Clyde Bergemann GmbH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clyde Bergemann GmbH Bundle

Clyde Bergemann GmbH showcases robust engineering expertise and a strong global presence, key strengths in a competitive industrial market. However, potential reliance on specific technologies and evolving environmental regulations present significant challenges that demand careful navigation. Understanding these dynamics is crucial for any stakeholder looking to leverage or mitigate these factors.

Want the full story behind Clyde Bergemann GmbH's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Clyde Bergemann GmbH excels in highly specialized industrial technologies, particularly in boiler cleaning, material handling, and waste heat recovery. This deep expertise translates into advanced solutions that significantly boost plant efficiency and curb emissions, a critical advantage in specialized sectors.

Their proprietary technologies are a key strength, directly enhancing operational performance and environmental adherence for their global clientele. For instance, their advanced sootblower systems are designed for maximum cleaning efficiency, reducing downtime and fuel consumption, which is crucial for power plants and industrial boilers operating in 2024 and beyond.

Clyde Bergemann GmbH boasts an extensive array of products and services, encompassing vital equipment such as sootblowers and DRYCON bottom ash systems, complemented by robust service support. This holistic offering ensures clients receive not just machinery but also ongoing maintenance, spare parts, and expert guidance, cultivating enduring customer loyalty and predictable income.

Clyde Bergemann GmbH boasts an impressive global market presence, reaching customers in over 130 countries spanning six continents. This vast international footprint is a significant strength, diversifying revenue streams and mitigating risks associated with reliance on any single regional economy or regulatory environment. Their established global service network ensures consistent support for a wide array of industrial clients, no matter their location.

Focus on Environmental Solutions

Clyde Bergemann's commitment to environmental solutions is a significant strength, directly addressing the global demand for cleaner industrial processes. Their boiler cleaning systems are engineered to reduce carbon emissions, a crucial factor in combating climate change. For instance, advancements in their technology have demonstrated potential reductions in CO2 output by up to 5% in certain applications.

Beyond emission control, their innovative dry bottom ash handling systems offer substantial water savings. These systems can conserve millions of liters of water annually per plant, a vital benefit in water-scarce regions and a key differentiator in the market. This focus on sustainability aligns perfectly with increasing regulatory pressures and corporate environmental, social, and governance (ESG) goals, making Clyde Bergemann a preferred partner.

- Reduced Carbon Footprint: Boiler cleaning technologies contribute to lower CO2 emissions in industrial facilities.

- Water Conservation: Dry bottom ash handling systems significantly reduce water consumption in power plants.

- Alignment with Global Trends: Strong focus on sustainability meets growing market demand and regulatory requirements for greener operations.

Diverse Industry Application

Clyde Bergemann GmbH's strength lies in its broad applicability across numerous heavy industries. Serving sectors like power generation, waste-to-energy, biomass, oil & gas, marine, and pulp & paper means the company isn't reliant on the fortunes of just one market. This diversification is a significant advantage, buffering against sector-specific economic slowdowns and providing a wider customer base. For instance, in 2024, the global power generation sector saw continued investment in efficiency upgrades, a key area for Clyde Bergemann's offerings.

This wide industry reach translates into robust market penetration and resilience. The company's solutions are integral to operational efficiency and environmental compliance, making them essential across these varied industrial landscapes. Their expertise in optimizing combustion and emissions control is valued in sectors facing increasing regulatory scrutiny and the drive for sustainability.

- Diverse Customer Base: Operates in power generation, waste-to-energy, biomass, oil & gas, marine, and pulp & paper.

- Risk Mitigation: Diversification reduces dependency on any single industry's performance.

- Market Opportunity: Broad application opens doors to multiple growth avenues.

- Essential Solutions: Critical for efficiency and environmental performance across all served sectors.

Clyde Bergemann GmbH's core strength is its deep specialization in industrial cleaning and material handling technologies, particularly for boilers and waste heat recovery. This focus allows them to develop highly efficient and environmentally conscious solutions, which are essential for industries aiming to optimize performance and meet stringent regulations. Their advanced sootblower systems, for example, are critical for maintaining boiler efficiency, directly impacting fuel consumption and operational uptime for clients in 2024.

