CNOOC Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNOOC Bundle

Uncover the strategic brilliance behind CNOOC's marketing efforts with our comprehensive 4Ps analysis. We delve into how their product portfolio, pricing structures, distribution networks, and promotional campaigns create a powerful market presence.

Go beyond the surface—get access to an in-depth, ready-made Marketing Mix Analysis covering CNOOC's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

CNOOC Limited's core business centers on the exploration, development, production, and sale of crude oil and natural gas. As China's leading offshore oil and gas producer, these commodities are fundamental to its operations.

The company is strategically focused on expanding its reserves and boosting production volumes. CNOOC has ambitious targets to surpass 2 million barrels of oil equivalent (BOE) per day by 2025, a significant leap from its record-setting performance in 2024.

CNOOC's refining and chemicals segment, though secondary to its upstream focus, demonstrates strategic horizontal integration. This processing of crude oil into refined products and chemicals creates higher-value outputs, serving industrial clients and broadening the company's revenue base.

In 2024, CNOOC's refining capacity was around 24.2 million tons per year, with its chemical production including ethylene and other derivatives. This downstream diversification is crucial for capturing more value across the hydrocarbon chain.

CNOOC's crude oil and natural gas quality are paramount for their market appeal. For instance, their crude oil is often characterized by its API gravity, a measure of its density, and its sulfur content, which impacts refining costs and environmental compliance. In 2024, CNOOC continued to focus on producing lighter, sweeter crude grades, which are generally more desirable for refiners.

Natural gas specifications, particularly for Liquefied Natural Gas (LNG), center on purity and composition, ensuring it meets stringent international standards for combustion and downstream processing. CNOOC's commitment to quality control ensures their LNG is suitable for diverse global energy markets, a crucial factor in their 2024 sales strategy.

Energy Solutions & Value-Added Services

CNOOC is moving beyond just selling crude oil and natural gas by offering comprehensive energy solutions and services that add extra value. This strategic shift is evident in their commitment to greener energy sources and advanced technologies. For instance, they are actively expanding their offshore wind power capacity and developing onshore solar projects.

A key part of this strategy involves integrating carbon capture, utilization, and storage (CCUS) technologies into their operations. This not only helps reduce their environmental footprint but also positions them as a forward-thinking energy provider. These efforts are designed to strengthen their market appeal and actively contribute to the global shift towards sustainable energy.

CNOOC's investment in these areas reflects a broader industry trend. By 2024, the global renewable energy market was projected to reach over $1.5 trillion, with offshore wind alone seeing significant growth. CNOOC's participation in CCUS is also noteworthy, as the global CCUS market is expected to grow substantially, driven by net-zero emission targets.

- Expansion in Offshore Wind: CNOOC is increasing its investment in offshore wind farms, contributing to China's ambitious renewable energy goals.

- Development of Photovoltaic Projects: The company is also developing onshore solar power installations, diversifying its renewable energy portfolio.

- Integration of CCUS Technology: CNOOC is implementing carbon capture, utilization, and storage solutions to reduce emissions from its operations.

- Enhanced Value Proposition: These initiatives aim to offer customers more than just energy commodities, providing integrated and sustainable solutions.

Technological Advancement in E&P

CNOOC's commitment to technological advancement in Exploration and Production (E&P) is a cornerstone of its strategy. The company is a leader in developing intelligent oil and gas fields, integrating advanced digital technologies to streamline operations. For instance, CNOOC has been a pioneer in leveraging AI, notably with its proprietary 'Hi-Energy' model, to enhance seismic data interpretation and reservoir characterization. This focus on innovation directly translates into improved efficiency and resource recovery.

The company's investment in cutting-edge E&P technologies is crucial for its success in challenging offshore environments. CNOOC has significantly advanced its deepwater exploration and production capabilities, enabling it to tap into previously inaccessible reserves. This technological prowess not only optimizes the extraction of resources but also reinforces its competitive edge in the global oil and gas market, particularly in complex offshore operations.

Key technological advancements by CNOOC include:

- Development of intelligent oil and gas fields: Implementing digital twins and IoT solutions for real-time monitoring and control.

- AI-driven exploration and production: Utilizing models like 'Hi-Energy' for enhanced seismic analysis and predictive maintenance.

