Central National-Gottesman PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central National-Gottesman Bundle

Unlock the hidden forces shaping Central National-Gottesman's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and evolving social trends are impacting their operations. Gain a critical edge by leveraging these actionable insights for your own strategic advantage. Download the full report now and make informed decisions.

Political factors

Changes in global trade policies and tariffs significantly influence Central National-Gottesman's (CNG) operational costs and market access. For instance, the imposition of new tariffs on paper products by major importing nations can directly increase the cost of goods for CNG's customers, potentially dampening demand. Conversely, favorable trade agreements can open up new markets or reduce existing barriers, boosting export opportunities. The World Trade Organization (WTO) reported that global trade growth slowed to 0.9% in 2023, a notable deceleration from previous years, highlighting the sensitivity of the sector to trade policy shifts.

Geopolitical tensions create substantial risks for CNG's supply chain and distribution. Conflicts or political instability in key sourcing regions for pulp or manufacturing hubs can lead to unforeseen disruptions, impacting production schedules and raw material availability. For example, the ongoing geopolitical situation in Eastern Europe has already demonstrated its capacity to affect energy prices and logistics, indirectly influencing the paper and packaging industry. CNG must remain agile in its sourcing strategies, potentially diversifying suppliers to mitigate these risks and ensure continuity of operations across its global network.

Navigating complex customs regulations and trade sanctions is a critical challenge for CNG. Different countries have varying import duties, product standards, and phytosanitary requirements for pulp and paper products, demanding meticulous compliance. The European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, could also impact the cost of imported goods based on their embedded carbon emissions, requiring companies like CNG to adapt their reporting and potentially their production processes.

Governments globally are increasingly scrutinizing forestry and manufacturing, with a focus on sustainability. For instance, the European Union’s Deforestation Regulation, effective from late 2024, mandates due diligence for products like paper and wood, impacting supply chains. This means Central National-Gottesman (CNG) must ensure its raw materials are deforestation-free, directly influencing sourcing costs and product availability.

These regulations, including varying national logging quotas and evolving manufacturing emission standards, shape production costs and the types of paper products CNG can offer. For example, stricter environmental controls in North America or Europe could necessitate investments in cleaner production technologies, potentially increasing operational expenses. Compliance is non-negotiable for maintaining market access and a positive brand image.

The political stability of nations where Central National-Gottesman (CNG) sources raw materials or distributes its products is crucial for maintaining smooth operations. For instance, in 2024, regions like Eastern Europe, a key sourcing area for certain industrial components, experienced ongoing geopolitical tensions which could impact logistics and material availability.

Unforeseen political shifts, such as sudden policy changes or governmental instability, can create significant disruptions. These can affect supply chains, alter market demand for CNG's offerings, and introduce considerable operational risks, as seen in 2024 when trade policy adjustments in a major Asian market led to temporary import restrictions for similar industries.

By diligently monitoring the political climates in its key operational territories, CNG can better anticipate and proactively mitigate potential business interruptions. This proactive approach is essential for ensuring consistent performance and safeguarding against unforeseen market volatility, a strategy that proved beneficial for companies navigating the economic uncertainties of 2024.

International Relations and Alliances

Central National-Gottesman's (CNG) international relations significantly shape its global operations. For instance, strong trade agreements, like the USMCA which replaced NAFTA in 2020, can bolster cross-border fertilizer trade, a key market for CNG. Favorable diplomatic ties can streamline logistics and reduce tariffs, enhancing market access in regions like Latin America where CNG has a notable presence.

Conversely, geopolitical tensions can introduce considerable risk. Trade disputes, such as those impacting agricultural inputs between major economies, could lead to supply chain disruptions or increased costs for CNG's raw materials. As of early 2024, ongoing trade negotiations and sanctions in various regions continue to present a dynamic landscape for international commerce.

- Trade Agreements: Favorable bilateral and multilateral trade pacts can reduce import/export duties for CNG's products, improving cost competitiveness.

- Geopolitical Stability: Regions with stable political environments tend to offer more predictable markets and investment opportunities for CNG.

- Sanctions and Embargoes: International sanctions can directly restrict CNG's ability to conduct business in certain countries or with specific entities.

- Diplomatic Relations: The overall health of diplomatic relations between countries where CNG operates or sources materials impacts market access and operational ease.

Subsidies and Economic Incentives

Government subsidies and economic incentives play a crucial role in shaping industry dynamics, and for Central National-Gottesman (CNG), these can significantly influence strategic planning. For instance, the US government's Inflation Reduction Act of 2022, enacted in August 2022, offers substantial tax credits for clean energy manufacturing and deployment, which could directly benefit CNG if it invests in or supports related supply chains. These incentives are designed to encourage investments in new technologies and sustainable practices, thereby altering the competitive landscape and potentially boosting operational efficiency.

CNG should actively seek to leverage these government programs where they align with its business objectives. For example, a 2024 report from the Department of Energy highlighted a 15% increase in federal funding for advanced recycling technologies compared to 2023, presenting a tangible opportunity for CNG to explore partnerships or internal development in this area. Such strategic alignment can lead to cost reductions and enhanced market positioning.

- Sustainable Forestry Incentives: Federal and state programs in 2024 offered tax credits for sustainable forest management practices, potentially reducing operational costs for any timber-related activities CNG might engage in.

