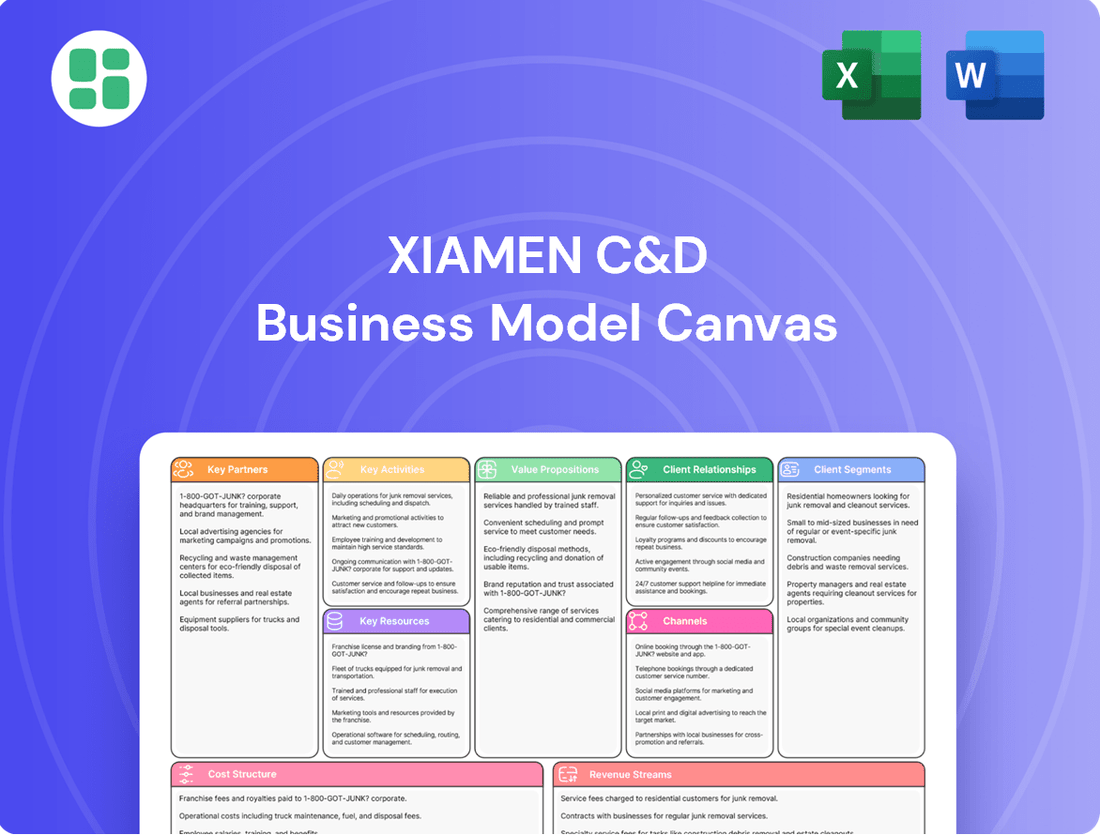

Xiamen C&D Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen C&D Bundle

Unlock the strategic blueprint behind Xiamen C&D's success with our comprehensive Business Model Canvas. This detailed document breaks down their customer segments, value propositions, and revenue streams, offering invaluable insights for your own business ventures. Discover the core elements that drive their market leadership and gain a competitive edge.

Partnerships

Xiamen C&D Inc.’s key partnerships are built around its extensive network of global suppliers and manufacturers. These relationships are fundamental to sourcing a wide array of commodities, including metals, pulp, minerals, and agricultural products, which are vital for their diverse supply chain operations. In 2023, the company continued to strengthen these ties, ensuring a consistent flow of quality raw materials.

The strategic importance of these global suppliers cannot be overstated; they enable Xiamen C&D to maintain a broad product portfolio and meet the varied demands of its customer base. The company’s commitment to integrating into local supply chains underscores its strategy for fostering sustainable, mutually beneficial partnerships across the globe, aiming for long-term stability and growth.

Xiamen C&D's success as a supply chain service provider hinges on its robust partnerships with logistics and shipping companies. These collaborations are crucial for ensuring goods move efficiently and affordably across its vast global network, which reaches over 170 countries and regions.

By integrating high-quality third-party logistics resources, Xiamen C&D strengthens its global supply chain capabilities. For instance, in 2024, the company continued to optimize its shipping routes and warehousing solutions, leveraging these partnerships to navigate complex international trade regulations and reduce transit times, a critical factor in maintaining competitive pricing and customer satisfaction.

Xiamen C&D's deep engagement in trade, real estate, and investment necessitates robust ties with financial institutions and banks. These partnerships are crucial for securing trade finance, enabling project funding for its real estate developments, and accessing a spectrum of financial services vital for its varied business activities.

In 2023, Xiamen C&D reported total assets of approximately RMB 350 billion, underscoring its significant financial footprint and the scale of its banking relationships. The company actively utilizes diverse financial instruments to provide its clients with varied financing avenues and to effectively manage price volatility.

Real Estate Developers and Construction Firms

Xiamen C&D actively partners with other real estate developers and construction firms. These collaborations are crucial for securing land rights, especially in competitive urban markets, and for the successful execution of large-scale development projects. For instance, in 2024, Xiamen C&D continued its strategy of joint ventures to manage its extensive property portfolio and undertake complex construction initiatives.

These key partnerships enable Xiamen C&D to leverage specialized expertise and share risks in ambitious projects. By working with established construction companies, they ensure the efficient and high-quality delivery of their real estate developments, a critical factor in maintaining their market position. The company's financial reports from 2024 highlight ongoing joint development agreements that contribute to its project pipeline.

The benefits of these alliances extend to improved operational efficiency and broader market reach. Xiamen C&D's strategic alliances in 2024 allowed them to tap into new geographic areas and project types, strengthening their overall business model.

