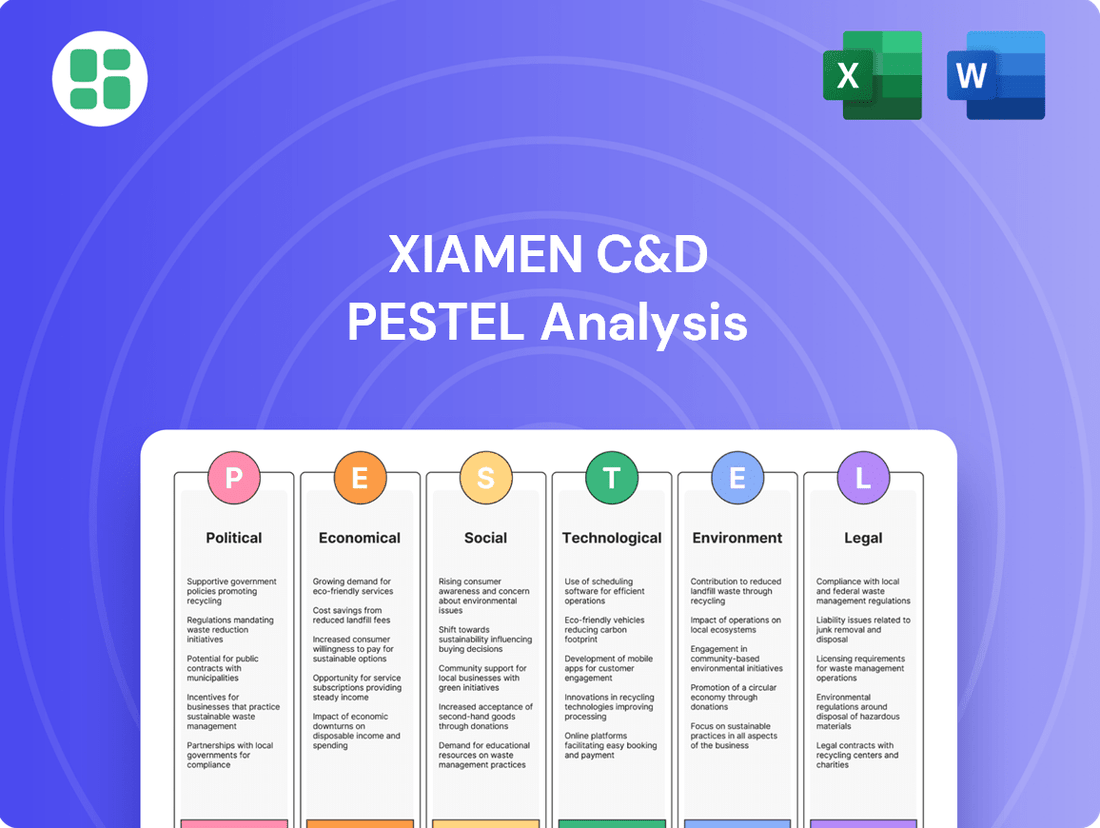

Xiamen C&D PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen C&D Bundle

Unlock the strategic landscape surrounding Xiamen C&D with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operational environment and future trajectory. Equip yourself with the knowledge to anticipate market shifts and capitalize on emerging opportunities. Purchase the full analysis now for actionable intelligence that drives informed decision-making.

Political factors

The Chinese government is actively working to stabilize its vast real estate sector, a key area for Xiamen C&D. Recent policy shifts in 2024 include adjustments to lending conditions for developers and measures to encourage home buying, aiming to prevent systemic risks and ensure project completion.

These government interventions, such as reducing mortgage rates and relaxing purchase limits in various cities, are designed to boost buyer confidence and liquidity for developers. For instance, by late 2024, several major cities had seen a noticeable uptick in property transactions following targeted easing measures.

China's foreign trade laws are increasingly complex, with new export control regimes significantly affecting Xiamen C&D's global operations. For instance, the 2023 export control law broadened the scope of regulated items, impacting the company's ability to move certain goods internationally.

The introduction of stricter controls on dual-use items and an anti-sanction regime by the Chinese government directly challenges companies like Xiamen C&D, which rely on international trade. Compliance with these evolving policies is paramount for maintaining supply chain integrity and avoiding penalties, which could affect their reported revenue streams.