- Green Manufacturing Credits: The 2022 Inflation Reduction Act continues to provide significant tax credits for manufacturing components used in renewable energy, a sector CNG could tap into.

- Recycling Technology Grants: Increased government grants for advanced recycling infrastructure, observed through 2023-2024, present opportunities for CNG to invest in circular economy initiatives.

Government regulations concerning environmental standards and product safety directly impact Central National-Gottesman's (CNG) operational costs and market access. For instance, the EU's upcoming Deforestation Regulation, effective late 2024, mandates due diligence for products like paper, requiring CNG to ensure its raw materials are deforestation-free, which could influence sourcing costs.

The political stability of sourcing regions is paramount; geopolitical tensions in areas like Eastern Europe, a key sourcing region for industrial components, can disrupt logistics and material availability for CNG throughout 2024.

Government subsidies and incentives, such as the 2022 Inflation Reduction Act's clean energy manufacturing credits, offer potential cost benefits for CNG if it aligns its investments with these programs.

Governmental actions, from trade policies to environmental regulations, significantly shape the operating landscape for Central National-Gottesman (CNG). For example, the World Trade Organization noted a slowdown in global trade growth to 0.9% in 2023, underscoring the impact of trade policy shifts on market access.

What is included in the product

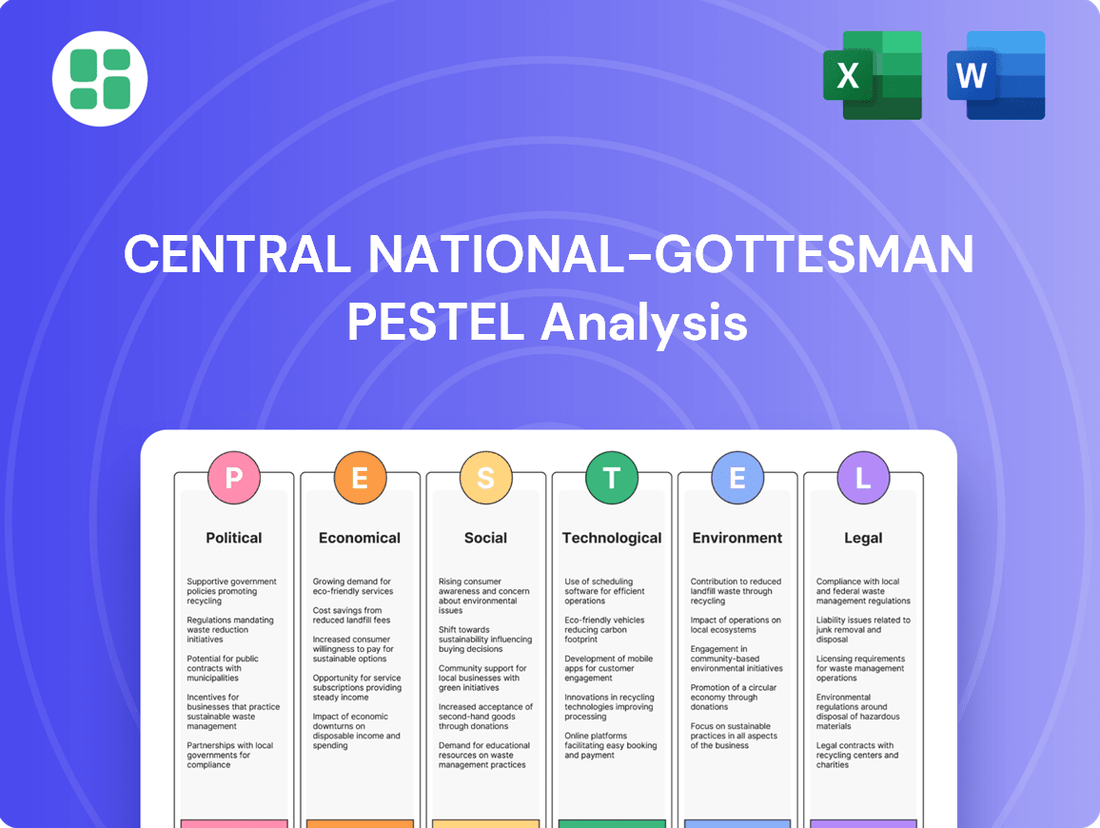

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Central National-Gottesman, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

A concise summary of Central National-Gottesman's PESTLE analysis provides a clear overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Global economic growth is projected to moderate in 2024 and 2025, with the International Monetary Fund (IMF) forecasting 3.2% growth for both years. This slowdown, coupled with persistent inflation and high interest rates in major economies, increases the risk of recession. For Central National-Gottesman (CNG), this means a potential dampening of demand for pulp, paper, and packaging, as these sectors are sensitive to industrial output and consumer spending patterns.

Economic contractions can directly impact CNG's sales volumes and pricing power. For instance, a significant global recession could lead to reduced orders from manufacturers and a decrease in consumer purchasing of goods that rely on packaging. CNG's ability to navigate these cycles will depend on its supply chain agility and cost management strategies.

Conversely, periods of economic expansion, even if moderate, can provide opportunities for CNG. Increased industrial activity and robust consumer spending would naturally translate to higher demand for its products. The challenge for CNG will be to maintain efficient operations and a flexible supply chain to capitalize on any upturns while mitigating the impact of potential downturns.