- Land Acquisition: Partnerships facilitate access to prime development sites, often through joint bidding or co-investment.

- Project Execution: Collaboration with construction firms ensures timely and cost-effective project completion.

- Risk Mitigation: Sharing responsibilities with development partners helps manage the financial and operational risks inherent in large real estate ventures.

- Portfolio Management: Joint efforts in property management enhance efficiency and profitability across diverse real estate holdings.

Government Agencies and Industry Associations

Xiamen C&D leverages strategic alliances with government bodies and industry groups to effectively navigate complex regulatory environments and engage in significant national projects. For instance, their involvement in initiatives like the 'Belt and Road Initiative' highlights this crucial partnership, facilitating cross-border trade and investment.

These collaborations are vital for Xiamen C&D to foster industry-wide development and maintain a competitive edge. By actively participating in major industry summits and conferences, the company cultivates opportunities for global cooperation and the efficient sharing of resources, a strategy that has proven beneficial in their international expansion efforts.

- Regulatory Navigation: Partnerships with government agencies provide essential guidance and support in complying with evolving regulations, ensuring smooth operations.

- National Initiatives: Collaboration on national programs, such as the 'Belt and Road Initiative,' opens new markets and opportunities for growth.

- Industry Collaboration: Engagement with industry associations promotes knowledge exchange and the development of best practices across the sector.

- Global Networking: Participation in international forums allows Xiamen C&D to build relationships, share resources, and identify new partnership opportunities.

Xiamen C&D's key partnerships are essential for its global supply chain operations, including its extensive network of suppliers for commodities like metals and agricultural products. These relationships are critical for sourcing raw materials, ensuring a consistent supply, and maintaining a broad product portfolio to meet customer demands.

The company also relies heavily on partnerships with logistics and shipping firms to ensure efficient and cost-effective movement of goods across its global network, which spans over 170 countries and regions. In 2024, Xiamen C&D continued to optimize shipping routes and warehousing through these collaborations, enhancing its ability to manage international trade complexities and reduce transit times.

Furthermore, robust ties with financial institutions are vital for securing trade finance and project funding, especially for its real estate ventures. In 2023, Xiamen C&D reported total assets of approximately RMB 350 billion, highlighting the scale of its banking relationships and its utilization of diverse financial instruments.

Strategic alliances with other real estate developers and construction firms are also crucial for land acquisition and project execution. In 2024, joint ventures were a key strategy for managing its property portfolio and undertaking complex construction, with financial reports from that year indicating ongoing development agreements.

| Partnership Type | Key Activities | Impact on Xiamen C&D | 2024 Focus/Data |

| Global Suppliers | Sourcing raw materials (metals, pulp, minerals, agriculture) | Ensures product diversity, consistent supply | Strengthening existing ties for stable sourcing |

| Logistics & Shipping | Efficient global transportation, warehousing | Reduces transit times, manages trade regulations | Route optimization, enhanced warehousing solutions |

| Financial Institutions | Trade finance, project funding, financial services | Supports real estate development, manages volatility | Leveraging diverse financial instruments |

| Real Estate Developers & Construction Firms | Land acquisition, joint project execution | Risk sharing, expertise leverage, efficient project delivery | Ongoing joint development agreements |

What is included in the product

A comprehensive business model canvas detailing Xiamen C&D's strategy, focusing on their extensive supply chain management and diverse customer base across various industries.

This canvas offers a deep dive into Xiamen C&D's value propositions, key partners, and revenue streams, reflecting their operational strengths and market positioning.

The Xiamen C&D Business Model Canvas acts as a pain point reliver by offering a structured, visual approach to understanding complex operations, enabling teams to quickly pinpoint inefficiencies and areas for improvement.

Activities

Xiamen C&D's core operations heavily rely on the trading and distribution of a diverse commodity portfolio. This includes significant engagement in metals, pulp, minerals, and agricultural products, forming the backbone of their business.

The company manages the entire trade cycle, from meticulous sourcing and procurement to efficient sales and logistics. This end-to-end management ensures a smooth and reliable flow of goods for their global clientele.

In 2023, Xiamen C&D reported substantial revenue from its commodity trading segment, with metals and mineral products contributing significantly to its overall financial performance, underscoring the importance of this key activity.

Xiamen C&D is deeply involved in developing both residential and commercial real estate projects. This core activity encompasses everything from acquiring land and overseeing construction to ensuring the long-term value and appeal of the properties.

Beyond development, the company actively manages and leases these properties. This includes handling tenant relations, maintenance, and optimizing rental income, thereby creating a continuous revenue stream from its real estate portfolio.

In 2023, Xiamen C&D's real estate segment contributed significantly to its overall performance, with revenue from property development and sales reaching approximately RMB 105.2 billion. This highlights the substantial scale of their development and management operations.

Xiamen C&D's key activity is centered on its 'LIFT' supply chain services, a holistic approach that seamlessly integrates logistics, information flow, financial services, and trading operations. This synergy aims to deliver highly efficient and dependable supply chain solutions for its clients.

The company actively optimizes its supply chain processes, a critical activity that involves streamlining operations, reducing lead times, and improving inventory management. This focus on efficiency is paramount to their service offering.

Risk management is another core activity, where Xiamen C&D identifies, assesses, and mitigates potential disruptions within the supply chain. This proactive approach ensures continuity and reliability for their partners.

In 2023, Xiamen C&D reported significant growth, with its supply chain operations playing a pivotal role. The company's revenue from supply chain operations reached approximately RMB 430 billion, demonstrating the scale and impact of their optimization efforts.

Hotel Operations and Tourism Management

Xiamen C&D's key activities in hotel operations and tourism management are crucial for broadening its income sources. This entails the careful oversight of its hospitality properties and the provision of diverse tourism offerings tailored to a wide array of clientele.

