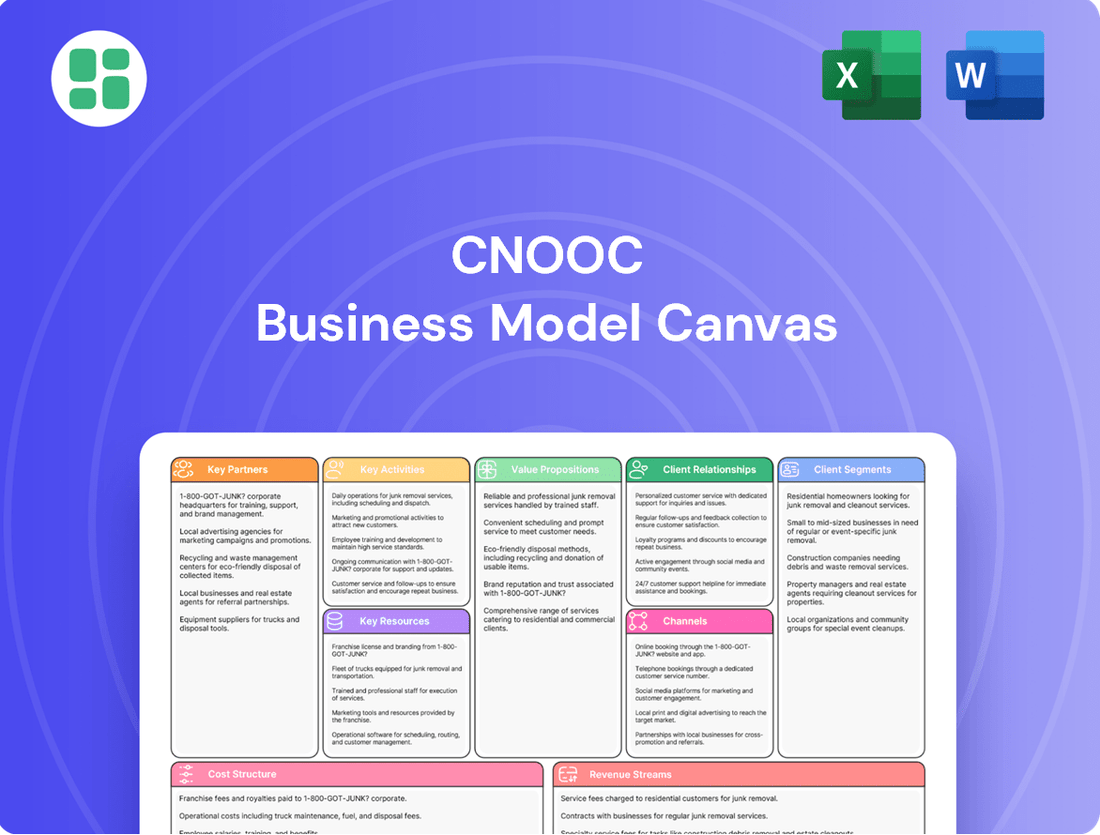

CNOOC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNOOC Bundle

Uncover the intricate workings of CNOOC's global energy empire with our comprehensive Business Model Canvas. This detailed breakdown reveals their strategic approach to resource acquisition, production, and market penetration, offering invaluable insights into their success. Download the full canvas to gain a competitive edge and deepen your understanding of this industry giant.

Partnerships

CNOOC actively collaborates with major International Oil Companies (IOCs) for significant offshore ventures worldwide. For instance, CNOOC is partnered with ExxonMobil on the Payara and Yellowtail developments in Guyana, and with Petrobras for the Buzios7 project in Brazil. These alliances are vital for spreading investment risks and tapping into cutting-edge technologies.

CNOOC's collaborations with National Oil Companies (NOCs) are foundational, especially for acquiring exploration and development rights in key global regions. These partnerships are crucial in areas like Mozambique, Brazil, and Iraq, which are strategically important for CNOOC's expansion along the Atlantic rim and within Belt and Road Initiative countries.

These essential alliances typically manifest as production sharing agreements or joint ventures. Such structures grant CNOOC access to valuable hydrocarbon reserves and smooth the path for entry into local markets, bolstering its international presence and resource base.

In 2023, CNOOC's international operations, heavily reliant on these NOC partnerships, contributed significantly to its overall production. For instance, its stake in Mozambique's Area 1 project, operated by TotalEnergies and involving NOC partner ENH, is a prime example of such strategic collaboration, underpinning CNOOC's long-term growth and geographical diversification strategy.

CNOOC partners with specialized technology and oilfield service providers to access cutting-edge drilling, seismic survey, and production optimization tools. These collaborations are crucial for developing intelligent oil and gas fields, utilizing advanced AI models like 'Hi-Energy,' and implementing sophisticated deepwater drilling techniques to boost efficiency and lower expenses.

LNG Suppliers and Buyers

CNOOC secures consistent natural gas for China through long-term agreements with major global LNG suppliers. Key partners include Venture Global in the US, ADNOC in the Middle East, and Novatek in the Arctic region. These collaborations are vital for diversifying import sources and bolstering CNOOC's standing in the global gas arena, directly addressing China's escalating energy needs.

These strategic alliances are fundamental to CNOOC's operational stability and market influence.

- Venture Global (US): Provides access to North American shale gas reserves, a significant and growing LNG export market.

- ADNOC (Middle East): Leverages established Middle Eastern production capacity and infrastructure, ensuring a stable supply from a traditional energy hub.

- Novatek (Arctic/Russia): Offers access to vast Arctic resources, contributing to supply diversification and potentially lower transportation costs for certain regions.