Central National-Gottesman's profitability is significantly influenced by the volatile pricing of essential raw materials such as wood pulp and timber. These price swings, driven by factors like global demand shifts, extreme weather events impacting harvests, and geopolitical disruptions, directly affect the company's cost of goods sold. For instance, during 2024, lumber prices experienced notable volatility, with futures contracts for framing lumber trading within a range of $350 to $500 per thousand board feet, showcasing the unpredictable nature of the market.

To mitigate these risks, CNG must employ sophisticated hedging techniques and maintain agile inventory management systems. Continuous monitoring of commodity markets is crucial to anticipate price movements and adjust procurement strategies accordingly. The ability to adapt to these raw material price fluctuations is a key determinant of the company's financial performance and competitive edge in the paper and packaging industry.

Currency exchange rate fluctuations present a significant consideration for Central National-Gottesman (CNG) given its global distribution operations. As transactions occur across multiple currencies, CNG is exposed to the inherent volatility of foreign exchange markets. For instance, a strengthening US dollar against other major trading currencies could negatively impact the reported value of international sales and increase the cost of imported goods, potentially squeezing profit margins.

For example, if CNG sources a significant portion of its paper and packaging products from Europe, a scenario where the Euro weakens considerably against the US dollar in 2024 or 2025 could lead to higher operational costs when converting USD to EUR for these purchases. Conversely, if CNG has substantial sales denominated in a weaker currency, that revenue translates to less USD upon repatriation. Managing this exposure through hedging instruments or strategic pricing adjustments is crucial for maintaining financial stability and predictable earnings.

Inflation Rates and Interest Rates

Inflationary pressures remain a key concern for businesses like Central National-Gottesman (CNG). For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.3% year-over-year in May 2024, though it has shown signs of moderating from its 2022 peaks. This persistent inflation directly translates to higher operational costs for CNG, impacting everything from raw material sourcing and transportation to labor expenses and energy consumption. Effectively managing these rising costs is crucial for maintaining profitability.

In tandem with inflation, interest rates have been on an upward trajectory. The Federal Reserve's benchmark interest rate has been held in a range of 5.25% to 5.50% as of mid-2024, a significant increase from previous years. This environment makes borrowing more expensive for CNG, affecting its ability to finance new capital expenditures or manage working capital efficiently. Higher borrowing costs can deter investment in growth opportunities and strain the company's overall financial health.

- Inflationary Impact: US CPI at 3.3% (May 2024) indicates continued upward pressure on operational expenses for CNG.

- Interest Rate Environment: The Federal Reserve's target rate of 5.25%-5.50% (mid-2024) increases the cost of capital for CNG.

- Cost Management: CNG needs robust strategies to mitigate rising transportation, labor, and energy costs.

- Financing Strategy: Careful consideration of borrowing costs is essential for CNG's investment and financial planning.

Consumer Spending Patterns and Industry Demand

Consumer spending habits, especially the growth in e-commerce and demand for packaged goods, directly fuel the need for packaging and related paper products, a core area for Central National-Gottesman (CNG). For instance, in 2024, global e-commerce sales were projected to reach over $6.3 trillion, a significant driver for packaging volumes.

Shifts in what consumers want, like a preference for digital content over physical media or a strong push for eco-friendly packaging solutions, directly impact the types and quantities of products CNG distributes. By 2025, the sustainable packaging market is expected to exceed $400 billion globally, highlighting this crucial trend.

- E-commerce Growth: Continued expansion of online retail in 2024 and 2025 necessitates increased packaging materials.

- Packaged Goods Demand: Steady consumer reliance on packaged goods supports consistent demand for paper and packaging products.

- Sustainability Focus: Growing consumer preference for sustainable packaging options influences product mix and sourcing strategies for CNG.

- Digital Shift Impact: While not directly CNG's product, a broader consumer shift towards digital media can indirectly affect demand for certain paper-based products like magazines.

Global economic growth is expected to moderate in 2024 and 2025, with the IMF forecasting 3.2% growth for both years. This slowdown, coupled with persistent inflation and high interest rates, increases recession risk, potentially dampening demand for Central National-Gottesman's (CNG) pulp, paper, and packaging products. Economic contractions can directly impact CNG's sales volumes and pricing power, making agile supply chains and cost management critical for navigating these cycles.

Central National-Gottesman's profitability is significantly influenced by the volatile pricing of essential raw materials like wood pulp and timber. For instance, lumber futures traded between $350 and $500 per thousand board feet in 2024, showcasing market unpredictability. CNG must employ sophisticated hedging and agile inventory management to mitigate these risks and adapt to price fluctuations, which are key to its financial performance.

Currency exchange rate fluctuations pose a significant challenge for CNG's global operations. A strengthening US dollar, for example, could negatively impact reported international sales values. If CNG sources heavily from Europe, a weaker Euro in 2024-2025 could increase operational costs when converting USD to EUR for purchases, impacting profit margins.

