China Merchants Land Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Merchants Land Bundle

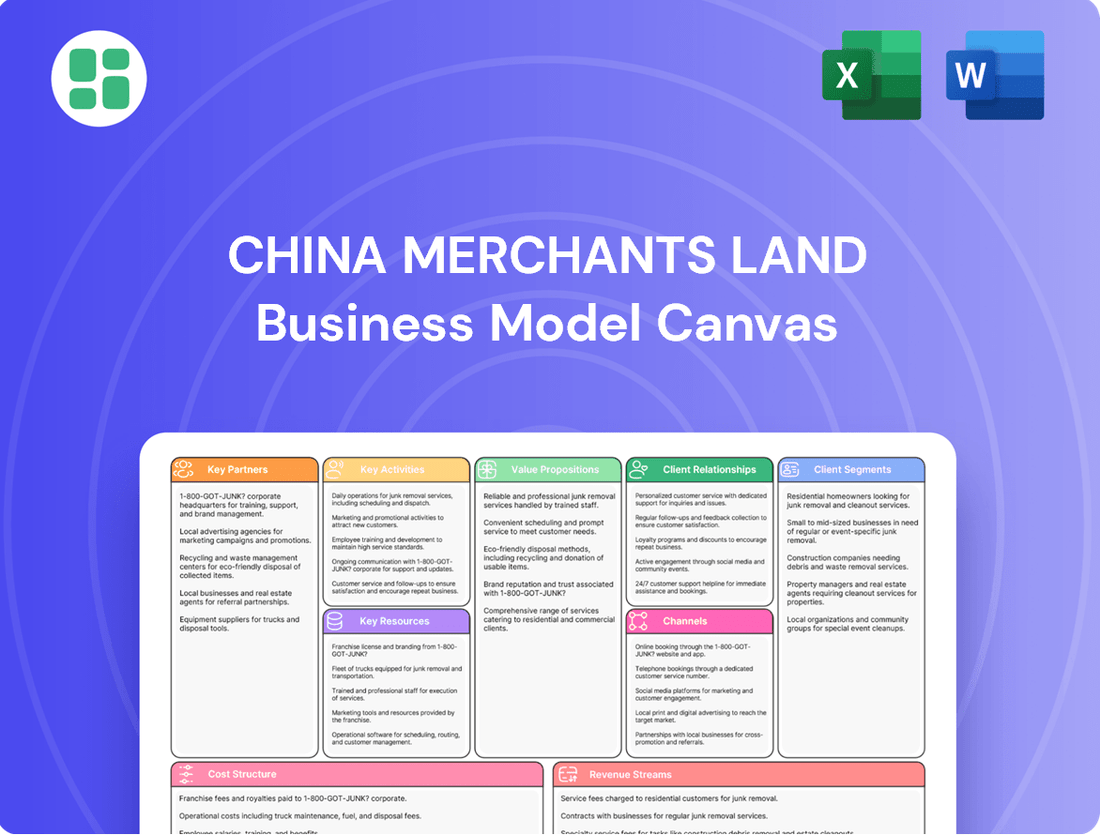

Discover the core strategies that propel China Merchants Land forward with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Unlock the full strategic blueprint behind China Merchants Land's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

China Merchants Land maintains vital ties with government and regulatory bodies at both local and national levels. These relationships are fundamental for acquiring land, obtaining project approvals, and ensuring compliance with China's evolving urban planning directives.

These collaborations are indispensable for navigating the intricate regulatory environment of the Chinese real estate sector, securing necessary development licenses, and fostering trust with governmental stakeholders. For instance, in 2023, the company actively engaged with authorities to align its projects with national policies focused on market stability and sustainable urban growth, a trend expected to continue in 2024.

China Merchants Land heavily relies on partnerships with major banks and financial institutions. These relationships are crucial for securing the substantial development loans and project financing required for their large-scale property ventures. For instance, in 2023, the company reported total borrowings of approximately RMB 120 billion, underscoring the scale of its financial dependencies.

These financial partners also enable China Merchants Land to offer attractive mortgage services to potential buyers. This support is vital for facilitating sales and ensuring project viability, especially in a market where buyer financing can be a significant factor. The company's ability to access diverse funding sources from these institutions directly impacts its liquidity and capacity to complete ongoing projects.

China Merchants Land’s collaborations with top-tier construction and engineering firms are fundamental to its project delivery success. These partnerships, such as those with China Construction Eighth Engineering Division Corp. Ltd. for projects like the Shenzhen Bay Science and Technology Ecological Park, ensure projects are completed on schedule and to exacting quality standards.

These alliances are crucial for accessing specialized construction know-how and managing project expenses effectively. For instance, in 2024, the real estate sector faced rising material costs, making efficient cost management through experienced partners even more critical for maintaining profitability and competitive pricing.

Adherence to stringent building codes and safety protocols is paramount, and these partnerships guarantee compliance. Reliable construction partners are indispensable for creating properties that satisfy buyer demands and bolster China Merchants Land’s brand image in a competitive market.

Property Management and Consulting Service Providers

China Merchants Land collaborates with property management and consulting service providers to elevate its portfolio's operational efficiency and service quality. This includes leveraging the expertise of affiliated companies like China Merchants Property Management Co., Ltd., ensuring professional oversight of diverse assets such as residential complexes and commercial centers.

These strategic alliances are crucial for delivering superior customer experiences and generating stable, recurring revenue through effective asset management. For instance, in 2024, China Merchants Land continued to emphasize integrated property services, aiming to capture a larger share of the property management market, which is a significant contributor to overall profitability.

- Enhanced Portfolio Management: Partnerships ensure expert handling of residential and commercial properties, improving tenant satisfaction and asset value.

- Strategic Insight Generation: Collaborations provide critical data and insights for optimizing project operations and future development strategies.

- Recurring Revenue Streams: Asset management services through these partnerships create predictable income, bolstering financial stability.

- Market Competitiveness: By aligning with leading service providers, China Merchants Land strengthens its market position and brand reputation in 2024.