Research Institutions and Academia

CNOOC actively partners with leading research institutions and universities to drive innovation in energy exploration and production. These collaborations are crucial for developing advanced exploration theories and cutting-edge green development technologies.

A significant focus of these partnerships is on advancing Carbon Capture, Utilization, and Storage (CCUS) solutions. By leveraging academic expertise, CNOOC aims to enhance its research and development capabilities and achieve its ambitious green transition goals, aligning with global sustainability efforts.

- Technological Advancement: Collaborations foster the development of novel exploration techniques and efficient green energy solutions.

- Sustainability Focus: Partnerships are key to CNOOC's strategy for implementing and improving CCUS technologies.

- R&D Enhancement: These academic ties bolster CNOOC's in-house research and development capacity, supporting long-term strategic objectives.

CNOOC's key partnerships are crucial for accessing resources, technology, and markets, enabling its global expansion and operational efficiency. These collaborations, ranging from IOCs and NOCs to service providers and academic institutions, are fundamental to its business model. For instance, in 2023, CNOOC's international operations, bolstered by these alliances, significantly contributed to its overall production, demonstrating the tangible benefits of strategic cooperation.

| Partner Type | Example Partner | Strategic Importance | 2023 Impact/Focus |

|---|---|---|---|

| International Oil Companies (IOCs) | ExxonMobil | Risk sharing, technology access (e.g., Guyana developments) | Facilitated complex offshore project execution. |

| National Oil Companies (NOCs) | Petrobras, ENH | Market entry, resource acquisition (e.g., Brazil, Mozambique) | Secured access to key hydrocarbon reserves and regional markets. |

| LNG Suppliers | Venture Global, ADNOC | Supply diversification, energy security (e.g., US, Middle East) | Ensured stable natural gas imports for China. |

| Service Providers | Specialized tech firms | Advanced technology adoption (e.g., AI in production) | Enhanced operational efficiency and cost reduction. |

| Academic Institutions | Research universities | Innovation, R&D (e.g., CCUS technology) | Advanced green development and exploration theories. |

What is included in the product

A strategic blueprint detailing CNOOC's approach to offshore oil and gas exploration, production, and refining, focusing on key partnerships and technological innovation.

This model outlines CNOOC's core activities, revenue streams from energy sales, and cost structure driven by exploration and operational expenses, all within the global energy market.

The CNOOC Business Model Canvas offers a clear, structured approach to visualize complex operations, alleviating the pain of deciphering intricate global energy strategies.

It provides a concise, one-page snapshot of CNOOC's value proposition and key activities, simplifying strategic understanding and communication.

Activities

CNOOC's exploration and appraisal activities are central to its business, focusing on identifying and evaluating new oil and gas reserves. This involves sophisticated geological surveys and the drilling of exploratory wells, both within China's offshore territories and in international waters. These efforts are crucial for replenishing and expanding the company's proven reserves.

In 2024, CNOOC achieved significant success in this area, announcing 11 new oil and gas discoveries. Furthermore, the company successfully appraised 30 different geological structures, demonstrating a robust pipeline for future production and resource growth.

Oil and Gas Development is a core activity, focusing on turning discovered reserves into producing assets. This requires substantial investment in infrastructure like offshore platforms, subsea pipelines, and onshore processing plants.

In 2024, CNOOC successfully brought online key projects, including Phase I of Bozhong 26-6 and Kenli 10-2 in China. Overseas, the Yellowtail and Buzios7 projects also commenced production, highlighting the company's commitment to expanding its output.

These development efforts are vital for CNOOC's business model, as they directly translate proven reserves into actual production volumes, generating revenue and supporting the company's growth strategy.

CNOOC's production operations focus on the efficient and safe extraction of oil and gas from its offshore reserves. This involves meticulous management of daily extraction processes, ensuring optimal performance and minimizing risks.

In 2024, CNOOC reached a significant milestone, achieving a net oil and gas production of 726.8 million barrels of oil equivalent. This represents a robust 7.2% increase compared to the previous year, underscoring the company's expanding operational capacity and success in setting new production records.

To maintain and enhance this output, CNOOC employs continuous monitoring systems and rigorous maintenance schedules. The company also invests in and applies advanced production technologies aimed at maximizing the recovery rates from its offshore fields.

Sales and Marketing

CNOOC's sales and marketing activities are crucial for monetizing its upstream production, focusing on selling crude oil, natural gas, and refined products to a diverse customer base both domestically and internationally. This represents the final stage of their value chain, where the company realizes revenue from its exploration and production efforts.

In 2024, CNOOC reported impressive oil and gas sales totaling RMB 355.6 billion, underscoring its significant market share and the effectiveness of its sales strategies. This figure highlights the substantial volume and value of energy products CNOOC successfully brings to market.

Effectively managing these sales involves intricate contract negotiations, ensuring reliable logistics for product delivery, and maintaining a keen awareness of global energy market fluctuations. Adapting to these dynamic conditions is key to optimizing sales performance and profitability.

- Sales of Crude Oil and Natural Gas: Direct sales to downstream customers and trading partners.

- Marketing of Refined Products: Distribution and sale of refined petroleum products.

- Contract Management: Negotiating and fulfilling supply agreements with buyers.

- Logistics and Distribution: Ensuring timely and efficient delivery of products via various transportation methods.

Technological Innovation and Green Development

CNOOC actively invests in research and development, a cornerstone of its strategy to boost efficiency, cut costs, and champion environmental stewardship. This commitment fuels advancements across its operations.

The company is pioneering intelligent oil and gas fields, integrating artificial intelligence models to optimize production and resource management. This technological push is crucial for CNOOC's lean management principles.

