China Merchants Land SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Merchants Land Bundle

China Merchants Land's strategic positioning reveals key strengths in its extensive land reserves and strong government backing, but also highlights potential weaknesses in market diversification and reliance on specific economic cycles. Understanding these dynamics is crucial for navigating the competitive real estate landscape.

Want the full story behind China Merchants Land's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

China Merchants Land Holdings Limited boasts a robustly diversified property portfolio. This includes a wide range of offerings from residential developments to commercial spaces, encompassing sales, leasing, and comprehensive property management. This broad operational scope, spread across numerous Chinese cities, significantly reduces reliance on any single market segment or service, thereby bolstering its stability and resilience.

China Merchants Land's strong backing from its parent, China Merchants Group (CMG), is a significant advantage. As a state-owned enterprise, CMG provides substantial brand recognition and access to extensive resources. This affiliation translates to easier capital acquisition and strategic direction, vital for success in the competitive real estate sector.

China Merchants Land's strength lies in its broad geographic presence across key economically vibrant cities in China. This includes significant operations in Foshan, Guangzhou, Chongqing, Nanjing, Jurong, and Xi'an, as of the latest available data from early 2024. This strategic distribution across diverse regional markets helps mitigate risks associated with localized economic fluctuations or policy changes, providing a more stable operational base.

Recurring Revenue from Property Management and Investment

China Merchants Land benefits from stable, recurring revenue beyond just property sales. Its property management and investment segments provide a consistent income stream, enhancing financial stability. For instance, the company secured renewals for property management agreements extending through 2027, ensuring predictable cash flow for several years.

This recurring revenue acts as a crucial buffer against the cyclical nature of property development and sales. It allows the company to maintain operations and invest in future projects even during market downturns.

- Diversified Income Streams: Property management and investment services contribute significantly to China Merchants Land's financial resilience, reducing reliance on volatile development sales.

- Long-Term Contracts: Renewed property management agreements, extending to 2027, underscore the stability and predictability of these recurring revenue sources.

- Financial Stability: The consistent income from these services provides a solid financial foundation, enabling the company to navigate market fluctuations more effectively.

Strategic Focus on Residential and Commercial Complexes

China Merchants Land's strategic concentration on developing both residential and commercial complexes is a significant strength, allowing it to serve a broad range of market needs. This includes a mix of apartments, villas, office spaces, and retail outlets, demonstrating a comprehensive approach to urban development.

This integrated strategy fosters synergistic growth, where mixed-use projects can enhance each other's value. For instance, the company's projects often combine living spaces with retail and office components, creating self-sustaining communities and capturing multiple revenue streams.

In 2023, China Merchants Land reported a total revenue of approximately RMB 52.1 billion, with a substantial portion derived from its property development segment. This highlights the success of its focused strategy in generating consistent financial performance.

- Diversified Project Portfolio: Development of apartments, villas, offices, and retail shops caters to varied customer demands.

- Synergistic Development: Mixed-use projects create integrated environments, enhancing overall project value and appeal.

- Revenue Generation: The focus on complexes allows for multiple income streams from sales and leasing, contributing to financial stability.

China Merchants Land's diversified property portfolio, spanning residential, commercial, and management services across numerous Chinese cities, underpins its market resilience. This broad operational scope, as seen in its early 2024 presence in cities like Foshan and Guangzhou, mitigates risks tied to single market segments or localized economic downturns.

The company's financial strength is further bolstered by stable, recurring revenue streams from property management and investment segments. Renewed property management agreements extending through 2027 ensure predictable cash flow, acting as a crucial buffer against the cyclical nature of property development and sales.

| Key Strength | Description | Supporting Data (as of early 2024/2025) |

| Diversified Portfolio & Geographic Reach | Wide range of property types (residential, commercial) and presence in multiple key Chinese cities. | Operations in Foshan, Guangzhou, Chongqing, Nanjing, Jurong, Xi'an. |

| Recurring Revenue Streams | Consistent income from property management and investment services. | Property management agreements renewed through 2027. |

| Strong Parent Backing | Support from state-owned China Merchants Group (CMG). | Access to extensive resources and easier capital acquisition. |

| Integrated Development Strategy | Focus on mixed-use projects combining residential, commercial, and retail. | Synergistic growth potential, capturing multiple revenue streams. |

What is included in the product

Provides a strategic overview of China Merchants Land’s internal capabilities and external market dynamics, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis to pinpoint and address China Merchants Land's strategic challenges.

