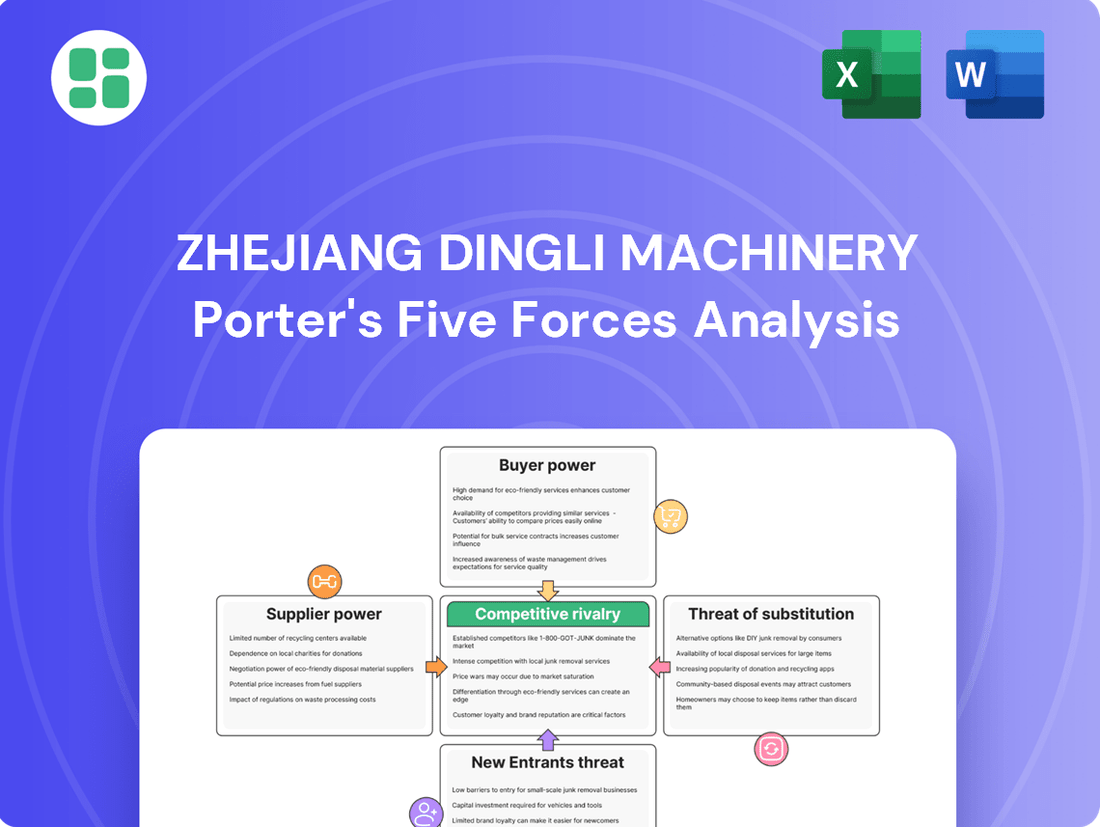

Zhejiang Dingli Machinery Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Dingli Machinery Bundle

Zhejiang Dingli Machinery faces moderate bargaining power from buyers due to product differentiation, while suppliers exert some influence through specialized components. The threat of new entrants is moderate, balanced by capital requirements and established brand loyalty. Substitutes pose a low threat, given the specialized nature of aerial work platforms. Competitive rivalry is intense, driven by global players and technological advancements.

The complete report reveals the real forces shaping Zhejiang Dingli Machinery’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Zhejiang Dingli's reliance on suppliers for specialized components such as hydraulic systems, engines, and control units significantly influences supplier bargaining power. These critical parts often have few, if any, readily available substitutes, especially when they are proprietary or require specific certifications for aerial work platforms.

The stabilization of global supply chains for heavy construction equipment in 2025, as suggested by industry analyses, could potentially reduce supplier bargaining power by ensuring more consistent access to essential materials and parts. This improved predictability offers manufacturers like Zhejiang Dingli Machinery a stronger footing in negotiations.

However, the landscape remains dynamic; any resurgence of geopolitical instability or unforeseen logistical challenges in late 2024 or early 2025 could rapidly re-empower suppliers. For instance, a sudden spike in steel prices, which saw significant volatility in 2023 and early 2024, could quickly shift leverage back to raw material providers.

