China Merchants Land PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Merchants Land Bundle

Unlock critical insights into China Merchants Land's operating environment with our comprehensive PESTLE analysis. Understand the political stability, economic growth, and technological advancements shaping its trajectory. This detailed report is your key to identifying opportunities and mitigating risks. Download the full version now to gain a strategic advantage.

Political factors

The Chinese government's commitment to stabilizing the property market remains a key political factor, with ongoing initiatives into 2025 aimed at preventing further downturns. These efforts include significant policy adjustments, such as reductions in mortgage interest rates and lower minimum down-payment requirements, designed to stimulate buyer interest.

Further bolstering these measures, tax incentives are being offered to encourage home purchases, reflecting a strategic push to restore market confidence and foster sustainable growth within the real estate sector. For instance, by early 2024, several major cities had already eased purchase restrictions.

China's 'whitelist' lending program, initiated in January 2024 with a multi-trillion-yuan allocation, aims to revitalize the property sector by channeling funds to stalled projects. This initiative signals a government effort to ensure the completion and delivery of housing, a critical factor for social stability and economic confidence.

The program encourages banks to extend credit to carefully selected, financially viable developments, suggesting a strategic move towards supporting developers with stronger fundamentals. This targeted approach aims to de-risk lending and encourage financial institutions to participate actively in stabilizing the housing market.

Despite its intentions, the program's impact has been somewhat constrained, with banks exhibiting continued caution. This hesitancy stems from the persistent high debt levels observed across many property developers, making them reluctant to increase exposure without more robust assurances of project viability and developer solvency.

China's government is actively managing the housing market by limiting new commercial property development and prioritizing affordable housing solutions. This policy shift directly supports new urban residents, young families, and migrant workers by increasing their access to suitable living spaces.

Urban village renovation is a key initiative, with significant investment in 2024 to upgrade dilapidated areas, addressing critical safety concerns and improving the overall quality of life for residents. This focus on revitalizing existing urban areas is expected to continue, fostering more sustainable city development.

Decentralization of Property Market Regulation

Local governments in China are increasingly gaining more authority over their property markets. This decentralization means they can decide how to handle unsold housing, including purchasing it and repurposing it. For example, in 2023, several cities announced plans to buy unsold homes for affordable housing projects, signaling a more localized approach to market stabilization.

This shift allows for responses that are better suited to the unique conditions of each region, aiming to make the property market work more smoothly. It represents a move away from uniform national policies to more adaptable, city-specific strategies.

- Increased Local Autonomy: Local governments can now directly intervene in their housing markets.

- Tailored Market Responses: Policies are becoming more responsive to regional economic and housing demands.

- Focus on Unsold Inventory: Powers include buying and reallocating unsold housing stock.

- Market Efficiency Goals: The aim is to improve the overall functioning and stability of local property markets.

Shifting Regulatory Stance from 'Three Red Lines'

Beijing has significantly shifted its regulatory approach by easing the stringent 'three red lines' policy. This framework, initially implemented to curb excessive developer leverage, inadvertently triggered substantial financial distress within the property sector, impacting companies like China Merchants Land. The reversal signals a move towards a more accommodative stance, prioritizing the prevention of systemic financial crises and fostering a more stable, sustainable development model for real estate.

This policy evolution is a critical factor for China Merchants Land and the broader property market. The 'three red lines' policy, introduced in 2020, imposed strict debt-to-asset, debt-to-equity, and cash-to-short-term debt ratio limits on developers. By relaxing these, the government aims to inject liquidity and confidence back into the market, which experienced a significant downturn in late 2023 and early 2024. For instance, property sales in major Chinese cities saw a year-on-year decline of over 20% in early 2024, highlighting the severity of the situation the policy shift seeks to address.

- Policy Reversal: The dismantling of the 'three red lines' policy signals a less punitive environment for property developers.

- Market Stabilization Focus: The government's current priority is to prevent a wider financial crisis and support market recovery.

- Impact on Developers: This change offers potential relief to highly leveraged companies, allowing for more flexible financial management.

- Sector Sustainability: The aim is to balance risk management with the need for continued, albeit more controlled, development.

The Chinese government's proactive stance in stabilizing the property market continues through 2025 with policies like reduced mortgage rates and lower down payments to boost buyer confidence. Tax incentives are also in play, alongside a multi-trillion-yuan 'whitelist' lending program initiated in early 2024 to fund viable stalled projects and ensure housing delivery, a critical factor for social stability.

Local governments are gaining more authority to manage their property markets, including purchasing unsold homes for affordable housing, a strategy seen in several cities during 2023. This decentralization allows for more tailored regional responses to market conditions, aiming for greater efficiency and stability.

