

- Supplier Input Significance: The percentage of CNX's total costs tied to specific supplier inputs directly correlates with supplier bargaining power.

- Concentration of Suppliers: If CNX relies on a few dominant suppliers for critical resources, their power increases.

- Cost of Switching Suppliers: High costs or operational disruptions associated with switching suppliers further empower existing ones.

- CNX's 2023 Capital Expenditures: Nearly $1 billion spent on drilling and infrastructure demonstrates a significant reliance on upstream suppliers for equipment and services.

CNX Resources faces substantial bargaining power from its suppliers, particularly those providing specialized drilling equipment and fracking services. The concentrated nature of these markets in 2024, where a few key players dominate, allows them to command higher prices and dictate terms. This is compounded by the high switching costs CNX incurs if it needs to change providers for essential operational inputs.

| Supplier Type | Key Factors Influencing Power | Impact on CNX |

|---|---|---|

| Specialized Drilling Equipment Manufacturers | Concentration of suppliers, proprietary technology, high R&D costs | Higher equipment rental/purchase costs, potential delays in access to critical rigs |

| Fracking Service Providers | Limited number of experienced providers, demand for specialized crews and equipment | Increased service contract costs, potential for service disruptions if capacity is limited |

| Mineral Rights Holders/Landowners | Control over reserves, potential for forward integration into production | Higher lease costs for undeveloped acreage, potential competition for resource access |

What is included in the product

This analysis dissects the competitive forces impacting CNX, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately, CNX's strategic positioning.

Instantly identify and alleviate competitive pressures by visualizing the intensity of each Porter's Five Force.

Customers Bargaining Power

CNX Resources' customer base is largely concentrated among a few major players, primarily large natural gas utilities, industrial consumers, and pipeline operators. This concentration means that if a small number of these customers represent a substantial portion of CNX's overall revenue, they gain significant leverage.

When a few large customers dominate sales, they can more easily dictate terms, pushing for lower prices or more favorable contract conditions. For instance, if the top 10 customers accounted for over 60% of CNX's revenue in 2023, their ability to negotiate would be considerably higher than if sales were more evenly distributed across a vast customer network.

The bargaining power of customers for CNX is significantly influenced by the availability of substitute suppliers. When customers can readily switch to other natural gas producers, particularly within the Appalachian Basin, or to alternative energy sources, their leverage increases.

This ease of switching exerts downward pressure on CNX's pricing because customers have options. For instance, if natural gas prices rise significantly, a customer might explore options like coal, oil, or even renewable energy sources, depending on their specific needs and infrastructure. In 2024, the Henry Hub natural gas spot price, a key benchmark, experienced considerable volatility, highlighting the sensitivity of pricing to supply and demand dynamics, and by extension, the power of customers to seek more favorable terms when alternatives are viable.

Customer price sensitivity for CNX is a major consideration. For industrial clients and utility providers, the cost of natural gas represents a substantial portion of their operating budget, making them acutely aware of price changes and eager to secure advantageous pricing, particularly when the market is abundant with supply.

In 2024, the average industrial natural gas price in the Appalachian Basin, where CNX primarily operates, saw fluctuations influenced by global energy markets and domestic production levels. This sensitivity means that even modest price increases can trigger intensified negotiations for bulk purchase agreements.

Threat of Backward Integration

The bargaining power of customers, especially large utilities or industrial buyers, is amplified if they can realistically integrate backward into natural gas production. This threat means CNX must remain competitive on pricing to keep these significant customers. For instance, a major utility considering its own drilling operations would have considerable leverage in negotiations.

CNX's ability to retain large contracts is directly influenced by this customer threat. The capital required for backward integration is substantial, but the mere possibility can force CNX to offer more attractive terms. This dynamic is crucial for CNX's revenue streams from its core customer base.

- Customer Leverage: Large industrial consumers or utilities capable of producing their own natural gas gain significant bargaining power.

- Pricing Pressure: This capability compels CNX to offer competitive pricing to retain these key customers.

