China Merchants Land Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Merchants Land Bundle

China Merchants Land navigates a complex real estate landscape, where buyer bargaining power and the threat of substitutes significantly influence its strategic positioning. Understanding these forces is crucial for any stakeholder looking to grasp the company's competitive environment.

The complete report reveals the real forces shaping China Merchants Land’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For China Merchants Land, the most crucial input is land itself. The entities supplying this land, whether local governments conducting auctions or private owners, wield significant influence. This power is shaped by government land supply strategies, city development plans, and how intensely other developers compete for prime locations.

In 2023, China's land sales volume saw a notable decline, with the total transaction value falling by approximately 15% year-on-year, according to various real estate research firms. This trend suggests a potential softening of supplier power as demand from developers may be less aggressive, especially with ongoing government efforts to cool the property market.

Suppliers of essential construction materials like steel, cement, and glass, as well as skilled labor, hold moderate bargaining power over China Merchants Land. This power is amplified when specialized materials or in-demand skilled trades are required, allowing suppliers to dictate terms more effectively.

In 2024, China's construction sector experienced significant price volatility for key materials. For instance, rebar prices saw fluctuations, impacting project budgets. Similarly, the availability of specialized construction labor in rapidly developing urban centers like Shenzhen or Shanghai can shift leverage towards these workers, increasing labor costs for developers.

Access to capital is absolutely critical for property developers like China Merchants Land. Banks, bond markets, and various financial institutions are the primary suppliers of these essential funds. In 2024, China's real estate sector has faced significant deleveraging efforts and generally tighter financing conditions, which has amplified the bargaining power of these capital providers.

This increased leverage for lenders means they can dictate more stringent terms, impacting interest rates and repayment schedules. For China Merchants Land, securing favorable lending terms is not just beneficial; it's vital for maintaining its development pipeline and overall financial stability in this challenging market environment.

Technology and Service Providers

Technology and service providers, including those offering smart home systems, construction software, and property management platforms, wield considerable influence. The increasing demand for digitalization and sustainable building practices in China's real estate sector, as evidenced by the estimated 2024 growth in China's smart home market potentially reaching over 300 billion yuan, means specialized providers can negotiate higher fees. This directly impacts China Merchants Land's operational expenditures.

Architects, engineers, and marketing agencies are also key players. As the complexity of urban development projects grows, the need for highly skilled and innovative design and marketing solutions intensifies. For instance, the average cost for architectural design services in major Chinese cities can range significantly, with top-tier firms commanding premiums, which represents a direct cost factor for developers like China Merchants Land.

- Increased Demand for Smart Home Technology: China's smart home market is projected for substantial growth in 2024, with an estimated value exceeding 300 billion yuan, giving technology providers significant leverage.

- Specialization in Sustainable Construction: As sustainability becomes a core focus, providers of green building technologies and expertise can command higher prices, impacting development costs.

- Talent Scarcity in Specialized Services: A shortage of highly skilled architects and engineers in niche areas can lead to increased service fees for China Merchants Land.

- Marketing Agency Fees: The cost of engaging leading marketing agencies for property launches in competitive Chinese markets can be substantial, reflecting their bargaining power.

Government Regulations and Approvals

The Chinese government wields considerable power as a supplier of essential regulatory approvals, licenses, and overarching policy frameworks that dictate the real estate landscape. For China Merchants Land, this translates into a direct impact on their ability to operate and develop projects.

Changes in key areas such as urban planning directives, environmental protection standards, pre-sale regulations, and broader property market policies can significantly alter China Merchants Land's operational efficiency, project development schedules, and ultimately, their cost structures. For instance, in 2024, stricter environmental impact assessments for new developments, a trend observed across many major Chinese cities, could add an estimated 5-10% to project development costs and extend approval timelines by several months.

- Government as a Supplier: The state provides the critical licenses and policy environment necessary for property development.

- Impact of Regulatory Changes: Shifts in urban planning, environmental rules, and sales policies directly affect project timelines and expenses for developers like China Merchants Land.

- 2024 Regulatory Trends: Increased scrutiny on environmental compliance and pre-sale fund management in 2024 has led to longer approval processes and higher compliance costs for real estate firms.

