CNOOC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNOOC Bundle

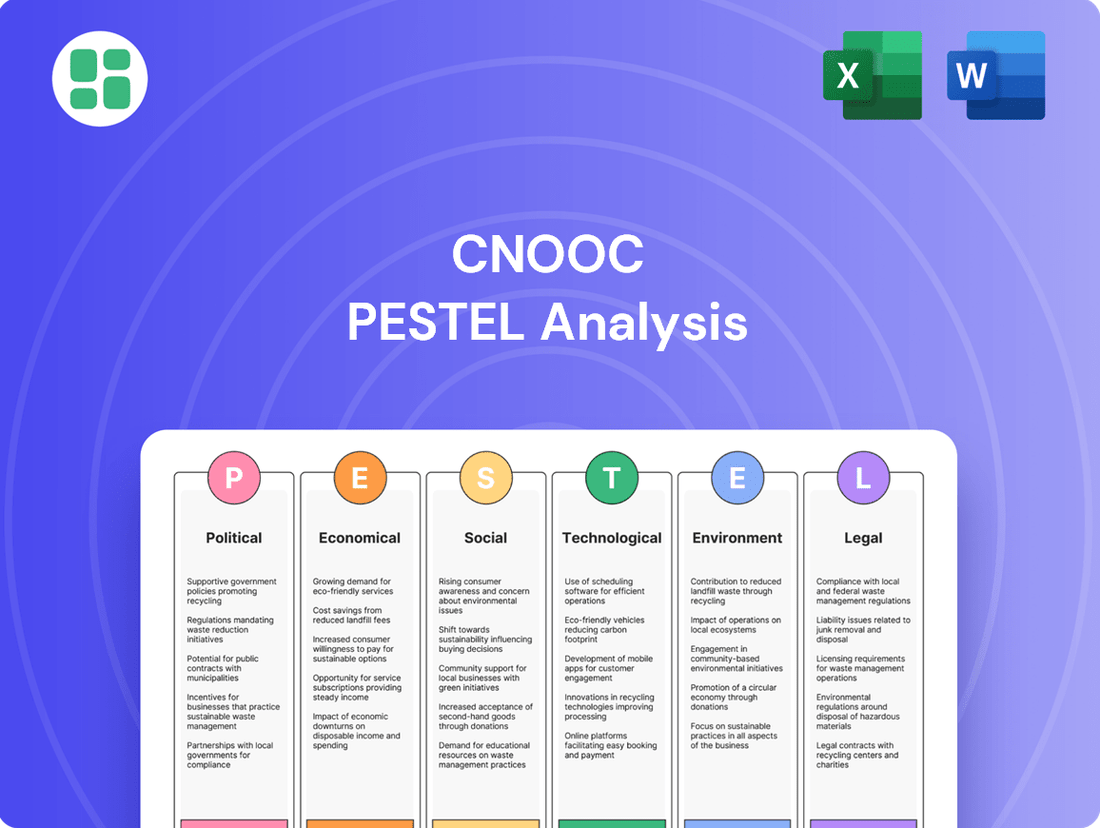

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping CNOOC's global operations. Our comprehensive PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and identify strategic opportunities. Equip yourself with actionable intelligence to navigate the complexities of the energy sector. Download the full version now and gain a decisive advantage.

Political factors

As China's state-owned enterprise (SOE), CNOOC operates under the significant influence of Beijing's energy policies and national strategic goals. The government's emphasis on energy security, particularly boosting domestic oil and gas output, directly shapes CNOOC's operational targets and investment strategies.

This close government tie offers CNOOC advantages like easier access to capital and protection within the domestic market. However, it also means the company must align with government directives and shifting political priorities, impacting its autonomy in decision-making.

Geopolitical tensions, especially between the United States and China, present substantial political risks for CNOOC. The US government's actions, such as blacklisting and the potential for sanctions on Chinese state-linked entities, directly threaten CNOOC's global oil trading operations. These pressures can lead to operational disruptions, higher compliance expenses, and damage to the company's reputation.

The impact of these political dynamics is already evident. CNOOC has previously explored exiting operations in certain Western nations due to concerns over sanctions. This strategic consideration underscores the tangible effect of international relations on the company's global footprint and operational viability.

China's national energy security strategy places a significant mandate on CNOOC to bolster domestic oil and gas production. This imperative directly influences CNOOC's operational priorities, pushing for increased output from its Chinese fields.

In 2023, CNOOC announced plans to boost its Bohai Bay production to 30 million tons of oil and gas equivalent by 2025, underscoring this domestic focus. This strategy aims to guarantee a consistent energy supply for China's expanding economy, potentially influencing investment decisions away from some international projects in favor of domestic exploration and development.

