CNOOC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNOOC Bundle

Curious about CNOOC's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up in the competitive energy landscape. Understand which ventures are powering growth and which require a closer look.

Unlock the full potential of this analysis by acquiring the complete BCG Matrix. It provides a detailed quadrant breakdown, actionable insights into CNOOC's market share and growth, and the strategic roadmap you need to make informed decisions about their investments.

Stars

CNOOC's involvement in Guyana's offshore projects, such as the Yellowtail development, firmly places them in the Star category of the BCG matrix. This region is a powerhouse for oil and gas expansion, and CNOOC's overseas production saw a robust 10.8% increase in 2024, significantly bolstered by these ventures.

These Guyanese projects exhibit exceptional growth potential, and CNOOC commands a considerable stake in these fast-evolving offshore fields. This strategic positioning allows CNOOC to capitalize on the high demand and increasing production volumes characteristic of a Star asset.

The Bozhong 26-6 Oilfield Development Project (Phase I) is a crucial element in CNOOC's strategy, aiming to bolster its domestic production capabilities. This project is central to CNOOC's objective of achieving its production growth targets, especially as China's largest offshore oil and gas producer.

Located in the strategically important Bohai Bay, a region known for its significant offshore oil and gas reserves, Bozhong 26-6 is poised to enhance CNOOC's market position. This development directly supports the company's efforts to meet increasing domestic energy demand and maintain its leading role in the Chinese market.

The Kenli 10-2 Oilfield Development Project (Phase I) in Bohai Bay is a significant Star for CNOOC. This initiative is slated to introduce new domestic production in 2025, aligning with CNOOC's objective to consistently boost reserves and output.

This development highlights CNOOC's strong standing and ongoing commitment to investing in high-growth domestic offshore oil production. In 2024, CNOOC reported a substantial increase in its domestic oil and gas production, with offshore fields like those in Bohai Bay playing a pivotal role.

Ultra-Deepwater Gas Discoveries

CNOOC's ultra-deepwater gas discoveries are a testament to its prowess in frontier exploration, with recent major breakthroughs in carbonate rocks. The Liwan 4-1 structure and Lingshui 36-1 gas field exemplify this success, revealing substantial potential in previously undeveloped high-growth regions. These achievements solidify CNOOC's standing as a leader in deepwater technology and resource acquisition, with the successful conversion of these reserves into production poised to drive future expansion.

The strategic importance of these ultra-deepwater assets is underscored by their contribution to CNOOC's overall production profile and future growth trajectory. The company's investment in advanced exploration and production technologies has been crucial in unlocking these complex reservoirs.

- Liwan 4-1: A significant deepwater gas discovery, contributing to CNOOC's production and reserves.

- Lingshui 36-1: Another major ultra-deepwater gas field, showcasing CNOOC's technological capabilities.

- High-Growth Potential: These discoveries are in areas with significant untapped resource potential.

- Technological Leadership: CNOOC's success highlights its advanced deepwater exploration and production expertise.

Integrated Offshore Wind Power

CNOOC's integrated offshore wind power initiative is a clear Star in its BCG Matrix. This segment is experiencing rapid growth, fueled by China's ambitious renewable energy targets.

The company is actively developing deep-sea wind power capabilities, aiming to significantly boost its green electricity consumption. By 2025, CNOOC expects to consume a substantial amount of green electricity, underscoring the strategic importance of this sector.

- Strategic Integration: CNOOC is combining offshore wind with its existing oil and gas infrastructure, creating a synergistic advantage.

- High-Growth Market: The offshore wind sector in China is expanding rapidly, driven by national policies promoting clean energy.

- Deep-Sea Expertise: CNOOC is investing in and developing unique expertise in deep-sea wind power technology.

- Green Energy Targets: The company is committed to increasing its green electricity consumption, with significant targets set for 2025.

CNOOC's offshore wind power initiative is a clear Star, capitalizing on China's strong push for renewable energy. The company is actively developing deep-sea wind capabilities, aiming to significantly increase its green electricity consumption, with substantial targets set for 2025.

