Clyde Bergemann GmbH PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clyde Bergemann GmbH Bundle

Navigate the complex external landscape impacting Clyde Bergemann GmbH with our expert PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the company's operational environment. This comprehensive report offers crucial insights for strategic planning and competitive advantage. Download the full version now to gain actionable intelligence and secure your market position.

Political factors

Global and regional governmental policies on industrial emissions, such as carbon taxes and stricter air quality standards, directly influence the demand for Clyde Bergemann's emission reduction technologies. For instance, the European Union's Emissions Trading System (EU ETS) has seen carbon prices fluctuate, with allowances trading around €65-€100 per tonne of CO2 in early 2024, incentivizing industries to adopt cleaner solutions.

Compliance requirements drive industries to invest in solutions like improved boiler cleaning and waste heat recovery. Many nations are setting ambitious net-zero targets, with over 130 countries having pledged to reach net-zero emissions by mid-century. This creates a sustained demand for technologies that enhance energy efficiency and reduce pollution from industrial processes.

Political shifts towards or away from environmental protection can significantly impact market opportunities and regulatory enforcement. For example, changes in administration in countries like the United States can lead to adjustments in environmental regulations, affecting the pace of adoption for technologies like those offered by Clyde Bergemann.

Energy transition policies are significantly reshaping the energy landscape, directly impacting Clyde Bergemann's traditional client base in fossil fuel power generation. Governments worldwide are increasingly implementing regulations and incentives to accelerate the shift towards renewable energy sources and phase out coal and natural gas. For instance, the European Union's 'Fit for 55' package aims for a 55% reduction in greenhouse gas emissions by 2030, which necessitates a substantial decrease in fossil fuel reliance.

Clyde Bergemann needs to strategically adapt its product and service portfolio to align with these evolving market demands. This includes developing solutions for cleaner energy production technologies such as biomass and waste-to-energy plants, which are seeing increased investment. Simultaneously, optimizing the efficiency and environmental performance of existing conventional power plants during this transition period remains crucial, offering a stable, albeit potentially shrinking, revenue stream. The global renewable energy market is projected to reach over $1.9 trillion by 2024, according to some industry forecasts, highlighting the immense growth potential in this sector.

Government incentives for green technologies present significant growth opportunities. Many nations are offering substantial subsidies, tax credits, and favorable financing for renewable energy projects and the retrofitting of existing infrastructure. For example, the Inflation Reduction Act in the United States provides billions in tax credits for clean energy manufacturing and deployment. These policies can de-risk investments in new technologies and create a more favorable environment for companies like Clyde Bergemann that can offer solutions supporting this transition.

Clyde Bergemann GmbH, as a global technology provider, is significantly influenced by international trade agreements and tariffs. For instance, the European Union's trade policies, which include agreements with numerous countries, facilitate smoother operations and market access for German companies like Clyde Bergemann. Conversely, the imposition of tariffs, such as those seen in trade disputes between major economies, can increase the cost of imported components for manufacturing and raise prices for exported equipment, impacting competitiveness.

The global supply chain for industrial equipment relies heavily on the efficient movement of goods. For 2024 and looking into 2025, ongoing trade negotiations and potential shifts in trade policies, such as those affecting critical raw materials or specialized components, could introduce volatility. For example, disruptions stemming from geopolitical tensions, like those impacting shipping routes or specific national economies, can directly affect delivery times and operational costs for Clyde Bergemann's projects worldwide.

Political Stability in Key Markets

The political stability of Germany, where Clyde Bergemann GmbH is headquartered, remains a cornerstone of its operations. As of early 2024, Germany continues to demonstrate robust democratic institutions and a commitment to the rule of law, contributing to a predictable business environment. This stability is vital for securing long-term contracts and maintaining client confidence, particularly in sectors reliant on consistent industrial output.

Clyde Bergemann's global client base spans various regions, making the political climate in those markets equally important. For instance, significant industrial activity in countries like China and India, both key markets for industrial equipment, necessitates monitoring their respective political landscapes. China's ongoing focus on economic development and industrial modernization, despite geopolitical considerations, generally supports continued investment in infrastructure and energy sectors. India, similarly, has been implementing economic reforms aimed at boosting manufacturing and infrastructure, which bodes well for companies like Clyde Bergemann, though occasional policy shifts require careful navigation.

Political instability can directly impact Clyde Bergemann's business through several channels:

- Project Delays: Unforeseen political unrest or significant policy changes in client countries can halt or significantly delay ongoing projects, impacting revenue streams and project completion timelines.

- Investment Security: For both Clyde Bergemann and its clients, political stability ensures the security of investments in new equipment and plant upgrades. Fluctuations can deter necessary capital expenditure.

- Operational Risks: Increased security concerns, trade restrictions, or changes in regulatory frameworks stemming from political instability can elevate operational costs and risks.

Subsidies and Incentives for Industrial Modernization

Government initiatives, such as the German government's €30 billion Future Package for climate protection and energy transition through 2026, directly support industrial modernization and the adoption of cleaner technologies. These subsidies and grants, including tax incentives for energy efficiency investments, reduce the capital expenditure for clients looking to upgrade their facilities. This financial support makes Clyde Bergemann's advanced solutions for plant optimization and emissions control more accessible and attractive, potentially accelerating project timelines.

