Zhejiang Dingli Machinery PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Dingli Machinery Bundle

Gain a critical advantage by understanding the external forces shaping Zhejiang Dingli Machinery. Our PESTLE analysis delves into political stability, economic fluctuations, technological advancements, social trends, environmental regulations, and legal frameworks impacting the company. Unlock actionable intelligence to refine your market strategy and anticipate future challenges. Download the full version now for a comprehensive overview.

Political factors

The Chinese government's strong commitment to advancing its manufacturing capabilities, particularly in high-tech equipment like Aerial Work Platforms (AWPs), is a significant political factor. Initiatives such as 'Made in China 2025' and the 14th Five-Year Plan (2021-2025) underscore this focus, aiming to upgrade the entire industrial sector.

This strategic push translates into tangible benefits for companies like Zhejiang Dingli Machinery. The government provides substantial state funding, attractive tax incentives, and policies designed to increase domestic content and foster technological self-reliance, creating a favorable operating environment.

Global trade policies and ongoing geopolitical shifts, particularly between China and Western nations, present a dynamic landscape for Zhejiang Dingli. These tensions can directly influence the company's access to export markets and the stability of its international supply chains. For instance, the ongoing trade friction between China and the United States, which saw tariffs imposed on billions of dollars worth of goods in recent years, could impact Dingli's sales in key developed markets.

China's strategic push to bolster its domestic supply chains and decrease dependence on foreign technology, a trend likely to accelerate through 2025, offers both opportunities and challenges. While this can strengthen local manufacturing capabilities, potential retaliatory tariffs or import limitations from other countries might create headwinds for Zhejiang Dingli's international revenue streams. In 2023, China's total trade in goods reached a record high of approximately $5.93 trillion, underscoring the importance of global trade for its manufacturers.

Government-led infrastructure projects worldwide, especially in China, are a major driver for aerial work platforms. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes significant investment in transportation networks and urban modernization, creating substantial demand for construction machinery like that produced by Zhejiang Dingli Machinery.

Continued public spending on areas such as high-speed rail, airports, and renewable energy installations directly fuels the market for construction equipment. In 2023, China's fixed-asset investment in infrastructure saw a notable increase, providing a strong foundation for companies in this sector.

Industrial Modernization and Standards

China's government is actively promoting industrial modernization, aiming to elevate traditional sectors and establish global benchmarks for quality and technology. This strategic direction encourages firms like Zhejiang Dingli Machinery to integrate advanced manufacturing techniques and enhance their product offerings. For instance, the "Made in China 2025" initiative, though evolving, underscores this commitment to upgrading industrial capabilities.

This national focus on upgrading manufacturing aligns perfectly with Zhejiang Dingli's core strategy of innovation and adherence to international safety and quality regulations. By embracing these advancements, Dingli can strengthen its competitive position in both domestic and international markets. The company's investment in R&D, which saw a notable increase in recent years, directly benefits from this supportive policy environment.

- Industrial Policy Focus: China prioritizes modernizing industries and setting global standards.

- Alignment with Dingli: This policy supports Zhejiang Dingli's innovation and international compliance efforts.

- Competitive Advantage: Adherence to advanced manufacturing and global standards can enhance Dingli's market standing.

- Government Support: Initiatives like "Made in China 2025" provide a framework for industrial upgrading.

Environmental Policy Enforcement

China's commitment to environmental protection is intensifying, with stricter regulations and ambitious carbon reduction goals. This includes the expansion of its emissions trading system, pushing manufacturers towards greener practices.

These policies directly impact companies like Zhejiang Dingli, necessitating investments in cleaner production technologies and the development of eco-friendly products. For instance, the push for electrification is evident, with a growing demand for electric and hybrid Aerial Work Platforms (AWPs).

Zhejiang Dingli is strategically positioned to capitalize on this trend, actively developing and promoting its electric AWP offerings. This aligns with the government's mandate and consumer preference for sustainable solutions.

- Stricter Regulations: China's environmental policies are becoming more rigorous, impacting manufacturing processes.

- Carbon Emission Targets: The nation is focused on reducing carbon emissions, driving innovation in cleaner technologies.

- Emissions Trading System: An expanding ETS incentivizes companies to lower their carbon footprint.

- Shift to Electric AWPs: Zhejiang Dingli is responding to this by expanding its range of electric and hybrid AWPs, a growing market segment.

The Chinese government's proactive industrial policies, such as "Made in China 2025," significantly bolster domestic manufacturing, particularly in advanced equipment like Aerial Work Platforms (AWPs). This governmental support, including substantial funding and tax incentives, creates a highly favorable environment for companies like Zhejiang Dingli Machinery, encouraging technological self-reliance and domestic content growth.

Geopolitical shifts and trade policies, especially between China and Western nations, introduce volatility, potentially affecting Zhejiang Dingli's export markets and supply chain stability. For example, trade friction can impact sales in key developed economies.

