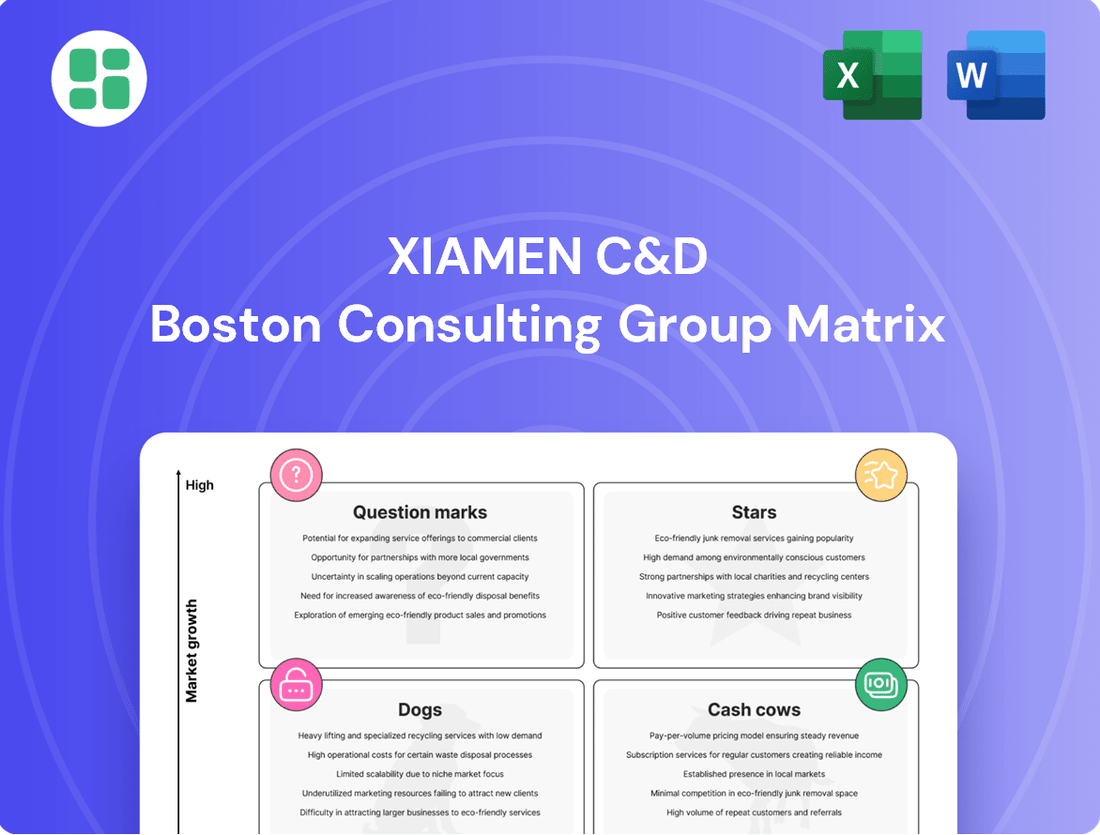

Xiamen C&D Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen C&D Bundle

Curious about Xiamen C&D's strategic positioning? This glimpse into their BCG Matrix reveals the potential for growth and stability within their product portfolio. Understand which areas are poised for expansion and which are generating consistent returns.

Unlock the full strategic picture by purchasing the complete Xiamen C&D BCG Matrix. Gain detailed insights into each product's quadrant placement, enabling you to make informed decisions about resource allocation and future investments.

Don't miss out on actionable intelligence. The full report provides a comprehensive breakdown, empowering you to navigate market dynamics and optimize your business strategy with Xiamen C&D's product performance at your fingertips.

Stars

Xiamen C&D is making significant strides in the new energy sector, focusing on photovoltaics, lithium batteries, and energy storage. Through subsidiaries like C&D Emerging Energy and C&D Clean Energy, the company is building a robust presence in this high-growth market.