Beijing's easing of the 'three red lines' policy, a framework that previously curbed developer leverage, signals a shift towards a more accommodative stance. This move aims to prevent systemic financial crises and foster sustainable development, offering potential relief to developers facing liquidity challenges, especially after property sales in major cities declined over 20% year-on-year in early 2024.

| Policy Initiative | Objective | Status/Impact (as of early 2025) | Relevance to China Merchants Land |

|---|---|---|---|

| Mortgage Rate Reductions & Lower Down Payments | Stimulate buyer interest and market activity. | Ongoing, with positive but varied impact across cities. | Increases potential buyer pool and affordability. |

| 'Whitelist' Lending Program (started Jan 2024) | Revitalize property sector by funding stalled projects. | Multi-trillion yuan allocated; banks show cautious participation due to developer debt. | Potential access to project financing if projects are deemed viable. |

| Easing of 'Three Red Lines' Policy | Reduce developer financial distress and prevent systemic risk. | Reversal of strict leverage limits, allowing more flexibility. | Offers financial relief and operational flexibility for developers. |

| Increased Local Government Autonomy | Tailor market responses and manage unsold inventory. | Cities can buy unsold homes for affordable housing (e.g., 2023 initiatives). | Adaptability to local market dynamics and potential for localized support. |

What is included in the product

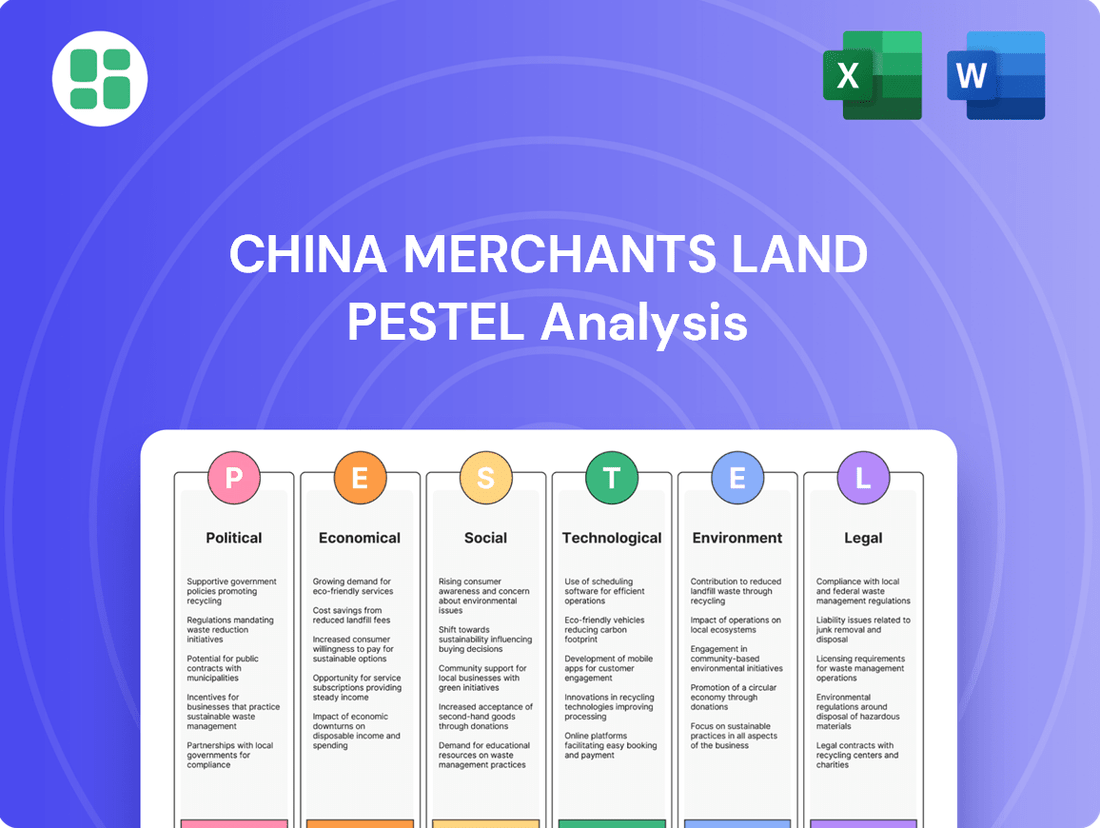

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting China Merchants Land, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

This PESTLE analysis for China Merchants Land offers a clear, summarized version of the full report, making it easy to reference during meetings and presentations, thereby relieving the pain point of sifting through extensive data.