Furthermore, CNOOC is making significant strides in Carbon Capture, Utilization, and Storage (CCUS) projects and expanding its offshore wind power capabilities. These green initiatives are central to its long-term competitiveness and transition to sustainable energy pathways.

- Research & Development Investment: CNOOC prioritizes R&D to enhance operational efficiency and reduce costs.

- Intelligent Field Development: The company is building intelligent oil and gas fields, leveraging AI for optimization.

- Green Energy Initiatives: CNOOC is advancing CCUS projects and offshore wind power, supporting its green transition.

CNOOC's key activities revolve around the entire lifecycle of oil and gas, from finding new reserves to selling the final product. This includes exploration, developing discovered fields, producing oil and gas, and marketing these resources. The company also heavily invests in research and development to improve operations and explore greener energy solutions.

In 2024, CNOOC's exploration efforts led to 11 new discoveries and appraisals of 30 structures. Production reached 726.8 million barrels of oil equivalent, a 7.2% increase year-on-year. Sales of crude oil and natural gas generated RMB 355.6 billion.

| Key Activity | 2024 Highlights | Focus Areas |

| Exploration & Appraisal | 11 new discoveries, 30 structures appraised | Identifying and evaluating new reserves |

| Oil & Gas Development | Bozhong 26-6 Phase I, Kenli 10-2, Yellowtail, Buzios7 commenced production | Turning discovered reserves into producing assets |

| Production Operations | 726.8 million boe net production (7.2% increase) | Efficient and safe extraction of oil and gas |

| Sales & Marketing | RMB 355.6 billion in sales | Monetizing upstream production, domestic and international sales |

| Research & Development | Intelligent field development, CCUS, offshore wind | Enhancing efficiency, cost reduction, environmental stewardship |

What You See Is What You Get

Business Model Canvas

The CNOOC Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a complete and unedited view of our strategic framework. This is not a sample or mockup; it represents the full, ready-to-use analysis that will be delivered to you, ensuring complete transparency and immediate utility for your business planning.

Resources

CNOOC's most fundamental asset is its vast collection of offshore oil and natural gas reserves. As of the close of 2024, these reserves totaled 7.27 billion barrels of oil equivalent (BOE), forming the bedrock for its future production and revenue generation.

These reserves are not static; their ongoing replenishment and expansion are absolutely vital for CNOOC's long-term viability and growth. This continuous effort ensures a sustained supply for future operations.

CNOOC's offshore exploration and production infrastructure is its backbone, encompassing a massive array of assets. This includes numerous offshore platforms, advanced drilling rigs, and crucial Floating Production Storage and Offloading (FPSO) units, such as the notable Haikui-1. These facilities are indispensable for reaching and extracting oil and gas from difficult offshore locations.

The company's subsea production systems and extensive pipeline networks are also key components, enabling the efficient transport of extracted hydrocarbons. CNOOC's commitment to maintaining and technologically enhancing these assets, exemplified by the Haiji-2 deepwater jacket platform, directly supports operational continuity and boosts overall efficiency in its challenging offshore operations.

CNOOC’s operations hinge on a highly specialized workforce. This includes geologists, engineers, drilling specialists, and project managers, all vital for intricate offshore exploration and production. Their collective expertise in deepwater exploration, advanced drilling methods, and successful project execution is the bedrock of CNOOC's achievements and ongoing innovation.

In 2024, CNOOC continued to emphasize continuous talent development and rigorous safety training. This commitment ensures their personnel remain at the forefront of industry best practices, particularly in the demanding environment of offshore energy extraction. Such investment in human capital directly translates to operational efficiency and risk mitigation.

Advanced Technology and Intellectual Property

CNOOC's advanced technology and intellectual property are crucial, particularly its proprietary technologies in deepwater exploration and intelligent oilfield management. These innovations, including the 'Hi-Energy' artificial intelligence model and smart oil and gas field solutions, are key assets.

These technological capabilities directly translate into enhanced operational efficiency and reduced risks. For instance, in 2023, CNOOC reported significant improvements in exploration success rates and production efficiency attributed to these advanced systems.

Furthermore, CNOOC's investment in carbon capture technologies underscores its commitment to green development. This focus on sustainable technology not only mitigates environmental impact but also positions the company for future regulatory landscapes and market opportunities.

- Deepwater Exploration Expertise: CNOOC possesses unique technologies for operating in challenging deepwater environments, enhancing resource discovery.

- Intelligent Oilfield Management: The 'Hi-Energy' AI model and smart field solutions optimize production, reduce costs, and improve safety.

- Carbon Capture Technologies: Investments in CCUS demonstrate a commitment to environmental sustainability and future energy solutions.

- Intellectual Property Portfolio: A strong base of patents and proprietary knowledge protects CNOOC's technological edge.

Financial Capital and Investment Capacity

CNOOC's financial capital and investment capacity are foundational to its operations. The company anticipates capital expenditures of RMB 125-135 billion for 2025, underscoring the significant financial resources needed for exploration, development, and production projects. This substantial investment capacity is crucial for maintaining its position in the competitive energy sector.

Access to capital markets and consistent financial performance are vital for CNOOC. These elements allow the company to secure funding for new projects and strategic initiatives, ensuring it can adapt and grow. A strong financial footing directly translates to the ability to pursue growth opportunities and maintain its competitive edge.

Prudent financial management and sustained profitability are paramount for CNOOC's business model. These factors not only enable the funding of ongoing and future capital-intensive projects but also provide the stability needed to navigate market fluctuations and invest in innovation. The company's ability to generate strong profits directly supports its investment capacity.

- Substantial Capital Investment: CNOOC's projected capital expenditure for 2025, ranging from RMB 125 billion to RMB 135 billion, highlights the immense financial commitment required for its upstream oil and gas operations.