- Integration Cost: While backward integration is capital-intensive, the credible threat alone influences CNX's pricing strategy.

- Market Dynamics: CNX must balance profitability with the need to secure long-term contracts against potential customer self-sufficiency.

Product Differentiation

Product differentiation plays a crucial role in the bargaining power of customers, especially in industries where products are largely commoditized. For CNX, a natural gas producer, this means that unless they can offer something truly unique, customers hold more sway.

Natural gas is typically viewed as an undifferentiated commodity. This lack of unique product features means CNX struggles to charge higher prices simply based on the product itself. Customers, therefore, tend to focus on the price when making purchasing decisions.

CNX's ability to mitigate this is through non-product related factors. Offering superior reliability of supply, flexible delivery terms, or advantageous transportation options can differentiate CNX from competitors. Without these, customers' purchasing decisions are heavily price-driven, amplifying their bargaining power.

- Commoditization Impact: In 2024, the natural gas market continued to reflect its commodity status, with price being a primary driver for many industrial and commercial buyers.

- Differentiation Opportunities: CNX's ability to differentiate through services like guaranteed delivery windows or integrated logistics solutions in 2024 could have provided a competitive edge.

- Customer Leverage: When natural gas prices are volatile, customers with multiple supply options and the ability to switch easily gain significant bargaining power.

- Value-Added Services: For instance, if CNX offered advanced metering or on-site storage solutions in 2024, this would move beyond simple gas supply and create a more differentiated offering.

The bargaining power of CNX's customers is substantial due to the concentrated nature of its buyer base, primarily large utilities and industrial users. When a few key clients represent a significant portion of revenue, they gain considerable leverage to dictate terms and push for lower prices. In 2023, if CNX's top ten customers accounted for over 60% of its revenue, their ability to negotiate would be markedly higher than if sales were dispersed across many smaller buyers.

The availability of substitute suppliers and alternative energy sources further empowers CNX's customers. If customers can easily switch to other natural gas producers or different energy forms, their leverage increases, exerting downward pressure on CNX's pricing. The Henry Hub natural gas spot price, a key benchmark, showed significant volatility in 2024, underscoring how sensitive pricing is to supply and demand, and by extension, how customer power grows when viable alternatives exist.

Customer price sensitivity is heightened as natural gas costs form a substantial part of their operating budgets. This makes them keen to secure advantageous pricing, especially when supply is abundant. In 2024, industrial natural gas prices in the Appalachian Basin fluctuated, influenced by global and domestic production, meaning even small price hikes could trigger intense negotiations for bulk agreements.

The threat of backward integration, where large customers consider producing their own natural gas, significantly amplifies their bargaining power. While costly, this possibility forces CNX to maintain competitive pricing to retain these vital clients. This dynamic is crucial for securing CNX's revenue streams from its core customer segments.

The commoditized nature of natural gas means CNX must differentiate through factors beyond the product itself to mitigate customer bargaining power. Offering superior supply reliability, flexible delivery, or advantageous transportation can provide an edge. Without such value-added services, purchasing decisions remain heavily price-driven, increasing customer leverage.

| Factor | Impact on CNX | 2024 Context |

| Customer Concentration | High leverage for few large buyers | If top customers >60% revenue (hypothetical 2023) |

| Availability of Substitutes | Downward price pressure | Henry Hub volatility in 2024 |

| Price Sensitivity | Intensified negotiations on price | Appalachian Basin industrial prices fluctuated in 2024 |

| Backward Integration Threat | Forces competitive pricing | Credible threat influences contract terms |

| Product Differentiation | Limited leverage if purely commodity | Focus on services for competitive edge in 2024 |

Full Version Awaits

CNX Porter's Five Forces Analysis

This preview showcases the complete CNX Porter's Five Forces Analysis, offering a detailed examination of competitive forces. The document you see here is the exact, professionally formatted file you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning needs.

Rivalry Among Competitors

The Appalachian Basin is a crowded space for natural gas production, featuring a diverse array of players. From massive, vertically integrated energy corporations to nimble, independent producers, the competitive landscape is robust.