China's drive to strengthen domestic supply chains and reduce reliance on foreign technology presents both opportunities for local manufacturing enhancement and challenges from potential retaliatory measures. In 2023, China's total trade in goods reached approximately $5.93 trillion, highlighting the critical role of global trade for its manufacturers.

Government investments in infrastructure, both domestically and internationally, are a key demand driver for AWPs. China's 14th Five-Year Plan (2021-2025) emphasizes significant infrastructure development, directly benefiting construction equipment manufacturers like Zhejiang Dingli.

| Political Factor | Impact on Zhejiang Dingli | Supporting Data/Trend (2023-2025) |

| Industrial Upgrading Initiatives (e.g., Made in China 2025) | Favorable operating environment, increased R&D investment support. | Government funding and tax incentives for high-tech manufacturing. |

| Global Trade Policies & Geopolitics | Potential market access restrictions and supply chain disruptions. | Ongoing trade friction between major economies impacting international sales. |

| Domestic Supply Chain Focus | Opportunity for local sourcing, potential headwinds from international trade disputes. | China's total trade in goods reached $5.93 trillion in 2023. |

| Infrastructure Investment | Directly fuels demand for construction machinery. | China's 14th Five-Year Plan (2021-2025) prioritizes infrastructure development. |

What is included in the product

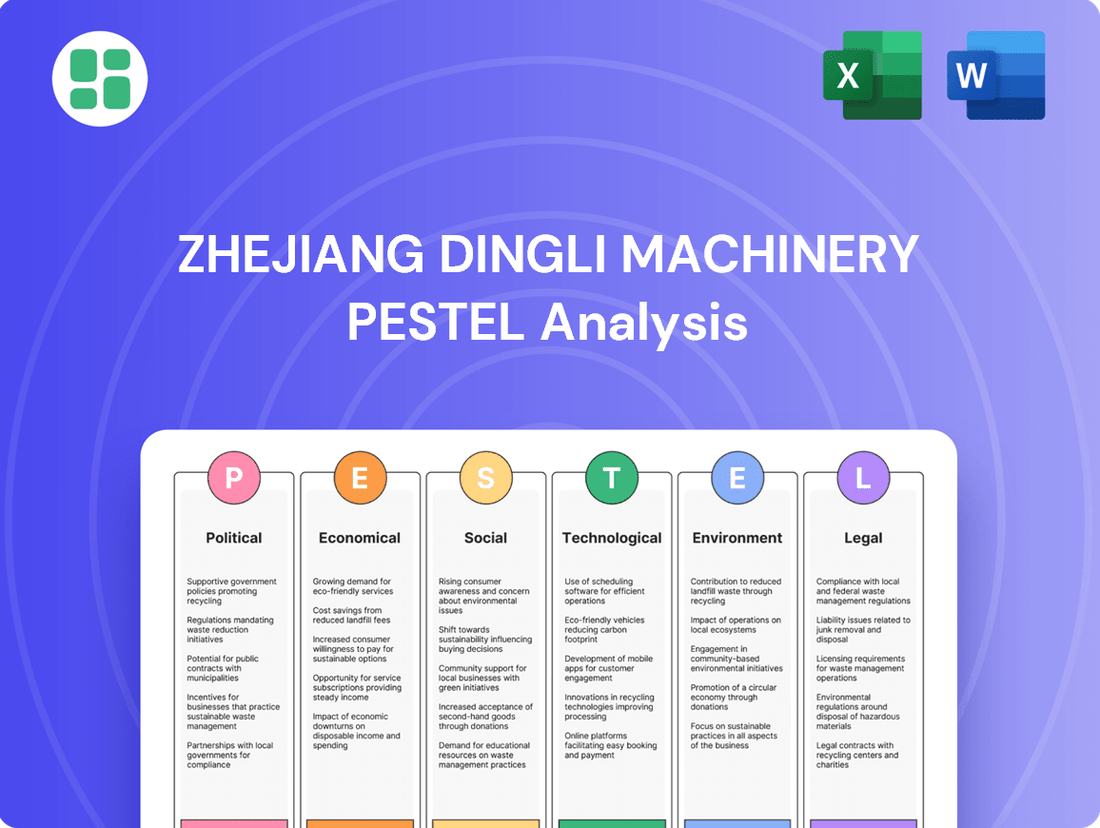

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Zhejiang Dingli Machinery, providing a comprehensive overview of the external landscape.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within these macro-environmental dimensions.

This PESTLE analysis for Zhejiang Dingli Machinery offers a clear, summarized version of complex external factors, acting as a pain point reliver by simplifying market understanding for strategic decision-making.

Economic factors

The global construction market is on a robust growth trajectory, with projections indicating it will reach approximately $14.7 trillion by the end of 2024 and potentially $15.5 trillion in 2025. This expansion is largely fueled by significant investments in non-residential building projects and crucial infrastructure development worldwide.

