Central National-Gottesman SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central National-Gottesman Bundle

Central National-Gottesman's market position is shaped by its established distribution network and strong supplier relationships, but it also faces evolving digital competition and potential supply chain disruptions.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Central National-Gottesman (CNG) stands out with its extensive global distribution network, covering a wide range of essential products. This includes pulp, paper, packaging, tissue, wood products, and even metals, showcasing a significant level of diversification.

This broad product portfolio is a key strength, as it effectively reduces the company's vulnerability to downturns in any single market segment. For instance, in 2024, while the paper market might experience some headwinds, strong performance in packaging or wood products could offset those challenges.

CNG's international presence is substantial, with operations spanning numerous countries. This global footprint not only grants them access to a wider customer base but also enhances their logistical efficiency and supply chain resilience, a critical advantage in today's interconnected economy.

Central National-Gottesman (CNG) stands as a titan in its distribution sectors, recognized as one of the world's largest. Its robust market position is further solidified by impressive estimated revenues of $9 billion to $10 billion reported for 2023.

This considerable financial strength and established market leadership provide CNG with a significant competitive edge, enabling it to effectively manage industry dynamics. The company's deep roots, dating back to its founding in 1886, highlight a remarkable history of resilience and enduring industry connections.

Central National-Gottesman (CNG) has a proven track record of strategic acquisitions, significantly bolstering its market position. Recent examples include the acquisition of S.P. Richards in January 2023 and TG Graphics in May 2023. These moves, alongside earlier ones like Lewis Paper and Connemara Converting in 2022, highlight CNG's aggressive growth strategy.

These acquisitions are not merely about size; they are about enhancing capabilities and market penetration. By integrating companies like S.P. Richards, a major distributor of office products, CNG expands its product portfolio and customer base, creating a more comprehensive offering in the paper and distribution sectors. This strategic expansion directly strengthens its competitive advantage.

Comprehensive Supply Chain Management and Customer Service

Central National-Gottesman (CNG) excels in providing comprehensive supply chain management, marketing, and sales services, acting as a vital link between global producers and consumers. This integrated approach is a significant strength, ensuring efficient product movement and fostering robust client relationships.

The company's dedication to streamlining operations and delivering exceptional customer service is powered by its focus on knowledge, innovation, and adaptability. This commitment translates into tangible benefits for its partners.

- Global Reach: CNG's ability to connect diverse markets facilitates efficient global trade for its clients.

- Service Integration: The seamless offering of supply chain, marketing, and sales functions provides a one-stop solution.

- Customer Focus: A commitment to high-quality customer service builds loyalty and strengthens partnerships.

- Adaptability: The company's willingness to innovate and adapt ensures it remains competitive in dynamic markets.

Adaptability to Evolving Market Demands

Central National-Gottesman (CNG) demonstrates a strong capacity to adjust to changing market needs, a vital attribute in the fast-paced pulp and paper sector. This adaptability is key to their sustained success.

The company has strategically broadened its product portfolio beyond traditional paper, incorporating packaging and tissue segments. These areas are currently experiencing significant growth, positioning CNG to capitalize on emerging market opportunities.

CNG’s flexibility enables it to effectively navigate shifts in consumer preferences and industry trends, including the growing demand for eco-friendly and sustainable products. For instance, the global sustainable packaging market was valued at approximately $274.1 billion in 2023 and is projected to reach $477.7 billion by 2030, growing at a CAGR of 8.2%. This aligns perfectly with CNG's diversification strategy.

- Diversification into Growth Segments: Expansion into packaging and tissue markets offers new revenue streams.

- Response to Sustainability Trends: Catering to the increasing demand for eco-friendly solutions enhances market relevance.

- Agility in a Dynamic Industry: The ability to pivot and adapt ensures resilience against market volatility.

Central National-Gottesman's (CNG) extensive global distribution network is a significant strength, allowing it to serve a broad customer base across various essential product categories. This diversification, encompassing pulp, paper, packaging, and tissue, mitigates risks associated with any single market segment. CNG's substantial international presence, operating in numerous countries, enhances logistical efficiency and supply chain resilience, a critical advantage in today's interconnected economy.

The company's robust market position, evidenced by estimated revenues between $9 billion and $10 billion for 2023, underscores its financial strength and established industry leadership. This allows CNG to effectively navigate industry dynamics and leverage its deep-rooted industry connections dating back to 1886.

CNG's strategic acquisition history, including S.P. Richards and TG Graphics in 2023, demonstrates a commitment to growth and enhanced capabilities. These acquisitions expand its product portfolio and customer reach, strengthening its competitive advantage in the distribution sector.