The company's proprietary technologies are a significant differentiator, providing tangible benefits like reduced emissions and enhanced operational performance. For instance, their innovative dry bottom ash handling systems not only improve plant efficiency but also contribute significantly to water conservation, potentially saving millions of liters of water per plant annually. This commitment to sustainability is increasingly vital as global ESG mandates intensify.

Their comprehensive product and service portfolio, including sootblowers and DRYCON systems, coupled with robust after-sales support, fosters strong customer relationships and recurring revenue. This holistic approach ensures clients receive ongoing value, reinforcing Clyde Bergemann's position as a trusted partner in critical industrial processes.

Clyde Bergemann GmbH's extensive global reach, serving over 130 countries, provides significant market diversification and resilience. This broad international presence ensures a stable revenue base, mitigating risks associated with economic downturns in any single region, while their established service network guarantees consistent support worldwide.

What is included in the product

Delivers a strategic overview of Clyde Bergemann GmbH’s internal and external business factors, highlighting its technological expertise and market position while acknowledging potential operational challenges and competitive pressures.

Offers a clear, actionable SWOT analysis for Clyde Bergemann GmbH, pinpointing key areas for strategic improvement and risk mitigation.

Weaknesses

Clyde Bergemann's strong ties to capital-intensive industries like power generation and heavy manufacturing expose it to the volatility of economic cycles and investment trends. For instance, a slowdown in global manufacturing output, which saw a contraction in some key regions during 2023, can directly dampen demand for their specialized equipment and services.

This reliance means that downturns in these core sectors can lead to significant revenue fluctuations for the company. Furthermore, the nature of large industrial projects, often requiring substantial client investment and long lead times, can create extended periods of uncertainty in sales pipelines.

Maintaining technology leadership in specialized industrial solutions, such as those offered by Clyde Bergemann GmbH, necessitates ongoing and significant investment in research and development. This continuous R&D is crucial for innovation, adapting to evolving industry standards, and meeting increasingly stringent environmental regulations.

The substantial expenditure required to stay competitive and develop next-generation solutions could strain the company's financial resources if not managed with exceptional efficiency. For instance, the rapid advancements in critical areas like carbon capture technologies or the broader renewable energy sector may demand considerable capital outlay to effectively integrate these innovations into their product lines.

Clyde Bergemann's reliance on the industrial sector makes it vulnerable to economic downturns. For instance, a slowdown in global manufacturing, as seen in the projected 0.5% contraction of global industrial production for 2024 by some analysts, directly translates to reduced demand for their equipment and services. This can lead to project postponements and a dip in new installations, impacting revenue streams.

Market Competition Intensity

The industrial equipment and services sector, especially for boiler cleaning and ash handling, is fiercely competitive. Clyde Bergemann faces rivals ranging from niche specialists to broad industrial conglomerates, all vying for market share.

This intense rivalry often translates into significant pricing pressure, which can erode profit margins. Companies like Clyde Bergemann must constantly innovate and enhance service quality to stand out. For instance, in the global industrial boiler market, which was valued at approximately USD 60 billion in 2023 and projected to grow, differentiation is key to maintaining a competitive edge.

Furthermore, larger competitors may leverage their scale to offer comprehensive, bundled solutions. This can present a challenge for Clyde Bergemann if its offerings are perceived as less integrated compared to broader packages from diversified players, potentially impacting its ability to win larger contracts.

- Intense Rivalry: Faces competition from specialized firms and large industrial groups.

- Pricing Pressure: High competition leads to demands for lower prices, impacting profitability.

- Need for Innovation: Continuous investment in new technologies and service improvements is essential.

- Bundled Solutions: Competitors may offer integrated packages that challenge product-specific approaches.

Dependency on Traditional Energy Sector

Clyde Bergemann's reliance on the traditional energy sector, particularly thermal power plants, presents a notable weakness. Historically, a substantial part of their revenue, especially from boiler cleaning and ash handling systems, is tied to fossil fuel-based power generation. This dependence makes the company vulnerable to the global transition towards renewable energy sources.

The ongoing phase-out of coal-fired power plants in many developed economies, a trend expected to accelerate through 2024 and into 2025, directly impacts demand for Clyde Bergemann's core offerings. For instance, the European Union's commitment to reducing coal power generation, with many member states aiming for phase-outs by 2030 or earlier, signifies a shrinking market for these traditional solutions. This necessitates a proactive strategy for diversification and innovation to mitigate long-term risks.