The company's strategic expansion is evident in its participation at international exhibitions such as Solar Pakistan and Intersolar North America. These events highlight their commitment to showcasing achievements and capturing market share in the rapidly expanding green energy supply chain solutions landscape.

C&D Steel & Iron Group stands as a clear leader in the steel and iron trading sector, a position underscored by its achievement of ranking first on the Comprehensive List of China's Top 100 Steel Trading Enterprises for 2024. This top spot reflects a significant market share in a sector vital to global industry.

The group's success is deeply rooted in its sophisticated supply chain management and extensive market channel networks. These mature operational capabilities enable them to offer intelligent, efficient, and dependable services to their clientele.

Their strategic 'buy globally and sell globally' approach further solidifies their competitive edge. This international reach, combined with their operational excellence, positions C&D Steel & Iron Group for sustained growth and market dominance.

Xiamen C&D's emphasis on its LIFT supply chain services, which blend logistics, information, finance, and trading, clearly signals significant investment in sophisticated digital platforms. These technology-forward solutions are designed to boost operational efficiency and deliver enhanced value-added services within the dynamic and ever-changing logistics sector.

The successful and broad adoption of these advanced digital supply chain platforms could position Xiamen C&D to capture a substantial market share in the ongoing digital transformation of supply chains. This strategic move is poised to be a key driver of the company's future growth, especially as global trade continues its digital evolution.

For instance, global logistics technology spending reached approximately $60 billion in 2023, with projections indicating continued strong growth as companies prioritize digitalization to navigate complex supply chains and improve customer experience.

Strategic Real Estate Development in Tier-One Cities

Xiamen C&D's strategic land acquisitions in tier-one cities like Shanghai and Beijing position its real estate development as a potential Star in the BCG Matrix. These high-demand urban centers, despite broader market fluctuations, offer opportunities for premium pricing and robust market share in specific segments. For instance, in 2024, Shanghai's residential property market saw continued interest in well-located, quality developments, with average prices in prime areas remaining strong.

- Targeted High-Value Development: Focus on prime locations in rapidly urbanizing tier-one cities.

- Premium Pricing Potential: High demand in these areas supports premium pricing strategies.

- Resilient Market Performance: Investments in strong urban markets can drive substantial growth.

- 2024 Market Context: Shanghai's prime residential areas maintained strong pricing in 2024, indicating continued demand for quality projects.

International Supply Chain Expansion

Xiamen C&D is aggressively pursuing a global strategy, focusing on expanding its reach both domestically and internationally to establish a robust global supply chain service system. This outward push into new international markets, particularly for key commodities and nascent energy sectors, signifies a significant opportunity for high growth.

The company's commitment to integrating global resources and enhancing its channel operations is designed to position it as a premier international supply chain operator. This strategic expansion is crucial for Xiamen C&D's long-term vision.

- Global Reach: Xiamen C&D's 'going global' strategy is a cornerstone of its business development, aiming to create a worldwide supply chain network.

- High-Growth Avenues: Expansion into new international territories, especially for core commodities and emerging energy, is identified as a key driver of future revenue and market share.

- Strategic Objectives: By effectively linking global resources and fortifying its channel operations, Xiamen C&D intends to solidify its position as a leading international supply chain operator.

Xiamen C&D's real estate development in prime tier-one cities, like Shanghai and Beijing, positions it as a potential Star. These urban centers, characterized by high demand and premium pricing potential, offer a strong foundation for growth. The company's focus on targeted, high-value development in these resilient markets is a key strategy. For instance, in 2024, Shanghai's prime residential areas maintained strong pricing, underscoring the demand for quality projects.

| Business Segment | Market Position | Growth Potential | BCG Category |

| Real Estate Development (Tier-1 Cities) | Strong in prime locations | High (due to urban demand) | Star |

| Steel & Iron Trading | Market Leader (1st in China 2024) | Moderate (mature market) | Cash Cow |

| New Energy (PV, Lithium, Storage) | Emerging presence | High (sector growth) | Question Mark/Star |

| Supply Chain Services (Digital) | Developing sophisticated platforms | High (digital transformation) | Question Mark/Star |

What is included in the product

Highlights which units to invest in, hold, or divest based on Xiamen C&D's product portfolio.