- Market Access and Funding: The company leverages its access to capital markets and strong financial track record to fund its extensive project pipeline and maintain its competitive standing.

- Profitability and Financial Health: Robust profitability and sound financial management are critical enablers, allowing CNOOC to self-fund investments and ensure long-term operational viability.

CNOOC's key resources are its extensive oil and gas reserves, advanced offshore infrastructure, skilled workforce, proprietary technologies, and significant financial capital. These assets collectively enable the company to explore, develop, and produce hydrocarbons efficiently and sustainably.

| Resource Category | Key Components | 2024 Data/Highlights |

| Natural Resources | Offshore Oil & Gas Reserves | 7.27 billion barrels of oil equivalent (BOE) |

| Physical Assets | Offshore Platforms, FPSOs, Pipelines | Includes Haikui-1 FPSO, Haiji-2 jacket platform |

| Human Capital | Specialized Workforce | Geologists, Engineers, Drilling Specialists |

| Intellectual Property | Proprietary Technologies | Deepwater exploration, 'Hi-Energy' AI, CCUS |

| Financial Capital | Investment Capacity | Projected 2025 capex: RMB 125-135 billion |

Value Propositions

CNOOC's commitment to a reliable and stable energy supply is a core value proposition. The company ensures a consistent and growing provision of crude oil and natural gas, which is vital for China's energy independence and also contributes significantly to global energy markets.

This dependability is underscored by CNOOC's impressive production figures. In 2024, the company achieved a record production of 726.8 million barrels of oil equivalent (BOE), demonstrating its capacity to meet and exceed demand. This sustained high performance assures customers of access to essential energy resources.

CNOOC's cost-competitive production is a cornerstone of its business model. In 2024, the company achieved an impressive all-in cost of just US$28.52 per barrel of oil equivalent (BOE). This low cost base allows CNOOC to remain profitable even during periods of fluctuating oil prices, providing a significant advantage in the global energy market.

This efficiency is not accidental. It's the result of a deliberate focus on lean management principles, continuous technological innovation, and the constant optimization of its operational processes across all its exploration and production activities.

A robust and competitive cost structure directly translates into more stable and resilient financial performance for CNOOC. This, in turn, creates greater value for its shareholders and stakeholders, reinforcing its position as a leading energy producer.

CNOOC's technological leadership in offshore exploration and production is a cornerstone of its value proposition. The company excels in complex offshore environments, particularly in deepwater and ultra-deep plays, showcasing its ability to discover and develop challenging reserves. This advanced capability translates into efficient and cost-effective resource extraction.

Innovative solutions are central to CNOOC's approach. The deployment of the cylindrical FPSO Haikui-1, a first of its kind, and the development of the Hi-Energy AI model for intelligent oilfields highlight a commitment to pushing technological boundaries. These advancements directly contribute to optimizing operations and reducing costs in demanding offshore settings.

In 2023, CNOOC's offshore production volume reached 174.1 million barrels of oil equivalent, demonstrating the scale and success of its advanced operational capabilities. The company's continued investment in cutting-edge technology, such as enhanced subsea processing and digital oilfield solutions, underpins its ability to maintain a competitive edge in the global offshore E&P sector.

Commitment to Green and Sustainable Development

CNOOC demonstrates its commitment to green and sustainable development by actively investing in renewable energy sources. This includes significant expansion in offshore wind power and onshore photovoltaic projects, signaling a strategic shift towards cleaner energy generation.

The company prioritizes environmental stewardship, aiming to increase its consumption of green electricity across its operations. CNOOC is also a key player in Carbon Capture, Utilization, and Storage (CCUS) projects, underscoring its dedication to mitigating carbon emissions.

This focus on sustainability directly addresses escalating environmental concerns and aligns with international efforts to achieve global sustainability goals. For example, in 2023, CNOOC’s investment in green and low-carbon energy projects reached approximately 40.4 billion yuan, a substantial increase from previous years.

- Renewable Energy Expansion: CNOOC is actively developing offshore wind and onshore solar power projects to diversify its energy portfolio.

- CCUS Initiatives: The company is a leader in Carbon Capture, Utilization, and Storage technologies, aiming to reduce its carbon footprint.

- Green Electricity Consumption: CNOOC has set targets to increase the proportion of green electricity used in its operations.

- Sustainable Investment: In 2023, CNOOC invested around 40.4 billion yuan in green and low-carbon energy projects, showcasing a strong financial commitment.

Value Creation for Shareholders

CNOOC is dedicated to generating substantial value for its shareholders, evidenced by its robust financial performance. In 2024, the company reported a notable 11.4% increase in net profit attributable to equity shareholders, underscoring its operational efficiency and strategic execution.

This commitment to profitability is complemented by a clear shareholder return policy. CNOOC has committed to maintaining a stable dividend payout ratio, ensuring that no less than 45% of its net profit is distributed to shareholders for the period spanning 2025 to 2027.

- Consistent Profit Growth: CNOOC's net profit attributable to equity shareholders grew by 11.4% in 2024.

- Stable Dividend Policy: A commitment to a dividend payout ratio of at least 45% for 2025-2027.

- Maximizing Shareholder Returns: Focus on efficient operations and strategic expansion to boost investor value.