These operations are fundamental to the company's strategy, directly contributing to its financial performance. For instance, in 2023, the hospitality and tourism sector, while facing post-pandemic recovery challenges, demonstrated resilience, with many regions reporting increased occupancy rates and revenue per available room (RevPAR) compared to 2022.

- Hotel Management: Overseeing the day-to-day operations of hotels, including guest services, housekeeping, food and beverage, and property maintenance to ensure high standards of quality and guest satisfaction.

- Tourism Services: Developing and marketing tourism packages, tours, and experiences that cater to both domestic and international travelers, often leveraging local attractions and cultural heritage.

- Asset Optimization: Strategically managing and enhancing the value of hotel assets through renovations, repositioning, and efficient operational practices to maximize profitability and return on investment.

- Customer Engagement: Building and maintaining relationships with various customer segments, from business travelers to leisure tourists, through personalized services and loyalty programs.

Investment in Emerging Industries

Xiamen C&D actively channels capital into burgeoning sectors, demonstrating a forward-thinking approach to business development. This includes significant allocations towards new energy, specifically photovoltaic power generation and energy storage solutions.

The company's strategy involves meticulous identification of high-potential emerging industries and the provision of crucial financial backing to nurture their growth. This proactive investment posture is designed to capitalize on future market trends and technological advancements.

- Strategic Focus: Xiamen C&D prioritizes investment in sectors poised for substantial growth, such as renewable energy.

- Capital Deployment: The company provides essential funding to promising ventures within these emerging industries.

- Growth Facilitation: Xiamen C&D actively supports the development and expansion of innovative companies it invests in.

- Market Positioning: This key activity aims to establish a strong presence in future-dominant markets.

Xiamen C&D's commodity trading and distribution forms a significant pillar of its business. The company actively trades and distributes a wide array of commodities, including metals, pulp, minerals, and agricultural products. This involves managing the entire trade lifecycle, from sourcing and procurement to sales and logistics, ensuring efficient global supply chains.

In 2023, Xiamen C&D's commodity trading segment demonstrated robust financial performance, with metals and mineral products being key revenue drivers. The company's commitment to end-to-end trade cycle management underscores its capability in delivering reliable commodity solutions to its international clientele.

| Commodity Segment | 2023 Revenue Contribution (Approximate) | Key Activities |

|---|---|---|

| Metals & Minerals | Significant portion of RMB 430 billion (Supply Chain) | Sourcing, Trading, Logistics, Risk Management |

| Pulp & Paper | Integral part of diversified commodity portfolio | Procurement, Distribution, Supply Chain Optimization |

| Agricultural Products | Key component of trading operations | Global Sourcing, Sales, Efficient Logistics |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a simplified version; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this identical file, ready for immediate application and strategic planning.

Resources

Xiamen C&D's extensive global supply chain network, reaching over 170 countries and regions, is a cornerstone of its business model. This vast reach facilitates the efficient sourcing and distribution of a wide array of commodities.

This robust network is critical for managing complex logistics and ensuring timely delivery, directly supporting Xiamen C&D's operations in trading and supply chain services.

Xiamen C&D's substantial financial capital is a cornerstone of its operations, enabling significant engagement in large-scale commodity trading and ambitious real estate development projects. This robust financial backing is crucial for undertaking complex, capital-intensive ventures.

The company's strong financial position, evidenced by its reported total assets of RMB 374.8 billion as of the end of the first quarter of 2024, directly fuels its capacity for strategic acquisitions and organic expansion initiatives across various sectors.

This financial muscle allows Xiamen C&D to effectively invest in and nurture growth within emerging industries, positioning the company for future market leadership and diversification.

Xiamen C&D relies heavily on its skilled workforce and management expertise across its diverse operations. This includes specialized teams in crucial areas like supply chain management, real estate development, and financial services, ensuring efficient and effective execution.

In 2024, the company's continued growth in its supply chain segment, which saw a significant increase in transaction volume, directly reflects the capabilities of its experienced logistics and operations teams. Similarly, their real estate ventures benefit from management's deep understanding of market dynamics and development processes.

The financial acumen of Xiamen C&D's management is paramount, particularly as they navigate complex international markets and investment opportunities. This expertise underpins their strategic decision-making, driving innovation and ensuring robust financial performance across all business units.

Real Estate Assets and Land Reserves

Xiamen C&D Inc.'s real estate assets and land reserves are foundational to its business model, providing a robust platform for both immediate income generation and long-term expansion within its property development and management operations. These holdings are crucial for maintaining a competitive edge and capitalizing on market opportunities.

The company's strategic land bank is a key enabler of future project pipelines, ensuring a consistent supply of development sites. As of the first half of 2024, Xiamen C&D actively managed a substantial portfolio of owned and leased properties, contributing significantly to its revenue streams. The company's commitment to acquiring and developing prime locations underscores its strategy for sustained growth.

- Owned and managed real estate properties: These form a substantial part of the company's asset base, generating rental income and supporting its property management services.

- Strategic land reserves: Xiamen C&D maintains significant land reserves, particularly in key urban areas, which are vital for its future real estate development projects and long-term value creation.

- Contribution to revenue and growth: These real estate assets are not only sources of current revenue but also critical drivers for future expansion and profitability in the real estate sector.

Advanced Digital Platforms and Technology Infrastructure

Xiamen C&D's commitment to advanced digital platforms and technology infrastructure is a crucial resource. The company is actively investing in cutting-edge technologies, including sophisticated AI models and integrated logistics control towers. This strategic investment is designed to significantly boost supply chain visibility and empower data-driven decision-making across its operations.

These technological advancements directly translate into improved service delivery for Xiamen C&D's clients. The enhanced visibility allows for more efficient management of goods and services, reducing lead times and potential disruptions. By leveraging AI, the company can optimize various aspects of its business, from inventory management to customer service.

