Central National-Gottesman Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central National-Gottesman Bundle

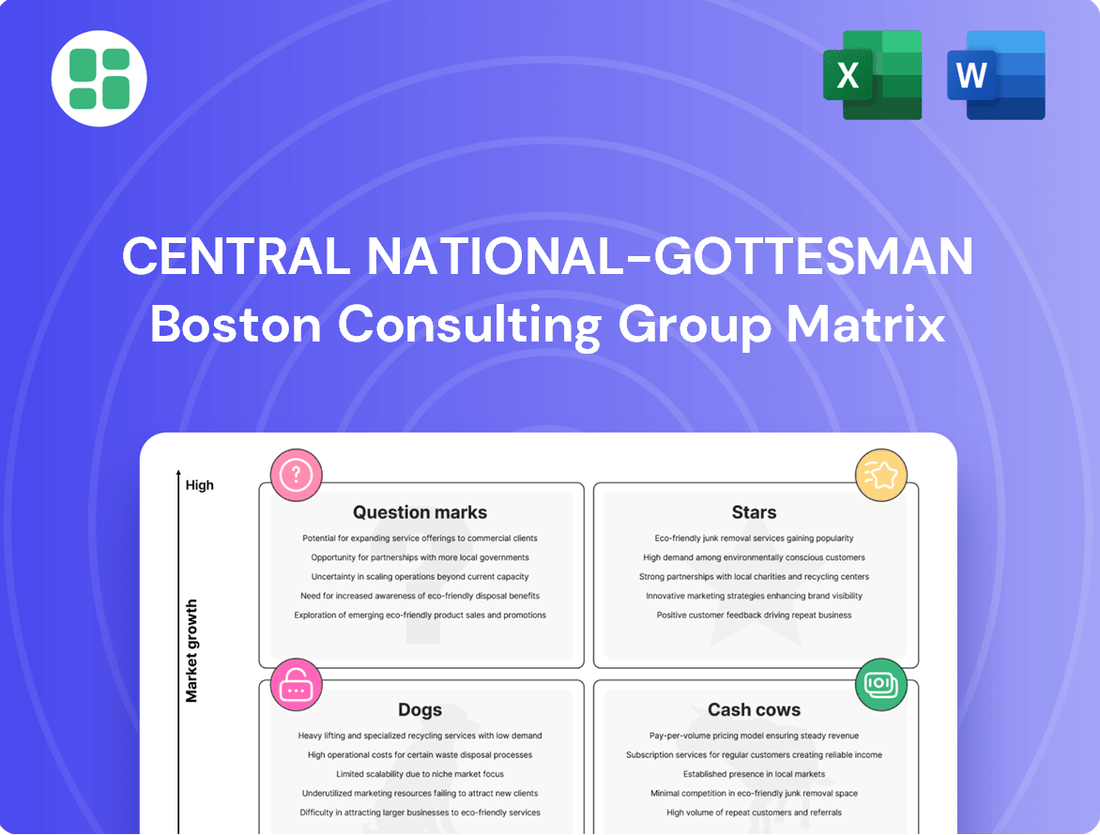

Unlock the strategic power of the Central National-Gottesman BCG Matrix and see precisely where its products shine as Stars, provide steady income as Cash Cows, lag as Dogs, or represent future potential as Question Marks. This is your chance to gain a crystal-clear understanding of their product portfolio's health and trajectory.

Don't settle for a glimpse; invest in the complete Central National-Gottesman BCG Matrix report. It offers detailed quadrant placements, actionable, data-driven recommendations, and a clear roadmap to optimize your investment and product development strategies.

The full Central National-Gottesman BCG Matrix provides a comprehensive view of the company's competitive positioning in today's dynamic market. With in-depth, quadrant-specific insights and strategic takeaways, this report is your essential tool for achieving competitive clarity and driving informed decisions.

Stars

Central National-Gottesman's distribution of sustainable packaging, particularly those made from paper and paperboard, is a key growth driver. This segment is well-positioned within the BCG matrix due to strong market tailwinds.

The global market for sustainable packaging is expected to see substantial growth, reaching an estimated USD 530.4 billion by 2035, up from USD 301.8 billion in 2025. Within this, paper and paperboard packaging is a leading category, indicating a robust demand for CNG's offerings.

This expansion is fueled by increasing consumer demand for eco-friendly products and corporate ESG (Environmental, Social, and Governance) initiatives in procurement. These factors suggest that CNG's sustainable packaging distribution aligns with high-growth, high-market-share product characteristics.