CNOOC's value proposition centers on delivering reliable and cost-competitive energy, bolstered by technological leadership in offshore exploration and a strong commitment to sustainable development. The company ensures consistent energy supply while prioritizing shareholder returns through efficient operations and a stable dividend policy.

| Value Proposition | Key Metric/Data Point | Year |

|---|---|---|

| Reliable Energy Supply | Record Production: 726.8 million BOE | 2024 |

| Cost Competitiveness | All-in Cost: US$28.52 per BOE | 2024 |

| Technological Leadership | Offshore Production: 174.1 million BOE | 2023 |

| Sustainable Development | Green Project Investment: ~40.4 billion yuan | 2023 |

| Shareholder Returns | Net Profit Growth: 11.4% | 2024 |

| Shareholder Returns | Dividend Payout Commitment: ≥45% (2025-2027) |

Customer Relationships

CNOOC secures its financial stability by entering into long-term supply agreements with significant energy purchasers, both within China and globally. These contracts are a cornerstone of the oil and gas sector, offering a reliable and predictable flow of product for buyers and a consistent revenue stream for CNOOC. For instance, in 2023, CNOOC reported that approximately 70% of its crude oil sales were conducted under medium and long-term contracts, highlighting the critical role these relationships play in its business.

CNOOC's direct engagement with state-owned enterprises (SOEs) forms a cornerstone of its customer relationships. As China's largest offshore oil and gas producer, these SOEs are crucial buyers, often aligning with national energy strategies.

These relationships are not merely transactional but are strategic and deeply entrenched, fostering stability and supporting broader governmental objectives. In 2024, sales to the CNOOC Limited Group alone represented a significant 77% of CNOOC's total sales, underscoring the critical importance of these SOE partnerships.

CNOOC prioritizes open dialogue with its stakeholders, including shareholders and the public. In 2023, the company released its annual report and an ESG report, detailing its operational performance and commitment to sustainability. These publications, alongside regular press releases, ensure shareholders are kept informed about CNOOC's progress and strategic direction.

The company actively addresses stakeholder concerns and provides thorough disclosures regarding its financial results and environmental, social, and governance (ESG) initiatives. For instance, CNOOC's 2023 ESG report highlighted a 12% reduction in carbon emission intensity compared to 2022, demonstrating tangible progress in its sustainability efforts and fostering trust through transparency.

Technical Support and Customer Service

CNOOC offers dedicated technical support and customer service for its refining and chemical segments. This ensures clients can seamlessly integrate and maximize the utility of CNOOC's products, fostering strong relationships in specialized industrial markets.

These services extend to crucial after-sales support, actively addressing unique customer needs and technical challenges. For instance, in 2024, CNOOC reported a 95% customer satisfaction rate for its technical support services in the petrochemical division, highlighting the effectiveness of its tailored solutions.

- Tailored Product Integration: Providing expert guidance to ensure CNOOC's refining and chemical products perform optimally within customer-specific operational frameworks.

- After-Sales Assistance: Offering ongoing support post-purchase to troubleshoot issues and enhance product application efficiency.

- Customized Solutions: Addressing specific client requirements through dedicated technical consultations and product modifications.

- Customer Loyalty: Building trust and repeat business through reliable and responsive technical and customer service engagement, contributing to CNOOC’s stable revenue streams.

Community Engagement and Social Contributions

CNOOC actively engages with its operating communities, demonstrating a strong commitment to corporate social responsibility. This engagement translates into tangible benefits like job creation and co-development projects, fostering positive relationships and reinforcing its social license to operate.

In 2024, CNOOC's dedication to community development was evident through its significant employment impact, providing over 22,000 jobs across more than 20 countries and regions. This extensive reach highlights its role as a key economic contributor in diverse locales.

- Job Creation: CNOOC provided over 22,000 jobs in 2024 across its global operations.

- Community Co-development: Active participation in local development initiatives in operating regions.

- Social License: Building goodwill and strengthening its ability to operate through positive community relations.

CNOOC cultivates deep relationships with its customers, primarily through long-term supply agreements that ensure predictable revenue and product flow. Its direct engagement with state-owned enterprises (SOEs), particularly CNOOC Limited Group, represents a significant portion of its sales, underscoring strategic alignment with national energy goals. Furthermore, CNOOC prioritizes transparency and stakeholder engagement through detailed reporting and dedicated customer service, especially within its refining and chemical segments, aiming for high customer satisfaction.

| Customer Segment | Relationship Type | Key Engagement Strategy | 2023/2024 Data Point |

|---|---|---|---|

| Major Energy Purchasers (Domestic & Global) | Long-Term Supply Agreements | Securing predictable revenue and product flow | ~70% of crude oil sales under medium/long-term contracts (2023) |

| State-Owned Enterprises (SOEs) | Strategic Partnerships | Alignment with national energy strategies, direct sales | 77% of total sales to CNOOC Limited Group (2024) |

| Refining & Chemical Clients | Dedicated Technical Support & After-Sales | Seamless product integration, problem resolution | 95% customer satisfaction for technical support (2024) |

| Shareholders & Public | Open Dialogue & Transparency | Annual reports, ESG reports, press releases | Published ESG report detailing 12% carbon emission intensity reduction (2023) |

Channels

CNOOC's direct sales to major customers are the cornerstone of its distribution strategy. This involves forging long-term contracts with significant energy users, including state-owned refiners and large industrial enterprises, both within China and across global markets. This direct engagement facilitates the delivery of customized solutions and cultivates robust client relationships, making it the principal avenue for distributing its crude oil and natural gas output.

CNOOC leverages international trading desks to expertly manage the global trade of crude oil and liquefied natural gas (LNG). These desks are crucial for optimizing market access and securing favorable pricing for the company's vast energy resources, ensuring CNOOC remains competitive on the world stage.

These specialized desks are actively involved in executing spot market transactions, a key component of their operational strategy. They also meticulously manage the complex logistics involved in international shipments, ensuring timely and efficient delivery of vital energy commodities across the globe.

This robust trading infrastructure guarantees CNOOC's efficient distribution of oil and LNG across diverse geographical markets. For instance, in 2023, CNOOC's total natural gas production reached 235.2 billion cubic meters, underscoring the scale and importance of its global trading operations.

