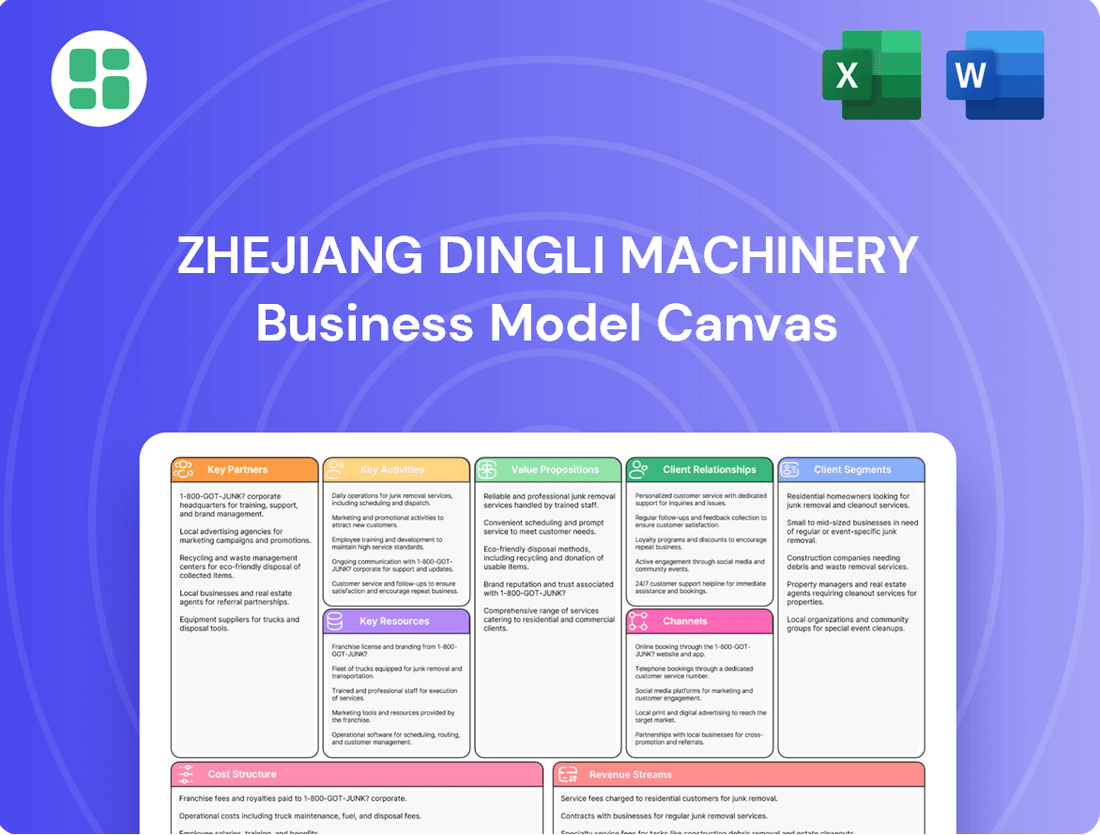

Zhejiang Dingli Machinery Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Dingli Machinery Bundle

Discover the strategic core of Zhejiang Dingli Machinery's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals their approach to customer relationships, key resources, and revenue streams, offering invaluable insights into their market dominance.

Unlock the full strategic blueprint behind Zhejiang Dingli Machinery's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Zhejiang Dingli Machinery's strategic alliances with global distributors are fundamental to its expansive market presence. The company boasts a robust distribution network spanning over 80 countries, guaranteeing worldwide accessibility for its aerial work platforms.

These collaborations are indispensable for penetrating new markets and fostering local sales expansion, with a particular focus on high-growth regions such as Europe, North America, and Southeast Asia. For instance, in 2023, Dingli reported a significant increase in international sales, directly attributable to the strength of its distributor relationships.

Zhejiang Dingli Machinery's strategic collaborations with European technology and R&D centers are crucial for its innovation pipeline. Its partnership with Magni in Italy and Teupen in Germany, for instance, directly fuels the development of advanced technologies and new product offerings. Dingli's investment in Teupen specifically bolsters its technical support and product development expertise.

Zhejiang Dingli Machinery's strategic alliance with MEC Aerial Work Platforms, formalized through joint ventures and minority stakes, significantly bolsters manufacturing efficiencies and fosters industry-wide innovation. This collaboration, dating back to 2016, has been instrumental in developing cutting-edge products such as Micro Scissors and Leak Containment Systems.

Key Partnership 4

Zhejiang Dingli Machinery's success hinges on strong relationships with its key component suppliers. These partnerships are crucial for maintaining the high quality and performance standards expected of Dingli's Aerial Work Platforms (AWPs).

The company strategically partners with leading global manufacturers to integrate top-tier components into its machines. This commitment to excellence ensures that Dingli's AWPs are equipped with reliable and efficient systems, contributing significantly to their operational capabilities and market reputation.

- High-End Component Integration: Dingli integrates premium components such as ECU-controlled Deutz engines, Dana axles, Bosch Rexroth power-driven systems, and Danfoss PVG hydraulic control systems.

- Supplier Reliability: These partnerships with renowned suppliers guarantee the consistent availability of high-quality parts, essential for Dingli's manufacturing process and product reliability.

- Performance Assurance: By collaborating with industry leaders, Dingli ensures that its AWPs benefit from advanced technology and robust engineering, directly impacting their performance and durability in demanding work environments.

Key Partnership 5

Zhejiang Dingli Machinery actively engages with international organizations and regulatory bodies to broaden its reach. A prime example is its registration as a supplier on the United Nations Global Marketplace (UNGM), which opens doors to a wider array of potential clients and signifies adherence to global procurement standards.

Crucially, Dingli's commitment to international market access is underpinned by its pursuit of essential certifications. Partnerships with accredited testing and certification bodies are vital for obtaining marks such as CE and ANSI, which are non-negotiable for many global markets.

- Supplier Registration: UNGM registration expands potential customer base and validates global standards compliance.

- Certification Compliance: CE and ANSI certifications, achieved through partnerships with testing bodies, are critical for international market entry.