- Deepwater technology enhancement: Investing in subsea production systems and advanced drilling techniques for ultra-deepwater environments.

- Carbon capture, utilization, and storage (CCUS): Exploring and implementing technologies to reduce emissions from E&P activities.

CNOOC's product offering extends beyond raw commodities to value-added services and diversified energy solutions. This includes the processing of crude oil into refined products and chemicals, catering to a broad industrial client base. Their commitment to quality ensures that crude oil and natural gas meet stringent specifications for global markets.

The company is actively expanding into renewable energy, notably offshore wind and onshore solar projects, demonstrating a strategic pivot towards sustainable offerings. Furthermore, CNOOC is integrating carbon capture, utilization, and storage (CCUS) technologies, positioning itself as a responsible energy provider focused on emission reduction.

CNOOC's product strategy is increasingly focused on providing integrated energy solutions. By 2025, they aim to surpass 2 million BOE per day, underscoring their commitment to expanding production of both traditional and cleaner energy sources. This diversification enhances their market appeal and aligns with global decarbonization trends.

What is included in the product

This analysis provides a comprehensive examination of CNOOC's marketing strategies, detailing its approach to Product, Price, Place, and Promotion with real-world examples and strategic implications.

Provides a clear, actionable framework to address CNOOC's marketing challenges by systematically analyzing and optimizing Product, Price, Place, and Promotion strategies.

Simplifies complex marketing decisions by offering a structured approach to identify and resolve pain points across CNOOC's entire marketing mix.

Place

CNOOC's operational heartland lies in China's offshore regions, specifically Bohai, the Western South China Sea, the Eastern South China Sea, and the East China Sea. These areas are crucial for its domestic production.

Beyond China, CNOOC boasts a substantial international presence. Its global reach extends to the Atlantic Ocean rim and numerous Belt and Road Initiative countries. This diversification includes significant assets and exploration efforts in locations like Guyana, Brazil, Nigeria, Mozambique, and Iraq, demonstrating a broad geographical strategy.

CNOOC heavily relies on direct sales, channeling a significant portion of its crude oil and natural gas to national and international oil companies, as well as industrial consumers. This B2B focus is characteristic of the energy sector, where large-scale transactions are the norm.

These direct sales are frequently underpinned by long-term supply contracts. For instance, in 2023, CNOOC's revenue from oil and gas sales, largely driven by these direct channels, reached approximately RMB 293.5 billion, demonstrating the stability these agreements provide.

These long-term arrangements are vital for CNOOC, offering a predictable revenue stream and allowing for efficient management of its substantial production volumes. They are a cornerstone of CNOOC's strategy in the global energy marketplace.

CNOOC leverages a sophisticated integrated transportation infrastructure to move its vast energy resources. This network is crucial for getting products from offshore extraction points to consumers efficiently.

The company's logistics backbone includes extensive pipeline systems for both crude oil and natural gas, facilitating domestic delivery. For global reach, CNOOC utilizes a fleet of tankers and specialized LNG carriers, underscoring its international market presence.

Strategically located logistics hubs, positioned close to major industrial centers, enhance CNOOC's distribution capabilities. In 2024, CNOOC reported significant investments in upgrading its pipeline and terminal infrastructure, aiming to boost capacity by an estimated 15% by year-end to meet growing demand.

Strategic Storage Facilities

CNOOC leverages strategic storage facilities to navigate the inherent volatility of the oil and gas market, ensuring a consistent supply even when demand fluctuates. These strategically located depots are essential for balancing inventory, which directly impacts product availability and the ability to capitalize on market opportunities. In 2023, CNOOC reported significant investments in infrastructure, including storage, to bolster its supply chain resilience.

These storage assets are more than just holding tanks; they are a crucial component of CNOOC's market strategy. By maintaining optimal inventory levels, the company can respond effectively to shifts in demand, thereby maximizing its sales potential and mitigating the impact of price swings. This proactive approach is vital in an industry where timely delivery and product availability are paramount.

- Inventory Management: CNOOC's storage facilities allow for the strategic accumulation of inventory during periods of lower demand or price, providing a buffer against future supply shortages.

- Market Responsiveness: The ability to quickly access stored products enables CNOOC to meet unexpected surges in demand and capitalize on favorable market conditions.

- Supply Chain Security: These facilities act as a critical safeguard against potential disruptions, such as geopolitical events or natural disasters, ensuring continuity of supply.