These programs aim to foster innovation and competitiveness within German industry. For instance, the Federal Ministry for Economic Affairs and Climate Action (BMWK) offers various funding opportunities for digitalization and energy efficiency projects. By lowering the financial burden on potential customers, these incentives can directly translate into increased demand for Clyde Bergemann's specialized equipment and services, particularly those focused on environmental performance and operational upgrades.

- Increased Demand: Government funding for industrial modernization directly boosts the market for Clyde Bergemann's solutions.

- Accelerated Adoption: Incentives lower client investment barriers, speeding up the uptake of new technologies.

- Focus on Green Tech: Subsidies often target energy efficiency and emissions reduction, aligning with Clyde Bergemann's offerings.

- Competitive Advantage: Clients leveraging these incentives can upgrade more affordably, enhancing their own competitiveness.

Governmental policies worldwide are increasingly focused on decarbonization, impacting industries reliant on fossil fuels. For example, the EU's carbon pricing mechanisms, with allowances trading in the €65-€100 range in early 2024, directly incentivize cleaner technologies like those Clyde Bergemann offers. Many nations are setting ambitious net-zero targets, with over 130 countries committed to this goal by mid-century, creating sustained demand for energy efficiency solutions.

Shifts in political administrations can alter environmental regulations, influencing technology adoption rates. For instance, changes in US federal policy can accelerate or decelerate the market for emission reduction equipment. Energy transition policies, such as the EU's 'Fit for 55' package aiming for a 55% emissions reduction by 2030, are driving a significant decrease in fossil fuel reliance, necessitating adaptation in Clyde Bergemann's product offerings towards renewables and waste-to-energy solutions.

Government incentives for green technologies, like the US Inflation Reduction Act providing billions in clean energy tax credits, de-risk investments and create favorable market conditions. Trade agreements and tariffs also play a crucial role; EU trade policies facilitate market access for German firms, while tariffs can increase costs for components and exported equipment, affecting competitiveness. Geopolitical tensions can also disrupt global supply chains, impacting delivery times and project costs for 2024-2025.

Political stability in Germany provides a predictable business environment, essential for long-term contracts. Monitoring the political landscapes of key client markets, such as China and India, is also vital, as their industrial modernization and economic reforms influence investment in energy and infrastructure sectors. Political instability in client countries can lead to project delays, impact investment security, and increase operational risks.

What is included in the product

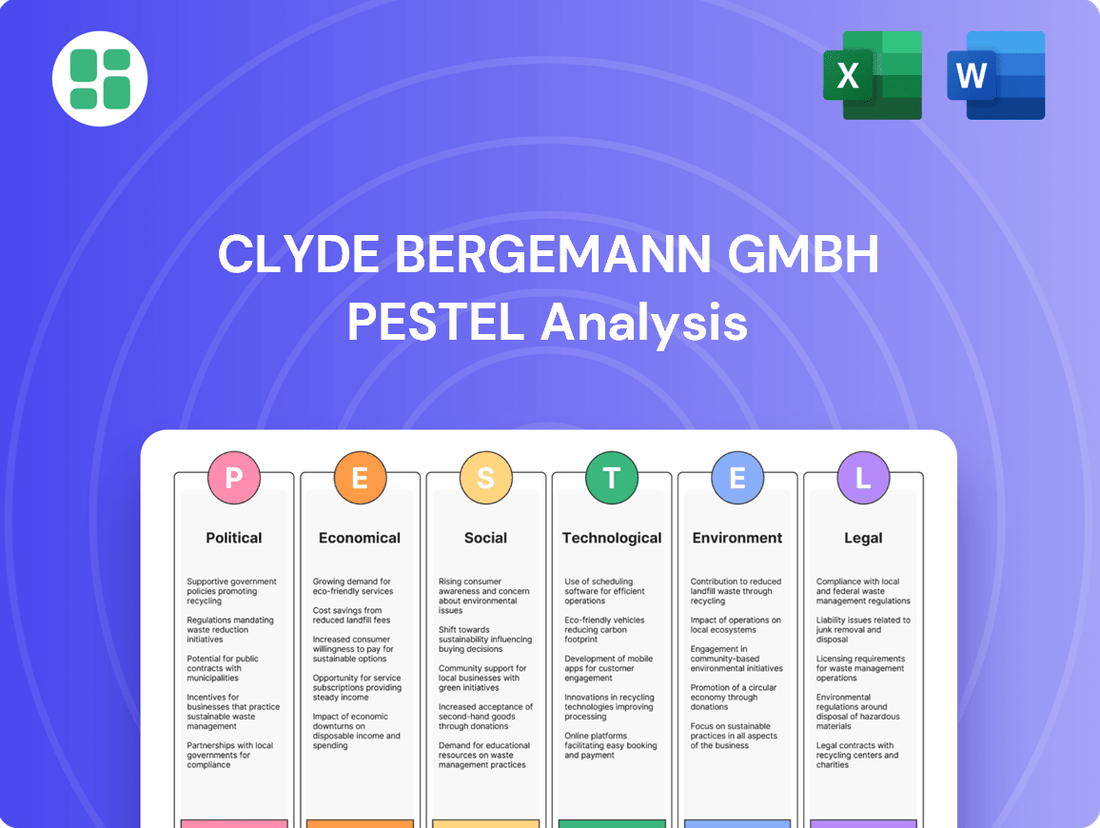

This PESTLE analysis delves into the external macro-environmental factors influencing Clyde Bergemann GmbH, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions to uncover critical opportunities and threats.