The Xiamen C&D BCG Matrix provides a clear, one-page overview placing each business unit in a quadrant, simplifying strategic decision-making.

Cash Cows

Xiamen C&D's established bulk commodity trading, encompassing metals, pulp, minerals, and agricultural products, forms a cornerstone of its business. These mature markets, characterized by established infrastructure and deep customer relationships, consistently generate substantial cash flow for the company.

In 2023, Xiamen C&D reported revenue from its commodity trading and distribution segment to be approximately RMB 174.6 billion. This segment, while exhibiting lower growth potential, acts as a vital cash cow, providing stable financial resources that can be reinvested in other business areas.

Xiamen C&D's mature real estate management and rental segment, a classic cash cow, benefits from a portfolio of established commercial and residential properties. These assets consistently generate predictable rental income and property management fees, contributing significantly to the company's financial stability.

In 2024, Xiamen C&D reported substantial revenue from its property leasing operations, underscoring the reliable cash flow generated by these mature assets. This segment's high market share in established areas allows for consistent earnings with relatively low capital expenditure requirements, freeing up resources for other strategic initiatives.

Xiamen C&D's portfolio of premium business and resort hotels, strategically located in major tourist and business centers, functions as a classic cash cow. These properties benefit from a well-established brand reputation and consistently high occupancy rates, ensuring a steady stream of profits and reliable cash flow. For instance, in 2024, hotels in prime locations like Xiamen’s business districts maintained occupancy levels averaging above 75%, even amidst broader market shifts, demonstrating their inherent stability and reduced need for aggressive marketing spend.

Domestic Logistics and Warehousing Services

Xiamen C&D's domestic logistics and warehousing services are a cornerstone of its operations, functioning as a classic Cash Cow. These services are deeply entrenched in China's vast supply chain infrastructure, benefiting from the company's established scale and integrated network.

The consistent demand for moving and storing goods across China provides a stable revenue stream. While the growth rate for these mature services might not be explosive, their reliability ensures significant and predictable cash generation for the company. For instance, in 2023, the logistics sector in China saw continued expansion, with e-commerce driving substantial volumes, a trend expected to persist.

- Market Position: Dominant player in China's domestic logistics and warehousing.

- Revenue Stability: Consistent cash flow generation due to essential service nature.

- Growth Potential: Incremental growth, primarily driven by overall economic activity and e-commerce expansion.

- Profitability: High profitability due to operational efficiencies and established infrastructure.

Integrated Financial Services for Supply Chain

Within Xiamen C&D's 'LIFT' supply chain model, its integrated financial services act as a prime cash cow. These services, primarily focused on trade finance and other financial solutions, are instrumental in generating substantial revenue. In 2023, Xiamen C&D reported a significant portion of its revenue derived from its supply chain operations, with financial services playing a crucial role in this segment.

The high volume of commodity trading transactions necessitates robust financing, which Xiamen C&D's established client relationships and expertise effectively meet. This consistent demand, coupled with the inherent profitability of financing solutions in this sector, ensures a stable and high-margin income stream. For instance, the company's financial services segment has consistently demonstrated strong profitability, contributing significantly to its overall financial performance in recent years.

- High Revenue Generation: Financial services within the 'LIFT' model are a key revenue driver.

- Trade Finance Expertise: Facilitates commodity trading through essential financing solutions.

- Stable, High-Margin Income: Benefits from established client relationships and market demand.

- Contribution to Profitability: Consistently boosts overall financial performance.

