CNX Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNX Bundle

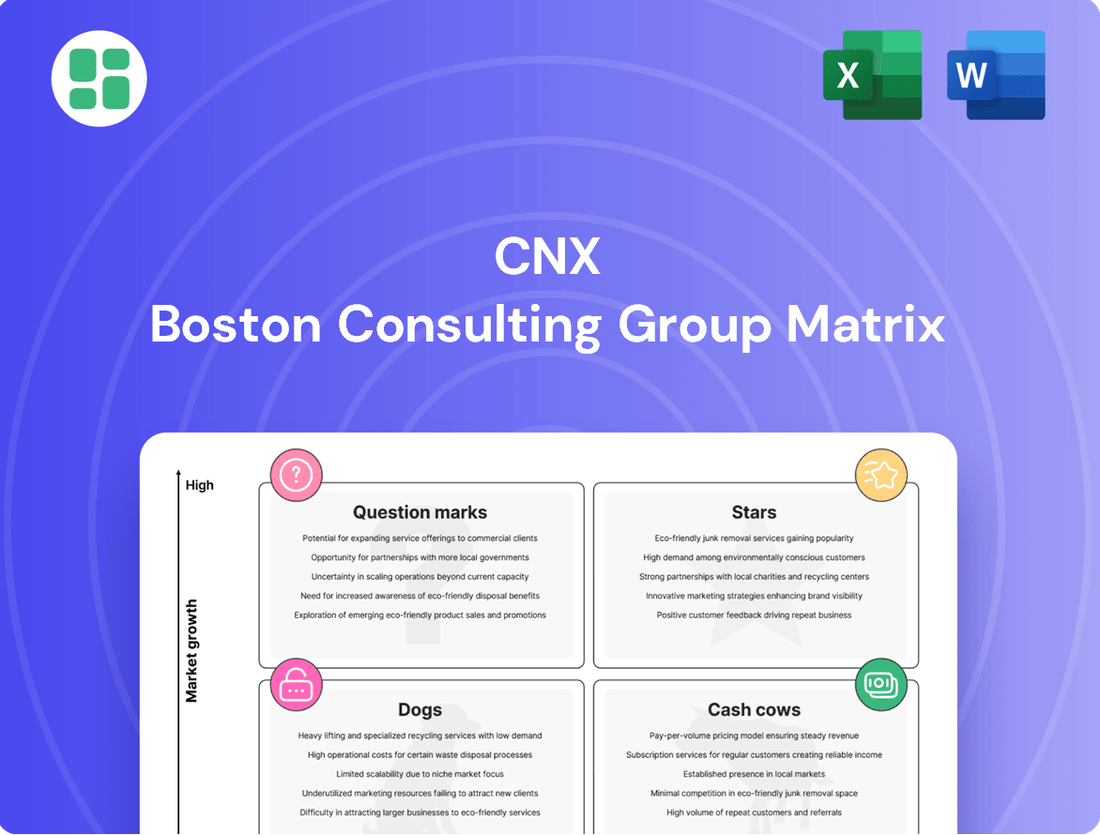

Uncover the strategic positioning of key products with our CNX BCG Matrix preview, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand the current landscape and identify areas for growth and resource allocation. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your portfolio.

Stars

CNX's deep Utica and Marcellus shale assets are performing remarkably well, showcasing impressive operational efficiency. The company has reported drilling times that are 10% faster and capital costs that are 5% lower compared to previous periods in these core areas. This focus on efficiency in the Appalachian Basin is crucial as the region anticipates a significant uptick in natural gas production.

CNX is a leader in capturing and selling Remediated Mine Gas (RMG), a key component of its low-carbon strategy. This involves selling environmental attributes and processing substantial volumes of RMG.

The RMG initiative is perfectly positioned to capitalize on the increasing demand for cleaner energy sources. The introduction of federal 45Z tax credits in 2024 is expected to significantly boost annual revenue, potentially adding hundreds of millions of dollars.

CNX's early and strategic focus on RMG establishes it as a frontrunner in the rapidly expanding market for environmental attributes, offering a distinct competitive advantage.

CNX's commitment to advanced drilling and completion technologies is a key differentiator. Investments in innovations like electric-driven pumps and the AutoSepSM automated flowback system directly translate to enhanced operational efficiency. For example, in 2023, CNX reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity by 10% year-over-year, partly attributable to these advanced technologies.