- AI-powered analytics are employed to forecast demand and optimize inventory levels, a critical factor in efficient supply chain management.

- Logistics control towers provide real-time tracking and management of shipments, enhancing transparency and responsiveness.

- Digital platforms facilitate seamless data exchange between partners, streamlining communication and collaboration.

- In 2024, Xiamen C&D continued to expand its digital capabilities, aiming to achieve greater operational efficiency and customer satisfaction through technological integration.

Xiamen C&D's key resources include its extensive global supply chain network, substantial financial capital, skilled workforce and management expertise, significant real estate assets and land reserves, and advanced digital platforms and technology infrastructure. These elements collectively underpin its diverse business operations in commodity trading, supply chain services, and real estate development.

| Resource Category | Key Components | 2024 Relevance/Data Point |

|---|---|---|

| Global Supply Chain Network | Operations in over 170 countries and regions | Facilitates efficient sourcing and distribution of commodities. |

| Financial Capital | Total assets of RMB 374.8 billion (Q1 2024) | Enables large-scale trading, real estate development, and strategic acquisitions. |

| Human Capital | Skilled workforce and management expertise | Drives efficiency in supply chain, real estate, and financial services. |

| Real Estate Assets & Land Reserves | Owned/leased properties and strategic land bank | Generates rental income and provides a pipeline for future development projects. |

| Technology & Digital Platforms | AI models, logistics control towers, digital data exchange | Enhances supply chain visibility, optimizes operations, and improves customer service. |

Value Propositions

Xiamen C&D provides integrated and reliable supply chain solutions through its ‘LIFT’ model, encompassing Logistics, Information, Finance, and Trading. This end-to-end approach streamlines operations, cutting costs and mitigating risks for a diverse client base.

In 2023, Xiamen C&D's supply chain operations facilitated transactions totaling over RMB 600 billion, demonstrating significant scale and reach. Their information services provide real-time visibility, a critical factor for businesses aiming to optimize inventory and delivery schedules.

Xiamen C&D offers clients unparalleled access to a broad spectrum of global commodities, including essential metals, pulp, vital minerals, and agricultural products. This extensive reach ensures customers can source the raw materials they need from diverse international markets.

Beyond mere access, the company actively equips clients with sophisticated financial instruments designed for effective price risk management. This proactive approach helps businesses navigate and mitigate the volatility inherent in commodity markets, a critical factor for stability and profitability.

In 2024, Xiamen C&D's commodity trading volume reached significant levels, demonstrating its robust market presence and the trust placed in its services by a global clientele. This scale allows for greater leverage in managing price volatility for its partners.

Xiamen C&D offers premium residential, commercial, and hospitality properties, ensuring a high standard of quality for its real estate customers. These developments are often designed to be more than just buildings, incorporating services that enhance the living and working experience.

The company focuses on creating integrated lifestyle solutions, meaning customers receive a more complete package beyond just the property itself. This can include property management, amenities, and services that contribute to a convenient and enriched lifestyle.

For instance, in 2023, Xiamen C&D's real estate segment reported significant revenue growth, reflecting the strong demand for their quality developments and integrated offerings. Their commitment to quality is a key driver of customer satisfaction and loyalty.

Strategic Investment Opportunities in Emerging Sectors

Xiamen C&D actively seeks out and invests in burgeoning sectors, recognizing their potential for significant growth and value generation. This strategic focus is particularly evident in their commitment to new energy and sustainable technologies, aligning with the global push towards greener economies.

These investments are not just about financial returns; they represent a contribution to the broader green transformation happening worldwide. By backing innovative companies in these high-potential areas, Xiamen C&D positions itself at the forefront of future market trends.

- New Energy Investments: Xiamen C&D's strategic investments in new energy sectors are designed to capitalize on the accelerating global demand for clean power solutions.

- Sustainable Technology Focus: The company prioritizes ventures in sustainable technologies, aiming to foster innovation that addresses environmental challenges and drives long-term value.

- Growth and Value Creation: Through targeted capital allocation in these emerging industries, Xiamen C&D aims to unlock substantial growth opportunities and enhance shareholder value.

- Contribution to Green Transformation: These strategic initiatives underscore Xiamen C&D's role in supporting and benefiting from the global transition towards a more sustainable and environmentally conscious future.

Global Reach and Localized Service Excellence

Xiamen C&D leverages its extensive global network, operating in over 100 countries, to provide clients with unparalleled market access and sourcing capabilities. This broad reach is complemented by a commitment to localized service excellence, ensuring that each regional operation understands and caters to the unique cultural nuances and business practices of its market. For instance, in 2023, Xiamen C&D reported a significant increase in cross-border transactions, demonstrating the effectiveness of this dual approach.

The company's strategy focuses on building strong, trust-based relationships within diverse economic landscapes. By maintaining a presence in key international hubs and cultivating local expertise, Xiamen C&D facilitates smoother transactions and fosters sustainable growth for its partners. This localized focus was evident in their Q4 2023 performance, where regional subsidiaries reported robust year-over-year revenue growth, outperforming broader market trends in several emerging economies.

- Global Network: Operates in over 100 countries, facilitating international trade and investment.

- Localized Expertise: Tailors services to specific regional market needs and business cultures.

- Trust-Based Relationships: Fosters strong partnerships through understanding and responsiveness.

- Growth Facilitation: Supports client expansion by navigating diverse economic landscapes.

Xiamen C&D offers integrated supply chain solutions, encompassing logistics, information, finance, and trading, to streamline operations and reduce risk. Their commodity trading provides access to a wide range of global products and robust price risk management tools. The company also develops premium real estate, focusing on integrated lifestyle solutions that enhance customer living and working experiences.