Switching suppliers for Zhejiang Dingli's essential, integrated components could incur substantial costs. These include expenses related to redesigning products, obtaining new certifications, and retooling manufacturing processes, all of which bolster the leverage of current suppliers.

Zhejiang Dingli's dedication to maintaining high standards in innovation and product quality means they rely on suppliers providing consistently reliable and high-performing parts. This dependence makes cultivating strong relationships with key suppliers a strategic imperative.

Supplier Concentration

Supplier concentration significantly impacts Zhejiang Dingli Machinery's bargaining power. If the market for specific Aerial Work Platform (AWP) components is dominated by a few large suppliers, their bargaining power naturally increases because there's less competition among them. This scenario could force Zhejiang Dingli to accept higher prices or less favorable terms for critical parts needed for its extensive product lines, including scissor lifts, boom lifts, and mast lifts.

For instance, in the specialized hydraulics market, which is crucial for AWP functionality, a few global players often hold substantial market share. If Zhejiang Dingli relies heavily on these concentrated suppliers, it faces a direct risk of increased input costs. In 2023, the global hydraulics market was valued at approximately $150 billion, with a notable portion of that concentrated in the hands of major manufacturers, potentially limiting negotiation leverage for buyers like Dingli.

- Limited Supplier Options: A concentrated supplier base means fewer alternatives for sourcing essential components, strengthening the position of existing suppliers.

- Price Sensitivity: Zhejiang Dingli's profitability can be directly affected by price increases from dominant component suppliers.

- Supply Chain Vulnerability: Reliance on a few key suppliers can create vulnerabilities in Dingli's supply chain, potentially leading to production delays if supply is disrupted.

Forward Integration Threat

The threat of forward integration by suppliers into AWP manufacturing, while theoretically possible, presents a low bargaining power lever for most component providers in the Zhejiang Dingli Machinery sector. This is primarily due to the substantial capital outlay and specialized technical knowledge needed to establish AWP production facilities. For instance, the average capital expenditure for a new aerial work platform (AWP) manufacturing plant can easily run into tens of millions of dollars, a significant barrier for many component suppliers.

While a large, diversified supplier might possess the financial muscle, the steep learning curve and established manufacturing processes within the AWP industry make it an unattractive proposition. The complexity of designing, engineering, and assembling AWPs, which often involves intricate hydraulic systems and safety-critical components, requires a different skill set than component manufacturing. Therefore, the direct threat of suppliers becoming competitors is minimal, limiting their ability to exert significant upward pressure on prices or demand preferential terms from Dingli Machinery.

However, the industry is not entirely devoid of such risks. If a key supplier were to achieve significant technological advancements or secure critical intellectual property related to AWP components, their potential for forward integration could increase. This would grant them greater leverage, potentially impacting Dingli Machinery's supply chain stability and cost structure. For example, a breakthrough in battery technology for electric AWPs could empower a battery supplier to consider vertical integration.

- Low Likelihood of Forward Integration: The high capital requirements and specialized expertise needed for AWP manufacturing deter most component suppliers.

- Significant Barriers to Entry: Establishing AWP production involves substantial investment in R&D, manufacturing infrastructure, and skilled labor.

- Industry Specific Knowledge: Success in AWP manufacturing demands deep understanding of hydraulics, safety standards, and end-user applications, which component suppliers may lack.

- Limited Leverage for Most Suppliers: Consequently, the threat of suppliers integrating forward remains a minor factor in the bargaining power dynamics for Zhejiang Dingli Machinery.

The bargaining power of suppliers for Zhejiang Dingli Machinery is influenced by the concentration of component providers and the potential for forward integration. A few dominant suppliers for critical parts like hydraulics can increase their leverage, potentially raising costs for Dingli. While forward integration by suppliers into AWP manufacturing is generally deterred by high capital and expertise requirements, significant technological advancements by a supplier could alter this dynamic.

The global hydraulics market, a key area for AWP components, saw a valuation of approximately $150 billion in 2023, with a notable concentration among major players. This concentration means Zhejiang Dingli might have limited negotiation options for these essential parts.

The threat of suppliers integrating forward into AWP manufacturing is low due to substantial barriers, including the tens of millions of dollars required for new production facilities and the specialized knowledge of hydraulics and safety standards needed.

Despite these barriers, a supplier achieving a breakthrough in areas like electric AWP battery technology could potentially consider vertical integration, thereby increasing their leverage over manufacturers like Zhejiang Dingli.