Regulatory Environment in Operating Regions

CNOOC's global operations are heavily influenced by the political stability and regulatory frameworks of its host countries. For instance, shifts in government policies or taxation in regions like Africa and South America can directly impact the feasibility and profitability of its exploration and production projects. The company's strategic expansion along the Belt and Road Initiative also means navigating a complex tapestry of diverse political landscapes.

The regulatory environment presents both opportunities and challenges for CNOOC. Changes in environmental regulations, for example, can necessitate significant capital expenditure for compliance, potentially affecting project timelines and costs. Conversely, stable and predictable regulatory regimes can attract further investment and facilitate smoother operations.

- Navigating Diverse Regulations: CNOOC must adapt to varying legal and regulatory requirements across its international portfolio, from production sharing agreements to local content mandates.

- Political Risk Mitigation: The company actively manages political risks, including potential nationalization or expropriation, through strategic partnerships and robust legal agreements.

- Impact of Geopolitical Shifts: Geopolitical tensions or trade disputes between major powers can indirectly affect CNOOC's access to technology, financing, and key markets.

Anti-corruption Campaigns and Governance

China's ongoing anti-corruption campaigns, spearheaded by the Central Commission for Discipline Inspection (CCDI), present a significant political factor for CNOOC. These intensified probes have targeted high-ranking officials within state-owned enterprises (SOEs), including those within CNOOC, highlighting systemic governance risks. This can create leadership instability and introduce legal complexities, potentially affecting investor sentiment due to the possibility of abrupt regulatory changes.

The impact of these campaigns can manifest in several ways for CNOOC. Leadership vacuums can disrupt strategic decision-making, while investigations may incur substantial legal and compliance costs. Furthermore, the perception of operational instability and the risk of sudden policy shifts can erode investor confidence, influencing the company's valuation and access to capital markets.

CNOOC has publicly acknowledged these challenges and has stated its commitment to upholding high standards of compliance and robust governance practices. This proactive stance aims to mitigate the risks associated with the anti-corruption drive and reassure stakeholders about the company's operational integrity and long-term stability.

- Governance Risks: Intensified anti-corruption probes by China's CCDI targeting SOE officials, including CNOOC, signal systemic governance vulnerabilities.

- Operational Impacts: Leadership vacuums and legal costs stemming from investigations can create perceived operational instability.

- Investor Confidence: The risk of sudden regulatory shifts due to anti-corruption measures can negatively impact investor confidence and CNOOC's market valuation.

- Compliance Commitment: CNOOC has affirmed its dedication to high standards of compliance and governance to navigate these political pressures.

CNOOC's operations are intrinsically linked to China's national energy security objectives, driving domestic production targets. For instance, CNOOC aims to increase Bohai Bay production to 30 million tons of oil and gas equivalent by 2025, reflecting this political imperative.

Geopolitical tensions, particularly with the United States, pose significant risks, potentially impacting CNOOC's global trading and access to technology. The company's strategic decisions, like previously considering exits from certain Western operations, demonstrate the tangible influence of international political relations.

China's anti-corruption campaigns, targeting state-owned enterprises, introduce governance risks and potential leadership instability within CNOOC, which can affect investor confidence and operational continuity.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CNOOC, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for CNOOC's operations and future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors affecting CNOOC.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands CNOOC's operating environment.

Economic factors

CNOOC's financial performance is intrinsically linked to the volatile global energy markets. In 2024, the company benefited from robust crude oil prices, which bolstered its profitability. However, a notable dip in Brent crude prices in early 2025, falling below the previous year's highs, directly impacted CNOOC's net income, even as production volumes saw an increase.

Looking ahead, CNOOC anticipates Brent oil prices to trade within a range of $70 to $85 per barrel in the near term. This price forecast is a critical input for CNOOC's revenue projections and informs its strategic decisions regarding capital expenditures and exploration activities.

The health of the global and Chinese economies is a key driver for CNOOC. In 2024, the International Monetary Fund (IMF) projected global economic growth at 3.2%, with China's economy also estimated to grow by 4.6%. This growth underpins energy demand, directly influencing CNOOC's sales volumes and its ability to set prices.

While global oil demand is anticipated to rise, factors like slower consumption in specific economies or heightened trade disputes could introduce market instability. For instance, ongoing geopolitical tensions can disrupt supply chains and impact energy prices, creating a more volatile operating environment for CNOOC.

CNOOC's strategic planning actively incorporates projected economic growth rates for both the international market and China. Understanding these forecasts helps the company anticipate future energy needs and adjust its investment and production strategies accordingly to navigate potential market fluctuations.