This segment is experiencing rapid growth, and CNOOC's strategic integration of offshore wind with its existing infrastructure provides a synergistic advantage. Their investment in deep-sea wind power technology highlights their commitment to this high-growth market.

CNOOC's involvement in Guyana's offshore projects, like the Yellowtail development, also firmly places them in the Star category. This region is a powerhouse for oil and gas expansion, and CNOOC's overseas production saw a robust 10.8% increase in 2024, significantly bolstered by these ventures.

These Guyanese projects exhibit exceptional growth potential, and CNOOC commands a considerable stake in these fast-evolving offshore fields, allowing them to capitalize on high demand and increasing production volumes.

| Asset/Project | BCG Category | Key Growth Driver | 2024 Production Impact | Future Outlook |

|---|---|---|---|---|

| Guyana Offshore Projects (e.g., Yellowtail) | Star | High global demand for oil, significant reserves | 10.8% increase in overseas production | Continued expansion and increased contribution to CNOOC's portfolio |

| Offshore Wind Power Initiative | Star | China's renewable energy targets, technological advancements | Active development and investment in deep-sea capabilities | Significant increase in green electricity consumption by 2025 |

| Bozhong 26-6 Oilfield (Phase I) | Star | Domestic energy demand, strategic Bohai Bay location | Bolstering domestic production capabilities | Enhancing market position and meeting national energy needs |

| Kenli 10-2 Oilfield (Phase I) | Star | Investment in high-growth domestic production | Substantial increase in domestic oil and gas production | Introduction of new domestic production in 2025 |

| Ultra-deepwater Gas Discoveries (e.g., Liwan 4-1, Lingshui 36-1) | Star | Frontier exploration success, substantial untapped potential | Successful conversion of reserves into production | Driving future expansion and showcasing technological leadership |