The Chinese government's strong push for digital supply chains, outlined in national action plans, directly impacts companies like Xiamen C&D. These plans champion the integration of advanced technologies such as AI, IoT, and blockchain to boost efficiency and build more robust supply networks.

In 2024, China's Ministry of Industry and Information Technology continued to emphasize smart manufacturing and digital transformation, with supply chain digitization a key component. This strategic alignment offers Xiamen C&D significant opportunities to leverage government support and incentives for adopting these advanced technologies, enhancing its service offerings.

Corporate Governance Reforms

Significant revisions to China's Company Law, effective July 2024, are enhancing corporate governance standards. These updates increase director and management accountability and strengthen shareholder rights, impacting companies like Xiamen C&D. The reforms necessitate adaptation in internal governance structures and disclosure practices to meet new compliance requirements and foster greater transparency.

Xiamen C&D, like other listed entities in China, must now navigate these updated legal frameworks. This includes potentially overhauling board structures, enhancing risk management protocols, and improving the quality and timeliness of financial reporting to align with the heightened expectations for corporate accountability and shareholder protection.

- Enhanced Director Liability: New provisions hold directors more directly accountable for corporate decisions and disclosures.

- Strengthened Shareholder Rights: Shareholders gain more avenues for redress and participation in key corporate decisions.

- Increased Transparency Demands: Companies face stricter requirements for public disclosure of financial and operational information.

National Economic Growth Targets

China's commitment to robust economic growth, evidenced by its 2024 GDP target of around 5%, directly impacts Xiamen C&D's operating environment. This ambitious target signals continued government focus on economic expansion, even amidst global uncertainties.

Policy support, including potential targeted stimulus measures aimed at boosting domestic consumption and stabilizing key industries like real estate and manufacturing, can create a more favorable landscape for Xiamen C&D's diverse business segments, from supply chain management to real estate development.

- China's 2024 GDP growth target: Approximately 5%.

- Government focus: Prioritizing economic stability and growth through policy interventions.

- Impact on Xiamen C&D: Potential for increased demand and supportive market conditions across its business lines.

- Key sectors benefiting: Real estate, manufacturing, and consumption-driven industries.

Government initiatives to stabilize China's real estate market, including adjusted lending conditions and measures to boost home buying, are crucial for Xiamen C&D. These policies aim to prevent systemic risks and ensure project completion, with some cities seeing increased property transactions by late 2024 due to easing measures.

Evolving foreign trade laws, such as China's 2023 export control law, present challenges for Xiamen C&D's international operations by broadening the scope of regulated items and introducing anti-sanction regimes.

The government's push for digital supply chains, emphasizing AI, IoT, and blockchain, offers Xiamen C&D opportunities for technological adoption and efficiency gains, supported by national plans and ministry guidance in 2024.

Revisions to China's Company Law, effective July 2024, enhance corporate governance by increasing director liability and shareholder rights, requiring Xiamen C&D to adapt its internal structures and disclosure practices for greater transparency and compliance.

| Policy Area | Key Development | Impact on Xiamen C&D | Year/Timing |

|---|---|---|---|

| Real Estate Stabilization | Adjusted lending, home buying incentives | Potential for increased demand and project viability | 2024 |

| Trade Regulations | Export controls, anti-sanction regimes | Compliance challenges for international trade | Effective 2023 onwards |

| Digital Supply Chains | Emphasis on AI, IoT, blockchain integration | Opportunities for efficiency and technological advancement | Ongoing, reinforced 2024 |

| Corporate Governance | Company Law revisions (director liability, shareholder rights) | Need for enhanced internal governance and transparency | Effective July 2024 |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Xiamen C&D across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within Xiamen C&D's operating landscape.

Provides a clear, actionable overview of external factors impacting Xiamen C&D, simplifying complex market dynamics for strategic decision-making.

Economic factors

China's real estate sector has faced a prolonged downturn, with property values declining and significant oversupply issues. This directly impacts Xiamen C&D's real estate development and management operations, presenting considerable challenges.

While government efforts are underway to stabilize the market, with projections suggesting a potential turnaround by late 2025, pricing pressures are anticipated to persist in the immediate future. This necessitates a cautious approach to investment for Xiamen C&D.

For instance, in early 2024, major Chinese developers faced significant debt defaults, highlighting the systemic risks within the sector. Xiamen C&D must therefore carefully manage its exposure and explore strategies to mitigate the impact of this ongoing market volatility.