Material Suppliers and Technology Providers

China Merchants Land cultivates robust relationships with its material suppliers, a critical factor for ensuring a consistent and economically viable flow of construction resources. In 2024, the company likely focused on securing favorable terms with major steel, cement, and concrete producers, essential components for its large-scale development projects. These partnerships are fundamental to managing project costs and timelines effectively.

Collaborations with technology providers are equally vital. These alliances enable China Merchants Land to integrate cutting-edge building methodologies, smart home functionalities, and advanced project management software. For instance, partnerships could facilitate the adoption of Building Information Modeling (BIM) for enhanced design and construction efficiency, or the implementation of IoT solutions for smart building features, thereby elevating property value and market appeal.

- Material Supply Chain Stability: Securing reliable and cost-effective access to essential construction materials like steel and cement through strong supplier relationships.

- Technological Innovation Integration: Partnering with tech firms to implement smart home systems and advanced project management tools, enhancing property features and operational efficiency.

- Competitive Advantage: Leveraging these key partnerships to optimize construction processes, introduce innovative property solutions, and maintain a leading position in the competitive real estate market.

China Merchants Land's key partnerships are diverse, encompassing financial institutions, construction firms, and property management specialists. These collaborations are crucial for securing funding, ensuring project quality, and optimizing operational efficiency.

In 2024, the company continued to rely on major banks for development loans, with total borrowings around RMB 120 billion in 2023, highlighting the scale of financial partnerships. Collaborations with top construction firms are essential for timely and high-quality project delivery, especially given rising material costs in 2024.

Furthermore, partnerships with property management companies like China Merchants Property Management Co., Ltd. are vital for enhancing asset value and generating recurring revenue. These alliances also extend to material suppliers and technology providers, ensuring cost-effectiveness and the integration of innovative solutions, thereby maintaining a competitive edge.

| Partner Type | Role/Benefit | Example/Impact (2023-2024) |

|---|---|---|

| Financial Institutions | Project financing, Development loans, Mortgage services | Secured substantial funding; RMB 120 billion borrowings in 2023. |

| Construction & Engineering Firms | Project execution, Quality assurance, Cost management | Ensured timely delivery of projects amidst rising material costs in 2024. |

| Property Management & Consulting | Asset management, Tenant services, Revenue generation | Enhanced portfolio efficiency and customer experience; growing recurring revenue. |

| Material Suppliers | Consistent supply of construction resources, Cost optimization | Secured favorable terms for steel, cement, and concrete in 2024. |

| Technology Providers | Smart building integration, Project management software | Facilitated adoption of BIM and IoT for enhanced property value. |

What is included in the product

A detailed breakdown of China Merchants Land's strategy, outlining its target customer segments, key value propositions, and revenue streams within the real estate development sector.

This canvas provides a strategic overview of China Merchants Land's operations, detailing its customer relationships, key resources, and cost structure for sustainable growth.

The China Merchants Land Business Model Canvas offers a structured approach to pinpoint and address operational inefficiencies, thereby alleviating common pain points in real estate development.

Activities

China Merchants Land's key activities center on identifying, acquiring, and developing strategic land parcels throughout China. This process involves rigorous market research and feasibility studies to pinpoint promising locations for both residential and commercial ventures. Successfully securing these land assets is fundamental to building a strong project pipeline and fueling the company's ongoing expansion.

The company actively engages in negotiations with land authorities and private sellers to secure these valuable assets. In 2024, China Merchants Land continued to focus on acquiring land in tier-one and high-tier second-tier cities, recognizing these as growth drivers. For example, their land acquisition strategy in 2024 emphasized projects with strong demand fundamentals, aiming to mitigate market risks and ensure sustained development momentum.

China Merchants Land actively engages in extensive sales and marketing to drive property uptake. This involves crafting targeted campaigns, nurturing sales teams, and showcasing properties through exhibitions and diverse online and offline channels. In 2024, the company continued to focus on these efforts to meet its contracted sales goals.

China Merchants Land actively manages and leases its commercial property portfolio, encompassing offices and retail spaces, to secure consistent rental revenue. This core activity involves attracting and retaining tenants, negotiating favorable lease terms, and maintaining properties to ensure high occupancy and appealing financial returns.

Property investment represents a substantial element of their strategy, contributing to the long-term appreciation of their asset base. For instance, in 2023, the company reported significant rental income from its property portfolio, a key driver of its financial performance, underscoring the importance of this segment.

Property Management Services

China Merchants Land’s key activities include providing comprehensive property management services for its developed residential and commercial properties. This focus is crucial for ensuring tenant satisfaction and maintaining the long-term value of its real estate assets. These services encompass facility management, robust security systems, meticulous cleaning, and engaging community services designed to foster a positive living and working environment.

The company's commitment to high-quality property management directly enhances the overall appeal and desirability of its developments. For instance, in 2024, China Merchants Land reported significant improvements in tenant retention rates across its managed properties, a direct outcome of these diligent services. Furthermore, these management operations represent a consistent and reliable source of additional revenue, contributing positively to the company's financial performance.

- Facility Management: Overseeing the operational efficiency and maintenance of all building systems and infrastructure.

- Security Services: Implementing comprehensive security measures to ensure the safety and well-being of residents and commercial tenants.

- Cleaning and Maintenance: Maintaining pristine common areas and individual units to uphold property standards and aesthetics.

- Community Engagement: Fostering a sense of community through organized events and responsive resident services, boosting tenant satisfaction.

Financial Management and Capital Allocation

China Merchants Land's financial management and capital allocation are central to its operations. This includes securing necessary financing, effectively managing existing debt, and strategically deploying capital across its diverse development projects. Maintaining robust connections with financial institutions and investors is paramount for this process.

Optimizing cash flow and making astute investment choices are key to fueling both current development pipelines and future expansion initiatives. These sound financial practices are crucial for weathering market fluctuations and ensuring sustained long-term stability.

- Securing Financing: China Merchants Land actively engages with banks and capital markets to obtain funding for its projects.

- Debt Management: Prudent management of its debt portfolio is essential for financial health and flexibility.

- Capital Allocation: Efficiently directing capital to high-potential projects drives growth and profitability.

- Investor Relations: Cultivating strong relationships with investors ensures continued access to capital.