These technological advancements are not just about environmental stewardship; they drive tangible economic benefits. The improved well performance and reduced operational costs achieved through these systems empower CNX to gain market share. In 2024, CNX's focus on superior execution in its core production activities, underpinned by these technologies, aims to further solidify its competitive position in the Appalachian Basin.

Strategic Acreage Expansion via Apex Energy II Acquisition

CNX's strategic acquisition of Apex Energy II's Appalachian basin assets, encompassing significant undeveloped Utica and Marcellus acreage, marks a pivotal expansion of its development footprint. This move directly bolsters its inventory of future production opportunities within a robust natural gas market, enhancing its position as a key player.

The integration of Apex Energy II's assets is projected to significantly increase CNX's production levels in 2025, a direct result of the expanded acreage and the company's ability to leverage its existing infrastructure. This expansion is a clear indicator of CNX's commitment to long-term market share growth in the dynamic energy sector.

- Strategic Expansion: Acquisition of Apex Energy II's Appalachian basin assets, including substantial undeveloped Utica and Marcellus acreage.

- Future Production: Provides a significant inventory of future production opportunities in a high-growth natural gas market.

- Infrastructure Leverage: Expected to boost 2025 production and contribute to long-term market share growth by utilizing existing infrastructure.

Natural Gas Supply for AI Data Centers

CNX is strategically marketing its low-carbon natural gas, enhanced with Remediated Mine Gas, as an ideal energy solution for the burgeoning AI data center sector in Appalachia. This move taps into a significant growth area, aiming to secure CNX's position in a developing but potentially vast market.

The company's proactive engagement at industry forums highlights its dedication to capitalizing on this emerging demand. For instance, in 2024, the demand for electricity by data centers in the U.S. was projected to reach approximately 300 terawatt-hours by 2030, showcasing the immense growth potential for energy providers.

- Targeting High-Growth Demand: AI data centers represent a rapidly expanding energy consumer, offering substantial revenue opportunities.

- Low-Carbon Advantage: CNX's emphasis on low-carbon natural gas, including blends, aligns with the increasing sustainability requirements of large tech companies.

- Regional Focus: The Appalachian region is a key area for data center development, leveraging existing infrastructure and energy resources.

- Industry Engagement: Participation in summits demonstrates CNX's commitment to building relationships and securing contracts within this new market.

CNX's strong performance in its core Appalachian Basin assets, with faster drilling times and lower capital costs, positions its natural gas production as a prime candidate for the 'Stars' category in the CNX BCG Matrix. The company's significant investments in advanced technologies, like the AutoSepSM system, are driving operational efficiency and reducing emissions, further solidifying its market leadership. This focus on superior execution and cost control, coupled with strategic acquisitions, ensures robust growth potential and high market share in a vital energy sector.

What is included in the product

Strategic insights into CNX's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

The CNX BCG Matrix offers a clear, one-page overview, instantly clarifying which business units require immediate attention, alleviating the pain of strategic uncertainty.

Cash Cows

CNX's established Appalachian Basin natural gas production, primarily from the Marcellus and Utica shales, functions as a prime example of a Cash Cow in the BCG matrix. These mature wells are the bedrock of the company's operations, boasting a substantial share of its proved reserves and consistently delivering robust free cash flow. In 2024, CNX reported that its Appalachian Basin assets continued to be the primary driver of its financial performance, contributing significantly to its operating income and cash generation capabilities.

CNX's owned midstream and gathering infrastructure acts as a classic cash cow. This extensive network of natural gas pipelines and processing facilities generates consistent, high-margin revenue by efficiently moving the company's own production and serving third parties. In 2024, this segment is expected to continue its role as a stable cash generator due to its high utilization and low growth profile, underpinning the company's financial strength.

CNX's long-term hedged natural gas volumes represent a significant portion of their future production. This strategy locks in prices, offering a stable and predictable revenue stream. For instance, as of their Q1 2024 earnings, CNX reported having approximately 7.0 trillion cubic feet (Tcf) of natural gas hedged for the long term, with a weighted average price of $3.16 per million British thermal units (MMBtu).

This extensive hedging program shields CNX from the inherent volatility of the natural gas market. By securing favorable prices for a substantial volume of their output, the company ensures consistent cash flow generation, a hallmark of a cash cow. This financial discipline allows for reliable planning and investment without being overly exposed to price downturns.

Consistent Free Cash Flow Generation and Shareholder Returns

CNX's status as a cash cow within the BCG matrix is firmly established by its impressive financial performance, marked by 22 consecutive quarters of positive free cash flow generation as of the first quarter of 2024. This sustained ability to produce cash exceeding operational and investment requirements underscores the maturity and stability of its business model.