E-commerce packaging solutions represent a significant star for Central National-Gottesman (CNG). The sustained growth in online retail directly fuels a strong demand for the protective and efficient packaging materials CNG specializes in distributing. This segment is a clear growth engine for the company.

By 2025, consumer preferences for e-commerce packaging are increasingly focused on durability, environmental responsibility, and user convenience. CNG is well-positioned to meet these evolving demands with its diverse product offerings.

The market for paper-based packaging within e-commerce experienced a notable 12% expansion in 2024. This rapid growth underscores the opportunity for CNG to capitalize on its extensive distribution capabilities and supply chain expertise within this burgeoning sector.

Central National-Gottesman's (CNG) high-performance packaging for the food and beverage sector is a clear star in their portfolio. This segment benefits from a robust supply of specialized paper and paperboard, crucial for a market increasingly prioritizing sustainability.

The sustainable packaging market, where CNG's food and beverage offerings are a major player, is projected for substantial growth. This trend is further bolstered by a growing consumer and regulatory push away from plastics towards more eco-friendly alternatives like paper.

This shift, driven by paper's recyclability and biodegradability, directly translates to sustained high demand for CNG's solutions. In 2024, the global sustainable packaging market was valued at over $280 billion, with the paper and paperboard segment showing particularly strong upward momentum.

Advanced Digital Printing Substrates

Advanced Digital Printing Substrates represent a significant growth opportunity for Central National-Gottesman (CNG). The global digital printing market is anticipated to reach USD 85.75 billion by 2035, expanding at a compound annual growth rate of approximately 7.35% starting in 2025. CNG's strategic focus on distributing specialized paper and board substrates tailored for these advanced digital printing technologies places it squarely within this expanding high-growth sector.

This segment is characterized by its innovative nature and the increasing demand for customization and faster production cycles across diverse industries, from packaging to commercial printing. CNG's role in supplying these critical materials for digital printing solutions solidifies its position as a star performer within the BCG matrix.

- Market Growth: Digital printing market projected to hit USD 85.75 billion by 2035, with a CAGR of 7.35% from 2025.

- CNG's Position: Distribution of specialized paper and board substrates for advanced digital printing.

- Key Drivers: Enabling customization and rapid turnaround times, fostering innovation.

- Strategic Importance: High-growth niche with increasing adoption across various industries.

Pulp and Packaging Distribution in Emerging Asian Markets

Pulp and Packaging Distribution in Emerging Asian Markets represents a significant star for Central National-Gottesman (CNG) within the BCG Matrix. The Asia-Pacific region is leading the charge in the global sustainable packaging market, with an impressive projected Compound Annual Growth Rate (CAGR) of 7.56% between 2025 and 2034. This robust growth, coupled with CNG's established presence and distribution networks in fast-developing economies, particularly in South Asia, positions this segment for substantial success.

India, specifically, stands out as the fastest-growing market for sustainable packaging, underscoring the immense potential for CNG to capture and maintain a high market share. The strategic alignment of CNG's distribution capabilities with the rapid industrialization and increasing consumer demand for sustainable solutions in these emerging markets is a key driver of its star status.

- Market Dominance: Asia-Pacific is the leading global market for sustainable packaging.

- High Growth Projection: The region is expected to grow at a CAGR of 7.56% from 2025 to 2034.

- India's Rapid Expansion: India is identified as the fastest-growing market within this segment.

- CNG's Strategic Advantage: Established distribution channels in rapidly industrializing Asian regions offer significant opportunities.

Central National-Gottesman's (CNG) sustainable packaging, especially for e-commerce and the food/beverage sector, are strong performers. These segments benefit from growing consumer preference for eco-friendly options and corporate ESG goals. The company's focus on paper and paperboard aligns perfectly with these market trends, positioning them as leaders in high-growth areas.