The company excels in integrated supply chain management, marketing, and sales services, acting as a crucial intermediary between producers and consumers. This comprehensive approach, coupled with a focus on knowledge, innovation, and adaptability, ensures efficient operations and fosters strong client relationships.

CNG's adaptability to evolving market needs is a key strength, particularly its expansion into growing segments like packaging and tissue. This strategic diversification aligns with market trends, such as the increasing demand for sustainable solutions, with the global sustainable packaging market valued at approximately $274.1 billion in 2023.

What is included in the product

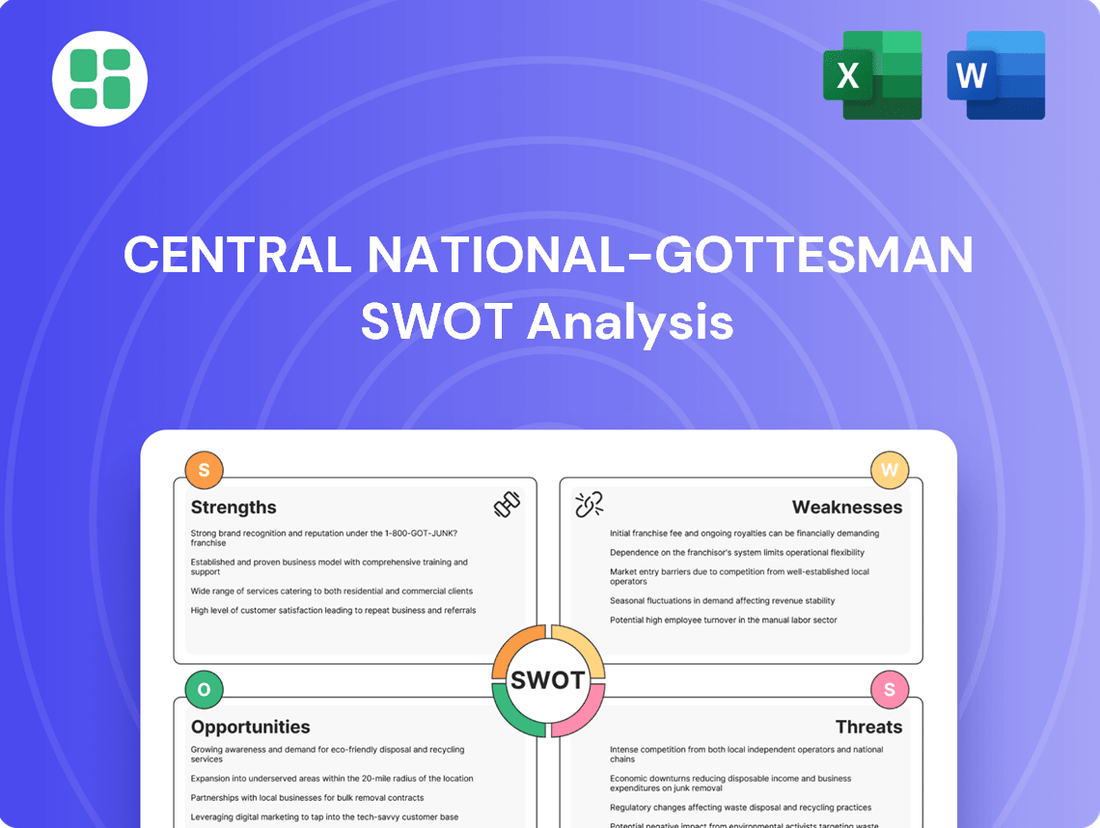

Delivers a strategic overview of Central National-Gottesman’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Offers a clear, organized SWOT framework to identify and address strategic challenges, relieving the pain of unstructured analysis.

Weaknesses

Central National-Gottesman (CNG) still has a substantial portion of its revenue tied to traditional paper products, especially printing and writing paper. This segment is experiencing a structural decline because more and more people are using digital platforms instead of paper. This ongoing shift to digital means less demand for these paper products, forcing CNG to constantly adjust its strategy.

The challenge for CNG is that profitability in these declining paper segments is becoming harder to maintain. High operating costs coupled with intense competition put pressure on margins, making it difficult to generate consistent returns from these legacy business areas.

Central National-Gottesman's position as a major distributor of pulp, paper, and wood products makes it inherently vulnerable to fluctuations in raw material prices, particularly for wood pulp and essential chemicals. These price swings can be quite significant, directly affecting the company's cost of goods sold and, consequently, its profitability. For instance, a 10% increase in pulp prices, a common occurrence, could substantially erode margins if not passed on to customers.