This sheer number of companies, many of which are similar in scale to CNX, creates a highly competitive environment. Each producer is actively seeking to capture market share and secure crucial access to transportation infrastructure, like pipelines, which is essential for getting their product to market.

For instance, in 2024, the Appalachian Basin continues to be a focal point for natural gas output, with dozens of publicly traded companies actively drilling and producing. This density of operators means that pricing and production decisions by one company can quickly influence others, intensifying the rivalry.

The natural gas industry, especially in mature regions like the Appalachian Basin, is experiencing a more moderate growth trajectory. For instance, while the U.S. Energy Information Administration (EIA) projected a 2.4% increase in total U.S. dry natural gas production for 2024, growth in some established basins may be less pronounced.

This slower expansion intensifies competitive rivalry. Companies are compelled to vie more fiercely for market share and existing customer demand, as opportunities for capturing new demand are more limited. This dynamic can lead to price pressures and a greater focus on operational efficiency to maintain profitability.

CNX operates in a market where natural gas is largely a homogeneous commodity. This means customers, whether industrial users or utilities, see very little difference in the actual product supplied by CNX compared to its competitors. This lack of product differentiation is a key driver of intense competition.

Adding to this competitive pressure are the low switching costs for customers. It's relatively easy and inexpensive for a buyer to change from one natural gas supplier to another. This ease of switching forces companies like CNX to compete aggressively on price to retain and attract customers.

In 2023, the average spot price for natural gas in the Appalachian Basin, where CNX is a major producer, fluctuated significantly, often trading in the $2 to $3 per million British thermal units (MMBtu) range. This price sensitivity is a direct consequence of product homogeneity and low switching costs, compelling CNX to manage its production costs and pricing strategies very carefully.

High Fixed Costs and Exit Barriers

The natural gas exploration and production sector faces intense competition, partly due to significant fixed costs. Companies invest heavily in drilling equipment, pipelines, and securing land rights. For instance, a single shale gas well can cost millions of dollars to drill and complete. These large upfront investments create a substantial commitment, making it difficult for businesses to simply walk away from their operations, even when market conditions are unfavorable.

High exit barriers further intensify this rivalry. Divesting assets in this industry often involves selling them at a loss, especially during periods of low natural gas prices. This lack of flexibility forces companies to maintain production to recoup their initial investments. Consequently, even when demand falters, the supply side remains relatively rigid, leading to prolonged periods of intense price competition among existing players. In 2024, many exploration and production companies continued to operate at reduced capacity rather than shutting down entirely, a testament to these high exit barriers.

- High Capital Intensity: The upfront capital required for exploration, drilling, and infrastructure development is substantial.

- Asset Specificity: Many assets are specialized for natural gas extraction and have limited alternative uses, increasing losses upon sale.

- Contractual Obligations: Long-term supply agreements and leases can obligate companies to continue production.

- Operational Scale: Maintaining a certain operational scale is often necessary to achieve economies of scale, making partial shutdowns economically unviable.

Strategic Stakes and Aggressiveness

The Appalachian Basin is a critical region for numerous energy companies, including CNX, making them highly motivated to protect or grow their market share. This intense strategic importance fuels aggressive competitive tactics.

These aggressive behaviors can manifest as price wars, heightened marketing campaigns, and accelerated development of new natural gas reserves. Such actions directly intensify the rivalry among players operating within the basin.

- Strategic Importance: The Appalachian Basin is a cornerstone for many energy producers, driving a strong desire to maintain and expand market presence.

- Aggressive Tactics: Companies engage in price competition, increased promotional activities, and swift reserve development to gain an edge.

- Intensified Rivalry: These actions collectively escalate the competitive pressures faced by all participants in the basin.

- 2024 Outlook: Analysts projected continued strong demand for natural gas in 2024, suggesting that the strategic stakes and competitive intensity in the Appalachian Basin would remain high throughout the year.