Xiamen C&D's significant exposure to commodity trading, including metals, pulp, and minerals, makes it inherently vulnerable to global price volatility. For instance, the price of LME primary copper, a key commodity, saw fluctuations throughout 2024, influenced by global economic outlooks and supply-side issues, directly impacting Xiamen C&D's trading revenues.

Geopolitical tensions and ongoing supply chain disruptions, such as those seen in global shipping in early 2025, can exacerbate these price swings. This volatility directly affects Xiamen C&D's profit margins and the valuation of its substantial commodity inventory, requiring nimble risk management strategies.

Consumer confidence in China has shown signs of weakness, impacting spending habits. Factors such as a decline in household wealth and concerns about future income are contributing to this cautious approach. This directly affects demand for goods and services, including real estate, which are key areas for Xiamen C&D.

While there's an expectation of a gradual reflationary trend in the economy, ongoing consumer pessimism remains a significant headwind. This sentiment could slow down the anticipated market recovery. For instance, retail sales growth in China, while showing some improvement, has not yet fully rebounded to pre-pandemic levels, reflecting this cautious consumer behavior.

Tourism Sector Rebound

China's tourism sector is demonstrating a robust rebound, directly benefiting Xiamen C&D's operations in hospitality and related services. Domestic tourism saw a significant surge, with data indicating a 47.3% year-on-year increase in domestic trips during the first quarter of 2024, reaching 1.27 billion. This recovery is fueled by factors such as eased travel restrictions and a growing appetite for domestic exploration.

International travel is also on an upward trajectory. In the first quarter of 2024, China received 31.2 million inbound international tourists, a substantial increase from the previous year. This growth is further supported by relaxed visa policies, enhanced transportation networks, and a notable consumer shift towards more curated and personalized travel experiences.

- Domestic Tourism Growth: 1.27 billion trips in Q1 2024, up 47.3% year-on-year.

- International Arrivals: 31.2 million inbound tourists in Q1 2024.

- Driving Factors: Relaxed visa policies, improved connectivity, and personalized travel trends.

Interest Rate and Inflation Trends

China's central bank has been implementing monetary easing, aiming to boost consumer prices and influence interest rate trajectories. This policy directly affects Xiamen C&D's borrowing expenses for its extensive real estate developments and the margins on its trading activities.

The prevailing interest rate environment, influenced by these easing measures, will shape the attractiveness of investments in emerging sectors where Xiamen C&D is expanding. For instance, as of early 2024, China's benchmark lending rates have seen adjustments, impacting the cost of capital for large-scale projects.

- Monetary Easing: Continued efforts by the People's Bank of China to manage liquidity and stimulate economic growth.

- Inflationary Pressures: Monitoring the Consumer Price Index (CPI) and Producer Price Index (PPI) for signs of sustained inflation or deflation.

- Financing Costs: The direct impact of interest rate changes on Xiamen C&D's debt servicing for real estate and other capital-intensive ventures.

- Investment Climate: How interest rate and inflation trends influence investor confidence and the overall economic outlook for Xiamen C&D's diverse business segments.

China's economic landscape presents a mixed bag for Xiamen C&D. The property sector's ongoing slump, marked by declining values and oversupply, directly challenges its real estate ventures, with pricing pressures expected to persist despite stabilization efforts anticipated by late 2025. Simultaneously, the company's significant commodity trading operations are susceptible to global price volatility, influenced by economic outlooks and supply chain disruptions, as seen with copper prices in 2024.

Consumer confidence remains subdued, impacting spending and demand for Xiamen C&D’s offerings, though a gradual economic reflation is anticipated. Conversely, the tourism sector is experiencing a strong rebound, with domestic travel surging 47.3% year-on-year in Q1 2024 and international arrivals reaching 31.2 million in the same period, benefiting hospitality segments.