- Shaping the Operating Environment: The government's influence fundamentally shapes the conditions under which all real estate developers in China must operate.

The bargaining power of suppliers for China Merchants Land is multifaceted, encompassing land, materials, capital, and specialized services. In 2024, while overall land sales volume softened, the power of suppliers in specialized construction materials and skilled labor remained significant due to price volatility and talent scarcity.

Lenders, in particular, gained leverage in 2024 due to tighter financing conditions in China's real estate sector, allowing them to impose stricter loan terms. Similarly, technology providers for smart homes and sustainable building practices saw their influence grow, driven by increasing market demand and the potential for market value to exceed 300 billion yuan in China for smart homes.

| Supplier Category | 2023/2024 Trend Impact | Bargaining Power Assessment |

|---|---|---|

| Land | Declining land sales volume (~15% YoY in 2023) | Moderate to Low (potentially increasing for prime locations) |

| Construction Materials & Labor | Price volatility, talent scarcity in urban centers | Moderate to High (for specialized items and skilled trades) |

| Capital Providers (Banks, Bond Markets) | Tighter financing conditions, deleveraging efforts | High (dictating stringent terms) |

| Technology & Service Providers (Smart Home, Sustainability) | Growing demand, market value >300 billion yuan (smart homes) | High (negotiating higher fees) |

| Government (Regulatory Approvals, Policies) | Stricter environmental assessments, policy shifts | Very High (shaping operating environment and costs) |

What is included in the product

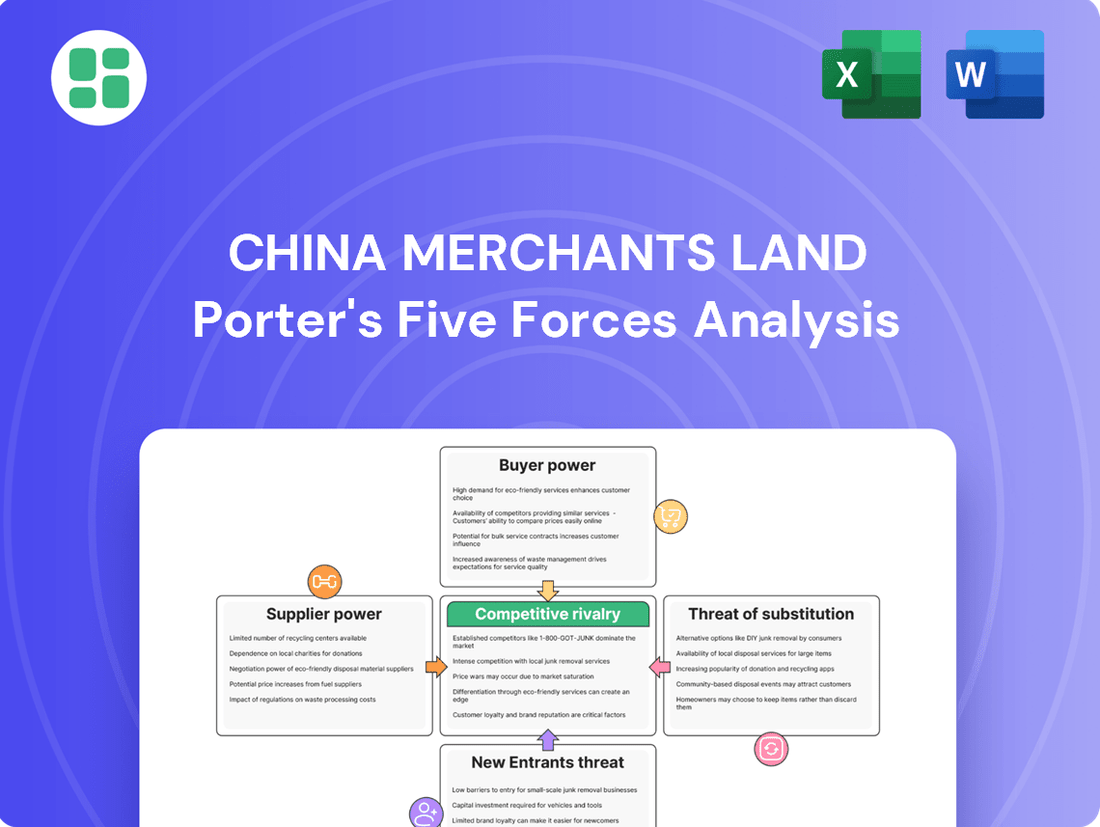

This analysis delves into the competitive forces impacting China Merchants Land, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate sector.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, allowing China Merchants Land to pinpoint and address strategic vulnerabilities.