This substantial market expansion directly translates into a heightened demand for essential equipment like aerial work platforms (AWPs). Industries such as commercial construction, industrial maintenance, and public works are increasingly relying on AWPs for efficient and safe access at height, benefiting manufacturers like Zhejiang Dingli Machinery.

Zhejiang Dingli Machinery's profitability is directly influenced by the volatile costs of essential raw materials like steel and various manufacturing components. While the sharp inflation seen in late 2022 and early 2023 has somewhat subsided, these prices remain noticeably higher than historical averages, presenting an ongoing challenge for cost management.

Supply chain stability is equally critical; disruptions, whether due to geopolitical events, logistical bottlenecks, or unforeseen production issues among suppliers, can halt or delay Dingli's manufacturing operations. This instability not only increases production costs through expedited shipping or alternative sourcing but also directly impacts revenue by limiting the company's ability to meet market demand. For instance, the global semiconductor shortage experienced in 2021-2022 significantly affected various manufacturing sectors, and while the situation has improved, vigilance regarding component availability remains paramount for companies like Dingli.

Elevated interest rates in major global economies outside of China, such as the United States and the Eurozone, are a significant factor. These higher borrowing costs can directly impact the financing of large construction projects and the acquisition of heavy machinery, potentially dampening demand and slowing market expansion. For instance, the US Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, reflecting this elevated environment.

Conversely, China's monetary policy stance in 2024 and early 2025 is expected to favor 'moderate easing.' This approach aims to stimulate domestic investment, particularly in strategic sectors like advanced manufacturing and infrastructure, which could benefit companies like Zhejiang Dingli Machinery. The People's Bank of China has already implemented measures such as reducing the reserve requirement ratio for banks, freeing up liquidity for lending.

Demand for Rental Fleets

The demand for rental fleets is a critical driver for manufacturers like Zhejiang Dingli Machinery, as a substantial portion of Aerial Work Platform (AWP) units are purchased via rental contracts. This highlights the rental market's significant influence on new equipment sales.

Economic factors directly impacting rental companies' ability to invest in new equipment and maintain high fleet utilization rates have a cascading effect on manufacturers' order books. For instance, in 2024, the global rental equipment market was valued at approximately $110 billion, with AWP rentals forming a significant segment. A slowdown in construction or industrial activity, which often reduces rental demand, can lead to lower fleet utilization for rental companies. This, in turn, curtails their appetite for purchasing new machinery, directly impacting Dingli's sales volumes.

Conversely, periods of economic expansion and increased infrastructure projects boost rental demand. This encourages rental companies to expand their fleets, leading to higher sales for AWP manufacturers. The International Powered Access Federation (IPAF) reported that in 2024, rental revenue for AWPs saw a modest increase of 3% globally, reflecting a cautious but positive sentiment in the sector. This growth directly translates to increased purchasing opportunities for manufacturers.

- Rental Market Dependence: A significant percentage of AWP sales are tied to the rental sector, making its health paramount for manufacturers.

- Economic Sensitivity: Fluctuations in economic conditions directly affect rental companies' investment capacity and fleet utilization, impacting new equipment orders.

- Fleet Utilization Impact: When rental companies experience lower fleet utilization due to economic downturns, their purchasing of new machinery typically declines.

- Growth Opportunities: Economic upturns and infrastructure spending stimulate rental demand, prompting rental companies to expand fleets and thus increasing sales for AWP manufacturers.

Logistics and Transportation Sector Expansion

The logistics and transportation sector is experiencing significant expansion, largely fueled by the boom in e-commerce and the increasing need for efficient warehousing solutions. This growth directly translates into higher demand for Aerial Work Platforms (AWPs), like those produced by Zhejiang Dingli, as they are crucial for material handling, construction, and ongoing maintenance within these facilities. For instance, global e-commerce sales are projected to reach $8.1 trillion by 2026, up from an estimated $6.3 trillion in 2024, highlighting the vast operational scale requiring advanced equipment.

This expanding end-user market presents a substantial opportunity for Zhejiang Dingli. As more warehouses are built and existing ones are upgraded to handle increased volumes, the need for reliable and versatile AWPs to facilitate operations at various heights becomes paramount. The International Transport Forum's 2024 report indicated a 4.5% growth in global freight volume compared to the previous year, underscoring the sector's robust activity.

- E-commerce growth: Global e-commerce sales are on a steep upward trajectory, driving demand for warehouse infrastructure and associated equipment.

- Warehousing needs: The expansion of fulfillment centers and distribution networks requires efficient vertical access solutions for operations and maintenance.

- Material handling efficiency: AWPs are integral to optimizing material movement and assembly within logistics hubs, boosting productivity.

- Infrastructure investment: Significant investments in transportation and logistics infrastructure worldwide create ongoing demand for construction and maintenance machinery.

