Zhejiang Dingli Machinery SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Dingli Machinery Bundle

Zhejiang Dingli Machinery boasts strong manufacturing capabilities and a growing international presence, but faces intense competition and potential supply chain disruptions. Our comprehensive SWOT analysis delves into these critical factors, providing a clear roadmap for navigating the market.

Want the full story behind Dingli Machinery's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Zhejiang Dingli Machinery is a dominant force in the aerial work platform (AWP) sector, boasting a comprehensive product lineup that includes scissor lifts, boom lifts, and mast lifts. This extensive range allows them to serve a wide array of industries and applications, solidifying their strong market presence. Dingli is consistently ranked among the top global AWP manufacturers.

Zhejiang Dingli Machinery stands out as a leader in China's new energy aerial work platform sector, boasting a significant electrification rate across its arm, scissor, and mast-type product lines. This commitment to green technology positions them favorably in a market increasingly prioritizing sustainability.

The company's robust investment in research and development fuels the continuous introduction of high-value-added, electrified, and intelligent aerial work platforms. For instance, in 2023, Dingli's R&D expenditure reached 276 million RMB, a 16% increase year-on-year, underscoring their dedication to technological progress and market leadership.

This forward-thinking approach ensures their product portfolio not only adheres to stringent international safety regulations but also proactively addresses the global demand for more sustainable and efficient operational solutions. Their focus on electrification and intelligent features is a key differentiator, aligning with industry trends and future market expectations.

Zhejiang Dingli Machinery has demonstrated strong financial performance, with sales showing consistent year-on-year growth. For the first half of 2025, the company reported sales of CNY 4,336.12 million, an increase from CNY 3,859.46 million in the same period of the previous year.

This upward trend extends to profitability, with net income also seeing significant increases. The company's revenue and earnings have frequently surpassed analyst expectations, highlighting its resilient financial health and effective operational management.

Global Strategic Layout and Localization

Zhejiang Dingli Machinery boasts an extensive global sales network, reaching over 80 countries and regions. This broad reach is complemented by a focused strategy on localization, particularly evident in its significant expansion within the US market.

The strategic acquisition of CMEC in the United States during 2024 is a key element of this localization. It establishes crucial manufacturing capabilities within the US, directly addressing and mitigating the financial impact of tariffs on export costs.

This approach bolsters the stability of its international supply chains and significantly enhances the efficiency of its service response for customers worldwide.

- Global sales network spans over 80 countries and regions.

- Strategic localization efforts focused on the US market.

- Acquisition of CMEC in 2024 established US manufacturing, reducing tariff impact.

- Enhanced supply chain stability and improved international customer service.

Commitment to Quality and Safety Standards

Zhejiang Dingli Machinery's unwavering commitment to quality and adherence to international safety standards is a significant strength. Their products are recognized for reliability, fostering strong customer confidence. This dedication to excellence is further underscored by their focus on occupational health and safety, integrating Environmental, Health, and Safety (EHS) risk management across all operations.

The company actively pursues 100% compliance with pollution emission standards, demonstrating a responsible approach to environmental stewardship. This proactive stance not only mitigates regulatory risks but also enhances their corporate image, solidifying their reputation as a trustworthy manufacturer in the global market.

- Product Excellence: Zhejiang Dingli's machinery consistently meets high-quality benchmarks and international safety certifications.

- EHS Integration: Occupational health and safety are paramount, with EHS risk management embedded in all business processes.

- Environmental Compliance: The company targets 100% adherence to pollution emission regulations.

- Reputation Building: This commitment to quality and safety cultivates customer trust and strengthens their market standing.

Zhejiang Dingli Machinery's product portfolio is exceptionally broad, covering scissor lifts, boom lifts, and mast lifts, making them a one-stop shop for aerial work platforms. Their strong market position is further solidified by their consistent ranking among the top global AWP manufacturers.

A key strength lies in their leadership within China's new energy AWP sector, with a high electrification rate across their product lines, aligning with global sustainability trends.

The company's significant investment in R&D, with 2023 R&D expenditure at 276 million RMB (a 16% year-on-year increase), fuels the development of advanced, electrified, and intelligent AWPs.

Their commitment to quality and adherence to international safety standards builds strong customer trust, complemented by a focus on environmental stewardship and regulatory compliance.

| Metric | 2023 | H1 2025 |

|---|---|---|

| R&D Expenditure (Million RMB) | 276 | N/A |

| Sales (Million CNY) | N/A | 4,336.12 |

| Global Reach (Countries) | 80+ | 80+ |

What is included in the product

Delivers a strategic overview of Zhejiang Dingli Machinery’s internal and external business factors, highlighting its competitive position and market dynamics.