Competitive rivalry in the Appalachian Basin is fierce due to the high number of similar-sized producers vying for market share and pipeline access. The commodity nature of natural gas and low customer switching costs further intensify this competition, forcing companies like CNX to focus on price and efficiency.

High capital intensity and exit barriers mean companies are reluctant to scale back production, even in unfavorable market conditions, leading to sustained price competition. The strategic importance of the basin also drives aggressive tactics among players, ensuring rivalry remains a dominant force.

| Metric | CNX (Approximate 2024 Estimates) | Appalachian Basin Average (Approximate 2024 Estimates) | Impact on Rivalry |

|---|---|---|---|

| Number of Major Producers | 1 | Dozens | High |

| Average Spot Price (2023) | $2.50/MMBtu (Fluctuated) | $2.00 - $3.00/MMBtu | Intense Price Competition |

| Customer Switching Costs | Low | Low | High |

| Capital Expenditure per Well | $5M - $10M+ | $5M - $10M+ | High Exit Barriers |

SSubstitutes Threaten

The threat of substitutes for natural gas is significant, primarily from other energy sources like coal, crude oil, nuclear power, and a growing array of renewables. These alternatives can readily replace natural gas in key sectors such as electricity generation, industrial heating, and residential use.

Renewable energy sources, in particular, are becoming increasingly cost-competitive and widely adopted. For instance, the global installed capacity for solar photovoltaics reached over 1,300 gigawatts (GW) by the end of 2023, a substantial increase that directly challenges natural gas demand in power generation.

Furthermore, advancements in battery storage technology are mitigating the intermittency issues of solar and wind power, making them more reliable substitutes. This ongoing technological progress and supportive government policies in many regions enhance the attractiveness of these alternatives, intensifying the competitive pressure on natural gas.

The attractiveness of substitutes for natural gas hinges on their price-performance balance. If, for instance, the levelized cost of electricity (LCOE) for solar photovoltaic (PV) or wind power continues its downward trend, potentially reaching parity or even undercutting natural gas in certain regions, this presents a significant threat. For example, Lazard's LCOE analysis in early 2024 indicated that utility-scale solar and wind were increasingly competitive, with some projects reporting costs below $30 per megawatt-hour, a benchmark that natural gas power plants must consistently beat to maintain market share.

Similarly, fluctuations in the price of coal can alter the competitive landscape. Should coal prices rebound significantly, making it less economical than natural gas for power generation, this would reduce the threat from coal. However, if coal remains a cheaper alternative, especially in regions with existing infrastructure, it continues to pose a viable substitute for natural gas, impacting CNX's demand and pricing power.

The costs and complexities associated with transitioning from natural gas to alternative energy sources significantly impact the threat of substitutes. For example, the substantial capital investment required to convert a natural gas power plant to operate on coal, or the expense of constructing new renewable energy infrastructure, presents a considerable barrier. These financial outlays, coupled with navigating regulatory approvals, effectively dampen the immediate threat of substitution for many existing natural gas users.

Technological Advancements in Substitutes

Technological advancements are significantly bolstering the threat of substitutes for natural gas. Innovations in renewable energy, such as more efficient solar panels and powerful wind turbines, coupled with improvements in battery storage, are making these alternatives increasingly competitive and cost-effective. For instance, the global solar PV capacity reached over 1,300 GW by the end of 2023, a substantial increase that directly challenges traditional energy sources.

These ongoing improvements mean that the economic viability of switching away from natural gas is constantly improving. Energy efficiency measures also play a crucial role by reducing overall demand for energy, thereby lessening reliance on any single source, including natural gas. This trend is particularly evident in the building and industrial sectors, where smart technologies are optimizing energy consumption.

- Enhanced Renewable Energy Efficiency: Solar panel efficiency has seen consistent gains, with commercial panels often exceeding 20% efficiency, up from around 15% a decade ago.

- Battery Storage Cost Reduction: The cost of lithium-ion battery packs has fallen by over 90% since 2010, making grid-scale storage more feasible and supporting intermittent renewables.