| Economic Factor | Impact on Xiamen C&D | Data/Trend (2024-2025) |

|---|---|---|

| Real Estate Sector | Challenges development and management operations; persistent pricing pressure. | Prolonged downturn; potential stabilization late 2025. Developers faced debt defaults in early 2024. |

| Commodity Trading | Vulnerable to global price volatility, impacting revenues and inventory valuation. | LME primary copper prices fluctuated in 2024 due to global economic outlook and supply. Shipping disruptions in early 2025 exacerbated swings. |

| Consumer Confidence | Weakens demand for goods and services, including real estate. | Concerns over household wealth and income lead to cautious spending. Retail sales growth not fully rebounded. |

| Tourism Sector | Benefits hospitality and related services. | Domestic trips: 1.27 billion in Q1 2024 (+47.3% YoY). International arrivals: 31.2 million in Q1 2024. |

| Monetary Policy | Affects borrowing costs and trading margins; influences investment attractiveness. | PBOC's monetary easing impacts interest rates. Benchmark lending rates adjusted in early 2024. |

Full Version Awaits

Xiamen C&D PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Xiamen C&D PESTLE Analysis details all the critical political, economic, social, technological, legal, and environmental factors impacting the company. You can trust that the insights and structure you see are precisely what you'll be working with.

Sociological factors

China's urbanization is evolving, moving beyond sheer growth to emphasize the quality and efficiency of its existing urban centers. By 2024, the urbanization rate reached 67%, indicating a maturing urban landscape. This transition means Xiamen C&D must adjust its real estate focus towards developing higher-quality, more sustainable urban living spaces that cater to evolving resident expectations.

Chinese consumers are increasingly prioritizing personalized and experience-driven travel, a significant departure from traditional sightseeing. This shift impacts sectors like tourism and hospitality, influencing demand for unique cultural immersion and bespoke itineraries.

A notable trend is the growing preference for green and low-carbon consumption, with consumers actively seeking sustainable products and services. This aligns with China's national environmental goals and presents opportunities for businesses focusing on eco-friendly offerings.

Furthermore, there's a discernible shift towards supporting domestic brands, often referred to as "guochao" or national trend. This preference influences purchasing decisions across various sectors, encouraging Xiamen C&D to adapt its product sourcing and marketing strategies to resonate with this nationalistic sentiment.

China's aging population is a significant demographic shift, with projections indicating that by 2035, over 30% of the population will be 60 or older. This trend directly influences Xiamen C&D's market by increasing demand for healthcare services, retirement living, and products catering to older consumers. Simultaneously, the growing economic power of millennials and Gen Z, born in the 1980s and 1990s, is driving demand for experiences, technology, and sustainable goods. For instance, in 2024, e-commerce sales in China, heavily influenced by younger demographics, are expected to continue their robust growth, presenting opportunities for Xiamen C&D to adapt its retail and distribution strategies.

Impact of Social Media on Consumption

Social media platforms are profoundly reshaping consumer behavior, with platforms like WeChat, Douyin, and Xiaohongshu acting as significant drivers for purchasing decisions. In 2024, these platforms are not just for social interaction but are crucial channels for discovery and transaction, particularly evident in the travel industry where user-generated content and influencer marketing heavily influence booking choices. Xiamen C&D's tourism and retail segments need to actively integrate these digital spaces to connect with a growing demographic that relies on social proof and online recommendations.

The influence of social media on consumption is undeniable, with a significant portion of consumers, especially younger demographics, actively seeking product and service information through these channels. For instance, in 2024, e-commerce sales directly attributed to social media marketing are projected to continue their upward trajectory, demonstrating the direct revenue potential. Xiamen C&D's businesses must therefore prioritize robust social media strategies, focusing on authentic engagement and seamless integration of sales functionalities to capture this digitally-native market.

- WeChat's dominance: Over 1.3 billion monthly active users in 2024 make it a vital platform for direct customer engagement and sales within China.

- Douyin's influence: Short-form video content on Douyin is increasingly converting viewers into buyers, especially for travel experiences and lifestyle products.

- Xiaohongshu's role: This platform acts as a powerful discovery engine for niche travel destinations and retail goods, driven by user reviews and lifestyle content.

- Revenue linkage: Businesses reporting increased revenue in 2024 often cite social media campaigns as a primary contributor to customer acquisition and sales conversion.

Work-Life Balance and 'Bleisure' Travel

The growing emphasis on work-life balance is fueling a significant shift in travel patterns, particularly the rise of 'bleisure' travel. This trend, where business trips are extended for personal leisure, is becoming more prevalent as companies adopt more flexible work arrangements. For instance, a 2024 study indicated that over 60% of business travelers now consider extending their trips for leisure activities, a notable increase from previous years.