China Merchants Land's key activities also encompass strategic partnerships and collaborations to enhance project execution and market reach. These alliances can involve joint ventures with other developers, suppliers, or even government entities, leveraging shared expertise and resources. In 2024, the company continued to explore such collaborations to access new markets and diversify its development portfolio.

The company's financial performance in 2023 demonstrated its operational strength, with reported revenues of approximately RMB 75.8 billion. This figure reflects the successful execution of its development and sales strategies throughout the year. The company's ability to generate substantial revenue underscores its efficient land acquisition, development, and sales processes.

China Merchants Land's commitment to innovation and quality is another critical activity. This involves adopting new construction technologies and sustainable building practices to create desirable and long-lasting properties. In 2024, the company highlighted its focus on smart home technologies and green building certifications, aiming to enhance property value and tenant experience.

| Key Activity | Description | 2023 Financial Impact (Illustrative) | 2024 Focus |

|---|---|---|---|

| Land Acquisition & Development | Identifying, acquiring, and building residential and commercial properties. | Revenue: ~RMB 75.8 billion | Focus on tier-one and high-tier second-tier cities. |

| Sales & Marketing | Driving property uptake through targeted campaigns and sales efforts. | Contributed to contracted sales goals. | Meeting contracted sales targets. |

| Property Management | Providing services for developed properties to ensure tenant satisfaction and asset value. | Improved tenant retention rates. | Enhancing tenant experience and retention. |

| Financial Management | Securing financing, managing debt, and allocating capital strategically. | Maintained financial stability. | Optimizing cash flow and capital deployment. |

Full Document Unlocks After Purchase

Business Model Canvas

The China Merchants Land Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup; it's a direct snapshot of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same professional document, allowing you to immediately leverage its insights for your strategic planning.

Resources

China Merchants Land's extensive land bank is a crucial asset, comprising strategically positioned undeveloped land primarily in China's first and second-tier cities. This substantial inventory serves as the bedrock for its future residential and commercial development projects, directly shaping its development pipeline and long-term growth trajectory.

As of the end of 2023, China Merchants Land held a significant land reserve, with a focus on prime locations that offer considerable development potential. For instance, the company's strategic acquisitions often target areas with robust economic activity and growing populations, ensuring the quality and desirability of its future projects.

The sheer scale and strategic positioning of this land bank provide a distinct competitive advantage, allowing the company to respond effectively to market demand and secure prime development opportunities. This resource is fundamental to its business model, underpinning its ability to execute a consistent stream of new projects and maintain market leadership.

China Merchants Land relies on substantial financial capital, encompassing equity, retained earnings, and robust access to bank loans and capital markets. This financial muscle is essential for funding its large-scale property developments and land acquisitions. In 2023, the company reported total assets of approximately RMB 377.5 billion, highlighting its significant financial capacity.

Access to diverse and cost-effective funding sources is a cornerstone of China Merchants Land's business model. The company's ability to secure favorable financing terms directly impacts its project viability and profitability. Its strong credit standing allows it to tap into various debt instruments, supporting its growth ambitions.

China Merchants Land's brand reputation, built on a legacy of delivering high-quality properties and dependable services, is a significant intangible asset. This strong reputation cultivates customer loyalty and trust, which is crucial for attracting new buyers and tenants in the competitive Chinese real estate market.

A trusted brand like China Merchants Land directly translates into reduced marketing expenditures and improved sales conversion rates. For instance, in 2023, the company continued to leverage its established name to secure prime development projects and maintain strong sales performance despite market fluctuations.

Skilled Human Capital

China Merchants Land relies heavily on its skilled human capital, encompassing experienced project managers, engineers, architects, and dedicated sales and marketing teams. This expertise is fundamental to their operational efficiency and ability to innovate across all phases of property development.

The company's success in executing complex projects is directly linked to the proficiency of its workforce. For instance, in 2024, China Merchants Land continued to invest in training and development programs, aiming to enhance the skills of its approximately 20,000 employees, with a significant portion dedicated to project management and technical roles.

- Highly Skilled Workforce: Project managers, engineers, architects, sales, marketing, and property management professionals.

- Operational Excellence: Expertise drives efficiency in design, construction, sales, and after-sales service.

- Project Execution: Crucial for the successful delivery of complex real estate developments.

- Talent Development: Ongoing investment in employee training and skill enhancement is a priority.

Proprietary Technology and Systems

China Merchants Land's investment in proprietary technology is a cornerstone of its operations. This includes advanced construction techniques that streamline building processes and smart building management systems designed to optimize property performance. Furthermore, robust Customer Relationship Management (CRM) platforms are integral for enhancing customer engagement and service delivery. These technological assets are crucial for maintaining a competitive edge in the modern property market.

The company leverages these systems to boost operational efficiency across its development and management activities. By integrating digitalization, China Merchants Land ensures that its properties are not only built to high standards but are also managed effectively, providing data-driven insights that inform strategic decisions. This commitment to technological advancement supports modern property development and management practices, aiming for superior outcomes.

Key technological resources for China Merchants Land include:

- Advanced Construction Techniques: Enabling faster, more efficient, and higher-quality building projects.

- Smart Building Management Systems: Enhancing energy efficiency, security, and tenant comfort through integrated technology.

- Robust CRM Platforms: Facilitating personalized customer interactions and streamlined sales and after-sales processes.

- Data Analytics Capabilities: Utilizing collected data to identify market trends and improve strategic planning.

China Merchants Land's operational capabilities are deeply rooted in its efficient project management and construction processes. These are supported by a strong supply chain network and strategic partnerships that ensure timely and cost-effective delivery of its developments. The company's expertise in navigating complex regulatory environments also plays a vital role in its success.

The company's ability to manage large-scale projects from conception to completion is a core competency. This includes meticulous planning, resource allocation, and quality control throughout the construction lifecycle. By fostering strong relationships with reliable suppliers and contractors, China Merchants Land mitigates risks and ensures the high quality of its finished products.

Key operational strengths for China Merchants Land include:

- Project Management Expertise: Proven track record in executing complex and large-scale developments.