This PESTLE analysis for Clyde Bergemann GmbH offers a clear, summarized version of external factors, simplifying complex market dynamics for easy referencing during strategic discussions and presentations.

Economic factors

Global industrial output is a key indicator for Clyde Bergemann, as its growth directly impacts demand for their efficiency solutions in sectors like power generation and pulp and paper. A healthy industrial economy, characterized by increased capital expenditure, fuels sales for upgrades and new projects.

The International Monetary Fund (IMF) projected global industrial production growth to be around 3.1% in 2024, a slight uptick from previous years, indicating a generally supportive environment for companies like Clyde Bergemann. However, this growth is not uniform across all regions, with some economies experiencing stronger manufacturing expansion than others.

Conversely, economic slowdowns or recessions can significantly dampen industrial activity, leading to delayed or canceled investments in new plants and equipment. This directly translates to reduced sales opportunities for Clyde Bergemann’s specialized offerings, highlighting the sensitivity of their business to broader economic cycles.

Fluctuations in global energy prices, especially for fossil fuels, directly affect the operational expenses for industrial facilities. For example, Brent crude oil averaged around $82.6 per barrel in early 2024, a significant factor for energy-intensive industries.

When energy costs rise, companies like those that would be clients for Clyde Bergemann are more motivated to invest in technologies that boost efficiency. This means systems like waste heat recovery, which can reduce fuel usage by up to 10%, become more attractive investments as businesses look to cut their operating expenditures.

Conversely, periods of lower energy prices, such as the dip in natural gas prices in some regions during late 2023, can reduce the immediate pressure for clients to adopt energy-saving solutions, potentially slowing down adoption rates for efficiency-enhancing technologies.

Capital expenditure (CAPEX) in key client sectors like power generation and pulp and paper is a critical driver for Clyde Bergemann. For instance, in the power generation sector, global CAPEX for new capacity, particularly in renewables and grid modernization, is projected to see significant growth. Reports from 2024 indicate a substantial increase in planned investments by major utilities, driven by decarbonization targets and the need for grid resilience.

The pulp and paper industry's CAPEX is influenced by demand for sustainable packaging and tissue products. While some segments might see cautious spending due to economic uncertainties, investments in efficiency upgrades and new, environmentally compliant machinery are expected to remain robust. For example, several major paper manufacturers announced significant CAPEX plans in late 2023 and early 2024 for plant modernization, aiming to reduce energy consumption and emissions.

Overall, a positive CAPEX outlook across these process industries, fueled by regulatory mandates for cleaner operations and the adoption of advanced technologies, directly translates to increased demand for Clyde Bergemann's specialized solutions for boiler efficiency and emissions control. The ability of these industries to fund such investments hinges on their profitability and access to capital, making economic forecasts a crucial factor.

Inflation and Interest Rates

Rising inflation presents a significant challenge for Clyde Bergemann GmbH. For instance, the Eurozone's inflation rate remained elevated in early 2024, hovering around 2.4% in March 2024, impacting the cost of essential materials and skilled labor. This upward pressure on operational expenses directly affects the company's profitability and necessitates careful adjustments to its pricing models to maintain competitive advantage and margins.

Furthermore, the prevailing interest rate environment, with the European Central Bank maintaining its key interest rates at 3.75% as of April 2024, influences investment decisions across the industrial sector. Higher borrowing costs can deter clients from undertaking substantial capital expenditures, such as upgrading industrial plants or initiating new construction projects. This slowdown in client investment directly translates to reduced demand for Clyde Bergemann's specialized products and services, potentially impacting market growth and revenue streams.

- Inflationary Pressures: Continued inflation in 2024-2025 is expected to increase raw material and labor costs for Clyde Bergemann.

- Interest Rate Impact: Elevated interest rates, such as the ECB's current stance, can dampen demand for large industrial projects.

- Financial Management: Proactive management of these economic variables is critical for Clyde Bergemann's sustained financial health and strategic planning.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Clyde Bergemann GmbH, a global technology provider. As the company operates in numerous international markets, variations in currency values directly influence its financial performance. For instance, a strengthening Euro could make Clyde Bergemann's exports more expensive for foreign buyers, potentially reducing sales volume. Conversely, a weaker Euro might make imported components, crucial for their manufacturing processes, more costly.

The impact extends to the translation of international revenues and profits. When earnings from overseas subsidiaries are converted back into Euros, significant exchange rate volatility can lead to unexpected gains or losses, complicating financial planning and potentially affecting reported profitability. For example, in early 2024, the Euro experienced moderate fluctuations against major currencies like the US Dollar and the Chinese Yuan, creating a dynamic environment for international businesses.

- Impact on Exports: A stronger Euro can increase the price of Clyde Bergemann's products in foreign markets, potentially dampening demand.

- Cost of Imports: Fluctuations affect the cost of raw materials and components sourced internationally, impacting production expenses.

- Revenue Translation: Exchange rate shifts alter the Euro value of profits earned in foreign currencies, introducing financial risk.

- Pricing Strategy: Volatility necessitates agile pricing adjustments to maintain competitiveness and profitability across different regions.

Global economic growth directly influences demand for Clyde Bergemann's efficiency solutions in heavy industries. A robust global economy, marked by increased industrial production and capital expenditure, typically translates to higher sales for their specialized equipment and services.