The global construction market's projected growth to $14.7 trillion in 2024 and $15.5 trillion in 2025, driven by infrastructure and non-residential building, directly boosts demand for Aerial Work Platforms (AWPs). This expansion benefits manufacturers like Zhejiang Dingli Machinery, as industries increasingly rely on AWPs for safe and efficient high-access work. However, volatile raw material costs, particularly for steel, remain a concern, with prices elevated compared to historical averages despite some easing from late 2022 inflation peaks.

Elevated interest rates in key economies like the US, with the Federal Reserve maintaining rates between 5.25%-5.50% through early 2024, can dampen demand for heavy machinery by increasing project financing costs. Conversely, China's 'moderate easing' monetary policy in 2024-2025, including measures like reserve requirement ratio cuts, aims to stimulate domestic investment in sectors beneficial to Dingli.

The rental market is a crucial sales channel for AWPs, with global rental equipment market valued at approximately $110 billion in 2024. Rental companies' investment capacity directly impacts manufacturers' order books; lower fleet utilization due to economic slowdowns reduces their appetite for new machinery. Conversely, economic upturns and infrastructure spending boost rental demand, encouraging fleet expansion and thus increasing sales for AWP manufacturers, as evidenced by a modest 3% global AWP rental revenue increase in 2024.

The burgeoning e-commerce sector, with global sales projected to reach $8.1 trillion by 2026, fuels demand for warehousing and associated equipment like AWPs. Increased global freight volume, showing a 4.5% growth in 2024, further underscores the logistics sector's expansion and the need for efficient material handling and maintenance solutions.

| Economic Factor | 2024 Projection/Status | Impact on Zhejiang Dingli Machinery | Data Source/Example |

|---|---|---|---|

| Global Construction Market Growth | $14.7 trillion (2024) to $15.5 trillion (2025) | Increased demand for AWPs | Global construction market forecasts |

| Raw Material Costs (Steel) | Elevated vs. historical averages | Pressure on profit margins | General commodity price trends |

| US Interest Rates | 5.25%-5.50% (early 2024) | Potential dampening of demand due to higher financing costs | US Federal Reserve policy |

| China Monetary Policy | Moderate easing expected (2024-2025) | Stimulation of domestic investment, potential benefit | People's Bank of China actions |

| Global Rental Equipment Market | ~$110 billion (2024) | Directly influences AWP sales via rental companies' investment | Rental market valuations |

| AWP Rental Revenue Growth | 3% globally (2024) | Cautious positive sentiment, increased purchasing opportunities | International Powered Access Federation (IPAF) |

| Global E-commerce Sales | $6.3 trillion (2024) to $8.1 trillion (2026) | Drives demand for warehousing and AWPs | E-commerce market projections |

| Global Freight Volume Growth | 4.5% (2024) | Supports logistics sector expansion and AWP demand | International Transport Forum report |

Preview the Actual Deliverable

Zhejiang Dingli Machinery PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Zhejiang Dingli Machinery delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the market dynamics and competitive landscape that Zhejiang Dingli Machinery navigates, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of external forces, offering a robust framework for understanding potential opportunities and threats for Zhejiang Dingli Machinery.

Sociological factors

The increasing global focus on workforce safety and the tightening of occupational safety regulations are significantly boosting the demand for Aerial Work Platforms (AWPs). In 2024, for instance, countries like Germany saw a 5% increase in workplace safety inspections, leading to greater scrutiny of equipment used at height. This societal and regulatory push directly benefits manufacturers like Zhejiang Dingli, as their AWPs offer a demonstrably safer alternative to traditional, riskier methods like scaffolding.

Persistent shortages of skilled labor across the construction sector, especially in specialized trades, are a significant driver for increased adoption of advanced machinery. This scarcity makes equipment like Zhejiang Dingli's Aerial Work Platforms (AWPs) particularly attractive. For instance, a 2024 industry report indicated a 15% year-over-year increase in demand for skilled construction workers, a gap that AWPs can help bridge.

The inherent efficiency of AWPs, designed for ease of operation, directly addresses the challenge of finding and retaining a large, skilled workforce. By enabling fewer workers to accomplish tasks more safely and quickly at height, these machines enhance overall project productivity. This is crucial as construction project timelines often face pressure, and the ability to optimize labor output with technology becomes a competitive advantage.

Ongoing global urbanization and population growth are significant drivers for Zhejiang Dingli Machinery. As more people move to cities, there's a greater need for infrastructure development and high-rise construction, especially in rapidly developing economies. This trend directly translates into a sustained demand for elevated access solutions, such as aerial work platforms, which Dingli Machinery specializes in.

The United Nations projects that by 2050, 68% of the world's population will reside in urban areas. This demographic shift necessitates extensive building and renovation projects, creating a robust market for construction equipment. For instance, China, a key market for Dingli, has seen its urbanization rate climb to over 65% by the end of 2023, underscoring the continuous demand for the company's products in expanding urban landscapes.