Inflationary pressures continue to affect businesses like CNG. The US CPI was 3.3% year-over-year in May 2024, indicating rising operational costs for raw materials, transportation, and labor. Concurrently, the Federal Reserve's benchmark interest rate remained between 5.25%-5.50% as of mid-2024, making borrowing more expensive and potentially deterring capital expenditures for CNG.

| Economic Factor | 2024/2025 Projection/Data | Impact on CNG |

|---|---|---|

| Global GDP Growth | IMF forecast: 3.2% (2024 & 2025) | Moderating growth may dampen demand for paper and packaging products. |

| Lumber Prices (Futures) | Range: $350-$500/thousand board feet (2024) | Volatility directly impacts CNG's cost of goods sold. |

| US CPI (Inflation) | 3.3% YoY (May 2024) | Increases operational costs for raw materials, transport, and labor. |

| Federal Funds Rate | 5.25%-5.50% (Mid-2024) | Higher borrowing costs affect capital expenditures and working capital management. |

Same Document Delivered

Central National-Gottesman PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Central National-Gottesman breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Growing global awareness of environmental issues is significantly shaping consumer and corporate purchasing habits. For Central National-Gottesman (CNG), this translates into increased pressure to source and distribute products derived from sustainably managed forests. For instance, the global market for sustainable packaging is projected to reach $437.2 billion by 2027, indicating a strong demand for eco-friendly alternatives.

Meeting these evolving market expectations necessitates a commitment to transparent supply chains and certified products. CNG must demonstrate its adherence to environmental standards, such as those set by the Forest Stewardship Council (FSC), to maintain credibility and capture market share. Companies with robust sustainability practices are increasingly favored by investors and consumers alike, with studies showing a correlation between ESG (Environmental, Social, and Governance) performance and financial returns.

The ongoing surge in e-commerce, a trend that accelerated significantly in recent years and is projected to continue its upward trajectory through 2025, has fundamentally reshaped packaging requirements. Consumers increasingly favor online shopping for its convenience, driving a greater demand for durable shipping materials capable of withstanding transit. This directly influences the types and volumes of packaging products that companies like Central National-Gottesman (CNG) distribute, necessitating a focus on corrugated board and protective packaging solutions.

By 2024, global e-commerce sales are expected to surpass $6.3 trillion, a substantial increase that underscores the importance of adapting to these evolving consumer purchasing behaviors. CNG's ability to cater to the specific packaging needs generated by this digital marketplace, from efficient shipping boxes to protective inserts, will be paramount for maintaining its market relevance and competitive edge in the coming years.

Stakeholders, from investors to employees and customers, are increasingly scrutinizing companies like Central National-Gottesman (CNG) for their commitment to corporate social responsibility (CSR). This goes beyond mere compliance, demanding ethical labor practices, active community involvement, and genuine environmental stewardship. For instance, a 2024 survey indicated that 70% of consumers consider a company's CSR efforts when making purchasing decisions, directly impacting brand loyalty and sales.

A strong CSR framework is no longer just a feel-good initiative; it's a strategic imperative. Companies with well-defined CSR programs often see enhanced brand reputation, which in turn aids in attracting and retaining top talent. In 2025, reports suggest that companies with high CSR scores experienced a 5% lower employee turnover rate compared to their less socially responsible peers, highlighting the direct link between ethical operations and workforce stability.

Demographic Shifts and Urbanization

Global demographic shifts, including a projected 2024 population of over 8.1 billion people, are significantly influencing consumption patterns for paper and packaging. Developing regions, particularly in Asia and Africa, are experiencing rapid population growth, which translates to increased demand for consumer goods and, consequently, their packaging. This trend is expected to continue, with the UN forecasting a global population of 9.7 billion by 2050.

Urbanization is another key driver. By 2024, over 60% of the world's population lives in urban areas, a figure projected to reach 68% by 2050. This concentration of people in cities intensifies the need for efficient logistics and a greater volume of packaged goods, from groceries to e-commerce deliveries. Central National-Gottesman (CNG) must adapt its distribution networks to serve these growing urban centers effectively.

- Population Growth: Global population expected to reach over 8.1 billion in 2024, with significant growth concentrated in developing nations.

- Urbanization Rate: Over 60% of the global population resides in urban areas in 2024, increasing demand for packaged goods in concentrated markets.

- E-commerce Impact: Rising urbanization fuels e-commerce, directly boosting demand for corrugated boxes and protective packaging materials.

- Market Opportunities: Demographic shifts create new market segments and alter demand for specific paper products, requiring strategic distribution adjustments.

Labor Force Dynamics and Talent Retention

Central National-Gottesman (CNG) faces evolving labor force dynamics. The availability of skilled professionals in key areas like logistics, sales, and specialized product management is paramount for efficient operations. For instance, the U.S. Bureau of Labor Statistics projected a 3.4% growth in logistics and supply chain occupations between 2022 and 2032, indicating a competitive talent landscape.

Shifts in labor market conditions directly impact CNG. Rising wage expectations, driven by inflation and demand, can increase operational expenditures. Furthermore, persistent skill shortages in specific sectors, such as experienced truck drivers or advanced manufacturing technicians, can hinder efficiency and service delivery. In 2024, the trucking industry alone faced a shortage of over 78,000 drivers, a figure that directly affects logistics companies.

Attracting and retaining top talent remains a strategic imperative for CNG's sustained growth and innovation. Companies are increasingly investing in competitive compensation packages, professional development opportunities, and a positive work environment to secure and keep their workforce. In 2025, employee retention strategies are expected to focus more on flexible work arrangements and robust benefits, with companies offering enhanced healthcare and retirement plans to stand out.

- Skilled Labor Needs: CNG relies on expertise in logistics, sales, and specialized product domains.