Economic factors

The Chinese real estate sector faced a significant downturn throughout 2024, a period marked by persistent declines in housing prices and sales volumes. This slump has notably affected household wealth and dampened consumer confidence across the nation.

However, the market began showing tentative signs of stabilization by early 2025. First-tier cities, in particular, witnessed a slowdown in price depreciation, with some areas even experiencing modest price gains in the first quarter of 2025, indicating a potential bottoming out.

Looking ahead to the remainder of 2025, real estate investment activity is projected to see a recovery. Despite this anticipated rebound, short-term pressures on pricing are likely to persist as the market navigates its path towards a more sustainable equilibrium.

China's central bank has actively pursued interest rate cuts, with the 5-year Loan Prime Rate (LPR) reaching a new low of 3.90% by April 2025. This reduction, coupled with an average mortgage rate decline to approximately 3.5%, aims to make homeownership more affordable and accessible.

To further invigorate the property market, mortgage policies have been adjusted. These include lowered down payment requirements and increased mortgage availability and approval rates, directly encouraging more potential buyers to enter the market and boosting overall transaction volumes.

China Merchants Land faces persistent oversupply issues, particularly in its lower-tier city markets. Second-hand home prices in these regions experienced significant annual declines in 2024, underscoring the depth of the inventory challenge. This oversupply necessitates a strong focus on inventory management and a strategic shift towards project completion rather than new developments.

Impact on Local Government Finances

Local governments in China are facing significant fiscal pressures, primarily due to a sharp decline in land sale revenues. This traditional income source, crucial for funding public services and development projects, has been severely impacted by the ongoing real estate downturn.

The reduced revenue from land sales, which accounted for a substantial portion of local government budgets, directly hinders their capacity to support the struggling real estate sector and undertake vital infrastructure investments. This creates a challenging environment for economic growth and stability.

- Fiscal Gap Widening: Many local governments are grappling with widening fiscal deficits as land sale income plummets. For instance, in 2023, land transfer fees for local governments nationwide saw a significant year-on-year decrease, exacerbating budget shortfalls.

- Reduced Infrastructure Spending: The financial strain translates into scaled-back infrastructure projects, impacting everything from transportation networks to urban renewal initiatives. This can slow down regional development and affect job creation.

- Vulnerability Exposed: The over-reliance on land sales has clearly exposed the inherent vulnerabilities in many local government financial models, prompting a need for diversification of revenue streams and more sustainable fiscal planning.

Overall Economic Growth and Consumer Sentiment

China's economic trajectory is expected to see growth in the range of 4.5% to 5% for 2024-2025. However, persistent economic uncertainties and subdued consumer confidence are creating headwinds for the real estate sector.

While household disposable incomes have shown resilience, the ongoing downturn in the property market has had a noticeable dampening effect on broader consumer spending patterns.

- Projected GDP Growth: 4.5%-5% for 2024-2025.

- Consumer Sentiment Impact: Weak confidence is negatively affecting the housing market.

- Consumption Linkage: Property market slump is a key factor in dampened overall consumption.

- Reform Necessity: Structural reforms are crucial for diversified, stable future growth.

Economic factors present a mixed outlook for China Merchants Land. While the government's monetary easing, including a 5-year LPR cut to 3.90% by April 2025 and lower mortgage rates around 3.5%, aims to stimulate the property market, persistent oversupply, especially in lower-tier cities, continues to pressure prices. Local governments face fiscal strain due to declining land sale revenues, impacting their ability to support the sector and infrastructure development, although overall GDP growth is projected between 4.5%-5% for 2024-2025.

| Economic Indicator | Value/Trend | Impact on China Merchants Land |

|---|---|---|

| GDP Growth (2024-2025 Projection) | 4.5%-5% | Supports overall economic activity, but property sector specific headwinds remain. |

| 5-Year LPR (April 2025) | 3.90% (New Low) | Reduces borrowing costs, potentially boosting buyer affordability and demand. |

| Average Mortgage Rate (Early 2025) | ~3.5% | Increases housing affordability, encouraging more purchases. |

| Oversupply in Lower-Tier Cities | Significant & Persistent | Pressures sales volumes and pricing, necessitates careful inventory management. |

| Local Government Fiscal Health | Strained (due to land sale revenue decline) | May limit government support for property market stimulus or infrastructure projects. |

Preview Before You Purchase

China Merchants Land PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for China Merchants Land delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides a detailed examination of the external forces shaping the real estate and development sector in China, offering valuable insights for stakeholders.

Sociological factors

Urbanization continues to be a major force in China, with people moving to major cities for better jobs and economic prospects. Even though the overall population growth has slowed, this movement to urban areas still fuels a strong demand for housing.