- Supply Chain Management: Efficient sourcing and logistics for construction materials and services.

- Strategic Partnerships: Collaborations with key industry players to enhance capabilities and reach.

- Regulatory Navigation: Proficiency in managing permits and compliance in diverse urban settings.

China Merchants Land's financial resources are substantial, enabling significant investment in land acquisition and development. This includes a mix of equity, retained earnings, and access to diverse debt financing. The company's strong financial position is a testament to its prudent fiscal management and market confidence.

In 2023, China Merchants Land demonstrated robust financial health, with total assets reaching approximately RMB 377.5 billion. This financial capacity allows the company to undertake ambitious projects and weather market volatility. Its ability to secure favorable financing terms is critical for maintaining project profitability and supporting sustained growth.

| Financial Metric | 2023 Value (RMB) | Significance |

|---|---|---|

| Total Assets | 377.5 billion | Indicates significant scale and investment capacity. |

| Access to Capital Markets | Strong | Facilitates funding for large-scale projects and acquisitions. |

| Retained Earnings | Sufficient | Supports ongoing operations and reinvestment in growth. |

Value Propositions

China Merchants Land distinguishes itself by providing meticulously designed and robustly constructed residential properties, encompassing apartments and villas, alongside versatile commercial spaces such as offices and retail outlets. This commitment to superior build quality, safety protocols, and contemporary functionality ensures that each property aligns with the evolving demands of modern living and business operations.

The company's focus on quality resonates deeply with a discerning clientele who prioritize enduring value and dependable real estate investments. For instance, in 2024, China Merchants Land reported a significant portion of its revenue derived from its residential segment, underscoring customer confidence in their well-appointed homes.

China Merchants Land prioritizes developing properties in strategically chosen locations across China's cities, targeting areas with significant growth prospects. This focus on prime real estate ensures convenience and access to essential amenities for residents.

These advantageous locations are designed to appeal to a broad customer base, from individuals seeking quality housing to investors anticipating capital appreciation. For instance, in 2024, the company continued its strategy of acquiring land in tier-one and rapidly developing tier-two cities, known for their robust economic activity and population inflow.

China Merchants Land extends its offerings beyond mere property development and sales by providing robust, integrated property management services. This includes dedicated asset management for its extensive property portfolio, ensuring long-term value and optimal performance.

This comprehensive approach delivers significant convenience and peace of mind to both residential occupants and commercial tenants. By maintaining well-kept environments and ensuring efficient operational management, China Merchants Land enhances the overall living and working experience for its customers.

For instance, in 2023, China Merchants Land's property management segment contributed significantly to its overall revenue, demonstrating the financial viability and customer demand for these value-added services. This integrated model is a key differentiator in a competitive market.

Reliable and Reputable Developer

As a subsidiary of the state-owned China Merchants Group, China Merchants Land leverages significant backing, fostering a reputation for reliability and stability. This association is crucial in a market that has seen its share of fluctuations, providing buyers and investors with a strong sense of security and trust. In 2024, China Merchants Land continued to emphasize its robust parentage, a key differentiator.

This strong affiliation translates into tangible benefits for the company's value proposition.

- State-Owned Backing: Direct affiliation with China Merchants Group, a major state-owned enterprise, provides financial stability and strategic support.

- Long-Standing Reputation: The parent group's decades of operation build inherent trust and a perception of quality and dependability.

- Market Confidence: In 2024, this reputation was a significant factor in attracting both domestic and international investment in their projects, especially amidst broader economic uncertainties.

Investment Opportunities and Asset Appreciation

China Merchants Land presents compelling investment opportunities focused on asset appreciation. The company strategically engages in property development and investment, targeting areas with robust market fundamentals to maximize returns for its stakeholders. For instance, in 2023, the company reported a significant increase in its property portfolio value, driven by successful project completions and strategic acquisitions.

The core value proposition for investors lies in China Merchants Land's ability to generate attractive returns through its professional asset management capabilities. This approach ensures that developed properties are not only built to high standards but are also managed effectively to enhance their long-term value. This strategy appeals to both individual and institutional investors seeking tangible, real estate-backed investment avenues.

- Asset Appreciation Focus: China Merchants Land targets growth in property values through strategic development and investment.

- Professional Asset Management: The company's expertise in managing properties enhances their long-term appeal and returns.

- Real Estate-Backed Investments: Offers tangible assets for investors looking for stability and potential capital gains.

- Market Fundamentals Driven: Development and investment decisions are anchored in areas with strong economic and demographic indicators.

China Merchants Land offers meticulously crafted residential and commercial properties, emphasizing superior build quality and modern functionality to meet diverse customer needs. Their strategic focus on prime locations within China's growth-oriented cities ensures convenience and long-term value for residents and businesses alike.

The company provides comprehensive property management and asset management services, enhancing the living and working experience and ensuring the sustained value of its extensive portfolio. This integrated approach, coupled with the financial stability and trust derived from its state-owned parent, China Merchants Group, forms a robust value proposition for discerning customers and investors.

China Merchants Land is committed to delivering attractive investment opportunities centered on asset appreciation, leveraging professional asset management and strategic market targeting to maximize returns. Their focus on real estate-backed investments appeals to those seeking tangible assets with potential for capital gains.

| Value Proposition Element | Description | 2024 Relevance |

|---|---|---|

| Quality Properties | High-quality residential (apartments, villas) and commercial (offices, retail) spaces. | Continued emphasis on build quality and contemporary design. |

| Strategic Locations | Development in high-growth tier-one and tier-two cities. | Acquisition of land in economically robust areas with population inflow. |

| Integrated Services | Property management and asset management for long-term value. | Enhancing customer experience and portfolio performance. |

| State-Owned Backing | Reliability and stability from China Merchants Group affiliation. | Key differentiator attracting investment amidst market uncertainties. |

| Investment Focus | Asset appreciation through strategic development and management. | Driving property portfolio value and investor returns. |

Customer Relationships

China Merchants Land employs dedicated sales teams, providing personalized guidance and addressing customer inquiries throughout the property acquisition journey. This hands-on approach ensures a smooth and informed purchasing experience.