CNG's advanced digital printing substrate distribution also shines, driven by the digital printing market's expansion and demand for customization. Furthermore, their pulp and packaging distribution in emerging Asian markets, particularly India, represents a significant star due to rapid industrialization and increasing adoption of sustainable solutions.

| CNG Segment | BCG Category | Key Growth Drivers | 2024 Data/Projections |

|---|---|---|---|

| Sustainable Packaging (Paper/Paperboard) | Star | Consumer demand for eco-friendly products, Corporate ESG initiatives | Global market over $280 billion in 2024; Paper segment showing strong upward momentum. |

| E-commerce Packaging | Star | Sustained growth in online retail, demand for protective and efficient packaging | Paper-based packaging in e-commerce expanded by 12% in 2024. |

| High-Performance Food & Beverage Packaging | Star | Consumer and regulatory push away from plastics, demand for recyclability and biodegradability | Sustainable packaging market growth bolstered by shift to paper alternatives. |

| Advanced Digital Printing Substrates | Star | Digital printing market expansion, demand for customization and faster production | Digital printing market projected to reach USD 85.75 billion by 2035 (CAGR 7.35% from 2025). |

| Pulp & Packaging Distribution (Emerging Asia) | Star | Rapid industrialization, increasing consumer demand for sustainable solutions | Asia-Pacific CAGR of 7.56% (2025-2034); India fastest-growing market. |

What is included in the product

This BCG Matrix overview provides strategic insights into Central National-Gottesman's portfolio, highlighting units for investment, divestment, or holding.

Central National-Gottesman BCG Matrix: A clear overview of your portfolio's health, easing strategic decision-making.

Cash Cows

Central National-Gottesman's (CNG) traditional pulp distribution is a prime example of a cash cow within the BCG matrix. This established global operation generates substantial and reliable cash flow, a direct result of its integral position in the paper industry's supply chain.

The global paper pulp market, a sector where CNG thrives, was valued at approximately USD 264.69 billion in 2025. While growth is steady, the projected compound annual growth rate (CAGR) between 2025 and 2033 is anticipated to be in the range of 2.5% to 3.8%.

This segment's strength lies in its consistent, high-volume cash generation. Pulp remains a fundamental raw material for a vast array of paper products globally, and CNG's distribution network requires minimal new investment to maintain its operational capacity and market share.

The distribution of standard paper and paperboard for packaging in mature markets like North America and Western Europe is a prime example of a cash cow for Central National-Gottesman (CNG). This segment benefits from established infrastructure and strong customer relationships, ensuring consistent revenue streams.

With the overall paper and paperboard packaging market projected to grow at a compound annual growth rate (CAGR) of 4.3% through 2029, these established markets offer stability. CNG's efficient logistics and deep market penetration in these regions allow for reliable profit generation without requiring substantial new investment to drive growth.

The global tissue paper market demonstrated remarkable resilience, emerging as a top performer in 2024. This sustained demand, coupled with the mature nature of the product category, positions CNG's tissue paper distribution as a prime cash cow.

CNG's extensive and efficient distribution channels for tissue products are a significant asset. These networks likely generate substantial and consistent cash flow, benefiting from stable consumer purchasing habits and relatively low competitive pressures.

Commercial Printing Paper (Stable Segments)

Even with broader declines in graphic papers, specific areas of commercial printing paper, like coated freesheet, experienced a notable 18% rebound in 2024, indicating a stabilization trend. Central National-Gottesman's (CNG) distribution of these steady commercial printing grades, especially for direct mail and other enduring uses, likely secures a substantial market share and generates consistent cash flow. This stability is further bolstered by established customer ties and streamlined logistics.

- Market Resilience: Coated freesheet segments within commercial printing paper saw an 18% rebound in 2024, signaling a stabilizing market.

- CNG's Position: CNG's distribution of these stable grades, particularly for direct mail, likely maintains a high market share.

- Revenue Generation: The segment benefits from existing customer relationships and efficient supply chains, ensuring steady cash generation.

Large-Volume Industrial Packaging

Central National-Gottesman's (CNG) distribution of large-volume industrial packaging, like corrugated materials vital for general manufacturing and logistics, operates as a cash cow. This segment thrives on steady demand across diverse sectors, supported by CNG's robust large-scale supply chain capabilities.

The paper and paperboard packaging market is a significant contributor, projected to reach USD 442.34 billion by 2025, underscoring the stable revenue streams from this sector.

- Consistent Demand: Essential industrial packaging experiences predictable demand from sectors like automotive, food and beverage, and e-commerce.

- Economies of Scale: CNG's large-scale operations allow for cost efficiencies in sourcing and distribution, boosting profitability.

- Market Stability: The industrial packaging market, unlike more volatile sectors, provides a reliable base for cash generation.

- Industry Growth: The broader paper and paperboard packaging market's projected growth to USD 442.34 billion in 2025 highlights the enduring strength of this segment.