The IMF projected global GDP growth to be around 3.2% for 2024, with a slight moderation to 3.1% in 2025, indicating a generally stable but not exceptionally strong economic environment. This growth is uneven, with emerging markets often showing more dynamism than developed economies, impacting regional demand for Clyde Bergemann's offerings.

Economic downturns or recessions, however, pose a significant risk, leading clients to postpone or cancel investments in new equipment and upgrades. For instance, a slowdown in manufacturing output, which saw varied regional performance in early 2024, can directly reduce the need for efficiency enhancements.

| Economic Indicator | Value/Projection | Source/Note |

| Global GDP Growth (2024) | 3.2% | IMF Projection |

| Global GDP Growth (2025) | 3.1% | IMF Projection |

| Industrial Production Growth (2024) | ~3.1% | IMF Projection |

| Eurozone Inflation (March 2024) | 2.4% | Eurostat |

| ECB Key Interest Rate (April 2024) | 3.75% | European Central Bank |

What You See Is What You Get

Clyde Bergemann GmbH PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the PESTLE analysis for Clyde Bergemann GmbH.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, with a comprehensive PESTLE breakdown for Clyde Bergemann GmbH.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete PESTLE analysis of Clyde Bergemann GmbH.

Sociological factors

Societal and corporate focus on Environmental, Social, and Governance (ESG) principles is accelerating, pushing industries towards sustainable operations and reduced environmental impact. Clyde Bergemann's emission reduction and energy efficiency technologies directly cater to this demand, making its solutions valuable for companies aiming to boost their ESG scores and public perception.

The global ESG investing market is projected to exceed $50 trillion by 2025, underscoring the significant financial incentive for businesses to prioritize sustainability. This growing pressure, coupled with increased regulatory scrutiny on environmental performance, positions Clyde Bergemann favorably as clients seek to comply and differentiate themselves.

The availability of skilled engineers, technicians, and specialized workers is fundamental for Clyde Bergemann's success across R&D, manufacturing, and service. In 2024, Germany, a key market, faced a shortage of around 500,000 skilled workers in technical fields, impacting industries like manufacturing.

Labor shortages and a deficit in specialized skills in Clyde Bergemann's operational regions can escalate labor expenses, cause project delays, and compromise service quality. For instance, the German engineering sector reported a 15% increase in recruitment challenges for highly specialized roles in early 2025.

Consequently, strategic investments in employee training programs and effective talent retention strategies are crucial for Clyde Bergemann to mitigate these risks and maintain its competitive edge.

Societal expectations and legal requirements for occupational health and safety (OHS) are increasingly stringent. Clyde Bergemann must ensure its equipment and services not only comply with but surpass these evolving standards, protecting both its workforce and client personnel. For instance, in 2023, workplace accidents in the industrial sector led to an estimated $170 billion in direct costs in the United States alone, highlighting the financial imperative of robust safety protocols.

A proactive approach to OHS significantly bolsters Clyde Bergemann's reputation, fostering trust with clients and stakeholders. Conversely, a failure to uphold high safety standards can result in substantial fines, legal liabilities, and irreparable damage to the company's brand image. For example, a major industrial incident in Germany in late 2024 resulted in a €5 million fine and a significant operational shutdown for the responsible company.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, from investors to the public, are increasingly scrutinizing companies for their social and environmental impact, demanding more than just legal compliance. Clyde Bergemann's existing focus on eco-friendly solutions provides a strong foundation, but expanding efforts in areas like ethical supply chains and robust employee welfare programs are crucial for bolstering brand image and attracting top talent. This proactive approach cultivates enduring stakeholder trust and loyalty.

Further strengthening Clyde Bergemann's CSR profile could involve tangible actions that resonate with current trends. For instance, aligning with the growing investor demand for Environmental, Social, and Governance (ESG) reporting, which saw global ESG assets reach an estimated $37.8 trillion in 2024, can be a significant differentiator. Initiatives that demonstrably improve community well-being or enhance employee development programs, such as investing in skills training that saw a 15% increase in corporate learning budgets in 2024, directly contribute to a positive societal footprint.

- Enhanced Brand Reputation: Demonstrating strong CSR can improve public perception, potentially leading to increased customer preference.

- Talent Attraction and Retention: Employees, particularly younger generations, prioritize working for socially responsible companies, with over 60% of millennials considering a company's social and environmental impact when choosing an employer in recent surveys.

- Investor Confidence: A solid ESG performance, a key component of CSR, is increasingly linked to better financial performance and lower risk, attracting socially conscious investors.

- Risk Mitigation: Proactive CSR can help companies avoid regulatory fines, reputational damage, and supply chain disruptions related to social or environmental issues.

Public Perception of Industrial Emissions

Public awareness and concern regarding industrial air pollution and climate change are on the rise globally. This growing societal pressure directly influences industries to adopt cleaner technologies and reduce their emissions. For instance, a 2024 report indicated that 78% of consumers are more likely to purchase from companies demonstrating strong environmental responsibility, a trend that directly benefits providers of emission-reduction solutions like Clyde Bergemann.

This heightened public scrutiny translates into increased demand for Clyde Bergemann's technologies that enable plants to operate more cleanly and efficiently. Such solutions not only improve a company's environmental footprint but also enhance its standing within local communities, fostering goodwill and potentially mitigating opposition to industrial operations. By offering ways to improve their environmental performance, companies can better align with public expectations.