What is included in the product

This Porter's Five Forces analysis for Zhejiang Dingli Machinery dissects the competitive intensity within the aerial work platform industry, examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly identify and address competitive threats with a visually intuitive Porter's Five Forces analysis for Zhejiang Dingli Machinery.

Simplify complex market dynamics into actionable insights, empowering strategic adjustments for Zhejiang Dingli Machinery.

Customers Bargaining Power

Zhejiang Dingli's customer base frequently includes major construction firms and extensive aerial work platform (AWP) rental companies. These clients typically procure AWPs in substantial quantities, giving them significant leverage.

The sheer volume of their purchases allows these large customers to negotiate aggressively on pricing, secure advantageous payment terms, and insist on robust after-sales service and support. For instance, in 2023, the global AWP market saw major players securing bulk orders that influenced overall pricing structures.

Zhejiang Dingli Machinery's strong reputation for innovation and quality significantly dampens customer bargaining power. By consistently introducing advanced features and ensuring high reliability, Dingli creates products that stand out in the market.

Customers prioritizing these attributes, such as adherence to stringent international safety standards, are often less swayed by price alone. This loyalty reduces their ability to negotiate lower prices, as they value Dingli's performance and safety assurances.

Customer switching costs for Aerial Work Platforms (AWPs) are a key factor influencing their bargaining power. While not as prohibitive as supplier switching costs for manufacturers, customers do face expenses when changing AWP brands. These can include the cost of retraining operators on new equipment, ensuring maintenance compatibility with existing service agreements, and adjusting parts inventory to suit a different fleet.

These incurred costs, though not insurmountable, create a degree of customer stickiness, meaning that existing customers are somewhat less likely to switch to a competitor solely based on price. For instance, a company with a large fleet of Zhejiang Dingli Machinery AWPs might face significant retraining expenses if they were to switch to a different manufacturer, potentially impacting their operational efficiency in the short term. This "stickiness" provides Zhejiang Dingli Machinery with a degree of leverage, somewhat tempering the bargaining power of its customers.

Importance of AWPs to Customer Operations

Aerial work platforms (AWPs) are not just equipment; they are fundamental to how customers in sectors like construction, logistics, and shipbuilding conduct their operations. These are significant capital expenditures, underscoring their importance for safe and efficient work at height. For instance, in 2023, the global construction equipment rental market, which heavily utilizes AWPs, was valued at approximately $120 billion, highlighting the scale of these investments.

Because AWPs are so critical, customers tend to focus heavily on performance and reliability when making purchasing decisions. This means that while price is a factor, the ability of the AWP to perform its job without failure, ensuring worker safety and project timelines, often takes precedence. This inherent need for dependable operation strengthens the bargaining power of customers who can demand higher quality and service.

- Critical Capital Investment: AWPs represent substantial financial outlays for businesses, making their operational efficiency paramount.

- Industry Dependence: Sectors like construction and shipbuilding rely heavily on AWPs for essential tasks, increasing their importance to customer operations.

- Performance Over Price: The need for safety and reliability often allows customers to prioritize product quality and service support over the lowest price point.

- Market Context: The robust global construction equipment rental market, valued around $120 billion in 2023, underscores the significant capital commitment customers make in AWPs.

Availability of Rental Options

The growing popularity of aerial work platform (AWP) rentals is a significant factor boosting customer bargaining power. This trend allows customers to access a variety of machinery without the substantial upfront investment of purchasing new equipment. In 2024, the global AWP rental market showed robust growth, with many businesses opting for rental solutions to manage costs and maintain fleet flexibility.

This increased availability of rental options means customers have more choices and are less tied to a single manufacturer. They can readily switch providers or choose different types of equipment based on specific project needs. This flexibility directly translates into stronger negotiation leverage.

- Increased Rental Adoption: Businesses are increasingly viewing AWP rentals as a strategic cost-management tool, reducing the need for large capital expenditures.

- Expanded Equipment Access: Rental markets provide access to a diverse range of AWPs, from scissor lifts to boom lifts, catering to varied project requirements.

- Reduced Manufacturer Lock-in: The ease of switching rental providers diminishes customer reliance on any single equipment manufacturer.

The bargaining power of Zhejiang Dingli Machinery's customers is considerable, primarily due to the significant capital investment involved in purchasing Aerial Work Platforms (AWPs). These large-scale acquisitions, often in bulk by major construction firms and rental companies, allow buyers to negotiate aggressively on price and terms. For example, the global AWP rental market's substantial valuation in 2023 highlights the scale of these customer commitments.