- Market Access: These collaborations facilitate access to diverse international markets by meeting stringent regulatory requirements.

Zhejiang Dingli Machinery's key partnerships are a cornerstone of its global strategy, enabling market penetration and technological advancement. Collaborations with distributors in over 80 countries ensure worldwide accessibility, with significant international sales growth reported in 2023. Strategic alliances with European R&D centers, like Magni and Teupen, drive innovation, while partnerships with component suppliers such as Deutz and Dana ensure high-quality manufacturing. Furthermore, engagement with bodies like the UN Global Marketplace and certification agencies for CE and ANSI marks are vital for international market access.

| Partnership Type | Key Partners | Impact | 2023 Data/Notes |

|---|---|---|---|

| Distribution | Global Distributors | Market Reach, Sales Expansion | Network in 80+ countries; increased international sales |

| Technology & R&D | Magni (Italy), Teupen (Germany) | Product Innovation, Technical Expertise | Directly fuels advanced technology development |

| Component Supply | Deutz, Dana, Bosch Rexroth, Danfoss | Quality Assurance, Performance | Integration of ECU-controlled Deutz engines, Dana axles |

| Industry Alliances | MEC Aerial Work Platforms | Manufacturing Efficiency, Product Development | Joint ventures since 2016; Micro Scissors development |

| Market Access & Compliance | UN Global Marketplace, Certification Bodies | Global Procurement, Regulatory Adherence | UNGM registration; CE & ANSI certifications |

What is included in the product

This Zhejiang Dingli Machinery Business Model Canvas outlines a strategy focused on providing high-quality aerial work platforms to diverse industries, leveraging efficient manufacturing and a strong distribution network.

It details customer segments like construction and logistics, channels including direct sales and distributors, and value propositions centered on safety, efficiency, and innovation.

Zhejiang Dingli Machinery's Business Model Canvas acts as a pain point reliever by streamlining complex operational data into a clear, actionable framework.

It provides a structured approach to identify and address inefficiencies, offering a concise snapshot to navigate challenges and optimize resource allocation.

Activities

Zhejiang Dingli Machinery's primary focus is on robust research and development, driving continuous innovation in aerial work platforms (AWPs). The company invests heavily in developing intelligent lifting solutions, automation, and eco-friendly models like electric and mild-hybrid AWPs to stay ahead in the industry.

Zhejiang Dingli Machinery's core activities revolve around the manufacturing and production of Aerial Work Platforms (AWPs). They employ advanced 'intelligent factory' principles to boost efficiency and maintain high quality standards.

Significant investments have been made in cutting-edge facilities, such as automated welding and eco-friendly spray lines. These modern production capabilities allow Dingli to produce a wide range of AWP models in large volumes.

In 2023, Dingli reported a revenue of 10.03 billion RMB, with a substantial portion attributed to its robust manufacturing output. This reflects their capacity to meet global demand for their diverse AWP product lines.

Zhejiang Dingli Machinery's key activities revolve around robust global sales and marketing to fuel its international expansion. The company actively cultivates and manages its vast distribution network, which spans more than 80 countries, ensuring its comprehensive range of Aerial Work Platforms (AWPs) reaches diverse markets through multiple sales channels.

Strategic market entry and targeted sales initiatives are paramount for Dingli to effectively capture market share in varied geographical regions. This proactive approach ensures the company's presence and competitiveness on a global scale, driving revenue growth and brand recognition.

Key Activitie 4

Zhejiang Dingli Machinery’s key activities include providing robust after-sales support and maintenance services, which is crucial for customer retention and fostering lasting partnerships. This commitment to service excellence directly impacts the perceived value and reliability of their aerial work platforms.

Dingli actively integrates advanced technology into its service offerings. This includes implementing remote diagnostics for quicker issue resolution, intelligent systems for efficient parts replacement, and predictive maintenance solutions to preemptively address potential equipment failures. For instance, in 2023, Dingli reported a significant increase in the adoption of its remote monitoring services, leading to a reduction in on-site repair times by an average of 15%.

- Enhanced Customer Satisfaction: By offering comprehensive support, Dingli ensures clients experience minimal downtime and maximum productivity with their equipment.

- Technological Integration: The company utilizes remote support, intelligent parts management, and predictive maintenance to streamline service delivery.

- Extended Equipment Lifespan: Proactive maintenance and reliable support contribute to the longevity and optimal performance of Dingli's machinery.

- Global Service Network: Dingli’s focus on service underpins its ability to support a global customer base effectively.

Key Activitie 5

Zhejiang Dingli Machinery places a strong emphasis on rigorous quality control and adherence to international safety standards to bolster its brand image and ensure market acceptance for its aerial work platforms (AWPs). This dedication is reflected in their strict compliance with standards such as ISO9001 and obtaining essential certifications like CE and ANSI. These quality and safety commitments are integral to every stage of their AWP lifecycle, from initial design through to manufacturing and final testing.

Dingli's commitment to quality is further demonstrated by its continuous investment in advanced testing equipment and skilled personnel. For instance, in 2023, the company allocated significant resources to upgrade its testing facilities, enabling more comprehensive validation of AWP performance and safety features. This proactive approach ensures that their products not only meet but often exceed industry benchmarks.

- ISO9001 Certification: Demonstrates a robust quality management system across all operations.

- CE Marking: Confirms compliance with European Union safety, health, and environmental protection standards for products sold within the European Economic Area.

- ANSI Approval: Signifies adherence to American National Standards Institute safety requirements, crucial for the North American market.

- In-house Testing: Comprehensive testing protocols cover structural integrity, operational safety, and environmental resilience.