What is included in the product

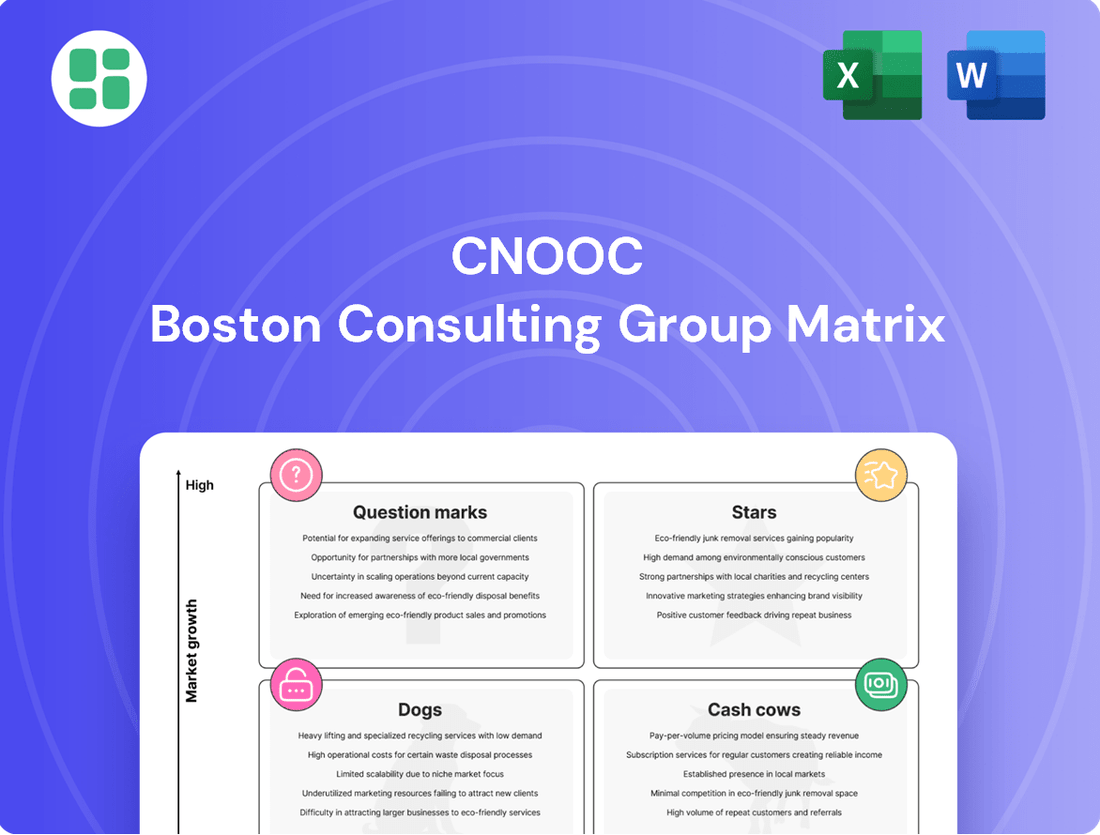

The CNOOC BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The CNOOC BCG Matrix provides a clear, one-page overview of each business unit's strategic position, relieving the pain of complex portfolio analysis.

Cash Cows

Mature Bohai Sea oilfields are CNOOC's established cash cows, representing a significant and reliable source of income. This region, as China's largest oil-producing area, benefits from mature infrastructure, ensuring stable and substantial cash flow generation for the company.

These fields typically require less new capital investment for maintenance compared to exploratory ventures, which directly contributes to their high profit margins. In 2023, CNOOC reported that its Bohai oil and gas production reached approximately 31.9 million tons of oil equivalent, underscoring the immense and consistent output from these mature assets.

CNOOC's Western South China Sea producing assets are the bedrock of its domestic output, representing mature fields that consistently deliver stable production. These established operations benefit from lower promotional and placement costs, allowing them to function as reliable cash generators for the company.

In 2023, CNOOC reported that its South China Sea segment, which includes these Western assets, contributed significantly to its overall oil and gas production, highlighting their ongoing importance. The efficiency and longevity of these fields ensure a steady inflow of cash, reinforcing their status as core cash cows.

The Yacheng 13-1 gas field, a cornerstone of CNOOC's portfolio, is firmly positioned as a Cash Cow. This mature, offshore Chinese asset, holding approximately 100 billion cubic meters of gas, consistently delivers a stable supply and substantial revenue streams.

With its well-established infrastructure and dominant market presence, Yacheng 13-1 enjoys high profit margins. While its growth prospects are limited due to its mature stage, its reliable output makes it a vital contributor to CNOOC's financial stability.

Large-Scale Existing International Producing Assets

Large-scale existing international producing assets, like certain mature fields in Brazil, function as Cash Cows for CNOOC. These operations, post-initial development, deliver consistent and significant output from established reserves.

These assets are crucial for generating stable cash flow, which is vital for funding CNOOC's strategic investments in other business segments. For instance, CNOOC's stake in the Mero project in Brazil, once past its initial high-growth phase, is expected to contribute substantially to this category.

- Stable Cash Generation: Mature international fields provide predictable revenue streams.

- Portfolio Support: Cash from these assets funds growth initiatives and R&D.

- Reduced Risk Profile: Established production offers lower operational and market volatility compared to new ventures.

- Example: CNOOC's participation in Brazil's pre-salt fields, like Mero, exemplifies this Cash Cow strategy.

Core Offshore Production Infrastructure

CNOOC's core offshore production infrastructure, comprising its established platforms and extensive pipeline networks, firmly sits within the Cash Cow quadrant of the BCG Matrix. This mature, high-volume asset base is a consistent generator of substantial cash flow, thanks to years of optimized operations and efficient extraction processes.

The significant cash generated by these assets requires relatively minimal new investment to maintain current production levels. In 2024, CNOOC reported that its offshore oil and gas production continued to be a primary driver of its financial performance, contributing significantly to its overall revenue and profit margins.