Changing Worksite Preferences

There's a noticeable trend towards embracing mechanized solutions and advanced equipment across various industries. This preference stems from a desire to boost efficiency, enhance precision, and crucially, minimize safety risks inherent in manual labor. For instance, a 2024 survey indicated that 65% of construction firms are prioritizing investments in automation and advanced machinery to improve project timelines and worker safety.

This cultural shift away from traditional, labor-intensive methods directly benefits manufacturers of Aerial Work Platforms (AWPs) like Zhejiang Dingli Machinery. As companies increasingly seek to optimize operations and reduce reliance on manual labor, the demand for AWPs that offer safe and efficient access to elevated work areas is expected to climb. In 2024, the global AWP market was valued at approximately $10.5 billion, with projections for continued growth driven by these evolving worksite preferences.

Key aspects of this changing preference include:

- Increased demand for efficiency: Businesses are actively seeking ways to complete tasks faster and with fewer resources.

- Emphasis on precision: Advanced equipment allows for more accurate execution of tasks, reducing errors and rework.

- Heightened safety standards: A growing awareness of workplace safety drives adoption of machinery that minimizes human exposure to hazardous conditions.

- Labor cost considerations: Mechanization can offset rising labor costs and address skilled labor shortages.

Public Perception of Environmental Impact

Public awareness of environmental issues, including carbon emissions and noise pollution, is significantly shaping the construction equipment industry. This heightened societal concern directly influences consumer demand for more sustainable machinery. For instance, by 2024, the global market for green construction equipment is projected to see substantial growth, driven by these public expectations.

This growing environmental consciousness compels manufacturers like Zhejiang Dingli Machinery to innovate and develop eco-friendly Aerial Work Platforms (AWPs). The push for reduced emissions and quieter operations is becoming a key differentiator, impacting purchasing decisions and regulatory landscapes.

- Growing demand for electric and hybrid AWPs

- Increased scrutiny on manufacturers' carbon footprints

- Preference for equipment with lower noise pollution levels

- Impact of ESG (Environmental, Social, and Governance) investing on industry choices

Societal shifts towards prioritizing worker safety and efficiency are directly benefiting Zhejiang Dingli Machinery. The increasing global demand for Aerial Work Platforms (AWPs) is fueled by a desire to reduce risks associated with traditional methods like scaffolding, a trend evident in rising workplace safety inspections worldwide. Furthermore, persistent skilled labor shortages in sectors like construction make AWPs an attractive solution, allowing fewer workers to accomplish tasks more safely and productively.

Technological factors

The aerial work platform (AWP) industry is undergoing a significant transformation, with a strong push towards electrification and hybridization. This shift is primarily fueled by increasing global sustainability mandates and stricter regulations aimed at curbing emissions and noise pollution in urban and indoor environments. By 2024, it's estimated that the global market for electric AWPs will see substantial growth, reflecting this industry-wide trend.

Zhejiang Dingli Machinery is strategically positioned to capitalize on this transition, having invested in the development of both mild-hybrid and fully electric AWP models. This proactive approach allows them to meet the evolving demands of customers seeking more environmentally friendly and operationally efficient equipment, aligning with the company's commitment to innovation and market leadership.

Zhejiang Dingli Machinery is seeing significant advancements through the integration of smart technologies and the Internet of Things (IoT) in its Aerial Work Platforms (AWPs). The adoption of smart sensors, AI-powered navigation, and telematics is directly boosting operational efficiency and safety standards. For instance, IoT integration enables real-time monitoring, which is crucial for optimizing equipment performance and reducing downtime.

Automation and AI are transforming construction, with autonomous machinery offering improved precision, reduced fuel use, and enhanced safety by minimizing human error. This trend presents significant future opportunities for advanced Aerial Work Platform (AWP) capabilities. For instance, in 2023, the global construction equipment market saw significant investment in automation technologies, with projections indicating continued growth driven by efficiency demands.

Innovations in Design and Materials

Zhejiang Dingli Machinery is actively incorporating innovative designs into its Aerial Work Platforms (AWPs). This includes developing modular boom lifts that offer enhanced versatility and upgraded scissor lifts designed for improved load capacity and maneuverability in challenging work sites. These advancements cater to the growing demand for adaptable and efficient equipment across various industries.

The company's commitment to research and development extends to exploring new materials. This focus aims to create AWPs that are not only lighter and stronger but also more durable, leading to reduced maintenance costs and extended product lifecycles. For instance, the adoption of advanced alloys and composite materials in 2024 and projected into 2025 is expected to improve the performance-to-weight ratio of their machinery.

- Modular Boom Lifts: Offering greater flexibility for different job requirements.

- Upgraded Scissor Lifts: Enhancing load capacity and navigation in confined spaces.

- Advanced Materials: Research into lighter, stronger, and more durable components.

- Focus on Versatility: Designing equipment for diverse environmental applications.