CNOOC's commitment to growth is evident in its robust capital expenditure (CapEx) plans. For 2025, the company has allocated a significant RMB 125-135 billion towards exploration, development, and production, underscoring its focus on expanding its resource base and undertaking ambitious projects.

This substantial investment capacity is directly tied to CNOOC's access to funding and the prevailing interest rate environment. Favorable financing conditions are crucial for CNOOC to pursue large-scale, capital-intensive ventures, particularly in deepwater exploration and the burgeoning new energy sector.

Cost Control and Operational Efficiency

CNOOC's commitment to cost control and operational efficiency remains a cornerstone of its strategy, especially as it navigates fluctuating global energy markets. The company has actively pursued lean management principles to bolster its profitability and resilience against oil price cycles.

In 2024, CNOOC reinforced its cost-competitive edge by successfully reducing its all-in cost per barrel of oil equivalent (BOE). This focus on stringent cost management, coupled with ongoing improvements in operational efficiency, is vital for maintaining robust profit margins even when energy prices experience volatility.

- All-in Cost per BOE Reduction: CNOOC achieved a notable decrease in its all-in cost per BOE in 2024, underscoring its success in cost management initiatives.

- Lean Management Focus: The company consistently emphasizes lean management practices to streamline operations and enhance overall efficiency.

- Profitability Amidst Volatility: Enhanced operational efficiency and cost control enable CNOOC to sustain high profit levels, even during periods of fluctuating oil and gas prices.

Exchange Rate Fluctuations

CNOOC's extensive international operations mean it's significantly exposed to exchange rate fluctuations. As of late 2024, the Chinese Yuan (CNY) has shown some volatility against the US Dollar (USD), impacting the translation of overseas revenues and expenses. For instance, a stronger USD relative to the CNY can reduce the reported value of CNOOC's dollar-denominated earnings when converted to Yuan.

These currency shifts directly affect CNOOC's financial performance and, consequently, shareholder returns. For example, if the Yuan strengthens considerably, the cost of overseas capital expenditures denominated in foreign currencies would effectively decrease when reported in CNOOC's financial statements. Conversely, a weaker Yuan would inflate these costs.

- Impact on Reported Earnings: Fluctuations in the CNY/USD exchange rate can alter the reported value of CNOOC's international revenue streams.

- Capital Expenditure Costs: Overseas investments become more or less expensive in Yuan terms depending on the currency's movement.

- Shareholder Returns: The net effect of these currency impacts can influence dividend payouts and the overall valuation of the company for investors.

- 2024 Yuan Performance: The CNY experienced a notable depreciation against the USD in early to mid-2024, creating headwinds for companies with significant USD-denominated liabilities or overseas earnings.

Global economic growth directly fuels energy demand, a critical factor for CNOOC. In 2024, the IMF projected global growth at 3.2%, with China's economy expanding by an estimated 4.6%, supporting robust energy consumption. However, a slowdown in major economies or escalating trade tensions in early 2025 could temper this demand, impacting CNOOC's sales volumes and pricing power.

CNOOC's financial health is closely tied to global oil prices, which saw strength in 2024 but experienced a dip below previous highs in early 2025. The company anticipates Brent crude to trade between $70-$85 per barrel in the near term, a key assumption for its revenue and investment strategies. This price range influences CNOOC's capital expenditure plans, including its significant RMB 125-135 billion allocation for 2025.

Exchange rate volatility, particularly between the Chinese Yuan and US Dollar, impacts CNOOC's international operations. A stronger USD in late 2024, for instance, can reduce the reported value of dollar-denominated overseas earnings when converted to Yuan, affecting overall profitability and shareholder returns.

| Economic Indicator | 2024 Projection/Actual | Early 2025 Trend | Impact on CNOOC |

|---|---|---|---|

| Global GDP Growth | 3.2% (IMF) | Potential slowdown due to economic headwinds | Affects overall energy demand |

| China GDP Growth | 4.6% (IMF) | Continued growth supporting domestic demand | Key driver for CNOOC's sales |

| Brent Crude Oil Price | Strong in 2024 | Dipped below 2024 highs | Directly impacts revenue and profitability |

| CNY/USD Exchange Rate | Volatile, with USD strength | Continued volatility | Influences translation of overseas earnings and costs |

Preview Before You Purchase

CNOOC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CNOOC PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into the strategic landscape affecting CNOOC's operations and future growth.

Sociological factors

Societal pressure for climate action is intensifying, pushing companies like CNOOC to adapt. Public awareness around the urgency of an energy transition directly influences corporate strategy.

CNOOC is responding by investing in green initiatives, aiming to balance its role as a fossil fuel producer with future energy needs. For instance, in 2023, the company reported significant progress in its offshore wind power projects, contributing to its renewable energy portfolio.

