Xiamen C&D SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen C&D Bundle

Xiamen C&D demonstrates robust strengths in its diversified business portfolio and strong supply chain integration, positioning it well within its operating sectors. However, potential threats from evolving market regulations and intense competition warrant careful consideration.

Want the full story behind Xiamen C&D's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Xiamen C&D Inc.'s strength lies in its broadly diversified business portfolio, encompassing supply chain services, real estate, hotels, tourism, and investments in new industries. This wide operational scope significantly mitigates risks by reducing dependence on any single market segment. For instance, in 2023, its supply chain segment contributed a substantial portion of revenue, while real estate and other segments provided additional stability, ensuring resilience against sector-specific downturns.

Xiamen C&D stands out as a premier supply chain service provider, adeptly managing a diverse portfolio of commodities like metals, pulp, minerals, and agricultural goods. This specialization allows them to offer comprehensive solutions across various industries.

The company boasts an impressive global supply chain network, reaching over 170 countries and regions, a testament to its extensive operational footprint. This vast network is further bolstered by more than 50 overseas offices, facilitating seamless international transactions and market penetration.

In 2024, Xiamen C&D achieved a significant overseas business volume exceeding $10 billion, underscoring its substantial international presence and the trust placed in its supply chain capabilities. This financial achievement highlights their ability to manage large-scale global operations efficiently.

Their robust global reach and deep expertise are vital for navigating the complexities of international trade, ensuring reliability and efficiency in their operations. This makes them a strong partner for businesses operating on a global scale.

Xiamen C&D boasts a formidable presence in real estate, with key subsidiaries like C&D Real Estate and Lianfa Group consistently recognized among China's leading developers. This strong sector position is evidenced by their robust project pipelines and market share.

The company's strategic national footprint, spanning over 70 cities in China, ensures a diversified and stable revenue generation and a substantial asset base. This broad operational reach mitigates regional economic downturns and captures growth opportunities across the country.

Recent actions, such as bolstering its stake in C&D Real Estate, underscore Xiamen C&D's commitment to strengthening its control and maximizing the potential within its core real estate segment, indicating a focused strategy for future growth and market leadership.

Commitment to Sustainability and Innovation

Xiamen C&D's dedication to sustainability is a significant strength, highlighted in its 2024 Sustainability Report. The company is actively implementing green supply chain management and investing in clean energy solutions, demonstrating a forward-thinking approach to environmental responsibility.

Further bolstering this strength, Xiamen C&D is strategically integrating advanced digital technologies, such as artificial intelligence. This integration aims to boost operational efficiency while simultaneously promoting environmentally friendly practices throughout its diverse industrial chains, aligning with growing investor demand for strong ESG performance.

- Green Initiatives: Focus on green supply chain management and clean energy investments.

- Digital Transformation: Adoption of AI and other digital technologies to enhance efficiency and sustainability.

- ESG Alignment: Commitment to sustainability practices meets global trends and investor expectations.

Strong Brand Value and State-Owned Background

Xiamen C&D Inc. benefits significantly from its affiliation with Xiamen C&D Corp., Ltd., a prominent entity that secured the 85th position on the 2024 Fortune Global 500 list. This strong brand value translates to enhanced market recognition and a broader sphere of influence.

Its state-owned background is a crucial strength, offering distinct advantages. These include facilitated access to capital, the ability to leverage preferential government policies, and a bolstered perception of stability and credibility. This inherent backing makes Xiamen C&D Inc. a more attractive proposition for both investors and business partners.

- Brand Recognition: Ranked 85th in the 2024 Fortune Global 500, showcasing substantial market presence.

- State-Owned Advantages: Facilitates access to capital and preferential policies.

- Credibility & Stability: State ownership enhances trust and long-term outlook for stakeholders.