This evolving behavior presents a clear opportunity for Xiamen C&D's hotel and tourism divisions. By recognizing and adapting to this demand, the company can develop innovative packages that seamlessly blend professional obligations with personal enjoyment. Consider the potential for bundled services that include business amenities alongside curated local experiences or wellness activities specifically designed for the bleisure traveler.

To capitalize on this, Xiamen C&D could consider:

- Developing tiered packages that offer business travelers discounted rates on extended stays or add-on leisure activities.

- Partnering with local attractions and tour operators to create exclusive experiences for guests who are extending their trips.

- Promoting flexible booking options that allow travelers to easily modify their itineraries to accommodate both business and leisure components.

- Highlighting the convenience and value proposition of combining work and leisure through targeted marketing campaigns.

China's aging demographic, with over 30% expected to be 60+ by 2035, is creating a growing market for healthcare and retirement services. Concurrently, the economic influence of millennials and Gen Z is driving demand for experiences, technology, and sustainable products, as evidenced by the robust growth in e-commerce sales in 2024, heavily driven by younger consumers.

Technological factors

China's push for digital and intelligent supply chains, driven by AI, IoT, and blockchain, is a significant technological factor. For Xiamen C&D, adopting these technologies is crucial for boosting efficiency and transparency in its operations.

The integration of AI and IoT allows for real-time tracking and predictive analytics, which can optimize inventory management and logistics. For instance, by 2024, the global supply chain management market is projected to reach $34.1 billion, highlighting the increasing reliance on digital solutions.

Technological advancements are reshaping the real estate landscape, with smart buildings and data centers emerging as key growth areas. Investor interest in data centers, crucial for the digital economy, has surged; for instance, global data center construction spending was projected to reach over $200 billion in 2024. Xiamen C&D can leverage this by integrating smart technologies like IoT sensors and AI-driven building management systems into its properties, enhancing efficiency and tenant experience.

Furthermore, exploring investments in technologically advanced property types, such as high-density computing facilities or specialized logistics hubs, aligns with future market demands. The increasing reliance on cloud computing and big data means the demand for secure, scalable data center infrastructure is expected to continue its upward trajectory through 2025 and beyond.

The global e-commerce market is experiencing robust growth, with projections indicating continued expansion. For instance, global e-commerce sales were estimated to reach over $6.3 trillion in 2024, a significant increase from previous years. This trend, coupled with government support for cross-border digital trade, directly influences Xiamen C&D's operational landscape. The company must adapt by enhancing its digital trade capabilities to capitalize on these evolving market dynamics.

Xiamen C&D's strategic approach to trade and distribution is increasingly shaped by the digital economy. As e-commerce platforms become more sophisticated and consumer preferences shift towards online purchasing, the company needs to invest in optimizing its digital infrastructure. This includes improving logistics, payment systems, and customer service for online transactions to remain competitive and effectively serve a broader customer base in the cross-border digital trade arena.

Data Security and Privacy Technologies

New regulations on network data security management, taking effect in January 2025, will mandate stronger data protection measures for businesses. Xiamen C&D needs to prioritize investments in advanced cybersecurity and data privacy technologies to meet these compliance requirements and protect its sensitive information across all digital platforms.

This focus on data security is critical as global spending on cybersecurity solutions is projected to reach $231.5 billion in 2025, highlighting the increasing importance of robust digital defenses. Companies like Xiamen C&D must adapt to this evolving landscape.

- Compliance with new data security regulations effective January 2025.

- Investment in advanced cybersecurity and data privacy technologies.

- Safeguarding sensitive information across all digital operations.

- Alignment with the projected global cybersecurity spending of $231.5 billion in 2025.

Innovation in Emerging Industries

Xiamen C&D's strategic focus on emerging industries, such as new energy and advanced materials, demands a keen eye on technological advancements. For instance, the company's significant investments in the electric vehicle (EV) supply chain, a sector projected to grow substantially, require constant evaluation of battery technology innovations and charging infrastructure developments. Staying ahead of these trends is vital for identifying future growth avenues and maintaining a competitive edge in its diverse business segments.

The company's commitment to innovation is evident in its research and development spending. In 2023, Xiamen C&D allocated a notable portion of its revenue towards R&D, particularly in areas like high-performance semiconductors and sustainable manufacturing processes. This proactive approach allows them to anticipate market shifts and integrate cutting-edge technologies into their operations and investment strategies, ensuring their portfolio remains robust and forward-looking.

