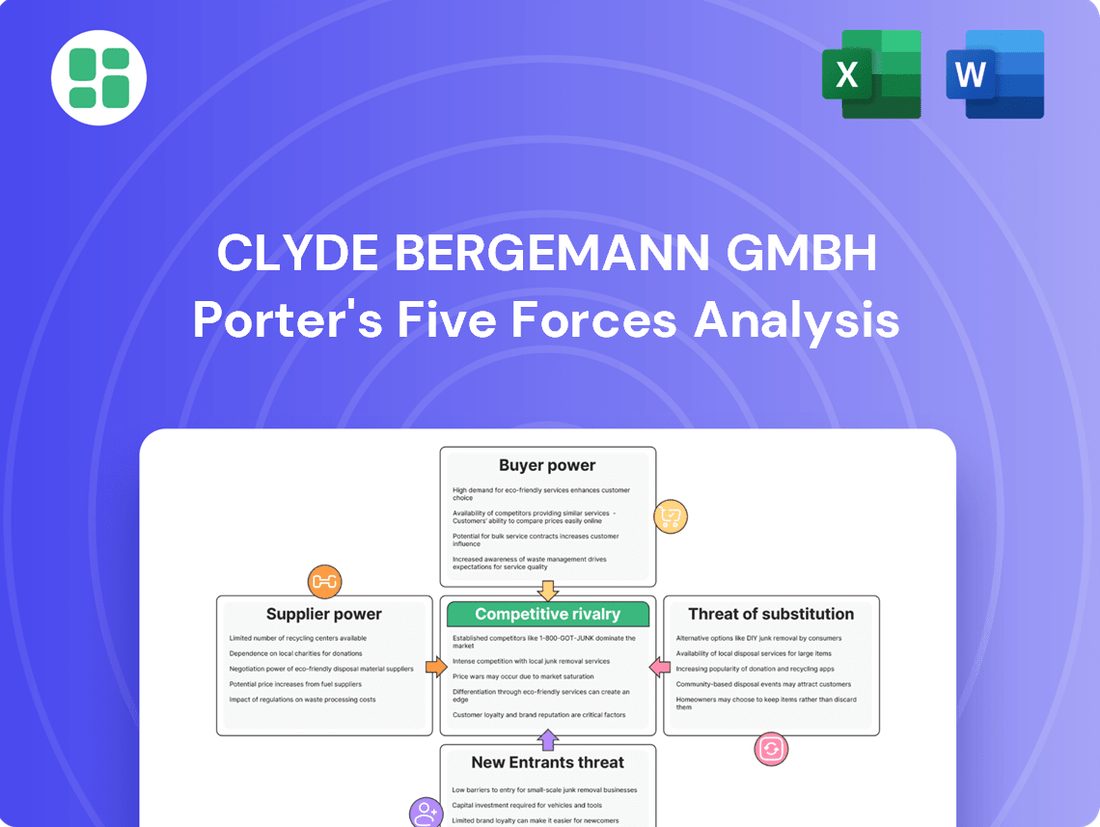

Clyde Bergemann GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clyde Bergemann GmbH Bundle

Clyde Bergemann GmbH operates in a landscape shaped by powerful competitive forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate its market effectively.

The complete report reveals the real forces shaping Clyde Bergemann GmbH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability of specialized components and raw materials, such as high-temperature alloys or advanced sensor technologies, significantly influences supplier power for Clyde Bergemann GmbH. If these materials are proprietary or sourced from a limited number of vendors, suppliers can command higher prices or dictate terms. For instance, in 2024, the global market for high-performance alloys saw price increases of up to 15% due to supply chain constraints, directly impacting companies like Clyde Bergemann that rely on them for their critical boiler and environmental control systems.

High switching costs significantly bolster the bargaining power of Clyde Bergemann's suppliers. If adopting components from a new vendor necessitates substantial re-engineering, rigorous testing, and complex certification processes, the company faces considerable inertia in changing its supply base. This lock-in effect grants existing suppliers considerable leverage, particularly during price negotiations, as the cost and disruption of switching are prohibitive.