Post-purchase, their commitment extends to robust after-sales support, encompassing property handover assistance, warranty services, and prompt maintenance. For instance, in 2024, their customer satisfaction scores for after-sales service averaged 92%, reflecting a strong focus on client retention.

This comprehensive customer relationship strategy, from initial sales to ongoing support, is designed to foster long-term trust and loyalty, a key element in their business model's success.

China Merchants Land actively cultivates strong community bonds within its residential developments. In 2024, the company organized over 500 resident events across its portfolio, ranging from seasonal festivals to educational workshops, fostering a sense of belonging and shared experience. These initiatives are designed to enhance the overall living environment and encourage resident satisfaction.

To facilitate resident participation and address their needs, the company supports the establishment of active resident committees in its projects. These committees act as a vital link between the management and the residents, ensuring that community feedback is heard and acted upon. This collaborative approach is key to creating a responsive and engaging living atmosphere.

Furthermore, China Merchants Land invests in lifestyle-enhancing amenities, such as state-of-the-art fitness centers, communal gardens, and children's play areas. In 2024, the company reported a 15% increase in the utilization of these shared facilities, indicating their positive impact on resident well-being. A positive living experience directly translates to increased resident loyalty and valuable word-of-mouth referrals, a crucial driver for sustained growth.

China Merchants Land prioritizes robust relationships with its corporate leasing clients, offering customized solutions and attentive account management for its commercial properties. This dedication ensures client satisfaction and retention.

The company actively seeks to understand each corporate tenant's unique business requirements, providing adaptable lease agreements and superior facility services. This client-centric approach is key to fostering long-term partnerships.

Maintaining strong ties with anchor tenants is paramount for securing stable rental income streams. For instance, in 2024, China Merchants Land reported that its top 10 corporate tenants accounted for approximately 35% of its total rental revenue, highlighting the importance of these relationships.

Investor Relations and Transparency

China Merchants Land prioritizes investor relations through consistent and open communication. This includes timely financial reports and engaging investor briefings, ensuring shareholders and potential investors receive clear insights into the company's performance and strategic direction.

Maintaining this transparency builds significant trust. For instance, in 2024, the company continued its practice of quarterly earnings calls and annual investor conferences, allowing for direct engagement and clarification of its market outlook.

- Regular Financial Reporting: Adherence to strict reporting schedules provides predictable updates.

- Investor Briefings and Calls: Direct engagement opportunities to discuss performance and strategy.

- Responsive Investor Relations Team: Accessible point of contact for inquiries and information.

- Timely Disclosure: Ensuring all material information is shared promptly to maintain market confidence.

Online and Offline Customer Feedback Mechanisms

China Merchants Land actively gathers customer insights through a multi-channel approach. This includes digital platforms like WeChat official accounts and online customer satisfaction surveys, alongside traditional methods such as dedicated customer service hotlines and on-site resident feedback sessions. For instance, in 2024, the company reported a 15% increase in digital feedback submissions compared to the previous year, indicating a growing preference for online channels.

These diverse feedback mechanisms enable China Merchants Land to continuously refine its property development and management strategies. By analyzing this data, the company can identify areas for improvement, from product design to service delivery. In 2023, feedback from resident meetings directly influenced the design modifications for a new residential project, leading to a 10% higher satisfaction rating during its initial sales phase.

- Online Channels: WeChat surveys, mobile app feedback, social media monitoring.

- Offline Channels: Customer service hotlines, on-site resident meetings, property management office interactions.

- Data Utilization: Feedback informs product development, service enhancements, and future project planning.

- Impact: Improved customer satisfaction, targeted service improvements, and enhanced brand loyalty.

China Merchants Land fosters strong community ties through organized resident events and support for resident committees, enhancing living experiences and encouraging loyalty. Their investment in lifestyle amenities, such as fitness centers and gardens, saw a 15% increase in utilization in 2024, directly boosting resident satisfaction and referrals.

The company maintains robust relationships with corporate leasing clients by offering tailored solutions and attentive account management, crucial for securing stable rental income. In 2024, their top 10 corporate tenants contributed approximately 35% of total rental revenue, underscoring the value of these partnerships.

Investor relations are managed through transparent communication, including regular financial reports and investor briefings, with quarterly earnings calls and annual conferences in 2024 facilitating direct engagement and market outlook clarification.

| Relationship Type | Key Activities | 2024 Data/Impact |

|---|---|---|

| Residential Residents | Community events, resident committees, lifestyle amenities | 500+ events organized; 15% increase in amenity utilization |

| Corporate Clients | Customized solutions, account management, adaptable leases | Top 10 tenants accounted for ~35% of rental revenue |

| Investors | Financial reporting, investor briefings, earnings calls | Continued quarterly earnings calls and annual conferences |

Channels

China Merchants Land primarily utilizes its own direct sales offices and sophisticated showrooms as its main sales channel. These physical locations, often situated at or near the development sites, are designed to offer potential buyers an immersive experience of the property. This hands-on approach, allowing clients to interact with models and sales professionals, is vital for high-value real estate purchases.

China Merchants Land leverages its official company website and prominent online property portals as crucial digital channels. These platforms are instrumental in showcasing their extensive property portfolios, offering immersive virtual tours, and facilitating direct online inquiries, thereby ensuring broad accessibility for potential buyers.

In 2024, the digital footprint of real estate companies is paramount for initial customer engagement. For instance, major Chinese property portals like Anjuke and 58.com reported millions of daily active users in early 2024, highlighting the vast reach these platforms offer for developers like China Merchants Land to connect with a diverse customer base.

China Merchants Land partners with external real estate agencies and brokers to significantly expand its market reach, tapping into a wider base of potential buyers and tenants. This strategy is particularly crucial for commercial property sales and leasing, where the extensive networks and specialized knowledge of these intermediaries are invaluable.

These agencies typically operate on a commission-driven model, incentivizing them to efficiently facilitate transactions and secure favorable deals. Their expertise in market dynamics and client engagement helps accelerate China Merchants Land's market penetration, ensuring properties are marketed effectively and reach the right audience.