China's urbanization rate was 66.16% in 2023. Experts predict this figure will climb to nearly 70% within the next five years, indicating sustained urban migration and its impact on the real estate sector.

Chinese consumers are increasingly prioritizing quality of life over mere ownership, driving demand for upgraded housing. This shift is evident as upgrade demand becomes a key factor for first-hand home purchases. For instance, in 2024, surveys indicated a significant portion of urban homebuyers were looking to move to larger or better-located properties, reflecting this evolving preference.

There's a noticeable surge in interest for smart home technologies and sustainable building practices. Buyers are actively seeking properties equipped with intelligent systems and eco-friendly designs, alongside comprehensive community facilities. This trend suggests a move away from the rapid, volume-focused construction of the past towards more sophisticated and resident-centric developments.

The growing affordability gap in China, particularly for younger demographics, presents significant social challenges. In 2024, the average home price in major Chinese cities remained disproportionately high compared to average incomes, pushing homeownership further out of reach for many. This economic strain contributes to delayed marriage and family formation, as aspiring homeowners often need substantial financial assistance from their parents.

This disparity has led to increased intergenerational financial reliance, with parents frequently subsidizing down payments for their children. To counter this, the Chinese government has been actively expanding its affordable housing programs and policies. By 2025, these initiatives aim to provide more accessible housing options for lower and middle-income families, seeking to ease the pressure on younger generations and promote more stable social structures.

Impact of Consumer Confidence on Purchasing Decisions

Weak consumer confidence, a significant sociological factor impacting purchasing decisions in China, continues to cast a shadow over the real estate market. This sentiment is largely driven by economic uncertainties and a noticeable increase in household debt levels.

This cautious consumer mood directly translates into subdued demand for retail spaces and prompts retailers to adopt a more measured approach to brand expansion. The overall health of the real estate sector is intrinsically linked to the restoration of buyer confidence, making it a critical element for market recovery.

- Consumer Confidence Index (CCI): While specific monthly figures fluctuate, general trends in China's CCI from late 2023 through mid-2025 have indicated a cautious to moderate level, reflecting underlying economic concerns.

- Retail Sales Growth: Retail sales growth, a direct indicator of consumer spending, has shown resilience but often at rates that suggest consumers are prioritizing essentials and are hesitant about discretionary purchases, particularly in sectors like high-end retail.

- Household Debt Levels: Household debt as a percentage of GDP in China has been on an upward trajectory, contributing to consumer anxiety and a greater propensity to save rather than spend, especially on large purchases like property.

- Property Market Sentiment: Surveys on property market sentiment among potential buyers consistently highlight concerns about future income stability and property value appreciation as key determinants of purchasing decisions.

Demographic Shifts and Future Housing Needs

China's demographic landscape is undergoing significant transformations, directly impacting housing demand. Population growth has plateaued, and the nation is experiencing a rapidly aging population. This shift means fewer young people entering the market for new homes and a growing segment of seniors who may require different housing solutions.

These profound demographic shifts necessitate a more strategic approach to real estate development. Developers are increasingly focusing on specific market segments and locations where demand fundamentals remain stronger. For instance, projects in higher-tier cities continue to attract robust demand due to urbanization and economic opportunities.

- Aging Population Impact: By 2025, China's population aged 65 and above is projected to exceed 200 million, creating a demand for accessible and senior-friendly housing.

- Urbanization Trends: Despite overall population plateauing, major cities like Shanghai and Beijing are still experiencing net population inflows, sustaining demand in these core areas.

- Shifting Household Structures: Smaller household sizes are becoming more common, potentially increasing the overall number of housing units needed even with slower population growth.

Urbanization continues to be a major force in China, with people moving to major cities for better jobs and economic prospects. Even though the overall population growth has slowed, this movement to urban areas still fuels a strong demand for housing.

China's urbanization rate was 66.16% in 2023. Experts predict this figure will climb to nearly 70% within the next five years, indicating sustained urban migration and its impact on the real estate sector.

Chinese consumers are increasingly prioritizing quality of life over mere ownership, driving demand for upgraded housing. This shift is evident as upgrade demand becomes a key factor for first-hand home purchases. For instance, in 2024, surveys indicated a significant portion of urban homebuyers were looking to move to larger or better-located properties, reflecting this evolving preference.

There's a noticeable surge in interest for smart home technologies and sustainable building practices. Buyers are actively seeking properties equipped with intelligent systems and eco-friendly designs, alongside comprehensive community facilities. This trend suggests a move away from the rapid, volume-focused construction of the past towards more sophisticated and resident-centric developments.