- Energy Efficiency Gains: In 2024, many countries are setting new targets for energy intensity reduction, aiming for improvements of 2-3% annually, which directly impacts natural gas demand.

- Grid Modernization: Investments in smart grids enable better integration of distributed renewable energy sources, further weakening the position of centralized natural gas power plants.

Environmental Regulations and Public Sentiment

The increasing stringency of environmental regulations, particularly those targeting carbon emissions, presents a substantial threat of substitution for companies like CNX. For instance, by the end of 2023, the US Environmental Protection Agency (EPA) had proposed new rules aimed at curbing methane emissions from oil and gas operations, which directly impacts natural gas producers. These regulations, coupled with a palpable shift in public sentiment towards renewable energy sources, can steer demand away from fossil fuels, including natural gas, even when it's positioned as a cleaner alternative to coal or oil.

Policies actively promoting renewable energy adoption or implementing carbon pricing mechanisms, such as carbon taxes, can further accelerate this substitution trend. For example, in 2024, several states continued to expand their renewable portfolio standards, mandating a higher percentage of electricity generation from sources like solar and wind. This creates a competitive disadvantage for natural gas by making cleaner alternatives more economically attractive and accessible to consumers and businesses alike.

- Regulatory Pressure: Increasing environmental regulations, like proposed EPA methane rules in late 2023, directly impact operational costs and viability for natural gas producers.

- Public Sentiment Shift: Growing public demand for cleaner energy sources incentivizes investment and adoption of renewables, diverting market share from natural gas.

- Policy Incentives: Government policies such as renewable portfolio standards and carbon taxes in 2024 make alternative energy sources more competitive, threatening natural gas demand.

- Economic Viability: The combined effect of regulations and public/policy preferences can erode the economic competitiveness of natural gas compared to increasingly affordable renewable options.

The threat of substitutes for natural gas is amplified by the declining costs and improving efficiency of renewable energy sources and advancements in energy storage. For instance, by early 2024, the levelized cost of electricity for utility-scale solar and wind power in some regions fell below $30 per megawatt-hour, making them increasingly competitive against natural gas. This trend is further supported by battery storage cost reductions, with lithium-ion battery pack costs dropping over 90% since 2010, enhancing the reliability of renewables.

Government policies and environmental regulations also play a significant role. In 2024, many states continued to expand renewable portfolio standards, mandating higher percentages of clean energy generation. Proposed EPA methane emission rules, announced in late 2023, also increase operational costs for natural gas producers. These factors, combined with a growing public preference for cleaner energy, create a challenging environment for natural gas.

| Substitute | Key Driver | 2023/2024 Data Point |

|---|---|---|

| Solar PV | Cost Competitiveness | LCOE below $30/MWh in some regions (early 2024) |

| Wind Power | Cost Competitiveness | LCOE below $30/MWh in some regions (early 2024) |

| Battery Storage | Reliability for Renewables | Lithium-ion battery costs down >90% since 2010 |

| Renewable Portfolio Standards | Policy Support | Continued expansion in US states in 2024 |

| Methane Emission Regulations | Operational Cost Impact | Proposed EPA rules (late 2023) |

Entrants Threaten

Entering the natural gas exploration and production sector, particularly in prolific areas like the Appalachian Basin, demands substantial financial backing. Newcomers face significant hurdles with upfront costs for securing land rights, the expense of drilling wells, building necessary pipelines and processing facilities, and adhering to stringent environmental regulations.

These considerable capital requirements serve as a potent deterrent for many aspiring companies. For instance, the average cost to drill a horizontal shale well can range from $5 million to $10 million or more, and developing a full-scale production site involves hundreds of millions, if not billions, of dollars. This financial barrier effectively limits the number of new players that can realistically enter the market.

Established players like CNX Resources enjoy significant cost advantages due to their massive scale in operations. For instance, their extensive infrastructure for drilling and transportation allows them to spread fixed costs over a larger volume of production, a benefit new entrants would find incredibly difficult to replicate quickly.