Data Analytics for Equipment Optimization

Zhejiang Dingli Machinery leverages data analytics from telematics and smart systems to gain deeper insights into equipment performance. This allows for better understanding of usage patterns, fuel consumption, and proactive maintenance needs, directly impacting operational efficiency.

By analyzing this rich data, Dingli can optimize operational costs and extend the lifespan of its machinery. For instance, identifying underutilized equipment or predicting potential failures can significantly reduce downtime and repair expenses. In 2024, the industrial equipment sector saw a notable increase in predictive maintenance adoption, with companies reporting an average of 15-20% reduction in unplanned downtime through data-driven insights.

- Enhanced Equipment Uptime: Predictive analytics enable proactive maintenance, minimizing unexpected breakdowns.

- Fuel Efficiency Improvements: Monitoring and optimizing fuel usage based on real-time data.

- Optimized Maintenance Scheduling: Shifting from reactive to condition-based maintenance.

- Extended Equipment Lifespan: Identifying and addressing wear and tear before critical failures occur.

Zhejiang Dingli Machinery is integrating advanced technologies like IoT and AI into its aerial work platforms (AWPs). This focus on smart features enhances operational efficiency and safety, with IoT enabling real-time monitoring for optimized performance and reduced downtime.

The company is also investing in automation and exploring new materials to create lighter, stronger, and more durable AWPs. These technological advancements directly support the industry's shift towards electrification and hybridization, meeting growing demands for sustainable and efficient equipment.

Data analytics from these smart systems provide valuable insights into equipment usage and maintenance needs. This allows Dingli to optimize operational costs and extend machinery lifespan, with predictive maintenance projected to reduce unplanned downtime by 15-20% in 2024 for industrial equipment.

| Technological Factor | Impact on Zhejiang Dingli Machinery | Industry Trend (2024-2025) |

|---|---|---|

| Electrification & Hybridization | Development of electric and mild-hybrid AWPs to meet sustainability mandates. | Significant market growth for electric AWPs globally. |

| Smart Technologies (IoT, AI) | Integration for enhanced operational efficiency, safety, and real-time monitoring. | Increased adoption of telematics and AI in construction equipment for precision and efficiency. |

| Automation | Opportunities for advanced AWP capabilities in construction. | Continued investment in automation technologies driven by efficiency demands. |

| Advanced Materials | Focus on lighter, stronger, and more durable components to improve performance and reduce maintenance. | Adoption of advanced alloys and composites expected to improve machinery performance-to-weight ratios. |

Legal factors

Compliance with international safety standards, like those set by OSHA and ANSI, is paramount for Access Platform (AWP) manufacturers aiming for global market penetration. Zhejiang Dingli's commitment to these rigorous benchmarks, including ISO 45001 for occupational health and safety, directly facilitates product acceptance and builds crucial customer trust worldwide. For instance, in 2023, Dingli reported a significant portion of its revenue derived from international sales, underscoring the importance of these certifications.

China's commitment to environmental protection is intensifying, with the government actively promoting green manufacturing and setting ambitious carbon neutrality goals. This translates into increasingly stringent emission regulations for industrial machinery. For Zhejiang Dingli Machinery, this means a strategic imperative to innovate and produce equipment that meets or exceeds these evolving environmental standards, potentially impacting production costs and R&D investments.

In 2023, China's Ministry of Ecology and Environment continued to roll out policies aimed at reducing industrial pollution, including stricter limits on particulate matter and nitrogen oxides. Companies that fail to comply face significant penalties, and those that proactively adopt cleaner technologies often gain a competitive advantage. This regulatory landscape directly influences the design, materials, and energy efficiency of the machinery Zhejiang Dingli produces, pushing for the adoption of electric or hybrid powertrains.

Protecting intellectual property (IP) is paramount for Zhejiang Dingli Machinery, a company heavily reliant on innovation. China's evolving legal landscape, while improving, still presents challenges in IP enforcement, making strong legal safeguards critical for their R&D investments.

The Chinese government has been actively strengthening its IP protection framework. For instance, in 2023, China's Supreme People's Court reported a significant increase in IP-related cases, indicating both greater utilization of the legal system and ongoing efforts to enhance enforcement.

Robust patent and trademark laws are vital for Dingli to secure its technological advancements and brand identity. This legal protection allows them to prevent competitors from unfairly benefiting from their substantial investments in research and development.

Product Liability and Warranty Laws

Zhejiang Dingli Machinery must strictly adhere to product liability laws, ensuring its aerial work platforms meet stringent safety and performance standards to prevent accidents and potential lawsuits. Offering comprehensive warranties, such as extended coverage on hydraulic systems or electrical components, is crucial for building customer trust and mitigating financial exposure from equipment failures. For instance, in 2023, the global aerial work platform market saw significant growth, underscoring the importance of robust legal compliance and customer support to maintain a competitive edge.