Uncovers critical market opportunities and competitive threats to guide strategic decision-making for Zhejiang Dingli Machinery.

Weaknesses

Zhejiang Dingli Machinery's reliance on overseas markets, particularly its significant capacity in China serving the US, exposes it to the volatility of tariff levels. This dependence makes the company susceptible to fluctuations in international trade policies.

Despite strategic moves to establish localized production facilities within the US, ongoing trade tensions and the potential for further tariff increases present a persistent and considerable challenge to Dingli's operational stability and profitability.

Zhejiang Dingli Machinery faces significant challenges due to the intense competition within the global aerial work platform market. This highly saturated environment features many well-established manufacturers, creating considerable pressure on pricing strategies and the ability to capture market share. For instance, in 2023, the global AWPs market was valued at approximately USD 8.5 billion, with growth projected to reach USD 12.7 billion by 2030, indicating a competitive landscape where differentiation is key.

Zhejiang Dingli Machinery, like many in the construction equipment sector, faces risks from supply chain disruptions and fluctuating raw material prices. The cost of essential inputs such as steel, aluminum, copper, and critical electronic components can move significantly, directly affecting production expenses and the company's ability to maintain stable pricing for its aerial work platforms (AWPs).

Sustainability Data Disclosure Lag

Zhejiang Dingli Machinery faces a challenge with its sustainability data disclosure, particularly regarding carbon emissions. The company has not yet released its most recent year's carbon emissions figures, nor has it outlined specific reduction targets or concrete climate commitments. This lack of up-to-date and detailed reporting, despite having an EHS statement, could be viewed as a weakness by stakeholders and investors who are increasingly prioritizing environmental responsibility.

The absence of comprehensive sustainability reporting, including specific data points on environmental impact, can create a perception of lagging behind industry best practices. This is particularly relevant as investors and consumers in 2024 and 2025 are placing greater emphasis on Environmental, Social, and Governance (ESG) factors. For instance, many publicly traded companies are now required to report Scope 1 and Scope 2 emissions, and increasingly, Scope 3. Dingli's current disclosure level may not meet these evolving expectations.

- Lack of recent carbon emissions data: Publicly available figures for the latest reporting period are not yet disclosed.

- Absence of clear reduction targets: The company has not specified quantifiable goals for reducing its environmental footprint.

- No stated climate commitments: Formal pledges or strategies related to climate change mitigation are not clearly articulated.

- Potential negative perception: Environmentally conscious investors and stakeholders may view this as a significant weakness.

Potential for Economic Slowdown in Key Markets

While the global Aerial Work Platform (AWP) market shows promise, a significant weakness for Zhejiang Dingli Machinery lies in the potential for an economic slowdown in its key markets. A downturn in major construction sectors, particularly in regions like North America and Europe, could directly curb demand for AWPs. For instance, projections indicated a slowdown in US construction spending growth for 2024, potentially impacting sales volumes.

This economic vulnerability translates into a direct threat to revenue streams. If construction activity falters, the need for rental and purchase of equipment like scissor lifts and boom lifts, Dingli's core products, will diminish. For example, a report from Statista suggested that construction output in the Eurozone might see only marginal growth in 2025, a scenario that could dampen the outlook for AWP manufacturers.

- Economic Slowdown Risk: Key markets for AWPs, such as the US and Europe, face potential economic headwinds that could reduce construction activity.

- Impact on Demand: A contraction in construction spending directly translates to lower demand for AWP equipment, affecting sales and revenue for manufacturers like Dingli.

- Regional Growth Concerns: Forecasts for construction spending in some critical regions indicate modest growth or even potential contraction, posing a direct threat to sales targets.

- Revenue Vulnerability: Reduced construction activity can lead to decreased rental rates and lower new equipment sales, impacting Dingli's financial performance.

Zhejiang Dingli Machinery's product portfolio, while diverse, shows a notable concentration in aerial work platforms (AWPs). This specialization, while a strength, also represents a weakness if the AWP market experiences a significant downturn. For instance, while the global AWP market is projected for growth, specific segments or regions could underperform, impacting Dingli more heavily than a more diversified manufacturer.

The company's reliance on a specific product category makes it vulnerable to shifts in demand or technological obsolescence within the AWP sector. If new technologies emerge that significantly alter the AWP landscape, Dingli might face challenges in adapting its product line quickly enough to maintain its competitive edge.