Central National-Gottesman (CNG) operates within a global pulp, paper, and packaging distribution sector known for its intense competition and a trend towards industry consolidation. This environment, marked by thin profit margins, means that even established players like CNG face constant pressure on pricing and market share from both numerous smaller distributors and larger, consolidating entities. For instance, the global paper and packaging market was valued at approximately $1.1 trillion in 2023 and is projected to grow, but this growth occurs within a highly fragmented landscape where competitive dynamics are fierce.

Increasing Regulatory and Environmental Compliance Costs

Central National-Gottesman, like others in the pulp and paper industry, faces mounting pressure from increasingly stringent environmental regulations. These rules, focusing on carbon emissions, water consumption, and responsible forestry, directly impact operational expenses. For instance, compliance with the EU Deforestation Regulation (EUDR), which came into effect in late 2024, requires robust traceability systems for forest-risk commodities, adding complexity and cost to supply chain management.

The financial implications of these regulations are significant. Companies must invest in cleaner technologies, sustainable sourcing, and enhanced reporting mechanisms. These investments, while necessary for long-term viability and market access, can strain profitability in the short to medium term. The ongoing evolution of these standards means continuous adaptation and expenditure will be a persistent challenge for Central National-Gottesman.

- Rising Compliance Expenses: Stricter environmental rules necessitate increased spending on sustainable practices and technology upgrades.

- EUDR Impact: The European Union Deforestation Regulation (EUDR), active from late 2024, demands costly traceability for forest-risk commodities.

- Investment in Sustainability: Significant capital is required for cleaner production methods and verifiable sustainable sourcing.

- Operational Cost Increases: Meeting evolving environmental standards directly translates to higher operational overheads for the company.

Impact of Rising Operational Costs

Central National-Gottesman, like many in the distribution sector, faces significant headwinds from escalating operational costs. The industry is currently experiencing pronounced labor shortages, driving up wages and impacting staffing levels. For instance, in the US, the truck driver shortage alone was estimated to be around 78,000 in 2023, a figure projected to grow. This scarcity directly translates to higher transportation expenses, a critical component for a distribution business.

These rising costs, coupled with increased fuel prices and general inflation, place considerable pressure on profit margins. In 2024, the Producer Price Index for transportation and warehousing services saw a notable uptick. This squeeze on margins necessitates constant vigilance in optimizing logistics networks and ensuring efficient workforce utilization to maintain competitiveness.

The impact on Central National-Gottesman’s profitability is direct, as these elevated expenses can erode earnings. The company must therefore focus on strategic initiatives such as:

- Improving supply chain efficiency to mitigate transportation cost increases.

- Investing in technology to enhance labor productivity and address shortages.

- Negotiating favorable terms with suppliers and carriers.

- Exploring opportunities for route optimization and load consolidation.

Central National-Gottesman's reliance on legacy paper products, particularly printing and writing paper, presents a significant weakness due to the ongoing structural decline in demand. This shift towards digital platforms directly impacts sales volumes for these traditional items.

The company faces challenges in maintaining profitability within these declining paper segments. High operational costs and intense market competition exert considerable pressure on profit margins, making it difficult to generate consistent returns from these established but shrinking business areas.

CNG's dependence on raw material price fluctuations, especially for wood pulp, poses a risk. For instance, a 10% increase in pulp prices, a common occurrence, could significantly reduce margins if these costs cannot be fully passed on to customers.

The company operates in a highly competitive and consolidating global market, characterized by thin profit margins. This environment, where the global paper and packaging market was valued at approximately $1.1 trillion in 2023, means CNG faces constant pressure on pricing and market share from both smaller distributors and larger, consolidating entities.

Preview Before You Purchase

Central National-Gottesman SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Central National-Gottesman's strategic positioning.

This is a real excerpt from the complete document, showcasing the detailed breakdown of Central National-Gottesman's Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version to leverage for your strategic planning.

Opportunities

The global market for sustainable packaging is experiencing significant growth, projected to reach $435.7 billion by 2027, a compound annual growth rate of 6.1% from 2022. This surge is fueled by increasing consumer demand for eco-friendly products and stricter government regulations worldwide. Central National-Gottesman (CNG) is well-positioned to leverage this opportunity by expanding its portfolio of recyclable and biodegradable paper-based packaging solutions, catering to the rising e-commerce sector and environmentally conscious buyers.

The pulp and paper sector is rapidly embracing digital transformation, presenting substantial opportunities for companies like Central National-Gottesman (CNG) to integrate AI into supply chains, implement automation, and leverage advanced data analytics. By investing in these cutting-edge technologies, CNG can significantly boost its operational efficiency, streamline logistics, and refine demand forecasting. For instance, the global pulp and paper market's digital transformation is projected to grow, with AI in supply chain management alone expected to reach billions by 2025, offering a clear path to cost reduction across CNG's vast distribution network.