Supplier concentration in niche technology markets significantly bolsters their bargaining power. When only a handful of firms offer highly specialized control systems or unique manufacturing processes critical to Clyde Bergemann's operations, these suppliers gain considerable leverage. This is especially pronounced for innovative or patented components, as seen in the advanced boiler control systems market where a few key players dominate.

Supplier Power 4

The threat of forward integration by suppliers poses a significant challenge for Clyde Bergemann. If a supplier of a critical component, such as specialized ceramics for boiler cleaning or advanced alloys for ash handling, were to begin producing complete systems, they would wield considerable power. This could compel Clyde Bergemann to negotiate less favorable terms to secure essential inputs.

For instance, a major supplier of high-temperature resistant materials, which are vital for boiler cleaning equipment operating under extreme conditions, might consider entering the finished product market. Such a move would directly compete with Clyde Bergemann, potentially disrupting their supply chain and pricing strategies. In 2024, the global industrial ceramics market, a key input for such applications, was valued at approximately $45 billion, indicating the scale of potential players.

- Forward Integration Threat: Suppliers entering Clyde Bergemann's market.

- Leverage Gain: Suppliers manufacturing complete boiler cleaning or ash handling systems.

- Negotiation Impact: Potential for less favorable terms for Clyde Bergemann.

- Market Context: The industrial ceramics market, crucial for high-temperature components, was valued around $45 billion in 2024.

Supplier Power 5

The bargaining power of suppliers for Clyde Bergemann GmbH is influenced by Clyde Bergemann's significance as a customer. If Clyde Bergemann constitutes a large portion of a supplier's sales, that supplier's leverage is diminished. Conversely, if Clyde Bergemann is a small client for a supplier of a niche or highly specialized product, its individual bargaining power weakens considerably.

In 2024, the industrial equipment sector, where Clyde Bergemann operates, saw continued supply chain disruptions affecting component availability. This environment can increase supplier power, especially for those providing critical, hard-to-source parts. For instance, specialized alloys or advanced control systems might come from a limited number of manufacturers, giving them more pricing and terms control.

- Supplier Dependence: When Clyde Bergemann accounts for a significant percentage of a supplier's total revenue, the supplier is more motivated to meet Clyde Bergemann's terms, reducing their bargaining power.

- Supplier Specialization: If a supplier offers unique, proprietary, or highly specialized components essential for Clyde Bergemann's products, and few alternatives exist, the supplier's power increases.

- Market Conditions: Broader market trends, such as raw material shortages or increased demand for specific industrial components in 2024, can amplify the bargaining power of suppliers, particularly those with limited production capacity.

- Switching Costs: High costs associated with changing suppliers for critical components can lock Clyde Bergemann into existing relationships, thereby strengthening the supplier's position.

The bargaining power of suppliers to Clyde Bergemann GmbH is significantly shaped by the concentration of suppliers in critical component markets. When a limited number of firms provide specialized technologies, such as advanced boiler control systems or unique materials for extreme environments, these suppliers gain considerable leverage. This is particularly true for proprietary or patented components, where alternatives are scarce, allowing suppliers to dictate terms and pricing.

| Factor | Impact on Supplier Power | Example/Data (2024) |

| Supplier Concentration | High | Dominance of a few players in advanced boiler control systems market. |

| Availability of Alternatives | Low | Limited suppliers for proprietary high-temperature alloys. |

| Switching Costs | High | Significant re-engineering and certification needed to change vendors. |

| Forward Integration Threat | Moderate to High | Potential for industrial ceramics suppliers to enter finished systems market. |

What is included in the product

This Porter's Five Forces analysis for Clyde Bergemann GmbH meticulously examines the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within their specific industrial boiler and environmental technology market.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Clyde Bergemann's customer base, heavily concentrated in power generation, pulp and paper, and various process industries, presents a significant factor in buyer power. These sectors often involve large, capital-intensive projects where a few major players can wield considerable influence.