While Dingli's reputation for quality and innovation mitigates some customer leverage, the increasing trend towards AWP rentals in 2024 further empowers buyers. This shift provides greater flexibility and choice, reducing reliance on any single manufacturer and strengthening their negotiating position.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation |

| Purchase Volume | High | Major construction and rental companies buy in large quantities. |

| Switching Costs | Moderate | Retraining, service compatibility, and parts inventory adjustments exist. |

| Product Criticality | High | AWPs are essential for operations in construction, logistics, etc. |

| Rental Market Growth | Increasing | 2024 saw robust growth in AWP rentals, offering more alternatives. |

Preview Before You Purchase

Zhejiang Dingli Machinery Porter's Five Forces Analysis

This preview showcases the complete Zhejiang Dingli Machinery Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within its industry. The document you see here is the exact, professionally formatted report you will receive immediately upon purchase, ensuring no surprises. You'll gain instant access to this comprehensive analysis, ready for immediate use and strategic decision-making.

Rivalry Among Competitors

The global aerial work platform (AWP) market is a battlefield of established giants, making competitive rivalry a significant force. Major international players like JLG, Terex, Haulotte, and Skyjack have long-standing reputations and extensive market share.

Zhejiang Dingli, while a global leader, faces this intense competition head-on. The market is characterized by a high degree of concentration among these key players, all vying for dominance through product innovation, pricing strategies, and distribution networks.

In 2024, the AWP market continued to see significant investment in research and development from these established firms, aiming to capture a larger slice of the estimated multi-billion dollar global market. For instance, JLG reported robust sales in its access equipment segment throughout 2024, indicating strong demand and the ongoing competitive intensity.

The aerial work platform (AWP) manufacturing sector, where Zhejiang Dingli Machinery operates, is defined by substantial fixed costs. These include significant investments in research and development, state-of-the-art production facilities, and the establishment of robust distribution channels.

These high fixed costs create a strong incentive for manufacturers to achieve and maintain high capacity utilization. Operating at peak production levels is crucial for spreading these overheads, which in turn can lead to aggressive pricing tactics as companies vie for market share.

This dynamic intensifies competitive rivalry, particularly when the market experiences periods of slower growth. For instance, in 2023, the global AWP market saw growth tempered by macroeconomic uncertainties, putting pressure on manufacturers like Dingli to manage capacity and pricing effectively.

The competitive landscape in the aerial work platform (AWP) industry is intensely driven by relentless product innovation. Companies are pouring resources into developing electric and hybrid models to meet growing environmental regulations and customer demand for sustainability. For instance, in 2024, the global AWP market saw a significant push towards electrification, with many manufacturers showcasing advanced battery technologies and charging solutions.

This focus extends to incorporating smart features, such as advanced telematics for remote monitoring and diagnostics, and enhanced safety systems, including improved stability control and operator assistance. Zhejiang Dingli Machinery’s strategic emphasis on electrification and intelligent manufacturing is therefore not just a trend, but a critical imperative for them to maintain and strengthen their competitive edge against rivals who are also heavily investing in these areas.

Market Growth and Regional Dynamics

The aerial work platform (AWP) market is poised for significant expansion, with projections indicating robust growth from 2024 through 2029. This upward trajectory is largely fueled by ongoing construction projects and infrastructure development, especially within the dynamic Asia-Pacific region.

While this market expansion presents lucrative opportunities, it concurrently intensifies competitive rivalry. As the market grows and attracts new entrants, existing players must contend with increased pressure to capture market share in these burgeoning geographical areas.

- Projected AWP Market Growth: Expected to grow from 2024 to 2029.

- Key Growth Drivers: Construction and infrastructure development, particularly in Asia-Pacific.

- Impact on Rivalry: Market growth attracts more competitors, leading to heightened competition for market share.

- Regional Focus: Asia-Pacific is identified as a key region driving both growth and competition.

Price Competition and Market Share Battles

Even with some product differentiation in the aerial work platform (AWP) market, price competition remains a crucial battleground, particularly for less specialized equipment. Zhejiang Dingli Machinery, like its peers, navigates intense market share contests. These often translate into strategic price adjustments or robust promotional campaigns that can put pressure on profit margins.