Customers Bargaining Power

Individual homebuyers, particularly in China's lower-tier cities, wield significant bargaining power. This is largely driven by elevated housing inventory levels, which stood at 499.5 million square meters by the end of April 2024, and a generally cautious market sentiment.

While major metropolitan areas like tier-1 cities are experiencing some stabilization, the national average housing price saw a decline of 0.4% in April 2024 compared to the previous month. This overall market condition, coupled with increasing housing stock, provides buyers with ample negotiation leverage when considering purchases.

Consequently, China Merchants Land must focus on delivering competitive pricing strategies, attractive incentives, and ensuring high-quality developments to effectively capture buyer interest and secure sales in this buyer-centric market.

Commercial tenants in China, especially those looking for office and retail spaces, are finding themselves with more leverage. This is largely due to an increase in empty properties and a surge of new developments hitting the market in many major Chinese cities. For instance, by the end of 2023, office vacancy rates in tier-one cities like Beijing and Shanghai hovered around 15-20%, creating a tenant's market.

This shift means landlords are increasingly competing on price to attract and retain tenants. Consequently, China Merchants Land's property investment and leasing income is directly impacted as they must adjust rental pricing strategies to remain competitive in this tenant-empowered environment.

Large-scale property investors and institutional buyers wield significant bargaining power over China Merchants Land. These entities, often purchasing entire commercial blocks or multiple residential units, can negotiate favorable terms due to their substantial capital outlay. Their focus on attractive yields and long-term value means they are highly sensitive to market conditions and the availability of alternative investment opportunities, directly influencing bulk sales and property valuations.

Economic Uncertainty and Consumer Confidence

Broad economic uncertainty and subdued consumer confidence in China significantly enhance customer bargaining power. Consumers are more cautious with large purchases like homes, and their willingness to spend is impacted by factors such as employment stability and housing loan pressure. This directly influences sales volumes and pricing strategies for China Merchants Land.

In 2024, China's economic outlook has been marked by a degree of uncertainty, leading to a dip in consumer confidence. For instance, the Purchasing Managers' Index (PMI) for the manufacturing sector, a key indicator of economic health, hovered around the expansion-contraction threshold for much of the year. This cautious sentiment translates to a heightened sensitivity to price and value among homebuyers, forcing developers like China Merchants Land to be more competitive.

- Consumer Confidence Index: Data from the National Bureau of Statistics of China indicated a fluctuating consumer confidence index throughout 2024, reflecting concerns about future economic prospects.

- Housing Market Sensitivity: The real estate sector, a major component of China's economy, experienced a slowdown in transaction volumes, particularly for new developments, as potential buyers adopted a wait-and-see approach due to economic headwinds.

- Impact on Pricing: The increased bargaining power of customers has put downward pressure on property prices and necessitated more flexible payment terms and promotional offers from developers to stimulate sales.

Availability of Financing for Buyers

The availability of financing significantly shapes buyer bargaining power. While mortgage conditions saw some easing in early 2025 with a slight dip in interest rates, the broader accessibility and ease of obtaining home loans remain critical factors influencing customer demand. For instance, if financing becomes more restrictive or rates climb, it directly curtails individual purchasing power, compelling developers like China Merchants Land to be more accommodating with pricing or payment structures to drive sales.

This dynamic directly translates into leverage for buyers. When financing is readily available and affordable, more individuals can enter the market, increasing competition among developers for their business. Conversely, tighter credit conditions or higher borrowing costs empower existing buyers or those with readily available funds, as they face fewer alternatives and developers become more eager to close deals. In 2024, for example, while mortgage rates fluctuated, the overall trend of increasing affordability in some regions meant buyers had more options, slightly tempering their immediate bargaining power compared to periods of high rates.