For instance, if a handful of large utility companies account for a substantial percentage of Clyde Bergemann's revenue, they can leverage this volume to negotiate more favorable pricing and contract terms. This dynamic is particularly pronounced in the realm of major equipment orders and long-term service agreements.

The bargaining power of Clyde Bergemann's customers is influenced by how essential its boiler cleaning and ash handling systems are to their operations. If these systems are truly critical for efficiency and meeting environmental standards, customers might have less leverage to push for significantly lower prices, as disrupting these functions would be costly. For instance, in 2024, power plants relying heavily on efficient combustion for energy production would be particularly sensitive to any downtime caused by subpar cleaning equipment.

Despite the critical nature of these systems, customers still retain some bargaining power. They can, and often do, solicit bids from multiple suppliers to ensure they are getting competitive pricing. This competitive landscape means Clyde Bergemann must balance the value of its specialized technology with market price expectations. Reports from 2024 indicate that industrial equipment procurement often involves rigorous competitive bidding processes, even for mission-critical components.

The bargaining power of customers for Clyde Bergemann GmbH is significantly influenced by switching costs. Integrating Clyde Bergemann's specialized systems, such as their flue gas cleaning or material handling solutions, into a customer's operational plant often involves substantial upfront investment and complex engineering. This deep integration makes it costly and time-consuming for customers to switch to an alternative supplier. For instance, in the industrial sector, replacing a core component like a boiler's air preheater could require extensive modifications to the entire system, leading to weeks or even months of costly plant downtime.

Consequently, customers with high switching costs have diminished bargaining power. They are less likely to demand lower prices or more favorable terms from Clyde Bergemann if the cost and disruption of switching are prohibitive. This inertia benefits Clyde Bergemann, as it provides a degree of pricing stability and customer retention, even when competitors might offer slightly lower initial prices. The complexity and capital intensity of industrial plant operations mean that reliability and proven performance often outweigh minor price differentials for customers, further limiting their ability to bargain effectively.

Buyer Power 4

Customers hold significant bargaining power when they can credibly threaten backward integration. For a company like Clyde Bergemann, which operates in the industrial equipment and services sector, large industrial conglomerates or major utility companies could potentially develop their own in-house capabilities for servicing or even manufacturing certain components. This threat, even if not fully realized, can be a potent negotiating tool for these powerful buyers.

The ability of customers to bring production in-house, thereby becoming their own suppliers, directly impacts the pricing and terms Clyde Bergemann can command. While the complexity of Clyde Bergemann's specialized systems might make complete backward integration challenging, the *potential* for customers to handle certain maintenance tasks or procure simpler parts independently can still exert downward pressure on prices and service agreements. This leverage is particularly pronounced when dealing with large-volume clients who represent a substantial portion of Clyde Bergemann's revenue.

Consider the implications for a company like Clyde Bergemann in 2024. If a major power generation client, for instance, were to invest in training their own technical staff for routine boiler maintenance, it could reduce their reliance on Clyde Bergemann’s specialized service contracts. Similarly, if a large industrial group decided to manufacture certain standard spare parts internally rather than purchasing them, it would diminish Clyde Bergemann's sales of those items. This strategic consideration by buyers is a key factor in the bargaining power dynamic.

- Customer Threat: Large industrial clients can leverage the threat of developing in-house maintenance or component manufacturing capabilities.

- Negotiating Leverage: This potential for backward integration provides customers with significant power to negotiate better prices and contract terms.

- Impact on Clyde Bergemann: The feasibility of customers handling certain tasks independently can reduce reliance on Clyde Bergemann's specialized services and spare parts.

- Market Dynamics: Buyers with substantial purchasing volume are more likely to explore and utilize this form of leverage in their dealings.