In 2023, the global AWP market saw significant activity. For instance, Genie (Terex) and JLG (Oshkosh Corporation) are major players that frequently engage in competitive pricing strategies. While specific 2024 price reduction data for Dingli is not yet fully available, industry trends indicate that companies are leveraging financing options and bundled service packages to offer competitive overall value, rather than just outright price cuts.

- Price Sensitivity: In segments where technical specifications are similar, buyers often prioritize the lowest upfront cost, forcing manufacturers to compete on price.

- Market Share Focus: Companies like Dingli are driven to capture market share, which can lead to temporary price concessions to attract new customers.

- Promotional Impact: Aggressive sales promotions, such as extended warranty periods or discounted parts, can boost sales volume but also erode profitability if not carefully managed.

The competitive rivalry within the aerial work platform (AWP) market is fierce, with established global players like JLG and Terex constantly innovating and adjusting pricing. Zhejiang Dingli Machinery, as a major global player, faces intense pressure from these competitors. The market's substantial fixed costs incentivize high production volumes, often leading to aggressive pricing strategies to maintain capacity utilization, especially during periods of slower growth.

In 2024, the AWP sector saw continued heavy investment in research and development, particularly in electrification and smart features, as companies like Dingli sought to differentiate themselves. This technological race, coupled with market expansion driven by infrastructure projects, particularly in Asia-Pacific, means companies are actively competing for market share through both innovation and strategic pricing, including financing and service bundles.

| Competitor | 2024 Estimated Market Share (Global AWP) | Key 2024 Focus |

|---|---|---|

| JLG (Oshkosh Corporation) | ~20-25% | Electrification, digital solutions |

| Terex (Genie) | ~15-20% | Productivity enhancements, sustainability |

| Haulotte | ~10-15% | New model launches, emerging markets |

| Skyjack | ~10-15% | Durability, cost-effectiveness |

| Zhejiang Dingli Machinery | ~10-15% | Global expansion, R&D in electric AWPs |

SSubstitutes Threaten

Traditional methods like scaffolding and ladders remain viable substitutes for aerial work platforms (AWPs), particularly for tasks at lower heights or those with simpler requirements. These established approaches often have a lower upfront investment compared to AWPs.

The cost-effectiveness of scaffolding and ladders can present a significant threat, especially in market segments where budget is a primary concern. For instance, in 2024, the global scaffolding market was valued at approximately USD 50 billion, indicating its continued substantial presence and appeal for certain applications.

For very high lifts or substantial material handling, cranes present a viable substitute for boom lifts. While AWPs, like those produced by Zhejiang Dingli Machinery, offer superior flexibility for personnel access and intricate elevated tasks, cranes excel in raw lifting power. In 2023, the global crane market was valued at approximately $35 billion, indicating a significant scale of operations for this alternative.

The decision between a crane and an Aerial Work Platform (AWP) hinges on specific job requirements. Cranes are generally more cost-effective for pure heavy lifting operations, whereas AWPs, including Zhejiang Dingli's boom lifts, are better suited for precise, elevated work involving personnel. This distinction highlights that while substitutes exist, the unique value proposition of AWPs in specific applications remains strong.

Emerging technologies like drones and robotics present a nascent substitution threat to Aerial Work Platforms (AWPs) in specific niche applications. Drones are increasingly capable of performing aerial inspections and data capture, potentially replacing AWPs in tasks requiring visual surveys or light payload delivery at height. For instance, in construction, drone-based progress monitoring can reduce the need for personnel in elevated positions.

Furthermore, advancements in robotics, particularly for repetitive or dangerous tasks at height, could also offer an alternative. While currently limited, as these technologies mature, they might reduce the demand for human-operated AWPs in certain maintenance or assembly operations. This long-term substitution risk is driven by the potential for increased efficiency, safety, and reduced labor costs, though widespread adoption for complex AWP functions remains a future consideration.

Safety and Efficiency Advantages of AWPs

The inherent safety features and operational efficiency of Aerial Work Platforms (AWPs) significantly diminish the appeal of many substitutes. Their design prioritizes worker well-being, offering stable platforms and fall protection, which are often lacking in traditional methods like scaffolding or ladders.

Global safety regulations are increasingly stringent, often mandating the use of secure elevated work platforms. This regulatory push directly favors AWPs over less secure alternatives, making them the preferred choice in many industries. For instance, in 2023, the global AWPs market was valued at approximately $10.5 billion, demonstrating a strong demand driven by safety compliance.