- High Volume, Low Growth: The infrastructure is designed for and achieves high production volumes in mature fields, characteristic of a Cash Cow.

- Consistent Cash Generation: These assets reliably produce significant operating cash flow with predictable returns.

- Low Incremental Investment: Maintaining production from these established fields typically demands lower capital expenditure compared to exploring new frontiers.

- Strategic Importance: While mature, this infrastructure remains critical for CNOOC's overall energy supply and financial stability.

CNOOC's mature Bohai Sea oilfields and Western South China Sea producing assets are prime examples of its Cash Cows. These established operations benefit from well-developed infrastructure, ensuring stable and significant cash flow generation with lower capital expenditure requirements for maintenance. The Yacheng 13-1 gas field also firmly fits this category, consistently delivering substantial revenue from its mature reserves.

These mature assets, including international holdings like certain Brazilian fields, are vital for CNOOC's financial health. They provide the predictable, high-margin revenue needed to fund new investments and research and development. In 2023, CNOOC's overall oil and gas production reached approximately 673.3 million barrels of oil equivalent, with mature fields being the primary contributors to this volume.

| Asset Category | Key Characteristics | Contribution to CNOOC | Example |

| Bohai Sea Oilfields | Mature, high-volume production, stable cash flow, low growth | Reliable income stream, funding for new projects | Bohai Bay fields |

| Western South China Sea | Established infrastructure, consistent output, cost-efficient | Core domestic production, strong profit margins | Various offshore fields |

| Yacheng 13-1 Gas Field | Mature, significant reserves, stable supply, high margins | Consistent revenue, market dominance | Yacheng 13-1 |

| Mature International Assets | Post-development, consistent output, significant cash generation | Supports strategic investments, portfolio diversification | Brazilian pre-salt fields (e.g., Mero) |

Full Transparency, Always

CNOOC BCG Matrix

The CNOOC BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis is ready for immediate use in your strategic planning, offering clear insights into CNOOC's business portfolio without any watermarks or demo content. You can confidently expect the same professional design and data-driven insights in the final downloadable file.

Dogs

CNOOC's divestment of its Gulf of Mexico assets in December 2024 suggests these were likely considered Dogs in the BCG Matrix. These assets probably held a low market share or experienced declining production within a mature and competitive basin, failing to align with CNOOC's strategic growth objectives.

This strategic move to divest underperforming units, such as those in the Gulf of Mexico, allows CNOOC to reallocate capital previously tied up in these less productive areas. Such divestitures are crucial for optimizing the company's portfolio and focusing resources on more promising ventures, potentially boosting overall profitability and operational efficiency in the near future.

Marginal or declining small fields represent CNOOC's "Dogs" in the BCG matrix. These are typically older offshore assets with dwindling production and low market share. For instance, many mature fields in the Bohai Sea, while historically significant, now exhibit declining output, making their operational costs increasingly challenging to justify against their low returns.

These fields are characterized by low growth prospects and minimal profitability, often consuming resources without generating substantial cash flow. While CNOOC might continue to operate them for a period, their economic viability is under constant review. The focus here is on minimizing further investment and exploring options for efficient decommissioning or sale.

CNOOC's refining and chemical segments, while not its primary focus, may present challenges. If these operations show a low market share and struggle with profitability compared to the dominant upstream exploration and production (E&P) business, they could be categorized as Dogs in the BCG matrix.

For instance, if CNOOC's refining segment experienced a decline in margins throughout 2024 due to overcapacity in certain petrochemical products, and its chemical division faced increased competition leading to reduced market share, these would be indicators of underperformance.

Unsuccessful Exploration Blocks

Unsuccessful exploration blocks in CNOOC's portfolio, according to the BCG matrix, are those where initial surveys or drilling efforts have not resulted in commercially viable discoveries. These represent areas that, despite initial high-growth potential, have failed to prove up significant reserves. As such, they cease to be productive and unfortunately consume capital without generating any returns.