Weaknesses

China Merchants Land experienced a notable downturn in its sales performance during the first half of 2025. Unaudited contracted sales fell by 18.24% compared to the same period in 2024, reaching approximately RMB16.09 billion. This decline signals a weakening demand in the property market for the company.

The second quarter of 2025 proved particularly difficult, with contracted sales plummeting by 27.12% year-on-year. While there were signs of a sequential improvement from the first quarter, the overall year-on-year contraction highlights ongoing headwinds in converting sales pipelines into realized revenue.

China Merchants Land experienced a significant downturn in 2024, swinging to a net loss. This marks a stark contrast to its previous performance and highlights considerable financial challenges. The company's gross profit margin also saw a substantial decrease, falling to 8.5% in 2024 from 14.2% in 2023, indicating severe pressure on its core operations and pricing power.

This sharp decline in profitability is likely a direct consequence of the ongoing real estate market slowdown in China and potentially increased operating expenses or a need to offer discounted pricing to move inventory. The reduced margins directly impact the company's ability to generate profits from its sales, a critical weakness in the current economic climate.

China Merchants Land's significant reliance on the Chinese real estate sector leaves it vulnerable to the persistent market downturn. This exposure means the company is directly impacted by diminished consumer confidence and declining housing prices, which have been ongoing issues for years. For instance, in 2023, national housing prices in China saw a continued decline, with many major cities experiencing year-on-year drops, creating substantial headwinds for developers like China Merchants Land.

Financial Strain from New Government Policies

New government policies, like the requirement to sell only completed homes, are creating significant financial pressure for developers, including China Merchants Land, especially those already struggling with cash flow.

While some financing avenues are being opened up, the substantial capital needed to finish ongoing projects could severely strain the company's financial capacity.

- Increased Capital Requirements: Mandates for selling finished homes necessitate higher upfront investment in construction, impacting developers with existing liquidity challenges.

- Financing Scale: The sheer volume of funding required to complete a large number of unfinished projects poses a significant hurdle, potentially exacerbating financial strain.

- Policy Impact on Cash Flow: Recent policy shifts, particularly those affecting sales cycles and project completion timelines, directly influence developers' ability to manage their cash flow effectively.

Limited Geographic Diversification Outside Mainland China

China Merchants Land's significant reliance on the Chinese market presents a key weakness. While the company has stated ambitions for international expansion, its operational footprint remains heavily concentrated within mainland China and Hong Kong. This lack of geographic diversification exposes the company to substantial risks tied to China's specific economic cycles and evolving regulatory landscape.

For instance, as of the first half of 2024, China Merchants Land's revenue streams were overwhelmingly derived from its projects within mainland China. This concentration means that any downturns or policy shifts impacting the Chinese real estate sector, such as stricter lending rules or slower economic growth, can disproportionately affect the company's financial performance and future prospects. The limited international presence means fewer alternative revenue sources to offset potential domestic headwinds.

- Dominant Revenue Source: Over 90% of China Merchants Land's revenue in FY2023 originated from its mainland China operations.

- Regulatory Sensitivity: The company's business is highly susceptible to changes in Chinese property market regulations and government policies.

- Economic Interdependence: Performance is directly correlated with the economic health and consumer confidence within mainland China.

China Merchants Land's financial performance in 2024 was challenging, marked by a swing to a net loss and a significant drop in gross profit margin to 8.5% from 14.2% in 2023. This contraction in profitability directly impacts its ability to generate returns and underscores its vulnerability to the ongoing real estate market slowdown. The company's reliance on the Chinese market, which saw continued declines in national housing prices in 2023, further exacerbates these weaknesses.

Policy shifts requiring the sale of only completed homes place substantial financial strain on developers like China Merchants Land, especially those facing existing liquidity challenges. The sheer capital needed to finish ongoing projects presents a significant hurdle, potentially straining financial capacity and impacting cash flow management. This makes the company highly sensitive to regulatory changes and economic conditions within China.

The company's geographic concentration in mainland China and Hong Kong is a notable weakness, exposing it to significant risks tied to China's economic cycles and regulatory environment. With over 90% of its revenue in FY2023 derived from mainland China, any downturns or policy shifts in the Chinese real estate sector can disproportionately affect its financial performance, limiting alternative revenue sources to offset domestic headwinds.