- Enhanced Worker Safety: AWPs provide a stable, protected working environment, reducing the risk of falls and injuries compared to ladders or scaffolding.

- Increased Productivity: Their ease of deployment and maneuverability allows for quicker setup and repositioning, leading to more efficient task completion.

- Regulatory Compliance: Adherence to strict safety standards in construction and maintenance often necessitates the use of AWPs, making them a requirement rather than an option.

- Versatility in Applications: AWPs are adaptable to a wide range of tasks, from building maintenance and electrical work to tree trimming and event setup, outperforming specialized or less flexible alternatives.

Cost-Benefit Analysis for Customers

Customers weigh the advantages of aerial work platforms (AWPs) against alternatives by examining factors like safety, operational efficiency, labor expenses, and project completion times. For instance, a construction project requiring intricate work at significant heights might find that an AWP's speed and enhanced safety features justify its cost over traditional scaffolding or crane rental, especially when considering reduced labor needs.

The cost-benefit calculation is crucial. While AWPs represent an upfront investment, their ability to accelerate tasks and minimize risks can lead to substantial savings. For example, in 2024, the average cost of a workplace accident in the construction industry can be tens of thousands of dollars, a figure AWPs are designed to mitigate.

- Safety Enhancement: AWPs significantly reduce the risk of falls, a leading cause of fatalities and injuries in elevated work.

- Efficiency Gains: Faster setup and operation compared to traditional methods can shorten project timelines.

- Labor Cost Reduction: Fewer personnel may be needed to operate and manage AWPs, leading to direct labor savings.

- Risk Mitigation: The inherent stability and controlled movement of AWPs minimize the potential for costly accidents and project delays.

While traditional methods like scaffolding and ladders are substitutes, their limitations in safety and efficiency for higher or more complex tasks are significant. Cranes offer an alternative for heavy lifting, but AWPs provide superior maneuverability for personnel access at height. Emerging technologies like drones and robotics are nascent threats, currently limited to niche applications like inspections.

| Substitute Type | Key Characteristics | Threat Level to AWPs | Market Size (Approximate 2024) | Zhejiang Dingli's Competitive Advantage |

| Scaffolding & Ladders | Lower upfront cost, suitable for low heights | Moderate (for basic tasks) | Scaffolding: USD 50 billion | Safety, efficiency, and maneuverability at height |

| Cranes | High lifting capacity | Low to Moderate (for pure lifting) | Cranes: USD 35 billion | Precision personnel access and complex positioning |

| Drones & Robotics | Automated inspections, light payload delivery | Low (emerging, niche applications) | N/A (nascent market) | Human-operated precision and versatility |

Entrants Threaten

The aerial work platform (AWP) manufacturing sector, where Zhejiang Dingli Machinery operates, necessitates significant capital outlays. Companies need to invest heavily in cutting-edge research and development to innovate and stay competitive, alongside establishing state-of-the-art manufacturing plants equipped with advanced machinery. Furthermore, building a robust global distribution and after-sales service network requires substantial financial commitment.

These considerable upfront costs create a formidable barrier for any new company aspiring to enter the AWP market. For instance, setting up a new production line for a single AWP model can easily run into tens of millions of dollars, encompassing machinery, tooling, and quality control systems. This high barrier effectively deters many potential entrants, thereby reducing the threat of new competition for established players like Dingli.

Developing and manufacturing Aerial Work Platforms (AWPs) demands a deep well of specialized engineering expertise, especially in areas like hydraulics, sophisticated electronics, and critical safety systems. This technical know-how isn't easily replicated.

Companies such as Zhejiang Dingli have spent considerable time and resources cultivating this knowledge base over many years. This accumulated experience presents a significant hurdle for any new player attempting to enter the market and quickly match their capabilities.

The capital expenditure required for advanced research and development, coupled with the need for specialized manufacturing equipment, further erects barriers. For instance, the global AWP market, valued at approximately $8.5 billion in 2023, is expected to grow, but entry requires substantial upfront investment in these specialized areas.

Established players like Zhejiang Dingli have cultivated strong brand reputations, built on years of delivering quality, innovation, and reliability. This deep-seated trust is a significant hurdle for newcomers. In 2023, Dingli reported revenue of ¥7.6 billion, underscoring its market presence.