The company's commitment to carbon capture, utilization, and storage (CCUS) technologies also reflects an effort to align with global decarbonization goals and public expectations for a more sustainable energy future.

Attracting, retaining, and developing a skilled workforce is paramount for CNOOC, particularly given the specialized nature of offshore oil and gas operations and its expansion into new energy ventures. The company’s strategy, focused on ‘promoting corporate development with high-quality talent,’ underscores the critical role of human capital in maintaining operational efficiency and fostering innovation within the competitive global energy landscape.

CNOOC's commitment to safeguarding employee rights and fostering a supportive work environment is key to its talent management. For instance, in 2023, CNOOC reported a workforce of approximately 113,000 employees, highlighting the scale of its human resource needs. This emphasis on nurturing its talent pool ensures the company can meet the demands of both its traditional energy sectors and its growing renewable energy initiatives.

CNOOC demonstrates a strong commitment to Corporate Social Responsibility (CSR), focusing on societal service, community harmony, and local benefit. This dedication is evident in their active participation in public welfare, including significant investments in ecological compensation and restoration initiatives. For instance, in 2023, CNOOC allocated over ¥1.5 billion to environmental protection and sustainable development projects, underscoring their role in enhancing public environmental awareness and fostering community well-being.

Health, Safety, and Environmental (HSSE) Standards

CNOOC places significant emphasis on Health, Safety, and Environmental (HSSE) standards, a crucial aspect given the high-risk nature of offshore oil and gas exploration and production. The company's commitment is evident in its proactive approach to managing operational hazards, including severe weather events. For instance, CNOOC's preparedness for super typhoons underscores its dedication to maintaining production safety and minimizing risks to personnel and assets.

Adherence to rigorous HSSE protocols is not merely a regulatory requirement but a fundamental pillar of CNOOC's operational philosophy. This commitment directly impacts the well-being of its workforce and the protection of the marine environment. By consistently meeting and exceeding these standards, CNOOC safeguards its reputation and ensures sustainable business practices. In 2023, CNOOC reported a significant reduction in its Lost Time Injury Frequency Rate (LTIFR), demonstrating the effectiveness of its safety management systems.

- Production Safety Focus: CNOOC actively manages risks associated with offshore operations, including extreme weather like super typhoons.

- Employee and Environmental Protection: Strict HSSE standards are vital for safeguarding CNOOC's employees and the surrounding ecosystems.

- Reputational Management: Upholding high HSSE standards is critical for maintaining CNOOC's corporate image and stakeholder trust.

- Performance Metric: CNOOC's LTIFR for 2023 was 0.25 per million man-hours, a testament to its safety commitment.

Community Engagement and Local Impact

CNOOC's extensive global operations, spanning over 20 countries and regions, underscore the critical importance of robust community engagement. The company's commitment to local prosperity and safety is paramount for maintaining operational continuity and fostering goodwill.

Effective stakeholder relations and contributions to local development are not merely good practice but essential for CNOOC's social license to operate. For instance, in 2023, CNOOC's corporate social responsibility initiatives focused on areas like education and environmental protection, directly impacting local communities.

- Job Creation: CNOOC directly employs thousands of individuals globally, providing significant economic opportunities in the regions where it operates.

- Community Investment: The company invests in local infrastructure projects and social programs, aiming to enhance the quality of life for residents.

- Safety Focus: Prioritizing the safety of local communities surrounding its operational sites is a core tenet of CNOOC's engagement strategy.

- Stakeholder Dialogue: Regular consultations with local leaders and residents ensure that CNOOC's activities align with community needs and expectations.

Societal expectations are increasingly focused on environmental sustainability and ethical business practices, influencing CNOOC's operational strategies and public perception.

The company's commitment to corporate social responsibility (CSR) includes significant investments in community development and environmental protection, as evidenced by over ¥1.5 billion allocated in 2023 to such projects.

Furthermore, CNOOC's emphasis on attracting and retaining a skilled workforce, comprising approximately 113,000 employees in 2023, highlights the critical role of human capital in its diversified energy operations.