Furthermore, negative public perception often acts as a catalyst for stricter environmental regulations. As of early 2025, several major economies are implementing or considering enhanced emissions standards, driven in part by public advocacy. This regulatory shift creates a more favorable market environment for companies like Clyde Bergemann, whose expertise lies in helping industrial facilities meet and exceed these evolving compliance requirements.

- Growing Consumer Demand: 78% of consumers in 2024 favor environmentally responsible companies.

- Community Relations: Cleaner operations improve industrial facilities' local acceptance.

- Regulatory Impact: Rising public concern fuels stricter emissions standards globally.

Societal expectations for corporate social responsibility (CSR) are intensifying, with a growing emphasis on ethical practices and community impact. Clyde Bergemann's commitment to sustainability and employee well-being aligns with these evolving demands, enhancing its brand image and stakeholder trust.

The global ESG investing market's projected growth to over $50 trillion by 2025 highlights the financial advantages of strong CSR performance. Clyde Bergemann's focus on emission reduction technologies directly addresses this trend, positioning it favorably for socially conscious investors.

Labor shortages in skilled technical roles, such as the estimated 500,000 deficit in Germany in 2024, pose a significant challenge. Clyde Bergemann must prioritize talent development and retention to mitigate potential cost increases and operational disruptions.

Heightened public awareness of climate change and air pollution drives demand for cleaner industrial solutions. Clyde Bergemann's emission reduction technologies directly cater to this, with 78% of consumers in 2024 favoring environmentally responsible companies.

| Sociological Factor | Impact on Clyde Bergemann | Supporting Data (2024/2025) |

| ESG Focus | Increased demand for sustainable technologies, enhanced brand reputation. | Global ESG assets estimated at $37.8 trillion in 2024. |

| Skilled Labor Shortage | Risk of increased labor costs, project delays, and service quality issues. | Germany faced a shortage of ~500,000 skilled workers in technical fields in 2024. |

| Public Environmental Awareness | Growing market for emission reduction solutions, improved community relations. | 78% of consumers in 2024 prefer environmentally responsible companies. |

| Occupational Health & Safety (OHS) Standards | Need for robust safety protocols to avoid fines and reputational damage. | Industrial accidents in the US cost an estimated $170 billion in direct costs in 2023. |

Technological factors

The rapid evolution of sensor technology and the Internet of Things (IoT) is revolutionizing industrial operations. These advancements allow for continuous, real-time data collection from complex machinery like boilers and material handling systems.

Clyde Bergemann GmbH can leverage this by integrating IoT sensors into its equipment. This enables predictive maintenance, anticipating potential failures before they occur, and optimizing system performance. For instance, by monitoring vibration and temperature data, potential issues can be flagged, preventing costly breakdowns.

This data-driven approach empowers clients with enhanced operational reliability. By proactively identifying inefficiencies and potential problems, Clyde Bergemann's solutions can significantly reduce unplanned downtime, a critical factor in industrial settings where downtime can cost millions. The global industrial IoT market was valued at approximately $215 billion in 2023 and is projected to grow significantly, indicating strong demand for such integrated solutions.

The ongoing digital transformation in industrial sectors presents a prime opportunity for Clyde Bergemann to innovate. By developing advanced control systems for their sootblowers and ash handling equipment, the company can seamlessly integrate with existing plant-wide automation infrastructure. This allows for enhanced operational efficiency and predictive maintenance capabilities.

Clyde Bergemann can leverage digitalization to offer remote monitoring and diagnostic services, providing clients with real-time insights into equipment performance. This not only boosts operational efficiency and reduces labor costs for customers but also improves overall plant safety by minimizing manual interventions in potentially hazardous environments.

Clyde Bergemann can leverage ongoing advancements in materials science and engineering to enhance its energy efficiency and waste heat recovery systems. For instance, the global waste heat recovery market was valued at approximately $50 billion in 2023 and is projected to grow significantly, driven by the need for industrial decarbonization and cost savings.

Research into novel heat exchange technologies, such as advanced ceramic materials or phase-change materials, offers potential for higher thermal conductivity and durability in extreme industrial environments. This could translate to more efficient energy conversion, with some emerging technologies demonstrating potential efficiency gains of up to 15% in specific applications.

By staying abreast of these technological shifts, Clyde Bergemann can develop next-generation products that offer superior performance, catering to a wider range of industrial sectors seeking to reduce their environmental footprint and operational expenses.

Artificial Intelligence and Machine Learning Applications

Artificial intelligence (AI) and machine learning (ML) are poised to significantly transform Clyde Bergemann's operations and client services. These technologies can analyze extensive operational data to predict equipment malfunctions, optimize boiler cleaning routines, and streamline material flow. For instance, AI-driven predictive maintenance could reduce unplanned downtime by an estimated 10-15% in industrial settings, directly translating to cost savings and improved efficiency for Clyde Bergemann's clients.

By integrating AI and ML, Clyde Bergemann can offer enhanced predictive capabilities, giving them a notable edge in the market. This allows for more proactive maintenance strategies, moving beyond reactive repairs to a more efficient, forward-looking approach. The global AI market in industrial applications is projected to reach over $30 billion by 2025, indicating a strong demand for such advanced solutions.

- AI-driven predictive maintenance can reduce industrial equipment downtime by 10-15%.