- Technological Monitoring: Xiamen C&D actively tracks advancements in areas like AI-driven logistics, 5G applications for industrial automation, and next-generation battery chemistries.

- Disruptive Innovation Adoption: The company evaluates emerging technologies that could reshape traditional industries, such as advanced robotics in warehousing and blockchain for supply chain transparency.

- Investment Opportunity Identification: Continuous technological assessment helps Xiamen C&D pinpoint startups and established firms with breakthrough innovations in sectors like biotechnology and renewable energy storage.

- Competitive Advantage: By embracing new technologies, Xiamen C&D aims to enhance operational efficiency, develop novel products and services, and secure long-term market leadership across its diversified interests.

Technological advancements are fundamentally reshaping Xiamen C&D's operational landscape, particularly in supply chain management and real estate. The integration of AI, IoT, and blockchain is driving efficiency and transparency, with the global supply chain management market projected to reach $34.1 billion by 2024. Furthermore, smart building technologies, fueled by a global data center construction spending exceeding $200 billion in 2024, offer significant avenues for enhancing property value and tenant experience.

The burgeoning e-commerce sector, with global sales estimated over $6.3 trillion in 2024, necessitates Xiamen C&D's investment in robust digital infrastructure, including logistics and payment systems. Simultaneously, upcoming data security regulations effective January 2025 demand increased investment in cybersecurity, aligning with a projected global cybersecurity spending of $231.5 billion in 2025.

| Technological Trend | Relevance to Xiamen C&D | 2024/2025 Data Point |

| AI & IoT in Supply Chains | Enhanced efficiency, real-time tracking, predictive analytics | Global Supply Chain Management Market: $34.1 billion (2024) |

| Smart Buildings & Data Centers | Improved property management, increased investor interest | Global Data Center Construction Spending: >$200 billion (2024) |

| E-commerce Growth | Need for optimized digital infrastructure, cross-border trade capabilities | Global E-commerce Sales: >$6.3 trillion (2024) |

| Cybersecurity & Data Privacy | Compliance with new regulations, protection of sensitive information | Global Cybersecurity Spending: $231.5 billion (2025) |

Legal factors

The revised PRC Company Law, effective July 1, 2024, brings about substantial shifts in corporate governance. Key changes include more stringent deadlines for capital contributions, increased accountability for directors, and improved protections for shareholders.

Xiamen C&D must meticulously align its corporate framework and internal policies with these new legal stipulations to ensure ongoing compliance. This includes adapting to the updated regulations concerning director duties and the mechanisms for safeguarding shareholder rights, which are now more robust.

China's new Network Data Security Management Regulations, taking effect January 1, 2025, establish a comprehensive legal structure for data processing. These regulations mandate strict adherence to personal information protection and outline specific procedures for cross-border data transfers, impacting companies like Xiamen C&D with significant digital footprints.

Xiamen C&D's digital operations, spanning supply chain management and e-commerce, will face increased scrutiny under these new rules. Failure to comply could result in penalties, potentially affecting the company's ability to leverage data for strategic advantage and international business expansion.

Recent amendments to China's Foreign Trade Law and the implementation of new Regulations on Export Control of Dual-Use Items, effective December 1, 2024, significantly reshape the landscape for companies like Xiamen C&D involved in international commerce. These legal shifts introduce stricter oversight on the movement of goods, particularly those with potential military applications, directly impacting Xiamen C&D's global supply chain and distribution networks.

Navigating these evolving export control frameworks and anti-sanction policies is paramount for Xiamen C&D to mitigate risks of legal repercussions and operational interruptions. For instance, the 2023 U.S. Commerce Department's Bureau of Industry and Security (BIS) continued to update its Entity List, affecting over 1,000 Chinese companies, underscoring the global trend towards more stringent export management.

Real Estate and Property Rental Regulations

New regulations on residential property rentals, effective September 15, 2025, are set to standardize procedures and protect the rights of all parties involved in rental agreements. This legislative update, coupled with existing measures to stabilize the property market, means Xiamen C&D's real estate operations must adjust to new legal requirements for property management and sales.