The growing affordability gap in China, particularly for younger demographics, presents significant social challenges. In 2024, the average home price in major Chinese cities remained disproportionately high compared to average incomes, pushing homeownership further out of reach for many. This economic strain contributes to delayed marriage and family formation, as aspiring homeowners often need substantial financial assistance from their parents.

This disparity has led to increased intergenerational financial reliance, with parents frequently subsidizing down payments for their children. To counter this, the Chinese government has been actively expanding its affordable housing programs and policies. By 2025, these initiatives aim to provide more accessible housing options for lower and middle-income families, seeking to ease the pressure on younger generations and promote more stable social structures.

Weak consumer confidence, a significant sociological factor impacting purchasing decisions in China, continues to cast a shadow over the real estate market. This sentiment is largely driven by economic uncertainties and a noticeable increase in household debt levels.

This cautious consumer mood directly translates into subdued demand for retail spaces and prompts retailers to adopt a more measured approach to brand expansion. The overall health of the real estate sector is intrinsically linked to the restoration of buyer confidence, making it a critical element for market recovery.

China's demographic landscape is undergoing significant transformations, directly impacting housing demand. Population growth has plateaued, and the nation is experiencing a rapidly aging population. This shift means fewer young people entering the market for new homes and a growing segment of seniors who may require different housing solutions.

These profound demographic shifts necessitate a more strategic approach to real estate development. Developers are increasingly focusing on specific market segments and locations where demand fundamentals remain stronger. For instance, projects in higher-tier cities continue to attract robust demand due to urbanization and economic opportunities.

| Sociological Factor | 2024/2025 Trend/Data | Impact on China Merchants Land |

|---|---|---|

| Urbanization & Migration | Urbanization rate reached 66.16% in 2023, projected to hit ~70% by 2028. Major cities still attract significant migration. | Sustained demand for housing in urban centers, particularly for new developments and upgrades. |

| Consumer Preferences | Increased demand for quality of life, smart homes, and sustainable features. Upgrade demand is a key driver. | Need to focus on premium, feature-rich properties and community amenities. |

| Affordability & Intergenerational Support | High home prices relative to income, leading to reliance on parental financial support for down payments. | Potential for slower sales cycles for entry-level housing; increased demand for family-oriented properties. |

| Consumer Confidence | Cautious consumer sentiment due to economic uncertainties and rising household debt. | Reduced demand for discretionary retail spaces; emphasis on essential services and value-driven offerings. |

| Demographic Shifts | Rapidly aging population (over 200 million aged 65+ by 2025) and smaller household sizes. | Opportunity for senior living developments and smaller, efficient housing units; potential decrease in demand for large family homes. |

Technological factors

The real estate sector is seeing a significant uptake in smart home technologies, fueled by consumers wanting more automated and energy-efficient living spaces. This includes everything from smart thermostats and lighting to advanced security systems and integrated property management platforms. For China Merchants Land, embracing these innovations is key to creating properties that are not only modern but also offer tangible benefits like reduced utility costs and enhanced convenience, thereby boosting market appeal and property valuations.

By 2024, the global smart home market was projected to reach over $100 billion, with China being a major contributor to this growth. This trend indicates a strong consumer appetite for connected living. China Merchants Land can capitalize on this by integrating smart features into its developments, potentially commanding premium pricing and attracting a tech-savvy buyer demographic, thereby differentiating itself in a competitive market.

Technological advancements are significantly altering China's construction landscape. Innovations like 3D printing and the use of advanced building materials, such as self-healing concrete and high-performance composites, are becoming more prevalent. These technologies promise to make construction faster, more sustainable, and ultimately cheaper.

The drive towards greener development is pushing the adoption of efficiency-enhancing materials and systems. For instance, pre-fabricated building components and smart building management systems are increasingly integrated to meet stringent environmental regulations and reduce operational costs. China's commitment to carbon neutrality by 2060 further fuels this trend, with the construction sector expected to play a crucial role.

Big Data Analytics and Artificial Intelligence (AI) are transforming how companies like China Merchants Land operate. These technologies are crucial for accurately tracking market trends, automating property valuations, and streamlining real estate operations. For instance, AI can analyze vast datasets to predict future market shifts, offering a significant edge in strategic planning.

AI-powered tools provide invaluable insights for investment and portfolio management. This enables developers to make more informed, data-driven decisions, moving beyond traditional methods. Predictive analytics, a key component of AI, allows for forecasting market behavior, which is essential for optimizing development and investment strategies in the dynamic Chinese real estate sector.

Digital Platforms for Sales and Customer Engagement

China Merchants Land is leveraging digital platforms to transform its sales and customer engagement strategies. The real estate sector, in general, is seeing a significant shift towards online channels for property listings, virtual tours, and direct customer interaction. This digital evolution is crucial for enhancing the buyer experience and improving operational efficiency for developers.