Xiamen C&D's diversified business model is a key strength, spanning supply chain services, real estate, and investments. This broad operational scope, as seen in its 2023 performance where supply chain services were a major revenue driver while other segments offered stability, significantly reduces reliance on any single sector. Their position as a leading supply chain provider for commodities like metals and pulp, supported by a global network reaching over 170 countries with more than 50 overseas offices, underscores their international operational capacity. This extensive reach was further validated by over $10 billion in overseas business volume in 2024, demonstrating their capability in managing large-scale global transactions efficiently.

| Business Segment | 2023 Performance Highlight | Global Reach |

|---|---|---|

| Supply Chain Services | Substantial revenue contribution, leading provider for metals, pulp, minerals, agriculture. | 170+ countries, 50+ overseas offices. |

| Real Estate | Key subsidiaries recognized as top developers in China. | Presence in 70+ cities across China. |

| Investments & Other | Provides additional stability and diversification. | N/A |

What is included in the product

Analyzes Xiamen C&D’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Xiamen C&D's strategic challenges, turning potential weaknesses into opportunities for growth.

Weaknesses

Xiamen C&D Inc. experienced a substantial hit to its profitability in 2024. Despite a slight revenue increase in the first quarter of 2025, the company's net profit for the full year 2024 saw a dramatic drop of 77.52%, falling to CNY 2,945.81 million from CNY 13,104 million in 2023. This steep decline, even with growing revenues, points to potential issues with operational efficiency or cost control measures that are impacting the company's bottom line.

Xiamen C&D Inc.'s extensive involvement in trading commodities such as metals, pulp, and agricultural products leaves it vulnerable to global price volatility. For instance, during Q1 2024, LME three-month copper prices saw fluctuations of over 10%, directly impacting the value of C&D's inventory and trading book.

While the company employs futures contracts to hedge against these movements, substantial and unexpected price drops can still erode profit margins and negatively affect revenue. This exposure is a critical consideration, as a significant downturn in commodity prices could impact the company's financial performance, as seen in potential inventory write-downs.

Xiamen C&D's substantial exposure to China's real estate sector presents a significant weakness. The company's profitability and asset valuations are directly tied to the health and regulatory landscape of this market. For instance, in 2023, the Chinese real estate sector experienced considerable headwinds, with property sales declining and developer defaults increasing, directly impacting companies with large real estate portfolios.

Any significant slowdown, policy tightening, or liquidity crunch in China's property market could disproportionately affect Xiamen C&D. This reliance makes the company vulnerable to market volatility and governmental interventions that could curtail development or impact sales, potentially leading to reduced earnings and asset devaluation.

Complexity of Managing a Diverse Conglomerate

Operating across a wide array of sectors, including intricate global supply chains, real estate, hospitality, and nascent industries, introduces substantial management hurdles for Xiamen C&D. This inherent diversity can escalate operational complexity, potentially foster inefficiencies, and complicate the maintenance of uniform performance benchmarks across its varied business units.

The broad scope of Xiamen C&D's operations can lead to a dilution of strategic focus and a strain on resource allocation, as management attempts to balance priorities across disparate market segments. For instance, while the company reported significant growth in its supply chain segment, maintaining that momentum alongside developments in its property and investment arms requires sophisticated oversight.

- Operational Complexity: Managing diverse operations from logistics to real estate requires specialized expertise in each area, increasing the potential for missteps.

- Efficiency Challenges: Inefficiencies can arise when best practices from one sector are not easily transferable to another, impacting overall profitability.

- Performance Dilution: The need to spread resources and attention thinly across many business lines can prevent any single segment from achieving its full potential.

- Resource Allocation Strain: Deciding where to invest capital and management talent becomes more challenging with a broad portfolio, potentially leading to suboptimal decisions.

Potential for Lower Profit Margins in Supply Chain Trading

While Xiamen C&D's supply chain operations boast impressive revenue, exceeding CNY 700 billion in 2024, the inherent nature of commodity trading and distribution often leads to thinner profit margins. This business model relies heavily on high turnover and meticulous risk management to achieve significant net income. Consequently, even minor supply chain disruptions can have a disproportionate effect on profitability, as evidenced by the 2024 net income performance.