| Metric | 2023 | 2024 (H1) | Change |

|---|---|---|---|

| Gross Profit Margin | 14.2% | 8.5% | -5.7 pp |

| Contracted Sales (RMB billion) | 38.8 (FY2023) | 16.09 (H1 2024) | -18.24% (YoY H1) |

| Net Profit/Loss | Profit | Loss | Turnaround |

Preview Before You Purchase

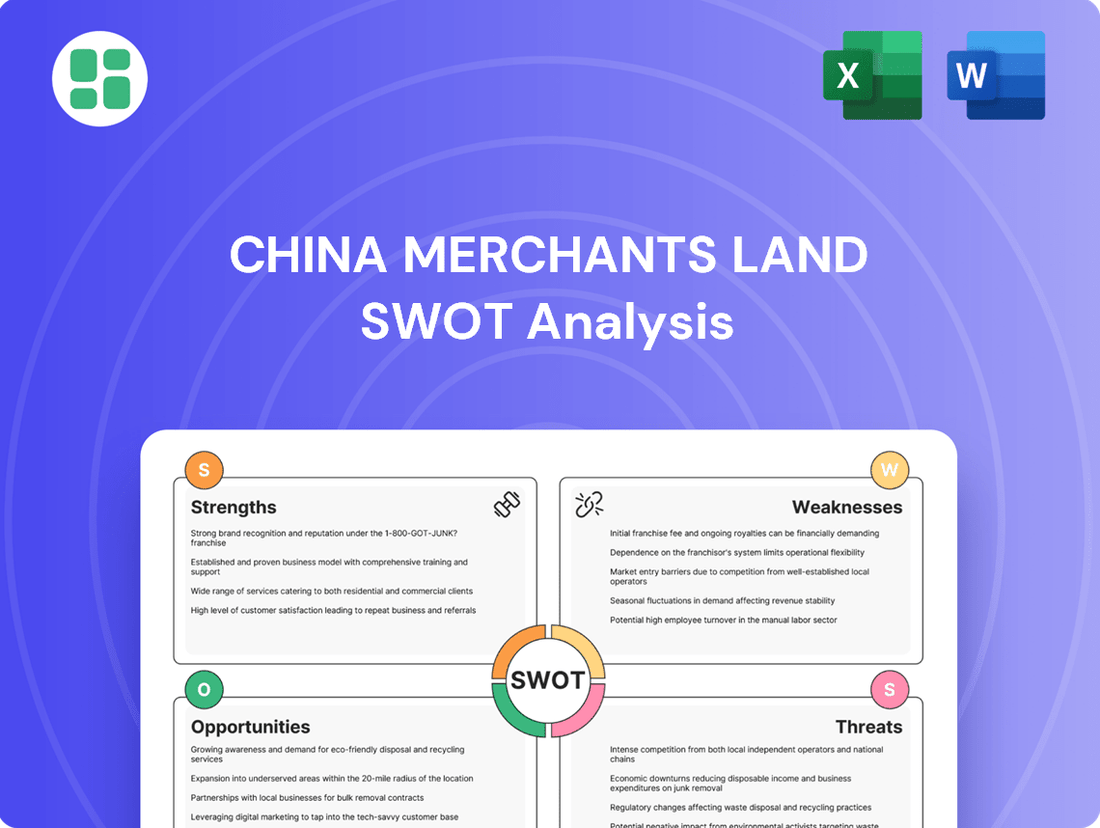

China Merchants Land SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear overview of China Merchants Land's Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the complete, in-depth analysis.

Opportunities

The Chinese government's commitment to stabilizing the property market presents a significant opportunity. Initiatives like the 'white list' mechanism, designed to ensure developers can access necessary financing, and the push for urban village renovations are expected to inject much-needed liquidity and demand into the sector.

These supportive policies, including efforts to reduce mortgage rates, are strategically aimed at stimulating domestic consumption and fostering a gradual recovery of the real estate market through 2025. For China Merchants Land, this translates to a more favorable operating environment and potential for increased sales and project development.

Major Chinese metropolises such as Shanghai and Shenzhen are exhibiting nascent signs of market stabilization. By early 2025, these Tier-1 cities are experiencing modest upticks in property values and a noticeable rise in transaction volumes for both new and existing homes.

This localized rebound, potentially bolstered by the relaxation of stringent home-buying regulations in these prime urban centers, creates strategic avenues for China Merchants Land to focus its development and sales efforts. For instance, Shanghai's residential market saw a 3% year-on-year price increase in Q1 2025, coupled with a 15% surge in transaction numbers.

The Chinese government's focus on affordable and rental housing presents a significant opportunity. Initiatives to boost subsidized housing supply and encourage renting are creating new market avenues. For instance, by mid-2024, urban affordable housing projects were projected to see substantial completion rates, directly addressing the needs of a growing population segment.