- Cost Optimization: Strategic storage can also facilitate cost savings by allowing CNOOC to purchase crude oil or refined products at lower prices and store them for later sale.

Global Energy Trading Hubs

CNOOC's 'Place' in its marketing mix encompasses its strategic presence in global energy trading hubs. This is crucial given the international nature of commodity markets and CNOOC's significant role as a seller of crude oil and natural gas on the world stage. The company actively participates in these hubs, where pricing is a direct reflection of worldwide supply and demand forces.

These hubs are vital for CNOOC to connect with a broad spectrum of international buyers and trading partners. Key trading centers like Singapore, Houston, and London are critical for price discovery and transaction execution. For instance, the Brent crude oil benchmark, heavily traded in Europe, significantly influences global oil prices, including those CNOOC achieves.

CNOOC's engagement in these hubs involves navigating complex market dynamics and interacting with major energy trading platforms and participants. In 2024, global oil markets continued to be shaped by geopolitical events and the energy transition, with significant trading volumes occurring on platforms like CME Group and ICE. CNOOC's ability to effectively participate here directly impacts its revenue streams.

- Global Reach: CNOOC leverages international trading hubs like Singapore for Asia-Pacific operations and Houston for North American markets.

- Price Influence: The company's sales on these hubs are subject to global benchmarks such as Brent and WTI, which saw average prices fluctuating significantly throughout 2024 due to supply constraints and demand shifts.

- Market Access: Participation in these hubs allows CNOOC to access a diverse customer base and optimize the sale of its crude oil and natural gas production.

- Risk Management: Trading hubs also provide avenues for hedging and managing price volatility inherent in the energy commodity markets.

CNOOC's 'Place' strategy hinges on its extensive operational footprint, spanning China's offshore fields and a broad international network, including key regions like Guyana and Nigeria. This geographical diversification is complemented by a sophisticated logistics infrastructure, featuring pipelines, tankers, and LNG carriers, which ensures efficient product delivery. Strategic storage facilities further enhance supply chain resilience and market responsiveness.

Furthermore, CNOOC actively engages in major global energy trading hubs such as Singapore and Houston. This presence is critical for price discovery and accessing a wide array of international buyers, directly influencing its revenue generation. The company's participation in these hubs means its sales are benchmarked against global prices like Brent crude, which experienced notable volatility in 2024 due to supply and demand dynamics.

| Location Type | Key Regions/Hubs | Strategic Importance | 2024/2025 Data/Context |

|---|---|---|---|

| Domestic Operations | Bohai, South China Sea, East China Sea | Core production areas for China's energy needs | Continued investment in enhancing domestic offshore production capacity. |

| International Operations | Guyana, Brazil, Nigeria, Mozambique, Iraq, Belt and Road Initiative countries | Diversification of supply sources and market reach | Expansion of exploration and production activities in key international basins. |

| Logistics & Infrastructure | Pipelines, Tankers, LNG Carriers, Terminals | Efficient transportation and delivery of energy products | Reported 15% capacity increase target for pipeline and terminal infrastructure by end of 2024. |

| Trading & Market Access | Singapore, Houston, London | Price discovery, international sales, risk management | Active participation in global energy markets, influenced by benchmarks like Brent crude. |