Key considerations regarding these lower profit margins include:

- Thin Margins: Commodity trading is characterized by low per-unit profit, demanding substantial sales volume.

- Turnover Dependency: Profitability is directly tied to the speed and efficiency of inventory movement.

- Risk Sensitivity: Price volatility and logistical challenges can quickly erode already slim profit expectations.

- Operational Efficiency: Maintaining cost control across extensive supply chains is critical for margin preservation.

Xiamen C&D's significant reliance on the volatile commodity markets, including metals and agricultural products, exposes it to substantial price fluctuations. For example, during the first half of 2024, global nickel prices experienced swings of up to 15%, directly impacting the company's inventory valuation and trading profits.

Furthermore, the company's deep integration into China's real estate sector presents a considerable weakness, making it susceptible to downturns and regulatory changes within that market. The 2023 performance of the Chinese property market, marked by a 7% contraction in sales, highlights this vulnerability.

The company's broad diversification across multiple industries, from logistics to hospitality, creates operational complexity and potential inefficiencies. Managing such a wide array of businesses can dilute strategic focus and strain resource allocation, potentially hindering optimal performance across all segments.

| Weakness Category | Specific Concern | Impact Example (2024/2025 Data) |

| Market Volatility | Commodity Price Fluctuations | Q1 2024: Copper prices dropped 10%, affecting trading book value. |

| Sectoral Dependence | Real Estate Market Downturn | 2023: Chinese property sales declined 7%, impacting related assets. |

| Operational Complexity | Diversified Business Management | Broad portfolio can lead to inefficiencies and diluted strategic focus. |

| Profit Margin Sensitivity | Low Margins in Supply Chain | Despite CNY 700B+ revenue in supply chain (2024), thin margins are sensitive to disruptions. |