CNOOC's stringent Health, Safety, and Environmental (HSSE) standards, demonstrated by a 2023 Lost Time Injury Frequency Rate (LTIFR) of 0.25 per million man-hours, are vital for protecting its workforce and maintaining stakeholder trust.

| Sociological Factor | CNOOC's Response/Data (2023 unless specified) | Impact |

|---|---|---|

| Environmental Awareness & Climate Action | Investments in offshore wind; CCUS technology development; ¥1.5 billion+ in environmental projects. | Aligns with public demand for sustainability, enhances corporate image. |

| Workforce Management & Development | Approx. 113,000 employees; focus on talent quality. | Ensures operational efficiency and innovation in traditional and new energy sectors. |

| Health, Safety, and Environment (HSSE) | LTIFR of 0.25 per million man-hours; preparedness for extreme weather. | Protects employees and ecosystems, builds trust, ensures operational continuity. |

| Corporate Social Responsibility (CSR) | Community engagement, local benefit initiatives, public welfare participation. | Strengthens social license to operate, fosters goodwill with local communities. |

Technological factors

CNOOC's commitment to technological advancement is paramount for its reserve replacement and production growth, especially in difficult deepwater operations. The company is actively investing in research for critical oil and gas E&P technologies, such as advanced seismic imaging and enhanced oil recovery (EOR) methods.

These innovations are designed to unlock previously inaccessible resources and significantly boost output from its existing fields. For instance, CNOOC has been a pioneer in deepwater exploration, with its Liwan 3-1 gas field development showcasing its capabilities in complex subsea environments.

In 2023, CNOOC reported a 1.4% increase in oil and gas equivalent production to 677 million barrels of oil equivalent (boe), a testament to the effectiveness of its technological strategies in overcoming operational challenges and expanding its resource base.

CNOOC is significantly advancing its digital transformation, integrating AI through its 'Hi-Energy' model to boost operational intelligence across its oil and gas business. This strategic push involves developing intelligent fields and refining digital applications.

The company is accelerating the deployment of unmanned and semi-unmanned offshore platforms, a key initiative for 2024 and into 2025, aimed at streamlining management and improving efficiency. These advancements are crucial for maintaining competitiveness in a rapidly evolving energy landscape.

CNOOC is making significant strides in new energy, particularly offshore wind. By the end of 2023, the company had commissioned 10.55 gigawatts of offshore wind power capacity, a substantial increase that underscores its commitment to green development. This expansion is a core part of their strategy to diversify beyond traditional oil and gas.

Beyond wind, CNOOC is also investing heavily in carbon capture, utilization, and storage (CCUS). They are advancing regional pilot projects for CCS/CCUS, aiming to integrate these technologies to reduce their carbon footprint. This focus on CCUS, alongside their growing offshore wind portfolio, highlights CNOOC's proactive approach to evolving energy demands and environmental regulations.

Cybersecurity and Data Protection

As CNOOC increasingly embraces digitalization and integrates advanced AI models, cybersecurity has emerged as a paramount technological concern. Protecting its vast digital assets, including critical infrastructure, sensitive operational data, and proprietary exploration technologies, from evolving cyber threats is fundamental to maintaining operational continuity and a competitive edge.

The company's commitment to robust cybersecurity measures is a cornerstone of its ongoing digital transformation initiatives. For instance, in 2023, global cybersecurity spending in the energy sector was projected to reach approximately $12.9 billion, highlighting the industry's focus on this area. CNOOC's investment in advanced threat detection and response systems directly addresses these escalating risks.

- Cybersecurity Investment: CNOOC's strategic allocation of resources towards advanced cybersecurity solutions is crucial for safeguarding its digital infrastructure.

- AI Integration Risks: The deployment of AI in operations introduces new attack vectors that necessitate sophisticated, AI-powered defense mechanisms.

- Data Protection Mandates: Compliance with evolving data protection regulations globally requires stringent measures to secure proprietary information and customer data.

- Operational Resilience: Effective cybersecurity is directly linked to maintaining uninterrupted operations and preventing costly disruptions.

Refining and Chemical Operations Innovation

CNOOC's refining and chemical operations are a significant part of its business, and technological advancements are key to making these processes more efficient and environmentally friendly. For instance, in 2023, CNOOC's refining segment processed approximately 24 million tons of crude oil, highlighting the scale where even small efficiency gains can yield substantial results.

The company is actively investing in petrochemicals to counter potential drops in fuel demand due to the energy transition. This strategic move necessitates continuous technological upgrades across its downstream facilities. CNOOC aims to secure domestic supply of advanced materials, a goal supported by its 2024-2025 investment plans focusing on high-value petrochemical products.

Key areas of technological focus include:

- Advanced Catalysis: Developing and implementing new catalysts to improve reaction yields and reduce energy consumption in chemical production.

- Process Optimization: Utilizing digital technologies and AI to monitor and fine-tune refining and chemical processes in real-time, enhancing operational efficiency.

- Environmental Technologies: Investing in technologies for emissions reduction, waste heat recovery, and water management to minimize the environmental footprint of its operations.