These blocks are essentially cash traps within the company's exploration strategy. For instance, in 2024, CNOOC, like many global energy firms, faced the inherent risks in frontier exploration. While specific figures for unsuccessful blocks are proprietary, the industry average for exploration success rates can be quite low, often below 20% for deepwater or complex geological plays. This highlights the significant financial drag these ventures can impose.

- Capital Drain: Unsuccessful blocks tie up capital that could be reinvested in more promising ventures or profitable existing operations.

- Opportunity Cost: The resources allocated to these blocks represent an opportunity cost, meaning they could have been used for activities with a higher probability of generating returns.

- Strategic Re-evaluation: Such blocks often necessitate a strategic re-evaluation, potentially leading to write-offs or a decision to divest if further investment is deemed uneconomical.

Outdated or Inefficient Ancillary Services

Outdated or inefficient ancillary services represent CNOOC's potential Dogs in the BCG Matrix. These are often older operational units or support functions that are not core to the company's primary exploration and production (E&P) business. They typically suffer from low market share and inefficient operations, draining resources without making substantial contributions to overall profitability or strategic objectives.

These units might include legacy infrastructure or services that have become redundant due to technological advancements or shifts in the market. For instance, CNOOC might have older logistical support systems or minor refining assets that are no longer competitive. In 2024, while specific figures for ancillary services are not publicly detailed as distinct BCG categories, CNOOC's focus remains on optimizing its core upstream and midstream operations, indicating a strategic move away from less profitable, non-core activities.

- Legacy Infrastructure: Older pipelines or storage facilities not aligned with current E&P scale.

- Non-Core Support Functions: Inefficient administrative or operational units detached from primary business drivers.

- Low Market Share Assets: Minor business segments with minimal competitive standing.

- Resource Drain: Units consuming capital and management attention with negligible returns.

CNOOC's "Dogs" are typically older, marginal fields with declining production and low market share, such as mature assets in the Bohai Sea. These units offer minimal profitability and growth prospects, often consuming resources without significant returns. The company strategically reviews these for efficient decommissioning or divestment to optimize its portfolio.

Unsuccessful exploration blocks also fall into the Dog category, representing capital consumed without commercial discoveries. These blocks, while possessing initial high-growth potential, fail to yield viable reserves, becoming cash traps. The industry average exploration success rate, often below 20% for complex plays in 2024, underscores the financial drag these ventures can impose.

Outdated ancillary services and non-core support functions that are inefficient and have a low market share also qualify as Dogs. These units may include legacy infrastructure or minor business segments that are not competitive and drain resources. CNOOC's focus on optimizing core upstream and midstream operations in 2024 indicates a strategic shift away from such less profitable activities.

Question Marks

CNOOC's acquisition of petroleum contracts for 10 exploration blocks in Mozambique and Iraq positions these as Question Marks within its BCG Matrix. These ventures are in high-growth potential regions, aligning with CNOOC's strategy to expand its global footprint, yet its current market share in these specific areas is low.

Significant capital investment is crucial for CNOOC to assess the commercial viability of these Mozambique and Iraq blocks. The success of these exploration efforts will determine if they can transition from Question Marks to Stars, requiring careful resource allocation and risk management.

CNOOC's focus on screening and building onshore photovoltaic projects marks a strategic entry into the burgeoning renewable energy sector. Despite this initiative, CNOOC's current market share in onshore solar is minimal, indicating a nascent position in this competitive landscape.

Significant capital expenditure is necessary for these projects to achieve scale and build a competitive foothold. For context, in 2023, China's total installed solar capacity reached over 600 GW, with onshore projects forming the bulk of this.

CNOOC is actively advancing regional Carbon Capture, Utilization, and Storage (CCUS/CCS) pilot projects, notably in the Bohai Sea and Hainan. These initiatives place CNOOC within a high-growth, emerging market focused on decarbonization, aligning with global sustainability trends.