- Financing Impact: Lower interest rates in early 2025 improved buyer affordability.

- Demand Sensitivity: Tighter financing or higher rates can weaken demand for developers.

- Developer Response: Developers may lower prices or offer flexible terms to boost sales.

- Market Leverage: Readily available financing generally reduces buyer bargaining power.

The bargaining power of customers for China Merchants Land is substantial, driven by high inventory and cautious consumer sentiment. In April 2024, housing inventory reached 499.5 million square meters, and national average housing prices declined by 0.4% month-on-month, creating a buyer's market. This necessitates competitive pricing and attractive incentives from developers.

| Metric | Value (End of April 2024) | Implication for Bargaining Power |

|---|---|---|

| Housing Inventory (sqm) | 499.5 million | High inventory increases buyer leverage. |

| National Avg. Housing Price Change (MoM) | -0.4% | Price decline indicates buyer power. |

| Consumer Confidence Index | Fluctuating (NBS Data) | Economic uncertainty amplifies buyer caution and negotiation strength. |

Preview the Actual Deliverable

China Merchants Land Porter's Five Forces Analysis

This preview showcases the comprehensive China Merchants Land Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape within the real estate sector. The document you see here is the exact, fully formatted analysis you will receive immediately upon purchase, ensuring no discrepancies or missing information. This detailed report is ready for your immediate use, offering valuable insights into market dynamics and strategic positioning.

Rivalry Among Competitors

The Chinese property development landscape, despite some consolidation trends, remains incredibly competitive with a vast array of developers. China Merchants Land contends with significant rivalry from both state-backed entities and private firms, vying for prime land, customer attention, and market dominance across diverse urban areas and property types.

This market fragmentation fuels a fierce battle for resources and buyers. For instance, in 2024, the total sales volume of the top 100 Chinese developers reached approximately RMB 9.7 trillion, indicating a highly concentrated top tier but still a substantial number of smaller players contributing to the overall competitive intensity.

The real estate market in China is currently experiencing intense price competition. This is largely due to falling property prices in numerous cities and the substantial amount of unsold inventory developers are holding. Consequently, companies like China Merchants Land are compelled to offer discounts and special deals to encourage buyers, which directly affects their revenue and profit margins.

China Merchants Land's own performance reflects this challenging environment. In the first half of 2025, the company reported a year-on-year decrease in contracted sales. This decline underscores the significant pressure from competitors and the broader market conditions that necessitate aggressive pricing strategies.

Competitive rivalry in China Merchants Land's market goes well beyond just pricing. Buyers are increasingly focused on a developer's brand reputation, the tangible quality of their projects, and the reliability of their after-sales service. This emphasis means that even in a tough market, developers with strong state backing and a history of successful project delivery, like China Merchants Land, benefit from a pronounced flight-to-quality trend.

China Merchants Land, with its established reputation, can indeed attract buyers. However, to maintain this advantage, the company must constantly innovate its offerings and uphold exceptionally high standards in construction and customer service. For instance, in 2023, while the overall property market faced headwinds, developers with strong brand equity, often linked to state-owned enterprises, saw relatively more stable sales volumes in key cities.

Regional and Segment Specific Competition

Competitive rivalry for China Merchants Land is a complex landscape that shifts significantly depending on the specific region and property segment. For instance, competition in China's tier-1 cities like Beijing and Shanghai, where demand is high but land is scarce, differs greatly from that in lower-tier cities that may face oversupply or slower absorption rates. This regional variation means China Merchants Land must tailor its strategies to the unique competitive pressures present in each market it operates within.

The intensity of competition also varies by property type. In the residential segment, China Merchants Land might face numerous developers vying for the same buyer pool, especially in rapidly urbanizing areas. Conversely, the commercial or industrial segments could present a different set of competitors, perhaps including specialized developers or international players, each with distinct advantages and market focuses. Understanding these segment-specific dynamics is crucial for China Merchants Land to navigate the competitive environment effectively.

Data from 2024 highlights these disparities. For example, while some tier-1 cities continued to see robust, albeit moderating, demand for prime residential properties, many lower-tier cities experienced steeper price corrections and higher inventory levels. This uneven market performance directly translates into varied competitive intensity across China Merchants Land's portfolio. The company's ability to adapt to these localized competitive pressures, such as by adjusting product offerings or pricing strategies, is key to its success.