The adoption of these digital tools allows for a more streamlined and accessible property search and transaction process. For instance, virtual assistants and chatbots provide immediate, round-the-clock support, addressing potential buyer queries and guiding them through the initial stages of engagement. This 24/7 availability is a key factor in meeting the expectations of today's digitally savvy consumers.

By embracing these technological advancements, China Merchants Land can expect to see tangible benefits. For example, a study by the National Association of Realtors in 2024 indicated that 97% of homebuyers used online resources to find their homes. Furthermore, companies that effectively integrate digital sales platforms have reported up to a 20% increase in lead generation and a 15% improvement in conversion rates.

- Increased Online Presence: Digital platforms expand reach to a wider pool of potential buyers and tenants.

- Enhanced Customer Experience: Virtual tours and AI-powered support offer convenience and instant information.

- Operational Efficiency: Automation of sales processes and customer service reduces costs and improves response times.

- Data-Driven Insights: Digital interactions provide valuable data for understanding customer preferences and market trends.

Green Building Technology and Energy Efficiency

Green building technology is a significant trend in China, with a growing demand for digital systems to monitor and enhance energy consumption in structures. This push involves implementing low-carbon heating and cooling solutions and utilizing energy-efficient construction materials, reflecting a broader commitment to sustainability.

Integrating smart home technologies with green building principles offers a powerful way to cut down the carbon footprint associated with construction. For instance, China's government has set ambitious targets, aiming for 65% of all new buildings to meet green building standards by 2025, a policy that directly fuels the adoption of these advanced technologies.

- Increased Demand for Digital Energy Tracking: Building owners and developers are increasingly investing in smart systems to optimize energy usage.

- Adoption of Low-Carbon Systems: There's a noticeable shift towards installing efficient heating and cooling technologies.

- Focus on Energy-Efficient Materials: The use of sustainable and energy-saving building materials is becoming standard practice.

- Smart Home Integration: Combining smart home features with green building practices is seen as crucial for reducing environmental impact.

Technological advancements are reshaping the real estate sector, with smart home adoption and digital sales platforms becoming central. By 2024, the global smart home market exceeded $100 billion, with China a key driver. China Merchants Land can leverage AI and Big Data for market trend analysis and operational efficiency, while digital sales tools enhance customer engagement and streamline transactions, as 97% of homebuyers used online resources in 2024.

| Technology Trend | Impact on China Merchants Land | Supporting Data (2024/2025 Projections/Trends) |

|---|---|---|

| Smart Home Integration | Enhanced property appeal, premium pricing, reduced operational costs | Global smart home market projected to exceed $100 billion in 2024; China a major contributor. |

| Digital Sales Platforms | Wider buyer reach, improved customer experience, increased lead generation | 97% of homebuyers used online resources in 2024; digital platforms can boost lead generation by 20%. |

| AI & Big Data Analytics | Informed investment decisions, predictive market analysis, streamlined operations | AI adoption in real estate can lead to a 15% improvement in conversion rates. |

| Green Building Tech | Meeting environmental regulations, attracting eco-conscious buyers, operational savings | China aims for 65% of new buildings to meet green standards by 2025. |

Legal factors

New national standards for 'quality homes' took effect in May 2025, elevating requirements for building quality, floor height, sound insulation, and lighting. This signifies a move towards higher-quality residential developments across China.

China is also accelerating its adoption of carbon-neutral construction standards. This includes mandating renewable materials in public projects and enforcing stricter emissions penalties under the revised Environmental Protection Law, which came into effect in January 2025.

The nationwide enforcement of the Regulation on Wage Payment for Migrant Workers in 2024 introduces significant changes, mandating real-time salary monitoring through blockchain platforms. This move aims to ensure timely and transparent wage disbursement, a critical issue in the construction industry.

Developers now face joint liability for subcontractors' defaults, directly addressing historical problems of delayed wage payments to migrant workers. This policy shift underscores China's focus on improving labor conditions and fostering ethical business practices within the construction sector, potentially impacting project costs and timelines for companies like China Merchants Land.

China's commitment to environmental protection is underscored by the submission of a draft Ecological and Environmental Code for deliberation in April 2025. This landmark legislation aims to consolidate and strengthen existing environmental regulations, creating a more unified and effective legal framework. The code is designed to address policy fragmentation and close legislative loopholes, thereby bolstering accountability for achieving the nation's ambitious climate targets.