- Historical Revenue Linkage: A significant portion of Clyde Bergemann's business is historically linked to thermal power generation, including coal-fired plants.

- Global Energy Transition: The global shift towards renewable energy sources and the phasing out of fossil fuels pose a long-term threat to demand for traditional product lines.

- Market Shrinkage: The accelerating phase-out of coal power, with many countries targeting 2030 or earlier, directly reduces the addressable market for their established technologies.

- Strategic Adaptation Needed: The company must strategically adapt and diversify its offerings to remain competitive in a changing energy landscape.

Clyde Bergemann's focus on specialized industrial equipment, while a strength, also presents a weakness due to the capital-intensive nature of its client industries. This reliance makes the company susceptible to economic cycles and shifts in industrial investment. For example, a slowdown in global manufacturing, which saw some sectors experiencing contractions in 2023, can directly impact demand for their high-value machinery and services.

The need for continuous, substantial investment in research and development to maintain technological leadership is another significant weakness. This is crucial for adapting to evolving industry standards and environmental regulations, such as the push for cleaner industrial processes. For instance, integrating advanced solutions for carbon capture or enhancing efficiency in renewable energy applications requires considerable R&D expenditure, potentially straining financial resources if not managed effectively.

The company's historical revenue generation from thermal power plants, particularly those relying on fossil fuels, poses a considerable challenge given the global energy transition. The accelerating phase-out of coal-fired power, with many nations targeting 2030 or earlier for complete shutdowns, directly shrinks the market for Clyde Bergemann's traditional offerings. This necessitates a strategic pivot towards diversification and innovation to address long-term market viability.

Preview the Actual Deliverable

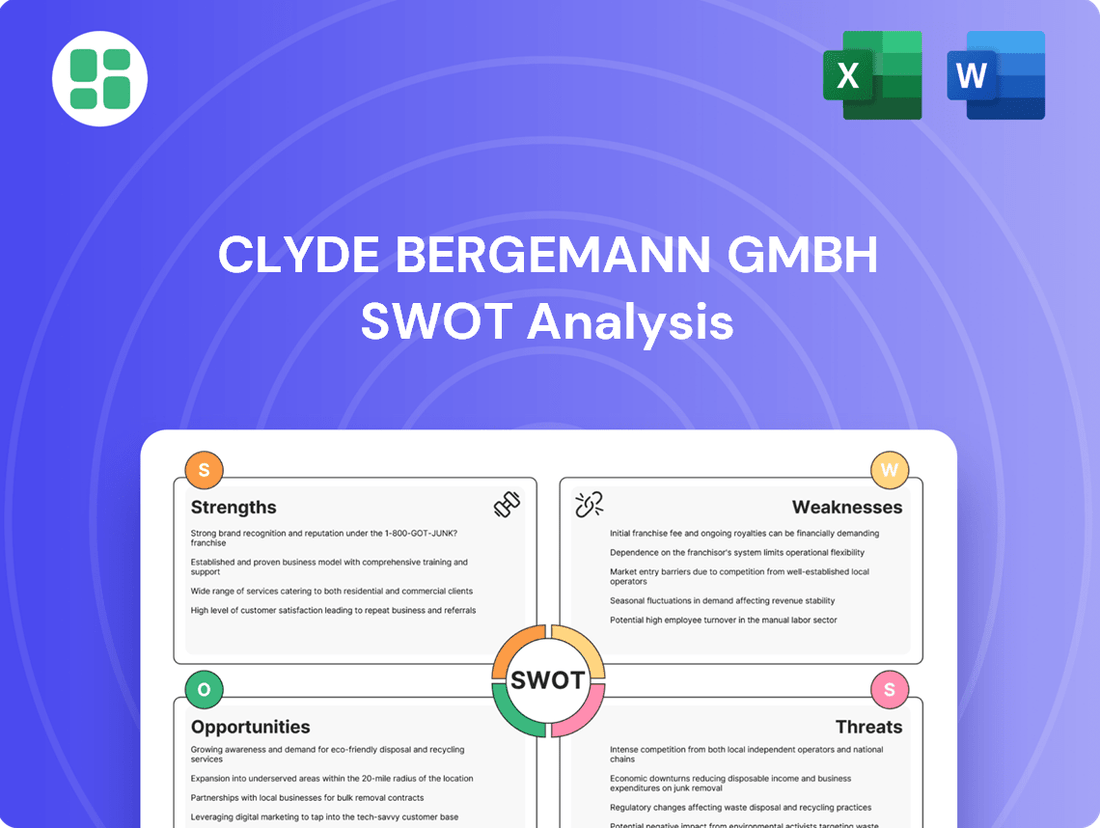

Clyde Bergemann GmbH SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Clyde Bergemann GmbH's Strengths, Weaknesses, Opportunities, and Threats. This detailed report is designed to offer actionable insights for strategic planning.