- Wage Inflation Impact: Rising wages in 2024 and 2025 directly affect operational costs for companies like CNG.

- Skill Shortages: Sectors like trucking experienced significant driver shortages in 2024, impacting supply chains.

- Talent Retention Focus: Companies are prioritizing development and flexible work to retain employees in 2025.

Societal attitudes towards health and wellness are increasingly influencing product demand. Consumers are showing a greater preference for products that promote well-being, which can impact the types of paper and packaging materials favored by end-users. For instance, the global market for wellness products is projected to reach $7.0 trillion by 2025, indicating a broad shift in consumer priorities.

Central National-Gottesman (CNG) must remain attuned to these evolving consumer preferences. A focus on products that align with healthy lifestyles, such as those used in food packaging that emphasizes freshness and safety, could present new opportunities. Companies that demonstrate a commitment to consumer health and safety often build stronger brand loyalty and market resilience.

Changes in social values, including a growing emphasis on ethical consumption and corporate accountability, are also shaping the business landscape for CNG. Stakeholders expect businesses to operate with integrity, which includes fair labor practices and community engagement. By 2024, reports indicate that over 60% of consumers are more likely to purchase from brands that demonstrate strong ethical values.

The demand for transparency in supply chains is another significant societal factor. Consumers and investors alike are scrutinizing how products are made and where they come from, pushing companies like CNG to provide clear and verifiable information about their sourcing and manufacturing processes. This focus on ethical sourcing and production is becoming a key differentiator in the market.

| Sociological Factor | Impact on CNG | 2024/2025 Data/Trend |

| Health & Wellness Trends | Shifts demand towards packaging supporting well-being. | Global wellness market projected to reach $7.0 trillion by 2025. |

| Ethical Consumption | Increases expectation for responsible business practices. | Over 60% of consumers favor brands with strong ethical values (2024). |

| Supply Chain Transparency | Requires clear communication on product origins and ethics. | Growing consumer and investor demand for verifiable sourcing information. |

Technological factors

Advancements in automation, like automated warehouses and robotic sorting, are poised to significantly boost Central National-Gottesman's (CNG) supply chain efficiency. Autonomous vehicles are also entering the logistics landscape, promising faster deliveries.

Implementing these technologies can lead to substantial reductions in labor costs and a marked decrease in operational errors. For instance, the global warehouse automation market was projected to reach $30 billion by 2026, indicating widespread adoption and potential for significant cost savings.

These improvements in speed and accuracy translate directly into a competitive edge for CNG by optimizing delivery times and enhancing overall customer satisfaction in the paper and packaging industry.

Central National-Gottesman (CNG) must enhance its digital presence as B2B e-commerce continues to grow. By 2024, B2B e-commerce sales were projected to reach $3.5 trillion in the US alone, highlighting the critical need for robust online transaction capabilities. This means investing in intuitive online ordering portals and real-time inventory management systems to meet customer expectations for efficiency and transparency.

Seamless integration with customer procurement systems is also paramount. This technological factor allows for streamlined order processing and improved customer service, directly impacting sales cycles. For instance, companies that adopted digital procurement platforms in 2024 reported an average reduction in processing time by 25%, demonstrating the tangible benefits of such integrations for businesses like CNG.

Technological advancements in pulp, paper, and packaging are continuously reshaping the industry. Innovations like lightweighting, improved strength, and novel barrier properties are directly influencing product development. For instance, the drive for sustainable packaging solutions has seen a surge in research and development for biodegradable and compostable materials, with the global biodegradable packaging market projected to reach an estimated USD 47.9 billion by 2028, growing at a CAGR of 6.8%.

Central National-Gottesman (CNG) must remain agile and informed about these evolving material sciences to maintain its competitive edge. Offering customers cutting-edge solutions, particularly those with enhanced sustainability profiles or superior performance characteristics, is crucial. This includes embracing new fiber sources and processing technologies that reduce environmental impact while boosting product functionality.

Data Analytics and Predictive Modeling

Central National-Gottesman (CNG) can significantly benefit from advanced data analytics and predictive modeling. These technologies offer deep insights into fluctuating market trends and allow for more accurate demand forecasting, crucial in the paper and packaging industry. For instance, by analyzing historical sales data and external economic indicators, CNG could better anticipate shifts in demand for specific paper grades or packaging solutions.

Leveraging these analytical tools translates directly into improved operational efficiency and reduced waste. Predictive modeling can optimize inventory levels, minimizing the costs associated with overstocking or the lost sales from understocking. In 2024, companies across various sectors saw significant gains in efficiency; for example, a report by McKinsey indicated that businesses adopting advanced analytics experienced an average of 10-15% improvement in operational performance.

Furthermore, robust data-driven strategies bolster competitive intelligence. By monitoring competitor activities, customer behavior patterns, and global supply chain dynamics through data analytics, CNG can refine its market positioning and identify emerging opportunities. This proactive approach, informed by real-time data, is essential for maintaining a competitive edge in a dynamic global marketplace.

- Market Trend Analysis: Utilizing big data to identify emerging consumer preferences and industry shifts in paper and packaging.

- Demand Forecasting Accuracy: Employing predictive models to anticipate future demand for specific products, improving production planning.

- Supply Chain Optimization: Analyzing logistics data to streamline distribution, reduce transit times, and lower transportation costs.