Preview Before You Purchase

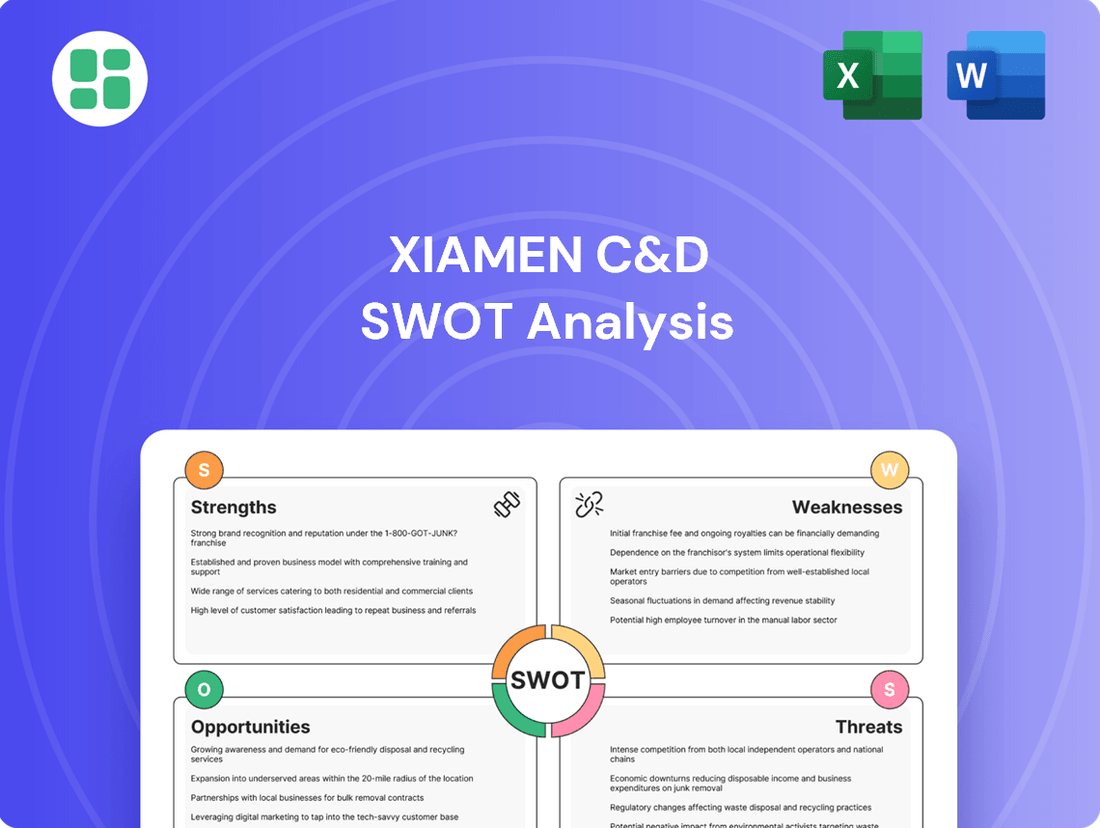

Xiamen C&D SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Xiamen C&D's strategic positioning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, providing actionable insights into Xiamen C&D's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Xiamen C&D's strategic focus on international expansion, particularly leveraging initiatives like the Belt and Road, is a prime opportunity. With over 50 overseas entities already in place, the company is well-positioned to further broaden its global supply chain network.

This expansion into new geographical markets allows Xiamen C&D to tap into a wider client base and diversify its revenue sources. Strengthening its global service system will solidify its role as a leading international supply chain operator, enhancing its competitive edge.

Xiamen C&D's strategic focus on new energy, including photovoltaics, lithium batteries, and energy storage, taps into sectors poised for significant expansion. For instance, the global energy storage market is projected to reach $277.1 billion by 2030, growing at a CAGR of 22.1% from 2023, according to Precedence Research, indicating substantial opportunity.

The company's investments in the semiconductor industry also align with a sector experiencing robust demand and technological advancements. The global semiconductor market, valued at $611.4 billion in 2023, is expected to grow to $1,024.3 billion by 2030, with a CAGR of 7.7%, as reported by Statista, presenting a strong avenue for diversification and future revenue streams.

Xiamen C&D's strategic embrace of digital transformation and AI presents a significant opportunity. By integrating AI-driven intelligent services, as seen in their pulp and paper operations, the company can unlock substantial efficiencies.

Further investment in advanced analytics and automation is poised to optimize supply chains and streamline decision-making processes. For instance, in 2024, companies leveraging AI in supply chain management reported an average reduction in operational costs by up to 15%, a benchmark Xiamen C&D can aim for.

This digital push also opens avenues for innovative service development, allowing Xiamen C&D to differentiate itself in competitive markets and potentially capture new revenue streams through data-driven solutions and enhanced customer experiences.

Strategic Acquisitions and Partnerships

Xiamen C&D's robust financial position and diverse business interests provide a strong foundation for strategic acquisitions and partnerships. This allows the company to actively seek out opportunities that can enhance its market presence, integrate cutting-edge technologies, or open doors to new industry sectors.

For instance, Xiamen C&D's successful acquisition of an increased stake in C&D Real Estate exemplifies its capacity to leverage its financial strength for growth. Such strategic moves are crucial for reinforcing its market leadership and building a more formidable competitive edge in the dynamic business landscape.

- Market Expansion: Acquisitions can quickly grant access to new geographic markets or customer segments.

- Technology Acquisition: Partnerships or buyouts can bring in valuable intellectual property and innovative technologies.

- Synergistic Growth: Integrating acquired businesses can create operational efficiencies and revenue synergies.

- Diversification: Strategic moves can further diversify Xiamen C&D's revenue streams and reduce reliance on any single market.

Increased Demand for Sustainable Supply Chain Solutions

The escalating global focus on Environmental, Social, and Governance (ESG) criteria is fueling a significant rise in the demand for sustainable and green supply chain solutions. Xiamen C&D's established dedication to green development, encompassing green materials, eco-friendly buildings, and circular economy principles, positions it advantageously to capture environmentally aware clientele and distinguish its offerings in the market.