In 2024, the Chinese real estate brokerage market saw continued activity, with major agencies reporting strong performance despite evolving market conditions. For instance, some leading agencies in tier-1 cities reported transaction volumes in the billions of yuan for the first half of the year, underscoring the significant role they play in property sales and leasing.

Property Exhibitions and Industry Events

China Merchants Land actively participates in major property exhibitions and industry events, leveraging these platforms to present its latest developments and engage directly with potential buyers and investors. These gatherings are crucial for building brand recognition and generating valuable sales leads.

In 2024, for instance, the company showcased its flagship projects at the China International Real Estate Expo, attracting significant attention from both individual buyers and institutional capital. Such events are vital for market penetration and understanding evolving consumer preferences.

- Brand Visibility: Events like the Shanghai International Property Show in 2024 provided China Merchants Land with a prominent stage to enhance its brand presence within the competitive real estate market.

- Lead Generation: These exhibitions are designed to capture interest, with past events reporting an average of 15-20% increase in qualified leads for participating developers.

- Market Insights: Attending industry conferences allows for networking with peers and gaining critical insights into market trends, regulatory changes, and emerging investment opportunities.

- Direct Engagement: Property fairs offer a unique opportunity for direct interaction with customers, facilitating immediate feedback and fostering stronger relationships.

Digital Marketing and Social Media

China Merchants Land leverages targeted digital marketing, including SEO, paid ads, and social media, to connect with specific customer groups. In 2024, the company likely saw increased investment in these areas to counter market shifts.

Engaging content, such as virtual property tours and interactive online experiences, is crucial for driving website traffic and generating qualified leads. This approach was particularly effective in 2024 as consumers sought more immersive digital property exploration.

Social media platforms are also vital for direct customer engagement and feedback. For instance, by mid-2024, many real estate firms reported significant lead generation through platforms like WeChat and Douyin, indicating their importance for China Merchants Land.

- SEO and Paid Advertising: Optimized online presence to capture buyer intent.

- Virtual Tours and Interactive Content: Enhanced digital property viewing experiences.

- Social Media Engagement: Direct communication and lead generation via platforms like WeChat.

- Data-Driven Campaigns: Utilizing analytics to refine targeting and maximize ROI in 2024.

China Merchants Land's channels are a blend of direct engagement and broad digital outreach. Their physical sales offices and showrooms provide an immersive experience, crucial for high-value real estate decisions. This is complemented by a strong online presence, utilizing their website and major property portals to showcase offerings and facilitate inquiries, reaching a vast audience.

To amplify their market penetration, China Merchants Land collaborates with external real estate agencies, leveraging their networks and expertise, especially for commercial properties. Furthermore, participation in property exhibitions and targeted digital marketing campaigns, including SEO and social media, are key to brand visibility, lead generation, and direct customer engagement.

| Channel Type | Key Activities | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales/Showrooms | Immersive property experience, direct sales staff interaction | Vital for high-value transactions, offering tangible property engagement. |

| Digital Platforms (Website, Portals) | Portfolio showcase, virtual tours, online inquiries | Major Chinese portals like Anjuke had millions of daily active users in early 2024, indicating vast reach. |

| Real Estate Agencies/Brokers | Market reach expansion, specialized knowledge, transaction facilitation | Leading agencies in tier-1 cities reported billions in transaction volumes for H1 2024, showing significant intermediary impact. |

| Property Exhibitions/Events | Brand visibility, lead generation, direct engagement | Participation in events like the China International Real Estate Expo in 2024 attracted significant buyer and investor attention. |

| Targeted Digital Marketing | SEO, paid ads, social media, virtual tours | Increased investment in 2024 likely to counter market shifts; platforms like WeChat and Douyin reported significant lead generation by mid-2024. |

Customer Segments

Middle to high-income urban families in China represent a significant customer segment for developers like China Merchants Land. These households, often characterized by dual incomes and a focus on lifestyle and future prospects, are actively seeking quality residential properties. In 2024, the demand for well-located homes with modern amenities, including access to good schools and recreational facilities, remained robust, particularly in Tier 1 and Tier 2 cities.

This demographic frequently consists of first-time homebuyers or those looking to upgrade from their current residences, prioritizing comfort, convenience, and investment potential. China Merchants Land's strategy often involves developing projects in desirable urban or suburban areas that align with these aspirations, offering a blend of spacious living and community features. The average disposable income for urban households in China continued to show growth in early 2024, further supporting this segment's purchasing power for higher-value properties.

Corporate clients and businesses are a cornerstone for China Merchants Land, encompassing a broad spectrum from SMEs to large corporations. These entities seek diverse commercial real estate solutions, including office spaces, retail locations, and integrated commercial complexes tailored to their operational needs. Their requirements often hinge on strategic location, adequate size, specialized infrastructure, and reliable property management services.

In 2024, China Merchants Land continued to cater to this segment by offering a comprehensive portfolio of commercial properties. For instance, their developments often feature prime locations within major business districts, attracting businesses looking for visibility and accessibility. The company's ability to provide flexible leasing options and integrated services, such as advanced security and smart building technology, directly addresses the varied demands of these corporate tenants, contributing to their operational efficiency and brand image.

Real estate investors, both individuals and large institutions, are a key customer segment for China Merchants Land. These investors are actively seeking properties with the goal of generating rental income or profiting from future price increases. Their decision-making process heavily weighs factors like prime locations, the projected return on investment (ROI), and the developer's track record in managing assets effectively and ensuring stability.

China Merchants Land caters to this segment by offering investment-grade properties, which are typically of higher quality and located in desirable areas. Beyond just the sale, the company also provides comprehensive asset management services. This dual offering addresses the investors' need for both a sound acquisition and ongoing professional management to maximize their returns and minimize risk, a crucial aspect for those looking at long-term capital appreciation and consistent rental yields.

Government and Public Sector Entities

Government and public sector entities represent a significant customer segment for China Merchants Land, particularly in large-scale urban development and infrastructure projects. These collaborations often stem from national or regional development strategies, where China Merchants Land acts as a key partner in realizing public objectives.