Zhejiang Dingli Machinery's key activities encompass robust manufacturing, driven by advanced technology and a commitment to quality. The company also focuses on extensive global sales and marketing, supported by a vast distribution network and strategic market entry initiatives. Furthermore, providing comprehensive after-sales support and maintenance, including remote diagnostics and predictive maintenance, is a crucial element of their operations.

| Activity | Description | Key Metrics/Examples |

|---|---|---|

| Manufacturing & Production | Producing a wide range of Aerial Work Platforms (AWPs) using intelligent factory principles and advanced facilities. | Large-scale production capacity, high-quality standards, automated welding, eco-friendly spray lines. |

| Sales & Marketing | Expanding global reach through a comprehensive distribution network and targeted sales strategies. | Presence in over 80 countries, multiple sales channels, strategic market penetration. |

| After-Sales Service & Support | Ensuring customer satisfaction through efficient maintenance, remote diagnostics, and predictive maintenance. | 15% reduction in on-site repair times (2023), remote monitoring adoption, intelligent parts management. |

| Quality Control & Compliance | Adhering to international safety and quality standards to enhance brand reputation and market acceptance. | ISO9001 certification, CE marking, ANSI approval, advanced in-house testing facilities. |

Preview Before You Purchase

Business Model Canvas

The Zhejiang Dingli Machinery Business Model Canvas you are previewing is the precise document you will receive upon purchase. This means you are seeing a direct representation of the final, comprehensive analysis, complete with all sections and data points. Upon completing your order, you will gain full access to this exact same, ready-to-use business model canvas, allowing you to immediately leverage its insights for strategic planning.

Resources

Zhejiang Dingli Machinery's advanced manufacturing facilities, including its 'Future Factory' expansion in Zhejiang province, are foundational. These intelligent factories are large-scale operations featuring state-of-the-art machinery and robotics, enabling efficient, high-volume production of aerial work platforms.

Intellectual property, encompassing a significant portfolio of innovation and utility model patents, stands as a crucial intangible asset for Zhejiang Dingli Machinery. This robust IP foundation safeguards their technological advancements and market position.

Dingli's commitment to modular design principles and cutting-edge technologies, exemplified by their pioneering oil-free and all-electric MEWP series, is directly protected by these patents. This intellectual capital is the bedrock of their distinctive product development and sustained competitive advantage.

In 2023, Zhejiang Dingli Machinery reported total assets of approximately 24.4 billion RMB, with a substantial portion attributed to their investment in research and development, which fuels the creation and protection of this vital intellectual property.

Zhejiang Dingli Machinery's human capital is a cornerstone of its business model. The company boasts a workforce of over 2,500 employees, a significant portion of whom are highly skilled professionals. This includes dedicated R&D technicians and engineers who are crucial for innovation and product development.

The expertise of this human capital extends to design, manufacturing, and global market penetration. Dingli's international R&D centers further bolster its capacity for cutting-edge product creation and adaptation to diverse market needs. This skilled workforce is directly responsible for the company's competitive edge.

Key Resource 4

Zhejiang Dingli Machinery's strong brand reputation and market leadership are cornerstones of its business model. As a leading global manufacturer of Aerial Work Platforms (AWPs), Dingli commands significant leverage in the industry.

The company's position as one of the top three AWP manufacturers globally, and number one in China, is a testament to its commitment to innovation, quality, and stringent international safety standards. This established reputation directly translates into customer trust and a competitive advantage.

- Global Market Position: Dingli ranks among the top three AWP manufacturers worldwide.

- Domestic Dominance: Holds the number one market share for AWPs in China.

- Brand Equity: Reputation built on consistent innovation, product quality, and adherence to international safety standards.

- Competitive Advantage: Strong brand recognition facilitates market penetration and customer loyalty.

Key Resource 5

Zhejiang Dingli Machinery's robust financial foundation is a cornerstone of its business model. As a publicly traded entity on the Shanghai Stock Exchange, the company benefits from access to capital markets, facilitating investment in research and development, factory enhancements, and international expansion efforts. For instance, in 2023, the company reported revenues of ¥10.5 billion, demonstrating significant operational scale.

Government support plays a crucial role in Dingli Machinery's financial strategy. The company has consistently received grants and subsidies, which are vital for funding innovation and maintaining competitiveness. This financial backing allows for strategic investments in advanced manufacturing technologies and the pursuit of new market opportunities. Their commitment to R&D is substantial, with expenditures often exceeding 5% of annual revenue.

Efficient capital management further bolsters the company's stability and growth potential. A healthy debt-to-equity ratio, which stood at approximately 0.6 in late 2023, indicates a prudent approach to leveraging financial resources. This financial discipline ensures that Dingli Machinery can navigate market fluctuations and continue its trajectory of expansion and technological advancement.

- Public Listing: Shanghai Stock Exchange provides access to capital for growth initiatives.

- Government Support: Grants and subsidies fuel R&D and market penetration.

- Financial Health: A strong debt-to-equity ratio (around 0.6 in late 2023) ensures stability.

- Revenue Growth: Achieved ¥10.5 billion in revenue in 2023, showcasing strong market presence.

Zhejiang Dingli Machinery's key resources include its advanced manufacturing capabilities, a strong portfolio of intellectual property, a skilled workforce, a leading brand reputation, and a robust financial foundation supported by public listing and government grants.

These elements collectively enable the company to innovate, produce high-quality aerial work platforms (AWPs), and maintain its competitive edge in the global market.

The company's investment in R&D, protected by patents, fuels its development of innovative products like oil-free and all-electric MEWPs.

Dingli's global market leadership, evidenced by its top-three ranking worldwide and number one position in China, is a direct result of these integrated resources.

| Resource Category | Key Assets/Attributes | 2023 Data/Notes |

|---|---|---|

| Manufacturing Facilities | Intelligent Factories, Robotics, 'Future Factory' Expansion | Large-scale, high-efficiency production |

| Intellectual Property | Patents (Innovation, Utility Model) | Safeguards technological advancements |

| Human Capital | Over 2,500 Employees, R&D Technicians, Engineers | Expertise in design, manufacturing, global markets |

| Brand & Market Position | Top 3 Global AWP Manufacturer, #1 in China | Reputation for innovation, quality, safety |

| Financial Foundation | Publicly Traded (SSE), Government Support, Revenue | ¥10.5 billion revenue (2023), Debt-to-equity ~0.6 (late 2023) |

Value Propositions

Zhejiang Dingli Machinery's value proposition centers on its exceptionally broad and diverse product lineup. This includes various types of scissor lifts, boom lifts, and mast lifts, ensuring that a wide array of elevated work applications can be addressed effectively.