- Enhanced Competitive Intelligence: Monitoring market signals and competitor strategies through data analytics for strategic advantage.

Cybersecurity and Data Protection

Central National-Gottesman's reliance on digital platforms necessitates stringent cybersecurity. The global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the increasing importance and investment in this area. Protecting proprietary data, client details, and operational integrity is essential for maintaining customer confidence and uninterrupted operations.

Compliance with evolving data protection laws, such as GDPR and CCPA, is a critical technological factor. Failure to adhere to these regulations can result in substantial fines and reputational damage. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

- Cybersecurity Investment: Companies are increasing spending on advanced threat detection and prevention systems.

- Data Breach Costs: The average cost of a data breach in 2024 was estimated at $4.73 million globally, underscoring the financial impact of security failures.

- Regulatory Landscape: Navigating and complying with diverse international data privacy regulations is a significant operational challenge.

- Digital Transformation Risks: As CNG expands its digital footprint, the attack surface for cyber threats grows, demanding continuous vigilance.

Central National-Gottesman (CNG) must prioritize advancements in automation and AI to enhance operational efficiency and reduce costs. For instance, the global AI market was projected to reach $200 billion in 2024, indicating a significant trend towards AI-driven solutions. Similarly, the adoption of autonomous mobile robots in warehouses is expected to grow, with the market size projected to exceed $10 billion by 2027, offering potential for faster, more accurate material handling.

| Technological Factor | Impact on CNG | Supporting Data (2024/2025 Projections) |

| Automation & Robotics | Increased supply chain efficiency, reduced labor costs, fewer operational errors. | Global warehouse automation market projected to reach $30 billion by 2026. |

| B2B E-commerce Growth | Need for robust online platforms, seamless integration with customer systems. | US B2B e-commerce sales projected to reach $3.5 trillion in 2024. |

| Material Science Innovations | Development of sustainable, high-performance paper and packaging products. | Global biodegradable packaging market projected to reach USD 47.9 billion by 2028. |

| Data Analytics & AI | Improved demand forecasting, operational efficiency, competitive intelligence. | Companies using advanced analytics saw average 10-15% operational performance improvement (McKinsey). |

| Cybersecurity & Data Privacy | Protection of data, compliance with regulations, maintaining customer trust. | Global cybersecurity market projected to exceed $300 billion in 2024. Average data breach cost in 2024: $4.73 million. |

Legal factors

Central National-Gottesman's global operations necessitate strict adherence to a patchwork of international trade laws and customs regulations. These rules govern everything from tariffs and quotas to product standards and documentation requirements for cross-border shipments. Failure to comply can result in significant delays, fines, and reputational damage, impacting the cost and efficiency of their supply chain.

For instance, the World Trade Organization (WTO) reported that in 2023, trade facilitation measures, aimed at streamlining customs procedures, were implemented by 150 member economies, yet significant variations persist. Changes in these regulations, such as the introduction of new import duties or stricter product inspections, can directly affect CNG's profitability and the competitiveness of its products in various markets.

Central National-Gottesman (CNG) operates within a global landscape of stringent environmental protection laws. These regulations, covering forestry, pulp and paper manufacturing, and waste disposal, directly influence the sourcing of raw materials and the company's own production processes. For instance, in 2024, the European Union continued to enforce its Circular Economy Action Plan, pushing for higher recycling rates in packaging, which impacts the paper and board sector where CNG is active.

Compliance with these environmental mandates, such as permissible emission levels and wastewater treatment standards, is not just a legal necessity but a core operational requirement for CNG and its suppliers. Failure to adhere can result in significant fines, operational disruptions, and the potential loss of essential operating licenses. The ongoing focus on sustainability means that companies like CNG must continually adapt their practices to meet evolving environmental standards, which can add to operational costs but also drive innovation.

Central National-Gottesman (CNG), as a major distributor in the pulp, paper, and packaging sectors, must navigate a complex web of anti-trust and competition laws across its global operations. These regulations are designed to prevent market manipulation and foster a level playing field for all businesses. For instance, the European Union's competition framework, enforced by the European Commission, scrutinizes mergers and acquisitions that could significantly reduce competition. In 2024, the Commission continued its active enforcement, reviewing numerous transactions within various industries, setting a precedent for how companies like CNG must structure their strategic alliances and market entry strategies to avoid penalties.

Labor Laws and Employment Regulations

Central National-Gottesman (CNG) navigates a complex web of labor laws across its global operations, impacting everything from minimum wage requirements to workplace safety standards. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay, while individual states may have higher requirements. Similarly, in Europe, regulations like the General Data Protection Regulation (GDPR) indirectly affect employment practices by governing how employee data is handled. The company must remain vigilant about these varying national and local mandates to ensure fair treatment and prevent costly litigation.

Maintaining compliance is not just about avoiding penalties; it’s fundamental to fostering a stable and productive workforce. In 2024, companies worldwide faced increased scrutiny on fair wage practices and diversity and inclusion initiatives. For example, reports indicate a growing trend of class-action lawsuits related to wage and hour disputes, highlighting the financial risks of non-compliance. CNG's commitment to adapting its employment policies to evolving legislation, such as new mandates on remote work or employee benefits, is therefore critical for sustained operational integrity and positive employee relations.