Central National-Gottesman (CNG) can capitalize on the robust economic expansion occurring in emerging markets, especially across Asia. Nations like China and India are witnessing substantial growth fueled by increasing urbanization and a rising middle class, which directly translates to a greater demand for paper and paper-based products.

CNG's established global distribution network positions it well to serve these burgeoning markets. The company has the potential to significantly increase its market share by meeting the growing consumption needs driven by demographic shifts and improved living standards in these regions.

Diversification into Bio-based Products and Specialty Materials

Central National-Gottesman (CNG) has a significant opportunity to diversify by distributing bio-based products and specialty materials. This aligns with a broader industry trend toward sustainability and innovation. For instance, the global market for bio-based chemicals was valued at approximately $109.7 billion in 2023 and is projected to reach $210.9 billion by 2030, indicating substantial growth potential.

CNG can leverage its existing distribution network to introduce these advanced materials, such as nanocellulose, which offers unique properties for applications ranging from packaging to advanced composites. This strategic move could unlock new revenue streams and appeal to environmentally conscious customers. The specialty chemicals market, in particular, is robust, with projections suggesting continued expansion driven by demand for high-performance materials.

- Expanding into bio-based chemicals offers access to a rapidly growing market, with global valuations already in the hundreds of billions.

- Distributing advanced materials like nanocellulose allows CNG to tap into niche markets with high-value applications beyond traditional paper products.

- This diversification enhances CNG's sustainability profile and strengthens its competitive positioning as a forward-thinking distributor in the evolving materials landscape.

Strategic Partnerships and Value-Added Services

Central National-Gottesman (CNG) can capitalize on market shifts by pursuing strategic cross-border collaborations. These partnerships can unlock new avenues for innovation and help navigate increasingly intricate global supply chains. For instance, a partnership with a European paper producer could streamline access to specialty grades for the North American market, a move that aligns with the growing demand for sustainable packaging solutions observed throughout 2024.

Expanding its service portfolio beyond traditional distribution presents another significant opportunity. Offering custom converting services, such as slitting or sheeting paper to precise customer specifications, can create a distinct competitive advantage. Similarly, developing specialized logistics solutions for niche industries, like high-volume printing or archival paper, could open up lucrative new revenue streams. This aligns with market trends showing a preference for tailored solutions, a pattern expected to continue into 2025.

- Cross-border collaborations: Forge partnerships to enhance innovation and manage supply chain complexities.

- Value-added services: Offer custom converting and specialized logistics to differentiate from competitors.

- Niche market focus: Target specific industries requiring tailored paper solutions for increased revenue.

- Market alignment: Capitalize on the growing demand for customized and sustainable paper products.

Central National-Gottesman (CNG) can capitalize on the increasing global demand for sustainable packaging, a market projected to reach $435.7 billion by 2027. By expanding its offerings of recyclable and biodegradable paper-based solutions, CNG can cater to the growing e-commerce sector and environmentally conscious consumers. Furthermore, digital transformation within the pulp and paper industry presents opportunities to enhance efficiency through AI and advanced data analytics, with AI in supply chain management alone showing significant growth potential by 2025.

Diversifying into bio-based chemicals and specialty materials, such as nanocellulose, offers access to rapidly expanding markets. The bio-based chemicals market was valued at approximately $109.7 billion in 2023 and is expected to reach $210.9 billion by 2030. CNG can leverage its distribution network to introduce these advanced, high-value materials, enhancing its sustainability profile and competitive edge.

Strategic cross-border collaborations can unlock innovation and streamline global supply chains, addressing the growing demand for sustainable packaging observed throughout 2024. Expanding service portfolios to include custom converting and specialized logistics for niche industries can create distinct competitive advantages. This focus on tailored solutions aligns with market trends expected to continue into 2025, opening lucrative new revenue streams.

| Opportunity Area | Market Projection/Data Point | CNG's Strategic Advantage |

|---|---|---|

| Sustainable Packaging | Global market to reach $435.7B by 2027 (6.1% CAGR) | Leverage existing network for eco-friendly paper solutions. |

| Digital Transformation | AI in supply chain management showing significant growth by 2025 | Implement AI/analytics for operational efficiency and forecasting. |

| Bio-based Chemicals & Specialty Materials | Bio-based chemicals market: $109.7B (2023) to $210.9B (2030) | Distribute advanced materials like nanocellulose for new revenue. |

| Cross-border Collaborations & Value-Added Services | Growing demand for customized and sustainable paper products | Enhance innovation, manage supply chains, offer tailored solutions. |

Threats

The ongoing migration to digital platforms continues to erode demand for printing and writing papers, a core area for Central National-Gottesman. This structural shift means less need for traditional paper products, directly impacting sales volumes in these segments. For instance, global printing and writing paper consumption saw a notable decline in the early 2020s, with projections indicating a continued downward trend through 2025.