Dingli boasts an impressive offering of over 400 distinct Aerial Work Platforms (AWPs). These machines provide working heights that span from a modest 5 meters all the way up to a substantial 44 meters, demonstrating their capability to suit different industries and project scales.

This extensive portfolio is a key differentiator, guaranteeing that customers can locate the precise equipment tailored to their unique operational requirements. The sheer breadth of their offerings means less compromise and more optimized solutions for any elevated task.

Zhejiang Dingli Machinery is deeply committed to innovation, consistently pushing the boundaries of technology to offer intelligent, high-performance lifting solutions. This dedication is evident in their product lines, which incorporate advanced features designed to boost both productivity and safety for users.

Their machinery boasts cutting-edge technologies, including sophisticated remote monitoring systems and integrated diagnostic tools, all built around flexible, modular designs. For instance, in 2023, Dingli launched several new models, including mild-hybrid boom lifts, underscoring their proactive approach to meeting evolving industry demands and maintaining a competitive edge.

Zhejiang Dingli Machinery offers high-quality aerial work platforms that meet stringent international safety standards, including CE and ANSI certifications. This commitment to quality, managed under ISO9001, ensures reliable and secure working environments for customers.

By adhering to these rigorous standards, Dingli provides peace of mind and helps mitigate operational risks for its clients, underscoring the value of dependable equipment in demanding industries.

Value Proposition 4

Zhejiang Dingli Machinery's commitment to environmental sustainability is a core value proposition. They are actively developing eco-friendly Aerial Work Platforms (AWPs) that significantly reduce environmental impact.

Dingli has been at the forefront of innovation with their oil-free and all-electric MEWP series, alongside the introduction of mild-hybrid options. These advancements directly address the growing demand for greener construction and maintenance solutions.

- Reduced Emissions: Dingli's electric and hybrid AWPs drastically cut down on harmful emissions, contributing to cleaner air quality.

- Lower Noise Pollution: The all-electric models offer a quieter operation, which is crucial for urban environments and noise-sensitive work sites.

- Operational Cost Savings: By eliminating the need for traditional fuels and reducing maintenance on combustion engines, these machines offer lower running costs for users.

- Alignment with Global Trends: This focus on sustainability positions Dingli favorably within the global market, which is increasingly prioritizing environmentally responsible equipment.

Value Proposition 5

Zhejiang Dingli Machinery's value proposition centers on significantly boosting operational efficiency and productivity for its users. This is achieved through innovative features designed for safe and effective elevated work. For instance, their boom lifts offer a full 360-degree rotation, allowing for greater maneuverability and reduced repositioning time on job sites. Similarly, their scissor lifts can be driven at full height without the need for outriggers, streamlining operations and saving valuable time.

Further enhancing this value is the company's commitment to reducing customer operating and maintenance costs. This is largely thanks to a smart modular product design. By utilizing common components across their range, Dingli Machinery simplifies maintenance and ensures easier availability of parts. This thoughtful design approach directly translates into lower downtime and more predictable expenses for their clients, a crucial factor in the competitive construction and industrial sectors.

- Enhanced Efficiency: Features like 360-degree rotation on boom lifts and drive-at-height capabilities on scissor lifts directly improve job site workflow.

- Cost Reduction: Modular product design with common components lowers customer operating and maintenance expenses.

- Improved Maintainability: The focus on common parts and thoughtful design makes Dingli equipment easier and more cost-effective to service.

- Productivity Gains: Ultimately, these design elements empower users to complete tasks faster and more safely, maximizing their output.

Zhejiang Dingli Machinery's value proposition is built on providing a comprehensive and innovative range of Aerial Work Platforms (AWPs). Their extensive catalog, featuring over 400 models including scissor lifts, boom lifts, and mast lifts, caters to diverse working height requirements from 5 to 44 meters. This broad selection ensures clients can find the exact equipment for their specific operational needs.

The company's commitment to technological advancement is a key differentiator. Dingli consistently integrates intelligent features and advanced technologies, such as remote monitoring and modular designs, into their products. For example, their introduction of mild-hybrid boom lifts in 2023 highlights their proactive approach to industry demands and sustainability.

Furthermore, Dingli prioritizes quality and safety, adhering to stringent international standards like CE and ANSI, and operating under ISO9001. This ensures their machinery is not only reliable but also provides a secure working environment, mitigating operational risks for their customers.

Dingli also champions environmental sustainability through its development of eco-friendly AWPs, including oil-free and all-electric options. This focus on reducing emissions and noise pollution aligns with global trends and offers users lower operational costs.

Finally, Dingli enhances user productivity and efficiency through smart design. Features like 360-degree rotation on boom lifts and drive-at-full-height capabilities on scissor lifts streamline operations. Their modular design with common components also reduces maintenance costs and downtime, making their equipment more cost-effective to operate and maintain.

| Value Proposition Aspect | Key Features/Benefits | Supporting Data/Examples |

|---|---|---|

| Product Breadth & Depth | Extensive range of AWPs, catering to varied needs. | Over 400 models; working heights from 5m to 44m. |

| Innovation & Technology | Intelligent, high-performance lifting solutions. | Mild-hybrid boom lifts (launched 2023), remote monitoring. |

| Quality & Safety Assurance | Reliable and secure equipment meeting global standards. | CE, ANSI certifications; ISO9001 quality management. |

| Environmental Sustainability | Eco-friendly AWPs reducing environmental impact. | Oil-free and all-electric MEWP series. |

| Operational Efficiency & Cost Savings | Enhanced productivity and reduced operating expenses. | Modular design with common parts, drive-at-height capability. |

Customer Relationships

Zhejiang Dingli Machinery prioritizes strong customer relationships through dedicated after-sales support and extensive technical service networks. This ensures customers worldwide receive prompt assistance and maintenance, fostering trust and loyalty.

The company leverages a robust dealer network across numerous regions, facilitating timely service and maintenance. This widespread presence is crucial for enhancing customer satisfaction and building long-term relationships, as demonstrated by their commitment to global accessibility.

Dingli's commitment extends to innovative support methods, including remote assistance and intelligent part replacement. This proactive approach minimizes downtime and maximizes operational efficiency for their clients, reinforcing their position as a reliable partner.