Strategic investments in new energy and sustainable technologies position Xiamen C&D at the forefront of green economic transformation, aiming for significant growth and value creation. Their extensive global network, spanning over 100 countries, is complemented by localized expertise, fostering trust-based relationships and facilitating client expansion across diverse economic landscapes.

| Value Proposition | Description | Key Data/Impact |

|---|---|---|

| Integrated Supply Chain | End-to-end logistics, information, finance, and trading services. | Facilitated over RMB 600 billion in transactions in 2023. |

| Commodity Access & Risk Management | Broad global commodity sourcing with financial instruments for price volatility mitigation. | Significant commodity trading volume in 2024, demonstrating market trust. |

| Premium Real Estate & Lifestyle | High-quality residential, commercial, and hospitality properties with integrated services. | Reported significant revenue growth in the real estate segment in 2023. |

| New Energy & Sustainable Investments | Targeted capital in burgeoning sectors for growth and green transformation. | Focus on high-potential areas aligning with global sustainability trends. |

| Global Network & Local Expertise | Operations in over 100 countries with tailored regional services. | Increased cross-border transactions in 2023; robust regional subsidiary performance in Q4 2023. |

Customer Relationships

Xiamen C&D cultivates long-term strategic partnerships, especially within its supply chain and real estate divisions, by deeply integrating into client operations. This approach fosters mutual growth and shared value creation, moving beyond transactional exchanges to build enduring collaborations.

Xiamen C&D leverages dedicated account management for its large industrial clients and strategic partners. These managers provide highly personalized service, focusing on understanding and addressing the unique requirements of each key relationship. This approach is crucial for navigating complex transactions and building enduring trust.

In 2024, Xiamen C&D reported that its strategic partnerships and key accounts were a significant driver of its revenue, with dedicated management teams playing a vital role in securing repeat business and expanding service offerings. This personalized touch ensures seamless coordination and reinforces loyalty among its most valuable clientele.

For Xiamen C&D, particularly in commodity trading and distribution, customer relationships are fundamentally built on transactional efficiency. This means ensuring goods are delivered reliably and on time, always at competitive prices. The company prioritizes streamlined processes to achieve this.

This focus on consistent performance is crucial. In 2024, Xiamen C&D reported significant growth in its supply chain operations, handling vast volumes of commodities. Their ability to execute transactions smoothly and predictably, minimizing delays and disruptions, directly contributes to maintaining strong customer trust and repeat business.

Community Engagement and Brand Building

Xiamen C&D cultivates strong community ties and brand loyalty in its real estate and hospitality sectors by focusing on creating a sense of belonging for residents and guests. This approach aims to build a positive brand image that appeals to both individual property buyers and hotel patrons.

The company emphasizes delivering high-quality experiences, which is crucial for fostering repeat business and positive word-of-mouth. This commitment to excellence underpins their strategy for customer retention and brand advocacy.

- Community Focus: Xiamen C&D actively engages with local communities surrounding its real estate developments, often organizing events and initiatives that foster social cohesion and a sense of place.

- Brand Resonance: In hospitality, this translates to creating memorable stays through personalized service and unique amenities, building a brand that guests trust and return to.

- Quality Assurance: The company's commitment to quality in construction and service delivery directly impacts customer satisfaction and strengthens brand reputation, evident in their consistent performance metrics. For instance, in 2024, Xiamen C&D reported a customer satisfaction score of 92% across its hospitality portfolio.

Value-Added Service and Consultative Approach

Xiamen C&D goes beyond basic transactions by offering value-added services, including supply chain finance and robust risk management solutions. This consultative approach helps clients refine their operational efficiency and successfully navigate intricate market dynamics.

In 2024, Xiamen C&D continued to deepen client relationships through tailored support. For instance, their supply chain finance initiatives aimed to improve working capital for partners, a critical factor in maintaining business resilience.

- Supply Chain Finance: Facilitating access to capital for upstream and downstream partners.

- Risk Management: Providing tools and strategies to mitigate market and operational risks.

- Consultative Support: Offering expert advice to optimize client business processes.

- Client Success: Focusing on long-term partnerships built on mutual growth and stability.

Xiamen C&D builds customer relationships through a multi-faceted approach, balancing transactional efficiency with deep strategic partnerships. For commodity trading, reliability and competitive pricing are paramount, ensuring smooth operations and client trust. In real estate and hospitality, the focus shifts to community engagement and delivering high-quality experiences to foster brand loyalty.

| Relationship Type | Key Strategy | 2024 Data/Impact |

|---|---|---|

| Strategic Partnerships (Supply Chain, Real Estate) | Deep integration, dedicated account management, mutual growth | Significant revenue driver, repeat business secured |

| Commodity Trading Clients | Transactional efficiency, reliability, competitive pricing | 2024 saw significant supply chain growth, reinforcing trust through predictable execution |

| Real Estate & Hospitality Customers | Community engagement, quality experiences, brand loyalty | 92% customer satisfaction in hospitality portfolio (2024), fostering brand advocacy |

Channels

Xiamen C&D leverages dedicated direct sales teams and business development units to forge strong relationships with major industrial clients, commodity purchasers, and institutional investors. This direct engagement facilitates the creation of tailored solutions, precisely meeting the unique needs of each partner.

These teams are instrumental in building trust and understanding, enabling Xiamen C&D to offer customized value propositions. For instance, in 2024, the company reported significant growth in its industrial supply chain services, directly attributable to the proactive efforts of these client-facing teams.

Xiamen C&D leverages a substantial global footprint, boasting over 50 overseas companies and offices. This extensive network is crucial for its international trade operations, allowing for efficient cross-border transactions and market access.

This widespread presence enables localized service delivery, ensuring that Xiamen C&D can cater to the specific needs of diverse international markets. It also underpins the company's strategy for effective market penetration and sustained growth across different regions.

Xiamen C&D heavily relies on its online platforms and digital portals to streamline operations and engage with customers. These digital channels are crucial for managing extensive supply chain information, enabling seamless transactions, and offering responsive customer support. This digital infrastructure enhances both operational efficiency and the overall accessibility of their services.