Zhejiang Dingli Machinery's competitive positioning is further challenged by the presence of established global players with extensive distribution networks and brand recognition. While Dingli has expanded its reach, it may still lag behind competitors in terms of market penetration in certain key regions, limiting its ability to capture a larger share of the global market.

The company's financial performance is closely tied to the capital expenditure cycles of its customers, primarily in the construction and rental industries. Economic slowdowns or reduced investment in these sectors can lead to delayed or cancelled orders, directly impacting Dingli's revenue and profitability. For example, a contraction in global infrastructure spending, a key driver for AWP demand, could pose a significant risk.

Preview Before You Purchase

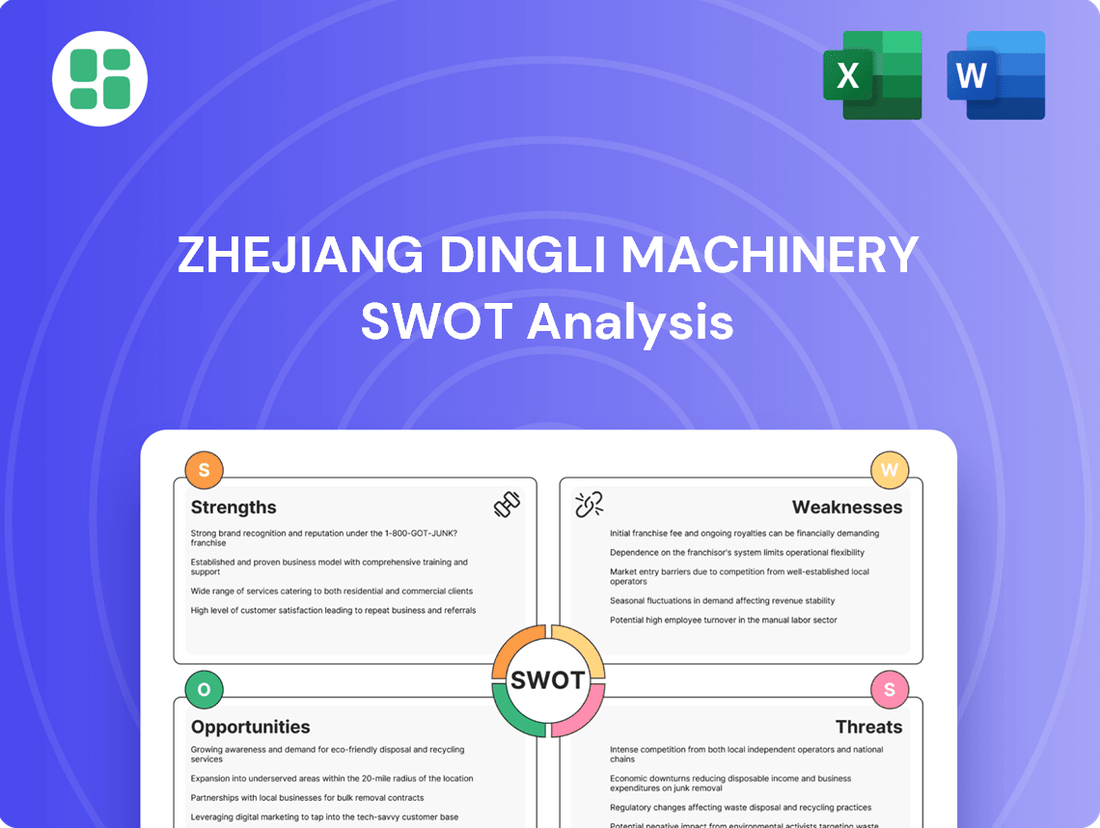

Zhejiang Dingli Machinery SWOT Analysis

This preview reflects the real Zhejiang Dingli Machinery SWOT analysis document you'll receive—professional, structured, and ready to use. It offers a concise overview of the company's Strengths, Weaknesses, Opportunities, and Threats. Upon purchase, you'll gain access to the complete, in-depth analysis, providing a comprehensive understanding of Dingli Machinery's strategic position.

Opportunities

The global aerial work platform (AWP) market is experiencing robust expansion, with projections indicating continued strong growth through 2030. This upward trend is fueled by escalating urbanization and significant investments in infrastructure development worldwide, creating a consistent demand for safe and efficient elevated access solutions across construction, maintenance, and logistics sectors.

Analysts forecast the AWP market to reach over $20 billion by 2028, demonstrating a compound annual growth rate of approximately 6% in the coming years. This growth is particularly pronounced in emerging economies where infrastructure projects are rapidly advancing, presenting substantial opportunities for AWP manufacturers like Zhejiang Dingli Machinery.