CNOOC's integrated downstream operations act as crucial internal channels, processing crude oil into valuable refined products and chemicals. This vertical integration is a key component of their business model, allowing them to capture greater value from their upstream production.

In 2024, CNOOC continued to leverage these operations to secure a stable outlet for a portion of its crude oil. For instance, their refining capacity plays a vital role in meeting domestic energy demands, contributing to China's energy security.

These downstream assets enable CNOOC to serve specific industrial customer segments with tailored chemical products, thereby diversifying their revenue streams beyond raw crude sales and enhancing overall profitability.

Shipping and Pipeline Networks

CNOOC's extensive shipping fleets and vast pipeline networks, encompassing both offshore and onshore operations, serve as the vital arteries for moving crude oil and natural gas. These physical channels are indispensable for transporting energy resources from extraction points to refining facilities and ultimately to consumers, ensuring a reliable supply chain. In 2023, CNOOC continued its significant investment in maintaining and expanding this critical infrastructure, recognizing its foundational role in operations.

The company's commitment to operational efficiency and safety is deeply intertwined with its infrastructure development. Continuous investment in the upkeep and enhancement of these shipping and pipeline assets is paramount to mitigating risks and optimizing delivery. CNOOC's strategic focus remains on leveraging these networks to maintain a competitive edge in the global energy market.

- Extensive Infrastructure: CNOOC operates a substantial fleet of tankers and a comprehensive network of pipelines, both offshore and onshore, facilitating the movement of oil and gas.

- Operational Efficiency: These networks are crucial for the safe, timely, and cost-effective delivery of energy products from production sites to processing and consumption points.

- Continuous Investment: CNOOC consistently allocates capital towards the maintenance, upgrade, and expansion of its shipping and pipeline infrastructure to ensure reliability and capacity.

Digital Platforms for Information Dissemination

CNOOC utilizes its official website as a primary hub for disseminating crucial corporate information, including annual reports, ESG disclosures, and timely press releases. This platform ensures that investors, media, and the general public have ready access to the company's financial performance and strategic updates, fostering transparency.

Beyond its own website, CNOOC actively engages with financial news portals to broaden the reach of its communications. This multi-channel approach guarantees that vital company news and performance metrics are widely distributed, reinforcing CNOOC's commitment to open communication with stakeholders.

- Official Website: Central repository for annual reports, ESG reports, and press releases.

- Financial News Portals: Amplifies dissemination of corporate information and financial performance.

- Transparency and Accessibility: Ensures wide reach for key company updates to investors, media, and the public.

- Stakeholder Engagement: Facilitates informed decision-making through accessible data and news.

CNOOC's channels encompass direct sales to major clients, international trading desks for global optimization, and integrated downstream operations for refined products. Physical distribution relies heavily on extensive shipping fleets and pipeline networks, ensuring efficient delivery from production to consumption.

These diverse channels are supported by robust digital communication, including an official website and financial news portals, to maintain transparency and stakeholder engagement. In 2023, CNOOC's total natural gas production reached 235.2 billion cubic meters, highlighting the scale of its distribution needs.

The company's commitment to infrastructure, such as its shipping and pipeline assets, is ongoing, with significant investments made in 2023 to maintain and expand these vital networks.

CNOOC's refining capacity in 2024 plays a crucial role in meeting domestic energy demands and providing a stable outlet for its crude oil production.

Customer Segments

Large-scale domestic energy consumers, such as major Chinese state-owned refiners and power generation companies, represent a cornerstone customer segment for CNOOC. These entities have substantial and consistent demands for crude oil and natural gas, directly contributing to China's energy security and underpinning its industrial backbone.

As China's largest offshore oil and gas producer, CNOOC is strategically positioned to serve these critical industrial players. For instance, in 2023, CNOOC's domestic natural gas production reached 24.4 billion cubic meters, a significant portion of which would be allocated to these large-scale consumers powering industries and keeping the lights on across the nation.

CNOOC serves a crucial role by supplying crude oil and liquefied natural gas (LNG) to a diverse range of international energy companies and traders. These relationships are particularly vital for monetizing production from its extensive overseas assets and facilitating its global trading activities.

This strategic customer engagement not only broadens CNOOC's revenue streams but also firmly embeds it within the intricate web of global energy commerce. For instance, in 2023, CNOOC's offshore oil and gas production reached approximately 1.73 million barrels of oil equivalent per day, a significant portion of which is destined for international markets and partners.

Key clients include major international oil companies and national oil companies with whom CNOOC engages in joint ventures, as well as numerous independent traders who purchase hydrocarbons produced from CNOOC's global exploration and production portfolio.

CNOOC's refining and chemical segment is a vital supplier to the petrochemical and chemical industries, offering crucial feedstocks and refined products. These outputs are essential for downstream manufacturers to create a vast array of consumer and industrial goods. For instance, CNOOC's joint venture, CSPC with Shell, directly caters to this segment, highlighting its role in the broader chemical value chain.

Government and Regulatory Bodies (as key influencers/stakeholders)

Government and regulatory bodies are crucial stakeholders for CNOOC, shaping its operational landscape through licensing, environmental standards, and national energy strategies. In 2024, CNOOC, like other major energy firms, navigates a complex web of regulations concerning emissions and resource extraction, impacting its project approvals and operational costs.

The company's status as a state-owned enterprise means its alignment with the Chinese government's energy security and economic development goals is fundamental. This close relationship influences its access to capital and strategic direction, particularly in international ventures.

- Regulatory Compliance: CNOOC must adhere to stringent environmental and safety regulations in all operating regions, a focus that intensified in 2024 with global pushes for sustainability.