Zhejiang Dingli Machinery cultivates enduring alliances with major clients, particularly large rental companies, by consistently delivering dependable product performance and robust service. This focus on reliability underpins their strategy for fostering long-term customer loyalty.

Dingli's advanced Aerial Work Platforms (AWPs), recognized for their superior quality and innovative features, are a preferred choice for leading international head rental companies. This preference translates into sustained and mutually beneficial business relationships, as evidenced by their strong order books from these key partners.

These valued partnerships are often enhanced through comprehensive ongoing support and tailored fleet management solutions. For instance, in 2023, Dingli reported a significant increase in repeat business from major rental partners, highlighting the success of their relationship-centric approach.

Zhejiang Dingli Machinery prioritizes direct sales and engagement via a dedicated sales force and regional offices, offering personalized attention to its clientele. This direct approach fosters a deeper understanding of specific customer needs, enabling the delivery of highly tailored solutions. For instance, in 2024, Dingli Middle East Trading actively engaged with clients across the region, strengthening localized support and cultivating robust customer relationships.

Customer Relationship 4

Zhejiang Dingli Machinery prioritizes a user-centric approach in its customer relationships, focusing heavily on ergonomic designs and features that directly enhance the operator's experience and safety. This commitment is evident in their equipment's intuitive controls, tilt alarms, and readily accessible emergency stop buttons.

By ensuring a comfortable and safe work environment, Dingli cultivates trust and fosters a strong preference for its machinery among operators. This dedication to user needs is a key differentiator.

- User-Centric Design: Emphasis on intuitive controls and ergonomic features for enhanced operator comfort.

- Safety Features: Integration of tilt alarms and emergency stop buttons to ensure operator and site safety.

- Operator Experience: Aiming for a comfortable and secure working environment, boosting productivity.

- Brand Loyalty: Building trust and preference through a consistent focus on user needs and safety.

Customer Relationship 5

Zhejiang Dingli Machinery fosters proactive customer relationships by integrating advanced technology. Real-time assistance and predictive maintenance are key, allowing Dingli to stay ahead of potential issues.

Through telematics and diagnostic tools, equipment performance is monitored remotely. This enables Dingli to provide timely alerts for necessary maintenance, minimizing unexpected downtime for their clients.

This proactive strategy directly benefits customers by optimizing equipment utilization.

- Proactive Maintenance: Dingli's telematics allow for remote monitoring, predicting maintenance needs before they cause breakdowns.

- Reduced Downtime: By addressing potential issues early, customers experience significantly less operational interruption.

- Optimized Utilization: Ensuring equipment is always in peak condition maximizes its productive use for the customer.

Zhejiang Dingli Machinery cultivates strong customer relationships through a multi-faceted approach, blending direct engagement with robust dealer networks and advanced technological support. Their commitment to user-centric design and proactive maintenance, exemplified by initiatives like remote diagnostics and intelligent part replacement, ensures high customer satisfaction and loyalty.

The company's focus on providing dependable product performance and comprehensive after-sales service, particularly with major rental companies, has led to significant repeat business. This strategy is further reinforced by their global presence, enabling timely and accessible support worldwide.

| Customer Relationship Aspect | Key Initiatives | Impact/Benefit |

|---|---|---|

| After-Sales Support & Technical Service | Global service networks, remote assistance, intelligent part replacement | Prompt assistance, minimized downtime, enhanced operational efficiency |

| Dealer Network Engagement | Extensive regional dealer presence | Timely service, enhanced customer satisfaction, long-term relationship building |

| Major Client Partnerships | Dependable product performance, robust service, tailored fleet management | Sustained business, increased repeat business (e.g., significant increase reported in 2023) |

| Direct Sales & Regional Focus | Dedicated sales force, regional offices, personalized attention | Deeper understanding of needs, tailored solutions, strengthened localized support (e.g., 2024 Dingli Middle East Trading activities) |

| User Experience & Safety | Ergonomic designs, intuitive controls, safety features (tilt alarms, emergency stops) | Enhanced operator comfort and safety, increased trust and brand preference |

| Proactive Maintenance & Technology | Telematics, remote monitoring, predictive maintenance | Reduced downtime, optimized equipment utilization, proactive issue resolution |

Channels

Zhejiang Dingli Machinery's primary sales channel is a vast global distribution network. This network spans over 80 countries and includes more than 200 domestic dealers, ensuring broad market penetration for their aerial work platforms (AWPs).

This extensive reach allows Dingli to connect with a diverse international customer base. It also facilitates local support and service, crucial for customer satisfaction and product adoption in various regions.

Direct sales teams and regional offices are crucial for engaging large clients and specific market segments. For instance, in 2023, Zhejiang Dingli Machinery reported that its direct sales channels contributed significantly to its revenue, especially in developed markets where direct client interaction is key to closing substantial deals.

Establishing dedicated entities, such as Dingli Middle East Trading, enables focused market penetration and the implementation of tailored sales strategies in vital regions. This localized approach allows for better understanding of regional demands, as seen with the company's expansion efforts in the Middle East, aiming to replicate its success in other international markets.

This direct engagement model is instrumental in securing large orders and fostering robust, direct relationships with key clientele. The company's strategy emphasizes building trust and providing customized solutions, which has been a driving factor in its ability to secure major contracts and maintain a loyal customer base.

Participation in international trade shows and industry exhibitions is a key channel for Zhejiang Dingli Machinery. These events allow Dingli to showcase its latest innovations and connect with potential customers and partners globally. For instance, in 2023, Dingli actively participated in numerous international exhibitions, a strategy that contributed to its robust sales growth.

Channel 4

Zhejiang Dingli Machinery leverages its official website and various industry-specific online portals as key channels for customer engagement and information dissemination. These digital platforms are crucial for showcasing their extensive product range, detailing technical specifications, and facilitating direct customer inquiries, thereby supporting their global sales operations.

In 2024, the company's online presence played a significant role in reaching a wider audience. For instance, their website likely saw substantial traffic from potential buyers seeking information on aerial work platforms and related machinery. This digital footprint is essential for both lead generation and brand building in the competitive heavy machinery market.