These changes are critical for Xiamen C&D as they directly impact how the company engages with the rental market. For instance, the new rules may introduce stricter licensing for property managers or mandate specific lease agreement clauses, potentially affecting operational costs and revenue streams. Staying compliant is paramount to avoid penalties and maintain market trust.

- Standardized Rental Procedures: New laws effective September 15, 2025, will enforce uniform practices across the residential rental sector.

- Stakeholder Rights Protection: Regulations aim to enhance fairness and security for both landlords and tenants.

- Market Stabilization Efforts: Ongoing government initiatives continue to influence property market dynamics, requiring adaptive strategies.

- Impact on Xiamen C&D: The real estate division must align its property management and transaction practices with these evolving legal frameworks.

Emerging Environmental Legal Framework

China's commitment to environmental governance is solidifying with the anticipated unveiling of its first comprehensive Environmental Code. A draft of this landmark legislation was presented in April 2025, aiming to consolidate and strengthen existing environmental regulations. This development is poised to significantly influence Xiamen C&D's operational framework, mandating stricter compliance with evolving standards in pollution control, biodiversity preservation, and sustainable economic practices.

The new Environmental Code will likely introduce more rigorous enforcement mechanisms and potentially higher penalties for non-compliance, impacting Xiamen C&D's supply chain management and production processes. Companies will need to proactively adapt to these enhanced requirements to ensure continued operational legality and maintain a positive corporate image. For instance, China's Ministry of Ecology and Environment reported a 15% increase in environmental inspections in 2024, signaling a trend towards stricter oversight that the new code will formalize.

- Environmental Code Draft: Unveiled April 2025, consolidating existing environmental laws.

- Impact on Xiamen C&D: Requires adherence to new standards for pollution prevention and ecological protection.

- Enforcement Trends: Expect stricter oversight and potential penalties for non-compliance.

- Industry Adaptation: Proactive adjustments in supply chain and production processes will be crucial.

The legal landscape in China is dynamically evolving, presenting both challenges and opportunities for Xiamen C&D. New regulations, such as the revised PRC Company Law effective July 1, 2024, and the Network Data Security Management Regulations from January 1, 2025, demand rigorous corporate governance and data protection adherence. Furthermore, updated foreign trade laws and export control measures, effective December 1, 2024, necessitate careful navigation of international commerce. The anticipated Environmental Code, with a draft presented in April 2025, signals a trend towards stricter environmental compliance, impacting operational processes and supply chains.

| Legal Area | Effective Date | Key Impact on Xiamen C&D | Relevant Data/Trend |

|---|---|---|---|

| PRC Company Law Revision | July 1, 2024 | Stricter director accountability, enhanced shareholder protection. | Increased director liability in cases of negligence. |

| Network Data Security Management Regulations | January 1, 2025 | Mandatory personal information protection, cross-border data transfer procedures. | China's data localization requirements affect 90% of companies operating online. |

| Export Control of Dual-Use Items | December 1, 2024 | Stricter oversight on goods movement, potential impact on global supply chains. | Global trade restrictions impacting over 1,000 Chinese entities in 2023. |

| Environmental Code (Draft) | April 2025 (Draft) | Stricter pollution control, biodiversity preservation, and sustainability standards. | 15% increase in environmental inspections by China's Ministry of Ecology and Environment in 2024. |

Environmental factors

China's commitment to environmental governance is intensifying with the development of its Ecological and Environmental Code. A draft of this comprehensive legislation, integrating diverse regulations on pollution control and ecological preservation, was released in April 2025.

This evolving legal framework is poised to significantly influence Xiamen C&D's compliance strategies and sustainability initiatives. The code's broad scope, encompassing aspects from air quality standards to waste management, will necessitate a thorough review of current operations to ensure alignment with national environmental objectives.

China's commitment to green development, including its 2030 carbon peaking and 2060 carbon neutrality targets, significantly shapes industrial operations. Xiamen C&D must integrate these environmental mandates across its supply chain and investment portfolios, pushing for greener technologies and sustainable practices.

In 2023, China's renewable energy capacity saw substantial growth, with solar and wind power installations reaching new highs, underscoring the national drive towards low-carbon development. This trend necessitates that Xiamen C&D prioritizes eco-friendly solutions in its real estate and industrial ventures to maintain compliance and competitive advantage.