- Optimizing boiler cleaning schedules through AI can improve energy efficiency by up to 5%.

- The global AI market for industrial applications is expected to exceed $30 billion by 2025.

- ML algorithms can analyze complex operational data to identify efficiency bottlenecks in real-time.

Development of New Materials and Manufacturing Techniques

Advances in materials science, particularly in high-temperature alloys and advanced corrosion-resistant coatings, are directly enhancing the operational lifespan and efficiency of Clyde Bergemann's industrial equipment. For instance, the global market for advanced materials is projected to reach over $200 billion by 2025, with significant growth in specialized alloys used in demanding sectors like power generation and heavy industry.

New manufacturing techniques, such as additive manufacturing or 3D printing, offer substantial opportunities. This technology allows for the creation of intricate, lightweight, and highly efficient components that were previously impossible to produce. In 2024, the additive manufacturing market was valued at approximately $20 billion, with a strong growth trajectory driven by its application in aerospace and industrial machinery, suggesting potential cost reductions and faster production cycles for Clyde Bergemann.

- Enhanced Durability: High-temperature alloys and specialized coatings increase equipment resilience in extreme conditions.

- Improved Performance: Lighter and more efficient components, enabled by new manufacturing methods, boost overall system performance.

- Cost and Lead Time Reduction: Additive manufacturing can streamline production, lowering costs and speeding up delivery of critical parts.

- Product Innovation: The ability to create complex geometries opens doors for novel product designs and enhanced capabilities.

Technological advancements in AI and IoT are reshaping industrial operations, enabling predictive maintenance and real-time data analysis for equipment like boilers. Clyde Bergemann can integrate these technologies to offer enhanced operational reliability and efficiency, reducing costly downtime. The global industrial IoT market, valued at around $215 billion in 2023, highlights the significant demand for such integrated solutions.

Legal factors

Clyde Bergemann GmbH's clients face increasingly strict environmental regulations, particularly concerning air emissions like nitrogen oxides (NOx) and sulfur oxides (SOx). For instance, in 2024, many European countries are enforcing tighter NOx limits under the Industrial Emissions Directive, pushing industries to invest in advanced flue gas cleaning technologies. This regulatory pressure directly fuels demand for Clyde Bergemann's expertise in emission control systems.

Failure to comply with these environmental mandates, including waste disposal and water discharge standards, carries significant financial risks. In 2025, industrial facilities can expect penalties for non-compliance to escalate, with potential fines reaching millions of euros, alongside the risk of temporary or permanent operational shutdowns. This underscores the critical need for reliable environmental solutions, a core offering of Clyde Bergemann.

Clyde Bergemann GmbH must navigate stringent Occupational Health and Safety (OHS) regulations that dictate the design, installation, and operation of industrial equipment. Adherence to these OHS laws across all operational territories is paramount for worker protection and mitigating legal risks. For instance, in Germany, the Occupational Safety and Health Act (Arbeitsschutzgesetz) mandates employers to ensure the safety and health of their employees, with non-compliance potentially leading to substantial fines and operational disruptions.

Maintaining compliance with OHS standards is vital for Clyde Bergemann's reputation and accident prevention. In 2023, workplace accidents in Germany's industrial sector resulted in an estimated €3.4 billion in direct and indirect costs, highlighting the significant financial implications of safety lapses. Therefore, ensuring products and services meet or exceed these safety benchmarks is critical to avoid costly legal liabilities and reputational damage.

Clyde Bergemann GmbH, as a global entity, must meticulously adhere to a multifaceted landscape of international trade and customs regulations. These legal frameworks govern the cross-border movement of goods, directly influencing the company's supply chain operations and its ability to access diverse markets. For instance, the World Trade Organization (WTO) agreements, which set many of the global trade rules, are constantly evolving, impacting tariffs and non-tariff barriers.

Navigating these complexities is critical for maintaining efficient operations and competitive pricing. Changes in trade policies, such as the imposition of new tariffs or the alteration of import/export quotas, can significantly affect the cost of components and the final price of Clyde Bergemann's products. In 2024, ongoing trade discussions and potential adjustments to existing agreements, like those within the European Union or between major trading blocs, will continue to be a key area of focus for compliance and strategic planning.

Intellectual Property (IP) Protection Laws

Clyde Bergemann GmbH's competitive edge is built upon its unique technologies and forward-thinking solutions. Strong intellectual property laws, encompassing patents, trademarks, and trade secrets, are vital for safeguarding its research and development expenditures and deterring the unauthorized use or duplication of its innovations. For instance, the global patent landscape continues to evolve, with significant activity in industrial machinery and process engineering, areas where Clyde Bergemann operates. The World Intellectual Property Organization (WIPO) reported a 3.5% increase in international patent filings in 2023, highlighting the increasing importance of IP protection.

Effective enforcement of these IP rights is essential for Clyde Bergemann to sustain its market standing and foster ongoing innovation. In 2024, many jurisdictions are strengthening their IP enforcement mechanisms, recognizing the economic impact of IP theft. For companies like Clyde Bergemann, this means a more robust framework to protect their technological advancements.

Key aspects of IP protection for Clyde Bergemann include:

- Patent Protection: Securing patents for novel machinery designs and process improvements to prevent competitors from copying their core technologies.

- Trademark Safeguarding: Protecting brand names and logos to ensure customer recognition and prevent brand dilution in a competitive market.