- Regional Dynamics: Competition intensifies in tier-1 cities due to high demand and limited supply, while lower-tier cities may face greater pressure from oversupply.

- Segment Specificity: The residential market often sees broader competition than specialized commercial or industrial property segments.

- Market Performance: 2024 data indicates uneven market conditions, with tier-1 cities generally outperforming lower-tier cities, impacting competitive intensity.

- Strategic Adaptation: China Merchants Land must adjust its approach based on the unique competitive landscape of each city and property segment to maintain its market position.

Policy-Driven Market Dynamics

Government policies are a major force shaping competition in China's real estate sector. Initiatives like stimulus packages, developer financing support, and urban development plans directly impact market dynamics. For instance, in 2024, the People's Bank of China continued to adjust monetary policy, with benchmark lending rates seeing some adjustments, influencing developer borrowing costs and project feasibility.

Developers adept at aligning with national and local government priorities, such as those focused on affordable housing or urban regeneration, often secure a competitive edge. Navigating policy shifts effectively, like prioritizing land purchases in strategically designated higher-tier cities or economic development zones, allows companies to capitalize on government-backed growth opportunities.

- Policy Alignment: Developers focusing on government-supported projects, such as those in the affordable housing sector, saw increased opportunities in 2024.

- Financing Access: Government efforts to stabilize the property market included measures to ensure financing for developers with sound projects, impacting competitive access to capital.

- Urban Planning Influence: Urban planning initiatives, like the development of new economic zones, directed investment and competition towards specific geographic areas.

Competitive rivalry is a defining characteristic of China Merchants Land's operating environment. The sheer number of developers, from state-backed giants to smaller regional players, creates a constant battle for market share and resources. This intense competition is evident in the market's overall sales figures, with the top 100 developers in China collectively achieving approximately RMB 9.7 trillion in sales in 2024, underscoring a dynamic yet crowded field.

The pressure is amplified by falling property prices and significant unsold inventory, forcing developers like China Merchants Land into aggressive pricing strategies. This is reflected in China Merchants Land's own reported decline in contracted sales for the first half of 2025, a direct consequence of this competitive pricing environment and broader market headwinds.

Beyond price, brand reputation and project quality are critical differentiators. While China Merchants Land benefits from its established name, particularly in tier-1 cities where demand remains strong despite limited supply, maintaining this edge requires continuous innovation and high standards. In 2023, developers with strong state backing and proven track records, such as China Merchants Land, experienced relatively more stable sales volumes compared to their less established counterparts.

The competitive landscape is further segmented by region and property type. Tier-1 cities present different challenges than lower-tier cities grappling with oversupply, and the residential market's competition differs from that in commercial or industrial segments. China Merchants Land must therefore adopt nuanced strategies tailored to each specific market context to effectively navigate the intense rivalry.

SSubstitutes Threaten

The growing rental market presents a significant threat of substitution for property ownership. In 2024, major Chinese cities continued to see expansion in their rental sectors, offering viable alternatives to buying. This trend is particularly pronounced among younger demographics who may find the high cost of homeownership prohibitive.

Economic uncertainties and fluctuating property prices in 2024 encouraged more individuals to consider renting. This shift is fueled by the increasing professionalization of the rental market, with more institutional players entering the space, providing greater choice and stability for renters. For instance, the rental yield in some prime urban areas remained competitive, making renting an attractive financial proposition.

For investors, real estate is just one piece of a much larger investment pie. They can easily shift their capital towards alternatives like stocks, bonds, or mutual funds if those avenues offer more attractive returns or lower perceived risk. For instance, in early 2024, the S&P 500 saw significant gains, potentially drawing investor attention away from real estate.

Direct investments in other industries, from technology startups to renewable energy projects, also represent viable substitutes. If China Merchants Land's development projects are seen as less promising or more volatile than opportunities in these other sectors, investors might choose to allocate their funds elsewhere, directly impacting the demand for its properties.