Opportunities

Rising global energy prices, coupled with a strong push from both businesses and governments towards greater operational efficiency, are fueling a significant demand for technologies that reduce energy usage. For instance, industrial energy consumption accounts for a substantial portion of global energy use, making efficiency improvements a critical focus area.

Clyde Bergemann’s waste heat recovery systems and advanced boiler cleaning solutions directly address this need by enabling industrial facilities to achieve considerable energy savings. These offerings are perfectly aligned with the market's drive for sustainability and cost reduction.

This growing emphasis on energy efficiency represents a considerable opportunity for Clyde Bergemann, not only for its existing product lines but also for the development of new, innovative solutions that further enhance energy optimization in industrial processes.

Governments globally are tightening environmental rules on emissions, waste, and pollution. For instance, the European Union's Industrial Emissions Directive (IED) continues to push for cleaner industrial practices. This creates a strong demand for companies like Clyde Bergemann that offer solutions for compliance.

The increasing focus on sustainability means industries must invest in technologies that reduce their environmental footprint. Clyde Bergemann's specialized systems for emissions control and material handling directly address these growing needs, positioning them to benefit from this trend.

Emerging markets, particularly in Asia-Pacific, are experiencing rapid industrialization and infrastructure development, creating substantial demand for Clyde Bergemann's core technologies. This growth is directly translating into increased opportunities for boiler cleaning, ash handling, and waste heat recovery systems. For instance, the International Energy Agency projected that developing economies in Asia would account for over 60% of global energy demand growth through 2025, underscoring the vast potential for Clyde Bergemann's solutions.

Investments in new power plants and industrial facilities across these regions are a key driver. By 2024, global investment in energy infrastructure was expected to reach trillions, with a significant portion allocated to new builds in emerging economies. This presents a direct avenue for Clyde Bergemann to expand its market share and secure new projects, capitalizing on the ongoing industrial expansion.

Integration of Industry 4.0 Technologies

Clyde Bergemann can leverage the increasing adoption of Industry 4.0 technologies to bolster its market position. By integrating solutions like the Internet of Things (IoT) and artificial intelligence (AI) into their existing product lines, the company can offer enhanced monitoring and predictive maintenance services. This move aligns with the broader industrial trend; for instance, the global Industrial IoT market was valued at approximately USD 212.1 billion in 2023 and is projected to grow significantly, indicating strong customer demand for such advancements.

The strategic implementation of these digital tools presents a clear opportunity for Clyde Bergemann to differentiate its offerings and create new value propositions. Customers are increasingly seeking operational efficiencies and reduced downtime, which smart technologies can directly address. For example, predictive maintenance, powered by AI and sensor data, can anticipate equipment failures before they occur, saving clients substantial costs and improving overall productivity.

- Enhanced Product Value: Incorporating IoT for real-time performance monitoring and AI for predictive maintenance can significantly increase the value proposition of Clyde Bergemann's systems.

- New Revenue Streams: Offering data-driven services, such as remote diagnostics and performance optimization, can open up new recurring revenue opportunities beyond traditional equipment sales.

- Improved Customer Efficiency: By enabling clients to achieve greater operational efficiency and minimize unplanned downtime, Clyde Bergemann strengthens customer loyalty and satisfaction.

Growth in Renewable Energy Support Infrastructure

The global transition towards renewable energy sources presents a significant opportunity for Clyde Bergemann to adapt its core competencies. While traditional fossil fuel markets may face pressure, the demand for specialized auxiliary systems within the renewable energy sector is growing. Clyde Bergemann's established expertise in heat exchange and material handling can be strategically applied to support emerging technologies.