- Trade Secret Management: Implementing rigorous internal policies to protect confidential R&D data, manufacturing processes, and customer lists.

- Enforcement Strategies: Actively monitoring the market for infringements and pursuing legal action when necessary to defend their intellectual assets.

Product Liability and Warranty Laws

Product liability and warranty laws are critical for Clyde Bergemann, shaping their responsibilities for product safety and performance. These legal frameworks require the company to ensure its boiler cleaning systems, material handling technologies, and waste heat recovery systems meet stringent safety standards and honor all warranty commitments. For instance, in 2024, product liability claims in the industrial equipment sector saw an average settlement of $1.5 million, highlighting the financial implications of non-compliance.

Failure to adhere to these regulations can lead to significant legal risks, damage customer trust, and result in costly litigation. Clyde Bergemann's proactive approach to compliance, including rigorous quality control and transparent warranty terms, is essential for mitigating these potential issues and maintaining its market reputation.

- Product Safety Standards: Ensuring all systems meet or exceed international safety certifications, such as ISO 45001 for occupational health and safety.

- Warranty Fulfillment: Clearly defining warranty periods and coverage for all product lines to manage customer expectations and legal obligations.

- Risk Mitigation: Implementing robust testing and quality assurance processes to minimize defects and potential liability claims.

- Customer Trust: Demonstrating commitment to product reliability and customer support to build long-term relationships and avoid disputes.

Clyde Bergemann GmbH operates within a complex web of legal frameworks that significantly influence its business operations and market positioning. These legal factors encompass environmental compliance, occupational health and safety, international trade, intellectual property, and product liability. Staying abreast of evolving regulations in these areas is crucial for mitigating risks and capitalizing on opportunities.

The company must navigate stringent environmental regulations, particularly concerning emissions, which directly impact the demand for its flue gas cleaning technologies. Failure to comply with these mandates, including waste disposal and water discharge standards, carries substantial financial penalties, potentially leading to operational shutdowns. Furthermore, adherence to Occupational Health and Safety (OHS) laws is paramount for worker protection and avoiding costly legal liabilities, with workplace accidents in Germany's industrial sector incurring significant economic costs.

International trade and customs regulations govern the cross-border movement of goods, affecting supply chain efficiency and market access, with evolving WTO agreements influencing tariffs and trade barriers. Protecting intellectual property through patents, trademarks, and trade secrets is vital for safeguarding R&D investments and deterring infringement, as evidenced by the increasing global patent filings. Finally, product liability and warranty laws dictate the company's responsibilities for product safety and performance, making robust quality control and transparent warranty terms essential for maintaining customer trust and avoiding litigation.

| Legal Factor | Impact on Clyde Bergemann GmbH | Relevant Data/Trends (2023-2025) |

|---|---|---|

| Environmental Regulations | Drives demand for emission control systems; non-compliance incurs significant fines. | Tighter NOx limits in Europe (2024); potential fines up to millions of euros for non-compliance (2025). |

| Occupational Health & Safety (OHS) | Ensures worker protection and mitigates legal risks; impacts operational costs. | German industrial sector accident costs estimated at €3.4 billion (2023). |

| International Trade & Customs | Affects supply chain, market access, and pricing; influenced by evolving trade agreements. | Ongoing trade discussions and potential adjustments to EU agreements (2024). |

| Intellectual Property (IP) | Protects R&D, deters infringement, and sustains market standing; robust enforcement is key. | 3.5% increase in international patent filings (2023); strengthening IP enforcement mechanisms (2024). |

| Product Liability & Warranty | Governs product safety and performance; non-compliance leads to litigation and reputational damage. | Average settlement for product liability claims in industrial equipment ~$1.5 million (2024). |

Environmental factors

The intensifying global commitment to combating climate change places significant pressure on industrial operations to curb greenhouse gas (GHG) emissions. This trend directly benefits Clyde Bergemann by increasing the demand for their energy-efficient solutions.

Clyde Bergemann's advanced boiler cleaning and waste heat recovery systems are crucial for industries aiming to enhance energy efficiency and reduce fuel usage, directly leading to lower CO2 output. For instance, the global power generation sector, a key market for Clyde Bergemann, is under immense pressure to decarbonize, with many nations setting ambitious net-zero targets by 2050.

In 2024, the International Energy Agency reported that while renewable energy sources are growing, fossil fuels still account for a substantial portion of global energy consumption, highlighting the ongoing need for efficiency improvements in existing industrial infrastructure. Companies are actively investing in technologies that support their decarbonization strategies to meet these evolving regulatory and market expectations.

Growing worries about the availability of essential resources like water and raw materials, alongside escalating prices, are pushing industries to boost their operational efficiency. This trend is particularly pronounced in sectors heavily reliant on energy and material inputs, where cost savings and sustainability are paramount.

Clyde Bergemann's technologies directly address this by optimizing plant performance and enabling the recovery of valuable energy. For instance, their boiler cleaning systems can improve heat transfer efficiency by up to 10%, directly reducing fuel consumption and thus resource use. This focus on efficiency makes their solutions increasingly attractive as industries strive to do more with less.

The global push for sustainability is reshaping industrial waste management, with a strong focus on circular economy principles. This means industries are increasingly pressured to cut down on waste and find ways to reuse or recycle by-products, turning potential liabilities into assets. For instance, by 2025, the European Union aims to increase recycling rates for municipal waste to 65%.