Central National-Gottesman's (CNG) distribution of standard paper and paperboard for packaging in mature markets like North America and Western Europe exemplifies a cash cow. This segment benefits from established infrastructure and strong customer relationships, ensuring consistent revenue streams.

The global paper and paperboard packaging market is projected to grow at a compound annual growth rate (CAGR) of 4.3% through 2029, offering stability. CNG's efficient logistics and deep market penetration in these regions allow for reliable profit generation without requiring substantial new investment to drive growth.

The global tissue paper market demonstrated remarkable resilience, emerging as a top performer in 2024. This sustained demand, coupled with the mature nature of the product category, positions CNG's tissue paper distribution as a prime cash cow, generating substantial and consistent cash flow from stable consumer purchasing habits.

CNG's distribution of large-volume industrial packaging, like corrugated materials vital for general manufacturing and logistics, operates as a cash cow. This segment thrives on steady demand across diverse sectors, supported by CNG's robust large-scale supply chain capabilities, with the broader paper and paperboard packaging market projected to reach USD 442.34 billion by 2025.

| CNG Business Segment | BCG Category | Key Characteristics | Market Data Point | CNG Advantage |

| Pulp Distribution | Cash Cow | Established, reliable cash flow | Global pulp market valued at ~$264.69 billion (2025) | Integral to paper industry supply chain, minimal investment needed |

| Standard Packaging Distribution (Mature Markets) | Cash Cow | Consistent, high-volume revenue | Paper & paperboard packaging CAGR: 4.3% through 2029 | Efficient logistics, deep market penetration |

| Tissue Paper Distribution | Cash Cow | Stable consumer demand, low competitive pressure | Top performer in 2024 | Extensive and efficient distribution channels |

| Industrial Packaging Distribution | Cash Cow | Steady demand across diverse sectors | Paper & paperboard packaging to reach $442.34 billion (2025) | Robust large-scale supply chain capabilities |

What You’re Viewing Is Included

Central National-Gottesman BCG Matrix

The Central National-Gottesman BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed by strategy experts, contains no watermarks or demo content, ensuring you get a professional and analysis-ready file. You can confidently use this preview as a direct representation of the complete BCG Matrix report that will be yours to edit, print, or present. Unlock immediate strategic clarity with this professionally designed, instantly downloadable document.

Dogs

The market for graphic papers, including newsprint, is experiencing a persistent downturn. Projections indicate a compound annual growth rate of -1.3% for this segment between 2025 and 2030, highlighting a shrinking demand driven by the ongoing shift towards digital media and a general decline in print consumption.

Central National-Gottesman's (CNG) involvement in distributing these traditional papers places them squarely within this declining market. The reduced readership and advertising revenue for newspapers directly impact the demand for newsprint, making it a challenging product category.

This segment of CNG's business exemplifies a 'dog' in the BCG matrix. It generates low returns and requires continuous resource allocation in a market that offers little prospect for significant growth or recovery, thereby tying up capital that could be better utilized elsewhere.

Uncoated woodfree paper, a staple for offices and publishing, is a classic example of a 'dog' in the BCG matrix for Central National-Gottesman (CNG). Its market is characterized by low growth and declining demand, a trend clearly reflected in North American shipments which hit their lowest point in 2024.

This decline is fueled by the persistent shift towards digital communication and a reduced need for physical office materials. As a result, CNG's investment in this segment offers limited potential for significant market share expansion or revenue growth, making it a challenging product line to manage.

Specialty graphic papers designed for niche print media sectors, particularly those experiencing a decline like certain artistic or promotional papers, would be categorized as Dogs in the BCG Matrix. These products are characterized by limited and shrinking demand, often struggling against the pervasive shift towards digital alternatives. In 2024, the global specialty paper market, while diverse, saw segments catering to traditional print face headwinds; for instance, certain high-end art paper manufacturers reported single-digit revenue declines, reflecting reduced print runs for magazines and brochures.

Outdated Paper Converting Services

Outdated paper converting services within Central National-Gottesman (CNG) that cater to industries with declining demand or rely on antiquated methods would be classified as Dogs in the BCG Matrix. These operations likely struggle to adapt to evolving market needs, such as the shift towards sustainable packaging or digital printing solutions.

If CNG has minimal exposure to these legacy segments, their contribution to overall returns would be negligible, potentially only breaking even. This stagnation is often characterized by low growth and low market share.