Property and Land Use Regulations

China's construction sector is primarily governed by national laws such as the Civil Code, Construction Law, Urban and Rural Planning Law, and the Environmental Impact Assessment Law. These, alongside stringent national standards, dictate construction methods, quality benchmarks, and safety protocols. For instance, the Ministry of Housing and Urban-Rural Development oversees adherence to these regulations, impacting project timelines and costs for developers like China Merchants Land.

Navigating these intricate property and land use regulations is crucial for China Merchants Land's project development and land acquisition strategies. The government's focus on sustainable urban development and environmental protection, as emphasized in the Environmental Impact Assessment Law, means thorough due diligence and compliance are non-negotiable. Failure to comply can result in significant fines or project delays, impacting financial performance.

- Key Legislation: Civil Code, Construction Law, Urban and Rural Planning Law, Environmental Impact Assessment Law.

- Regulatory Oversight: Ministry of Housing and Urban-Rural Development plays a significant role in enforcing standards.

- Impact on Developers: Compliance directly affects project feasibility, costs, and timelines for companies like China Merchants Land.

- Focus Areas: Sustainability and environmental protection are increasingly emphasized in land use and construction planning.

New Regulations on Residential Property Rentals

New regulations impacting residential property rentals in China, effective September 2025, are set to standardize the rental market and bolster tenant and landlord protections. These measures are designed to elevate the quality of rental housing development and foster a more balanced housing system that integrates rental and owner-occupied properties. A key component is the mandate for real-name contracts, enhancing transparency and accountability in rental agreements.

Furthermore, these upcoming regulations will introduce requirements for fund supervision accounts, ensuring that rental payments are managed securely and transparently. This aims to mitigate risks associated with rental transactions and build greater confidence within the market. The government's focus on these aspects reflects a strategic push towards a more regulated and sustainable rental housing sector.

- Standardized Procedures: Regulations effective September 2025 will introduce uniform practices for residential property rentals.

- Stakeholder Protection: New rules are designed to safeguard the rights and interests of both tenants and landlords.

- Housing System Integration: The regulations promote higher development standards for rental housing, aiming to integrate it with owner-occupied models.

- Enhanced Transparency: Requirements for real-name contracts and fund supervision accounts will increase accountability in rental transactions.

China's evolving legal landscape heavily influences the real estate sector, with new national standards for 'quality homes' taking effect in May 2025, raising building quality and insulation benchmarks. The revised Environmental Protection Law, effective January 2025, enforces stricter emissions penalties, aligning with the nation's carbon-neutral construction goals. Furthermore, the 2024 Regulation on Wage Payment for Migrant Workers mandates real-time salary monitoring via blockchain, aiming to ensure timely payments and holding developers jointly liable for subcontractor defaults, impacting labor costs and project management.

The draft Ecological and Environmental Code, presented in April 2025, consolidates environmental regulations to bolster accountability for climate targets. Residential property rental regulations, effective September 2025, will standardize the market with real-name contracts and fund supervision accounts for enhanced transparency and tenant/landlord protection.

| Legal Area | Key Development/Regulation | Effective Date | Impact on China Merchants Land |

|---|---|---|---|

| Construction Quality | New 'Quality Homes' Standards | May 2025 | Increased building material and construction costs; potential for higher property values. |

| Environmental Law | Revised Environmental Protection Law | January 2025 | Stricter emissions penalties, increased compliance costs for sustainable practices. |

| Labor Law | Regulation on Wage Payment for Migrant Workers | 2024 | Mandatory real-time salary monitoring, joint liability for wage defaults; improved labor relations but added administrative burden. |

| Environmental Law | Draft Ecological and Environmental Code | Expected 2025 | Consolidated environmental regulations, increased accountability for climate targets; requires proactive environmental strategy. |

| Property Rentals | New Rental Market Regulations | September 2025 | Standardized rental agreements, enhanced transparency; potential impact on rental income streams and property management. |

Environmental factors

China's real estate sector is increasingly prioritizing sustainability, with a significant push towards green building standards. By 2025, a mandate requires all new urban construction projects to adhere to these rigorous standards. This directive aims to boost energy efficiency and ensure better alignment with broader environmental regulations.

This regulatory shift is compelling developers like China Merchants Land to integrate eco-friendly construction methods and materials. For instance, the adoption of advanced insulation, low-emission glazing, and renewable energy sources in new developments is becoming standard practice, reflecting a commitment to environmental responsibility and long-term operational cost savings.

China is significantly ramping up its commitment to sustainable development by implementing more stringent regulations and fostering technological advancements. This includes setting specific carbon emissions reduction targets, particularly for sectors like building materials, which are crucial for companies like China Merchants Land.