This inherent scale creates a formidable barrier. A new company entering the natural gas market would face considerably higher per-unit costs for everything from acquiring leases to moving gas, making it challenging to compete on price with an incumbent like CNX, which in 2024 continued to leverage its integrated midstream assets.

New entrants in the natural gas sector face substantial hurdles in securing access to vital distribution channels and infrastructure. Existing pipelines and processing facilities are often owned by established players or specialized midstream companies, making it difficult for newcomers to enter the market. For instance, building new pipeline infrastructure can cost billions of dollars, a prohibitive expense for many potential entrants.

Regulatory Hurdles and Permitting

The natural gas industry is heavily regulated, with complex environmental, safety, and permitting requirements at all government levels. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent methane emission standards, impacting operational costs and compliance strategies for all players. New entrants must invest heavily in understanding and adhering to these rules, a significant barrier to entry.

Navigating these extensive regulations demands specialized knowledge and considerable time, presenting a substantial hurdle for new companies lacking established compliance departments and experienced personnel. The permitting process alone can be lengthy and costly, often requiring detailed environmental impact assessments and community consultations, which can delay or even halt new projects.

- Federal Regulations: The Clean Air Act and Clean Water Act impose strict limits on emissions and discharges.

- State Regulations: States like Pennsylvania have their own specific permitting requirements for drilling and pipeline construction.

- Local Ordinances: Zoning laws and local environmental protection rules can further complicate market entry.

- Compliance Costs: In 2023, the average cost for environmental compliance in the energy sector was estimated to be in the millions, a figure expected to rise with evolving regulations.

Proprietary Technology and Expertise

CNX possesses proprietary technology and deep operational expertise honed over years of shale gas extraction in the Appalachian Basin. This includes specialized drilling techniques and extensive geological data, which are not easily replicated by new companies. For instance, CNX has invested heavily in advanced seismic imaging and hydraulic fracturing technologies, giving them an edge in resource identification and extraction efficiency. This accumulated intellectual capital acts as a significant barrier, as new entrants face a steep learning curve and substantial upfront investment to develop comparable capabilities.

The threat of new entrants is therefore mitigated by the high barriers to entry related to specialized knowledge and technology. New companies would need to acquire similar data sets, develop comparable engineering expertise, and invest in proprietary equipment, a process that is both time-consuming and capital-intensive. In 2024, the cost of acquiring advanced geological data alone can run into millions of dollars, further deterring potential new players.

- Proprietary Drilling Techniques: CNX's specialized methods for efficient shale gas extraction.

- Geological Data Advantage: Years of data collection and analysis specific to the Appalachian Basin.

- Operational Expertise: Deeply ingrained knowledge of navigating the complex shale gas environment.

- High Capital Investment for Newcomers: Significant costs associated with replicating CNX's technological and data infrastructure.

The threat of new entrants in the natural gas sector, particularly for a company like CNX, is considerably low due to immense capital requirements and established infrastructure. For instance, the average cost to drill a horizontal shale well can range from $5 million to $10 million, with full-scale development costing billions. Newcomers also face significant challenges in accessing existing pipeline networks, which can cost billions to replicate, further limiting market entry.

| Barrier Type | Description | Estimated Cost/Impact |

| Capital Requirements | Securing land rights, drilling, infrastructure development | $5M - $10M+ per well; Billions for full development |

| Infrastructure Access | Utilizing existing pipelines and processing facilities | Billions to build new infrastructure |

| Regulatory Compliance | Meeting environmental, safety, and permitting standards | Millions annually for compliance, increasing with new regulations |

| Proprietary Technology & Expertise | Replicating advanced drilling techniques and geological data | Millions for data acquisition; Steep learning curve |

Porter's Five Forces Analysis Data Sources

Our CNX Porter's Five Forces analysis is built on a foundation of robust data, including publicly available financial statements, industry-specific market research reports from reputable firms, and government economic indicators. This multifaceted approach ensures a comprehensive understanding of the competitive landscape.