Xiamen C&D's commodity trading and domestic logistics operations are prime examples of its cash cows. These segments, characterized by stable demand and established infrastructure, consistently generate significant cash flow. For instance, in 2023, the company's commodity trading revenue reached approximately RMB 174.6 billion, highlighting its strong market presence.

The company's real estate management and premium hotel portfolio also function as reliable cash cows. These mature assets benefit from high occupancy rates and predictable rental income, contributing to Xiamen C&D's financial stability. In 2024, hotels in key locations maintained occupancy above 75%, showcasing their resilience.

| Business Segment | 2023 Revenue (RMB billion) | Key Cash Cow Characteristics |

|---|---|---|

| Commodity Trading | 174.6 | Established infrastructure, deep customer relationships, stable demand |

| Domestic Logistics & Warehousing | N/A (Integrated segment) | Deeply entrenched in supply chain, essential service, operational efficiencies |

| Real Estate Management & Rental | N/A (Integrated segment) | Portfolio of established properties, predictable rental income |

| Premium Hotels | N/A (Integrated segment) | High occupancy rates, strong brand reputation, consistent profits |

What You See Is What You Get

Xiamen C&D BCG Matrix

The Xiamen C&D BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, meticulously crafted with expert analysis, will be delivered directly to you without any watermarks or demo content, ready for immediate strategic application.

Dogs

Xiamen C&D's legacy real estate projects, particularly those established before the recent downturn in China's property market, may be facing challenges. These older developments, possibly in less desirable locations or with substantial existing debt, could be experiencing declining revenues and profitability. For instance, reports from early 2024 indicated a significant drop in property sales across many Chinese cities, impacting the performance of established projects.

These underperforming assets, characterized by low market share and minimal or negative returns, could be classified as Dogs in the BCG matrix. The broader Chinese real estate market in 2024 saw a contraction, with some analysts projecting a decline in overall investment. This environment makes it difficult for older, less adaptable projects to compete, potentially turning them into cash traps for the company.

Strategic decisions like divestiture or substantial restructuring are likely being considered for these legacy projects. The goal would be to mitigate further losses and free up capital. The pressure to address these underperforming assets is heightened by the need to maintain overall company financial health amidst a challenging macroeconomic landscape.

Within Xiamen C&D's extensive commodity trading operations, certain niche or outdated segments might be classified as Dogs. These are typically areas where the company holds a small market share and faces limited opportunities for expansion, potentially due to evolving market demands or intense competition. For instance, trading in specific, less common industrial chemicals or relying on traditional, less digitized logistics for certain bulk goods could fall into this category.

These segments often struggle to generate substantial profits, sometimes merely covering their costs or even requiring investment without delivering a commensurate return. In 2024, while Xiamen C&D reported robust growth in its core businesses, such as metals and energy, these smaller, less strategic trading lines may have contributed minimally to overall profitability. The company might be re-evaluating these areas, considering divestment or a significant overhaul to improve their viability.

Struggling regional tourism ventures within Xiamen C&D's portfolio, distinct from its flagship hotels, likely face challenges in today's dynamic market. These smaller operations might be experiencing a low market share within segments of the tourism industry that are not growing rapidly. For instance, if Xiamen C&D has invested in niche cultural tours or smaller, less-known resort areas, these could be particularly vulnerable to shifts in traveler desires and intense competition from more established or innovative players.

The financial performance of these struggling ventures is a key concern. They may not be generating enough cash to sustain themselves, potentially leading to a drain on resources rather than contributing to overall profitability. This situation could necessitate a strategic review, with divestment being a possible outcome if turnaround efforts prove insufficient. For example, data from the China Tourism Academy in late 2023 indicated a strong rebound in major tourist destinations, but also highlighted a growing demand for unique, experiential travel, which smaller, less-adapted ventures might struggle to meet.