CNOOC is heavily investing in technological innovation to enhance its oil and gas exploration and production, particularly in challenging deepwater environments. This includes advancements in seismic imaging and enhanced oil recovery techniques, which are crucial for unlocking new reserves and boosting output from existing fields. The company's successful deepwater projects, like the Liwan 3-1 gas field, demonstrate its technological prowess.

The company is also accelerating its digital transformation by integrating AI, such as its 'Hi-Energy' model, to improve operational intelligence and efficiency across its business. This digital push includes the development of intelligent fields and the deployment of unmanned offshore platforms, a key focus for 2024 and 2025, aimed at streamlining operations and maintaining a competitive edge.

CNOOC's technological strategy extends to new energy, with significant investments in offshore wind power. By the end of 2023, they had commissioned 10.55 GW of offshore wind capacity, underscoring a commitment to diversification and green energy. Furthermore, the company is actively developing carbon capture, utilization, and storage (CCUS) technologies through regional pilot projects to reduce its carbon footprint.

| Technological Focus Area | Key Initiatives | 2023/2024-2025 Data/Projections |

|---|---|---|

| Exploration & Production | Advanced seismic imaging, Enhanced Oil Recovery (EOR), Deepwater technology | Pioneered deepwater exploration; 2023 production: 677 million boe (up 1.4%) |

| Digitalization & AI | 'Hi-Energy' AI model, Intelligent fields, Unmanned platforms | Accelerating deployment of unmanned/semi-unmanned platforms in 2024-2025 |

| New Energy | Offshore wind development, CCUS technology | 10.55 GW offshore wind commissioned by end of 2023; Advancing regional CCUS pilot projects |

| Refining & Petrochemicals | Advanced catalysis, Process optimization, Environmental technologies | Processed ~24 million tons crude oil in 2023; Investing in high-value petrochemicals for 2024-2025 |

Legal factors

CNOOC's significant offshore footprint, especially in the South China Sea, places it directly under the purview of intricate international maritime laws and ongoing territorial disputes. These geopolitical tensions introduce considerable legal ambiguity and operational hurdles, affecting CNOOC's exploration licenses and the progression of its projects in these contested maritime zones.

Navigating these delicate legal and political arenas is paramount for CNOOC. For instance, as of early 2025, disputes over resource rights in the South China Sea continue to involve multiple nations, potentially impacting CNOOC's access to lucrative offshore blocks and requiring robust legal and diplomatic strategies to mitigate risks and ensure continued operations.

CNOOC operates under strict environmental regulations and emissions standards, both within China and across its global operations. These rules are becoming increasingly rigorous as governments worldwide push for decarbonization.

The company actively prioritizes environmental protection and energy conservation. For instance, CNOOC incorporates carbon pricing into its investment decisions, reflecting the growing financial implications of emissions. In 2023, CNOOC reported a 7.1% reduction in CO2 emissions intensity compared to 2022, reaching 20.2 kg of CO2 per barrel of oil equivalent.

To meet these mandates, CNOOC is implementing energy-saving retrofit projects. These initiatives are crucial for complying with national climate policies, such as China's dual carbon goals, and international agreements like the Paris Agreement, which aim to limit global warming.

The legal framework for oil and gas exploration and production licenses is critical for CNOOC's operations. This includes navigating complex permitting processes and understanding contractual terms with host governments, which can vary significantly by region. Adherence to these regulations is paramount for securing and maintaining access to vital resources, particularly as CNOOC expands its international footprint.

In 2024, CNOOC secured petroleum contracts for 10 exploration blocks across Mozambique, Brazil, and Iraq, highlighting the importance of successfully navigating diverse legal and regulatory environments. These awards underscore the company's ongoing efforts to acquire new reserves and demonstrate its capacity to meet the stringent legal requirements of various national oil companies and governments.

Anti-corruption and Compliance Laws

CNOOC navigates a complex web of anti-corruption and compliance laws, a critical factor for its global operations. These regulations extend across its domestic activities in China and its international ventures, demanding rigorous adherence to ethical business practices.

The intensified anti-corruption investigations by Chinese authorities in recent years underscore the imperative for companies like CNOOC to maintain robust internal controls and a strong commitment to business integrity. This focus directly impacts operational risk and strategic planning.

To foster a culture of compliance, CNOOC actively implements comprehensive anti-corruption and integrity training programs for its entire workforce. This proactive approach aims to ensure all employees understand and uphold lawful and compliant operational standards.

- Regulatory Scrutiny: CNOOC faces stringent anti-corruption laws in China, such as the Anti-Unfair Competition Law, and international regulations like the U.S. Foreign Corrupt Practices Act (FCPA) for its overseas projects.

- Compliance Investment: Companies in the energy sector, including CNOOC, are estimated to spend billions annually on compliance programs, a trend likely to continue through 2025 as regulatory enforcement remains high.