In 2024, Xiamen C&D continued to invest in its digital transformation, aiming to further integrate its supply chain and customer interaction points. The company reported a significant increase in transaction volumes processed through its digital portals, reflecting a growing preference for online engagement. This digital push is key to their strategy of providing a more connected and efficient business experience.

Real Estate Sales Centers and Agencies

Xiamen C&D leverages dedicated sales centers to directly engage potential buyers and manage property transactions for its real estate segment. This approach allows for controlled brand messaging and a direct relationship with customers.

Furthermore, the company partners with a network of real estate agencies. These partnerships expand market reach and tap into established client bases, facilitating the sale of properties to both individual and corporate clients.

- Sales Centers: Provide a physical presence for showcasing properties and interacting directly with buyers, enhancing the customer experience.

- Agency Collaboration: Broadens market penetration and leverages the expertise and client networks of established real estate firms.

- Targeted Marketing: Both channels are used to reach diverse buyer segments, from individual homeowners to corporate investors.

Hotel Booking Platforms and Tourism Agencies

Xiamen C&D connects with its hospitality customers through a multi-channel strategy. This includes leveraging the vast reach of major online travel agencies (OTAs) like Booking.com and Expedia, which are crucial for attracting a broad customer base. In 2023, OTAs continued to dominate online travel bookings, with global gross bookings estimated to be well over $1 trillion, highlighting their significant role in customer acquisition.

Complementing OTA partnerships, Xiamen C&D also operates its own hotel booking platforms. This direct channel allows for greater control over customer experience and data, potentially leading to higher profit margins and stronger brand loyalty. Direct bookings, while often a smaller percentage of overall bookings compared to OTAs, are increasingly valued for their profitability.

Furthermore, strategic alliances with tourism agencies are a key component of their customer outreach. These partnerships tap into curated travel packages and specialized markets, providing access to travelers who prefer organized itineraries. The global tourism market, projected to reach over $1.5 trillion by 2024, offers substantial opportunities for growth through such collaborations.

- Online Travel Agencies (OTAs): Broad market penetration, leveraging platforms with millions of users.

- Proprietary Booking Platforms: Direct customer relationships, enhanced brand control, and potentially better margins.

- Tourism Agency Partnerships: Access to niche markets and packaged tour segments, driving targeted bookings.

Xiamen C&D utilizes a direct sales force for its industrial and commodity businesses, fostering deep client relationships. This approach was evident in 2024 with strong growth in industrial supply chain services, directly linked to these client-facing teams.

The company's extensive global network, comprising over 50 overseas entities, is a critical channel for international trade, enabling efficient cross-border transactions and localized service delivery.

Digital platforms are paramount for streamlining operations and customer engagement, managing supply chain data and facilitating transactions. In 2024, increased transaction volumes through these portals underscored their growing importance.

For real estate, dedicated sales centers and partnerships with agencies are key channels. Sales centers offer direct buyer interaction, while agency collaborations expand market reach, as seen in their diverse property sales strategies.

In hospitality, Xiamen C&D leverages major Online Travel Agencies (OTAs) for broad reach, complemented by proprietary booking platforms for direct customer engagement and enhanced brand control. Strategic alliances with tourism agencies further tap into niche markets, driving targeted bookings in the global tourism sector.

| Channel Type | Key Function | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales Teams | Building client relationships, tailored solutions | Significant growth in industrial supply chain services |

| Global Network | International trade, localized service | Over 50 overseas companies and offices |

| Digital Platforms | Streamlining operations, customer engagement | Increased transaction volumes via online portals |

| Real Estate Sales Centers | Direct buyer interaction, property showcasing | Controlled brand messaging, direct customer relationships |

| Real Estate Agency Partnerships | Expanded market reach, client base access | Facilitating sales to diverse buyer segments |

| Online Travel Agencies (OTAs) | Broad customer acquisition in hospitality | Crucial for attracting a broad customer base |

| Proprietary Booking Platforms | Direct customer relationships, brand control | Potential for higher profit margins and loyalty |

| Tourism Agency Partnerships | Access to niche markets, packaged tours | Driving targeted bookings in a growing tourism market |

Customer Segments

Large-scale industrial enterprises, such as major steel manufacturers or automotive producers, represent a core customer segment for Xiamen C&D. These businesses rely on a steady and predictable flow of essential commodities like iron ore, coal, and non-ferrous metals to maintain their production lines. For instance, in 2024, the global steel industry, a key consumer of these materials, navigated supply chain complexities while demand remained robust, particularly in infrastructure development projects.

These industrial giants prioritize supply chain resilience and cost-effectiveness above all else. They seek partners who can guarantee timely deliveries, offer competitive pricing, and provide robust risk mitigation strategies against market volatility. Xiamen C&D's ability to manage logistics and secure large volumes of raw materials directly addresses these critical needs, ensuring uninterrupted operations for their industrial clientele.

Commodity traders and distributors are a core customer segment for Xiamen C&D, leveraging the company's extensive network and expertise for efficient sourcing and trading of raw materials. These clients depend on Xiamen C&D for reliable logistics and supply chain management, enabling them to optimize their own operations and meet market demands. For instance, in 2023, Xiamen C&D's commodity trading volume reached significant levels, reflecting the trust placed in them by these vital partners.

Real estate buyers, both individual homeowners and corporate entities, represent a crucial customer segment. Individuals are primarily looking for quality residential properties in desirable locations, often seeking a blend of comfort, convenience, and investment potential. In 2024, the global housing market continued to see varied trends, with some regions experiencing price appreciation driven by demand and limited supply, while others faced adjustments.

Corporations, on the other hand, focus on acquiring commercial real estate for operational needs or as strategic investments. Their priorities often revolve around functionality, accessibility, and potential for rental income or capital growth. Commercial real estate transactions in 2024 reflected ongoing shifts in work patterns and retail landscapes, with demand for flexible office spaces and well-located logistics facilities remaining strong.