Sustainability remains a dominant force in China's real estate sector, driving demand for green building certifications and eco-conscious development. Xiamen C&D's property division must integrate sustainable design, construction, and operational strategies to align with evolving market preferences and increasingly stringent environmental regulations.

The push for greener buildings is evident, with China aiming for 30% of new urban construction to be green buildings by 2025. This trend necessitates Xiamen C&D to invest in energy-efficient materials and water-saving technologies, ensuring their projects meet high environmental performance standards.

Resource Scarcity and Circular Economy

China's draft Environmental Code emphasizes circular economy principles, pushing for green design, manufacturing, and industrial waste utilization. This regulatory shift directly impacts Xiamen C&D's commodity trade and distribution operations, necessitating a heightened focus on resource efficiency and waste minimization.

The push for a circular economy means Xiamen C&D will likely see increased demand for sustainably sourced materials and a greater emphasis on supporting the recycling and reuse of commodities. This aligns with global trends; for instance, the global circular economy market was valued at approximately $2.5 trillion in 2023 and is projected to reach $4.7 trillion by 2030, indicating a substantial growth opportunity for companies adapting to these principles.

- Circular Economy Standards: Expect stricter guidelines for product lifecycles and waste management in commodity trading.

- Green Design & Manufacturing: Xiamen C&D may need to prioritize partners adhering to eco-friendly production processes.

- Industrial Waste Utilization: Opportunities may arise in trading or facilitating the use of recycled or repurposed industrial byproducts.

- Resource Efficiency: A core tenet will be optimizing the use of raw materials throughout the supply chain.

Environmental Protection in Supply Chains

Global efforts to bolster supply chain resilience and security are increasingly embedding environmental factors, notably clean energy advancements. Xiamen C&D's supply chain operations are therefore tasked with integrating eco-friendly practices, such as minimizing emissions and optimizing logistics for a reduced carbon footprint.

This focus extends to responsible sourcing of materials, aligning with growing investor and consumer demand for sustainability. For instance, the push for decarbonization in logistics saw global shipping emissions fall by an estimated 1.9% in 2023 compared to 2022 levels, according to preliminary data from the International Maritime Organization, highlighting a tangible shift in operational priorities.

- Emission Reduction Targets: Implementing strategies to meet or exceed national and international carbon reduction goals.

- Green Logistics: Optimizing transportation routes and modes to minimize fuel consumption and emissions.

- Sustainable Sourcing: Prioritizing suppliers with strong environmental credentials and traceable sustainable practices.

- Circular Economy Integration: Exploring opportunities for waste reduction and resource reuse within the supply chain.

China's environmental regulations are tightening, with the draft Ecological and Environmental Code released in April 2025 setting a new benchmark for compliance. This code, alongside national targets like carbon peaking by 2030, mandates Xiamen C&D to embed sustainability across its operations, from real estate to commodity trading.

The growing emphasis on green buildings, with a target of 30% new urban construction being green by 2025, means Xiamen C&D's property division must prioritize energy efficiency and eco-friendly materials. Furthermore, the circular economy principles within the draft code present both challenges and opportunities for resource efficiency and waste utilization in their commodity business.

Supply chain resilience is increasingly linked to environmental performance, pushing Xiamen C&D to adopt greener logistics and responsible sourcing. The global shift towards decarbonization, evidenced by a 1.9% drop in global shipping emissions in 2023, underscores the need for the company to actively reduce its carbon footprint.

| Environmental Factor | 2024/2025 Impact on Xiamen C&D | Supporting Data/Trend |

|---|---|---|

| Ecological and Environmental Code (Draft) | Mandates stricter compliance for pollution control and ecological preservation. | Released April 2025. |

| Carbon Neutrality Targets | Requires integration of low-carbon practices across supply chain and investments. | China's 2030 carbon peaking and 2060 carbon neutrality goals. |

| Green Building Mandates | Drives demand for sustainable design, materials, and operational strategies in real estate. | China's target for 30% of new urban construction to be green by 2025. |

| Circular Economy Principles | Necessitates focus on resource efficiency and waste minimization in commodity trade. | Global circular economy market valued at ~$2.5 trillion in 2023. |

| Supply Chain Decarbonization | Prompts integration of eco-friendly logistics and responsible sourcing. | Global shipping emissions fell ~1.9% in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Xiamen C&D is built on a robust foundation of data from official Chinese government statistics, international trade organizations, and reputable economic and industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.