The 2024-25 Action Plan for energy conservation and carbon emissions reduction underscores these national objectives. This plan mandates greater oversight and adherence from industries that are major contributors to carbon emissions, directly impacting operational strategies and investment decisions.

China's national green transformation strategy is driving sustainable practices in urban and rural planning, emphasizing low-carbon design and ecological protection. This initiative aims to reshape the construction sector, with pilot projects under the Beautiful China Initiative serving as national benchmarks for more sustainable urbanization.

Resource Scarcity and Waste Management

China's growing focus on resource efficiency and waste reduction is directly impacting the real estate sector. Concerns about the availability of raw materials and the environmental impact of construction waste are driving a demand for building materials and systems that are more efficient. This trend is particularly relevant for developers like China Merchants Land, as it necessitates a shift in their procurement and construction practices.

The draft Ecological and Environmental Code highlights a commitment to a circular economy, emphasizing green design, manufacturing, and the comprehensive utilization of industrial waste. This regulatory push encourages developers to adopt more sustainable resource management strategies throughout their projects. For instance, the code may mandate increased use of recycled materials or penalize excessive waste generation on construction sites.

- Increased demand for recycled and sustainable building materials: Expect a rise in the use of materials like recycled concrete aggregate and low-carbon cement.

- Focus on waste reduction and recycling on-site: Developers will need to implement robust waste management plans to divert construction and demolition waste from landfills.

- Incentives for green building certifications: Government policies may offer benefits for projects achieving high standards in resource efficiency and waste management.

- Innovation in construction techniques: Prefabrication and modular construction methods can significantly reduce material waste and improve resource utilization.

Climate Change Adaptation in Real Estate

China's environmental regulations are increasingly emphasizing climate change adaptation, a critical factor for real estate developers like China Merchants Land. This means a growing need for climate-resilient designs and careful site selection, particularly in regions prone to extreme weather events. For instance, coastal cities in China are already experiencing impacts from rising sea levels and increased storm intensity, necessitating robust adaptation strategies in new developments.

The integration of climate action into China's new environmental code, effective from January 1, 2024, underscores a commitment to long-term ecological resilience. This code encourages sustainable building practices and penalizes environmentally damaging activities, directly impacting development costs and feasibility. Developers must now factor in the costs associated with climate-proofing infrastructure and materials, potentially increasing upfront investment but mitigating future risks.

- Climate Resilience in Development: By 2025, it's projected that climate-related events could cause significant economic losses, driving demand for properties in less vulnerable locations and with enhanced resilience features.

- Regulatory Impact: The updated environmental code's focus on ecological resilience may lead to stricter permitting processes for projects in environmentally sensitive areas, potentially delaying or increasing the cost of development.

- Investment in Green Building: China's green building market is expected to grow substantially, with an estimated market size of over RMB 2 trillion by 2025, signaling a shift towards sustainable and climate-adapted real estate.

- Adaptation Costs: While specific figures for China Merchants Land are not public, the broader industry trend suggests that incorporating climate adaptation measures could add 5-10% to construction costs, a necessary investment for long-term asset value preservation.

China's environmental policies are increasingly focused on climate change adaptation, requiring developers like China Merchants Land to prioritize climate-resilient designs and careful site selection. By 2025, climate-related events are projected to cause significant economic losses, further driving demand for properties with enhanced resilience features.

The updated environmental code, effective January 1, 2024, integrates climate action, encouraging sustainable building practices and penalizing environmentally damaging activities, which directly impacts development costs and feasibility. This necessitates factoring in climate-proofing infrastructure and materials, potentially increasing upfront investment but mitigating future risks.

The green building market in China is expected to grow substantially, with an estimated market size exceeding RMB 2 trillion by 2025, signaling a significant shift towards sustainable and climate-adapted real estate. While specific adaptation costs for China Merchants Land are not public, broader industry trends suggest these measures could add 5-10% to construction costs.

| Environmental Factor | Impact on China Merchants Land | Data/Projection |

|---|---|---|

| Climate Change Adaptation | Need for climate-resilient designs, careful site selection | By 2025, climate events could cause significant economic losses, increasing demand for resilient properties. |

| Environmental Code (Jan 1, 2024) | Impacts development costs, feasibility; encourages sustainable practices | Potential 5-10% increase in construction costs for adaptation measures. |

| Green Building Market Growth | Opportunity for sustainable development | Estimated market size to exceed RMB 2 trillion by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Merchants Land is built on a comprehensive review of official Chinese government publications, economic data from international organizations like the IMF and World Bank, and reports from reputable real estate and market research firms. We analyze regulatory changes, demographic shifts, technological advancements, and environmental policies impacting the Chinese property sector.