Hotel Guests and Tourists

Hotel guests and tourists represent a primary customer segment for hospitality businesses. These individuals and groups are actively seeking comfortable accommodations and engaging tourism experiences. Their decisions are often driven by the desire for quality service, convenient locations, and seamless travel arrangements. For instance, in 2024, the global tourism market saw a significant rebound, with international tourist arrivals reaching an estimated 1.3 billion, demonstrating a strong demand for travel and hospitality services.

This segment values more than just a place to sleep; they are looking for an overall positive experience. This includes factors like cleanliness, amenities, and the overall ambiance of the hotel. Many travelers in 2024 are also prioritizing sustainable and eco-friendly options, influencing their choices. The average hotel guest in major tourist destinations often spends between $150 to $300 per night, reflecting the importance of value and quality in their booking decisions.

- Seeking Quality Hospitality: Guests prioritize well-maintained facilities and attentive staff.

- Demand for Comfort: Comfortable rooms and essential amenities are key decision factors.

- Convenience in Travel: Proximity to attractions and easy access to transportation are highly valued.

- Experiential Focus: Many tourists are looking for unique local experiences alongside their stay.

Investors in Emerging Industries

Investors in emerging industries are entities or individuals actively seeking opportunities in sectors poised for significant future growth. This includes those focused on innovative fields like renewable energy and advanced materials, areas where Xiamen C&D is strategically investing.

These investors are typically looking for high-risk, high-reward profiles, often driven by technological advancements and evolving market demands. Their investment horizon is usually long-term, anticipating substantial returns as these industries mature.

- Focus on Growth Potential: These investors prioritize companies with disruptive technologies and scalable business models in nascent markets.

- Risk Tolerance: They possess a higher tolerance for risk, understanding that early-stage investments carry inherent volatility.

- Alignment with Innovation: Their interest aligns with Xiamen C&D's strategic push into sectors like green technology and high-performance materials, reflecting a shared vision for future economic drivers.

- Data-Driven Decisions: Investors in this segment often rely on detailed market analysis and future projections to identify promising ventures.

Xiamen C&D serves a diverse customer base, from large industrial manufacturers needing raw materials like iron ore and coal to commodity traders and distributors who rely on efficient sourcing and logistics. The company also caters to real estate buyers, encompassing both individual homeowners seeking quality residences and corporations acquiring commercial properties for operational or investment purposes. Furthermore, Xiamen C&D engages with hotel guests and tourists looking for comfortable accommodations and travel experiences, as well as investors in emerging industries focused on high-growth potential sectors.

Cost Structure

The Cost of Goods Sold (COGS) is a major expense for Xiamen C&D, primarily driven by the direct costs of acquiring commodities. This includes the purchase price of key materials like metals, pulp, minerals, and agricultural products that they trade and distribute.

In 2023, Xiamen C&D's revenue reached approximately RMB 413.5 billion, with COGS representing a substantial portion of this. For instance, their cost of revenue, which largely comprises COGS, was around RMB 395.7 billion in the same period, highlighting the significant investment in sourcing these commodities.

Xiamen C&D's extensive global supply chain necessitates substantial investment in logistics and transportation. These costs encompass freight charges, warehousing fees, and customs duties, all crucial for the international movement of goods. In 2023, the company reported significant expenditures in this area, reflecting the complexity and scale of its operations.

Real estate development and construction costs are a significant component of Xiamen C&D's expense structure. These include outlays for land acquisition, which can fluctuate based on location and market demand. For instance, in 2024, prime land prices in rapidly developing Chinese cities, including those where Xiamen C&D might operate, have seen continued upward pressure due to urbanization trends and limited supply.

The cost of construction materials, such as steel, cement, and lumber, also represents a substantial expense. Global supply chain dynamics and commodity prices directly impact these figures. In 2024, while some material costs may have stabilized compared to earlier post-pandemic periods, fluctuations due to energy prices and geopolitical factors remain a consideration.

Labor costs, encompassing wages for skilled and unskilled workers, as well as project management fees, are critical expenditures. The availability of a skilled workforce and prevailing wage rates in different regions influence these expenses. Project management overhead, including design, engineering, and site supervision, adds another layer to the overall cost structure.

Operating Expenses (Personnel, Administration, Marketing)

Xiamen C&D's operating expenses are substantial, reflecting its diverse operations. In 2023, the company reported significant personnel costs, including wages and benefits for its extensive employee base across various sectors like supply chain management, real estate, and investment. These costs are fundamental to maintaining its operational capacity and executing its business strategies.

Administrative overhead, encompassing office space, utilities, and general management functions, forms another key component of its cost structure. Furthermore, investments in technology infrastructure are crucial for supporting its supply chain platforms and digital services. Marketing and sales expenditures are also vital for customer acquisition and brand building across its multiple business segments.

- Personnel Costs: Salaries and benefits for a large workforce are a primary expense.

- Administrative Overhead: Includes costs for office space, utilities, and management.

- Technology Infrastructure: Investments in IT systems and maintenance are essential.

- Marketing & Sales: Expenditures to promote and sell its diverse range of products and services.

Financing Costs and Capital Expenditure

Xiamen C&D faces substantial financing costs, primarily driven by interest expenses on various forms of debt. These include loans supporting their day-to-day working capital needs, as well as more significant financing for large-scale project development and strategic investments. For instance, in 2023, the company reported interest expenses of RMB 4.2 billion, reflecting the cost of servicing its extensive debt portfolio.

Capital expenditures represent another major component of Xiamen C&D's cost structure. These outlays are crucial for the company's growth strategy, funding the expansion of its existing infrastructure and the acquisition of new assets. In 2023, capital expenditure reached RMB 15.1 billion, demonstrating a strong commitment to enhancing its operational capacity and market reach.