The global market for electric and hybrid Aerial Work Platforms (AWPs) is experiencing robust growth, driven by increasing environmental consciousness and stricter emissions standards. In 2024, projections indicated the electric AWP market alone could reach over $7 billion, with a compound annual growth rate exceeding 10% through 2030. This trend is fueled by lower operational costs, reduced noise pollution, and enhanced safety features compared to their traditional counterparts.

Zhejiang Dingli Machinery, as an early adopter and innovator in new energy AWPs, is strategically positioned to benefit from this significant industry shift. Their commitment to developing and expanding their electric and hybrid AWP offerings aligns perfectly with the escalating demand for sustainable and efficient equipment in construction, maintenance, and logistics sectors worldwide.

Global infrastructure spending is on the rise, with projections indicating significant growth. For instance, the US alone is investing heavily in infrastructure upgrades, creating a robust demand for construction equipment. This surge in public works, alongside a strong uptick in residential and commercial building projects, directly translates into increased opportunities for Aerial Work Platforms (AWPs) like those produced by Zhejiang Dingli Machinery.

Expansion into Emerging Markets and Rental Sector Growth

Zhejiang Dingli Machinery can capitalize on the burgeoning demand for Aerial Work Platforms (AWPs) in emerging markets, particularly within the Asia-Pacific region. This area is witnessing accelerated urbanization and industrialization, driving infrastructure development and consequently, the need for AWPs. For instance, the Asia-Pacific construction equipment rental market was valued at approximately USD 25 billion in 2023 and is projected to grow robustly, offering a significant opportunity for Dingli to expand its reach and market share.

Furthermore, the global rental sector for AWPs presents a particularly attractive growth avenue. The construction industry, a primary consumer of AWPs, is increasingly opting for rental solutions due to cost-effectiveness and flexibility. This trend is evident globally, with the global AWP rental market expected to reach over USD 20 billion by 2027. Dingli's strategic focus on this segment could unlock substantial revenue streams and enhance its competitive positioning.

- Asia-Pacific construction equipment rental market projected to grow significantly.

- Increasing adoption of AWP rentals in the construction sector worldwide.

- Urbanization and industrialization in emerging markets fuel AWP demand.

Technological Advancements and Smart Features

Ongoing technological innovations like remote operation, automation, and advanced battery technologies are significantly transforming the aerial work platform (AWP) industry. Zhejiang Dingli is well-positioned to capitalize on these advancements, integrating smart features to boost product efficiency and safety.

By leveraging its research and development strengths, Dingli can embed telematics and other intelligent systems, making its AWPs more appealing to a growing base of tech-savvy customers. This focus on smart features is crucial for maintaining a competitive edge in the evolving AWP market.

- Remote Operation: Enabling operators to control AWPs from a safe distance, increasing operational flexibility and safety.

- Automation: Incorporating automated functions to streamline complex tasks, improving productivity and reducing human error.

- Advanced Battery Technologies: Developing and integrating more efficient and longer-lasting battery solutions for electric AWPs, reducing downtime and environmental impact.

- Telematics: Utilizing connected technology for real-time monitoring, diagnostics, and performance tracking of AWPs, enhancing fleet management and predictive maintenance.

Zhejiang Dingli Machinery is poised to benefit from the global surge in infrastructure development and urbanization, particularly in emerging markets like the Asia-Pacific region. The company's focus on electric and hybrid AWPs aligns with increasing environmental regulations and demand for sustainable solutions, a market segment projected to grow significantly. Furthermore, the expanding AWP rental market worldwide offers a substantial avenue for revenue growth and market penetration.

Threats

Ongoing geopolitical tensions, particularly the trade friction between major economies like the US and China, present a considerable threat. These conflicts often manifest as tariffs and other protectionist measures, directly increasing the cost of goods for export and potentially disrupting established supply chains. For Zhejiang Dingli, this means higher operational expenses and a more complex environment for accessing international markets, which could dampen export revenue.

An economic slowdown in major markets like Europe and North America could significantly curb construction and industrial output, directly impacting demand for Zhejiang Dingli's aerial work platforms (AWPs). For instance, if global GDP growth slows to below 2% in 2024, as some forecasts suggest, this would likely translate to fewer infrastructure projects and less factory expansion, areas where AWPs are crucial.

Persistent inflation, potentially remaining elevated through 2025, coupled with higher interest rates, poses a dual threat. Customers may find it more expensive to finance new equipment purchases, while Dingli itself could face increased costs for raw materials, energy, and borrowing, squeezing profit margins.