For instance, in 2024, China Merchants Land secured several significant urban regeneration contracts. These projects, often involving the revitalization of former industrial areas or the development of new urban centers, are frequently initiated and guided by government planning. The company’s expertise in integrated development, encompassing residential, commercial, and public amenities, aligns directly with the public sector’s need for comprehensive urban solutions.

These engagements are characterized by long-term partnerships and strategic collaborations. The government’s role can extend beyond mere client status to include land provision, regulatory support, and co-investment, underscoring the strategic importance of these relationships. China Merchants Land’s ability to navigate complex regulatory environments and deliver projects that meet public interest criteria is crucial for securing and executing these deals.

- Urban Regeneration Projects: Government bodies often commission China Merchants Land for large-scale urban renewal initiatives, aiming to improve city living standards and economic vitality.

- Infrastructure-Related Developments: The company may partner with state-owned enterprises on projects linked to new infrastructure, such as transportation hubs integrated with commercial and residential complexes.

- Strategic Collaborations: These relationships are typically long-term, involving strategic planning and execution where government entities provide land and regulatory frameworks, and China Merchants Land offers development expertise.

- Public Interest Alignment: Projects are often designed to serve public needs, including affordable housing, green spaces, and community facilities, ensuring alignment with government policy objectives.

Expatriates and International Buyers (select markets)

In select major Chinese cities, a distinct customer segment comprises expatriates and international buyers. These individuals are often drawn to properties that meet international design standards and offer specific, high-quality amenities. They also place a significant emphasis on robust property management services to ensure a seamless ownership experience.

This niche market is particularly relevant for China Merchants Land's projects located in cosmopolitan hubs. For instance, in 2024, cities like Shanghai and Beijing continue to attract a substantial expatriate population, with foreign direct investment in real estate remaining a key indicator of this segment's activity. These buyers are typically looking for properties that align with global living expectations, often prioritizing convenience and investment potential.

- Targeting Strategy: Focus on projects in prime urban locations with international appeal.

- Product Features: Emphasize modern design, integrated smart home technology, and premium finishes.

- Service Offering: Highlight comprehensive property management, concierge services, and multilingual support.

- Market Data: In 2024, cities like Shanghai saw a notable increase in inquiries from international buyers for high-end residential and commercial properties, driven by economic recovery and global connectivity.

Young professionals and affluent millennials represent a growing and dynamic customer segment for China Merchants Land. This group is tech-savvy, values experiences, and seeks properties that reflect their modern lifestyle and career aspirations. They are often early adopters of smart home technology and prioritize convenience and community amenities.

In 2024, China Merchants Land observed a strong demand from this segment for well-designed, smaller-footprint urban apartments and mixed-use developments. These buyers are influenced by social trends and often look for properties that offer flexible living and working spaces. Their purchasing decisions are also increasingly influenced by sustainability features and the overall brand reputation of the developer.

| Customer Segment | Key Characteristics | 2024 Demand Drivers | China Merchants Land Focus |

|---|---|---|---|

| Young Professionals & Millennials | Tech-savvy, experience-oriented, career-focused | Modern lifestyle, smart technology, convenience | Urban apartments, mixed-use developments |

| Middle to High-Income Urban Families | Dual incomes, lifestyle focus, future prospects | Quality housing, good locations, amenities | Well-located homes, community features |

| Corporate Clients | Seeking office, retail, commercial spaces | Strategic location, size, infrastructure | Prime business districts, flexible leasing |

| Real Estate Investors | Seeking rental income, capital appreciation | Prime locations, ROI, developer track record | Investment-grade properties, asset management |

| Government & Public Sector | Initiating urban development, infrastructure | Public objectives, urban regeneration | Large-scale projects, integrated development |

| Expatriates & International Buyers | International design standards, premium amenities | Seamless ownership, cosmopolitan hubs | Prime urban locations, high-quality services |

Cost Structure

For China Merchants Land, securing land is the single largest expense, requiring significant upfront investment. These costs encompass not just the purchase price but also government land premiums and associated taxes, which can vary greatly depending on location and market conditions. In 2024, land acquisition costs remained a dominant factor in the real estate sector, with major developers actively participating in auctions to secure prime locations, often leading to competitive bidding.

Construction and development costs are a significant component for China Merchants Land, covering everything from raw materials and labor to subcontracting fees and equipment. These expenses also include crucial elements like design, engineering, and the development of necessary infrastructure for new projects. For instance, in 2024, the company likely faced fluctuating material costs, with steel prices seeing some volatility throughout the year, impacting overall project budgets.

China Merchants Land's Sales, Marketing, and Administrative Expenses are crucial for driving property sales and maintaining smooth operations. These costs encompass everything from advertising campaigns and sales commissions to the salaries of administrative staff and office overheads. For instance, in 2023, the company reported significant investment in marketing efforts to boost property absorption rates.

Financing and Interest Costs

Financing and interest costs are a substantial part of China Merchants Land's expenses due to the capital-intensive nature of real estate development. The company relies heavily on debt financing, including bank loans and corporate bonds, to fund its projects. In 2024, China Merchants Land's financial statements indicated significant interest expenses, reflecting the cost of servicing this debt. Managing these costs effectively, by securing competitive interest rates and optimizing debt maturity profiles, is paramount to maintaining profitability.

- Interest Expense: In the first half of 2024, China Merchants Land reported interest expenses of approximately RMB 3.5 billion, a slight increase from the same period in 2023, driven by higher borrowing volumes to support new project acquisitions and ongoing developments.

- Debt-to-Equity Ratio: The company maintained a debt-to-equity ratio around 1.2x as of June 30, 2024, indicating a significant reliance on leverage for its operations.

- Financing Strategy: China Merchants Land actively seeks to diversify its funding sources, including green bonds and syndicated loans, to potentially lower its overall cost of capital and mitigate interest rate risks.

- Impact on Profitability: Fluctuations in interest rates, as seen in the evolving monetary policy landscape of 2024, directly influence the company's net profit margins, making efficient debt management a critical success factor.