Clyde Bergemann's expertise in ash handling systems is directly relevant here. Their technology manages solid waste from combustion, and there's a significant opportunity to innovate further by developing systems that facilitate the recovery and reuse of valuable materials within ash. This aligns with the growing demand for solutions that minimize the environmental footprint of industrial processes and by-products.

Air and Water Quality Standards

Stricter air and water quality standards, driven by global environmental concerns, directly influence industrial processes. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine National Ambient Air Quality Standards (NAAQS) for pollutants like fine particulate matter (PM2.5) and ozone, impacting industries that emit these substances. These regulations necessitate advanced emission control technologies.

Clyde Bergemann's solutions are designed to address these evolving requirements. Their technologies, such as advanced burner systems and flue gas cleaning equipment, are crucial for clients aiming to meet or exceed these increasingly stringent environmental benchmarks. By reducing particulate matter, SOx, and NOx, the company enables its customers to operate within legal limits and avoid penalties.

The emphasis on environmentally sound operations is a significant advantage for Clyde Bergemann. As public and governmental pressure mounts regarding pollution and its associated health consequences, demand for solutions that promote cleaner industrial practices is expected to grow. This aligns with global trends, such as the European Union's Green Deal, which sets ambitious targets for reducing pollution across member states.

- Growing Stringency: Many regions are tightening emission limits, with some countries aiming for near-zero emissions in certain sectors by 2030.

- Technological Demand: The market for advanced emission control systems is projected to expand significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 5% in the coming years.

- Compliance as a Driver: Non-compliance with air and water quality standards can result in substantial fines, with some environmental violations leading to penalties in the millions of dollars.

- Market Differentiation: Companies offering demonstrable emission reduction capabilities, like Clyde Bergemann, gain a competitive edge in a market increasingly prioritizing sustainability.

Climate Change Adaptation and Resilience

Industrial facilities, including those served by Clyde Bergemann, face escalating physical risks from climate change, such as more frequent extreme weather events. For instance, the World Meteorological Organization reported in 2023 that the number of weather, climate, and water-related disasters has increased fivefold since the 1970s, impacting supply chains and operational continuity.

Clyde Bergemann's core offerings, designed for efficiency and emissions reduction, inherently bolster plant resilience. Their systems, like advanced boiler cleaning technologies, ensure optimal performance and reliability, which are critical for maintaining operations during adverse environmental conditions. This focus on robust system performance indirectly aids in adapting to the stresses imposed by a changing climate.

Looking ahead, there's a growing opportunity for Clyde Bergemann to develop and integrate solutions that directly assist plants in adapting to and mitigating climate change impacts. This could involve equipment that enhances water management in drought-prone areas or systems that improve energy efficiency to reduce reliance on fluctuating energy sources.

Key considerations for Clyde Bergemann in this area include:

- Enhanced operational continuity: Ensuring their equipment functions reliably during extreme weather events, thereby minimizing downtime.

- Support for climate adaptation strategies: Developing technologies that help clients manage resources more effectively in response to climate shifts.

- Contribution to overall plant resilience: Positioning their solutions as integral to a plant's ability to withstand and recover from climate-related disruptions.

The increasing global focus on environmental protection, particularly climate change mitigation, directly benefits Clyde Bergemann. Stricter regulations on emissions, such as those targeting CO2, SOx, and NOx, are driving demand for the company's energy-efficient boiler cleaning and waste heat recovery systems. For example, many countries have set net-zero targets by 2050, creating a sustained need for decarbonization technologies in sectors like power generation.

Resource scarcity and rising costs of materials like water and fuel also encourage industries to improve operational efficiency. Clyde Bergemann's solutions, which can enhance heat transfer efficiency by up to 10%, directly address this by reducing fuel consumption and optimizing resource utilization. This makes their offerings increasingly valuable as businesses strive for cost savings and sustainability.

The push for circular economy principles is transforming waste management, pressuring industries to minimize waste and maximize resource recovery. Clyde Bergemann's ash handling systems offer an opportunity for further innovation in recovering valuable materials from by-products, aligning with the growing demand for solutions that reduce industrial environmental footprints.

Stricter air and water quality standards necessitate advanced emission control technologies. Clyde Bergemann's flue gas cleaning and burner systems are vital for clients needing to meet these evolving environmental benchmarks, helping them avoid penalties and operate within legal limits.

| Environmental Factor | Impact on Clyde Bergemann | Supporting Data (2024-2025) |

|---|---|---|

| Climate Change Mitigation | Increased demand for energy efficiency and emission reduction solutions. | Global power generation sector under pressure to decarbonize; many nations aim for net-zero by 2050. |

| Resource Scarcity & Cost | Higher demand for technologies that improve operational efficiency and reduce resource consumption. | Boiler cleaning can improve heat transfer efficiency by up to 10%, reducing fuel use. |

| Circular Economy & Waste Management | Opportunity for innovation in waste by-product recovery and reuse. | EU aims for 65% municipal waste recycling by 2025; focus on turning liabilities into assets. |

| Air & Water Quality Standards | Demand for advanced emission control technologies to meet stricter regulations. | EPA continues to refine National Ambient Air Quality Standards (NAAQS) for pollutants like PM2.5 and ozone. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Clyde Bergemann GmbH is meticulously constructed using data from official government publications, reputable economic databases, and leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company's operations.