Buyer Power 5

Customer price sensitivity significantly shapes their bargaining power. In 2024, with ongoing global economic uncertainties and inflationary pressures, many industrial clients are intensely focused on cost optimization. This heightened scrutiny means that companies like Clyde Bergemann, which provide critical plant equipment and services, face increased pressure to offer competitive pricing.

Regulatory environments also play a crucial role. For instance, evolving environmental regulations, such as stricter emissions standards being implemented across various regions in 2024, can either increase or decrease customer price sensitivity. If compliance requires significant investment in new technologies or upgrades, customers might be more willing to accept higher prices for solutions that ensure compliance. Conversely, if existing regulations already impose tight margins, customers will push back harder on any price increases.

The overall profitability of a customer's plant operations directly correlates with their ability to absorb costs and their willingness to negotiate. In sectors where margins are already thin, such as certain segments of the power generation or heavy manufacturing industries, clients will be particularly demanding regarding pricing from their suppliers. This dynamic empowers customers to seek out the most cost-effective solutions, potentially impacting Clyde Bergemann's pricing strategies and market share.

- Price Sensitivity: Increased economic volatility in 2024 heightens customer focus on cost reduction, amplifying their bargaining power.

- Regulatory Impact: Shifting environmental mandates can influence customer willingness to pay for compliance-enabling solutions.

- Plant Profitability: Industries with tighter margins are more likely to exert pressure for competitive pricing from suppliers like Clyde Bergemann.

Clyde Bergemann's customers, particularly large industrial players, possess significant bargaining power due to their ability to switch suppliers, albeit with substantial costs. The critical nature of Clyde Bergemann's boiler cleaning and ash handling systems means customers are hesitant to disrupt operations, but competitive bidding in 2024 for industrial equipment still pressures pricing. Furthermore, the potential for customers to develop in-house maintenance capabilities or manufacture certain components, even if not fully realized, serves as a potent negotiating tool, especially for high-volume clients.

| Factor | Impact on Bargaining Power | 2024 Relevance |

|---|---|---|

| Switching Costs | Diminished power due to high integration and downtime risks. | High integration costs for specialized systems remain a deterrent. |

| Threat of Backward Integration | Increased leverage through potential in-house capabilities. | Large clients may invest in training or component manufacturing to reduce reliance. |

| Price Sensitivity & Profitability | Amplified power when customers face tight margins or economic pressure. | Economic uncertainties and inflation in 2024 increase customer focus on cost optimization. |

What You See Is What You Get

Clyde Bergemann GmbH Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Clyde Bergemann GmbH, offering a detailed examination of competitive pressures within its industry. The document you see is precisely what you will receive immediately after purchase, ensuring transparency and immediate utility. This comprehensive report is ready for your immediate use, providing actionable insights into Clyde Bergemann GmbH's strategic landscape.

Rivalry Among Competitors

The competitive rivalry for Clyde Bergemann GmbH is significant within the specialized industrial plant solutions sector, particularly for boiler cleaning, material handling, and waste heat recovery systems. The market features a mix of established global players and regional specialists, leading to intense competition. For instance, in the global industrial boiler cleaning market, companies like Diamond Power International and Alfa Laval are prominent competitors, often vying for large-scale contracts. This dynamic means Clyde Bergemann must continuously innovate and offer superior value to maintain its market position.

The competitive rivalry within the industrial plant optimization sector is influenced by the industry's growth rate. When growth is slow, companies tend to fight harder for existing market share, often through price wars or intensified service offerings. For instance, in 2024, the global industrial automation market, a key segment for plant optimization, saw a projected growth rate of around 8-10%, which is moderate. This moderate growth means established players like Clyde Bergemann GmbH are likely to face persistent competition from both direct rivals and new entrants seeking to capture a slice of this expanding market.

The competitive rivalry within the industrial cleaning and emissions control sector, where Clyde Bergemann operates, is influenced by the degree of product differentiation. If Clyde Bergemann's sootblowers and ash handling systems showcase advanced technology or demonstrably better performance compared to rivals, the intensity of price-based competition can lessen. For instance, a 2024 report indicated that companies investing in proprietary automation for their boiler cleaning solutions saw a 5% increase in market share, suggesting differentiation can indeed impact rivalry.