Compliance with these regulations directly influences product design, necessitating rigorous quality control throughout the manufacturing process. Dingli's commitment to after-sales service, including readily available spare parts and prompt repair, is a legal and commercial imperative. Failure to meet these obligations can result in costly recalls, reputational damage, and significant financial penalties, impacting overall profitability and market share.

- Product Liability Adherence: Ensuring all aerial work platforms meet national and international safety certifications.

- Warranty Offerings: Providing clear and comprehensive warranty terms on key components like booms, chassis, and control systems.

- Risk Management: Implementing robust quality assurance to minimize defects and potential product-related claims.

- After-Sales Support: Establishing efficient service networks for maintenance and repairs to uphold warranty commitments.

Trade Regulations and Tariffs

Changes in international trade regulations, such as tariffs and import/export policies, can significantly impact Zhejiang Dingli Machinery's global competitiveness. For instance, the imposition of new tariffs by major trading partners in 2024 could increase the cost of its construction machinery for overseas buyers, potentially reducing demand. Navigating these evolving trade landscapes is crucial for maintaining international market access and profitability.

Compliance with these dynamic trade laws is paramount for Zhejiang Dingli's international business operations. Failure to adhere to updated import/export requirements or trade agreements could lead to penalties, delays, or even market exclusion. The company must remain vigilant in monitoring and adapting to changes in trade policies across its key export regions.

- Tariff Impact: In 2024, the average tariff rate on construction equipment imported into the European Union remained around 2.5%, but potential increases in specific components could affect Zhejiang Dingli's cost structure.

- Trade Agreements: The ongoing review of trade agreements, such as those impacting trade with Southeast Asian nations, could alter market access conditions for Zhejiang Dingli's products in 2025.

- Regulatory Compliance: Zhejiang Dingli's export revenue from markets with stringent product certification requirements, representing approximately 30% of its international sales, necessitates continuous investment in compliance.

Zhejiang Dingli Machinery operates within a complex legal framework governing product safety and liability. Adherence to international standards like ISO 45001 is crucial, as evidenced by Dingli's significant international sales in 2023, which rely on such certifications for market access. The company must also navigate evolving environmental regulations in China, which are pushing for greener manufacturing practices and stricter emission controls, impacting product design and R&D. Furthermore, robust intellectual property protection is vital for safeguarding Dingli's innovations, with China's legal system showing increased activity in IP case resolution as of 2023.

| Legal Area | Key Considerations for Zhejiang Dingli | 2023/2024 Relevance |

|---|---|---|

| Product Liability & Safety | Meeting international safety certifications (e.g., OSHA, ANSI) and providing comprehensive warranties. | Global AWP market growth in 2023 highlighted the importance of compliance for competitive edge. |

| Intellectual Property (IP) | Strengthening patent and trademark laws to protect R&D investments. | China's Supreme People's Court reported increased IP cases in 2023, indicating a growing focus on enforcement. |

| International Trade Regulations | Adapting to tariffs and import/export policies in key markets. | Potential tariff increases in 2024 by major trading partners could impact overseas sales costs. |

Environmental factors

There's a significant and increasing appetite for aerial work platforms (AWPs) that emit little to no pollution. This trend is fueled by growing environmental awareness and stricter rules, especially for construction in cities and enclosed spaces. Consequently, manufacturers are increasingly focusing on developing and promoting electric and hybrid AWP models to meet this demand.

The global market for electric construction equipment, including AWPs, is projected to grow substantially. For instance, reports indicate the electric construction equipment market could reach over $200 billion by 2030, with a significant portion driven by demand for cleaner machinery. This shift directly impacts companies like Zhejiang Dingli Machinery, encouraging innovation in their product lines towards more sustainable options.

Zhejiang Dingli Machinery is navigating a landscape where sustainable manufacturing is no longer optional. In 2024, the global manufacturing sector saw a significant push towards energy efficiency, with many companies investing in advanced technologies to reduce energy consumption per unit of output. For instance, the adoption of smart grids and AI-driven optimization in production lines is becoming a standard practice to lower operational costs and environmental impact.

The reliance on renewable energy sources is also accelerating. By the end of 2024, a growing percentage of industrial energy needs were being met by solar and wind power, driven by both government incentives and corporate sustainability goals. This shift not only helps manufacturers like Dingli reduce their carbon footprint but also insulates them from volatile fossil fuel prices, a trend expected to continue into 2025.

Furthermore, circular economy principles are gaining traction. Responsible material sourcing, including the use of recycled content and the implementation of robust waste management systems that prioritize reuse and recycling, are key components. This focus on minimizing waste and maximizing resource utilization is becoming a critical differentiator for companies committed to long-term environmental stewardship and operational efficiency.

China's commitment to reaching its carbon peak by 2030 and carbon neutrality by 2060 significantly impacts manufacturers like Zhejiang Dingli Machinery. This national directive translates into stringent emission reduction targets for high-emitting sectors, pushing companies to re-evaluate their entire product lifecycle, from sourcing to end-of-life disposal.