- Training Reach: CNOOC's commitment to training aims to cover its tens of thousands of employees, ensuring a consistent understanding of ethical conduct across all levels of the organization.

Trade Laws and Sanctions Compliance

CNOOC navigates a complex web of international trade laws and sanctions, presenting significant compliance challenges. The United States, in particular, has imposed sanctions on various Chinese entities, impacting companies like CNOOC. These sanctions can create hurdles for global operations, potentially increasing costs and disrupting supply chains.

For instance, the US Treasury Department's Office of Foreign Assets Control (OFAC) has previously listed entities associated with CNOOC, requiring stringent adherence to sanctions programs. This necessitates robust compliance frameworks to avoid penalties and maintain access to international markets. Failure to comply can result in substantial fines and reputational damage, affecting CNOOC's ability to secure financing and engage in international trade, especially concerning its significant liquefied natural gas (LNG) business.

- US Sanctions Impact: CNOOC's trading arm has faced US blacklisting, directly affecting its compliance obligations and operational costs.

- Supply Chain Disruptions: Sanctions can impede CNOOC's global LNG operations and disrupt its access to essential supply chains.

- Increased Operational Costs: Maintaining compliance with evolving international trade laws and sanctions necessitates significant investment in legal and operational safeguards.

CNOOC's global operations are heavily influenced by international maritime law, particularly concerning its extensive activities in the South China Sea. Ongoing territorial disputes in this region create significant legal complexities for exploration and production licenses, requiring sophisticated legal and diplomatic engagement to mitigate risks and ensure operational continuity.

The company must also adhere to increasingly stringent environmental regulations worldwide, including emissions standards and carbon pricing mechanisms. CNOOC's reported 7.1% reduction in CO2 emissions intensity in 2023, reaching 20.2 kg CO2 per barrel of oil equivalent, demonstrates its efforts to align with national climate goals and international agreements like the Paris Agreement.

Navigating diverse legal frameworks for exploration and production licenses is crucial, as evidenced by CNOOC securing contracts for 10 blocks across Mozambique, Brazil, and Iraq in 2024. This highlights the need for robust compliance with varied national oil company and government regulations.

Furthermore, CNOOC faces significant legal challenges related to anti-corruption laws, both domestically in China and internationally, such as the U.S. Foreign Corrupt Practices Act (FCPA). The company invests heavily in compliance training for its tens of thousands of employees to ensure adherence to ethical business practices and avoid penalties.

International trade laws and sanctions, particularly from the United States, also pose compliance hurdles. CNOOC's trading arm has experienced US blacklisting, impacting its operations and necessitating significant investment in legal safeguards to maintain access to global markets and supply chains, especially for its substantial LNG business.

| Legal Factor | Description | Impact on CNOOC | 2024/2025 Relevance |

|---|---|---|---|

| International Maritime Law | Governs activities in international waters, including disputed territories. | Affects exploration rights and project progression in contested areas like the South China Sea. | Ongoing territorial disputes necessitate continuous legal and diplomatic strategies. |

| Environmental Regulations | Standards for emissions, pollution control, and carbon management. | Requires investment in energy-saving retrofits and compliance with decarbonization targets. | CNOOC's 2023 CO2 intensity reduction of 7.1% shows proactive adaptation to stricter rules. |

| Exploration & Production Licensing | Legal frameworks governing resource extraction rights. | Varies by country, impacting securing and maintaining access to reserves. | 2024 contract awards in Mozambique, Brazil, and Iraq highlight the need for diverse legal compliance. |

| Anti-Corruption Laws | Prohibits bribery and unethical business practices. | Demands robust internal controls and training to avoid penalties and reputational damage. | Intensified enforcement in China and international scrutiny require ongoing compliance investment. |

| International Trade & Sanctions | Laws governing cross-border commerce and economic restrictions. | Can disrupt supply chains, increase operational costs, and limit market access. | US sanctions on associated entities require stringent adherence to avoid fines and maintain global LNG operations. |

Environmental factors

CNOOC acknowledges climate change as a pivotal element in its strategic planning, actively pursuing initiatives to lower its carbon emissions intensity. The company has set an ambitious target of achieving a 10-18% reduction in emissions intensity by 2025, using 2021 as its baseline year.

To reinforce these goals, CNOOC has integrated carbon pricing mechanisms into its investment decision-making framework. This ensures that the financial implications of carbon emissions are considered in all new projects and evaluations.

Furthermore, CNOOC is making strides in carbon capture, utilization, and storage (CCUS) technologies, advancing regional pilot projects. The company is also increasing its use of green electricity, demonstrating a commitment to cleaner energy sources across its operations.