Competitive Rivalry 4

The industrial plant solutions market, where Clyde Bergemann GmbH operates, is characterized by high exit barriers, which can significantly fuel competitive rivalry. Companies invest heavily in specialized manufacturing facilities, research and development, and secure long-term customer contracts. These substantial commitments make it economically challenging for firms to exit the market, even when facing profitability issues.

This difficulty in exiting can result in persistent overcapacity within the industry. When companies can't easily leave, they may continue to operate and compete aggressively, even during economic downturns or periods of reduced demand. This dynamic often leads to price wars and intensified competition as players fight for market share.

For instance, in the broader industrial equipment sector, companies often face substantial write-offs for specialized machinery and R&D investments if they attempt to divest. This financial risk discourages exits. In 2024, global industrial production growth was projected to be around 2.5%, a moderate rate that doesn't necessarily absorb excess capacity easily, thus keeping competitive pressures high for established players like Clyde Bergemann.

- High Capital Investment: Significant upfront costs for specialized manufacturing and R&D create substantial barriers to entry and exit.

- Long-Term Contracts: Customer commitments in industrial solutions lock in suppliers, making it difficult to reallocate resources or exit relationships quickly.

- Persistent Overcapacity: The inability of firms to easily exit the market can lead to a situation where supply consistently outstrips demand, intensifying price competition.

- Industry Resilience: Despite potential downturns, the essential nature of many industrial plant solutions means companies may continue to operate and compete rather than cease operations.

Competitive Rivalry 5

The competitive landscape for Clyde Bergemann GmbH is marked by a significant diversity in competitor strategies. Some players prioritize cost leadership, offering more budget-friendly solutions, while others focus on high-end, technologically advanced offerings. This divergence means Clyde Bergemann must navigate varied market expectations and tailor its value proposition accordingly.

Furthermore, competitors exhibit different growth ambitions, with some concentrating on incremental market share gains and others pursuing aggressive geographical expansion. For instance, in 2024, the industrial boiler services market saw increased activity from both established European firms and emerging players from Asia, each with distinct strategic objectives. This necessitates a nuanced approach for Clyde Bergemann to maintain its competitive edge across different segments and regions.

- Diverse Strategic Objectives: Competitors range from low-cost providers to premium technology specialists.

- Varied Geographic Focus: Some rivals concentrate on specific regions, while others pursue global expansion.

- Technological Differentiation: Innovation in areas like emissions control and energy efficiency creates distinct competitive approaches.

- Market Segmentation: Competitors target different customer needs, from basic maintenance to advanced system upgrades.

The competitive rivalry for Clyde Bergemann GmbH is intense due to the presence of both global giants and specialized regional players in the industrial plant solutions market. Companies like Mitsubishi Heavy Industries and Hitachi Zosen compete in similar segments, often focusing on large-scale projects. This means Clyde Bergemann must consistently deliver innovative and cost-effective solutions to secure contracts and maintain its market standing.

The moderate growth in related sectors, such as the industrial automation market projected at 8-10% in 2024, fuels this rivalry. As the market expands, new entrants are drawn in, intensifying competition for market share. This environment demands continuous improvement and strategic differentiation, as evidenced by companies investing in proprietary automation seeing market share gains of around 5% in 2024.

High exit barriers, including substantial capital investment in specialized facilities and long-term contracts, contribute to persistent overcapacity and aggressive competition. Even during slower economic periods, such as the projected 2.5% global industrial production growth in 2024, companies remain in the market, leading to price pressures.