China Merchants Land can leverage this by tailoring its development plans to align with these policy objectives. This strategic alignment allows the company to tap into the demand from new urban residents and lower-income families, a demographic increasingly prioritized by the state. The company's ability to deliver cost-effective housing solutions will be key to capturing this expanding market share.

Potential for Asset-Light Business Expansion

China Merchants Land has signaled a strategic shift towards asset-light property ventures, aiming to expand beyond its traditional asset-heavy development model and without geographical limitations. This move leverages their established REIT management expertise and opens avenues for new investment vehicles.

This diversification strategy is designed to unlock new revenue streams and enhance capital efficiency, a critical advantage in today's dynamic real estate landscape. For instance, by managing third-party assets or investing in platforms that facilitate property transactions, the company can generate fees and returns without significant capital outlay.

The potential benefits are substantial:

- Diversified Revenue Streams: Moving into asset-light models can create income from management fees, service charges, and performance-based incentives, reducing reliance on development profits.

- Improved Capital Efficiency: By not owning all underlying assets, the company can deploy capital more strategically, potentially leading to higher return on equity.

- Scalability: Asset-light businesses often exhibit greater scalability, allowing for faster expansion into new markets or property types with less upfront investment.

Long-Term Urbanization and Economic Development in China

China's urbanization trend continues to be a powerful long-term driver for the real estate sector. Despite recent economic headwinds, the government's focus on sustainable growth and urban development, particularly in tier-3 and tier-4 cities, presents a consistent demand for housing and commercial spaces. For instance, by the end of 2023, China's urbanization rate reached 66.16%, indicating a continued migration to urban centers.

Strategic positioning in these emerging urban areas allows companies like China Merchants Land to capitalize on future expansion. The government's 14th Five-Year Plan (2021-2025) emphasizes coordinated regional development and new urbanization, signaling continued policy support for infrastructure and property development in these regions. This long-term perspective suggests that well-chosen projects can achieve substantial appreciation as these areas mature and economic activity increases.

Key opportunities stemming from this trend include:

- Capitalizing on new urban clusters: Investing in projects within government-designated new urban development zones and economic corridors.

- Meeting diverse housing needs: Developing a range of residential properties to cater to the evolving demands of urban migrants and existing residents.

- Leveraging infrastructure development: Aligning property investments with significant government infrastructure spending in developing cities, enhancing accessibility and value.

- Long-term rental income potential: Securing stable returns through rental properties in rapidly growing urban centers with increasing populations.

The government's proactive measures to stabilize the property market, including financing support mechanisms and urban renovation plans, are expected to boost liquidity and demand through 2025. This policy focus aims to stimulate consumption and foster a gradual market recovery, creating a more favorable operating environment for China Merchants Land.

Emerging signs of stabilization in major cities like Shanghai and Shenzhen, with modest price upticks and increased transaction volumes by early 2025, offer strategic development and sales opportunities. For instance, Shanghai's residential market saw a 3% year-on-year price increase in Q1 2025, alongside a 15% surge in transactions.

The government's emphasis on affordable and rental housing presents new market avenues, with urban affordable housing projects projected for substantial completion by mid-2024. China Merchants Land can align its development strategies with these objectives to capture demand from new urban residents and lower-income families.

China Merchants Land's strategic shift towards asset-light property ventures, leveraging REIT management expertise, opens avenues for new investment vehicles and diversified revenue streams. This approach enhances capital efficiency and scalability, allowing for faster expansion with less upfront investment.

| Opportunity Area | Key Driver | 2025 Outlook | China Merchants Land Relevance |

|---|---|---|---|

| Policy Support for Market Stabilization | Government financing initiatives ('white list'), urban renovations | Increased liquidity and demand | More favorable operating environment, potential sales growth |

| Tier-1 City Market Rebound | Relaxed home-buying regulations, increased transactions | Nascent stabilization, modest price upticks | Strategic focus for development and sales (e.g., Shanghai Q1 2025: +3% price, +15% transactions) |

| Affordable & Rental Housing Growth | Government focus on subsidized housing and renting | New market avenues, increased demand from specific demographics | Tailoring development to policy objectives, capturing new market share |

| Asset-Light Ventures | Diversification beyond traditional development, REIT expertise | New revenue streams, enhanced capital efficiency, scalability | Unlocking fee-based income, strategic capital deployment |

Threats

The Chinese property market is expected to continue its downward trend through 2025, with nationwide sales and prices likely to see further declines, though potentially at a slower pace than experienced in 2024. This ongoing market weakness presents a significant threat, potentially leading to sustained pressure on China Merchants Land's revenue generation and overall profitability.