CNOOC's extensive offshore operations necessitate stringent oil spill prevention and rapid response capabilities as paramount environmental concerns. The company actively invests in advanced technologies and rigorous training to minimize the likelihood of spills and ensure swift, effective containment and cleanup should an incident occur.

In 2023, CNOOC reported a significant commitment to environmental protection, allocating substantial funds towards safety protocols and ecological restoration projects. This focus is crucial given the inherent risks of offshore resource development and the increasing regulatory scrutiny surrounding environmental stewardship in the energy sector.

CNOOC operates in diverse marine ecosystems, making biodiversity protection a critical environmental factor. The company's commitment to 'prioritizing ecological protection' guides its efforts to mitigate operational impacts.

In 2023, CNOOC initiated or continued several ecological compensation and restoration projects aimed at minimizing its footprint on marine life and habitats. For instance, its efforts in the Bohai Sea are designed to support the recovery of fish populations and protect sensitive seabed environments, reflecting a proactive approach to environmental stewardship.

Water Management and Waste Disposal

CNOOC prioritizes responsible water management and waste disposal as key environmental commitments. The company actively manages both non-hazardous and hazardous waste streams originating from its diverse operational activities, aiming for enhanced efficiency and minimized ecological impact throughout its entire value chain.

In 2023, CNOOC reported a significant reduction in its overall waste generation, with efforts focused on recycling and reuse initiatives. The company's commitment to water stewardship is evident in its investments in advanced water treatment technologies, aiming to reduce freshwater consumption and ensure responsible discharge practices, aligning with evolving environmental regulations and sustainability goals.

- Water Consumption: CNOOC aims to reduce freshwater intake by implementing closed-loop systems and optimizing water usage in its offshore and onshore operations.

- Waste Reduction Initiatives: The company focuses on minimizing waste at the source, with a growing emphasis on recycling and repurposing materials generated from exploration and production activities.

- Hazardous Waste Management: CNOOC adheres to strict protocols for the safe handling, treatment, and disposal of hazardous waste, ensuring compliance with international and national environmental standards.

- Environmental Performance: Continuous monitoring and reporting of water and waste management metrics are integral to CNOOC's environmental performance evaluation and improvement strategy.

Transition to Cleaner Energy Sources

CNOOC is strategically integrating hydrocarbon and new energy development, signaling a significant move towards cleaner energy solutions. This commitment is evident in their expansion of offshore wind power and careful evaluation of onshore photovoltaic projects.

The company is actively accelerating the adoption of green power, with a clear objective to surpass 1 billion kilowatt-hours of green electricity consumption by the year 2025. This proactive approach positions CNOOC to capitalize on the global transition to more sustainable energy sources.

- Integrated Energy Development: CNOOC is actively pursuing a dual strategy of developing both traditional hydrocarbon resources and new energy sectors.

- Renewable Energy Expansion: This includes significant investments in expanding offshore wind power capabilities and rigorous screening of onshore photovoltaic (PV) projects.

- Green Power Substitution: The company is expediting the substitution of conventional energy with green power across its operations.

- 2025 Green Electricity Target: CNOOC aims to exceed 1 billion kWh in green electricity consumption by 2025, demonstrating a tangible commitment to sustainability.

CNOOC's environmental strategy centers on reducing its carbon footprint and managing operational impacts. The company targets an 10-18% reduction in emissions intensity by 2025, using 2021 as a baseline, and integrates carbon pricing into investment decisions.

Protecting marine biodiversity and preventing oil spills are critical for CNOOC's offshore operations, with significant 2023 investments in ecological restoration and spill response technologies.

Responsible water and waste management are key priorities, with CNOOC aiming to reduce freshwater intake and increase recycling, reporting reduced waste generation in 2023.

CNOOC is expanding into new energy, focusing on offshore wind and evaluating solar projects, with a goal to consume over 1 billion kWh of green electricity by 2025.

| Environmental Focus | Target/Metric | Year | Status/Action |

|---|---|---|---|

| Emissions Intensity Reduction | 10-18% | 2025 | Baseline 2021; Carbon pricing integrated |

| Green Electricity Consumption | >1 billion kWh | 2025 | Accelerating adoption |

| Ecological Restoration | Ongoing | 2023 | Bohai Sea projects for fish populations and seabed environments |

| Waste Reduction | Reported reduction | 2023 | Focus on recycling and reuse |

PESTLE Analysis Data Sources

Our CNOOC PESTLE Analysis is built on a robust foundation of data from official government publications, international energy organizations, and reputable financial news outlets. We integrate insights from regulatory bodies, economic indicators, and industry-specific market research to ensure comprehensive coverage.