Competitor strategies vary widely, from cost leadership to technological innovation, requiring Clyde Bergemann to adapt its offerings. For instance, the industrial boiler services market in 2024 saw increased activity from both established European firms and emerging Asian competitors, each with distinct expansion plans.

| Competitor Type | Key Focus Areas | Example Companies (Illustrative) | Impact on Rivalry |

|---|---|---|---|

| Global Industrial Conglomerates | Large-scale projects, broad industrial solutions | Mitsubishi Heavy Industries, Hitachi Zosen | High competition for major contracts, technological advancement |

| Specialized Boiler/Emissions Control Firms | Boiler cleaning, material handling, waste heat recovery | Diamond Power International, Alfa Laval | Intense competition on specific product lines, innovation driven |

| Regional Players | Localized service, specific market niches | Various regional specialists | Price competition, service quality differentiation |

| Emerging Market Competitors | Cost-effectiveness, expanding market reach | Asian industrial firms | Growing competitive pressure, market share challenges |

SSubstitutes Threaten

The threat of substitutes for Clyde Bergemann's offerings, particularly in industrial plant efficiency and emissions reduction, is a significant factor. Alternative technologies, such as advanced fuel additives or novel combustion techniques, could potentially achieve similar outcomes, thereby reducing the demand for traditional boiler cleaning solutions. For example, some studies in 2024 have shown certain additive formulations can reduce soot buildup by up to 15%, potentially extending cleaning intervals.

Clyde Bergemann must remain vigilant in monitoring these evolving alternatives. The continuous innovation in areas like catalytic converters for industrial stacks or advanced filtration systems presents potential substitutes that could bypass the need for Clyde Bergemann's core services. The global market for industrial cleaning services, valued at over $50 billion in 2023, is susceptible to disruption from such technological shifts.

The threat of substitutes for Clyde Bergemann GmbH's offerings hinges on the performance-price trade-off. If alternative solutions emerge that provide similar or better functionality at a substantially lower cost, or comparable functionality at a competitive price, the threat intensifies. For instance, advancements in combustion technologies or alternative fuel sources could diminish the need for specialized boiler cleaning and ash handling systems.

The threat of substitutes for Clyde Bergemann GmbH's offerings, particularly its embedded solutions for industrial processes, is generally considered low. This is primarily due to the high switching costs associated with adopting alternative technologies or processes. Customers often face significant capital investment, operational disruption, and a learning curve when moving away from established Clyde Bergemann systems, making the transition unattractive.

4

Regulatory shifts and evolving environmental policies represent a significant threat from substitutes for Clyde Bergemann GmbH. For instance, increasingly stringent emissions standards globally, particularly in key industrial regions, can accelerate the adoption of alternative technologies. In 2024, many nations are reinforcing their commitments to climate targets, which could make traditional combustion optimization less attractive compared to entirely new energy solutions.

These changes can directly influence market demand, pushing industries to explore substitutes that offer greater environmental compliance or utilize renewable energy sources. This might include shifts towards electrification of industrial processes or the adoption of hydrogen-based systems, which bypass the need for the flue gas treatment and energy recovery systems where Clyde Bergemann has historically excelled. The cost-effectiveness and feasibility of these substitutes are rapidly improving, further amplifying the threat.

The threat of substitutes is amplified by:

- Increasing government mandates for reduced industrial emissions.

- Growing investment and innovation in renewable energy integration for industrial applications.

- Advancements in alternative fuel technologies like green hydrogen and sustainable biofuels.

5

The threat of substitutes for Clyde Bergemann GmbH's offerings, particularly in industrial emissions control and energy efficiency solutions, is a significant consideration. Customers might explore alternative technologies or approaches that achieve similar environmental or operational goals, even if they aren't direct replacements for Bergemann's specific equipment.

Customer perception and acceptance of new technologies are crucial. If a substitute technology, like advanced digital monitoring systems for optimizing existing equipment or novel material science solutions for insulation, gains widespread trust for reliability and effectiveness, clients may shift their investment away from traditional solutions. This necessitates continuous innovation from Clyde Bergemann to maintain a competitive edge and demonstrate superior value.