What You See Is What You Get

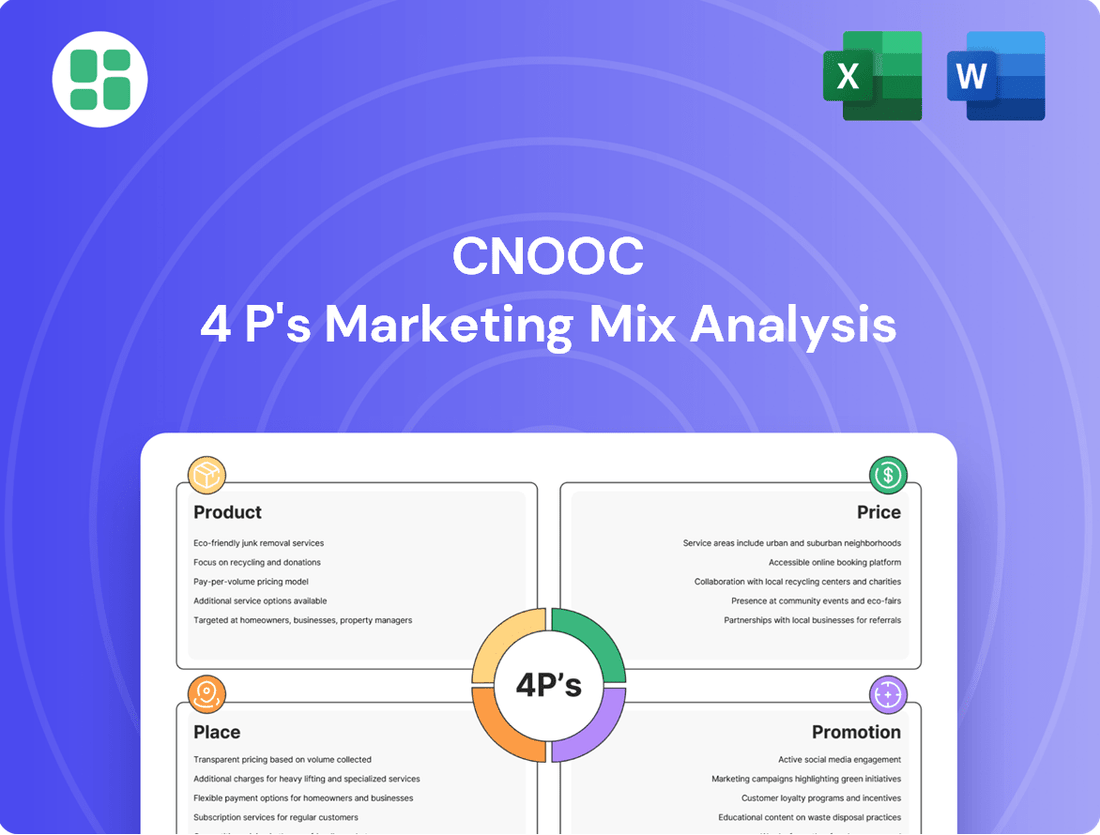

CNOOC 4P's Marketing Mix Analysis

The preview you see here is the exact CNOOC 4P's Marketing Mix Analysis you will receive upon purchase. This comprehensive document is fully complete and ready for your immediate use. You can buy with full confidence, knowing there will be no surprises.

Promotion

CNOOC, as a publicly traded entity, prioritizes robust investor relations and transparent financial reporting. This commitment is demonstrated through its regular dissemination of performance updates, strategic plans, and future outlooks via annual reports, quarterly announcements, and investor webcasts.

In 2023, CNOOC reported a net profit attributable to equity holders of approximately RMB 161 billion, showcasing strong financial health. The company actively engages with the financial community through numerous investor conferences and roadshows, aiming to foster trust and provide clear insights into its operations and market position.

CNOOC demonstrates a strong commitment to Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) principles, integrating them into its core operations. This dedication is evident in its transparent reporting of green development initiatives, emission reduction targets, and ecological protection efforts, as highlighted in its latest ESG reports.

In 2023, CNOOC reported a significant reduction in CO2 emissions intensity, underscoring its focus on environmental stewardship. The company also detailed substantial investments in employee welfare programs and community engagement, reflecting its commitment to social responsibility. These initiatives are crucial for building long-term stakeholder trust and ensuring sustainable growth.

CNOOC's extensive global operations, particularly as China's largest offshore oil and gas producer, necessitate robust government and stakeholder engagement. This promotional pillar is crucial for navigating complex regulatory landscapes and securing necessary approvals for projects, such as the recent advancements in the Lufeng 14-8 oilfield in 2024.

Effective engagement fosters a positive operating environment and builds trust with local communities, vital for maintaining a social license to operate. CNOOC's commitment to corporate social responsibility, often highlighted in its annual reports, directly supports these relationships and is a key aspect of its promotional strategy.

Industry Conferences & Thought Leadership

CNOOC actively participates in global energy forums and industry conferences, such as the International Petroleum Week (IP Week) and the World Petroleum Congress. These events serve as crucial platforms for CNOOC to highlight its advancements in offshore exploration technology and its commitment to sustainable energy development.

By engaging with peers and experts, CNOOC shares its strategic outlook on the evolving energy landscape, positioning itself as a thought leader. For instance, at the 2024 OTC (Offshore Technology Conference), CNOOC presented its latest findings on deepwater gas field development, reinforcing its expertise.