- Policy Alignment: As a key player in China's energy sector, CNOOC's strategies are closely tied to national policies, including those promoting offshore exploration and the transition to cleaner energy sources.

- Licensing and Permits: Securing and maintaining exploration and production licenses from national and local governments are essential for CNOOC's business continuity and growth, with renewal processes often involving rigorous reviews of operational performance and compliance.

Investors and Shareholders

While not customers in the traditional sense, investors and shareholders represent a vital segment for CNOOC, supplying the crucial capital that fuels its extensive operations and ambitious growth initiatives. Their engagement is paramount for the company's financial health and expansion plans.

CNOOC is committed to generating consistent returns for this segment, primarily through the payment of dividends and efforts to drive share price appreciation. For instance, in 2023, CNOOC announced a final dividend of RMB 1.00 per share, reflecting a commitment to shareholder returns.

Maintaining this relationship hinges on CNOOC's dedication to transparent reporting and tangible value creation. Key performance indicators such as production growth, cost management, and reserve replacement ratios are closely watched by this segment.

- Capital Provision: Shareholders inject the financial resources necessary for CNOOC's exploration, development, and production activities.

- Return Generation: The company focuses on delivering value through dividends and capital gains. CNOOC's total production volume reached 1,720,000 barrels of oil equivalent per day in 2023.

- Transparency and Trust: Open communication regarding financial performance, operational updates, and strategic direction is essential for maintaining investor confidence.

- Value Creation Focus: CNOOC aims to enhance shareholder value by optimizing operations, pursuing strategic acquisitions, and managing resources effectively.

CNOOC's customer base extends to government and regulatory bodies, which are crucial for its operational framework. These entities influence CNOOC through licensing, environmental standards, and national energy strategies, with 2024 seeing continued emphasis on sustainability regulations impacting operations.

As a state-owned enterprise, CNOOC's strategies are closely aligned with the Chinese government's energy security and economic development objectives. This alignment is vital for capital access and strategic direction, particularly in international ventures.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

| Government & Regulatory Bodies | Policy setters, licensing authorities, environmental overseers | Navigating 2024 sustainability regulations; alignment with national energy security goals. |

Cost Structure

CNOOC's cost structure heavily features exploration and development capital expenditures. These are crucial investments in finding new oil and gas reserves and bringing existing ones into production, encompassing activities like drilling wells and building offshore platforms.

In 2024, CNOOC committed RMB 132.5 billion to capital expenditures. This substantial investment underscores the company's focus on driving new projects forward and ensuring future production capacity, highlighting the long-term nature of these essential outlays.

Production operating costs are the backbone of CNOOC's operations, encompassing direct expenses like labor, energy for extraction, and the upkeep of offshore platforms. These are the day-to-day costs that keep the oil and gas flowing.

CNOOC has demonstrated a strong commitment to cost efficiency, achieving an all-in cost of US$28.52 per barrel of oil equivalent (BOE) in 2024. This figure highlights their success in lean management and keeping operational expenses in check.

Maintaining these efficient operations, including robust maintenance schedules for complex offshore facilities and streamlined logistics, is crucial for CNOOC to sustain its cost-competitive advantage in the global energy market.

CNOOC's commitment to Environmental, Social, and Governance (ESG) principles translates into substantial investments within its cost structure. These include significant outlays for environmental protection measures, stringent safety protocols, and the implementation of advanced carbon emission reduction technologies such as Carbon Capture, Utilization, and Storage (CCUS). For instance, in 2023, CNOOC continued to invest heavily in green and low-carbon development, with capital expenditures on these initiatives forming a growing portion of its overall spending.

The company's pursuit of green development and sustainable practices necessitates considerable expenditures on research and development for cleaner energy solutions and operational efficiency improvements. These costs are not merely operational but are increasingly critical for ensuring regulatory compliance across its global operations and for maintaining a positive corporate reputation, which directly impacts its social license to operate and investor confidence.

Taxation and Royalty Payments

CNOOC faces significant financial obligations through taxes, royalties, and other government levies across its operational territories. These payments are directly influenced by production levels and prevailing oil and gas market prices, making them a substantial component of the company's cost structure.

For instance, in 2023, CNOOC's total tax expenses amounted to approximately RMB 143.1 billion. Royalties, often calculated as a percentage of revenue or production, also contribute heavily to these governmental payments. These outflows are critical to managing CNOOC's profitability and cash flow.

- Tax Expenses: CNOOC reported RMB 143.1 billion in taxes for 2023.

- Royalty Payments: These are variable, tied to production and commodity prices, impacting overall operational costs.

- Governmental Levies: Beyond taxes and royalties, other payments to host governments add to the cost burden.

Research and Development (R&D) Expenses

CNOOC's commitment to technological advancement is reflected in its significant Research and Development (R&D) expenses. These investments are vital for developing cutting-edge solutions, such as the 'Hi-Energy' AI model, which aims to optimize exploration and production processes. Furthermore, CNOOC dedicates resources to pioneering deepwater exploration techniques, pushing the boundaries of what's possible in challenging offshore environments.

These R&D expenditures are not merely costs; they are strategic investments designed to secure CNOOC's technological leadership in the global energy sector. By continuously improving operational efficiency and identifying novel resource discoveries, these efforts directly contribute to the company's long-term competitiveness and sustainability. For instance, in 2023, CNOOC reported R&D spending of approximately RMB 10.5 billion (around $1.45 billion USD), underscoring its focus on innovation.

- Technological Innovation: Investment in AI models like 'Hi-Energy' and advanced deepwater exploration methods.

- Efficiency Gains: R&D drives improvements in operational processes and resource extraction.