- Low Market Growth: Industries like traditional print advertising or certain types of paper packaging are experiencing secular declines. For example, global newspaper and magazine advertising revenue has been on a downward trend for years, impacting demand for related paper products.

- Minimal Market Share: Even within declining sectors, these outdated services may hold a small share, further limiting their revenue potential.

- Low Profitability: Operations that cannot innovate or find new markets often face price pressures and diminishing margins.

- Need for Divestment or Restructuring: Such units typically require significant investment to modernize or are candidates for divestment to free up resources for more promising areas.

Distribution in Geographically Declining Print Markets

Central National-Gottesman's distribution operations in geographically declining print markets, particularly those heavily reliant on traditional graphic papers, are categorized as Dogs. These regions are characterized by rapid digital adoption, leading to a significant drop in print consumption.

CNG's low market share in these shrinking print sectors further solidifies their Dog status. For example, in 2024, the global paper and pulp market, while showing some resilience, saw continued pressure on graphic paper segments due to digitization trends.

- Declining Print Demand: Markets with high digital penetration, such as Western Europe and North America, experienced an average decline of 3-5% in graphic paper demand in 2024.

- Low Market Share: CNG's presence in these specific declining segments often represents less than 5% of the regional market.

- Limited Growth Prospects: The outlook for traditional print distribution in these areas offers minimal to negative growth for the foreseeable future.

- Strategic Consideration: Divestment or a significant strategic pivot away from these specific product lines and regions is often the recommended course of action for Dog business units.

Products or business units categorized as Dogs within the BCG matrix are those operating in low-growth markets with low relative market share. These are typically underperforming assets that generate low profits or even losses, consuming more resources than they return. For Central National-Gottesman (CNG), examples would include specific legacy paper grades facing obsolescence or distribution channels in rapidly declining print regions.

These Dog segments require careful management, often leading to decisions about divestment, liquidation, or minimal investment to sustain operations. The key characteristic is the lack of future growth potential, making them a drain on resources that could be allocated to more promising business areas. For instance, a specific type of coated paper used primarily for print advertising might fall into this category if its market share is small and the overall demand for that paper grade is shrinking significantly.

In 2024, the graphic paper segment, particularly newsprint and certain uncoated freesheet papers, continued to exhibit characteristics of a Dog for many distributors. The North American uncoated freesheet market, for example, saw shipments decline by approximately 8% year-over-year in 2024, with demand for printing and writing grades particularly weak.

Central National-Gottesman's exposure to these specific segments would be classified as Dogs, reflecting their low market growth and, potentially, low market share within those declining niches. These operations are unlikely to generate substantial returns and may require significant strategic review.

| CNG Business Segment Example | Market Growth Rate (Est. 2024-2029) | CNG Relative Market Share (Est.) | BCG Classification |

|---|---|---|---|

| Newsprint Distribution | -4.0% | Low | Dog |

| Uncoated Free Sheet (Printing/Writing) | -2.5% | Low | Dog |

| Specialty Papers (Niche Print) | -1.5% | Low | Dog |

Question Marks

Central National-Gottesman's foray into emerging bio-based packaging materials positions these products as question marks within the BCG matrix. These innovative materials, while tapping into a growing sustainable packaging market projected to reach over $400 billion globally by 2027, likely possess a low current market share.

The high growth potential of these bio-based alternatives hinges on factors like consumer acceptance, regulatory support, and scalability. For instance, the global bioplastics market alone was valued at approximately $50 billion in 2023 and is expected to see robust growth, indicating a fertile ground for such innovations.

Significant capital investment will be crucial for CNG to nurture these question marks into stars, requiring research and development, production capacity expansion, and market penetration strategies to capture a larger share of this expanding sector.

Central National-Gottesman (CNG) venturing into new, high-growth geographic regions with a limited presence, like certain developing economies in Africa or Latin America, could be classified as question marks within the BCG Matrix framework. These areas present exciting potential for future expansion, but they also come with significant risks and require substantial capital outlay to establish a foothold and build necessary infrastructure.

For instance, consider the projected growth in sub-Saharan Africa's manufacturing sector, which was estimated to grow by over 5% annually in the years leading up to 2024, according to various industry reports. Entering such markets would necessitate heavy investment in local distribution networks and potentially manufacturing facilities, a classic characteristic of a question mark investment.