This consistent cash surplus is a key driver of shareholder returns, with CNX actively utilizing these funds for significant share repurchase programs. For instance, in 2023, the company repurchased approximately $200 million of its common stock, a testament to its commitment to enhancing shareholder value.

- Consistent Free Cash Flow: CNX has delivered 22 consecutive quarters of positive free cash flow, showcasing operational efficiency and financial discipline.

- Shareholder Returns: The company prioritizes returning capital to shareholders, evidenced by substantial share repurchase programs, such as the $200 million buyback in 2023.

- Mature Business Model: This financial strategy highlights CNX as a stable, mature entity focused on rewarding its investors.

Integrated Water Sourcing, Delivery, and Disposal Services

CNX's integrated water sourcing, delivery, and disposal services function as a classic Cash Cow within the BCG Matrix. This segment offers a mature, indispensable service, generating consistent and reliable cash flow for the company. By managing water for its own natural gas operations, including recycling and reuse, CNX significantly lowers its operational expenses and environmental footprint.

Furthermore, CNX extends these vital water management solutions to third-party clients, creating an additional, stable revenue stream. This dual approach solidifies its position as a dependable contributor to the company's overall financial health. For instance, in 2023, CNX reported significant water recycling rates, demonstrating the efficiency and cost-effectiveness of its integrated model.

- Mature Service Line: Water management is an essential, established component of natural gas extraction.

- Cost Reduction: Recycling and reusing produced water directly lowers operational expenditures.

- Stable Revenue: Providing these services to third parties creates a predictable income source.

- Environmental Benefits: Reduced water usage and waste disposal contribute to sustainability efforts.

CNX's Appalachian Basin natural gas production is a prime Cash Cow, consistently generating substantial free cash flow. This mature segment, with a significant share of proved reserves, underpins the company's financial stability. In 2024, these operations remained the primary driver of CNX's financial performance, contributing significantly to operating income.

The company's owned midstream and gathering infrastructure also acts as a classic Cash Cow. This network provides high-margin revenue by efficiently moving natural gas and serving third parties. Its high utilization and low growth profile in 2024 solidify its role as a stable cash generator.

CNX's long-term hedged natural gas volumes, with approximately 7.0 Tcf hedged as of Q1 2024 at a weighted average price of $3.16/MMBtu, offer predictable revenue. This strategy shields the company from market volatility, ensuring consistent cash flow, a key characteristic of a Cash Cow.

CNX's integrated water management services are another Cash Cow. This mature segment provides indispensable services, generating reliable cash flow by managing water for its own operations and third parties. In 2023, significant water recycling rates demonstrated the efficiency and cost-effectiveness of this model.

| Business Segment | BCG Category | Key Characteristics | 2024 Outlook |

|---|---|---|---|

| Appalachian Basin Natural Gas Production | Cash Cow | Mature wells, substantial reserves, consistent free cash flow | Primary driver of financial performance |

| Owned Midstream & Gathering Infrastructure | Cash Cow | High-margin revenue, efficient transport, third-party services | Stable cash generator due to high utilization |

| Long-Term Hedged Natural Gas Volumes | Cash Cow | Price security, predictable revenue, market volatility shield | Ensures consistent cash flow generation |

| Integrated Water Management Services | Cash Cow | Mature service, reliable cash flow, cost reduction via recycling | Dependable contributor to financial health |

Full Transparency, Always

CNX BCG Matrix

The preview you are currently viewing is the identical CNX BCG Matrix document you will receive immediately after your purchase. This ensures you know exactly what you are buying, with no hidden surprises or altered content. You can confidently assess its strategic value and professional presentation before committing. Upon completion of your purchase, this fully formatted and analysis-ready CNX BCG Matrix will be instantly accessible for your immediate business planning needs.

Dogs

CNX's legacy coalbed methane (CBM) properties in Virginia, while historically significant, now represent a smaller segment of its production compared to its shale gas focus. These older CBM assets, unless repurposed for new growth initiatives, are likely characterized by low growth and a diminishing market share within the company's portfolio. For instance, in 2023, CNX's CBM production accounted for a fraction of its total output, with the company increasingly prioritizing its Marcellus and Utica shale plays.

In 2024, CNX strategically divested several non-core assets, such as rights-of-way, surface acreage, and specific non-operated oil and gas interests. These sales are characteristic of shedding 'dog' assets, which are typically those with limited strategic importance, low growth prospects, and a negligible impact on overall profitability or market standing.