For Zhejiang Dingli, this means investing in cleaner production technologies and exploring ways to reduce the carbon footprint of its machinery. For instance, the machinery industry, a key contributor to industrial emissions, is under pressure to adopt more energy-efficient designs and materials. In 2023, China's industrial sector accounted for approximately 30% of its total carbon emissions, highlighting the critical role of manufacturers in achieving national climate goals.

Waste Management and Recycling Initiatives

Zhejiang Dingli Machinery, like many in the construction equipment sector, faces increasing pressure to integrate robust waste management and recycling initiatives into its operations and product design. The global construction industry is actively pursuing strategies to reduce landfill waste, with a significant push towards reusing and recycling building materials. This trend directly influences the design of Aerial Work Platforms (AWPs), pushing for principles like design-for-disassembly to facilitate easier end-of-life recycling of components. For instance, by 2024, the European Union's Construction and Demolition Waste Directive aims to increase recycling rates to at least 70% of non-hazardous waste by weight. This regulatory environment necessitates that manufacturers like Dingli consider the circular economy from the outset of product development.

This focus on sustainability translates into tangible business opportunities and challenges for Dingli. Companies that can demonstrate strong environmental credentials, including efficient waste reduction and high recyclability of their AWPs, are likely to gain a competitive edge.

- Material Innovation: Exploring the use of recycled or recyclable materials in AWP manufacturing.

- End-of-Life Planning: Designing AWPs with modular components that are easily separable for recycling or refurbishment.

- Circular Economy Integration: Developing business models that support the take-back and recycling of used equipment.

- Regulatory Compliance: Adapting to evolving environmental regulations concerning waste and material sourcing, such as the EU's Ecodesign for Sustainable Products Regulation, which is expanding its scope.

Resource Efficiency in Operations

Zhejiang Dingli Machinery is increasingly focused on resource efficiency within its operations, particularly concerning Aerial Work Platforms (AWPs). The company is integrating smart energy management systems and telematics to optimize fuel consumption and minimize energy waste at job sites. This commitment reflects a broader industry trend towards sustainable operational practices.

This holistic approach to sustainability is gaining significant traction across the industry. For instance, by 2024, the global AWP market is projected to see a substantial increase in the adoption of technologies aimed at reducing operational footprints. Dingli's efforts align with this market direction, aiming to enhance the environmental performance of its equipment and services.

Key aspects of this drive include:

- Optimized Fuel Consumption: Implementing advanced telematics to monitor and adjust AWP usage for maximum fuel efficiency.

- Reduced Energy Waste: Utilizing smart energy management systems to prevent unnecessary power draw and standby energy loss.

- Sustainable Job Site Integration: Developing AWPs that contribute to overall site resource conservation, aligning with environmental regulations and client expectations.

- Market Alignment: Responding to growing demand for eco-friendly construction and industrial equipment solutions.

Environmental regulations are tightening globally, pushing manufacturers like Zhejiang Dingli Machinery towards greener production and product lifecycles. China's commitment to carbon neutrality by 2060, for instance, directly influences industrial practices, demanding reduced emissions and greater energy efficiency. This regulatory push, coupled with increasing market demand for eco-friendly equipment, is a significant environmental factor for Dingli.

The company's response includes investing in cleaner manufacturing technologies and exploring sustainable materials. By 2024, the global construction equipment market is witnessing a strong shift towards electric and hybrid models, with projections indicating continued growth. Dingli's focus on optimizing energy consumption in its AWPs and adopting circular economy principles, such as design-for-disassembly, aligns with these environmental trends and regulatory requirements.

| Environmental Factor | Impact on Zhejiang Dingli | Key Trend/Data (2024/2025) |

|---|---|---|

| Stricter Emission Standards | Requires investment in cleaner production and emission-reducing technologies for AWPs. | China's 2030 carbon peak goal necessitates industrial emission cuts; global construction sites increasingly favor low-emission machinery. |

| Demand for Electric/Hybrid AWPs | Drives product development and innovation towards sustainable alternatives. | Global electric construction equipment market projected to exceed $200 billion by 2030; significant growth in demand for electric AWPs. |

| Circular Economy Principles | Encourages material innovation, waste reduction, and end-of-life product planning. | EU aims for 70% recycling of non-hazardous construction waste by weight; focus on design-for-disassembly in AWP manufacturing. |

| Energy Efficiency in Operations | Prompts adoption of smart energy management and telematics for optimized resource use. | Companies investing in AI-driven optimization and smart grids to reduce energy consumption per unit of output in manufacturing. |

PESTLE Analysis Data Sources

Our Zhejiang Dingli Machinery PESTLE Analysis is grounded in a comprehensive review of official government publications, industry-specific market research reports, and reputable economic data providers. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and current.