The vast inventory of existing homes, especially in the resale market, presents a significant substitute for new housing developments. As of early 2024, many Chinese cities have seen a downward trend in secondhand property prices, making these existing units a more appealing financial option for potential buyers. This can directly dampen demand for new construction projects undertaken by developers like China Merchants Land.

Government-Provided Affordable Housing

Government-provided affordable housing acts as a significant substitute for commercial residential properties, particularly for lower and middle-income households. These initiatives directly address housing needs, potentially siphoning demand away from private developers such as China Merchants Land.

China's commitment to expanding affordable housing is substantial. By the end of 2023, the country had delivered over 6.7 million units of affordable rental housing. This aggressive expansion directly competes with the market segment targeted by private developers.

- Government Expansion: China's pledge to build 6.7 million affordable rental housing units by the end of 2023 directly impacts the demand for market-rate housing.

- Targeted Segments: These government programs specifically cater to lower and middle-income groups, which are also key customer bases for many private developers.

- Demand Diversion: The availability of subsidized or publicly managed housing can reduce the overall demand for privately developed residential properties, thereby increasing the threat of substitutes for companies like China Merchants Land.

Shifting Lifestyles and Preferences

Evolving consumer lifestyles are a significant threat of substitutes for China Merchants Land. For instance, a growing preference for smaller, more efficient urban living spaces, often driven by affordability and convenience, could reduce demand for the company's traditional larger-scale property developments. This trend was evident in 2024 with reports indicating a rise in demand for micro-apartments in major Chinese cities, a segment that might not align with China Merchants Land's core offerings.

Furthermore, a discernible shift towards suburban and even rural areas, fueled by factors like remote work adoption and a desire for more affordable housing or a different quality of life, also presents a substitute threat. If a substantial portion of the market moves away from dense urban centers where China Merchants Land has historically focused its developments, demand for its existing product lines could decline. The company must therefore remain agile in adapting its portfolio to these changing preferences to maintain its competitive edge in the evolving property market.

- Changing Housing Preferences: A notable trend in 2024 saw a segment of younger Chinese consumers expressing increased interest in compact, well-designed urban living solutions, potentially bypassing larger, traditional apartment units.

- Urban-to-Suburban Migration: While specific 2024 data is still emerging, early indicators suggest a continued, albeit nuanced, interest in suburban and exurban living for families seeking more space and potentially lower costs, posing a substitute to dense urban projects.

- Adaptability is Key: China Merchants Land's ability to pivot its development strategies to include diverse housing typologies, from efficient urban units to well-planned suburban communities, will be crucial in mitigating the threat of substitutes driven by lifestyle shifts.

The threat of substitutes for China Merchants Land is multi-faceted, encompassing rental markets, alternative investments, existing housing stock, government initiatives, and evolving consumer preferences. The increasing appeal of renting, driven by affordability and professionalization, offers a direct alternative to property ownership. Furthermore, investors can easily divert capital to other asset classes like stocks or bonds if they offer better risk-adjusted returns, as seen with the S&P 500's performance in early 2024.

| Substitute Category | Description | Impact on China Merchants Land | 2024 Relevance/Data Point |

|---|---|---|---|

| Rental Market | Growing availability and quality of rental properties. | Reduces demand for new home purchases. | Expansion of rental markets in major Chinese cities. |

| Alternative Investments | Stocks, bonds, mutual funds, direct industry investments. | Capital reallocation away from real estate. | S&P 500 gains in early 2024 potentially diverting investor capital. |

| Existing Housing Stock | Resale market properties. | Offers a cheaper alternative to new builds. | Downward price trends in secondhand properties in many Chinese cities. |

| Government Affordable Housing | Subsidized or publicly managed housing. | Direct competition for lower to middle-income segments. | China's delivery of over 6.7 million affordable rental units by end of 2023. |

| Evolving Consumer Lifestyles | Preference for smaller urban units or suburban/rural living. | Decreased demand for traditional, larger developments. | Rise in demand for micro-apartments in major Chinese cities. |

Entrants Threaten

The property development sector, particularly for large-scale players like China Merchants Land, presents a significant hurdle due to extremely high capital requirements. Acquiring prime land, funding extensive construction projects, and managing robust marketing campaigns demand billions in investment. For instance, in 2024, major urban land auctions in China saw prices escalate, with some prime plots exceeding RMB 10 billion, making it difficult for smaller entities to even enter the bidding process.