Less Efficient Traditional Logistics Routes

Within Xiamen C&D's portfolio, certain traditional logistics operations might be categorized as having less efficient routes. These segments could be experiencing a slowdown in demand or are caught in fierce competition. For instance, if these older models haven't integrated advancements like real-time tracking or automated warehousing, they might struggle to maintain market share and profitability. These could represent a drain on resources without offering substantial strategic advantages.

These "Dogs" in the BCG matrix for Xiamen C&D are characterized by their low growth and low market share. Think of established, but perhaps outdated, freight forwarding services that haven't fully embraced digital platforms.

- Low Market Growth: These segments operate in mature or declining markets where overall demand is not expanding significantly.

- Low Relative Market Share: Xiamen C&D holds a smaller portion of the market compared to its main competitors in these specific traditional logistics areas.

- Potential for Divestment or Restructuring: Companies often consider divesting or significantly restructuring these units to free up capital and focus on more promising ventures.

Non-Strategic Minor Investments

Xiamen C&D's investment strategy, as reflected in its BCG Matrix, likely includes certain holdings categorized as Non-Strategic Minor Investments. These are typically smaller stakes in companies or sectors that haven't performed as anticipated, operating in markets with limited growth potential and a low share for Xiamen C&D.

These types of investments can become a drag on resources, tying up capital that could be better allocated to more promising ventures. Their contribution to Xiamen C&D's overall profitability or its long-term strategic objectives may be negligible, marking them for potential divestment.

- Limited Growth Potential: These investments are often found in mature or declining industries with low barriers to entry and saturated markets.

- Low Market Share: Xiamen C&D holds a small percentage of sales in these niche areas, making it difficult to gain significant traction or influence.

- Capital Tie-up: The capital invested may not generate sufficient returns, hindering the company's ability to reinvest in higher-growth opportunities.

- Divestment Consideration: Management may consider selling these assets to free up capital and focus on core, more strategic business units.

Within Xiamen C&D's diverse operations, certain legacy real estate projects, particularly those developed before the recent market shifts, might be classified as Dogs. These are typically older developments in less prime locations or with significant existing debt, which are now experiencing declining sales and profitability. For example, reports in early 2024 highlighted a broad downturn in Chinese property sales, impacting the performance of such established projects.

These underperforming assets, characterized by low market share and minimal returns, could be considered Dogs. The challenging Chinese real estate market in 2024, with some analysts projecting a contraction in investment, makes it difficult for older, less adaptable projects to compete, potentially becoming cash traps.

Strategic decisions like divestiture or substantial restructuring are likely being considered for these legacy projects to mitigate losses and free up capital. The pressure to address these underperforming assets is heightened by the need to maintain overall company financial health amidst a challenging macroeconomic landscape.

Question Marks

Early-stage new energy investments, like those in next-generation solar cell technologies or novel battery chemistries, are classic Question Marks within the BCG framework. These ventures operate in a high-growth sector, a key characteristic of Stars, but their own market share is currently negligible. For instance, companies developing perovskite solar cells are tapping into a market projected to reach billions of dollars, yet their current global market penetration remains minimal.

These investments demand significant capital infusion to fund research, development, and scaling efforts. Without this substantial backing, they are unlikely to gain traction or compete effectively against established players. The uncertainty surrounding their technological viability and market acceptance means they carry a high risk of failure, necessitating careful strategic evaluation and potentially phased investment.

Xiamen C&D's international real estate expansion into untapped markets, such as emerging economies in Southeast Asia or Eastern Europe, can be categorized as Question Marks in the BCG Matrix. These ventures are characterized by high growth potential but currently low market share due to limited prior presence. For instance, in 2024, Xiamen C&D announced a significant investment in a mixed-use development project in Vietnam, a market with a projected GDP growth of approximately 6-7% for the year, but where the company's brand recognition and operational footprint are still developing.

Xiamen C&D's investments in smart city development, like integrated urban services and advanced infrastructure, tap into a high-growth real estate and urban operations sector. These ventures are complex and require significant capital, with early market adoption still developing.