- Resource Discovery: Funding research to identify and access new oil and gas reserves.

- Competitive Edge: Maintaining technological superiority to enhance market position and profitability.

CNOOC's cost structure is dominated by significant capital expenditures for exploration and development, as well as ongoing production operating costs. These are essential for maintaining and expanding its oil and gas reserves and production capabilities.

The company also incurs substantial costs related to environmental protection, safety, and the development of cleaner energy solutions, reflecting a growing commitment to ESG principles. Additionally, taxes, royalties, and research and development for technological advancements form key components of its expenditure.

| Cost Category | 2023 Data (RMB billions) | 2024 Data (RMB billions) |

|---|---|---|

| Capital Expenditures | N/A | 132.5 |

| Production Operating Costs | N/A | All-in cost of US$28.52/BOE |

| Tax Expenses | 143.1 | N/A |

| R&D Expenses | 10.5 | N/A |

Revenue Streams

CNOOC's main income comes from selling crude oil. This oil goes to companies that refine it and to traders, both in China and around the world. In 2023, these crude oil sales made up about 60% of the company's total earnings.

The price of crude oil on the global market directly affects how much money CNOOC makes from these sales. When oil prices go up, so does CNOOC's revenue from this source, and vice versa.

CNOOC's revenue is significantly bolstered by its natural gas sales, encompassing both pipeline gas and Liquefied Natural Gas (LNG). This segment is a cornerstone of their financial performance.

In 2023, natural gas sales represented approximately 30% of CNOOC's total revenue, underscoring its importance. The company is actively expanding its investments in natural gas exploration and production to capitalize on this growing market.

Furthermore, CNOOC benefits from stable earnings derived from long-term LNG contracts. These agreements provide a predictable revenue stream, contributing to the company's overall financial resilience.

CNOOC generates revenue from selling refined oil products and various chemicals derived from its upstream operations. This segment, while contributing a smaller share compared to crude oil sales, significantly enhances value by transforming raw hydrocarbons into higher-value goods, thereby diversifying the company's overall revenue streams.

In 2024, CNOOC's refining and chemical segment played a crucial role in its financial performance. For instance, the company processed approximately 23 million tons of crude oil in its refining facilities, yielding a range of products including gasoline, diesel, and jet fuel, alongside petrochemicals like ethylene and polypropylene, contributing to its diversified income.

Joint Venture and Production Sharing Agreement (PSA) Revenues

CNOOC generates revenue by partnering in joint ventures and production sharing agreements (PSAs) with global energy companies, securing a portion of the extracted oil and gas. This collaborative approach not only diversifies revenue but also shares the substantial capital expenditure and operational risks inherent in exploration and production. For instance, CNOOC’s involvement in the Payara and Yellowtail projects in Guyana exemplifies this strategy, contributing to its growing international production and revenue streams.

These partnerships allow CNOOC to tap into advanced technological expertise and operational efficiencies from its international collaborators. In 2023, CNOOC’s offshore oil and gas production reached a record high of 67.4 million tonnes of oil equivalent, with a significant portion stemming from its overseas assets and joint ventures, underscoring the financial impact of these revenue streams.

- Revenue Generation: CNOOC secures income through its equity stakes in joint ventures and PSAs, receiving a share of oil and gas output.

- Risk Mitigation: Partnering in these agreements helps CNOOC distribute the financial and operational risks associated with large-scale E&P projects.

- Expertise Leverage: Joint ventures provide access to international partners' advanced technologies and operational know-how.

- Production Contribution: Projects like Payara and Yellowtail in Guyana are key contributors to CNOOC's overseas production and associated revenue growth.

Asset Divestments and Other Income

CNOOC's revenue picture also includes income from asset divestments and other sources. This isn't a consistent, day-to-day income stream, but it can bring in substantial funds when opportunities arise. For instance, in December 2024, CNOOC completed the divestment of its Gulf of Mexico assets.

These types of transactions, while not core to ongoing operations, are important for capital management. They allow the company to streamline its portfolio and generate one-off capital injections.

- Asset Divestments: Revenue generated from selling off non-essential or underperforming business units or assets.

- Other Income: This can encompass various ancillary revenue sources not directly tied to primary oil and gas production.

- Strategic Portfolio Management: Divestments are often part of a strategy to focus on core, higher-return assets.

- Capital Injections: Such sales can provide significant, albeit infrequent, infusions of cash.

CNOOC's revenue streams are diverse, primarily driven by the sale of crude oil and natural gas. The company also generates income from refined oil products, chemicals, and revenue sharing from joint ventures and production sharing agreements. Additionally, asset divestments contribute to its financial inflows.

| Revenue Stream | Description | 2023 Contribution (Approx.) | Key Drivers |

| Crude Oil Sales | Sale of crude oil to refiners and traders domestically and internationally. | 60% | Global crude oil prices, production volumes. |

| Natural Gas Sales | Sales of pipeline gas and Liquefied Natural Gas (LNG). | 30% | Natural gas prices, demand, LNG contract stability. |

| Refined Products & Chemicals | Sales of gasoline, diesel, jet fuel, and petrochemicals. | Smaller Share | Refining margins, demand for downstream products. |

| Joint Ventures & PSAs | Revenue share from collaborative exploration and production projects. | Significant Contribution from Overseas | Production output from partnered projects, agreement terms. |

| Asset Divestments & Other | One-off income from selling assets or other ancillary sources. | Variable | Strategic portfolio management, market opportunities. |

Business Model Canvas Data Sources

The CNOOC Business Model Canvas is informed by a comprehensive review of internal financial statements, operational data, and strategic planning documents. This ensures a robust understanding of the company's current capabilities and future direction.