While these projects demonstrate CNOOC's commitment to CCUS/CCS, the company's commercial scale and market share in this sector remain limited to demonstration phases. This indicates an early stage of development for these critical decarbonization technologies within CNOOC's portfolio.

Significant capital investment is essential to transition these pilot projects from demonstration to industrial-scale operations. For instance, global CCUS projects require substantial upfront investment, with some estimates suggesting billions of dollars for large-scale facilities to achieve meaningful carbon reduction.

Artificial Intelligence and Digital Integration Initiatives

CNOOC's investments in artificial intelligence and digital integration, such as developing intelligent oil and gas fields and deploying AI models like 'Hi-Energy', position it within a high-growth digital transformation sector. These efforts are geared towards driving technological innovation and operational efficiency.

While these initiatives are crucial for future competitiveness, their direct impact on CNOOC's current market share is indirect. Continuous investment is necessary to translate these technological advancements into tangible, widespread competitive advantages.

- Intelligent Field Development: CNOOC is actively investing in smart oilfield technologies to enhance production and reduce operational costs.

- AI Model Deployment: The 'Hi-Energy' AI platform is being utilized to optimize exploration, drilling, and production processes, aiming for greater efficiency.

- Digital Transformation Focus: These initiatives align with CNOOC's broader strategy to embrace digital transformation, a sector experiencing significant growth.

- Market Share Impact: The direct contribution to market share is currently less pronounced, requiring ongoing investment to demonstrate a clear competitive edge.

New Deep-Play Exploration in Unproven Basins

New deep-play exploration in unproven basins represents CNOOC's "Question Marks" in the BCG Matrix. These ventures involve significant upfront investment in understanding complex geology, with the potential for substantial future returns if successful.

These high-risk, high-reward initiatives currently hold a low market share for CNOOC. For instance, in 2024, CNOOC's exploration budget allocated a significant portion to frontier areas, aiming to unlock new reserve potential.

- High Risk, High Reward: Ventures into unproven basins carry inherent geological and technological uncertainties.

- Low Market Share: CNOOC's current presence in these nascent areas is minimal, reflecting their early stage.

- Sustained Investment: De-risking these plays requires substantial and ongoing capital expenditure.

- Potential for Growth: Successful exploration can lead to significant new reserve additions and future market leadership.

CNOOC's ventures into new deep-play exploration in unproven basins are classic Question Marks. These are high-risk, high-reward opportunities where CNOOC is investing heavily to understand complex geology. While the potential for significant future returns is present, their current market share in these nascent areas is minimal.

In 2024, CNOOC's exploration budget saw a notable allocation towards these frontier areas, reflecting a strategic push to unlock new reserve potential. The success of these deep-play explorations is critical for CNOOC to potentially transform these Question Marks into future Stars.

Sustained and substantial capital expenditure is necessary to de-risk these plays and prove their commercial viability. Successful exploration in these unproven basins could lead to significant new reserve additions, potentially establishing future market leadership for CNOOC.

| Venture Area | BCG Category | Current Market Share | Investment Need | Growth Potential |

|---|---|---|---|---|

| Deep-Play Exploration (Unproven Basins) | Question Mark | Low | High (Capital Intensive) | High (if successful) |

| Mozambique & Iraq Petroleum Contracts | Question Mark | Low | High (Exploration & Development) | High (Regionally) |

| Onshore Photovoltaic Projects | Question Mark | Minimal | High (Scale & Infrastructure) | High (Renewable Sector Growth) |

| CCUS/CCS Pilot Projects | Question Mark | Limited (Demonstration Phase) | High (Industrial Scale-up) | High (Decarbonization Demand) |

| AI & Digital Integration | Question Mark | Indirect Impact | Continuous (Technology Advancement) | High (Operational Efficiency & Innovation) |

BCG Matrix Data Sources

Our CNOOC BCG Matrix is built on comprehensive data, integrating financial reports, market research, and internal operational data to provide a clear strategic overview.