- Digital Information Hub: The company's website and industry portals act as central repositories for product catalogs, technical data, and company news.

- Global Reach: These online channels are instrumental in connecting with international customers, overcoming geographical barriers to sales and support.

- Inquiry and Lead Generation: Digital platforms provide direct avenues for customer inquiries, enabling efficient lead qualification and sales follow-up.

- Brand Visibility: A strong online presence enhances brand recognition and establishes Zhejiang Dingli Machinery as a reliable player in the global market.

Channel 5

Channel 5 focuses on strategic partnerships with equipment rental companies. These partnerships allow Zhejiang Dingli Machinery to offer its aerial work platforms (AWPs) for lease through established rental networks. This approach is particularly effective in mature markets where rental is a common procurement method for construction and industrial equipment.

By collaborating with rental firms, Dingli effectively expands its market reach without the need for direct sales to every end-user. This indirect sales channel leverages the existing customer bases and distribution infrastructure of rental companies, providing access to a broader spectrum of users. For instance, in 2024, the global AWP rental market was valued at approximately $20 billion, highlighting the significant opportunity this channel presents.

- Strategic Alliances: Partnering with major equipment rental companies globally.

- Market Penetration: Accessing a wider customer base through rental fleets in regions like Europe and North America.

- Revenue Diversification: Generating revenue through bulk sales to rental partners, reducing reliance on individual sales.

- Brand Visibility: Increased brand exposure as Dingli equipment becomes a common sight in rental fleets.

Zhejiang Dingli Machinery utilizes a multi-faceted channel strategy to reach its global clientele. This includes a robust international distribution network comprising over 200 domestic dealers and operations in more than 80 countries, ensuring widespread market access.

Direct sales teams and regional offices are vital for engaging major clients and penetrating specific markets, particularly in developed regions where direct relationships are key to large transactions. Furthermore, the company actively participates in international trade shows and leverages its official website and online industry portals to showcase products, generate leads, and enhance brand visibility.

Strategic partnerships with equipment rental companies represent another significant channel, allowing Dingli to tap into the substantial AWP rental market, estimated at around $20 billion globally in 2024, by supplying their machinery to rental fleets.

| Channel Type | Key Activities | Target Audience | 2023/2024 Relevance | Strategic Importance |

| Global Distribution Network | Dealer sales, local support | Broad customer base | 80+ countries, 200+ dealers | Market penetration, accessibility |

| Direct Sales & Regional Offices | Large client engagement, tailored solutions | Major clients, specific markets | Significant revenue contribution in developed markets | Relationship building, high-value sales |

| Online Presence (Website, Portals) | Product showcase, lead generation, information hub | Global customers, potential partners | Essential for reach and brand building in 2024 | Brand visibility, customer engagement |

| Rental Company Partnerships | Bulk sales to rental fleets | Rental market participants | Access to $20 billion AWP rental market | Market access, revenue diversification |

Customer Segments

Construction companies are a core customer base for Zhejiang Dingli Machinery, relying on their Aerial Work Platforms (AWPs) for a wide array of projects. This includes everything from general building construction and installation to the complex demands of highway and bridge development.

The versatility of Dingli's AWPs caters to projects of all sizes, from massive commercial undertakings to niche applications requiring precise elevated access. In 2024, the global construction equipment market, which includes AWPs, was valued at approximately $210 billion, demonstrating the significant demand from this sector.

Equipment rental companies, both within China and globally, represent a core customer segment for Zhejiang Dingli Machinery. These businesses acquire Aerial Work Platforms (AWPs) to expand their rental fleets, catering to diverse industries needing temporary access solutions. Their purchasing decisions are heavily influenced by the AWPs' versatility, robust construction for durability, and crucially, their low ongoing maintenance requirements, which directly impact rental profitability.

Maintenance and facility management firms are key clients for Dingli, needing Aerial Work Platforms (AWPs) for a broad range of tasks. These companies tackle everything from industrial upkeep and general facility management to the maintenance of public infrastructure, relying on AWPs for safe and efficient elevated operations.

Dingli's equipment is crucial for these sectors, enabling tasks like high-level cleaning, intricate repairs, and thorough inspections. In 2024, the global AWPs market was projected to reach over $12 billion, highlighting the significant demand from industries like facility management that prioritize safety and productivity at height.

Customer Segment 4

Zhejiang Dingli Machinery serves industries with highly specific elevated access needs, including shipbuilding and aircraft maintenance. These sectors often require specialized Aerial Work Platforms (AWPs) capable of operating in demanding environments and meeting unique load or reach specifications. For instance, the global aerospace MRO (Maintenance, Repair, and Overhaul) market, a key area for specialized AWPs, was projected to reach approximately $80 billion in 2024, highlighting the demand for tailored equipment.

Logistics and warehousing operations also represent a significant customer segment, particularly those requiring AWPs for high-density storage or intricate inventory management. The e-commerce boom continues to drive growth in automated and high-reach warehousing solutions. In 2024, the global warehouse automation market was estimated to be worth over $25 billion, indicating a strong need for efficient material handling equipment, including specialized AWPs.

- Shipbuilding: Requires AWPs for hull access, component installation, and painting, often needing corrosion resistance and specific outreach capabilities.

- Aircraft Maintenance: Demands AWPs for fuselage work, engine access, and wing maintenance, with a focus on safety, precision, and minimal ground footprint.

- Logistics/Warehousing: Utilizes AWPs for high-level racking, order picking, and inventory management, prioritizing maneuverability and lifting capacity in confined spaces.

- Specialized Applications: Includes sectors like wind turbine maintenance or infrastructure inspection, where extreme reach, all-terrain capabilities, or specific payload capacities are paramount.

Customer Segment 5

Municipal engineering projects and public works departments are key customers for Zhejiang Dingli Machinery. These entities rely on Aerial Work Platforms (AWPs) for a variety of essential urban development and maintenance tasks. For instance, in 2024, governments worldwide continued to invest heavily in infrastructure upgrades, with projects like bridge repair and utility maintenance forming a significant portion of public spending.