This trend presents a clear opportunity for Xiamen C&D to leverage its existing sustainability initiatives. For instance, the company's reported progress in green building certifications, such as achieving LEED or similar standards for a portion of its portfolio, can be a powerful differentiator. The market for green logistics and supply chain management is expanding rapidly, with projections indicating substantial growth through 2025 and beyond, driven by regulatory pressures and corporate responsibility mandates.

- Growing ESG Investment: Global ESG investments are projected to exceed $50 trillion by 2025, indicating a strong client base seeking sustainable partners.

- Circular Economy Adoption: Companies are increasingly adopting circular economy models, creating demand for supply chain services that support resource efficiency and waste reduction.

- Regulatory Tailwinds: Stricter environmental regulations worldwide are pushing businesses to adopt greener supply chain practices, benefiting companies like Xiamen C&D that offer such solutions.

- Brand Differentiation: A strong commitment to sustainability can enhance Xiamen C&D's brand reputation, attracting clients who prioritize ethical and environmentally responsible partners.

Xiamen C&D's strategic expansion into new energy sectors, such as photovoltaics and lithium batteries, aligns with global growth trends. The new energy market is experiencing rapid expansion, with significant investment flowing into renewable energy solutions and battery technology. This presents a substantial opportunity for the company to capitalize on increasing demand for sustainable energy sources and storage solutions, further diversifying its portfolio.

The company's commitment to digital transformation, including the integration of AI and advanced analytics, offers a pathway to enhanced operational efficiency and innovation. By leveraging intelligent services, Xiamen C&D can optimize its supply chain, reduce costs, and improve decision-making processes. This digital focus is crucial for maintaining a competitive edge in an increasingly technology-driven global market.

Furthermore, Xiamen C&D's strong financial standing and diverse business operations provide a solid base for strategic acquisitions and partnerships. These moves can accelerate market penetration, facilitate technology acquisition, and unlock synergistic growth opportunities. By actively pursuing such strategic initiatives, the company can solidify its market leadership and expand into new, high-potential industries.

The growing global emphasis on ESG criteria presents a significant opportunity for Xiamen C&D to leverage its existing sustainability initiatives. By promoting green materials, eco-friendly buildings, and circular economy principles, the company can attract environmentally conscious clients and differentiate itself in the market. This focus on sustainability is increasingly becoming a key factor for businesses seeking responsible supply chain partners.

| Opportunity Area | Key Drivers | Xiamen C&D's Position |

|---|---|---|

| New Energy Markets | Global demand for renewables, battery technology growth | Strategic investments in photovoltaics, lithium batteries, energy storage |

| Digital Transformation & AI | Efficiency gains, data-driven decision making | AI integration in operations, advanced analytics adoption |

| Strategic Acquisitions & Partnerships | Market expansion, technology acquisition, synergistic growth | Strong financial position, diverse business interests |

| ESG & Green Supply Chains | Increasing ESG investment, regulatory push for sustainability | Commitment to green development, eco-friendly practices |

Threats

Global economic slowdowns, exemplified by the projected 2.7% global GDP growth in 2024 according to the IMF, create headwinds for Xiamen C&D. Increased trade protectionism and geopolitical tensions, such as ongoing trade disputes and regional conflicts, directly threaten its robust international trade and supply chain activities, potentially impacting revenue streams.

While Xiamen C&D demonstrated robust performance in Q1 2025, the broader Chinese real estate market presents significant threats. Concerns persist regarding potential oversupply, with national property sales volume experiencing fluctuations throughout 2024. Tightening regulations and ongoing debt challenges faced by other developers could also create ripple effects.

A prolonged downturn or unexpected policy shifts within China's real estate sector could directly impact Xiamen C&D's development and management operations. This could lead to reduced project pipelines and potentially strain the company's financial stability, especially given the sector's sensitivity to economic conditions.

Xiamen C&D faces significant competitive pressures across its diverse business lines. In its supply chain operations, it contends with established large-scale operators and a multitude of smaller, agile players. This crowded landscape can lead to price wars, impacting profitability.

The real estate sector is similarly crowded with numerous developers, both large and small, vying for market share. This intense competition in property development can suppress sales prices and increase marketing costs, requiring strategic differentiation and efficient execution to succeed.