The dynamic nature of labor legislation necessitates ongoing adaptation. Consider the impact of new regulations introduced in 2024 concerning gig economy workers or updated safety protocols in manufacturing sectors. These changes often require significant adjustments to HR policies and operational procedures. CNG's proactive approach to monitoring and integrating these legal shifts is essential for mitigating risks and maintaining its reputation as a responsible employer.

- Global Compliance Burden: CNG must adhere to diverse national and local labor laws, covering wages, working conditions, safety, and non-discrimination across its international workforce.

- Risk Mitigation: Strict compliance with labor regulations is vital to prevent legal disputes, fines, and damage to employee relations.

- Evolving Legislation: The company needs to be adaptable to changes in labor laws, such as those impacting remote work or employee data privacy, to remain compliant and competitive.

- Financial Impact: Non-compliance can lead to significant financial penalties, as evidenced by the rise in wage and hour litigation in recent years.

Product Liability and Safety Standards

Central National-Gottesman (CNG) must meticulously adhere to product liability and safety standards across all its operating regions. This involves ensuring that distributed products, particularly those with food contact or containing hazardous materials, comply with stringent packaging and safety regulations. For instance, in the European Union, the General Food Law Regulation (EC) No 178/2002 sets broad traceability and safety requirements, while specific directives govern food contact materials. Failure to comply can result in severe consequences, including costly product recalls and significant legal liabilities, impacting brand trust and financial performance.

CNG's commitment to product safety is paramount to avoiding legal repercussions and maintaining its market standing. The company needs to stay updated on evolving safety regulations, such as those concerning chemical restrictions like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, which impacts the sourcing and distribution of various paper and packaging products. Non-compliance can trigger investigations, fines, and potentially lead to product bans, directly affecting sales channels and profitability. For example, in 2023, the US Consumer Product Safety Commission (CPSC) reported issuing numerous recalls for children's products due to safety violations, highlighting the pervasive nature of these risks across industries.

- Regulatory Compliance: Adherence to food contact material regulations, hazardous substance controls, and general product safety directives is essential for CNG's global operations.

- Risk Mitigation: Proactive management of product liability risks through rigorous quality control and supplier vetting can prevent recalls, lawsuits, and associated financial losses.

- Reputational Management: Maintaining a strong record of product safety bolsters consumer confidence and safeguards CNG's brand reputation in a competitive marketplace.

- Market Access: Compliance with diverse international safety standards is a prerequisite for accessing and operating within various global markets, ensuring continued business growth.

Central National-Gottesman (CNG) operates under a framework of intellectual property (IP) laws, safeguarding its brands, proprietary processes, and distribution agreements. Protecting these assets is crucial for maintaining its competitive edge and market position. For instance, the United States Patent and Trademark Office (USPTO) reported an increase in patent filings in 2024, reflecting the growing importance of innovation and IP protection across industries, including the paper and packaging sector where CNG is active.

Navigating the complexities of IP, including trademarks, copyrights, and patents, requires vigilance. Infringement can lead to costly legal battles and damage to brand integrity. CNG must ensure its operations and marketing materials do not infringe on existing IP rights while actively defending its own. The rise of digital platforms and global e-commerce in 2024 further complicates IP enforcement, necessitating robust digital asset management and monitoring strategies.

The company's reliance on technology and proprietary data also brings it under the purview of data protection and privacy laws, such as GDPR and similar regulations worldwide. These laws dictate how customer and employee data can be collected, stored, and processed, with significant penalties for non-compliance. For example, fines under GDPR can reach up to 4% of global annual revenue, a substantial risk for any international corporation. Staying abreast of these evolving data privacy mandates is therefore critical for operational continuity and maintaining stakeholder trust.

Environmental factors

Climate change poses a significant threat to the availability and quality of timber, a critical raw material for the pulp and paper industry. Rising global temperatures and altered precipitation patterns are projected to increase the frequency and intensity of extreme weather events like droughts and wildfires, directly impacting forest health and timber yields. For instance, the 2023 wildfire season in Canada, one of the worst on record, led to significant timber losses and disruptions across various industries, including forestry.

These environmental shifts can severely disrupt timber supply chains, affecting the consistent availability of raw materials for companies like Central National-Gottesman. Adapting sourcing strategies to account for these changing environmental conditions, perhaps through diversified geographic sourcing or increased investment in sustainable forestry practices that enhance resilience, will be crucial for maintaining operational stability and mitigating risks.

Growing global emphasis on circular economy principles, with regulations pushing for waste reduction and increased recycling, directly impacts industries like packaging and paper. Central National-Gottesman (CNG) is feeling this pressure to make its distributed products easier to recycle and to increase the use of recycled materials. For instance, by 2025, the EU aims for a 65% recycling rate for municipal waste, a target that necessitates changes in how products are designed and sourced.

Growing global awareness of biodiversity loss and deforestation is significantly shaping consumer preferences and regulatory landscapes. This trend directly impacts industries relying on forest products, like Central National-Gottesman (CNG), by increasing demand for materials sourced from sustainably managed forests. Certifications such as the Forest Stewardship Council (FSC) or the Programme for the Endorsement of Forest Certification (PEFC) are becoming crucial market differentiators.