Within CNX's vast natural gas well portfolio, older or less productive wells with elevated operating expenses relative to their output are classified as 'dogs'. These assets, contributing little to overall production and cash flow, are typical in mature exploration and production portfolios.

CNX's 2024 operational reports, while not singling out specific 'dog' wells, indicate a strategic focus on optimizing their asset base. For instance, the company has consistently reported on its efforts to reduce lifting costs across its operations, a key indicator of managing underperforming assets. While specific data on the number of wells categorized as 'dogs' is not publicly disclosed, industry averages suggest that mature portfolios can have a significant percentage of such wells, often requiring minimal capital expenditure or eventual abandonment.

Deferred Marcellus Shale Completions (Temporary)

In 2024, CNX strategically deferred completion activities on certain Marcellus Shale wells due to persistently low natural gas prices and an oversupplied market. This decision reflects a cautious approach to capital allocation amidst challenging market conditions.

These temporarily curtailed assets can be viewed as fitting within the "Cash Cows" or potentially "Dogs" category of the BCG matrix, depending on their long-term production potential and the company's strategic outlook. During periods of market downturn, like the one experienced in 2024, these segments exhibit characteristics of low growth and, if not managed efficiently, can represent a drag on resources.

- Marcellus Shale Completions Deferred: CNX paused well completions in response to 2024's low natural gas prices.

- Market Conditions: The natural gas market in 2024 was characterized by oversupply, driving down prices.

- Strategic Rationale: Deferral aims to prevent cash expenditure in an unfavorable economic environment.

- BCG Matrix Implication: These assets represent a segment with low growth and potential low market share contribution during downturns, aligning with characteristics of a "Dog" or a mature "Cash Cow" needing careful management.

Outdated or Inefficient Operational Practices

Legacy operational practices or equipment that lag behind CNX's more advanced, technologically driven methods would be categorized as 'dogs' within the operational efficiency framework. These areas, by their nature, possess a low internal efficiency 'market share' and are prime candidates for either replacement or significant optimization efforts.

Consider, for instance, the potential for outdated machinery in certain plant operations. If a particular manufacturing line still relies on equipment purchased in the early 2010s, its output and energy consumption metrics might be significantly less favorable compared to newer installations. For example, if a new automated system can increase production by 15% and reduce energy costs by 10%, the older system is demonstrably underperforming.

- Outdated Equipment: Machinery predating significant technological advancements, leading to lower production rates and higher maintenance costs.

- Inefficient Processes: Manual workflows or older software systems that are slower and more prone to errors than current digital alternatives.

- High Energy Consumption: Older facilities or equipment that require substantially more energy to operate than modern, energy-efficient counterparts.

- Limited Scalability: Operational setups that cannot easily adapt to increased demand or changing production requirements, hindering growth.

Within CNX's portfolio, "dogs" represent assets or operations that exhibit low growth and a small market share, often characterized by declining production or high operating costs. These are typically older wells or legacy infrastructure that no longer contribute significantly to the company's overall performance. In 2024, CNX's strategic divestitures and deferral of certain well completions underscore efforts to manage and potentially shed these underperforming segments. For instance, the company's focus on optimizing its asset base by reducing lifting costs on older wells aligns with the management of "dog" assets.

| Asset Type | BCG Category | 2024 Status/Implication |

| Legacy CBM Properties | Dog | Low growth, diminishing market share; focus on shale gas. |

| Underperforming Wells | Dog | Elevated operating expenses relative to output; contribute little to cash flow. |

| Deferred Marcellus Completions | Dog/Cash Cow (potential) | Low growth due to market conditions; requires careful management of capital. |

| Outdated Operational Equipment | Dog | Lower production rates, higher energy consumption; candidates for replacement/optimization. |

Question Marks

CNX is strategically positioning itself to leverage its captured waste coal mine methane (RMG) as a feedstock for clean hydrogen production, a move significantly bolstered by the introduction of federal 45Z tax credits. This initiative taps into a burgeoning market with substantial future revenue prospects, though CNX's current footprint in the nascent hydrogen sector is minimal.

The company's foray into clean hydrogen production from RMG presents a classic question mark scenario within the BCG matrix. While the market is characterized by high growth potential, CNX's current market share is negligible, reflecting the early stage of this venture. For instance, the global green hydrogen market was valued at approximately $10 billion in 2023 and is projected to grow significantly, offering a clear opportunity for CNX if it can establish a strong foothold.