Zhejiang Dingli Machinery faces a highly competitive Aerial Work Platform (AWP) market. Established global giants and rapidly growing domestic manufacturers are all aggressively pursuing market share.

This intense rivalry often triggers price wars, which can significantly compress profit margins. For instance, the global AWP market experienced robust growth, with revenues estimated to reach approximately $12.6 billion in 2024, according to some industry analyses, highlighting the scale of competition.

Staying ahead requires substantial and ongoing investment in research and development to innovate and in marketing to build brand presence. Failure to do so risks losing ground to more aggressive competitors.

Supply Chain Fragility and Component Shortages

The global supply chain continues to be a significant vulnerability, with ongoing geopolitical tensions and unexpected events contributing to potential disruptions. These disruptions can directly impact Zhejiang Dingli Machinery by causing shortages of essential components, such as advanced microprocessors crucial for modern machinery control systems. For instance, the semiconductor shortage that began in 2020 and continued through 2023, with some effects lingering into 2024, significantly hampered manufacturing output across various industries, including heavy equipment.

Such component scarcity directly translates into production delays for Dingli Machinery, potentially pushing back delivery timelines for key products. Furthermore, the increased demand and limited supply of these critical parts drive up their acquisition costs, leading to higher manufacturing expenses. This cost inflation can squeeze profit margins or necessitate price increases, potentially affecting the company's competitiveness and its ability to satisfy customer demand promptly.

- Component Scarcity: Lingering effects from global semiconductor shortages in 2023-2024 continue to pose a risk to the availability of specialized electronic components.

- Increased Input Costs: The average price of key raw materials, like steel and specialized alloys, saw an approximate 8-12% increase in late 2023 and early 2024, impacting manufacturing overhead.

- Production Bottlenecks: Delays in receiving essential parts can create significant bottlenecks, potentially extending production lead times by 15-20% for certain product lines.

Rapid Technological Obsolescence and R&D Costs

The machinery industry faces a significant threat from rapid technological obsolescence, especially with the push towards electrification and automation. Zhejiang Dingli Machinery must contend with the reality that its current product lines could quickly fall behind if innovation isn't constant. For instance, the global construction equipment market is projected to see substantial growth in electric and hybrid machinery, a trend that requires proactive adaptation.

This relentless pace of change demands substantial and continuous investment in research and development. Such R&D expenditures, while crucial for staying competitive, can place a considerable strain on the company's financial resources. In 2023, for example, the machinery sector saw increased R&D spending as companies focused on developing next-generation equipment to meet evolving market demands and environmental regulations.

- Technological Shifts: The increasing demand for electric and automated machinery poses a risk of existing product lines becoming outdated.

- R&D Investment Burden: Keeping pace with innovation requires significant capital outlay for research and development, potentially impacting profitability.

- Market Competitiveness: Failure to adapt to new technologies could lead to a loss of market share to more agile competitors.

The escalating cost of raw materials, such as steel and hydraulic components, presents a significant hurdle, with prices showing an upward trend of 5-10% in late 2023 and early 2024. Coupled with persistent inflation, these rising input costs directly squeeze Zhejiang Dingli Machinery's profit margins. Furthermore, the company faces the threat of increased borrowing costs due to higher interest rates, potentially impacting its ability to finance growth initiatives or manage existing debt.

Intensified competition within the Aerial Work Platform (AWP) market, where global revenues are projected to reach around $12.6 billion in 2024, poses a substantial threat. This fierce rivalry, characterized by aggressive pricing strategies from both established players and emerging domestic manufacturers, can lead to compressed profit margins. Zhejiang Dingli must continuously invest in innovation and marketing to maintain its competitive edge against agile rivals.

Supply chain vulnerabilities, exacerbated by ongoing geopolitical tensions and the lingering effects of the 2023-2024 semiconductor shortage, create a risk of component scarcity. This can lead to production delays, potentially extending lead times by 15-20% for certain product lines. The increased cost of essential parts, with some raw material prices rising 8-12% in late 2023 and early 2024, further impacts manufacturing overhead and profitability.

Rapid technological obsolescence, particularly the shift towards electrification and automation in the machinery sector, poses a threat to Zhejiang Dingli's existing product lines. The growing demand for electric and hybrid machinery necessitates significant and ongoing investment in research and development, which could strain financial resources. Failure to adapt quickly to these technological shifts risks losing market share to more innovative competitors.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and insightful expert commentary to provide a robust and accurate assessment of Zhejiang Dingli Machinery.