Government regulations and licensing present a substantial barrier to entry in China's real estate sector. The Chinese government imposes rigorous licensing, approval, and policy compliance requirements, making it difficult for newcomers to establish a foothold. For instance, in 2023, the Ministry of Housing and Urban-Rural Development continued to emphasize stricter oversight on land acquisition and project development, adding layers of complexity and cost that deter potential new players.

Established developers, including China Merchants Land, often benefit from preferential access to prime land through established government relationships and robust banking ties. This can be seen in the land auction market where larger, well-capitalized firms frequently secure key plots. For instance, in 2023, major state-backed developers secured a significant portion of land sales in top-tier Chinese cities.

New entrants face considerable hurdles in acquiring desirable land banks and securing essential financing, especially within a more constrained credit environment. The cost of land acquisition and the stringent requirements for project financing can be prohibitive, limiting the ability of smaller or newer companies to compete effectively against incumbents with established capital access.

Brand Recognition and Trust

In China's real estate sector, where buyer confidence can be fragile, brand recognition and trust are critical differentiators. China Merchants Land, with its long-standing presence and history of successful project completions, has cultivated a strong reputation. This established credibility makes it significantly harder for new entrants to quickly gain market traction and secure customer loyalty.

New developers face substantial hurdles in building the trust necessary to attract buyers, especially in a market that has seen past instances of project delays or quality concerns. For example, in 2024, the market continued to grapple with the fallout from earlier developer defaults, emphasizing the importance of buyer assurance. China Merchants Land's established brand acts as a significant barrier, as consumers are more likely to commit to developers they perceive as stable and reliable.

- Established Reputation: China Merchants Land benefits from decades of development experience, fostering buyer confidence.

- Track Record of Delivery: Consistent project completion reinforces the company's reliability.

- Market Trust: In 2024, buyer sentiment remained cautious, favoring developers with proven stability.

- Barrier to Entry: New entrants struggle to replicate the brand equity and trust built over time by established players.

Market Saturation and Existing Oversupply

The Chinese real estate market, particularly in lower-tier cities, is grappling with significant oversupply and elevated inventory levels. For instance, by the end of 2023, the total housing inventory in many provincial capitals remained high, with some cities seeing months of supply well above the healthy benchmark of 12-18 months.

This market saturation presents a formidable barrier for new entrants. To gain traction, newcomers would likely need to engage in aggressive price competition, which can erode profit margins and deter investment. Such a scenario effectively raises the cost and risk associated with entering the market.

- Market Saturation: Many segments of the Chinese real estate market, especially in lower-tier cities, are facing oversupply and high inventory levels.

- Price Competition: This saturated market makes it challenging for new entrants to find profitable niches without engaging in aggressive price competition.

- Entry Barriers: Aggressive price competition further increases the barrier to successful entry for new real estate developers.

The threat of new entrants for China Merchants Land is significantly mitigated by the immense capital required for land acquisition and development, with prime urban land in 2024 often exceeding RMB 10 billion. Stringent government regulations and licensing further complicate market entry, as seen with the Ministry of Housing and Urban-Rural Development's continued emphasis on stricter oversight in 2023. Established developers also leverage preferential access to prime land and financing, a trend evident in 2023 where state-backed firms secured substantial land deals.

| Barrier Type | Description | Impact on New Entrants | 2024/2023 Data Point |

|---|---|---|---|

| Capital Requirements | High costs for land, construction, and marketing. | Prohibitive for smaller players. | Prime urban land auctions exceeding RMB 10 billion. |

| Government Regulations | Rigorous licensing, approvals, and policy compliance. | Increases complexity and cost. | Continued stricter oversight on land acquisition and development (2023). |

| Access to Prime Land | Preferential access for established developers via relationships. | Limits availability for newcomers. | Major state-backed developers securing significant land sales in top-tier cities (2023). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Merchants Land is built upon a foundation of comprehensive data, including official company filings, extensive industry research reports from reputable firms, and relevant macroeconomic indicators. This blend ensures a robust understanding of the competitive landscape.