- Showcasing Innovations: CNOOC uses conferences to demonstrate its cutting-edge technologies in offshore drilling and production.

- Industry Engagement: The company fosters relationships with stakeholders, sharing insights on global energy trends and challenges.

- Thought Leadership: Participation establishes CNOOC's reputation as a key player and innovator in the international oil and gas sector.

- Strategic Vision: CNOOC outlines its future plans and commitment to responsible resource management at these events.

Brand Reputation & Risk Management

CNOOC's brand reputation is a cornerstone of its promotional strategy, particularly given its status as a state-backed entity in the vital energy sector. Maintaining public trust and a positive image is paramount, influencing everything from investor confidence to regulatory relationships.

Risk management communication is intricately woven into CNOOC's promotional activities. This involves proactively addressing potential macro-political and economic uncertainties that could impact operations and the broader energy market. For instance, CNOOC's preparedness for and response to events like super typhoons are communicated to demonstrate operational resilience and commitment to stability.

- Brand Trust: CNOOC actively promotes its commitment to reliable energy supply and corporate social responsibility to bolster its reputation.

- Risk Communication: The company communicates its strategies for mitigating risks associated with geopolitical shifts and economic volatility.

- Operational Resilience: CNOOC highlights its robust operational capabilities, including preparedness for extreme weather events, to assure stakeholders of business continuity.

- Stakeholder Confidence: By transparently managing and communicating risks, CNOOC aims to maintain and enhance confidence among investors, partners, and the public.

Promotion for CNOOC encompasses a multi-faceted approach, focusing on investor relations, corporate social responsibility, and industry engagement to build trust and a strong brand reputation. The company actively communicates its financial performance, strategic direction, and commitment to sustainability to various stakeholders.

CNOOC leverages industry forums and conferences to showcase technological advancements and share its vision for the future of energy. This includes highlighting innovations in offshore exploration and production, as demonstrated at events like the 2024 OTC. The company also emphasizes its risk management strategies and operational resilience, particularly in the face of geopolitical and environmental challenges.

Financial transparency is key, with CNOOC providing regular updates on its performance, such as the reported net profit attributable to equity holders of approximately RMB 161 billion in 2023. This, combined with a strong emphasis on ESG principles and community engagement, reinforces its commitment to responsible growth and stakeholder confidence.

| Promotional Activity | Key Focus Areas | Examples/Data (2023-2024) |

|---|---|---|

| Investor Relations | Financial performance, strategic outlook, ESG | RMB 161 billion net profit (2023); Regular investor webcasts and reports |

| Industry Engagement | Technological innovation, energy trends, sustainability | Participation in OTC 2024, IP Week; Deepwater gas field development presentations |

| Corporate Social Responsibility | Environmental stewardship, community support, employee welfare | CO2 emissions intensity reduction (2023); Investments in community programs |

| Brand Management | Reliability, risk mitigation, operational resilience | Communication of typhoon preparedness; Proactive risk communication |

Price

CNOOC's crude oil and natural gas pricing is intrinsically linked to global benchmarks like Brent and West Texas Intermediate (WTI). For instance, in early 2024, Brent crude oil prices hovered around $80-$85 per barrel, directly impacting CNOOC's revenue streams for its oil production.

These international benchmarks serve as the primary reference points, absorbing the impact of global supply and demand shifts, geopolitical tensions, and broader economic trends. This means CNOOC's pricing strategy must constantly adapt to these external market forces.

The volatility observed in global energy markets, with WTI prices fluctuating between $75-$80 per barrel during the same period, underscores the critical importance of these benchmarks in determining CNOOC's realized prices.

CNOOC's marketing strategy heavily relies on long-term supply contracts, especially for its natural gas business, providing stability beyond volatile spot market fluctuations. These agreements often feature price adjustments tied to oil benchmarks or other market indicators, sometimes incorporating guaranteed minimum and maximum prices to manage risk.

For instance, in 2023, CNOOC's natural gas and pipeline segment revenue reached approximately RMB 232.5 billion, underscoring the significance of these contracted sales. The company actively utilizes financial derivatives, such as futures and options, to hedge against unpredictable price swings, thereby safeguarding its revenue streams and profitability.