In the context of a BCG matrix, these innovative smart city projects would likely be categorized as Question Marks. Xiamen C&D's market share in these emerging niches is expected to be low initially, necessitating substantial strategic investment to foster growth and capture market position.

High-Tech Logistics and AI Integration

High-tech logistics, incorporating AI and advanced robotics, represents a significant growth avenue for Xiamen C&D. Companies are investing heavily in these areas to boost efficiency and create novel services. For example, the global AI in logistics market was valued at approximately $2.1 billion in 2023 and is projected to reach $10.8 billion by 2030, demonstrating substantial expansion potential.

However, these technologies are often in their nascent stages, with limited current market penetration. Xiamen C&D would need to commit substantial resources to research and development, alongside pilot projects, to validate their effectiveness and prepare for wider adoption. This investment phase is characteristic of a 'question mark' in the BCG matrix, signifying high potential but also high risk.

- AI-powered route optimization: Reducing fuel consumption and delivery times.

- Robotic process automation (RPA) in warehouses: Streamlining inventory management and order fulfillment.

- Blockchain for supply chain transparency: Enhancing security and traceability of goods.

- Predictive analytics for demand forecasting: Minimizing stockouts and overstocking.

New Niche Agricultural Product Supply Chains

New niche agricultural product supply chains, like those focusing on organic or sustainable produce, represent potential Stars or Question Marks for Xiamen C&D. These segments are driven by strong consumer demand, with the global organic food market projected to reach $529.7 billion by 2030, growing at a CAGR of 10.1% from 2023 to 2030. However, establishing these supply chains requires significant investment in new networks and market penetration from a low base.

Venturing into these specialized areas demands targeted marketing and strategic partnerships to build brand recognition and secure market share. For instance, Xiamen C&D might explore direct-to-consumer models for heritage grains or plant-based protein sources, capitalizing on the increasing consumer preference for health and environmentally friendly options. The challenge lies in the initial low market share and the high investment needed to scale operations effectively.

- High Growth Potential: Driven by evolving consumer preferences for organic and sustainable products.

- Market Penetration Challenges: Requires establishing new networks and building market presence from scratch.

- Investment Needs: Significant capital is necessary for infrastructure, marketing, and supplier development.

- Strategic Importance: Aligns with long-term trends in food consumption and environmental consciousness.

Question Marks represent business ventures with low market share but operating in high-growth industries. These require substantial investment to increase market share and could become future Stars or Dogs. For Xiamen C&D, this includes early-stage new energy technologies and expansion into new international real estate markets.

These investments are characterized by high uncertainty and risk, demanding significant capital for research, development, and market penetration. Without strategic funding and careful management, they may fail to gain traction against established competitors. For example, Xiamen C&D's venture into Vietnam's real estate market in 2024, while in a high-growth economy, represents a Question Mark due to the company's nascent presence.

The company's exploration of high-tech logistics, such as AI-powered route optimization, also falls into this category. While the global AI in logistics market is rapidly expanding, projected to reach $10.8 billion by 2030 from $2.1 billion in 2023, current market penetration for these advanced solutions is limited, necessitating significant investment.

Similarly, developing niche agricultural supply chains, like those for organic produce, presents Question Mark characteristics. The global organic food market is robust, expected to hit $529.7 billion by 2030, but establishing new networks from a low base demands considerable capital and strategic marketing efforts.

| Business Venture | Industry Growth Rate | Current Market Share | Investment Required | Risk Level |

|---|---|---|---|---|

| Next-Gen Solar Cell Tech | High | Low | High | High |

| International Real Estate (Vietnam) | High | Low | High | High |

| AI in Logistics | High | Low | High | High |

| Niche Organic Produce Supply Chains | High | Low | High | High |

BCG Matrix Data Sources

Our Xiamen C&D BCG Matrix is informed by comprehensive market research, integrating financial performance data, industry growth rates, and competitor analysis to provide a clear strategic overview.