Specifically, the company is well-positioned to cater to the needs of biomass-fired power plants and waste-to-energy facilities. These operations, while renewable, often require efficient ash handling and robust heat recovery systems, areas where Clyde Bergemann has proven capabilities. The waste-to-energy market, in particular, is experiencing substantial growth, with projections indicating a significant expansion in capacity over the coming years.

- Supporting Biomass and Waste-to-Energy: Clyde Bergemann's heat exchange and material handling technologies are directly applicable to biomass and waste-to-energy plants, which require efficient ash management and thermal processes.

- Market Growth Projections: The global waste-to-energy market is expected to see considerable expansion, offering a growing customer base for specialized support infrastructure. For example, the market was valued at approximately USD 30 billion in 2023 and is anticipated to grow at a CAGR of around 6-7% through 2030.

- Leveraging Existing Expertise: The company can leverage its established engineering strengths to provide critical components and services for these burgeoning renewable energy sectors, minimizing the need for entirely new R&D efforts.

The escalating global demand for enhanced operational efficiency and reduced energy consumption presents a prime opportunity for Clyde Bergemann. Their waste heat recovery and boiler cleaning solutions directly address this market need, aligning with the widespread push for sustainability and cost savings across industries.

Stringent environmental regulations worldwide are compelling industries to invest in cleaner technologies, creating a strong market for Clyde Bergemann's emissions control and material handling systems. This trend is further amplified by rapid industrialization in emerging markets, particularly in Asia-Pacific, which is driving significant demand for the company's core offerings.

The integration of Industry 4.0 technologies, such as IoT and AI, offers Clyde Bergemann a pathway to enhance its product value through predictive maintenance and data-driven services, creating new revenue streams and improving customer efficiency. Furthermore, the company can leverage its expertise in heat exchange and material handling to support the growing renewable energy sectors, specifically biomass and waste-to-energy facilities.

| Opportunity Area | Key Driver | Clyde Bergemann Relevance | 2024/2025 Data/Projection |

|---|---|---|---|

| Energy Efficiency Demand | Rising energy prices, government mandates | Waste heat recovery, boiler cleaning | Industrial energy efficiency improvements are critical; global industrial energy consumption is a major focus. |

| Environmental Compliance | Stricter global emissions regulations | Emissions control, material handling | EU Industrial Emissions Directive (IED) drives demand for compliance solutions. |

| Emerging Market Growth | Industrialization and infrastructure development | Boiler cleaning, ash handling, waste heat recovery | Asia-Pacific projected to drive over 60% of global energy demand growth through 2025. |

| Digitalization (Industry 4.0) | Customer demand for operational efficiency, reduced downtime | IoT for monitoring, AI for predictive maintenance | Global Industrial IoT market valued at ~USD 212.1 billion in 2023, with significant projected growth. |

| Renewable Energy Transition | Shift towards sustainable energy sources | Heat exchange, material handling for biomass/waste-to-energy | Waste-to-energy market projected to grow at ~6-7% CAGR through 2030. |

Threats

Global economic instability, marked by persistent inflation and elevated interest rates, presents a significant threat to Clyde Bergemann GmbH. For instance, the IMF projected global growth to slow from 3.5% in 2023 to 2.9% in 2024, indicating a challenging environment for industrial investment.

This economic climate can directly curtail capital expenditure by industrial clients. Companies facing tighter credit conditions and uncertain demand may postpone or cancel investments in new plant construction, equipment upgrades, and large-scale projects, thereby impacting Clyde Bergemann's order intake and revenue streams.

The potential for recessions in key markets further exacerbates this threat. Such downturns typically lead to a sharp decrease in industrial activity and a reluctance to commit to long-term capital projects, directly affecting the demand for Clyde Bergemann's specialized engineering solutions and services.

Competitors introducing advanced, cost-saving technologies, such as those in advanced combustion or novel emission control systems, could significantly impact Clyde Bergemann's market position. For instance, advancements in carbon capture technology, which saw significant investment and pilot projects in 2024, could offer alternative solutions to traditional flue gas treatment. This necessitates ongoing investment in research and development to ensure Clyde Bergemann's offerings remain competitive and relevant in a rapidly evolving industrial landscape.

Government policies increasingly favor renewable energy sources and mandate the phase-out of coal-fired power plants, especially in major developed economies. This trend directly impacts Clyde Bergemann's traditional markets, as it signals a shrinking demand for systems associated with coal combustion.