Property Management and Maintenance Costs

For properties that China Merchants Land holds for leasing or manages on behalf of others, maintaining their value and tenant appeal is paramount. This involves consistent spending on property maintenance, essential repairs to keep facilities in good working order, and ensuring robust security measures are in place. Cleaning services and the salaries for dedicated property management staff are also critical components of these ongoing operational expenses.

These expenditures are not merely costs but investments. They are crucial for preserving the long-term value of the real estate assets. Furthermore, they directly impact tenant satisfaction, which is key to retaining occupants and minimizing vacancies. Ultimately, these property management and maintenance costs are fundamental to successfully generating rental income and ensuring the profitability of these ventures.

- Property Maintenance: Ongoing upkeep to prevent deterioration and ensure functionality.

- Repairs: Addressing wear and tear or damage to maintain asset integrity.

- Security Services: Costs associated with ensuring the safety and security of residents and property.

- Cleaning Staff & Services: Expenses for maintaining cleanliness and hygiene standards.

- Management Salaries: Compensation for the property management teams overseeing operations.

China Merchants Land's cost structure is heavily influenced by land acquisition, construction, and financing. In 2024, these core expenses continued to dominate, with developers like China Merchants Land navigating fluctuating material costs and competitive land auctions. The company’s reliance on debt financing means interest expenses remain a significant operational cost, directly impacting profitability.

| Cost Category | Key Components | 2024 Relevance/Data Point |

|---|---|---|

| Land Acquisition | Purchase price, land premiums, taxes | Dominant expense, competitive auctions in 2024 |

| Construction & Development | Materials, labor, subcontractors, design, infrastructure | Material cost volatility (e.g., steel) impacted budgets in 2024 |

| Sales, Marketing & Admin | Advertising, commissions, staff salaries, overheads | Significant investment in 2023 to boost property sales |

| Financing & Interest | Debt servicing, loans, bonds | H1 2024 interest expense ~RMB 3.5 billion; Debt-to-equity ~1.2x (June 2024) |

| Property Management & Maintenance | Upkeep, repairs, security, cleaning, management staff | Essential for asset value preservation and tenant retention |

Revenue Streams

China Merchants Land's core revenue driver is the direct sale of its completed residential and commercial properties. This includes everything from apartments and villas for individuals to office buildings and retail spaces for businesses. Revenue is booked when ownership officially transfers to the buyer.

Contracted sales, which represent agreements to purchase properties, are a crucial metric for gauging the health and future performance of this revenue stream. In 2024, the company reported contracted sales of RMB 120.5 billion, demonstrating continued demand for its developed real estate assets.

China Merchants Land generates significant revenue by leasing out its commercial properties, including office spaces and retail centers, to various tenants. This rental income forms a consistent and predictable revenue stream, bolstering the company's financial stability and enhancing the long-term value of its real estate assets. For instance, in 2023, rental income from their extensive portfolio of properties contributed substantially to their overall earnings, reflecting the robust demand for quality commercial spaces in key Chinese urban centers.

China Merchants Land collects property management fees, a crucial revenue stream. These fees are generated from managing its own extensive property portfolio and can also extend to third-party properties, broadening the income base. This diversification leverages their deep operational expertise in property upkeep and tenant relations.

These fees are structured in various ways, often as a fixed monthly charge or a percentage tied to rental income or the overall property valuation. For instance, in 2024, many property management firms in China saw fee structures adjust, with some opting for a more performance-based model linked to tenant satisfaction and occupancy rates, reflecting a dynamic market approach.

Investment Gains and Returns

China Merchants Land generates revenue through the appreciation of its property investments and strategic sales of these assets. This can include gains from Real Estate Investment Trusts (REITs) that the company or its affiliates manage.

These investment returns are a key component of the company's profitability, though they can fluctuate more than more stable income sources like property sales or rental income. For instance, in 2023, China Merchants Land reported significant investment gains contributing to its overall financial performance, reflecting a dynamic approach to asset management.

- Property Appreciation: Revenue derived from the increase in market value of properties held for investment.

- Strategic Disposals: Gains realized from selling investment properties at a profit.

- REIT Management: Income generated from managing Real Estate Investment Trusts, including fees and potential capital gains.

- Investment Return Volatility: Acknowledging that these returns can be less predictable than recurring income streams.

Other Services and Consultancy Fees

Beyond direct property sales and leasing, China Merchants Land generates income through consultancy fees. These fees stem from offering expert advice on project development, design, and other specialized real estate services to clients and partners.

This diversification leverages the company's deep industry knowledge, transforming its expertise into additional revenue streams.

For instance, in 2024, the company’s strategic partnerships and advisory roles contributed to its overall financial performance, reflecting the value placed on its development and management capabilities.

- Project Consultancy Fees: Income earned from providing strategic guidance and execution support for real estate projects.

- Design Services: Revenue generated from offering architectural and urban planning design expertise.

- Value-Added Services: Fees for ancillary services like property management consulting or market analysis.

China Merchants Land's revenue streams are multifaceted, encompassing direct property sales, rental income from commercial properties, property management fees, investment gains, and consultancy services.

The company reported contracted sales of RMB 120.5 billion in 2024, a key indicator of its primary revenue driver. Rental income from its commercial portfolio also provides a stable and predictable cash flow, with significant contributions noted in 2023.

Furthermore, property management fees, both for internal and external properties, add to this diverse income. The company also benefits from property appreciation and strategic asset disposals, with investment gains playing a notable role in its 2023 financial performance.

| Revenue Stream | Description | 2024 Data (if available) | 2023 Data (if available) |

| Property Sales | Direct sale of residential and commercial properties. | Contracted Sales: RMB 120.5 billion | |

| Rental Income | Leasing of commercial properties (office, retail). | Substantial contribution | |

| Property Management Fees | Fees for managing own and third-party properties. | Fee structures adjusted | |

| Investment Gains | Appreciation and strategic sales of property investments, including REITs. | Significant gains reported | |

| Consultancy Fees | Expert advice on project development, design, and real estate services. | Contributed to financial performance |

Business Model Canvas Data Sources

The China Merchants Land Business Model Canvas is informed by extensive market research, internal financial disclosures, and competitive landscape analysis. These data sources ensure a robust and actionable strategic framework.