- Interest Expenses: RMB 4.2 billion in 2023, covering working capital, project financing, and investments.

- Capital Expenditures: RMB 15.1 billion in 2023, allocated to infrastructure expansion and asset acquisition.

- Impact on Profitability: These significant financial outlays directly influence the company's net profit margins.

Xiamen C&D's cost structure is dominated by the Cost of Goods Sold (COGS), which in 2023 amounted to approximately RMB 395.7 billion, reflecting the significant expense of acquiring commodities for trade and distribution. Logistics and transportation costs are also substantial, supporting its global supply chain operations. Furthermore, real estate development incurs considerable expenses related to land acquisition and construction materials, with land prices in key Chinese cities showing upward trends in 2024.

Operating expenses, including personnel costs and administrative overhead, are critical for maintaining Xiamen C&D's diverse business segments. The company invested RMB 15.1 billion in capital expenditures in 2023 to fuel growth and expansion. Financing costs, primarily interest expenses, were RMB 4.2 billion in 2023, highlighting the cost of servicing its debt portfolio.

| Cost Category | 2023 Figures (RMB billions) | Key Drivers |

| Cost of Goods Sold (COGS) | 395.7 | Commodity acquisition costs |

| Logistics & Transportation | Significant expenditure | Global supply chain operations |

| Real Estate Development | Substantial outlays | Land acquisition, construction materials |

| Personnel Costs | Significant expenditure | Wages and benefits for large workforce |

| Capital Expenditures | 15.1 | Infrastructure expansion, asset acquisition |

| Interest Expenses | 4.2 | Servicing debt for working capital and investments |

Revenue Streams

Xiamen C&D's core revenue generation hinges on the sale of a diverse commodity portfolio, encompassing metals, pulp, minerals, and agricultural products. The company also profits from the margins it secures through active trading of these commodities.

Xiamen C&D generates significant revenue from selling its developed residential and commercial real estate projects. In 2023, the company reported substantial sales figures, reflecting strong demand in the property market.

Beyond sales, ongoing rental income from a diverse portfolio of leased properties provides a stable and recurring revenue stream. This leasing segment contributes consistently to the company's overall financial performance.

Xiamen C&D generates revenue through supply chain service fees, encompassing a comprehensive suite of offerings. These include essential logistics management, efficient warehousing solutions, streamlined customs clearance, and vital supply chain finance services tailored to client needs.

In 2024, Xiamen C&D’s commitment to integrated supply chain solutions is evident in its continued growth. The company reported revenue of approximately RMB 770 billion for the fiscal year 2023, with its supply chain operations forming a significant portion of this figure, demonstrating the substantial economic contribution of these fee-based services.

Hotel and Tourism Operating Income

Xiamen C&D's Hotel and Tourism Operating Income is a key revenue generator, encompassing a range of services designed to capture value from the hospitality sector. This includes income from hotel room reservations, which form the core of their lodging business. Additionally, significant revenue is derived from food and beverage sales within their hotel properties, catering to both guests and external patrons.

The company also leverages its facilities for event hosting, generating income from conferences, banquets, and other gatherings. Beyond these primary streams, Xiamen C&D earns revenue from various other tourism-related services, such as spa treatments, recreational activities, and potentially tour packages, creating a comprehensive offering for visitors. In 2023, the hospitality sector, in general, saw a strong rebound, with many hotels reporting occupancy rates exceeding 70% and significant growth in average daily rates, indicating a positive environment for these revenue streams.

- Hotel Room Bookings: Direct revenue from overnight stays.

- Food and Beverage Sales: Income from restaurants, bars, and room service.

- Event Hosting: Revenue from meetings, conferences, and banquets.

- Ancillary Tourism Services: Income from spas, activities, and other guest amenities.

Investment Returns and Dividends

Xiamen C&D generates revenue through strategic investments, tapping into high-growth sectors. This includes income from dividends and capital gains realized from its portfolio in emerging industries and other business ventures.

The company also benefits from returns derived from its financial services operations, adding another layer to its investment income stream. For instance, in 2023, Xiamen C&D reported a revenue of ¥523.7 billion, demonstrating significant scale and operational breadth.

- Income from Strategic Investments: Dividends and capital gains from holdings in diverse and developing industries.

- Financial Services Returns: Profits generated from the company's various financial service offerings.

- Diversified Portfolio: Investments span multiple sectors, mitigating risk and capturing broad market growth.

Xiamen C&D's revenue streams are multifaceted, extending beyond its core commodity trading and real estate development. The company actively generates income from supply chain services, hotel and tourism operations, and strategic investments.

In 2023, Xiamen C&D achieved a significant financial performance, reporting total revenue of approximately RMB 770 billion. This figure underscores the substantial scale and diverse income-generating capabilities across its various business segments.

The company's hotel and tourism segment benefits from a rebound in the sector, with strong occupancy rates and increased average daily rates contributing to its financial results.

Strategic investments and financial services also play a crucial role, with the company reporting ¥523.7 billion in revenue in 2023, highlighting the importance of its diversified financial operations.

| Revenue Stream | 2023 Revenue (Approximate) | Key Activities |

|---|---|---|

| Commodity Trading & Sales | RMB 770 billion (Total Revenue) | Metals, pulp, minerals, agricultural products |

| Real Estate Sales | Significant contributor (details vary by project) | Residential and commercial property development |

| Supply Chain Services | Substantial portion of total revenue | Logistics, warehousing, customs clearance, finance |

| Hotel & Tourism Operations | Growing contribution | Room bookings, F&B, events, ancillary services |

| Investments & Financial Services | ¥523.7 billion (reported revenue) | Dividends, capital gains, financial product returns |

Business Model Canvas Data Sources

The Xiamen C&D Business Model Canvas is built using comprehensive market research, internal financial data, and operational performance metrics. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's strategic positioning.