For instance, the European Union's commitment to a green transition, with many member states setting ambitious coal phase-out dates, presents a clear challenge. Germany aims to exit coal by 2038, while others like Austria and Sweden have already completed their transition. This shift necessitates that Clyde Bergemann, despite serving diverse industrial sectors, strategically adapts to a declining segment reliant on coal power generation.

Supply Chain Vulnerabilities

Global supply chain disruptions, exacerbated by geopolitical tensions and increasing trade protectionism, pose a significant threat to Clyde Bergemann GmbH. These factors can directly impact the availability and cost of essential raw materials and components, leading to higher production expenses and delivery delays. For instance, tariffs on key components, such as those affecting ash handling systems, can fundamentally alter the company's cost structure and overall competitiveness.

The ongoing volatility in global logistics, highlighted by shipping container shortages and port congestion throughout 2024, continues to affect lead times and freight costs. For example, the Red Sea shipping crisis, which began in late 2023 and persisted into 2024, has added significant surcharges and transit time increases for many industries, including heavy machinery manufacturing. This instability can disrupt production schedules and impact the company's ability to meet customer demands promptly, potentially eroding market share.

- Supply Chain Disruptions: Continued global supply chain volatility, including shipping delays and component shortages, directly impacts manufacturing timelines and costs.

- Geopolitical Risks: Escalating geopolitical tensions and trade protectionist policies can lead to increased tariffs and restrictions on the import/export of critical materials and finished goods.

- Cost Volatility: Fluctuations in raw material prices and increased freight charges, driven by global events, can significantly elevate production costs for Clyde Bergemann's specialized equipment.

- Competitive Disadvantage: Inability to secure materials or manage rising costs due to supply chain vulnerabilities can lead to delayed deliveries and reduced competitiveness against global peers.

Intense Price Competition

In the industrial boiler and environmental technology sector, intense price competition is a significant threat, particularly in mature markets or during economic slowdowns. This pressure can come from both long-standing competitors and emerging players, potentially squeezing profit margins. For Clyde Bergemann, this means customers might increasingly value lower costs over sophisticated features, forcing price adjustments or absorbing higher production expenses, which directly impacts financial health. The increasing commoditization of some industrial components further exacerbates this pricing challenge.

For instance, in the global industrial boiler market, which was valued at approximately USD 28.5 billion in 2023 and is projected to grow, price sensitivity is a constant factor. New market entrants, especially from regions with lower manufacturing costs, can intensify this competition. This dynamic can lead to a situation where:

- Profitability is pressured as companies are forced to match lower price points.

- Investment in R&D may be curtailed if margins shrink too significantly.

- Market share could be lost to competitors offering cheaper alternatives, even if less advanced.

- The perceived value of premium features might diminish in the eyes of cost-conscious buyers.

Intense price competition in the industrial boiler and environmental technology sectors poses a significant threat, particularly as economic conditions tighten. This pressure, often from emerging market competitors with lower cost structures, can erode profit margins for Clyde Bergemann. The increasing commoditization of certain industrial components further intensifies this challenge, potentially forcing price adjustments or the absorption of higher production expenses.

The global industrial boiler market, valued at roughly USD 28.5 billion in 2023, demonstrates this price sensitivity. New entrants can intensify competition, leading to reduced profitability, potential cuts in R&D, and market share loss to cheaper alternatives. This dynamic highlights the need for Clyde Bergemann to balance cost competitiveness with its technological offerings.

| Threat Category | Specific Impact | Market Context (2023-2025) | Potential Consequence for Clyde Bergemann |

| Intense Price Competition | Pressure on profit margins | Global industrial boiler market valued ~USD 28.5 billion (2023); increasing commoditization | Reduced profitability, potential R&D cuts, market share loss |

| Emerging Competitors | Undercutting prices with lower cost structures | Growth in regions with lower manufacturing costs | Need to match lower price points, potentially sacrificing margin |

| Economic Slowdowns | Increased customer focus on cost over features | IMF projected global growth slowing to 2.9% in 2024 | Diminished perceived value of premium features, impacting sales |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Clyde Bergemann GmbH's financial statements, comprehensive market research reports, and expert industry analyses to ensure a robust and insightful assessment.