Central National-Gottesman's (CNG) exploration into advanced digital printing services, such as variable data printing or personalized packaging, positions these as question marks within the BCG matrix. While the digital printing market is experiencing significant growth, projected to reach over $30 billion globally by 2025, CNG's current market share in providing these specific services, rather than just paper distribution, would likely be nascent and low.

Specialized Packaging for Next-Gen Technologies

Central National-Gottesman's involvement in specialized packaging for next-gen technologies, such as advanced electronics and EV components, likely falls into the Question Mark category of the BCG Matrix. While these sectors promise high growth potential due to rapid technological evolution, they also demand substantial investment in research and development and aggressive market penetration strategies to establish a dominant market share.

The demand for sophisticated packaging solutions in these emerging industries is projected to see significant expansion. For instance, the global market for electric vehicle battery packaging was estimated to be worth approximately USD 2.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, driven by the increasing adoption of EVs. Similarly, the advanced packaging market for semiconductors, crucial for next-gen electronics, is anticipated to reach over USD 70 billion by 2028, with a CAGR exceeding 6%.

To succeed in these dynamic segments, Central National-Gottesman would need to focus on:

- Developing innovative packaging materials that meet the stringent requirements of high-tech applications, such as thermal management, electrostatic discharge protection, and miniaturization.

- Forging strategic partnerships with key players in the electronics, automotive, and medical device industries to gain early access to market trends and customer needs.

- Investing heavily in R&D to stay ahead of technological advancements and to create proprietary solutions that offer a competitive edge.

- Building robust supply chains capable of handling the specialized nature and potentially volatile demand of these rapidly evolving markets.

Recycled Fiber Sourcing and Distribution Innovations

Central National-Gottesman (CNG) might be exploring innovative approaches to sourcing, processing, or distributing recycled fibers, placing these initiatives in the question mark category of the BCG matrix. The global market for recycled materials in packaging is experiencing robust growth, with projections indicating it could reach USD 245.56 billion by 2029. While this signifies a strong growth potential, CNG's market share in these nascent, unproven methods would likely begin at a low point.

These emerging strategies could involve advanced sorting technologies, novel fiber treatment processes, or optimized logistics for collecting and distributing recycled materials. The inherent uncertainty in adoption rates and the capital investment required for these innovations position them as question marks, requiring careful evaluation and potential investment to become future stars.

- Market Growth: The recycled materials packaging solutions market is projected to reach USD 245.56 billion by 2029, highlighting significant growth opportunities.

- Innovation Focus: CNG's question mark initiatives likely center on novel methods for recycled fiber sourcing, processing, or distribution.

- Market Share: Initial market share for these unproven, innovative approaches would be low, reflecting their developmental stage.

- Strategic Importance: Successful development and scaling of these innovations could transform them into future stars for CNG.

Central National-Gottesman's (CNG) investments in novel sustainable packaging solutions, such as biodegradable films derived from agricultural waste, are likely categorized as question marks in the BCG matrix. These ventures tap into a rapidly expanding market, with the global biodegradable packaging market projected to reach over $60 billion by 2028, exhibiting strong growth potential. However, CNG's current market share in these niche, emerging technologies would be relatively low, requiring significant investment to capture a larger piece of this growing pie.

The success of these question marks hinges on several factors, including consumer adoption of eco-friendly alternatives and favorable regulatory environments. For instance, the demand for plant-based plastics, a key component of bio-based packaging, saw a significant increase in 2023, with market size estimates reaching approximately $55 billion globally. CNG's strategic challenge is to nurture these nascent products through substantial R&D, enhanced production capabilities, and targeted marketing to transform them into future market leaders.

| Initiative | BCG Category | Market Potential | CNG Market Share | Strategic Imperative |

| Biodegradable Films (Agricultural Waste) | Question Mark | Global biodegradable packaging market projected >$60B by 2028 | Low (Niche Technology) | Invest in R&D, Production, Marketing |

| Recycled Fiber Innovations | Question Mark | Recycled materials packaging market projected $245.56B by 2029 | Low (Unproven Methods) | Develop, Scale, Evaluate Adoption Rates |

| Digital Printing Services | Question Mark | Global digital printing market projected >$30B by 2025 | Low (Specific Services) | Focus on R&D, Market Penetration |

BCG Matrix Data Sources

Our Central National-Gottesman BCG Matrix is informed by a blend of financial disclosures, market research reports, and industry-specific growth projections for comprehensive strategic analysis.