CNOOC strategically blends cost-plus and market-based pricing to optimize revenue. Their all-in production cost stood at US$28.52 per BOE in 2024, a figure that underscores their significant cost advantage in the global energy market.

This cost efficiency allows CNOOC to remain profitable through market volatility. Simultaneously, they adjust pricing to reflect customer perception and the prevailing competitive environment, ensuring market relevance and capturing value.

Geopolitical & Regulatory Influence

Geopolitical shifts and evolving international relations directly influence CNOOC's pricing, particularly given its status as a major Chinese state-owned enterprise with global operations. For instance, trade tensions or shifts in energy alliances can impact crude oil and natural gas benchmarks, which CNOOC's pricing is often tied to.

Domestic and international regulatory landscapes also heavily shape CNOOC's pricing power and profitability. New environmental regulations, carbon taxes, or changes in energy subsidies can necessitate adjustments to production costs and, consequently, selling prices.

- Global Energy Policies: CNOOC's pricing is sensitive to international energy policies, such as those impacting fossil fuel demand or the transition to renewables, which can affect commodity prices.

- Chinese Regulatory Environment: Domestic pricing for refined products and natural gas in China is often subject to government regulation, influencing CNOOC's pricing strategies within its home market.

- Environmental Compliance Costs: Increasing global and domestic environmental standards, including emissions controls, add to operational costs, which can be factored into pricing decisions.

Hedging Strategies & Risk Management

CNOOC likely employs sophisticated hedging strategies to navigate the inherent volatility in oil and gas prices, a critical component of its risk management. These strategies aim to stabilize revenue streams by locking in prices for future production, which is essential for maintaining consistent capital expenditure plans. For instance, in early 2024, Brent crude futures for delivery in late 2024 and 2025 traded within a range that CNOOC would likely consider when setting its investment budgets, aiming for a floor price that supports its project economics.

The company's approach to hedging would involve utilizing financial derivatives such as futures contracts, options, and swaps. These instruments allow CNOOC to manage price uncertainty, ensuring that even if market prices fall below a certain threshold, the company can still realize a predetermined price for a portion of its output. This predictability is crucial for long-term planning and investment decisions in a capital-intensive industry.

CNOOC's hedging strategy is likely designed to support a specific oil price range that underpins its capital expenditure. For example, if CNOOC's breakeven cost for new projects is around $50-$60 per barrel, its hedging program might aim to secure prices above this range for a significant portion of its future production. This proactive approach shields the company from adverse price movements and provides a more reliable financial foundation.

- Price Stabilization: Hedging aims to lock in prices for future oil and gas production, mitigating the impact of market volatility on revenue.

- Capital Expenditure Support: Predictable revenues from hedging enable CNOOC to confidently plan and fund its capital expenditure projects.

- Risk Mitigation: By using financial instruments, CNOOC reduces its exposure to potential price downturns in the energy markets.

- Strategic Range: The company likely targets an oil price range that ensures profitability and supports its long-term investment strategy.

CNOOC's pricing strategy is anchored to global oil and gas benchmarks like Brent and WTI, with their realized prices directly influenced by these market indicators. For instance, in early 2024, Brent crude prices were around $80-$85 per barrel, affecting CNOOC's revenue. The company also utilizes long-term contracts, particularly for natural gas, offering price stability through agreements often tied to oil benchmarks, as seen with their RMB 232.5 billion revenue from this segment in 2023.

| Pricing Factor | 2024/2025 Relevance | Impact on CNOOC |

|---|---|---|

| Global Benchmarks (Brent/WTI) | Brent ~$80-85/bbl (early 2024), WTI ~$75-80/bbl (early 2024) | Directly influences CNOOC's crude oil revenue. |

| Long-Term Contracts (Natural Gas) | RMB 232.5 billion revenue (2023) for gas/pipeline segment | Provides revenue stability, often with price adjustments linked to oil. |

| Cost of Production | US$28.52 per BOE (2024 all-in production cost) | Enables profitability through market volatility and supports competitive pricing. |

4P's Marketing Mix Analysis Data Sources

Our CNOOC 4P's Marketing Mix Analysis is grounded in a comprehensive review of company disclosures, including annual reports, investor presentations, and official press releases. We also incorporate market intelligence from industry publications and competitive analysis to ensure accuracy.