Furthermore, emerging players in various industries where Xiamen C&D operates are constantly innovating and challenging established market dynamics. Staying ahead requires substantial ongoing investment in research and development, alongside a keen ability to adapt to evolving market demands and technological advancements to avoid losing ground.

Regulatory and Policy Changes in China

As a significant player in China's state-owned enterprise landscape, Xiamen C&D faces considerable exposure to evolving regulatory frameworks. Changes in real estate policies, trade regulations, or directives concerning state-owned enterprises could directly impact its operational scope and profitability. For instance, shifts in China's real estate market regulations, which saw significant adjustments in 2024 to stabilize the sector, could influence Xiamen C&D's property development and sales segments.

Furthermore, any tightening of environmental regulations or new compliance requirements, particularly in its trading and logistics operations, could lead to increased operational costs. The ongoing reforms within China's state-owned sector, aimed at improving efficiency and market responsiveness, might also introduce new governance structures or strategic directives that Xiamen C&D must adapt to.

- Policy Shifts: Unfavorable changes in China's real estate or trade policies could constrain Xiamen C&D's core businesses.

- Compliance Costs: New environmental or operational regulations may necessitate significant investment in compliance measures.

- SOE Reforms: Restructuring or new mandates for state-owned enterprises could alter Xiamen C&D's strategic direction and operational autonomy.

Disruption from New Technologies and Business Models

Xiamen C&D faces significant threats from rapidly evolving technologies and innovative business models. The logistics sector, a core area for the company, is being transformed by advancements like AI-powered route optimization and autonomous delivery systems. For instance, by late 2024, many global logistics firms are investing heavily in AI to improve efficiency, with some reporting cost reductions of up to 15% through better planning.

Furthermore, the integration of blockchain technology into supply chains presents a potential disruption. Blockchain offers enhanced transparency, traceability, and security, which could challenge traditional methods of managing complex supply networks. Companies that effectively leverage blockchain in 2025 might gain a competitive edge in trust and operational integrity.

New business models emerging in adjacent sectors like real estate and other growth industries could also pose a threat. These models might offer more agile, technology-driven solutions that bypass or outcompete established players. A failure by Xiamen C&D to adapt to these shifts or to innovate at a comparable pace could lead to a decline in its market standing and operational advantages.

- Technological Advancements: AI in logistics, blockchain for supply chain transparency.

- New Business Models: Disruptive approaches in real estate and emerging industries.

- Pace of Innovation: Risk of falling behind if adaptation and innovation are slow.

- Market Position Erosion: Potential loss of competitive advantage due to technological lag.

Intensified global competition, particularly from agile and technologically advanced players in its trading and logistics segments, presents a significant threat. The IMF's projection of a 2.7% global GDP growth for 2024 highlights a challenging economic environment where market share gains are hard-won.

The Chinese real estate market's ongoing volatility, with property sales volume experiencing fluctuations throughout 2024, poses a direct risk to Xiamen C&D's development arm. Additionally, the company must contend with the threat of new, disruptive business models emerging in its operational sectors, potentially eroding its competitive edge if it fails to adapt swiftly.

| Threat Category | Specific Threat | Potential Impact |

|---|---|---|

| Economic & Market | Global economic slowdown (IMF: 2.7% global GDP growth 2024) | Reduced demand for traded goods and real estate. |

| Market & Competition | Intense competition in real estate and logistics | Price wars, margin compression, loss of market share. |

| Regulatory & Policy | Unfavorable policy shifts in China (real estate, SOE reforms) | Operational constraints, reduced profitability, strategic uncertainty. |

| Technological | Rapid technological advancements (AI in logistics, blockchain) | Risk of obsolescence, need for significant investment in R&D. |

SWOT Analysis Data Sources

This SWOT analysis for Xiamen C&D is built upon a foundation of robust data, including their official financial reports, comprehensive market research on the supply chain and logistics sectors, and insights from industry experts and analysts.