CNG's proactive commitment to sourcing from suppliers who adhere to responsible forestry practices is therefore not just an environmental imperative but a strategic business necessity. This commitment directly bolsters its environmental reputation, which in turn is vital for maintaining and expanding market access, particularly in regions with stringent environmental regulations or environmentally conscious consumer bases. Demonstrating a clear dedication to these principles can unlock new opportunities and strengthen existing relationships.

In 2024, the global forest certification market continued its expansion, with FSC certification covering over 200 million hectares worldwide. This highlights the increasing importance of such standards for businesses. For CNG, actively promoting and prioritizing these sustainable forestry practices within its supply chain is key to navigating these evolving environmental expectations and ensuring long-term viability and competitive advantage.

Carbon Footprint of Logistics and Operations

Central National-Gottesman's extensive global supply chain faces growing pressure regarding its environmental impact, especially concerning emissions from transportation and warehousing. For instance, the International Transport Forum reported that global freight transport emissions reached 10.6 gigatons of CO2 equivalent in 2023, a figure that directly affects companies with large logistical networks like CNG.

The company is actively being pushed to reduce its carbon footprint. This involves strategic initiatives such as optimizing delivery routes, transitioning to more sustainable transportation methods like electric vehicles or rail, and enhancing energy efficiency across its warehousing facilities. These efforts are crucial for meeting evolving regulatory standards and stakeholder expectations.

- Logistics Emissions: Global freight transport emissions are a significant environmental concern, impacting companies with extensive supply chains.

- Optimization Strategies: CNG must focus on route optimization and adopting cleaner transport modes to mitigate its carbon footprint.

- Energy Efficiency: Improving energy usage in warehousing operations is another key area for environmental performance enhancement.

- Strategic Investment: Addressing these environmental factors necessitates strategic financial commitments to infrastructure and technology upgrades.

Water Scarcity and Pollution in Manufacturing

Water is absolutely essential for pulp and paper production, and any issues with its availability or quality directly affect manufacturing output. Central National-Gottesman (CNG) requires its suppliers to follow rigorous water management protocols.

Environmental rules around water usage and what can be released back into the environment significantly shape operating expenses and where manufacturing facilities can be located. For instance, in 2024, the pulp and paper industry in the US faced increasing scrutiny over water discharge, with some regions implementing stricter limits on chemical oxygen demand (COD) and total suspended solids (TSS).

- Water Dependency: Pulp and paper manufacturing is a water-intensive process, making water availability a primary concern.

- Supplier Compliance: CNG mandates that its suppliers adhere to stringent water management practices to ensure sustainability and regulatory adherence.

- Regulatory Impact: Environmental regulations on water discharge and consumption directly influence operational costs and strategic site selection for manufacturing partners.

- Industry Trends: By 2025, water efficiency technologies are expected to become even more critical for pulp and paper mills to manage costs and meet evolving environmental standards.

Environmental factors significantly influence the pulp and paper industry, impacting everything from raw material sourcing to operational efficiency. Climate change poses a direct threat to timber availability, while increasing regulatory focus on circular economy principles pushes for greater recycling and reduced waste. Biodiversity concerns are also driving demand for sustainably sourced materials, making certifications like FSC increasingly vital for market access.

Central National-Gottesman (CNG) faces these challenges head-on. The company must adapt its supply chain to climate-induced timber disruptions and embrace circular economy models by enhancing product recyclability and increasing the use of recycled content. Furthermore, a commitment to sourcing from sustainably managed forests is essential for maintaining its environmental reputation and meeting evolving consumer and regulatory demands.

The company's logistical operations are also under scrutiny for their environmental impact. With global freight transport emissions a major concern, CNG is implementing strategies to reduce its carbon footprint, including route optimization and the adoption of cleaner transportation methods. Enhancing energy efficiency in warehousing is another key area for improvement.

Water management is critical for pulp and paper production, with environmental regulations on water usage and discharge directly affecting operational costs and site selection. CNG requires its suppliers to adhere to strict water management protocols, reflecting the industry's increasing focus on water efficiency and responsible discharge practices.

| Environmental Factor | Impact on CNG | Key Data/Trend (2024-2025) | Strategic Response |

|---|---|---|---|

| Climate Change & Timber Supply | Disruptions to raw material availability and quality | 2023 Canadian wildfires caused significant timber losses. Projected increase in extreme weather events. | Diversified sourcing, investment in resilient forestry practices. |

| Circular Economy & Waste Reduction | Pressure to increase recyclability and recycled content | EU target of 65% municipal waste recycling by 2025. | Designing for recyclability, increasing use of recycled materials. |

| Biodiversity & Deforestation | Demand for sustainably sourced materials | FSC certification covers over 200 million hectares globally (2024). | Prioritizing suppliers with FSC/PEFC certifications, promoting responsible forestry. |

| Logistics Emissions | Environmental impact of transportation and warehousing | Global freight transport emissions reached 10.6 Gt CO2e in 2023. | Route optimization, transition to electric vehicles/rail, warehousing energy efficiency. |

| Water Management | Dependency on water availability and quality for production | Stricter limits on COD and TSS in water discharge in US pulp/paper industry (2024). | Mandating rigorous water management protocols for suppliers, focus on water efficiency. |

PESTLE Analysis Data Sources

Our Central National-Gottesman PESTLE Analysis is grounded in comprehensive data from leading economic institutions, governmental bodies, and reputable market research firms. We meticulously gather insights from official policy documents, statistical databases, and industry-specific reports to ensure accuracy and relevance.