Dingli's AWPs are particularly well-suited for these public sector demands due to their versatility and reliability. Tasks such as maintaining streetlights, trimming trees along public thoroughfares, and conducting detailed inspections of bridges are common requirements. The robust design and adaptable nature of Dingli's platforms ensure they can effectively handle these diverse operational needs.

- Urban Development and Infrastructure Repair: Public works departments utilize AWPs for tasks like bridge inspections and repairs, contributing to the longevity and safety of civic infrastructure.

- Public Utility Maintenance: Streetlight maintenance, power line work, and other utility upkeep are critical functions where AWPs provide essential access.

- Tree Trimming and Landscaping: Municipal landscaping efforts, including the trimming of trees in public parks and along streets, frequently employ AWPs for safe and efficient operation.

- Versatility and Reliability: Dingli's platforms are designed to meet the rigorous demands of public sector work, offering dependable performance across a range of applications.

Zhejiang Dingli Machinery's customer base is broad, encompassing construction firms, equipment rental businesses, and maintenance/facility management companies. These sectors collectively drove significant demand in 2024, with the global construction equipment market valued around $210 billion and the AWPs market exceeding $12 billion. The company also serves specialized industries like shipbuilding and aircraft maintenance, along with logistics and warehousing operations, reflecting the diverse need for elevated access solutions.

| Customer Segment | Key Needs | 2024 Market Context (Illustrative) |

|---|---|---|

| Construction Companies | General building, infrastructure, installation | Global Construction Equipment Market: ~$210 billion |

| Equipment Rental Companies | Fleet expansion, versatility, low maintenance | Global AWPs Market: >$12 billion |

| Maintenance & Facility Management | Industrial upkeep, public infrastructure, cleaning, repairs | Global AWPs Market: >$12 billion |

| Specialized Industries (Shipbuilding, Aircraft MRO) | Specific reach, load capacity, demanding environments | Global Aerospace MRO Market: ~$80 billion |

| Logistics & Warehousing | High-density storage, order picking, maneuverability | Global Warehouse Automation Market: >$25 billion |

Cost Structure

Manufacturing and production costs are a major expense for Zhejiang Dingli Machinery. This includes the price of steel, various components, and the labor needed for assembly. For instance, in 2023, the cost of raw materials and components represented a substantial portion of their overall cost of sales.

Dingli also invests heavily in advanced manufacturing equipment and factory automation. While these investments boost efficiency and product quality, they also mean significant capital expenditure. This ongoing commitment to modernizing their production facilities is a key aspect of their cost structure.

Fluctuations in raw material prices can directly affect Dingli's profit margins. Looking back at financial reports from previous years, periods of increased steel prices, for example, have shown a noticeable impact on their profitability.

Zhejiang Dingli Machinery's commitment to innovation is a significant driver of its cost structure, with substantial ongoing expenditure dedicated to Research and Development (R&D). This investment is crucial for maintaining a competitive edge in the evolving aerial work platform (AWP) industry.

In 2023, Dingli's R&D expenses reached approximately 463 million RMB, representing about 4.4% of its revenue. This figure underscores the company's strategic focus on developing intelligent and eco-friendly models, alongside continuous improvements to its existing product lines.

The company operates global R&D centers, fostering a culture of innovation that fuels future growth. This sustained investment in R&D is designed to ensure Dingli remains at the forefront of technological advancements in the AWP sector.

Zhejiang Dingli Machinery dedicates substantial resources to its global sales, marketing, and distribution efforts. These costs are essential for promoting its aerial work platforms and sustaining its worldwide dealer network. Key expenditures include managing dealer partnerships, exhibiting at major industry trade shows, advertising campaigns, and compensating sales teams.

In 2024, the company's commitment to market expansion is evident, requiring significant upfront investment in marketing initiatives. For instance, the company reported sales revenue of RMB 4.44 billion in the first three quarters of 2024, indicating robust market activity and the ongoing costs associated with driving that sales volume.

4

Logistics and freight expenses are a major component of Zhejiang Dingli Machinery's cost structure, especially given the international shipping of its heavy machinery. For example, in 2024, global shipping costs saw significant volatility, with the Drewry World Container Index fluctuating throughout the year, directly impacting the company's landed costs for both inbound components and outbound finished goods.

These fluctuations in freight rates can noticeably affect profitability. Efficient supply chain management and the optimization of shipping routes are therefore critical for Zhejiang Dingli Machinery to maintain cost control and protect its profit margins. This involves strategic partnerships with logistics providers and continuous evaluation of transportation methods.

Key cost drivers within this category include:

- International freight rates: Direct costs associated with transporting machinery across continents.

- Fuel surcharges: Variable costs tied to global energy prices, impacting all modes of transport.

- Customs duties and tariffs: Import/export fees that vary by country and trade agreements.

- Warehousing and handling: Costs incurred at ports and distribution centers for storage and movement of goods.

5

Zhejiang Dingli Machinery's cost structure includes significant expenses related to after-sales service and warranty provisions. These costs are crucial for maintaining customer satisfaction and fostering long-term brand loyalty.

The company invests heavily in supporting customers post-purchase. This involves covering expenses for repairs, providing necessary spare parts, and offering ongoing technical assistance. For instance, in 2023, Zhejiang Dingli Machinery reported that its after-sales service network expansion and spare parts inventory management represented a substantial portion of its operational costs, ensuring prompt support for its global clientele.

- After-sales Service: Costs associated with repairs, maintenance, and technical support for products after the initial sale.

- Warranty Costs: Expenses incurred to fulfill warranty obligations, including parts replacement and labor for covered defects.

- Global Service Network: Investment in establishing and maintaining service centers and qualified technicians worldwide.

- Spare Parts Inventory: Capital tied up in stocking a sufficient range of spare parts to meet demand efficiently.

Zhejiang Dingli Machinery's cost structure is heavily influenced by manufacturing and production expenses, including raw materials like steel and components, as well as labor. Significant investments in advanced manufacturing equipment and automation, while boosting efficiency, represent substantial capital outlays that are a key part of their operational costs.