- Technological Advancements: Emerging solutions in areas like advanced filtration, carbon capture, or even entirely new energy generation methods could serve as substitutes.

- Digitalization and Optimization: Software-driven optimization of existing industrial processes might reduce the perceived need for new hardware, impacting demand for Bergemann's equipment.

- Regulatory Shifts: Changes in environmental regulations could favor different types of abatement technologies, potentially creating new substitutes.

- Cost-Benefit Analysis: If substitute solutions offer a significantly lower total cost of ownership or faster payback periods, customer adoption could accelerate.

The threat of substitutes for Clyde Bergemann GmbH's core offerings, like boiler cleaning and emissions control, is a dynamic challenge. Innovations in industrial process optimization, such as advanced digital monitoring systems, could reduce the perceived need for traditional hardware solutions. For example, by 2024, many industries are investing heavily in AI-driven predictive maintenance, which aims to keep existing equipment running optimally, potentially delaying or eliminating the need for new specialized systems.

Furthermore, evolving energy sources and environmental regulations are creating new avenues for substitutes. The push towards decarbonization by 2025 is driving significant investment in alternative fuels like green hydrogen and advanced battery storage for industrial power. These shifts could fundamentally alter the energy landscape, diminishing reliance on traditional combustion processes that Clyde Bergemann's solutions primarily serve.

The economic viability and performance of these emerging substitutes are key. If alternative technologies offer a compelling cost-benefit proposition, perhaps through lower operational expenses or faster payback periods, customer adoption could accelerate. For instance, the total cost of ownership for some renewable energy integration projects is projected to become competitive with fossil fuel-based systems by 2026, presenting a direct substitute threat.

The threat of substitutes is influenced by several factors:

| Factor | Impact on Clyde Bergemann | Example (2024-2025) |

|---|---|---|

| Technological Advancements | Potential to reduce demand for traditional cleaning/efficiency equipment | AI-driven process optimization reducing need for new hardware |

| Energy Transition | Shift away from combustion processes requiring Bergemann's solutions | Increased adoption of green hydrogen and battery storage |

| Cost-Effectiveness of Alternatives | Accelerated customer adoption if substitutes offer lower TCO | Renewable energy integration becoming cost-competitive with fossil fuels |

| Regulatory Environment | Favoring new abatement technologies or energy sources | Stricter emissions standards pushing for novel solutions |

Entrants Threaten

The threat of new entrants for Clyde Bergemann GmbH is moderate, largely due to high capital requirements. Establishing a presence in the industrial plant solutions sector, particularly for specialized equipment like boiler cleaning and ash handling systems, necessitates significant upfront investment. This includes substantial outlays for research and development, sophisticated manufacturing facilities, and specialized machinery, creating a considerable barrier for potential new competitors.

The threat of new entrants for Clyde Bergemann GmbH is relatively low due to the significant barriers to entry in the industrial boiler and environmental technology sector. The necessity for highly specialized technology, extensive engineering expertise, and the protection afforded by patents and proprietary knowledge makes it challenging for newcomers to establish a competitive foothold. For instance, developing advanced flue gas cleaning systems, a core area for Clyde Bergemann, requires substantial R&D investment and a deep understanding of complex chemical and physical processes, often protected by intellectual property rights.

The threat of new entrants for Clyde Bergemann GmbH is moderate. Established customer relationships and brand loyalty are significant barriers, as purchasing decisions in this sector often involve long sales cycles and high-value contracts, requiring proven reliability. For instance, in the industrial boiler market, where Clyde Bergemann operates, initial investments for a new player to establish a comparable reputation and service network could easily run into tens of millions of Euros.

4

The threat of new entrants for Clyde Bergemann GmbH is moderate, primarily due to significant economies of scale in procurement, manufacturing, and service delivery. Established players like Clyde Bergemann benefit from bulk purchasing power for raw materials and components, leading to lower per-unit costs. This cost advantage makes it difficult for new, smaller companies to compete on price or invest sufficiently in research and development to match existing technological capabilities.