Furthermore, Dingli benefits from extensive global distribution and service networks, a crucial advantage that new entrants would find incredibly challenging and costly to replicate. Building such infrastructure takes considerable time and investment, making it difficult for new companies to achieve comparable market access and customer support.

Stringent Safety Regulations and Certifications

The aerial work platform (AWP) market is characterized by stringent safety regulations and certification requirements, acting as a significant barrier to new entrants. Compliance with international standards such as OSHA, ANSI, and CE demands substantial investment in research, development, and manufacturing processes.

Meeting these rigorous compliance requirements is not only essential for market acceptance but also critical for managing product liability risks. For instance, the cost associated with obtaining and maintaining these certifications can be prohibitive for smaller, less-established companies looking to enter the market.

- High Compliance Costs: New entrants must allocate significant capital to ensure their products meet global safety benchmarks like ANSI A92.20 for boom-supported AWPs, which can easily run into millions of dollars for initial certification.

- Technical Expertise Required: Navigating and adhering to these complex standards necessitates specialized engineering and safety expertise, which is often scarce and expensive to acquire.

- Product Liability Insurance: The high cost of product liability insurance, driven by the safety-critical nature of AWPs, further increases the financial burden on newcomers. In 2024, premiums for manufacturers of heavy machinery can represent a substantial percentage of revenue.

Economies of Scale and Cost Advantages

The threat of new entrants in the Aerial Work Platform (AWP) market, particularly for a company like Zhejiang Dingli Machinery, is significantly influenced by existing economies of scale and cost advantages held by established players. Large, incumbent manufacturers benefit from substantial purchasing power for raw materials and components, leading to lower per-unit acquisition costs. This scale also extends to production, where higher output volumes allow for more efficient factory utilization and spreading fixed costs over more units. For instance, in 2023, major AWP manufacturers reported production volumes in the tens of thousands of units annually, a scale difficult for newcomers to replicate quickly.

New entrants face a steep challenge in matching these cost efficiencies. Without the established volume, they cannot negotiate favorable terms with suppliers or amortize their R&D and capital expenditures as effectively. This inherent cost disadvantage means that any new company entering the AWP sector would likely have to price their products higher or accept lower profit margins to be competitive, making it a financially precarious undertaking.

- Economies of Scale: Established AWP manufacturers leverage large-scale production to reduce per-unit costs.

- Procurement Advantages: Bulk purchasing of materials by incumbents leads to significant cost savings.

- R&D Investment: Larger firms can spread substantial R&D costs over a greater number of units.

- Cost Disadvantage for New Entrants: Newcomers struggle to achieve similar cost efficiencies, impacting initial competitiveness.

The threat of new entrants in the aerial work platform (AWP) market is considerably low due to substantial barriers. These include high capital requirements for manufacturing and R&D, the need for specialized technical expertise, and the significant challenge of replicating established brands and extensive distribution networks. Furthermore, stringent safety regulations and the cost of product liability insurance act as further deterrents.

Economies of scale enjoyed by incumbents like Zhejiang Dingli provide a significant cost advantage, making it difficult for newcomers to compete on price. For instance, in 2023, the global AWP market was valued at approximately $8.5 billion, with established players benefiting from decades of operational experience and market penetration.

| Barrier Category | Description | Impact on New Entrants |

| Capital Requirements | High investment in R&D, manufacturing facilities, and distribution networks. | Significant financial hurdle. Setting up a production line can cost tens of millions of dollars. |

| Technical Expertise | Deep knowledge in hydraulics, electronics, and safety systems. | Difficult to acquire quickly, requiring years of development. |

| Brand Reputation & Networks | Established trust and extensive global service/distribution. | Challenging and costly for newcomers to replicate. Dingli's 2023 revenue of ¥7.6 billion highlights its market presence. |

| Regulatory Compliance | Adherence to stringent safety standards (e.g., ANSI, CE). | High costs for certification and potential product liability insurance premiums. In 2024, these premiums can be a substantial percentage of revenue for heavy machinery manufacturers. |

| Economies of Scale | Lower per-unit costs due to high production volumes and bulk purchasing. | New entrants face a cost disadvantage, impacting initial competitiveness. Major AWP manufacturers produced tens of thousands of units in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Zhejiang Dingli Machinery draws upon a comprehensive set of data sources, including the company's annual reports and financial statements, alongside industry-specific market research reports and trade publications. We also incorporate data from financial databases and analyst reports to provide a robust understanding of the competitive landscape.