Research and Development (R&D) is another major cost driver, with approximately 4.4% of revenue, or 463 million RMB, allocated to R&D in 2023. This investment fuels innovation in intelligent and eco-friendly aerial work platforms (AWPs). Global sales, marketing, and distribution efforts, including dealer network support and trade show participation, are also significant expenditures, with early 2024 showing robust market activity requiring upfront marketing investment.

Logistics and freight costs are critical, especially for international shipping, with global shipping rates impacting landed costs. After-sales service and warranty provisions, encompassing repairs, spare parts, and technical support, are also substantial costs essential for customer retention and brand loyalty.

| Cost Category | 2023 Highlight | 2024 Trend/Impact |

|---|---|---|

| Manufacturing & Production | Raw materials and components a substantial portion of cost of sales. | Continued investment in automation. |

| Research & Development (R&D) | 463 million RMB (approx. 4.4% of revenue). | Focus on intelligent and eco-friendly models. |

| Sales, Marketing & Distribution | Costs for dealer network and trade shows. | Significant upfront investment in market expansion initiatives. |

| Logistics & Freight | Impact of raw material price fluctuations noted. | Volatility in global shipping costs affecting landed costs. |

| After-Sales Service & Warranty | Service network expansion and spare parts management were substantial costs. | Ongoing investment in global service network. |

Revenue Streams

Zhejiang Dingli Machinery's main income comes from selling Aerial Work Platforms (AWPs). This covers direct sales of various lifts like scissor lifts, boom lifts, and mast lifts to customers who use them directly, and importantly, to businesses that rent out this equipment around the world.

A significant portion of revenue is generated by supplying AWPs to the global equipment rental market, a key driver of their sales volume. For instance, in 2023, Dingli's revenue reached ¥11.5 billion, with a substantial part attributed to these sales.

The company also boosts its sales by regularly introducing innovative new models. The launch of advanced options, such as their mild-hybrid boom lifts, has proven effective in attracting customers and driving sales growth, contributing to their strong financial performance.

Revenue from international sales is a significant contributor to Zhejiang Dingli Machinery's overall income. In recent years, these overseas sales have consistently represented around 30-35% of the company's total revenue.

This strong performance in foreign markets is largely due to Dingli's extensive global distribution network and well-established strategic alliances across different regions. These international relationships are crucial for facilitating substantial export revenue and driving overseas market penetration, which is a key factor in the company's growth strategy.

Zhejiang Dingli Machinery generates recurring revenue through the sale of spare parts and components essential for the maintenance and repair of its Aerial Work Platforms (AWPs). This stream is bolstered by the company's substantial installed base, ensuring consistent demand for genuine parts.

In 2023, Dingli's aftermarket services, which include spare parts sales, contributed significantly to its overall financial performance, demonstrating the value of supporting product longevity and customer operational efficiency.

Revenue Stream 4

Zhejiang Dingli Machinery generates revenue through after-sales services, which include essential technical support, proactive maintenance contracts, and comprehensive training programs. These services go beyond standard warranty provisions, offering specialized maintenance packages and extended service agreements that create recurring income streams. This focus not only boosts customer loyalty but also ensures greater equipment operational efficiency.

In 2023, Zhejiang Dingli Machinery Co., Ltd. reported that its after-sales service segment played a significant role in its overall financial performance, contributing to customer satisfaction and operational continuity for its clients. The company's commitment to robust after-sales support is a key differentiator in the competitive aerial work platform market.

- After-Sales Services: Revenue from technical support, maintenance contracts, and training programs.

- Extended Service Agreements: Income generated from specialized maintenance packages and long-term service contracts.

- Customer Retention: These services are crucial for keeping customers engaged and loyal.

- Equipment Uptime: Ensuring machinery remains operational, which is vital for client productivity.

Revenue Stream 5

Zhejiang Dingli Machinery is exploring new revenue avenues beyond direct equipment sales by leveraging advanced telematics and intelligent technologies integrated into its Aerial Work Platforms (AWPs). These connected features open doors for subscription-based services.

The company anticipates significant growth from offering remote monitoring solutions and data-driven predictive maintenance. By analyzing operational data, Dingli can provide clients with insights to optimize AWP usage and minimize downtime, creating a recurring revenue stream. This strategic shift aligns with the broader industry trend towards smart equipment and the Internet of Things (IoT).

- Subscription Services: Offering remote monitoring and telematics data access on a recurring fee basis.

- Predictive Maintenance: Generating revenue through service contracts that utilize data analytics for proactive maintenance scheduling.

- Value-Added Data Insights: Monetizing aggregated and anonymized operational data for industry benchmarking or efficiency improvements.

- Software-as-a-Service (SaaS): Developing and licensing specialized software for AWP fleet management and optimization.

Zhejiang Dingli Machinery's revenue streams are primarily driven by the sale of Aerial Work Platforms (AWPs) to both direct users and rental companies globally. This core business saw significant growth, with total revenue reaching ¥11.5 billion in 2023.

Beyond new equipment, the company generates recurring income through spare parts sales and after-sales services, including maintenance contracts and technical support, which are vital for customer retention and equipment uptime.

Looking ahead, Dingli is expanding into subscription-based services, offering remote monitoring and predictive maintenance powered by telematics and intelligent technologies integrated into their AWPs, tapping into the growing demand for smart equipment solutions.

| Revenue Stream | Description | Key Driver | 2023 Contribution (Illustrative) |

|---|---|---|---|

| AWP Sales | Direct sales and sales to rental markets | Global demand, new model launches | Substantial portion of ¥11.5 billion total revenue |

| Spare Parts | Sales of components for maintenance | Large installed base, product longevity | Significant contributor to overall performance |

| After-Sales Services | Technical support, maintenance contracts, training | Customer loyalty, equipment operational efficiency | Key differentiator in the market |

| Subscription Services | Remote monitoring, predictive maintenance | Telematics, IoT integration, data insights | Emerging growth area |

Business Model Canvas Data Sources

The Zhejiang Dingli Machinery Business Model Canvas is constructed using comprehensive market research reports, financial disclosures, and internal operational data. These sources provide a robust foundation for understanding customer needs, competitive landscapes, and revenue streams.