CNX's potential expansion into industrial carbon capture and storage (CCS) aligns with a burgeoning environmental technology sector, particularly with the leverage offered by federal 45Q tax credits. These credits, which provide significant financial incentives for carbon sequestration, could make large-scale CCS projects more economically feasible. For instance, the U.S. Department of Energy has been actively supporting CCS development, with various projects receiving substantial funding, indicating a strong governmental push in this area.

While CNX's current footprint in large-scale CCS is likely nascent, this sector represents a high-growth opportunity. The global CCS market is projected to expand significantly, with estimates pointing to substantial growth in the coming years as industries seek to decarbonize. Success in this area, however, hinges on substantial capital investment and navigating evolving regulatory landscapes, which are critical factors for transforming early-stage initiatives into robust business segments.

CNX, as it pivots towards low-carbon solutions, is likely exploring or testing new energy transition technologies beyond its core methane capture. These could include areas like advanced biofuels or geothermal energy, representing high-growth but nascent markets where CNX's current footprint is minimal.

These ventures are inherently high-risk, high-reward propositions. For instance, the global advanced biofuels market was projected to reach approximately $100 billion by 2024, offering substantial upside potential but demanding significant upfront investment for viability assessment.

By investing strategically in these emerging fields, CNX aims to identify future growth engines. This approach aligns with a Stars or Question Marks quadrant in the BCG matrix, where substantial investment is needed to capture market share in rapidly expanding, yet unproven, technology sectors.

Development of Untapped or Frontier Plays within Appalachia

CNX Resources, while a leader in the mature Marcellus and Utica shale plays, is exploring potential 'frontier' plays within Appalachia. These deeper or more technically complex formations represent an opportunity for future growth, though CNX's current market share in these areas is minimal.

Developing these untapped plays would necessitate substantial investment in exploration and de-risking activities. Success in these ventures could transform them into future production stars for the company.

- Exploration Investment: CNX's 2024 capital expenditure plan includes allocations for exploring new geological horizons beyond its core acreage.

- De-risking Efforts: The company is employing advanced seismic imaging and pilot drilling programs to assess the commercial viability of frontier plays.

- Potential Upside: Early analysis suggests that some frontier plays could offer higher reserve densities and lower production costs compared to current operations.

- Strategic Focus: While not yet a significant contributor to production, these plays are a key component of CNX's long-term strategy to diversify its asset base.

Commercialization of Proprietary Technologies to Third Parties

CNX's proprietary technologies, such as AutoSepSM for enhanced operational efficiency and advanced methane reduction methods, are ripe for external commercialization. Currently, CNX likely holds a very small external market share for these innovations, presenting a significant opportunity for a new, high-growth revenue stream.

Shifting these technologies from internal tools to external product or service offerings necessitates a strategic pivot. This involves developing dedicated marketing and sales capabilities to reach and serve other exploration and production (E&P) companies effectively.

- Opportunity: Monetizing proprietary technologies like AutoSepSM and methane reduction techniques.

- Market Potential: Addressing a likely low current external market share among E&P companies.

- Strategic Shift: Transitioning from internal use to external product/service sales.

- Required Investment: Building dedicated marketing and sales infrastructure.

CNX's ventures into clean hydrogen production from methane and industrial carbon capture represent classic question marks. The markets are high-growth, but CNX's current market share in these nascent sectors is minimal, requiring significant investment to capture potential.

These emerging energy transition technologies and frontier plays also fall into the question mark category. They offer substantial future growth but demand considerable capital for exploration, de-risking, and market development, with current market penetration being negligible.

The commercialization of CNX's proprietary technologies, such as AutoSepSM, also presents a question mark. While the potential for external sales is high, the current external market share is extremely low, necessitating the development of new sales and marketing capabilities.

| Venture Area | Market Growth Potential | CNX Current Market Share | Key Challenge |

|---|---|---|---|

| Clean Hydrogen (RMG) | High | Negligible | Establishing production scale and market presence |

| Industrial Carbon Capture (CCS) | High | Negligible | Capital investment and regulatory navigation |

| Emerging Energy Transition Tech | High | Negligible | Technology validation and market adoption |

| Frontier Plays | High | Negligible | Exploration risk and development costs |

| Proprietary Technology Commercialization | High | Very Low (External) | Building sales/marketing infrastructure |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitive landscape analysis, to provide actionable strategic insights.