China Merchants Land faces a significant threat from intensified market competition within the Chinese real estate sector. The market has seen a notable increase in office supply, creating an oversupply situation in specific segments.

This surge in available space, combined with existing unsold inventory, is likely to exert downward pressure on prices. Developers like China Merchants Land may find it increasingly difficult to secure new development opportunities or to effectively sell their current projects in this environment.

China Merchants Land faces significant challenges from regulatory and policy uncertainties. For instance, the Chinese government's efforts to stabilize the property market, while intended to be supportive, have led to frequent and sometimes abrupt policy shifts. These changes, such as the recent focus on completed home sales and adjustments to financing channels, create an unpredictable operating environment.

Adapting to these evolving regulations requires substantial operational flexibility and can directly affect project development schedules and the overall financial health of developments. For example, changes in financing rules can tighten liquidity, impacting construction progress and sales timelines, as seen in the broader Chinese property sector throughout 2024.

Escalating Financial Risks for Developers

The ongoing real estate sector challenges in China present a significant threat, with several developers facing acute liquidity problems and the risk of defaulting on their debts. This broader crisis, which intensified through 2023 and into early 2024, has created a more difficult financing environment for the entire industry.

While China Merchants Land's state-backed status offers some insulation, the systemic nature of these financial risks means that access to capital and overall market confidence could still be negatively affected. For instance, the aggregate debt of major Chinese developers reached trillions of yuan, highlighting the scale of the sector's financial strain.

- Liquidity Squeeze: Developers are finding it harder to secure new funding and refinance existing debt, leading to cash flow pressures.

- Market Sentiment: Negative sentiment surrounding the property market can deter investors and homebuyers, impacting sales and valuations.

- Systemic Contagion: The financial distress of one developer can have ripple effects across the sector, potentially impacting suppliers, creditors, and even other developers.

- Regulatory Scrutiny: Increased government oversight and stricter lending policies aimed at deleveraging the sector can further constrain financial flexibility.

Diminished Consumer Confidence and Domestic Demand

A prolonged slump in China's property sector has severely eroded consumer confidence. This has resulted in falling housing prices and a substantial number of incomplete construction projects, creating a significant overhang. For China Merchants Land, this translates directly into suppressed demand for new housing and lower sales volumes, directly impacting its primary revenue streams.

The lingering effects of this downturn are evident in consumer sentiment surveys. For instance, a significant portion of surveyed households in late 2024 expressed concerns about future economic prospects, directly linked to the property market's instability. This cautiousness means potential buyers are delaying or abandoning purchases, a critical threat to developers like China Merchants Land.

- Reduced Housing Demand: Lower consumer confidence directly translates to fewer potential homebuyers entering the market.

- Decreased Sales Volumes: This reduced demand inevitably leads to lower unit sales for China Merchants Land.

- Price Sensitivity: Consumers are more hesitant to commit to purchases given falling property values, increasing price sensitivity.

- Impact on New Projects: The threat extends to the viability and sales performance of new developments undertaken by the company.

The persistent downturn in China's property market, with sales and prices expected to decline through 2025, poses a significant threat to China Merchants Land's revenue. Intensified competition and an oversupply of office space are further pressuring sales and development opportunities.

Regulatory uncertainty and frequent policy shifts create an unpredictable operating environment, impacting project timelines and financial health. The broader sector's liquidity crisis and developer defaults also threaten access to capital and market confidence, despite China Merchants Land's state-backed status.

Eroded consumer confidence, marked by falling housing prices and incomplete projects, directly suppresses demand and sales volumes. This cautiousness, evident in late 2024 consumer sentiment, means potential buyers are delaying purchases, critically impacting developers.

| Threat Category | Specific Impact | Data Point (2024/2025 Projection) |

|---|---|---|

| Market Downturn | Declining sales and revenue | Nationwide property sales expected to fall 5-10% in 2025 |

| Competition & Oversupply | Pressure on pricing and sales | Office vacancy rates in major Chinese cities projected to remain above 15% in 2025 |

| Regulatory Uncertainty | Operational disruptions and financing challenges | Increased scrutiny on developer debt-to-equity ratios, potentially limiting new project financing |

| Liquidity Crisis | Reduced access to capital and market confidence | Aggregate developer debt exceeding 10 trillion yuan, increasing systemic risk |

| Consumer Confidence | Suppressed housing demand and sales volumes | Consumer confidence index for housing market projected to stay below 2023 levels |

SWOT Analysis Data Sources

This SWOT analysis for China Merchants Land is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses. These sources provide a well-rounded view of the company's performance and the broader real estate landscape.