Central National-Gottesman faces increasing pressure from global environmental regulations, impacting its operations. For instance, in 2024, the European Union continued to strengthen its Green Deal initiatives, pushing for greater circularity in manufacturing and stricter emissions standards, which could affect the sourcing and processing of paper and pulp products.

The rising demand for sustainability from both consumers and corporate partners poses a significant threat. Companies are increasingly scrutinizing their supply chains for environmental impact, potentially leading to a shift away from suppliers perceived as less sustainable. This trend was evident in 2024 with major consumer goods companies setting ambitious net-zero targets, requiring their suppliers to demonstrate similar commitments.

Non-compliance with these evolving environmental mandates can lead to substantial financial penalties and severe reputational damage. Furthermore, the necessary investments in greener technologies and transparent, sustainable supply chains, such as enhanced waste management and reduced carbon footprints, can significantly inflate operational costs for CNG.

Global geopolitical uncertainties, including escalating trade tensions and the potential for new tariffs on forest-based products, pose a significant threat to Central National-Gottesman (CNG). These disruptions can severely impact international supply chains, affecting the cost and timely flow of goods for a global distributor.

The imposition of trade barriers, such as increased import duties, directly translates to higher sourcing costs for CNG. This can erode profit margins and make it more challenging to maintain competitive pricing for its diverse range of products.

Furthermore, these barriers can restrict CNG's access to key international markets, limiting its growth potential and revenue streams. For instance, if the European Union were to implement new tariffs on imported lumber products in 2024, it could directly affect CNG's European sales operations and sourcing strategies.

Intensified Digital Substitution Across Product Categories

The ongoing digital transformation presents a significant threat to Central National-Gottesman (CNG) beyond its core graphic paper business. As more industries embrace digital workflows, demand for traditional paper products, including office supplies and administrative documents, is likely to decline. This shift could impact CNG’s diversified portfolio as digital alternatives become the norm.

While the packaging sector shows resilience, the broader trend of digital substitution poses a slow but steady erosion risk for other paper-related segments. For instance, the increasing adoption of cloud-based document management and electronic communication could reduce the need for printed reports, memos, and other office paper products.

Consider these points regarding digital substitution:

- Declining Print Volumes: Global print volumes have been on a downward trend, with many businesses prioritizing digital communication and record-keeping.

- Office Supply Shift: The market for office paper supplies, while still substantial, faces pressure from digital alternatives and reduced office footprints.

- Digital Document Management: Widespread adoption of enterprise content management systems and digital archiving solutions directly competes with traditional paper usage.

- E-commerce Impact: While e-commerce drives packaging demand, the digital nature of online transactions also reduces the need for paper-based sales receipts and invoices.

Supply Chain Disruptions and Escalating Costs

Central National-Gottesman, like much of the pulp and paper industry, faces significant threats from ongoing supply chain disruptions. The scarcity of key raw materials, such as wood chips, directly impacts production capacity and cost. For instance, global shipping backlogs and port congestion, which persisted through much of 2024, continue to make sourcing and logistics a challenge.

Escalating costs across the board present another major hurdle. Rising energy prices, coupled with increased labor wages and higher transportation expenses, squeeze profit margins. These combined pressures can lead to unpredictable price volatility for finished goods, making it difficult for CNG to maintain stable pricing and reliable supply for its customers, a critical factor in a competitive market.

- Raw Material Scarcity: Persistent issues with wood chip availability due to climate events and increased demand in related industries.

- Energy Cost Volatility: Fluctuations in natural gas and electricity prices directly impact manufacturing overhead.

- Transportation Expenses: Elevated freight rates and fuel surcharges continue to add to the cost of delivering products globally.

- Labor Shortages: Difficulty in attracting and retaining skilled labor in manufacturing and logistics roles drives up wage pressures.

The ongoing digital transformation continues to threaten Central National-Gottesman's core business, as demand for printing and writing papers declines. This shift, evident in the global decline of print volumes through 2025, impacts sales across various paper segments. Furthermore, increasing environmental regulations, such as the EU's strengthened Green Deal initiatives in 2024, necessitate costly operational adjustments and pose risks of financial penalties for non-compliance.

SWOT Analysis Data Sources

This Central National-Gottesman SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry insights to provide a robust and accurate strategic overview.