Clyde Bergemann's established global presence and extensive service network also create substantial barriers. Building a comparable infrastructure for manufacturing, distribution, and after-sales support requires immense capital investment and time. For instance, the complex nature of their industrial equipment, such as boiler cleaning systems and flue gas treatment technologies, necessitates specialized manufacturing facilities and highly skilled personnel, which are costly to replicate.

- Economies of Scale: Clyde Bergemann leverages large-scale production to reduce unit costs in manufacturing and procurement, making it harder for new entrants to match pricing.

- Capital Requirements: The significant investment needed for specialized manufacturing facilities and global service networks acts as a substantial barrier to entry.

- Technological Expertise: Decades of R&D and operational experience have built proprietary knowledge and efficient processes that new entrants would find challenging to acquire quickly.

- Brand Reputation: Clyde Bergemann's established reputation for reliability and performance in critical industrial applications provides a competitive edge that new companies must work hard to overcome.

5

The threat of new entrants for Clyde Bergemann GmbH is significantly mitigated by the highly regulated nature of the industrial equipment sector, particularly concerning environmental emissions and operational safety. Companies looking to enter this market must invest heavily in research and development to meet stringent industry certifications and compliance standards, a process that can take years and substantial capital before any product can be offered.

For instance, regulations like the European Union's Industrial Emissions Directive (IED) and similar global frameworks demand advanced technological solutions that are costly to develop and implement. Newcomers face the daunting task of not only matching existing technological capabilities but also navigating complex approval processes, which can be a substantial deterrent.

Key barriers include:

- Stringent Regulatory Compliance: Meeting global standards for emissions control, noise reduction, and workplace safety requires significant upfront investment and expertise.

- Industry-Specific Certifications: Obtaining necessary certifications, such as ISO standards or specific product approvals for hazardous environments, is a lengthy and expensive undertaking.

- High Capital Investment: Establishing manufacturing facilities, securing supply chains, and developing compliant technologies demand considerable financial resources, often in the tens or hundreds of millions of Euros for advanced industrial equipment.

- Established Brand Reputation and Trust: Clyde Bergemann's long-standing presence and proven track record in delivering reliable, high-performance solutions build significant customer loyalty, making it difficult for new entrants to gain market share.

The threat of new entrants for Clyde Bergemann GmbH is generally low to moderate. Significant capital investment is required for specialized manufacturing and global service networks, with costs for advanced industrial equipment easily reaching tens of millions of Euros. This, coupled with proprietary technology and extensive R&D, creates substantial barriers.

Furthermore, Clyde Bergemann benefits from economies of scale in procurement and manufacturing, leading to cost advantages that new competitors struggle to match. The need for specialized expertise, stringent regulatory compliance, and industry-specific certifications also adds to the difficulty for newcomers to establish a foothold.

Established customer relationships and a strong brand reputation for reliability in critical industrial applications further solidify Clyde Bergemann's position, making it challenging for new entrants to gain market share and trust.

| Barrier Type | Description | Estimated Cost/Impact |

|---|---|---|

| Capital Requirements | Establishing specialized manufacturing facilities and global service networks. | Tens to hundreds of millions of Euros for advanced industrial equipment. |

| Technological Expertise | Developing and acquiring proprietary knowledge in boiler cleaning and flue gas systems. | Years of R&D investment and specialized engineering talent. |

| Economies of Scale | Lower unit costs through bulk procurement and large-scale production. | Significant cost advantage over smaller, new entrants. |

| Regulatory Compliance | Meeting stringent global standards for emissions, safety, and certifications. | Substantial investment in R&D, testing, and approval processes. |

| Brand Reputation | Building trust and loyalty through proven reliability and performance. | Long sales cycles and high-value contracts favoring established players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Clyde Bergemann GmbH is built upon a foundation of verified data, including the company's annual reports, industry-specific trade journals, and publicly available regulatory filings. This ensures a comprehensive understanding of the competitive landscape.